Summary

Table of Content

Language Learning Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Language Learning Market Size

The global language learning market size was valued at USD 85.1 billion in 2025. The market is expected to grow from USD 101.5 billion in 2026 to USD 649 billion in 2035, at a CAGR of 22.9% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The market for language learning is expanding due to increasing globalization & cross border communication and advancements in technology and digital platforms.

The increasing number of international students and global travelers is a key driver of the language learning market, as individuals seek language proficiency for academic, professional, and cultural integration purposes. According to Institute of International Education, 1,126,690 international students from more than 210 places of origin studied at U.S. higher education institutions during the 2023/2024 academic year, marking a 7% increase from the previous year. This upward trend reflects a growing demand for English language proficiency tests such as TOEFL, IELTS, and Duolingo English Test (DET), as universities continue to require standardized language assessments for admissions.

Language Learning Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 85.1 Billion |

| Market Size in 2026 | USD 101.5 Billion |

| Forecast Period 2026 - 2035 CAGR | 22.9% |

| Market Size in 2035 | USD 649 Billion |

| Key Market Trends | |

| Drivers | Impact |

| AI-Driven Personalization | Revolutionizes learning by adapting content to individual progress, boosting engagement and retention rates by up to 70% through adaptive algorithms and speech recognition. |

| Digital Transformation and Mobile Platforms | Enables flexible, on-demand access via apps like Duolingo and Babbel, expanding reach to busy professionals and emerging markets with microlearning and offline features |

| Corporate Training Demands | Drives B2B growth to over 56% market share as multinationals invest in language skills for global communication and cross-border collaboration. |

| Globalization and Immigration Trends | Fuels demand for multilingual proficiency, particularly English and Mandarin, amid rising workforce mobility and economic integration. |

| Rising popularity of study abroad and international travel | The rising popularity of study abroad and international travel drives demand for language learning, as individuals seek proficiency in foreign languages to enhance academic, professional, and cultural experiences. |

| Pitfalls & Challenges | Impact |

| Teacher Shortages | Insufficient qualified instructors limits scalable, high-quality programs, especially in emerging markets, hindering market expansion. |

| Limited Internet Access in Some Regions | In rural or underdeveloped areas, poor internet connectivity and low digital literacy hinder adoption of online and mobile language learning solutions. |

| Opportunities: | Impact |

| Integration with Education Systems | Partnerships with schools, universities, and international exchange programs can drive long-term adoption of language learning solutions. |

| Emerging Market Expansion | High smartphone penetration in Asia-Pacific drives 30% CAGR, tapping 2B+ new learners through localized content |

| Market Leaders (2025) | |

| Market Leaders |

6.7% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | United States, United Kingdom, Germany, Japan, and France |

| Future outlook |

|

What are the growth opportunities in this market?

Similarly, the increased number of international travel and tourism worldwide has increased the demand for learning languages for short and long stay travel. According to the World Tourism Barometer by the UN Tourism, the number of International Tourism (overnight visitors) estimated to be 1.4 billion in the year 2024 showed a growth of 11% from the previous year 2023. The increased mobility of people worldwide has increased the demand for basic language skills in common languages such as English, Spanish, French, and Mandarin languages by those intending to travel worldwide for business and entertainment purposes.

The rising demand for language proficiency in global business environments has made corporate training programs a key driver of growth in the language learning market. Organizations worldwide and in the fields of IT, finance, health care, and customer service are making significant investments in languages to upgrade skills and increase efficiency in the global work environment. The trend of work from home and global collaboration is also driving the demand for corporate languages as the global work environment requires efficient communication by the global workforce.

For instance, in May 2024, Wall Street English and HCLTech have recently entered into a strategic partnership to provide specific English language learning to IT professionals. This partnership will meet the growing requirement among IT companies to learn business English to communicate effectively with global clients. As companies are focusing on customer experience, global projects, and collaborations, they are including AI learning tools, web classrooms, and customized learning sessions on business English in their employee development plans.

Language Learning Market Trends

- The language learning industry is experiencing a strong trend toward digital and AI-powered platforms that enable personalized, adaptive, and interactive learning experiences. This trend began around 2018 with the rise of mobile apps, online courses, and AI tutors capable of speech recognition and real-time feedback. It is currently impacting the market by increasing accessibility, engagement, and learner outcomes across schools, universities, and corporate training. The trend is expected to dominate through 2032, driven by rising global demand for multilingual skills, remote learning adoption, and integration of gamification and AI-driven assessment tools.

- The growing use of gamification and immersion technology, including AR/VR and interactive storytelling, is emerging in the language learning industry. The emerging trend started around 2019 in the language learning industry, where various learning applications and websites were aimed at improving the retention levels of students. Language learners and education institutions are increasingly adopting this trend, which is expected to continue until 2030, as they seek gamified and experiential methods of learning.

Language Learning Market Analysis

Learn more about the key segments shaping this market

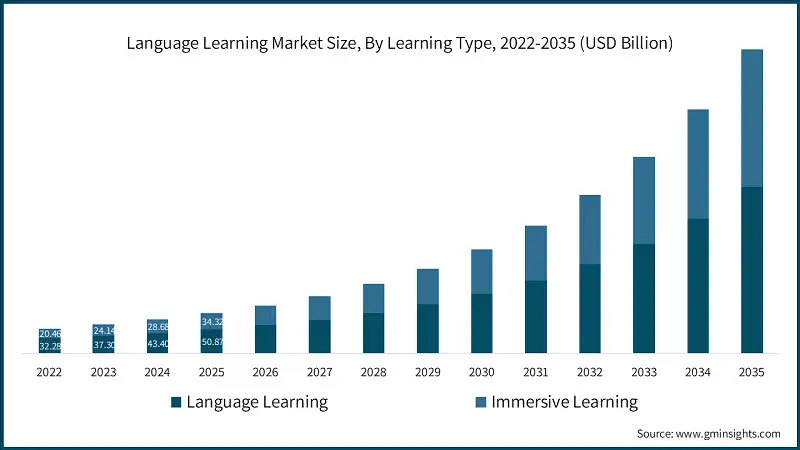

Based on learning type, the language learning market is segmented into language learning and immersive learning.

- The language learning segment was valued at USD 50.8 billion in 2025. Increasing globalization, expanding cross-border job options, and greater international study opportunities increases the demand for organized language learning in order to enhance your chances of success in the areas of academics, job opportunities, and migrating from one country to another.

- The immersive learning segment is expected to grow at a CAGR of over 24.3% by 2035. Increasing popularity of VR/AR simulations, virtual exchanges, and study-abroad programs is driving immersive language learning for real-world fluency and cultural competence.

- Growing corporate demand for experiential training and gamified platforms is accelerating adoption of immersive methods, offering higher retention rates over traditional approaches.

Learn more about the key segments shaping this market

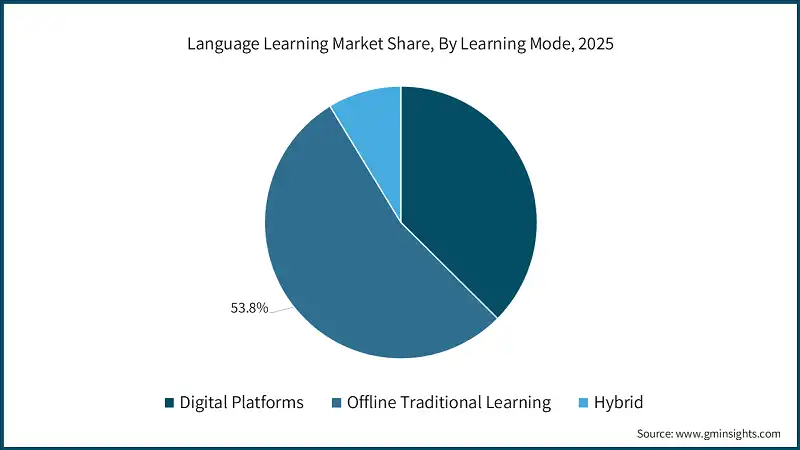

On the basis of learning mode, the language learning market is segmented into digital platforms, offline traditional learning and hybrid.

- The offline traditional learning segment held market share of 53.8% in 2025. Offline traditional learning remains relevant as many learners value structured classroom environments, direct teacher interaction, and peer collaboration. This is supported by growth on the part of institutions in regions that have limited digital infrastructure, for those learners preferring methods that are much more hands-on and face-to-face. Language schools continue to grow in urban centers to cater to professional and academic demand.

- The hybrid segment is expected to grow at a CAGR of 25.5% during the forecast period. Hybrid learning has been on the rise due to its flexibility, which brings together traditional classroom-based education and technology-based versions. This type of model suits working class students, as well as those seeking personalized curriculum coverage, while still being supported by classroom settings. In its strategy, it utilizes online platforms for practice, hence more engaging.

Based on application, the language learning market is segmented into educational, professional and others.

- The educational segment held market share of over 72.6% and accounted for USD 61.8 billion in 2025. The educational segment is expected to grow as schools, colleges, and universities increasingly integrate language learning into curricula to enhance global competence. Rising student mobility, study-abroad programs, and government initiatives promoting multilingualism drive adoption. Digital platforms complement traditional teaching, expanding reach and enabling personalized learning experiences for students.

- The professional segment is expected to grow at a CAGR of 24.4% during the forecast period. The professional segment is expanding as companies consider bilingual skills necessary for conducting global operations, customer service, and international collaborations. Corporate training sessions, professional course offerings, and language certifications are now common to skill employees. The growing trend of working from a distance, teamwork, or international collaborations is adding to the need to offer career-based language learning assistance.

Looking for region specific data?

North America language learning market accounted for USD 23.9 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- North America leads the trends in the marketplace due to its more developed, digitally-savvy population, its widespread application of mobile technologies, and continued financial support for innovative educational technologies.

- The North American education sector has been a leader in developing artificial intelligence (AI)-based platforms and virtual teaching models, which provide customised, scalable, and accessible means of providing language education.

- Consumer and enterprise demand continues to be strong, leading to continued product innovation and development in areas such as K–12, post-secondary, and corporate training.

- Furthermore, because numerous global organisations have established a physical presence in North America (primarily in the United States and Canada), many of these adaptive technologies have already been implemented, and their presence has led to a consistent stream of updates and beta testing of their products.

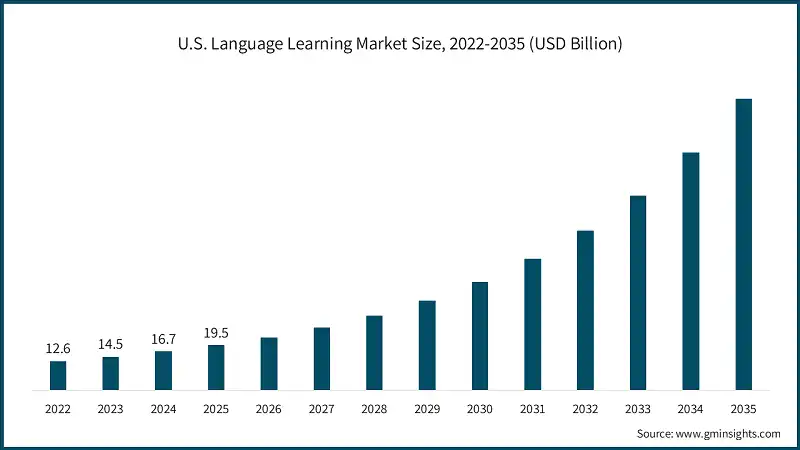

US language learning market is estimated to grow with a CAGR of 20.8% during the forecast period.

- The United States will be one of the most significant countries in this area. The overall high usage of language-learning solutions by students, combined with massive amounts of institutional demand, plus the emergence of many startups offering language-learning solutions, represent some of the key reasons for the current dominance in the U.S. of the language-learning market.

- Over the last several quarters, leading companies have taken steps to increase their use of artificial intelligence in their products, i.e. by providing "on-the-fly" correction, or voice-based interactive scenarios with animated characters integrated into their offerings.

The Asia Pacific dominated the global language learning market with a market share of 32.9% in 2025.

- Rapid 5G expansion and high smartphone penetration across India and Southeast Asia have democratized access to AI-powered apps.

- Rapid economic growth and increasing integration with global markets are driving individuals and professionals to learn English and other international languages. Businesses in Asia-Pacific are expanding internationally, creating a strong need for employees proficient in foreign languages to facilitate trade, cross-border communication, and career mobility.

The China language learning market was valued at USD 9.1 billion in 2025.

- The growth fueled by increased private investment in online platforms and the growing middle-class population's desire for academic and professional advancement.

- The rising use of smartphones and high-speed internet as well as e-learning platforms has increased awareness and access to learning foreign languages. There is also use of AI applications for learning languages due to technological advancements.

- Chinese Ministry of Education's "Double 100 Action" initiative, approved in May 2024. This policy aims to have 100 million students reach a certain English proficiency level by 2025 and 400 million by 2035, a massive government push that has directly boosted the demand for digital English language training services across the country.

The Europe language learning market is anticipated to grow at the CAGR of 22.1% during the analysis timeframe.

- Europe’s highly interconnected economies and the presence of the EU encourage cross-border business and labor mobility. Professionals and students increasingly seek language skills especially English, German, and French to enhance employability and participate in international trade.

- Programs such as Erasmus+ and other EU-supported educational initiatives promote multilingualism among students, driving demand for formal and informal language learning.

Italy language learning market is estimated to grow with a CAGR of 25% during the forecast period, in the Europe market.

- The growth is fueled by booming tourism recovery, immigrant integration needs, and EU-funded multilingual education initiatives.

- With globalization and increasing international business ties, professionals, students, and travelers in Italy are investing in foreign language skills primarily English, but also Spanish, German, and French to improve career prospects and academic opportunities.

Brazil leads the Latin American language learning market, exhibiting remarkable growth during the analysis period.

- Brazil’s language learning market is growing due to globalization of business and a young, tech-savvy population.

- The recent growth of e-learning driven by increasing availability of 4G networks has significantly increased the demand for English skills across Brazilian business sectors.

- Growth in disposable income among Brazil’s urban population is enabling more families and professionals to invest in private language courses and premium online learning services.

Saudi Arabia language learning market to experience substantial growth in the Middle East and Africa market in 2025.

- Saudi Arabia’s Vision 2030 focuses on economic diversity, international business, and the transformation of the education system. Language skills, especially English proficiency, are being encouraged to produce a competent global workforce.

- There is an increasing need for foreign language skills on the part of students and professionals who want to pursue further studies outside the country and gain employment with international companies operating in the Kingdom.

Language Learning Market Share

The language learning industry is led by players such as EF Education First, New Oriental Education & Technology Group Inc., Berlitz Corporation, Duolingo, and Busuu Ltd. (Chegg). These five companies cumulatively accounted for approximately 14% market share in 2025. These companies have strong business foundations with diversified language offerings, established educational programs, and broad geographical presence across Asia-Pacific, Europe, the Americas, and the Middle East. Their wide range of offerings, including online courses, mobile applications, in-person classes, and corporate training programs, enables them to maintain a competitive position in the market.

These players maintain their competitive advantage through the integration of technology, including the use of AI-based learning platforms, gamified mobile applications, and adaptive learning tools, which maximize engagement and learning results. Additionally, they spend extensively on the development of online content, teacher training, and language programs, thereby meeting the regional preferences of language learning. They also collaborate with institutions to strengthen their position within the industry and hence tap into the increasing demand for language skills through various sectors, including the professional, academic, and development sectors.

Language Learning Market Companies

Prominent players operating in the language learning industry are as mentioned below:

- Babbel Gmbh

- Berlitz Corporation

- Busuu Ltd. (Chegg)

- Duolingo

- EF Education First

- eLanguage, LLC

- HHM Education Company

- Inlingua International Ltd.

- McGraw-Hill Education, Inc.

- Memrise

EF Education First held 6.73% of the market in 2025, driven by immersive study-abroad programs, hybrid digital platforms, and tailored corporate training across 50+ languages. Its advantage stems from blending in-person cultural immersion with AI-enhanced apps, securing long-term contracts with 3,000+ global firms for employee mobility and soft skills development.

New Oriental held 4.68% of the market in 2025, powered by extensive K-12 tutoring, test prep, and online English courses in Asia. Its edge lies in massive scale via 1,000+ centers, adaptive tech for exam success, and partnerships with universities, dominating China's education market amid rising parental investments.

Berlitz Corporation captured 1.04% of the market through the proprietary Berlitz Method of live, immersive instruction in 70 languages. The company's strength is its 145-year legacy, 500+ global centers, and customized business programs, delivering proven ROI for Fortune 500 clients in real-world fluency.

Duolingo held 0.86% of the market in 2025, fueled by gamified AI lessons, 500M+ users, and Super Duolingo subscriptions generating $531M revenue. Its competitive advantage is addictive micro-learning streaks, free accessibility, and B2B English tools, leading app downloads and user engagement worldwide.

Language Learning Industry News

- In September 2024, Duolingo improved language learning with the addition of Adventures and AI Video Calls in September of 2024. Adventures feature story-based learning for English-speaking individuals studying French or Spanish-speaking individuals studying English. The AI Video Calls feature a simulation of actual conversations, now available for English, Spanish, or French-speaking learners with iOS devices using Duolingo Max.

- In December 2024, Rosetta Stone partnered with Youngstown State University (YSU) to enhance its Foreign Language Program. This collaboration integrates Rosetta Stone’s interactive platform with YSU’s expert faculty, offering immersive language learning in Spanish, French, German, and Italian. The initiative aims to equip students with practical skills for academic and professional success.

The language learning market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) from 2022 to 2035, for the following segments:

Market, By Language

- English

- Spanish

- German

- Chinese

- French

- Russian

- Portuguese

- Italian

- Korean

- Japanese

- Others

Market, By Learning Mode

- Digital platforms

- Offline traditional learning

- Hybrid

Market, By Application

- Educational

- Professional

- Others

Market, By Learning Type

- Language learning

- Immersive learning

Market, By End Use

- K-12 Students

- Higher Education Students

- Corporate / Professional Learners

- Direct-to-Consumer (DTC) Learners

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the language learning industry?

Key players include Babbel Gmbh, Berlitz Corporation, Busuu Ltd. (Chegg), Duolingo, EF Education First, eLanguage, LLC, HHM Education Company, Inlingua International Ltd., McGraw-Hill Education, Inc., and Memrise.

What was the valuation of the educational segment in 2025?

The educational segment held a market share of over 72.6%, valued at USD 61.8 billion in 2025.

Which region leads the language learning sector?

North America leads the market, accounting for USD 23.9 billion in 2025. The market is supported by a digitally-savvy population, widespread mobile technology adoption, and financial backing for innovative educational technologies.

What are the emerging trends in the language learning market?

Emerging trends include the adoption of gamification, AR/VR, and interactive storytelling for immersive learning experiences, as well as the integration of AI-powered tools for personalized and real-time feedback.

How much revenue did the offline traditional learning segment generate in 2025?

The offline traditional learning segment accounted for 53.8% of the market share in 2025.

What is the projected value of the language learning market by 2035?

The market is poised to reach USD 649 billion by 2035, fueled by the adoption of digital and AI-powered platforms.

What is the expected size of the language learning industry in 2026?

The market size is projected to reach USD 101.5 billion in 2026.

What was the market size of the language learning in 2025?

The market size was USD 85.1 billion in 2025, growing at a CAGR of 22.9% during the forecast period. The market is driven by increasing globalization, cross-border communication, and advancements in digital platforms.

Language Learning Market Scope

Related Reports