Summary

Table of Content

Industrial Machinery Components & Sensors Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industrial Machinery Components & Sensors Market Size

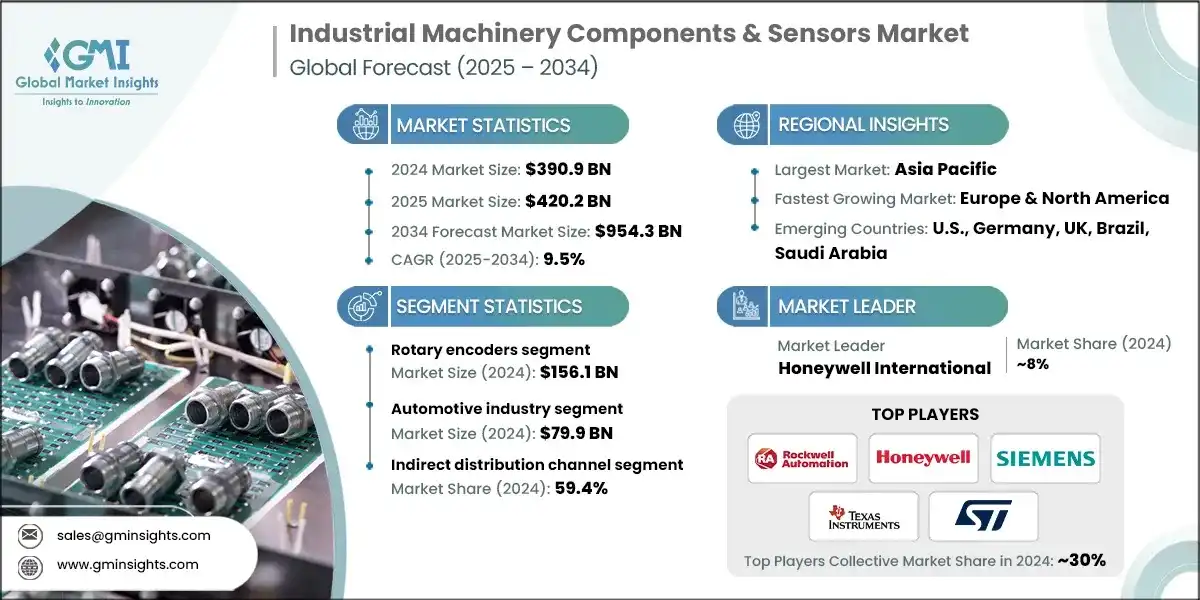

The global industrial machinery components & sensors market size was estimated at USD 390.9 billion in 2024. The market is expected to grow from USD 420.2 billion in 2025 to USD 954.3 billion in 2034, at a CAGR of 9.5% according to latest report published by Global Market Insights Inc.

To get key market trends

The industrial machinery components & sensors market is at a transformative phase shaped driven by several powerful forces that are reshaping the industrial landscape. One of the strongest drivers is the implementation of Industry 4.0 and smart manufacturing. As the factory transforms into a wise, networked ecosystem, the demand for sophisticated sensors and precision components has boomed.

These technologies facilitate real-time data capture, machine-to-machine interface, and predictive analytics, which are crucial for optimizing production, minimizing downtime, and improving product quality. Smart factories make extensive use of sensors to monitor temperature, pressure, vibration, and other essential parameters and hence are pivotal in today's industrial configurations.

Furthermore, with the increase in labor expenses and demands for consistent quality and efficiency, industries turn towards automation. Robots and automated systems require wide range of sensors and parts to operate precisely and securely. Ranging from proximity sensors and encoders to actuators and control systems, these parts are the backbone of automated operations. This is a special trend in industries such as automotive, electronics, and food processing, where speed and accuracy are of the essence. Not only does robot use increase productivity, but also workplace safety by eliminating human exposure to risky operations.

In addition to this, increased usage of predictive maintenance solutions and expansion of electric vehicles (EVs) and renewable energy industries are also key growth drivers. Predictive maintenance, fueled by sensor data and AI, enables organizations to foresee equipment breakdown before they take place, automatically leading to a drastic cut in downtime and maintenance expenses. This approach is gaining popularity across sectors including energy, mining, and pharma.

Simultaneously, the shift toward EVs and renewable energy is creating new opportunities for sensors and component manufacturers. EVs requires complex networks of sensors for batteries, motors, and safety features, while renewable power installations such as wind farms and solar parks rely on sensors to monitor performance and connect to the grid.

Industrial Machinery Components & Sensors Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 390.9 Billion |

| Market Size in 2025 | USD 420.2 Billion |

| Forecast Period 2025 – 2034 CAGR | 9.5% |

| Market Size in 2034 | USD 954.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Adoption of industry 4.0 and smart manufacturing | Drives demand intelligent sensors and components to enable real-time monitoring, automation, and data-driven decision-making in factories. |

| Expansion of industrial automation and robotics | Increases the need for precision components and motion sensors to support robotic arms, conveyors, and autonomous systems. |

| Rising demand for predictive maintenance solutions | Boosts sensor deployment for condition monitoring, reducing downtime and maintenance costs across critical industrial assets. |

| Growth in electric vehicle and renewable energy sectors | Accelerates the use of sensors in battery management, motor control, and energy monitoring systems for sustainable technologies. |

| Pitfalls & Challenges | Impact |

| High integration and installation costs | Limits adoption among small and mid-sized enterprises due to upfront investment in infrastructure and skilled labor. |

| Interoperability with legacy systems | Creates technical barriers when integrating modern sensors with outdated machinery and control systems. |

| Opportunities: | Impact |

| Cybersecurity risks in connected devices | Opens demand for secure sensor networks and industrial cybersecurity solutions to protect critical infrastructure. |

| Expansion of smart factories and industry 4.0 | Offers vast potential for sensor manufacturers to innovate and scale solutions tailored for intelligent, connected production environments. |

| Market Leaders (2024) | |

| Market Leaders |

Market share of ~8% |

| Top Players |

Collective market share in 2024 ~30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Europe & North America |

| Emerging countries | U.S., Germany, UK, Brazil, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Industrial Machinery Components & Sensors Market Trends

- Industrial machinery components & sensors industry is going through a sharp shift, fueled by the advancement of technology and changing industrial requirements. Perhaps the most notable trend is increasing demand for wireless sensor networks. The systems provide greater flexibility, lower installation costs, and the capability to operate well in remote or dangerous conditions. With industries demanding increased operational efficiency, it is no longer uncommon to see AI and edge analytics combined in sensors.

- This facilitates real-time decision-making and accommodates autonomous operation on multiple manufacturing lines. Indeed, almost 54% of large industrial companies have implemented AI-enabled sensors in mission-critical applications like predictive maintenance, quality control, and vision, reflecting the movement towards intelligent, self-managing systems.

- Another revolutionary trend is the emergence of digital twins computerized replicas of physical systems that reflect live operations. When coupled with AI and sensor feeds, digital twins facilitate predictive modeling, process optimization, and remote diagnostics. This technology is especially influential in industries such as aerospace, automotive, and energy, where accuracy and uptime matter. Through replication of real-life conditions and performance, digital twins enable engineers and operators to foresee failures, simulate scenarios, and optimize operations without affecting actual production. Not only is this more efficient but it also drastically cuts maintenance costs and downtime.

- Sustainability is also becoming a central theme, with ESG objectives and environmental laws compelling industries to turn to energy-efficient equipment and environmentally friendly sensor technologies. Sensors are increasingly used to track emissions, energy usage, and waste, allowing firms to achieve compliance levels while maximizing resource utilization. Also, investment in recyclable materials and low-power sensor designs is on the increase, demonstrating a greater focus on decreasing the industrial carbon footprint. Not only is this environmentally friendly, but it is also in line with consumer and investor expectations of sustainable operations.

Industrial Machinery Components & Sensors Market Analysis

Learn more about the key segments shaping this market

Based on component type, the industrial machinery components & sensors market can be segmented into rotary encoders, process control sensors, circuit protection devices, power and signal components and interface and control components. The rotary encoders accounted for revenue of around USD 156.1 billion in the year 2024 and is estimated to grow at a CAGR of 9.8% from 2025 to 2034.

- As industries increasingly adopt automation and robotics, the need for accurate position and speed feedback systems has surged, and rotary encoders are at the heart of this transformation. These devices are essential for ensuring the smooth operation of motors, actuators, and robotic arms, particularly in sectors like automotive manufacturing, semiconductor fabrication, and packaging.

- Furthermore, the rise of smart factories and Industry 4.0 initiatives has amplified the demand for encoders that can integrate with digital control systems, support real-time monitoring, and enhance operational efficiency. Technological advancements such as optical and magnetic encoder innovations, miniaturization, and wireless connectivity are also expanding in compact and mobile machinery.

Based on application, the industrial machinery components & sensors market is segmented as automotive industry, electronics and semiconductors, food and beverage, pharmaceutical and biotechnology, energy and utilities, aerospace and defense, chemical and process industries and mining and metals. The automotive industry held around USD 79.9 billion in the year 2024 and is estimated to grow at a CAGR of 10.1% during the forecast period.

- This growth is primarily driven by the rapid evolution of the automotive sector, particularly the global shift toward electric vehicles (EVs), autonomous driving technologies, and connected car ecosystems. These advancements require a wide array of sensors and components for functions such as motor control, battery management, driver assistance systems (ADAS), and vehicle-to-everything (V2X) communication.

- Additionally, automotive manufacturers are increasingly adopting smart manufacturing practices, including robotics, machine vision, and predictive maintenance, all of which rely heavily on high-performance sensors and control components. The push for fuel efficiency, safety compliance, and sustainability is further accelerating the integration of advanced industrial components in automotive production lines, making this sector a key growth engine for the market over the forecast period.

Learn more about the key segments shaping this market

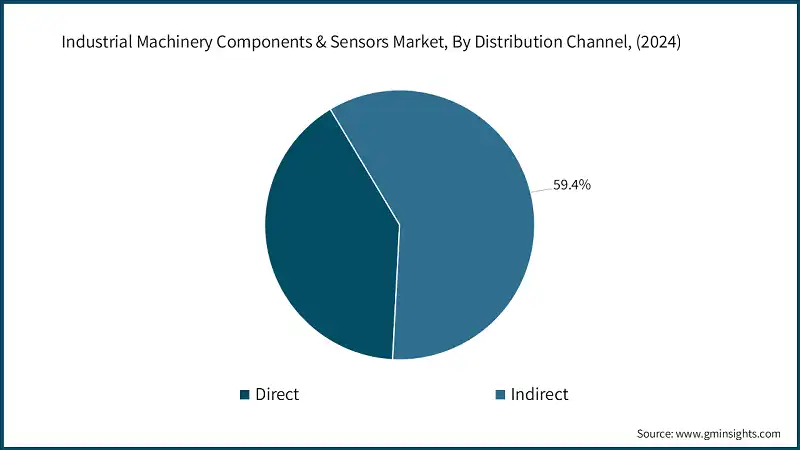

Based on distribution channel, the industrial machinery components & sensors market is segmented as direct and indirect. The indirect distribution channel held around 59.4% of the total market share in 2024 and is anticipated to grow at a CAGR of 9.7% during the forecast period.

- This growth is largely attributed to the increasing reliance on distributors, system integrators, and online B2B platforms that offer broader market reach, localized support, and value-added services. Indirect channels are particularly effective in catering to small and medium-sized enterprises (SMEs) that may not have direct access to manufacturers.

- Additionally, the rise of digital procurement platforms and industrial e-commerce such as Amazon Business, Alibaba, and specialized industrial marketplaces has made it easier for buyers to compare products, access technical support, and manage inventory efficiently. These platforms also enable faster delivery and better after-sales service, which are critical in industrial operations.

Looking for region specific data?

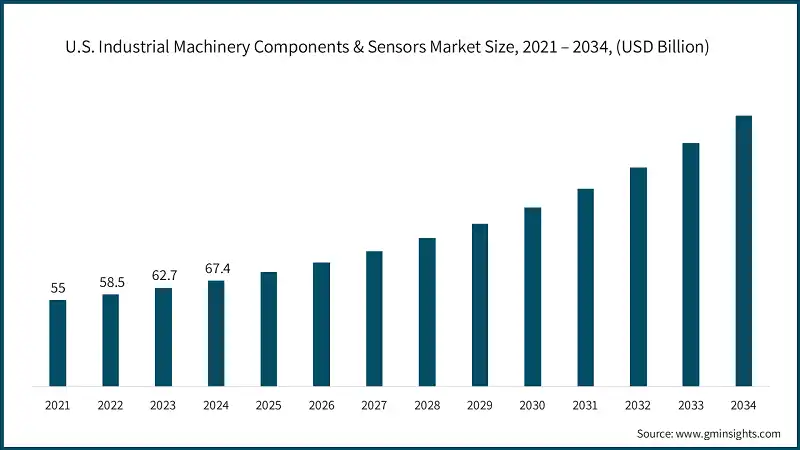

The U.S. dominates an overall North America industrial machinery components & sensors market and valued at USD 67.4 billion in 2024 and is expected to grow at a CAGR of 10.1% during the forecast period from 2025 to 2034.

- This growth is driven by the country's strong industrial base, early adoption of smart manufacturing technologies, and significant investments in automation, AI-integrated sensors, and digital infrastructure. The U.S. market benefits from a well-established ecosystem of OEMs, technology providers, and system integrators, particularly in high-tech sectors such as automotive, aerospace, semiconductors, and energy. Additionally, government initiatives promoting advanced manufacturing, clean energy, and infrastructure modernization are further accelerating the adoption of industrial components and sensors.

In the European industrial machinery components & sensors market, Germany is expected to experience significant and promising growth from 2025 to 2034.

- The country’s strong industrial foundation, particularly in automotive manufacturing, mechanical engineering, and industrial automation sectors that are heavy users of advanced sensors and precision components. As a global leader in Industry 4.0 adoption, Germany continues to invest in smart factories, robotics, and AI-driven production systems, all of which rely on high-performance industrial components and sensor technologies. Moreover, Germany’s emphasis on sustainability, energy efficiency, and digital transformation is accelerating the deployment of intelligent sensor networks and control systems across its industrial landscape. Government-backed initiatives and funding programs aimed at modernizing infrastructure and supporting green technologies are further fueling demand.

The Asia Pacific industrial machinery components & sensors market, China held 32.4% market share in 2024 and is expected to grow at a CAGR of 10.1% during the forecast period from 2025 to 2034.

- This growth is fueled by China’s expansive manufacturing sector, which continues to modernize rapidly through the adoption of smart factory technologies, industrial automation, and AI-integrated sensor systems. The country’s strong focus on becoming a global leader in advanced manufacturing supported by initiatives like “Made in China 2025” has significantly increased demand for high-performance industrial components and sensors.

- Moreover, China’s leadership in electric vehicle production, renewable energy deployment, and infrastructure development is further accelerating the need for precision sensors and control systems. The rise of local OEMs, government-backed innovation hubs, and foreign investments in industrial automation are also contributing to the market’s expansion.

In the Middle East and Africa industrial machinery components & sensors market, Saudi Arabia held 29.4% market share in 2024 and is expected to grow at a CAGR of 8.9% during the forecast period from 2025 to 2034.

- The country’s ambitious industrial diversification efforts under its Vision 2030 initiative, which aims to reduce dependence on oil and expand sectors such as manufacturing, renewable energy, and smart infrastructure is driving the growth of the market. As Saudi Arabia invests heavily in industrial automation, smart city projects, and digital transformation, the demand for advanced sensors and industrial components is rising significantly.

- Additionally, the development of mega-projects like NEOM, smart industrial zones, and automated logistics hubs is creating new opportunities for sensor integration in areas such as energy monitoring, process control, and predictive maintenance. The government’s focus on localizing manufacturing and attracting foreign direct investment (FDI) into high-tech industries is also accelerating the adoption of modern industrial technologies.

Industrial Machinery Components & Sensors Market Share

- In 2024, the prominent manufacturers in industrial machinery components & sensors industry are Rockwell Automation, Honeywell International, Siemens, and Texas Instruments and STMicroelectronics together these companies hold the market share of ~30%.

- Honeywell International, a leader in sensor integration and industrial automation, drives innovation through significant investments in smart sensor technologies. These advancements enhance predictive maintenance, enable remote monitoring, and deliver real-time analytics. A key differentiator is Honeywell Forge, the company's Industrial Internet of Things (IIoT) platform, which leverages AI and machine learning to optimize client operations. Furthermore, Honeywell International places a strong emphasis on cybersecurity, addressing the critical need for secure industrial control systems in today's interconnected manufacturing environments.

- Rockwell Automation excels by deeply integrating control systems, software, and intelligent devices. Its flagship platform, FactoryTalk, provides a unified environment for data analytics, visualization, and control. As a pioneer in digital twin technology, Rockwell empowers manufacturers to simulate and optimize production processes before implementation. Strategic collaborations with industry leaders like Microsoft and PTC enhance Rockwell's capabilities, delivering advanced solutions in cloud automation, edge computing, and augmented reality for industrial training and maintenance.

Industrial Machinery Components & Sensors Market Companies

Major players operating in the industrial machinery components & sensors industry include:

- Amphenol Corporation

- Bosch Sensortec

- Denso Corp

- di-soric

- First Sensor

- Holykell

- Honeywell International

- KELLER AG

- KWJ Engineering

- Merit Sensor

- NXP Semiconductors

- Pepperl+Fuchs

- Proxitron

- Raytek

- Rockwell Automation

- Sensitron

- SICK AG

- Siemens

- STMicroelectronics

- Texas Instruments

Texas Instruments leverages its semiconductor expertise to develop compact, efficient analogue and embedded processing solutions. By focusing on low-power, high-precision sensors, TI addresses the needs of industrial automation, robotics, and energy-efficient systems. The company leads in advanced packaging, AI-driven signal processing, and rugged designs for harsh environments. Additionally, TI supports developers with extensive design tools and reference platforms, accelerating time-to-market and fostering innovation.

Siemens maintains its leadership with a comprehensive portfolio spanning industrial automation, digitalization, and smart infrastructure. Through its Digital Industries division, Siemens delivers integrated solutions, including PLCs, SCADA, HMI, and its industrial IoT platform, MindSphere. As a leader in digital twin technology and AI-driven process optimization, Siemens also prioritizes sustainable manufacturing by developing energy-efficient components and systems aligned with global ESG goals. Its strong European presence and strategic global alliances further reinforce its market leadership.

Industrial Machinery Components & Sensors Industry News

- In February 2025, NXP, a semiconductor leader, acquired Kinara, a trailblazer in edge AI processing. This acquisition enriches NXP’s offerings with neural processing units (NPUs) and advanced AI software. These enhancements enable generative AI and real-time edge computing, particularly in industrial and automotive sectors. This strategic move underscores NXP’s commitment to delivering scalable AI-driven platforms for intelligent systems.

- In March 2025, Siemens completed the acquisition of Altair Engineering Inc., a global authority in simulation, high-performance computing (HPC), and industrial AI software. This acquisition significantly strengthens Siemens’ Xcelerator platform, positioning it as the world's most comprehensive AI-driven industrial software suite. By integrating Altair’s expertise, Siemens enhances its digital twin, simulation, and data science capabilities, enabling faster and smarter product development across industries. This move aligns with Siemens’ broader ONE Tech Company strategy to lead in industrial digitalization and AI advancements.

- In May 2025, Teledyne Technologies Incorporated, a leader in imaging and instrumentation, introduced three advanced variants of industrial CMOS image sensors. Ranging from 1.3 megapixels to an impressive 67 megapixels, these sensors were crafted using a delta space qualification methodology, complemented by rigorous radiation testing, making them ideal for diverse space-centric applications.

- In 2025, STMicroelectronics expanded its industrial sensor portfolio by launching a new line of AI-integrated MEMS sensors designed for predictive maintenance and condition monitoring in smart factories. These sensors combine machine learning cores with low-power edge processing, enabling real-time anomaly detection directly at the sensor level. This innovation supports applications in robotics, industrial automation, and asset tracking, helping manufacturers reduce downtime and improve operational efficiency.

The industrial machinery components & sensors market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Million Units) from 2021 to 2034, for the following segments:

Market, By Component type

- Rotary encoders

- Linear position sensors

- Precision potentiometers

- Resolvers and synchro’s

- Proximity and limit sensors

- Process control sensors

- Pressure sensors

- Temperature sensors

- Flow sensors

- Level sensors

- Vibration and acceleration sensors

- Circuit protection devices

- Surge protection devices

- Overcurrent protection

- ESD protection

- EMI/RFI filters

- Power and signal components

- Magnetic components

- Resistive components

- Capacitive components

- Interface and control components

- Switches and controls

- Connectors and terminals

- Human-machine interface (HMI)

Market, By Application

- Machine tools and metalworking equipment

- CNC machine tools

- Conventional machine tools

- Metal forming equipment

- Material handling and logistics equipment

- Automated guided vehicles (AGVs/AMRs)

- Conveyor and sorting systems

- Industrial cranes and hoists

- Forklifts and warehouse equipment

- Automated storage and retrieval systems

- Process control and automation equipment

- Industrial pumps and fluid handling

- Compressors and pneumatic systems

- Valves and actuators

- Heat transfer and thermal processing

- Mixing and blending equipment

- High-precision manufacturing equipment

- Semiconductor manufacturing equipment

- Pharmaceutical manufacturing equipment

- Medical device manufacturing

- Packaging and processing equipment

- Food and beverage processing

- Packaging machinery

- Automotive manufacturing equipment

- Body shop equipment

- Paint shop equipment

- Final assembly equipment

- Electric vehicle manufacturing

- Power generation equipment

- Traditional power generation

- Renewable energy equipment

- Construction and mining equipment

- Earthmoving equipment

- Mining equipment

- Textile and apparel machinery

- Fiber processing

- Fabric production

- Finishing equipment

- Printing and graphics equipment

- Commercial printing

- Industrial printing

Market, By End Use Industry

- Automotive industry

- Electronics and semiconductor

- Food and beverage

- Pharmaceutical and biotechnology

- Energy and utilities

- Aerospace and defence

- Chemical and process industries

- Mining and metals

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Which region leads the industrial machinery components & sensors sector?

The U.S. leads the North American market, valued at USD 67.4 billion in 2024, with a projected CAGR of 10.1% from 2025 to 2034.

Who are the key players in the industrial machinery components & sensors industry?

Key players include Amphenol Corporation, Bosch Sensortec, Denso Corp, di-soric, First Sensor, Holykell, Honeywell International, KELLER AG, KWJ Engineering, Merit Sensor, NXP Semiconductors, Pepperl+Fuchs, and Proxitron.

What are the upcoming trends in the industrial machinery components & sensors market?

Trends include wireless sensor networks, AI sensors, digital twins, sustainable technologies, and edge analytics for real-time insights.

What is the growth outlook for the indirect distribution channel from 2025 to 2034?

The indirect distribution channel held 59.4% of the market share in 2024 and is anticipated to showcase around 9.7% CAGR through 2034.

What was the valuation of the automotive industry segment in 2024?

The automotive industry segment was valued at USD 79.9 billion in 2024 and is set to expand at a CAGR of 10.1% during the forecast period.

How much revenue did the rotary encoders segment generate in 2024?

The rotary encoders segment generated approximately USD 156.1 billion in 2024 and is expected to witness over 9.8% CAGR till 2034.

What is the market size of the industrial machinery components & sensors in 2024?

The market size was estimated at USD 390.9 billion in 2024, with a CAGR of 9.5% expected through 2034. The growth is driven by the adoption of Industry 4.0, smart manufacturing, and the increasing demand for advanced sensors and precision components.

What is the expected size of the industrial machinery components & sensors industry in 2025?

The market size is projected to reach USD 420.2 billion in 2025.

What is the projected value of the industrial machinery components & sensors market by 2034?

The market is poised to reach USD 954.3 billion by 2034, fueled by advancements in wireless sensor networks, AI integration, and sustainability-focused technologies.

Industrial Machinery Components & Sensors Market Scope

Related Reports