Summary

Table of Content

Industrial Burner on Incineration Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Industrial Burner on Incineration Market Size

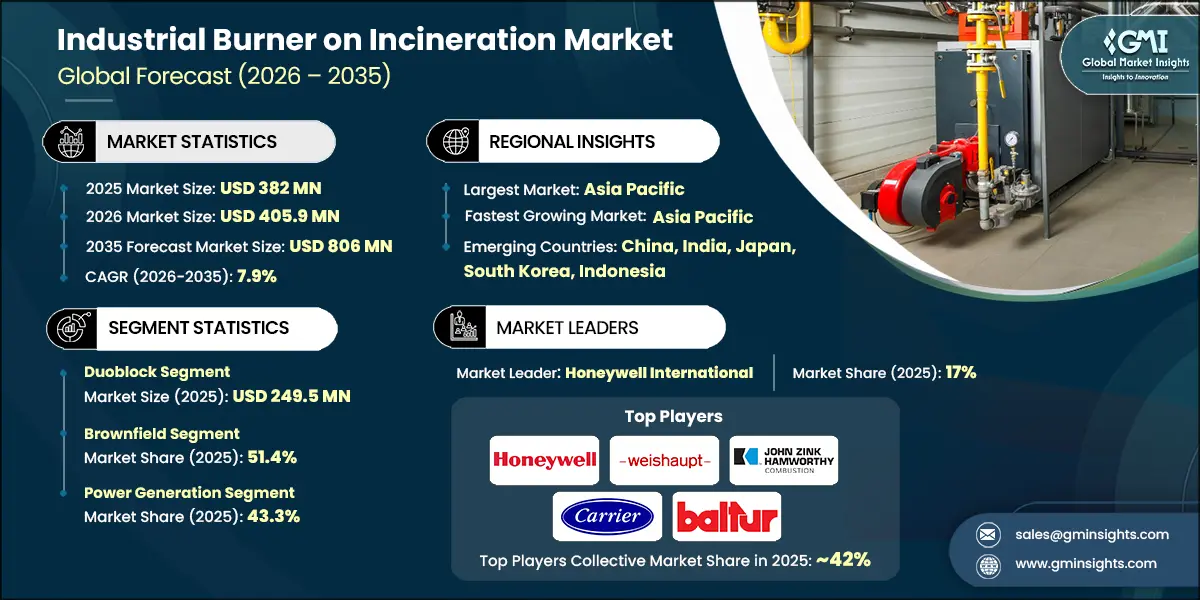

The industrial burner on incineration market was estimated at USD 382 million in 2025. The market is expected to grow from USD 405.9 million in 2026 to USD 806 million in 2035, at a CAGR of 7.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Rising levels of hazardous and industrial waste are creating demand for industrial burners in the incineration industry. Waste streams from chemical, health care and manufacturing activities generate a lot of waste that need controlled or compliant methods of disposal. Incinerator systems use an industrial burner to accomplish stable and high temperature performance from their burning operations. An effective burner allows the complete breakdown of toxic compounds created and reduces harmful emissions emitted during the disposal of the waste. Regulatory bodies require a thermal processing method, for reduction of risk to the public and the environment, that is dependable. Therefore, many operators purchase expensive burners that provide dependable combustion performance under varying waste conditions.

- The increased amount of waste being generated results in longer operating hours, subsequently increasing the demand for durable and efficient burner systems. Modern burners provide greater precision in maintaining the optimal temperature for an incineration process which increases safety and reliability of the operation. Waste Management Facility managers focus on acquiring new equipment that enables compliance with regulatory emission and efficiency requirements.

- The expansion of waste-to-energy facilities globally is driving the growth of the market of industrial burners used to burn waste materials. Waste-to-energy facilities depend on high-efficiency burners that provide reliable energy from waste materials while also converting them safely. Burners designed to produce energy from a wide variety of different types of waste ensure complete combustion while operating at a consistent and steady temperature. Because of this, municipal authorities and Waste-to-Energy Facility Operators have a vested interest in purchasing burners that meet all environmental regulations and limit the production of damaging emissions. The rising demand for energy recovery from waste will encourage new investments in durable and dependable system designs.

- The waste-to-energy projects will also require detailed control over the thermal processes used to generate energy and to provide safe operating conditions for the waste-to-energy facilities. With the ever-increasing growth of cities and the rising amounts of industry, more materials are becoming available to be converted into energy. By using new technologies in developing improved burner designs, manufacturers can produce burners with higher efficiency, lower maintenance needs, plus longer operational lives.

- The duoblock segment on the market for incineration industrial burners is predicated upon its combined & integrated design because duoblock burners house both the burner and fan together, making combustion more efficient. In addition to providing dependable fuel supply, their design permits precise gas-to-air mixing for stable flame control resulting in increased operational efficiencies. Consequently, duoblock burners have been widely adopted in industrial incinerators, waste-to-energy facilities as well as hazardous waste facilities because of their small & simple installation. The rapid growth of industrial waste generation and the growing need to find effective & environmentally compliant means of burning waste material will fuel the use of dual blocks.

Industrial Burner on Incineration Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 382 Million |

| Market Size in 2026 | USD 405.9 Million |

| Forecast Period 2026-2035 CAGR | 7.9% |

| Market Size in 2035 | USD 806 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising volumes of hazardous and industrial waste requiring safe disposal | Higher waste generation increases demand for high-efficiency incineration burners. |

| Expansion of industrial and municipal waste-to-energy facilities | Energy recovery projects boost demand for robust and high-capacity burner systems. |

| Stricter environmental regulations on waste treatment and emission control | Compliance requirements drive adoption of advanced burner systems with precise combustion control. |

| Pitfalls & Challenges | Impact |

| High capital cost of advanced low-emission burner systems | Cost barriers slow adoption in budget-constrained waste management projects. |

| Public opposition and regulatory scrutiny toward incineration facilities | Project delays and cancellations reduce short-term equipment demand. |

| Opportunities: | Impact |

| Development of ultra-low NOx and high-efficiency burner technologies | Advanced designs help operators meet emission norms and improve fuel efficiency. |

| Retrofit demand for aging incinerators to meet updated regulations | Upgrading existing facilities creates sustained replacement demand for burners. |

| Market Leaders (2025) | |

| Market Leader |

17% Market Share |

| Top Players |

Collective market share of ~42% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Japan, South Korea, Indonesia |

| Future outlook |

|

What are the growth opportunities in this market?

Industrial Burner on Incineration Market Trends

- The rise in the generation of industrial waste and hazardous waste is driving the increasing need for incineration burners, with companies looking for effective ways to deal with waste safely while reducing their impact on the environment. Industrial sectors such as chemical, pharmaceutical, and manufacturing depend on burners for the controlled combustion of waste. Regulatory standards also require that all waste be properly incinerated to minimize harmful emissions. Therefore, manufacturers are designing burners that can process a wider variety of waste streams than they were previously.

- Increasingly, companies are looking at energy efficiency and emission reduction as the top priorities when selecting burners. Advanced burners are designed to maximize fuel usage while minimizing NOx and CO emissions. Many industries are now focused on having systems that are compliant with Sarbanes-Oxley Act-compliant super funds environmental regulations, as well as meeting the goals set forth in their sustainability plans. Emerging combustion technologies allow for precise control of temperature and fuel application rates, helping to improve energy recovery process (ERP) and track emission levels during operations by using real-time monitoring systems.

- Municipalities are increasingly adopting waste-to-energy plants to manage urban waste sustainably. Incineration burners play a central role in converting waste into heat or electricity. Governments are promoting infrastructure development to reduce landfill dependence and improve energy recovery. Facility operators require burners that are reliable, maintainable, and compatible with various waste types. Service providers are offering customized solutions for municipal requirements.

- Increasingly modernized incinerator systems use modernized control systems to improve efficiency. Automation of the ratio of air and fuel will allow complete combustion and a constant thermal response from the burner The ability to monitor the burner digitally will allow the measurement of performance in real time and develop a predictive maintenance program. Improved burner construction reduces downtime while increasing reliability and reducing service costs. Manufacturers are developing modernized burners which are compact and modular for use in existing and new installations.

- Thermal destruction of hazardous, medical, and chemical waste is needed by many industries. Burners need to cope with corrosive or toxic waste while providing a safe environment for operators and meeting environmental regulatory requirements. Service companies are tailoring burners to meet each customer's specific operational needs. Reliability, durability, and low emission performance are important to industrial customers, and manufacturers are developing solutions to increase burner life and reduce operation risk.

Industrial Burner on Incineration Market Analysis

Learn more about the key segments shaping this market

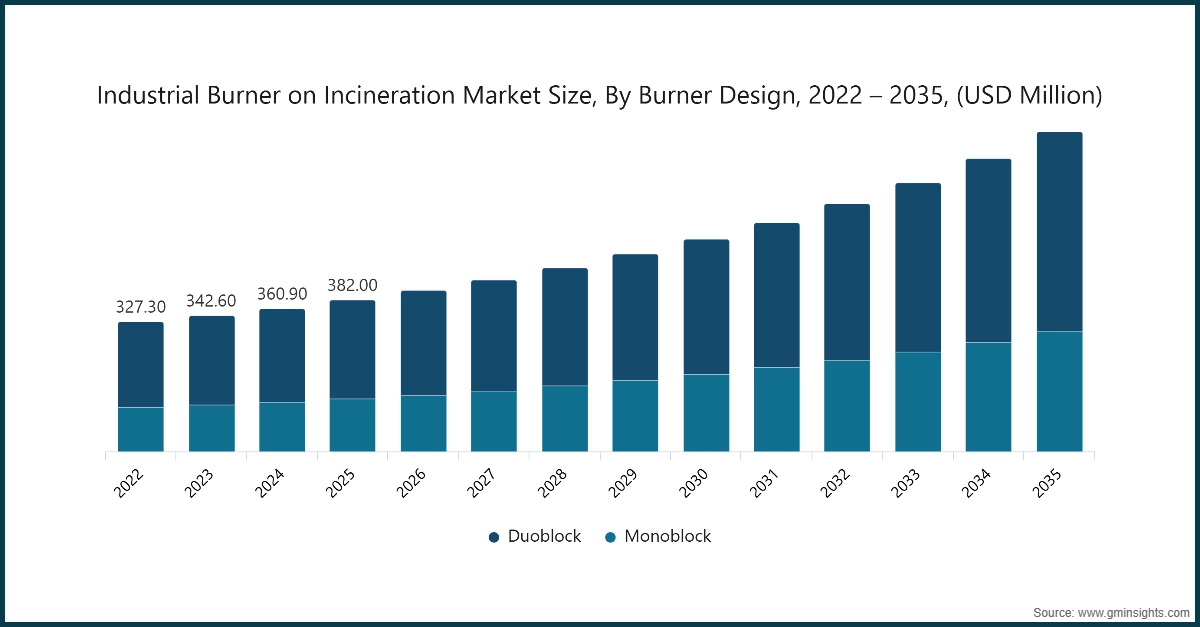

Based on burner design, the industrial burner on incineration market is categorized into monoblock and duoblock. The duoblock segment accounted for revenue of around USD 249.5 million in 2025 and is anticipated to grow at a CAGR of 7.4% from 2026 to 2035.

- The duoblock burner design dominates the industrial burner on incineration industry due to its integrated configuration that combines the burner and fan into a single unit. This design ensures precise air-fuel mixing, stable flame control, and efficient combustion, improving overall operational performance. Compact construction allows easier installation and maintenance, making it suitable for industrial incinerators, waste-to-energy plants, and hazardous waste treatment facilities.

- Rising industrial waste volumes and increasing demand for energy-efficient, environmentally compliant combustion solutions are driving adoption. The reliability, efficiency, and space-saving advantages of duoblock burners position this design as the leading choice in the global industrial burner on incineration industry .

Based on installation, industrial burner on incineration market consists of brownfield and greenfield. The brownfield emerged as leader and held 51.4% of the total market share in 2025 and is anticipated to grow at a CAGR of 8.1% from 2026 to 2035.

- The brownfield installation segment holds a major share in the industrial burner on incineration industry due to the growing need to upgrade or retrofit existing facilities. Brownfield projects involve integrating advanced burners into operational incinerators, enhancing combustion efficiency and reducing emissions without requiring entirely new infrastructure. Industries including waste-to-energy, chemical, and municipal waste management adopt this approach to meet regulatory standards and improve operational performance.

- Cost-effectiveness, reduced downtime, and compatibility with existing systems drive preference for brownfield installations. Increasing focus on optimizing legacy facilities and extending equipment lifespan reinforces the prominence of brownfield projects in the market.

Learn more about the key segments shaping this market

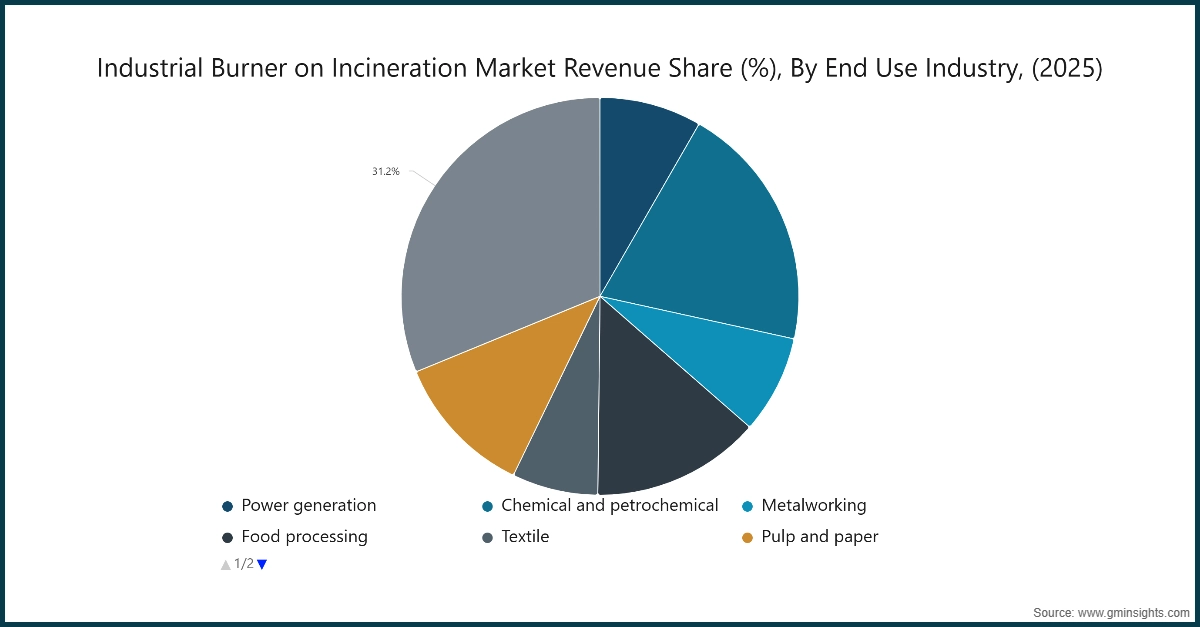

Based on end use industry, industrial burner on incineration market consists of power generation, chemical and petrochemical, metalworking, food processing, textile, pulp and paper, others. The power generation emerged as leader and held 43.3% of the total market share in 2025 and is anticipated to grow at a CAGR of 7.9% from 2026 to 2035.

- The power generation segment holds the largest share in the industrial burner on incineration industry due to the critical role of burners in producing energy from waste and fuel combustion. Industrial burners are used in thermal power plants and waste-to-energy facilities to ensure efficient heat generation, stable flame control, and reduced emissions.

- Growing electricity demand, expansion of renewable and alternative energy projects, and stringent environmental regulations are driving adoption. High operational reliability and energy efficiency requirements make industrial burners essential for continuous power production. The need for optimized combustion processes in power generation reinforces this segment’s leading position in the market.

Asia Pacific Industrial Burner on Incineration Market

Looking for region specific data?

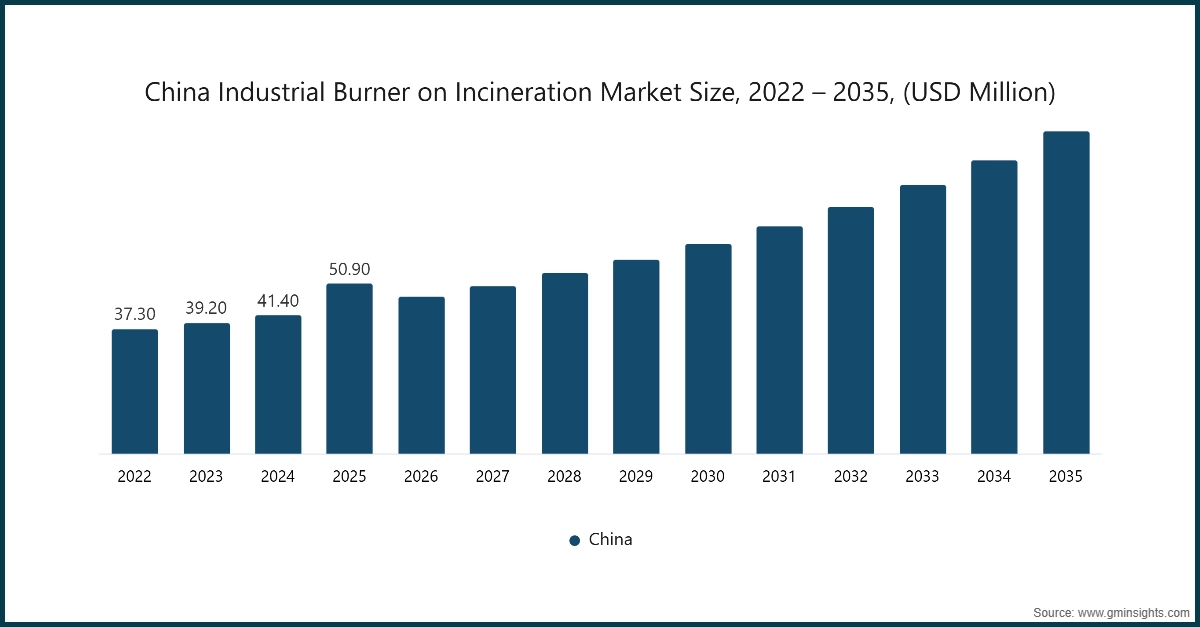

China dominates an overall Asia Pacific industrial burner on incineration market and valued at USD 50.9 million in 2025 and is estimated to grow at a CAGR of 8.3% from 2026 to 2035.

- The China industrial burner on incineration industry is driven by rapid industrialization and increasing volumes of hazardous and municipal waste. Power plants, chemical manufacturing facilities, and waste-to-energy plants require high-capacity burners for efficient waste combustion and energy recovery. Government regulations on waste management and emission control promote adoption of advanced incineration systems with integrated burners. Industrial sectors demand reliable, high-performance burners capable of handling diverse fuel types and operating continuously under high thermal loads. Urbanization and expansion of municipal waste treatment infrastructure further support market growth.

- Technological advancements in burner design, including improved combustion efficiency and emission reduction, enhance operational performance and compliance with environmental standards. China’s strong manufacturing base also facilitates domestic production of industrial burners, making advanced solutions more accessible for local incineration projects. Rising environmental awareness and stricter regulatory enforcement drive continuous investment in efficient, safe, and high-capacity industrial burner systems.

North America Industrial Burner on Incineration Market

In the North America industrial burner on incineration industry, the U.S. held 73.6% market share in 2025 and is anticipated to grow at a CAGR of 8% from 2026 to 2035.

The U.S. industrial burner on incineration industry is driven by demand from municipal waste-to-energy plants and industrial facilities, including chemical and pharmaceutical sectors. Aging incineration infrastructure and stricter emission regulations encourage upgrades and retrofitting of burners to improve efficiency and reduce pollutants. Industrial operators prioritize burners capable of handling multiple fuel types, including hazardous and low-calorific waste, to optimize combustion.

- Investment in energy recovery systems enhances demand for high-capacity, reliable burners. Advanced monitoring and control technologies support compliance with environmental standards and operational safety requirements. Growing focus on sustainable waste management and reduction of landfill usage drives adoption of modern burner systems across municipal and industrial applications.

Europe Industrial Burner on Incineration Market

In the Europe industrial burner on incineration industry, Germany is expected to experience significant and promising growth from 2026 to 2035.

- Industrial burner systems for incinerating waste are heavily influenced by European environmental regulations and emission control legislation, especially throughout Germany, France, and the United Kingdom. Advanced burner systems are necessary to achieve both high levels of operational combustion efficiency and low levels of pollutants released from municipal and industrial waste incinerators. The chemical, pharmaceutical, and food processing industries require burner systems capable of processing a wide variety of waste materials and still provide a considerable amount of energy recovery efficiency.

- Maintenance and upgrading of the existing incineration infrastructures force many companies to invest in high-performance burners. The availability of digital control technologies, automated fuel handling systems, and emissions monitoring systems assure companies of regulatory compliance and operational safety. The European commitment toward sustainable waste management practices and the use of waste to recover energy promotes continued growth for many businesses operating within the European waste industry.

Middle East and Africa Industrial Burner on Incineration Market

In the Middle East and Africa industrial burner on incineration industry, Saudi Arabia held a significant market share in 2025 promising growth from 2026 to 2035.

- The MEA industrial burner on incineration industry is driven by rapid urbanization, industrial growth, and increasing volumes of municipal and hazardous waste. Countries such as the UAE, Saudi Arabia, and South Africa are investing in waste-to-energy facilities and industrial incinerators to manage growing waste streams. High-temperature and large-capacity burners are required to operate efficiently in extreme climatic conditions.

- Industrial sectors, including oil, gas, and chemical processing, demand reliable and robust burner systems capable of continuous operation. Limited local manufacturing encourages reliance on imported high-performance burners from Europe and Asia. Environmental regulations and sustainability initiatives further promote adoption of advanced incineration solutions with improved combustion efficiency and emission control.

Industrial Burner on Incineration Market Share

In 2025, the prominent manufacturers in industrial burner on incineration industry are Honeywell International, Max Weishaupt, John Zink Hamworthy Combustion, Carrier, and Baltur collectively held the market share of ~42%. Honeywell is a global combustion and burner technology leader, offering advanced industrial burners, low-NOx systems and integrated control platforms. The company invests in IoT-enabled combustion management and low-emission burner upgrades to serve energy, petrochemical and municipal incineration applications. Honeywell’s global service network and automation expertise help support retrofits and energy-efficiency initiatives. Weishaupt is a German burner specialist known for high-precision gas and dual-fuel burners with low emissions and robust performance in industrial heating and incineration. The company emphasizes energy efficiency and digital diagnostics. Weishaupt’s strong presence in Europe and expanding global service footprint support adoption across manufacturing, chemical and power sectors.

Industrial Burner on Incineration Market Companies

Major players operating in the industrial burner on incineration industry include:

- Alfa Laval

- Babcock Wanson

- Baltur

- Bloom Engineering Company

- Carrier

- Fives Group

- Forbes Marshall Pvt. Ltd.

- Honeywell International

- John Zink Hamworthy Combustion

- Limpsfield Combustion Engineering

- Max Weishaupt

- Miura America Co.

- Oilon Group Oy

- QED Combustion

- Selas Heat Technology Company

John Zink Hamworthy is a prominent supplier of heavy-duty industrial burners and combustion solutions, focused on ultra-low emissions and hydrogen-capable systems. Its technology is widely used in refining, petrochemical, incineration and process industries. Strong engineering services and project execution capabilities underpin its market position.

Carrier’s Riello burner division is a key player in industrial and commercial combustion, offering a diverse range of gas, oil and hybrid burners. Riello’s products are known for reliability and emission compliance. The company continuously enhances fuel flexibility and controls to meet evolving regulatory requirements in industrial incineration and process heating.

Baltur competes with a broad portfolio of industrial burners and combustion modules suited to heat-treating, process, HVAC and incineration applications. The company emphasises compact, modulating burner designs and medium-power solutions that support diverse industrial needs. Continuous product innovation sustains its regional and global growth.

Industrial Burner on Incineration Industry News

- In September 2025, Fives Group unveiled the ITAS Invistableflame flameless burner at Gastech 2025. This burner is designed to achieve ultra?low NO? emissions and offers fuel flexibility from natural gas to hydrogen, supporting energy transition goals in industrial combustion.

- In June 2025, Alfa Laval secured a contract to supply the world’s first marine boiler system for ammonia waste incineration for four multi?gas carriers. The system integrates advanced combustion solutions to safely incinerate ammonia and support regulatory compliance onboard large vessels.

- In December 2024, Honeywell announced an expansion of its licensing agreement with AFG Combustion to include Callidus Ultra Blue hydrogen?capable process burners. These burners are designed for enhanced flexibility, capable of operating with high hydrogen blends to reduce carbon emissions in industrial heat applications.

- In June 2024, Riello launched a new high?efficiency multi?fuel burner series for industrial boilers capable of running on natural gas, fuel oil, and LPG with reduced NO? emissions.This development supports combustion flexibility in industrial heat and process systems.

The industrial burner on incineration market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Burner Design

- Monoblock

- Duoblock

Market, By Installation

- Brownfield

- Greenfield

Market, By Power Range

- < 300 kW

- 300 kW - 1 MW

- 1 - 5 MW

- 5 - 20MW

- 20 - 50 MW

- > 50 MW

Market, By End Use Industry

- Power generation

- Chemical and petrochemical

- Metalworking

- Food processing

- Textile

- Pulp and paper

- Others

The above information is provided for the following regions and countries:

North America

- The U.S.

- Canada

Europe

- Germany

- UK

- France

- Italy

- Spain

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

Latin America

- Brazil

- Mexico

- Argentina

MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the industrial burner on incineration industry?

Key players include Alfa Laval, Babcock Wanson, Baltur, Bloom Engineering Company, Carrier, Fives Group, Forbes Marshall Pvt. Ltd., Honeywell International, John Zink Hamworthy Combustion, Limpsfield Combustion Engineering, and Max Weishaupt.

What are the upcoming trends in the industrial burner on incineration market?

Key trends include advanced combustion technologies for higher energy efficiency, real-time emission monitoring, waste-to-energy integration, automated air–fuel ratio control, and modular burner designs for better compatibility and reliability.

Which region leads the industrial burner on incineration sector?

China leads the Asia Pacific market, valued at USD 50.9 million in 2025, with a projected CAGR of 8.3% through 2035. Growth is driven by rapid industrialization, increasing waste volumes, and stringent government regulations on waste management and emissions.

What was the market share of the power generation segment in 2025?

The power generation segment accounted for 43.3% of the total market share in 2025 and is set to expand at a CAGR of 7.9% up to 2035.

What was the market share of the brownfield segment in 2025?

The brownfield segment held 51.4% of the total market share in 2025 and is expected to grow at a CAGR of 8.1% till 2035.

How much revenue did the duoblock segment generate in 2025?

The duoblock segment generated approximately USD 249.5 million in 2025 and is anticipated to grow at a CAGR of 7.4% from 2026 to 2035.

What is the expected size of the industrial burner on incineration industry in 2026?

The market size is projected to reach USD 405.9 million in 2026.

What was the market size of the industrial burner on incineration in 2025?

The market size was USD 382 million in 2025, with a CAGR of 7.9% expected through 2035. The rising levels of hazardous and industrial waste are driving market growth.

What is the projected value of the industrial burner on incineration market by 2035?

The market is projected to reach USD 806 million by 2035, driven by increasing waste generation, regulatory compliance requirements, and advancements in burner technology.

Industrial Burner on Incineration Market Scope

Related Reports