Summary

Table of Content

India Gas Valve Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

India Gas Valve Market Size

The India gas valve market was estimated at USD 326.7 million in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. The demand for gas valves is being fuelled by India's industrial growth, which encompasses oil and gas, petrochemicals, power generation, manufacturing, and pharmaceuticals. These valves are instrumental in regulating the passage, pressure, and direction of gases in pipelines and processing plants.

To get key market trends

The growing demand for robust valve systems has led to the growth of industrial clusters, and Special Economic Zones (SEZs) in states like Gujarat, Maharashtra, Tamil Nadu, and Karnataka. As of 2023, India has approved 268 Special Economic Zones (SEZ) with most of them concentrated on industrial and manufacturing activities as stated by the Ministry of Commerce and Industry. They play a vital role in maintaining safety, facilitating automation, and meeting environmental regulations.

India Gas Valve Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 326.7 Million |

| Forecast Period 2025 - 2034 CAGR | 5.4% |

| Market Size in 2034 | USD 547 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

With a continuous urban sprawl and multiple projects like metro rail, smart cities, and city gas distribution (CGD) networks, India is seeing significant benefits in infrastructure development, which in turn is giving rise to demand for gas valves. According to the Petroleum and Natural Gas Regulatory Board (PNGRB), there are over 300 districts across India where CGD networks exist as of 2023, which signifies the rising demand for valves used in pipelines, city gas distribution stations, and pressure regulation systems.

Initiatives from the Government, such as “Make in India” and “Atmanirbhar Bharat” are also driving the growth of the market. According to the Department for Promotion of Industry and Internal Trade (DPIIT), the inflow of foreign direct investment (FDI) in the manufacturing sector stood at USD 21.34 billion during 2022-23. Domestic manufacturing and foreign investments have also been focused on jointly attracting industrial plants, directly increasing the demand for gas valves. These trends have led manufacturers to create innovative, automated, and reliable valve systems that are in demand by the marketplace.

India Gas Valve Market Trends

- The Indian market for gas valve is being revolutionized by technological solutions and automation that enhance the efficiency, reliability, and safety of operations. By using actuators, sensors, IoT integration, and remote control capabilities, smart and automated valves are gradually replacing/traditional gas valves. These smart systems provide real-time monitoring of valve performance, gas flow, pressure, and temperature — all of which can help predict maintenance needs and prevent unintended downtime.

- In certain industries—such as oil & gas, power, and chemicals—where precision matters and safety are paramount, automated valves can react better to changes in the conditions of the system, preventing accidents or damage to equipment. For instance, in the case of a sudden pressure surge or gas leak, an automated control valve can immediately recommend shut/close or gate or lower the flow without waiting for human intervention.

- Furthermore, SCADA (Supervisory Control and Data Acquisition) integration in cloud-based platforms facilitates centralized monitoring of multiple valve systems across various facilities. This is especially useful in large-scale operations such as city gas distribution, and refineries where a lot of systems are based on LNG terminals.

- Trends toward Industry 4.0 are similarly driving both manufacturers and end-users to think about advanced technologies that enable data analytics, energy optimization, and smart diagnostics. These developments not only improve operational safety and efficiency but also assist in regulatory compliance by accurately monitoring emissions and usage of gas.

Trump Administration Tariffs

The 26% Tramp administration's active tariffs on Indian exports has broken into the Indian valve market, trumping the gas valve market largely served by industries such as oil and gas, petrochemicals and manufacturing.

- This tariff further makes India gas valve manufacturer less competitive in the USA, thus may shift their export volumes. This would lead to a reduction in the income of Indian exporters and cause a trade imbalance.

- The higher tariffs are also increasing the cost of imported materials and parts used to manufacture gas valves. Manufacturers will have to choose between taking a hit on profits and keeping prices high, which will reduce demand.

- The Indian government is coordinating with U.S. to mitigate the impact of these tariffs on the final products. They have been talking about how to reduce tariffs on imports into the United States and increase trade between the two countries — with a target of $500 billion by 2030.

India Gas Valve Market Analysis

Learn more about the key segments shaping this market

Based on valve type, the India gas valve industry is segmented into liquefied petroleum gas valve, cryogenic valve, and air separation valve. In 2024, the cryogenic valve segment generated a revenue of USD 134 million and is expected to grow at a CAGR of around 5.2% during 2025 to 2034.

- India has been working to increase the import, storage, and distribution facilities of LNG to meet the growing need for cleaner fuels. India’s LNG import capacity will expand from 42.5 million metric tons per annum (MMTPA) in 2023 to 70 MMTPA in 2030, said the directors of the Petroleum and Natural Gas Regulatory Board (PNGRB).

- LNG also has to be stored and transported at below -160°C, so the need for cryogenic valves is increasingly critical to ensure safe and effective operations under these conditions without leakage. The demand for these valves has been spurred by the government’s “gas-based economy” policy push, such as the expansion of city gas distribution (CGD) networks and the setting up of LNG terminals.

- Cryogenic valves are also being utilized in healthcare, pharmaceuticals, and industrial manufacturing, where larger quantities of gas such as oxygen and nitrogen are needed, other than energy. The emergence of the COVID-19 pandemic underscored the necessity of having reliable oxygen supply systems, thus promoting investments in cryogenic storage as well as delivery equipment including valves. For instance, the Ministry of Health and Family Welfare claimed a 50% increase in oxygen storage capacity in 2021 that included cryogenic systems.

Learn more about the key segments shaping this market

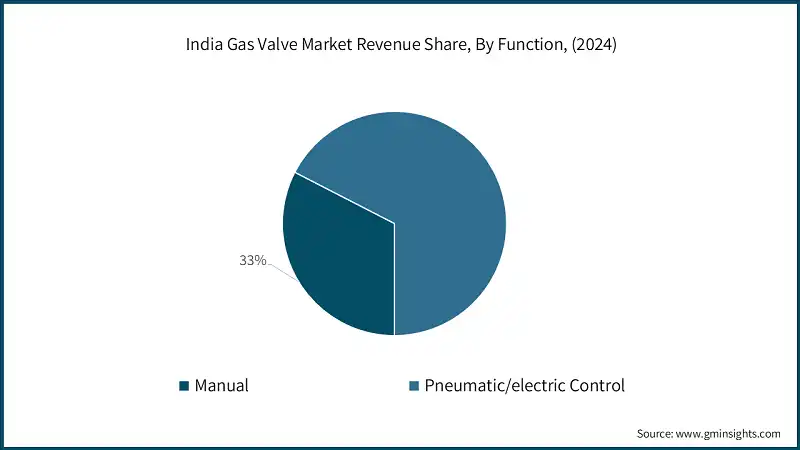

Based on function, the India gas valve market is manual and pneumatic/electric control. In 2024, the pneumatic/electric control segment accounted for over 67% market share and is expected to grow at a rate of 5.8% till 2034.

- The Indian gas valve market is being pushed toward vibrant growth by the introduction of pneumatic and electric control valves owing to their automation, accurate control, and safety features. Manufacturing, petrol chemical, oil & gas, and power are some industries that extensively use these valves. With India's ongoing industrialization and modernization of its infrastructure, more industries are adopting automated and remote-controlled systems to increase efficiency, minimize downtime, and ensure the safety of workers, especially while dealing with hazardous gases.

- They use compressed air to find pneumatic control valves preferred in hazardous environments since they will not generate any sparks. Electric control valves while allowing for the right control of flow are easily integrated with SCADA systems and offer digitization and Industry 4.0 compliance. Both these valves are crucial for industries where monitoring the process and shutting down quickly is very important, which is a feature that guarantees a fast response in case of a problem.

- The adoption of advanced gas flow control systems is also driven by government regulations regarding environmental safety and emissions control. For example, under the Environment Protection Act, of 1986, the Ministry of Environment, Forest and Climate Change (MoEFCC) had harder emission norms, forcing industries to use better gas handling systems. Pneumatic and electric valves enable accurate gas control and minimize leaks or unintentional gas discharge, assisting these compliance requirements. These are often favored for new installations and upgrades due to their low maintenance, energy efficiency, and long lifespan. The Ministry of Petroleum and Natural Gas states that India's target is to increase the share of natural gas in the energy mix from 6% in 2021 to 15% by 2030.

Based on the distribution channel, the market is segmented by direct and indirect. The indirect channel segment accounted for major share of 80% in 2024.

- Indirect distribution is dominating the gas valve market in India owing to the vast geography of the country its fragmented industrial base and the strong presence of an established distributor network. Both international and domestic gas valve manufacturers greatly depend on distributors, dealers, and agents to reach multiple customers located in varied regional and sector-based areas. This model allows manufacturers to reduce logistical complexity and costs while intermediaries benefit from their local knowledge and customer relationships.

- India valve customers are served by multiple industry segments — like oil and gas, chemicals, power generation, and pharmaceuticals — and many of them are located in industrial clusters or remote locations.

Looking for region specific data?

- The western region, specifically Maharashtra and Gujarat, accounts for the overall market share as it houses major petrochemical hubs, refineries, and natural gas production facilities. One of the significant contributors to crude oil production and gas in India accounts for a considerable amount of demand for industrial gas valves. On the other hand, the eastern part of the country, led by Assam, is becoming an increasingly wealthy area on the back of the underlying infrastructure projects and the natural gas development in the Brahmaputra valley.

- On the product front, pneumatic and electric control valves are increasingly adopted for gas flow control in vital industrial processes as they are accurate, have safety features, and are responsive. They also play a key role in reducing the hazards of gas leaks and find wide use in high-reliability, automated applications.

- Key Domestic and International Companies: Bolstered by the tremendous demand, the Indian gas valve market is led by the presence of domestic and international companies such as L&T Valves, Emerson Electric, Audco India, Rotex Automation, Hawa Engineers, etc. With such a large spectrum of valve solutions, these companies address diverse industrial requirements, expanding their manufacturing and distribution capabilities in response to the increasing demand.

- India’s gas market has favorable expansion potential in terms of years as the company policies are supportive, investment in energy infrastructure is soaring with a trend of automation and safety passing a guiding focus.

India Gas Valve Market Share

- The India gas valve industry is fragmented in nature with presence of the local and global players around the globe. Market players in the market include L&T Valves Limited, Emersion Electric, Amtech, Hawa Engineers LTD, and Imi Critical Engineering, which represented a share of 5.1% share of the market. These key players are engaged in strategic initiatives, like Merger & Acquisition; Facility expansion & Collaboration, to expand their product portfolio, reach a larger customer base, and establish their footprint in the market.

India Gas Valve Market Companies

Major players operating in the India gas valve industry are:

- Amtech

- Audco India

- Beekay Industries

- Emerson Electric

- Flosteer Engineers

- Fluidline Valves

- Hawa Engineers

- IMI Critical Engineering

- L&T Valves

- Rotex Automation

- Samson Controls

- Sri Venkat Engineers

- Uniklinger

- Unitech Combustion

- Virgo Valves and Controls

The utility solutions specialist Xylem supplies the Sensus RGS-10 Remote Gas Shutoff Valve for remotely controlling gas flow in utility applications. Xylem Direct Acting PRVs For SATURATED STEAM and COMRESSED AIR applications. Thermax Kurita Water Industries: Water treatment facility Various types of valves such as ball valves, butterfly valves, diaphragm valves, check valves, safety valves and pressure reducing valves. kurita. co.jp HIFLUX is a manufacturer that specializes in ultra-high-pressure valves, fittings and tubes including high-pressure needle valves, check valves and ball valves for pressures of up to 150,000 psi.

India Gas Valve Industry News

- In September 2023, Samson Controls announced the launch of its new factory for manufacturing valves and systems in Ranjangaon, Maharashtra.

- In February 2023, Emerson launched its first combustion safety shutoff valves, certified for biodiesel use in commercial boilers in Asian countries.

- In April 2018, Metso acquired the valve automation division of India-based Rotex.

This India gas valve market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) and shipment (Units) from 2021 to 2034, for the following segments:

Market, By Valve Type

- Liquefied petroleum gas valve

- Ball valve

- Check valve

- Gate valve

- Globe valve

- Others

- Cryogenic valve

- Ball valve

- Check valve

- Gate valve

- Globe valve

- Butterfly valves

- Others

- Air separation valve

- Ball valve

- Check valve

- Gate valve

- Globe valve

- Butterfly valves

- Others

Market, By Function

- Manual

- Pneumatic/electric control

Market, By Gas Type

- Liquefied natural gas

- Liquid nitrogen

- Hydrogen

- Oxygen

- Other gases

Market, By Application

- Supplying line

- Filling device

- Bulk storage tank

- Gas transportation

- Storage tank & piping

- Others

Market, By Industry Sector

- Water & wastewater

- Food & beverage

- Chemicals

- Pharma

- Pulp & paper

- Oil & gas

- Power

- Semiconductor

- Others

Market, By Distribution Channel

- Direct sales

- Indirect sales

Frequently Asked Question(FAQ) :

What is the size of cryogenic valve segment in the India gas valve industry?

The cryogenic valve segment generated over USD 134 million in 2024.

How big is the India gas valve market?

The India gas valve market was valued at USD 326.7 million in 2024 and is expected to reach around USD 547 million by 2034, growing at 5.4% CAGR through 2034.

Who are the key players in India gas valve market?

Some of the major players in the India gas valve industry include Amtech, Audco India, Beekay Industries, Emerson Electric, Flosteer Engineers, Fluidline Valves, Hawa Engineers, IMI Critical Engineering.

India Gas Valve Market Scope

Related Reports