Summary

Table of Content

India Natural Fiber Insulation Materials Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

India Natural Fiber Insulation Materials Market Size

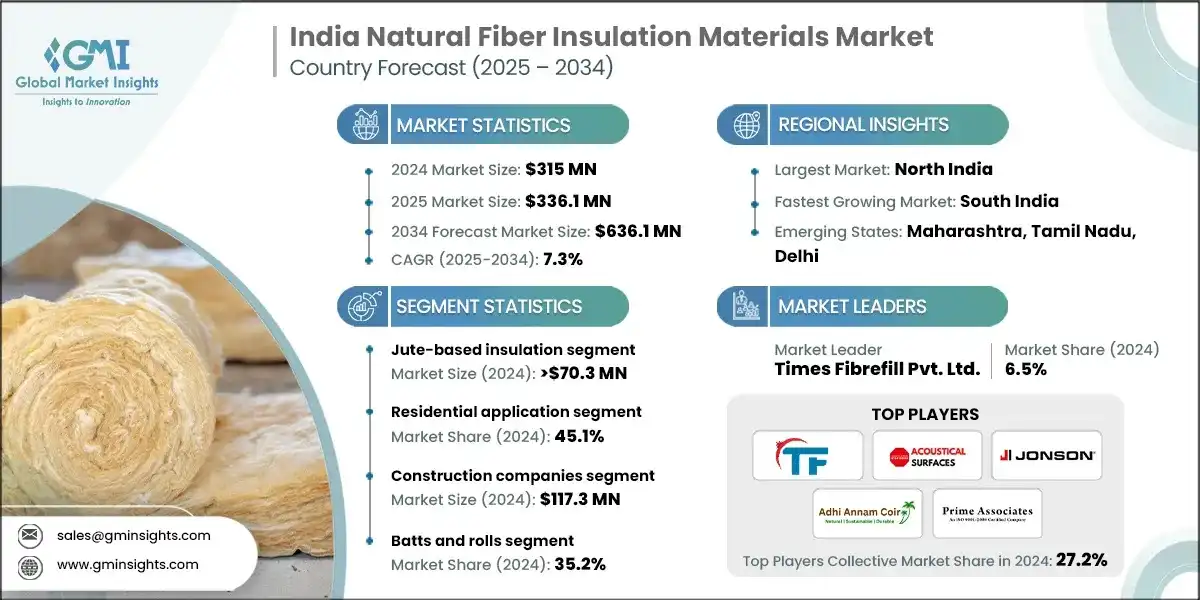

India natural fiber insulation materials market was estimated at USD 315 million in 2024. The market is expected to grow from USD 336.1 million in 2025 to USD 636.1 million in 2034, at a CAGR of 7.3% according to the latest report published by Global Market Insights Inc.

To get key market trends

- India natural fiber insulation materials market record significant growth because of increased awareness of sustainable construction practices & environmental concerns. Market dynamics arise from the rising demand for eco-friendly materials in buildings, driven by various government initiatives promoting green buildings and energy efficiency. Jute, coir, hemp, and banana fibers are natural fibers increasingly preferred because of their biodegradability, low-cost, and excellent thermal insulation properties.

- Residential, commercial and industrial buildings of the most significant use are the application landscape. In residential buildings thermal comfort and performance enhancement, as well as reduced energy consumption represent the value of natural fiber insulation. Many commercial and industrial sectors are using these inputs to comply with stringent environmental regulation standards and attain sustainability certifications like LEED.

- These materials are sustainable, alternates to synthetic insulations like fiberglass and foam. Indoor air quality improvements, moisture regulation, and biodegradability tend to be contributing factors consistent with India's environmental goals. Producing fiber from agricultural waste enhances rural economy development and waste management initiatives.

- North India is the leading region in this market because of the green consumers in the region, the alternative sources for green materials available in the North, the technological advancement, and the demand for the region's construction solutions.

- South India is the fastest growing region owing to increasing urbanization and a growing demand for sustainability and quality product.

India Natural Fiber Insulation Materials Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 315 Million |

| Forecast Period 2025 - 2034 CAGR | 7.3% |

| Market Size in 2034 | USD 636.1 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising environmental awareness and demand for eco-friendly building materials | This drives consumer and builder preferences toward natural fiber insulation, accelerating market adoption and encouraging manufacturers to innovate and expand product offerings. |

| Government initiatives promoting green construction and energy efficiency | Regulatory support and incentives facilitate market growth by reducing barriers, encouraging builders to incorporate natural fiber insulations, and fostering industry standards. |

| Increasing adoption of sustainable insulation solutions in residential and commercial sectors | As more sectors recognize benefits, demand increases, leading to economies of scale, lower costs, and wider acceptance of natural fiber insulation materials. |

| Pitfalls & Challenges | Impact |

| High initial costs and limited awareness among consumers | Higher upfront expenses and lack of consumer knowledge hinder adoption, slowing market growth and limiting penetration especially in price-sensitive segments. |

| Variability in fiber quality and supply chain challenges | Inconsistent quality and supply disruptions can compromise product reliability, affecting consumer confidence and market stability. |

| Opportunities: | Impact |

| Growing demand for biodegradable and renewable insulation materials | Increased interest creates avenues for innovation, new product development, and market differentiation, expanding customer base. |

| Expansion into rural markets and small-scale construction projects | Tapping into rural and small-scale sectors broadens market reach, accelerates adoption, and supports rural economic development. |

| Market Leaders (2024) | |

| Market Leaders |

6.5% market share |

| Top Players |

Collective market share of 27.2% in 2024 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North India |

| Fastest growing market | South India |

| Emerging states | Maharashtra, Tamil Nadu, Delhi |

| Future outlook |

|

What are the growth opportunities in this market?

India Natural Fiber Insulation Materials Market Trends

Increased environmental awareness, government initiatives, and sustainable construction practices have fostered conducive conditions for the needs of the India natural fiber insulation materials industry to grow at a fast pace. Advancement in technology has played a major role with innovations in fiber processing bonding techniques & composite formulations imparting better thermal, acoustic, and durability performance to natural fiber insulations. The recent development of bio-based binders and treated fibers has enhanced the performance of these products while ensuring ecological safety.

Product innovations continue to thrive as manufacturers are working on a wider specification range of natural fibers such as jute, coir, hemp, and banana fibers for certain insulation applications. These materials offer commercial biodegradability, a low carbon footprint, and very good insulation properties, meeting the demand for sustainable building materials. In addition, hybrid insulation products based on natural fibers and recycled/ bio-based materials are surfacing, thus giving a better performance and sustainability report.

Sustainability remains the main focus of the market, which supports the environment in line with India’s greater goals. In addition, with an increasing number of qualifying natural fiber insulations, green building certifications such as LEED and GRIHA have provided incentives for their use.

India Natural Fiber Insulation Materials Market Analysis

Learn more about the key segments shaping this market

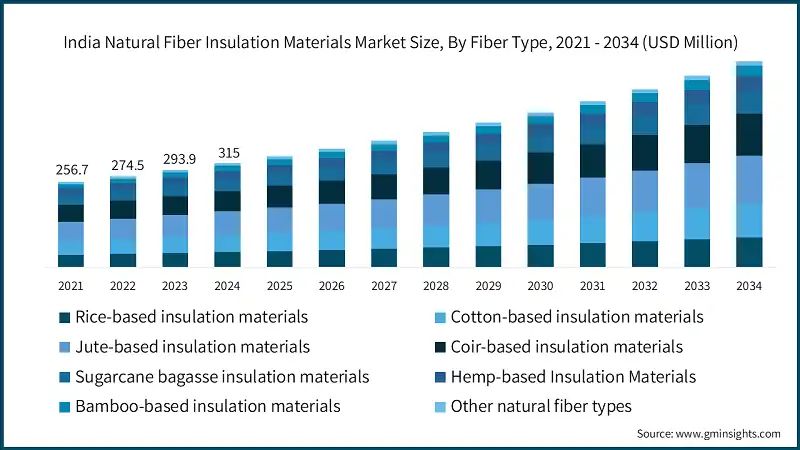

Based on fiber type, the market is segmented into rice-based insulation materials, cotton-based insulation materials, jute-based insulation materials, coir-based insulation materials, sugarcane bagasse insulation materials, bamboo-based insulation materials, other natural fiber types. The jute-based insulation crossed USD 70.3 million in 2024, with 7.9% CAGR expected through 2034.

- The natural fiber insulation market is growing in India with attention to several fibers. Jute is the most important of these with its availability, cost & biodegradability making it very useful. It is generally popular in low-cost and rural housing that is increasingly supported by government policies on sustainable housing.

- Rice-based insulation is coming into the limelight with India's huge production of rice having CAGR of 7.1%. Rice husks are lightweight and eco-friendly, scoring them potential market access in rural applications with advances in technology. Cotton offers the best insulation in terms of thermal and acoustic performance; however, these benefits are outweighed by the high costs and pest susceptibility.

- Sugarcane bagasse, the dried fibrous used after juice extraction, is being developed as a cheap and eco-friendly material for advanced insulation techniques as agricultural waste is being increasingly utilized.

- Bamboo is expected to gain importance in insulation technology, as it is fast renewable and has good sustainable credentials for today's conscious construction. Other fiber development, such as that of hemp and banana fiber, is in a much developmental stage and could lead to further diversification. Jute and coir have thus far dominated, but these add-on fibers would provide valuable opportunities for sustainable insulation solutions in India in the future.

Learn more about the key segments shaping this market

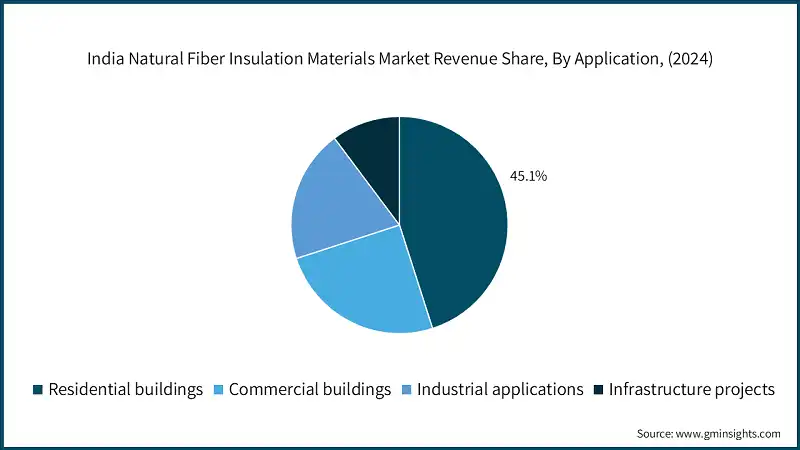

Based on application the market is segmented into residential buildings, commercial buildings, industrial applications, infrastructure projects. The residential application commands the major market share of 45.1% in 2024 and expected to grow at a CAGR of over 6.7% from 2025 to 2034.

- The trend regarding natural fiber insulation varies in India in different sectors. Residential buildings mostly account for the bulk of the demand and their market share. The soaring use of natural fiber insulation in residential projects results from growing awareness of sustainable and eco-friendly building practices combined with the incentives the government is extending to promote green buildings. Among these fibers, jute, coir, and rice husk receive most acceptance due to their low cost, thermal insulation, and biodegradability, making them ideally suited for rural and low-cost housing as well as exclusive eco-homes.

- Infrastructure projects, especially those aspiring for green building certifications, have been very quickly embracing natural fibers for insulation, soundproofing, and other building applications. Although with a considerable market share, these sectors are slow in growth compared with the residential ones because of higher standards of materials and costs involved.

Based on the end user market is segmented into construction companies, building material manufacturers and distributors, government and public sector, industrial end-users. The construction companies hold the market size of USD 117.3 million in 2024 and expected to grow at a 7.6% CAGR till 2034.

- Construction companies are the main promotors of eco-friendly material adoption in the country. Government support for sustainable and green building certifications such as LEED in India has led these companies to embrace natural fiber insulation in their homes, commercial entities, and infrastructure projects. They are now focused on energy-efficient, environmentally responsible buildings and are therefore the most prominent promoter of natural fiber in urban development and large projects within India.

- These building material manufacturers and distributors emerging with the current trends are also elevating their product lines with that of natural fiber insulation. Based on market trends, the focus of such companies is on developing affordable, durable, and fire-resistant fibers, often in collaborative research ventures with research institutes.

- The industrial end-user sectors which include textiles, manufacturing and infrastructure, increasingly utilize natural fibers to fit into various insulation and insulation applications. These end-users have moderate growth, although their rate of growth is less than that of construction companies.

Based on the form market is segmented into batts and rolls, boards and panels, loose-fill insulation, specialty forms. Batts and rolls command the 35.2% of the market share in 2024 and expected to grow at a CAGR of over 7.6% from 2025 to 2034.

- Batts and Rolls, because of their adaptability, ease of installation, and low cost, tend to dominate the residential and commercial projects. However, the demand for sustainable and environmentally safe materials is growing for all insulation types, including boards and panels, loose-fill insulation, and specialty forms, out of environmental concern and compliance with strict regulations.

- Product formulation innovations which are meant to improve thermal and fire performance are in the news. Also, the market is beginning to embrace smart insulation products with moisture and air barrier properties. While Batts and Rolls have been steadily holding the upper hand in the market, increased competition from alternative insulation forms is being witnessed in specialized markets. All these factors lead to the conclusion that sustainability, innovations, and efficiency determine the future of insulation products.

Looking for region specific data?

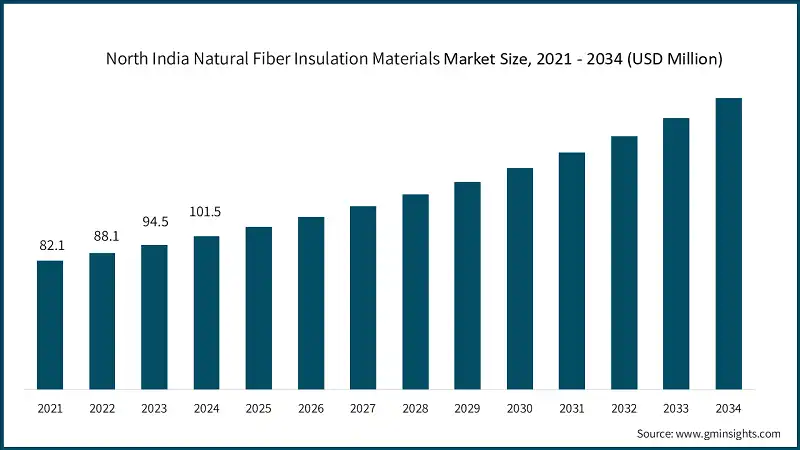

North India dominated the India natural fiber insulation materials market in captured 32.5% share and generated USD 101.5 million in revenue in 2024.

- North India is experiencing steady growth in the market for natural fiber insulation materials, where awareness regarding sustainable building practices among people coupled with government programs promoting eco-friendly constructions have propelled the market. The demand for natural fiber insulation in Delhi, Haryana, and Punjab was due to surges in urbanization and a focus on energy efficiency.

- West India comprises of states such as Maharashtra, Gujarat, and Rajasthan, the rapid urbanization and industrial growth, also together with the emerging market for natural fiber insulation materials, spread their wings in West India. Construction in this part of India is majorly focused on energy-efficient green buildings that, themselves, demand market spaces for eco-friendly insulation solutions.

- The rapid developments in the aspect of natural fiber insulation in South India have grown tremendous interest with sustainable architecture wherein green building practices are now commonly adopted. Tamil Nadu, Karnataka, and Kerala are some of the most important states asset-wise having plenty of natural resources such as coir and jute that could be converted into artificial insulation material.

- The natural fiber insulation market is beginning to make inroads in East India, encompassing West Bengal, Odisha, as well as Assam, with various regional initiatives developing sustainable development. There is strict scope for abundant resources like jute and coir, which act as the cheapest bio and eco-friendly raw materials for insulation products. The building trend toward using alternatives that use greener and more biodegradable insulation is primarily a consequence of elevating awareness of climate change and environmental issues.

- The market of the natural fiber insulating material is still at its developing stages in Central India. However, it is in the right direction of showing an upsurge potential backed by the growing awareness of environmental issues and government incentives towards eco-friendly construction. Such resourceful states as Madhya Pradesh and Chhattisgarh are known for their natural fibers like hemp and jute, which provide a very strong raw-material base.

India Natural Fiber Insulation Materials Market Share

Top 7 companies include Times Fibrefill Pvt. Ltd., Acoustical Surfaces, Godson Tapes Private Limited, Adhi Annam Coir Comforts, Prime Associates, Owens Corning, Saint-Gobain. These are prominent companies within the market operating in their respective regions and accounting the market share of 38.9%. These companies hold strong positions due to their extensive experience in India natural fiber insulation materials market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand for India natural fiber insulation materials across various regions.

- Times Fibrefill Pvt. Ltd.: Times Fibrefill Pvt. Ltd. specializes in insulation products made from natural fibers. The company has market with a share of 6.5% in 2024. An emphasis on eco-friendly and sustainable materials allows them to compete effectively in the burgeoning green construction segment of India.

- Acoustical Surfaces: Acoustical Surfaces basically serves the acoustic treatment market with insulation solutions. It’s very long experience with acoustic products will help with diversification into the realm of natural fiber insulation as it can rely on the existing customer network built with its construction and renovation practice. Their edge comes from technological innovation and focuses on high-performance materials.

- Adhi Annam Coir Comforts: Adhi Annam Coir Comforts is one of the largest coir-insulation and coir-products companies in the country. Their extended knowledge in natural coir fiber makes them strong competitors in the natural fiber insulation market, especially in eco-friendly and biodegradable insulation solutions.

- Prime Associates: Prime Associates is a conglomerate diversified in several industries including construction materials on natural fiber insulation products. With extensive distribution and marketing capabilities they have an edge. Their quality and customer-focus strategy are enabling them to gain market shares.

- Owens Corning: Owens Corning is the world leader in insulation and building materials, having a stronghold in India as well. It competes heavily due to its R&D, brand equity, and technology innovations spread across all insulation including natural fiber options. The excellent products and full solutions have established it as a household name.

- Saint-Gobain: This is yet another large player having multinational stature and portfolio in construction and insulation materials. This company has steadily invested in sustainable green building solutions, which also includes natural fiber-based insulation. Wide distribution, high reputation of its brand, and strong focus on innovation are the competitive advantages.

India Natural Fiber Insulation Materials Market Companies

Major players operating in the India natural fiber insulation materials industry are:

- Times Fibrefill Pvt. Ltd.

- Acoustical Surfaces

- Godson Tapes Private Limited

- Adhi Annam Coir Comforts

- Prime Associates

- BASF

- Owens Corning

- Saint-Gobain

- Knauf Insulation

India Natural Fiber Insulation Materials Industry News:

- In July 2024, Echon publicized about its expansion plans in India through increased domestic distribution. It sought to reinvent the construction environment in India with its advanced and eco-friendly building materials.

- In April 2022, Inovar Laminate Flooring introduced bony Building Systems with a thickness of 8 mm, amounting to INR 110/sq. ft. in Kochi, Kerala.

The India natural fiber insulation materials market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue (USD Million) and (Tons) in volume from 2021 - 2034 for the following segments:

Market, Fiber Type

- Rice-based insulation materials

- Rice husk insulation

- Rice straw insulation panels

- Cotton-based insulation materials

- Cotton stalk fiber insulation

- Recycled cotton textile insulation

- Jute-based insulation materials

- Jute fiber insulation batts

- Jute nonwoven insulation materials

- Coir-based insulation materials

- Coconut coir fiber insulation

- Coir composite panels

- Sugarcane bagasse insulation materials

- Hemp-based insulation materials

- Industrial hemp fiber insulation

- Hemp composite materials

- Bamboo-based insulation materials

- Bamboo fiber insulation panels

- Bamboo composite insulation

- Other natural fiber types

- Wheat straw insulation

- Flax and kenaf fiber insulation

- Palm fiber and banana fiber insulation

Market, By Application

- Residential buildings

- Individual houses and bungalows

- Apartment complexes and housing societies

- Affordable housing projects (PMAY)

- Commercial buildings

- Office buildings and it parks

- Retail and shopping centers

- Hotels and hospitality sector

- Educational institutions and schools

- Healthcare facilities and hospitals

- Industrial applications

- Manufacturing facilities and warehouses

- Cold storage and food processing

- Textile and garment industries

- Chemical and pharmaceutical plants

- Infrastructure projects

- Smart cities development

- Transportation infrastructure

- Government and public buildings

- Agricultural infrastructure and storage

Market, By End Use

- Construction companies

- Building material manufacturers and distributors

- Government and public sector

- Industrial end-users

- Manufacturing companies

- Food processing and cold chain

- Textile and apparel industry

- Chemical and process industries

Market, By Form

- Batts and rolls

- Flexible insulation batts

- Continuous roll insulation

- Pre-cut insulation panels

- Boards and panels

- Rigid insulation boards

- Semi-rigid panels

- Composite insulation panels

- Loose-fill insulation

- Blown-in insulation

- Poured insulation

- Spray-applied insulation

- Specialty forms

- Pipe insulation

- Duct insulation

- Reflective insulation systems

The above information is provided for the following regions and countries:

- North India

- Delhi NCR

- Punjab

- Haryana

- Uttar Pradesh

- Uttarakhand

- Himachal Pradesh

- Jammu & Kashmir

- West India

- Maharashtra

- Gujarat

- Rajasthan

- Goa

- South India

- Tamil Nadu

- Karnataka

- Kerala

- Andhra Pradesh and Telangana

- East India

- West Bengal

- Odisha

- Jharkhand

- Bihar

- Northeast States

- Central India

- Madhya Pradesh

- Chhattisgarh

Frequently Asked Question(FAQ) :

Who are the key players in the India natural fiber insulation materials market?

Key players include Times Fibrefill Pvt. Ltd., Acoustical Surfaces, Godson Tapes Private Limited, Adhi Annam Coir Comforts, Prime Associates, BASF, Owens Corning, Saint-Gobain, Knauf Insulation.

Which region leads the India natural fiber insulation materials market?

North India held 32.5% share with USD 101.5 million in 2024. Strong environmental awareness, government programs, and urbanization in Delhi, Haryana, and Punjab fuel the region's dominance.

What are the upcoming trends in the India natural fiber insulation materials market?

Key trends include innovations in fiber processing and bonding techniques, development of bio-based binders, hybrid insulation products combining natural fibers with recycled materials, and increasing adoption of green building certifications like LEED and GRIHA.

What is the market size of India natural fiber insulation materials in 2024?

The market size was USD 315 million in 2024, with a CAGR of 7.3% expected through 2034 driven by increased environmental awareness and government initiatives promoting sustainable construction practices.

What is the projected value of the India natural fiber insulation materials market by 2034?

The India natural fiber insulation materials market is expected to reach USD 636.1 million by 2034, propelled by rising demand for eco-friendly building materials and sustainable construction solutions.

What is the growth outlook for batts and rolls segment form from 2025 to 2034?

Batts and rolls segment is projected to grow at 7.6% CAGR till 2034, due to their adaptability, ease of installation, and cost-effectiveness in residential and commercial projects.

How much revenue did the jute-based insulation segment generate in 2024?

Jute-based insulation materials generated USD 70.3 million in 2024, owing to availability, cost-effectiveness, and biodegradability.

What was the market share of residential applications segment in 2024?

Residential applications held 45.1% market share in 2024, fueled by sustainable building practices and government green building incentives.

What is the current India natural fiber insulation materials market size in 2025?

The market size is projected to reach USD 336.1 million in 2025.

India Natural Fiber Insulation Materials Market Scope

Related Reports