Summary

Table of Content

Incinerator Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Incinerator Market Size

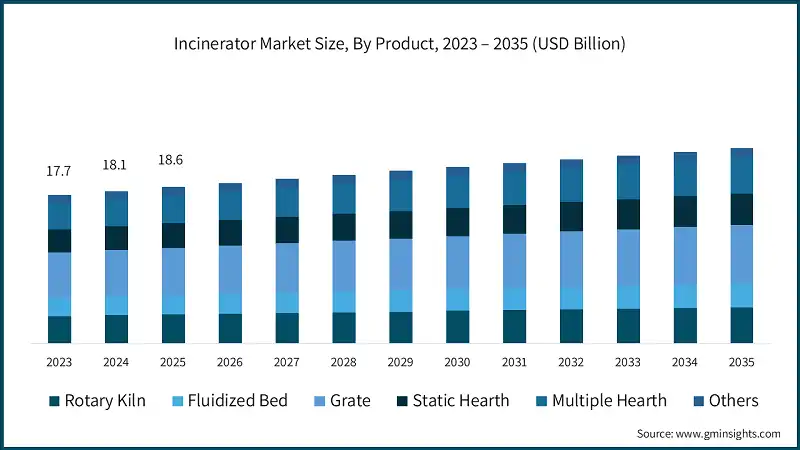

According to a recent study by Global Market Insights Inc., the incinerator market was estimated at USD 18.6 billion in 2025. The market is expected to grow from USD 19.1 billion in 2026 to USD 23.3 billion by 2035, at a CAGR of 2.2%.

To get key market trends

- Global urban waste streams and constrained landfill capacity will proliferate the business landscape. Municipal operators emphasize volume reduction, sanitary handling, and reliable baseload disposal to stimulate industry dynamics. Modern plants add high-throughput lines and district heating links to accelerate the business scenario.

- An incinerator is a facility or device that burns waste materials at high temperatures, converting them into ash, flue gases, and heat. It is primarily used for waste disposal and sometimes for energy recovery in waste-to-energy plants, while incorporating pollution control systems to reduce harmful emissions.

- Wastetoenergy integration with power and heat systems will proliferate the business landscape. Baseload steam supply, combined heat and power, and district energy offtakes stimulate industry dynamics. Boiler islands, steam cycles, and turbine retrofits that lift net efficiency accelerate the business scenario.

- For citation, in June 2025, The U.S. EPA finalized a consent decree with environmental groups requiring the establishment of federal rules for commercial and industrial incinerators by September 2024, plus publication of a proposed rule for "other solid waste incinerators" (e.g., institutional units) by June 2026.

- Tighter emission controls for NOx, SOx, dioxins, mercury, and particulates will proliferate the business landscape. Adoption of fluegas cleaning trains SCR, semidry/wet scrubbing, and activated carbon stimulates the industry dynamics. Continuous emissions monitoring and lowleakage furnace designs accelerate the business scenario.

- Healthcare and pharmaceutical waste streams with stringent infection control will proliferate the business landscape. Hightemperature, controlledair systems backed by robust segregation protocols stimulate the industry dynamics. Hospital chains deploy autoclave–incineration hybrids and scalable capacity to accelerate the business scenario.

- Industrial and hazardous waste from chemicals, refining, and advanced manufacturing will proliferate the business landscape. Rotary kilns and fluidized beds for heterogeneous, highcalorific feeds stimulate the industry dynamics. Feed preparation, predrying, and thermal oxidation lines that stabilize throughput accelerate the business scenario.

- For illustration, in January 2024, EPA proposed enhanced Clean Air Act standards targeting large municipal waste combustors (≥250 tpd), aiming to cut nine pollutants including SO and NO by an estimated 14,000 tons annually.

- Circular economic outcomes and residuals valorization will proliferate the business landscape. Bottomash metal recovery, slag conditioning, and ash beneficiation for construction materials stimulate the industry dynamics. Optimized ash handling, quenching, and sorting systems accelerate the business scenario.

- The incinerator market was valued at USD 17.4 billion in 2022 and grew at a CAGR of approximately 2% through 2025. Growing development of heat offtake corridors, seasonal thermal storage, and hybridization with heat pumps will stimulate the industry dynamics. Upgradation of condensate return, heat exchangers, and corrosion-resistant materials will accelerate the business scenario.

- Economic resilience through diversified revenue streams will proliferate the business landscape. Growing reliance on gate fees, electricity sales, heat contracts, and recovered materials will stimulate the industry dynamics. Upgradation of contractual structures to balance feedstock risk and performance incentives will accelerate the business scenario.

- Decarbonization and lifecycle emissions optimization will proliferate the business landscape. Growing implementation of high-efficiency boilers, energy recovery maximization, and fossil-fuel substitution will stimulate industry dynamics. Upgradation to carbon capture readiness, oxy-fuel concepts, and net-zero pathways for WtE will accelerate the business scenario.

Incinerator Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 18.6 Billion |

| Market Size in 2026 | USD 19.1 Billion |

| Forecast Period 2026-2035 CAGR | 2.2% |

| Market Size in 2035 | USD 23.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Stringent waste management & environmental regulations | Compliance mandates push adoption of advanced incineration technologies. |

| Rapid urbanization & industrial development | Rising waste volumes from cities and industries fuel demand for waste-to-energy solutions. |

| Limited availability of land for traditional landfill | Space constraints make incineration a preferred alternative for waste disposal. |

| Rising health & safety concerns | Rising health & safety concerns |

| Pitfalls & Challenges | Significant capital expenditure for plant construction and advanced emission-control systems limits market penetration. |

| Opportunities: | Impact |

| Integration of advanced emission-control technologies | Growing demand for low-emission systems creates scope for innovation and premium solutions. |

| Adoption of waste-to-energy for renewable power generation | Increasing focus on circular economy and clean energy drives incinerator-based electricity projects. |

| Carbon capture and utilization retrofits | Carbon capture and utilization retrofits |

| Expansion in emerging economies | Rapid infrastructure development and urban waste challenges in Asia-Pacific and Africa open large-scale project opportunities. |

| Market Leaders (2025) | |

| Market Leaders |

10.5% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | U.S., Germany, UK, Australia, and Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Incinerator Market Trends

- Increasing enforcement of global and regional environmental standards will proliferate the business landscape. Governments across developed and emerging economies are implementing strict regulations to curb landfill usage and reduce greenhouse gas emissions, creating a favorable environment for incinerator adoption.

- Compliance with frameworks such as the EU Waste Incineration Directive and similar national policies is compelling municipalities and industries to invest in advanced thermal treatment technologies. These regulations aim to minimize environmental hazards, control air pollutants, and ensure safe disposal of hazardous and biomedical waste, thereby accelerating the deployment of incineration systems.

- For instance, in July 2025, MiamiDade County Commission approved construction of a new 2,000 tpd waste-to-energy incinerator, aiming to replace the 2023-burned Doral plant; site selection and permitting to occur within the next 6–12 months.

- Accelerating urbanization and industrial expansion across emerging economies will sway the industry outlook. Rising population density in metropolitan areas is generating massive volumes of municipal solid waste, creating an urgent need for efficient disposal solutions.

- Incineration offers a practical alternative to landfills, particularly in urban regions where space constraints and environmental concerns are prevalent. The growing complexity of waste streams, including non-recyclable plastics and hazardous materials, is reinforcing the adoption of advanced incineration technologies.

- Escalating land scarcity and rising costs associated with landfill development will accelerate the adoption of incineration technologies. Urban regions face significant challenges in allocating land for waste disposal due to competing demands for residential, commercial, and industrial development.

- For reference, in July 2025, according to Xinhua report, China’s growth in waste-to-energy, with a Henan facility incinerating 1,800 tonnes per day, amid over 1,000 WtE plants processing 1.1 million tonnes daily, exporting technology globally (79 international projects as of May 2025).

- Increasing restrictions on landfill operations, driven by environmental concerns and regulatory mandates, are further stimulating market growth. Landfills are associated with methane emissions, groundwater contamination, and long-term ecological risks, prompting authorities to phase out traditional disposal methods.

- Growing awareness of health hazards associated with improper waste disposal will proliferate the business landscape. Biomedical and hazardous waste pose significant risks to public health and environmental safety if not managed effectively. Incineration offers a proven method for neutralizing pathogens, toxins, and harmful chemicals, ensuring compliance with stringent health and safety standards.

- Regulatory frameworks governing healthcare waste disposal are becoming more rigorous, compelling facilities to adopt advanced incineration technologies. These systems provide high-temperature combustion, ensuring complete destruction of hazardous materials and minimizing the risk of contamination.

Incinerator Market Analysis

Learn more about the key segments shaping this market

- Based on product, the industry is segmented into rotary kiln, fluidized bed, grate, static hearth, multiple hearth, and others. The grate incinerator market holds a share of 30.1% in 2025. Increasing deployment in large-scale municipal waste treatment facilities will proliferate the business landscape. Grate incinerators offer robust design and high throughput capacity, stimulating industry dynamics.

- The fluidized bed incinerator market is set to exceed USD 2.5 billion by 2035. Growing emphasis on efficient combustion and uniform heat distribution will proliferate the business landscape. Fluidized bed technology offers superior thermal efficiency and lower emissions, stimulating industry dynamics.

- For reference, in June 2025, The Greek government announced a USD 1.18 billion investment to build six new wastetoenergy plants, with a combined annual capacity of 1.19million tons, including major facilities in Attica and Crete, to align with EU landfill reduction targets.

- Rising demand for municipal solid waste and biomass treatment in waste-to-energy plants will accelerate the business scenario. Continuous advancements in bed material optimization and air distribution systems will enhance performance and reduce operational costs. Increasing preference for fluidized bed incinerators in regions with strict emission norms will sway industry expansion.

- The rotary kiln segment will witness a CAGR of over 2% by 2035. Increasing demand for high-temperature treatment of hazardous and industrial waste will proliferate the business landscape. Rotary kilns offer superior flexibility in handling diverse waste streams, including solids, liquids, and sludges, which will stimulate industry dynamics

- For citation, in January 2024, Clean Earth and Veolia North America signed a five-year agreement securing capacity at a stateoftheart hazardous waste incinerator under construction in Gum Springs, Arkansas, a USD300 million facility powered by solar energy and waste-heat recovery.

- The static hearth incinerator market was valued at USD 3 billion in 2025. Ongoing development of compact and portable static hearth units for emergency and temporary installations will strengthen market outlook. Increasing preference for low-maintenance incineration technologies will further augment product penetration.

- The multiple hearth incinerator market is set to exceed USD 4 billion by 2035. Growing demand for sludge and sewage treatment in municipal and industrial applications will proliferate the business landscape. Multiple hearth incinerators offer staged combustion and high thermal efficiency, stimulating industry dynamics.

Learn more about the key segments shaping this market

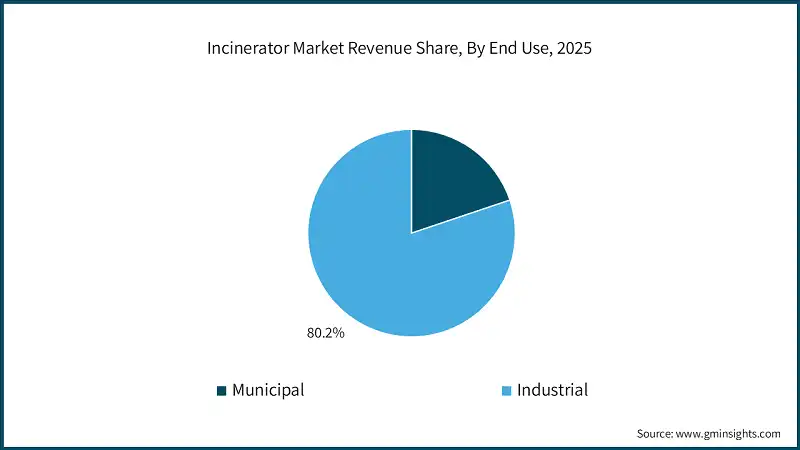

Learn more about the key segments shaping this market - Based on end use, the industry is divided into municipal and industrial. The industrial segment holds a share of 80.2% in 2025 and is set to exceed USD 18 billion by 2035. Growing industrialization across emerging economies coupled with rising hazardous and non-recyclable waste generation will proliferate the business landscape. Increasing emphasis on safe disposal of toxic by-products and compliance with occupational safety standards will stimulate industry dynamics.

- Ongoing development of integrated waste management systems within industrial facilities and adoption of energy recovery solutions will strengthen market outlook. Integration of automated control systems and real-time monitoring platforms will enhance operational efficiency and reliability.

- For instance, in August 2024, Hitachi Zosen Inova completed the commissioning of the Slough Multifuel wastetoenergy facility in the UK, capable of processing 480,000tons/year and generating 55MW of electricity plus steam for local industry.

- The municipal incinerator market will witness a CAGR of over 2.5% by 2035. Increasing urban population coupled with rising municipal solid waste generation will proliferate the business landscape. Growing emphasis on reducing landfill dependency and achieving zero-waste targets will stimulate industry dynamics.

- Expanding waste-to-energy projects in metropolitan areas in association with government-backed sustainability programs will accelerate the business scenario. Continuous investments in centralized incineration facilities integrated with energy recovery systems will sway industry expansion.

Looking for region specific data?

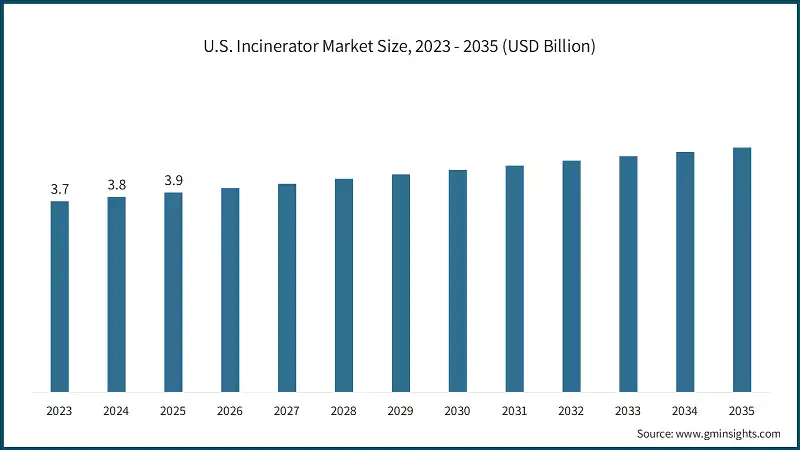

- The U.S. dominated the incinerator market in North America with around 90.7% share in 2025 and generated USD 3.9 billion in revenue. Upgradation of aging municipal incineration facilities and development of high-capacity plants in association with urban infrastructure modernization will accelerate the business scenario.

- The Europe incinerator industry is set to grow at a rate of over 1.5% by 2035. Stringent EU directives on waste incineration and emission control will proliferate the business landscape. Growing investments in high-efficiency incinerators integrated with energy recovery systems will stimulate industry dynamics.

- For illustration, in April 2025, Frontier and Hafslund Celsio launched a pioneering retrofit on a wastetoenergy incinerator outside Oslo, equipping it with carbon-capture technology capable of removing up to 400,000tons of CO per year, marking a scalable model for similar facilities across Europe.

- The North America incinerator market is projected to surge over USD 5 billion by 2035. Rising public-private partnerships for integrated waste management solutions and modernization of existing facilities will strengthen market outlook. Increasing focus on circular economy principles will further augment regional growth prospects.

- The Middle East & Africa incinerator market was valued at USD 1.7 billion in 2025. Expansion of waste-to-energy projects in GCC countries in association with renewable energy goals will accelerate the business scenario. Continuous investments in modern incineration facilities integrated with emission control systems will sway industry expansion.

- For instance, in March 2025, Baghdad initiated the development of a 3,000tpd, three-line wastetoenergy incinerator project valued at USD500 million, expected to generate approximately 780million kWh of electricity annually enough to power nearly 10 million people.

- The Asia Pacific incinerator market holds a share of 38.2% in 2025. Rapid urbanization and industrialization across emerging economies will proliferate the business landscape. Growing municipal solid waste generation coupled with limited landfill availability will stimulate industry dynamics.

- The Latin America incinerator market will exceed USD 1.5 billion by 2035. Growing urbanization and rising municipal waste generation will proliferate the business landscape. Increasing emphasis on reducing landfill dependency and improving waste management infrastructure will stimulate industry dynamics.

Incinerator Market Share

- The top 5 players in incinerator industry are Babcock & Wilcox Enterprises, SUEZ, Mitsubishi Heavy Industries, Inciner8 & Thermax contribute around 40% of the market share in 2025. The market is highly competitive, dominated by global players and niche specialists.

- Babcock & Wilcox is a recognized global player in the incinerator and waste-to-energy market, primarily known for its advanced boiler-integrated emission control systems. The company specializes in technologies such as flue gas desulfurization and selective catalytic reduction (SCR), which are critical for compliance with stringent environmental regulations.

- SUEZ is a leading name in the global incinerator market, leveraging its integrated waste management capabilities to deliver end-to-end solutions from collection to treatment and incineration. The company has a strong presence in Europe, where regulatory-driven demand for waste-to-energy facilities supports its growth.

- Mitsubishi Heavy Industries, through its environmental engineering division MHIEC, is a top-tier provider of incineration systems globally. The company is known for its advanced combustion technologies, including V-type stoker systems and innovative sludge incinerators, which deliver high efficiency and energy recovery.

- Inciner8 is a UK-based specialist in mobile and modular incinerators, serving niche markets such as healthcare, humanitarian aid, mining, and agriculture. Inciner8’s solutions are tailored for off-grid and emergency-response applications, making it a preferred choice for NGOs and government agencies.

- Thermax is a leading Indian provider of incineration solutions, offering CPCB-approved pyrolytic and multi-chamber incinerators for hazardous solid waste. Its products, with capacities ranging from 30 kg/h to 400 kg/h, are designed to meet stringent emission norms and include features such as heat recovery and automated feeding systems.

Incinerator Market Companies

- In the third quarter of 2025, Babcock & Wilcox Enterprises reported revenue of USD 149.0 million, compared to USD 152.6 million in the same period of 2024. Global Parts & Services delivered strong performance with revenue of USD 68.4 million, up from USD 61.7 million in the prior quarter, reflecting continued growth in aftermarket demand. Adjusted EBITDA from continuing operations improved to USD 12.6 million, compared to USD 8.0 million in the third quarter of 2024.

- Thermax Limited reported consolidated revenue of USD 1,156.7 million for fiscal year 2024, reflecting its strong position in the energy and environment solutions market. The company achieved a profit before tax of USD 98.5 million, underscoring its ability to maintain profitability despite challenging macroeconomic conditions and fluctuating input costs.

- Mitsubishi Heavy Industries reported a solid performance for the fiscal year 2024, with orders received by the Group rising to USD 45.2 billion, an increase of USD 2.5 billion, or 5.8% year-on-year, driven by growth across all segments, particularly the Energy Systems segment. Consolidated revenue advanced to 32.2 billion, up USD 2.4 billion, or 7.9% year-on-year.

Major players operating in the incinerator industry are:

- Alfa Therm

- Aswathi Industries

- Atlas Incinerators

- Babcock & Wilcox Enterprises

- CHUWASTAR

- Dutch Incinerators

- ECO Concepts

- For.Tec. Forniture Tecnologiche

- Haat Incinerator

- Igniss Energy

- Incinco

- Inciner8

- Keller Manufacturing

- KINC Mineral Technologies

- Maximus Envirotech

- MICROTEKNIK

- Mitsubishi Heavy Industries

- SUEZ

- Thermax

- Thermtech Industries

- Vikas Engineering

- Waste Spectrum

Incinerator Industry News

- In December 2025, Mitsubishi Heavy Industries Environmental & Chemical Engineering has secured a contract to deliver critical equipment for the Build-Operate-Transfer (BOT) redevelopment of the Taichung Wenshan Waste-to-Energy (WtE) facility in Taichung City, Taiwan. MHIEC finalized the agreement to supply core components, including advanced incineration systems, ensuring reliable and efficient plant operations. This project underscores MHIEC’s commitment to supporting sustainable energy solutions and enhancing waste management capabilities in Taiwan.

- In July 2025, SUEZ has commissioned a biogenic CO recovery unit at its Terres d’Aquitaine facility in Gironde, France, introducing an innovative local solution to curb emissions and promote sustainable agriculture. The installation captures carbon generated during the anaerobic digestion of biowaste. Co-financed by the Nouvelle-Aquitaine Region, the unit is designed to recover up to 3,500 tons of CO annually.

- In March 2025, Inciner8 unveiled its newly constructed headquarters in Burscough, Lancashire marking a major step in its strategic growth journey. This investment reinforces Inciner8’s commitment to innovation, sustainability, and superior customer service, positioning the company to scale operations and meet rising international demand.

- In September 2024, Thermax showcased its latest clean energy, air, and water technologies at Boiler India 2024, reinforcing its commitment to driving the energy transition. Among the highlights were advanced heating solutions, including the Greenpac biograte boiler, Thermeon 2.0, and cutting-edge biogas and carbon capture systems.

The incinerator market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Product

- Rotary kiln

- Fluidized bed

- Grate

- Static hearth

- Multiple hearth

- Others

Market, By End Use

- Municipal

- Industrial

The above information has been provided for the following regions & countries:

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Sweden

- Netherlands

- Russia

- Asia Pacific

- China

- Australia

- India

- Japan

- South Korea

- Middle East & Africa

- Qatar

- UAE

- Nigeria

- Saudi Arabia

- South Africa

- Latin America

- Brazil

- Argentina

- Mexico

Frequently Asked Question(FAQ) :

Who are the key players in the incinerator market?

Key players include Babcock & Wilcox Enterprises, SUEZ, Mitsubishi Heavy Industries, Inciner8, Thermax, Alfa Therm, Atlas Incinerators, CHUWASTAR, Dutch Incinerators, Igniss Energy, Keller Manufacturing, Maximus Envirotech, and Waste Spectrum.

What are the upcoming trends in the incinerator market?

Key trends include integration of carbon capture technologies, waste-to-energy expansion for renewable power, advanced emission-control systems, and circular economy initiatives with residuals valorization.

What is the growth outlook for the municipal segment from 2026 to 2035?

Municipal incinerators are projected to grow at over 2.5% CAGR till 2035, due to increasing urban population, rising waste generation, and zero-waste targets.

How much revenue did the grate incinerator segment generate in 2025?

Grate incinerators held 30.1% market share in 2025, leading the product segment with robust design and high throughput capacity for large-scale municipal waste treatment.

Which region leads the incinerator market?

U.S. held 90.7% share with USD 3.9 billion in 2024. Rapid urbanization, industrialization, and limited landfill availability fuel the region's dominance.

What was the valuation of the industrial end-use segment in 2025?

Industrial applications held 80.2% market share in 2025 and are set to exceed USD 18 billion by 2035, driven by hazardous waste disposal and compliance requirements.

What is the current incinerator market size in 2026?

The market size is projected to reach USD 19.1 billion in 2026.

What is the projected value of the incinerator market by 2035?

The incinerator market is expected to reach USD 23.3 billion by 2035, propelled by waste-to-energy adoption, technological advancements in emissions control, and carbon capture integration.

What is the market size of the incinerator in 2025?

The market size was USD 18.6 billion in 2025, with a CAGR of 2.2% expected through 2035 driven by rising urban waste generation, limited landfill capacity, and stringent environmental regulations.