Summary

Table of Content

Home Furnishing Materials Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Home Furnishing Materials Market Size

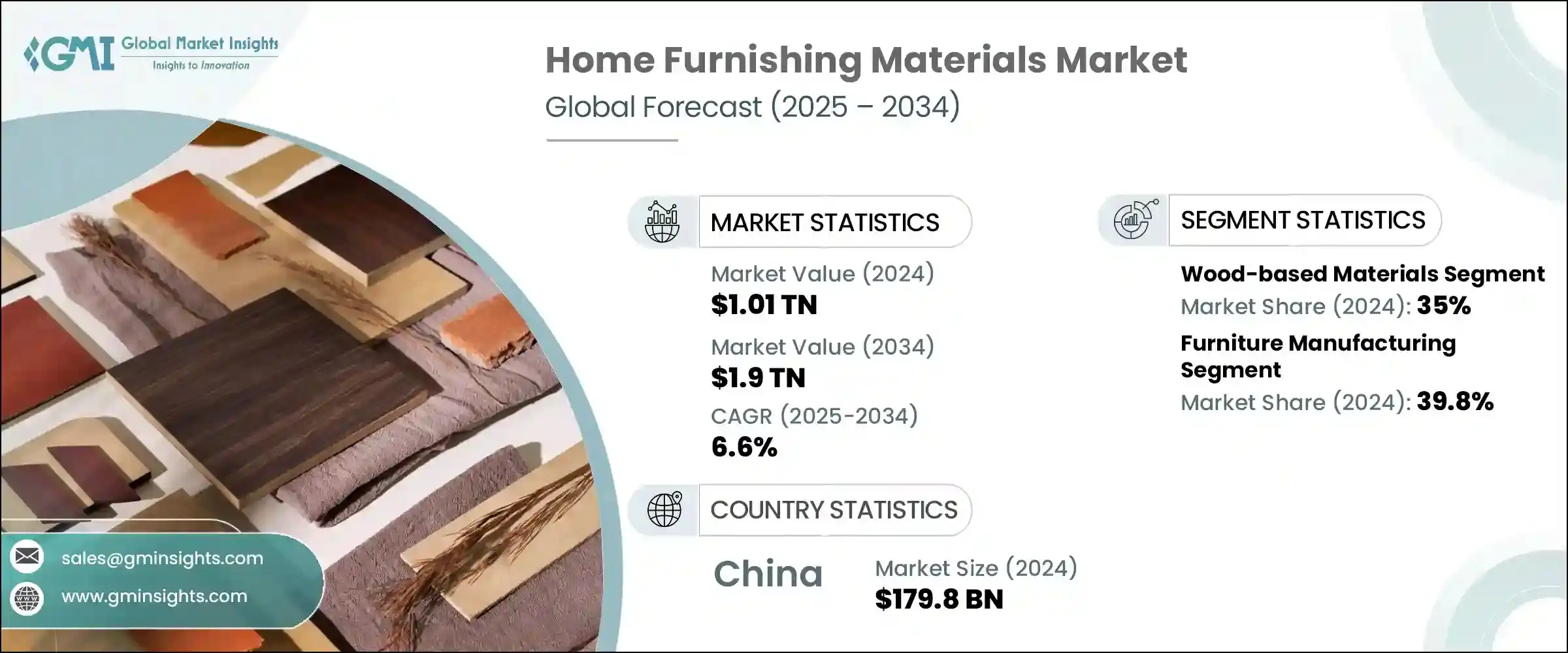

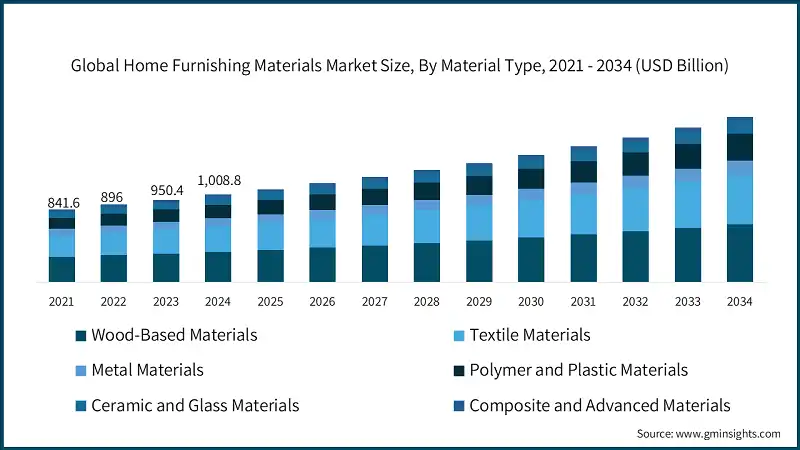

The global home furnishing materials market was estimated at USD 1.01 trillion in 2024. The market is expected to grow from USD 1.07 trillion in 2025 to USD 1.9 trillion in 2034, at a CAGR of 6.6%, primarily due to the continued resurgence of consumer spending on home upgrades and improvements to overall lifestyle following the COVID-19 pandemic. Overall, market growth can be attributed to various macro trends such as rising urbanization, growing middle class in emerging economies, and increasing consumer preference for home beautification and comfort.

To get key market trends

Asia Pacific dominates the home furnishing materials market, representing nearly 43.2% of the total value, supported by housing starts, renovations, and high disposable income - particularly in China. Growth drivers for these materials are increased trends in open floor concepts, spending on modular and multi-functional furniture, and a preference for engineered wood and eco-friendly materials.

The major growth in drivers resulting in market expansion is increased homeownership and home renovations spending. For example, global expenditure on remodeling in 2023 passed USD 4.9 trillion, sparking demand for wood, metal, textile, and synthetic furnishing materials. Furthermore, the urban population globally reached 57% in 2024, increasing demand for apartments and smaller homes that maximize smart furnishing and space usage.

Additionally, sales of engineered modular wood grew at 8.2% CAGR from 2021 to 2024 while sustainable furnishing materials such as recycled fabrics and FSC-certified wood materials continued to grow at over 12.5% CAGR during the same period. Lifestyle upgrades taking place in China, India, and Southeast Asia. Furthermore, the European market is approximately 19.8% of home furnishing materials, heavily supported by demand in Germany, the U.K., France, and Nordic countries, where attention to eco-friendly and luxury home furnishing materials continues to intensify. The Latin America market, and the jointly reported Middle East & Africa (MEA) markets come to about 14.1% of the home furnishing materials market, and these markets are seeing gradual growth through urban expansion projects and hospitality market growth.

On top of this, the increasing growth of the e-commerce channel has been critically important since it has paved the way for consumers to transact and purchase furniture and furnishing materials online. In 2024, online sales will comprise about 24% of global sales and consumer demand for more customization was driving growth.

Furthermore, companies such as IKEA, Ashley Furniture, Mohawk Industries, and Shaw Industries have dedicated significant resources to develop their digital platforms and AR tools to drive personalized shopping experiences. In addition, businesses also faced pressure from a new set of regulations that are universally mandating formaldehyde emission and footprint certifications. Therefore, manufacturers and other market participants were pursuing lower-VOC and greener materials and a whole new set of innovations into materials.

Home Furnishing Materials Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.01 Trillion |

| Forecast Period 2025 - 2034 CAGR | 6.6% |

| Market Size in 2034 | USD 1.9 Trillion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Urbanization & Middle-Class Expansion | Drives sustained demand for residential furnishing materials across emerging markets |

| Surge in Home Renovation & Remodeling Activities | Fuels replacement demand for wood, textile, and decorative materials |

| Growing Preference for Eco-Friendly & Modular Solutions | Accelerates adoption of sustainable and multi-functional furnishing materials |

| Pitfalls & Challenges | Impact |

| Volatile Raw Material Prices & Supply Chain Disruptions | Strain manufacturer margins and lead to project delays |

| Stringent Environmental Regulations on Emissions & Certifications | Increase compliance costs and complicated material sourcing |

| Opportunities: | Impact |

| Opens new premium segments by blending materials with IoT-enabled lighting, sensors, and adaptive fabrics | |

| Drives bulk demand for customized flooring, furniture, and textiles, boosting B2B revenues | |

| Rising Demand for Sustainable & Circular Materials | Spurs innovation in recycled fabrics, reclaimed wood, and low-VOC products, creating differentiation and brand premium |

| Market Leaders (2024) | |

| Market Leader |

|

| Top Players |

Collective market share in 2024 is 32% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Vietnam, Philippines, Indonesia, Brazil, Egypt |

| Future outlook |

|

What are the growth opportunities in this market?

Home Furnishing Materials Market Trends

- Expansion of smart & tech-enabled furnishing materials: Perhaps the most significant trend is the integration of technology into furnishing materials, from smart upholstery fabric and other materials with embedded sensors, to modular furniture enabled for wireless charging and light management and control. The smart furniture segment alone is expected to grow to at least a compounded annual growth rate (CAGR) of over 12% from 2024 to 2030, which means exciting opportunities for material suppliers that note devices compatibility with electronics and IoT devices, as consumer behavior is changing to have multi-functional, convenience-driven energy-efficient spaces

- Acceleration in sustainable & circular material adoption: Nearly 73% of global consumers would now like to buy sustainable home products, so manufacturers have moved on to accept the possibility of using recycled, certified and low- carbon materials. Year-on-year demand for FSC certified woods, OEKO-TEX fabrics and bio-based composites are up 14%. In the consumer sector, governments in the EU, U.S. and regions of Asia are restricting indoor air quality and formaldehyde emissions (i.e., not based on direct manufacturing influences), which should grow the range of low VOC products accepted globally. This regulatory activity, along with a burgeoning consumer base, forcing R&D investments to shift towards circular designed and biodegradable or reusable furnishing inputs

- Increasing urban micro-living fuels modular & space sensitive materials: In 2024, the global urban population reached 57%, along with unprecedented growth of small entrances and micro-homes. This trend is affecting demand for modular and lighter weight materials that allow for foldable or multi-use furniture or flexible interior partitioning. The push for engineered plywood, engineered composite panels and textiles used for quick reconfigurations, has captured some interest. Cost, performance, and available materials for frequent rearrangements remain an untapped need.

- E-commerce & digital visual-tools revolutionizing material sourcing: Online channels now capture 24% of total worldwide sales of home furnishing materials in 2024 versus 17% in 2020. The increase can be attributed to AR tools and virtual room planners offered by players such as IKEA, Wayfair, and Home Depot. Suppliers are investing in digital sample libraries, 3D texture simulation, local customization platforms, etc., to supply the increasing B2C and B2B requirements to visualize the aesthetic of materials before purchasing. The digital evolution is also enabling global supply chains and increasing the reach of SMEs accessing projects overseas.

- Policy incentives and green building codes accelerating material upgrades to premium: Countries ramping up tax incentives and compliance certifications through green building programs (e.g., LEED, BREEAM, IGBC) is indirect support for demand for certified wood, stone, and Low-emitting adhesives and finishes in residential and commercial markets. Under the EU Green Deal, the Renovation Wave program is targeting energy performance improvement in 35 million buildings by 2030 - this is a major driver in updated furnishing materials to comply with new environmental benchmarks.

Home Furnishing Materials Market Analysis

Learn more about the key segments shaping this market

- Wood-based materials remain dominating the home furnishings materials landscape, thanks to their versatility, aesthetics and range of applications across furniture, flooring, cabinets, and decorative wall components. Within the product mix, solid wood continues to be the top material for high-value furniture and luxury interior spaces, as it is durable and has a classic look, however, it is impacted by cost inflation and concerns over sustainability.

- The product group represented by engineered wood products, plywood, MDF and particleboard, is the largest by volume, thanks to affordability and versatility. In terms of physical characteristics, plywood is the strongest structural component in relation to its weight, while MDF lends itself well to painted finishes and extremely detailed designs. Particle board leads in the most budget-friendly product category, notwithstanding considerations of lower lifespan and moisture resistance to itself and other potential products in which it is combined.

- Trends driving this category include laminated and veneered composites which aim to leverage the look of exotic hardwoods and the affordability of an engineered core. The advancement of surface technology, including embossed-in-register (EIR) wood grains have allowed for the application of a more realistic wood surface into mid-tier furniture. Manufacturers are reacting to regulations around formaldehyde emissions by investing in low-VOC resins and sustainability certifications from forestry.

Learn more about the key segments shaping this market

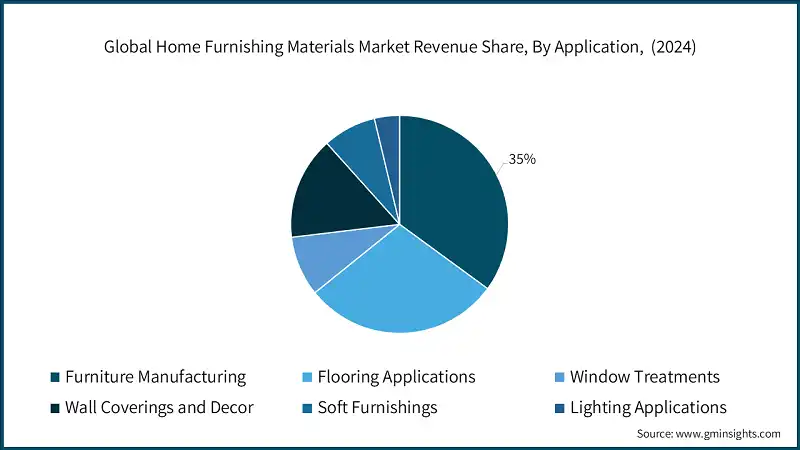

Based on application, the home furnishing materials market is segmented into furniture manufacturing, flooring applications, window treatments, wall coverings and decor, soft furnishings, lighting applications. The furniture manufacturing segment dominates the market accounting for around 39.8% share in 2024 and is expected to grow at a CAGR of over 6.4% from 2025 to 2034.

- Furniture manufacturing represents the largest application. The sheer volume of residential and commercial furnishing demand is huge, as it encompasses all living room furniture (sofas and accent tables), all bedroom furniture (beds, dressers, nightstands, wardrobes), all dining room furniture, all office systems, and more. Moreover, the predicted impact of PESTLE trends suggests urban middle-class growth and changes in work-from-home norms has driven consumer preferences for modular and ergonomic furniture and fixtures.

- The second largest application is flooring (wood, laminate, or vinyl-based material) that includes approximately 25.9% share and growing at 6.5% CAGR, benefiting from re-modeling activity in food service and retail industries. Based on Porter’s Five Forces, the bargaining power of suppliers is moderate due to price volatility and limited sources of supply. However, innovation in click-lock installations and waterproof engineered floors has intensified rivalry among competitors.

- Using SWOT analysis for the home furnishing materials market, the furniture segment's key strengths include high customization and design-lead differentiation, but it also faces a weakness with raw material price volatility. Heightened consumer preferences for space-saving, multi-functional furniture only amplifies challenges associated with consumer demand for one-size fits all solutions.

Looking for region specific data?

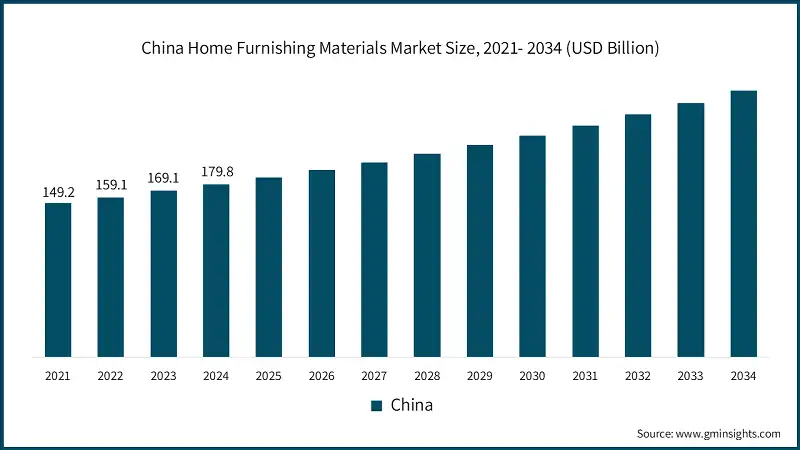

China dominated the home furnishing materials market in Asia Pacific with around 41.2% share and generated USD 179.8 billion in revenue in 2024.

- The growth of home furnishing materials in China is sustained by rising urbanization and e-commerce penetration rates and increasing demand coming from the millennial and Gen Z markets. Both online retail sales of physical goods by third-party sellers and Home décor and adaptive furniture were up 11% year-over-year year (YoY) in 2023; as was the growth rate of Home décor and adaptive furniture, which were +372% and +64.6% respectively from late 2023 campaigns held in November and December 2022.

- Domestic furnishing brands—such as Red Star Macalline, Oppein Home, Kuka Home, and Suofeiya Home—lead the market, with the top three collectively having roughly 10–20%, indicating that the fabric marketplace is moderately fragmented and highly competitive.

- Oppein and Kuka have achieved such market power due to their vertical integration of cabinetry (eg., MDF, particle board etc.) and engineered wood products to custom-installed products. The massive size of Oppein and Kuka's production enabled efficiencies along with proprietary strategic alliances and agile local and international export networks. As well, Red Star Macalline sells direct to the public through hundreds of specialty stores and is staggering compared to IKEA's operational growth, which as of the end of 2024 will include only 39 outlet stores in China.

- To grow, they are investing in smart manufacturing, automation, and sustainable material practices. The market fragmentation trend is peeking into consolidation: merger acquisitions and opening-up retail outlets is a favored conversion strategy. Producers across China operate in regional clusters (Foshan and Jiangsu) the new locations in Jiangsu, FoShan (Guangzhou) clusters affordable cost structure and scale efficiencies.

The home furnishing materials market in the U.S. is expected to experience significant and promising growth from 2025 to 2034.

- In the U.S., the demand for home furnishing materials is driven by trends toward reshoring, tariffs on Chinese products, and preferences for U.S. suppliers. Major players such as Ashley Furniture, Williams Sonoma (with West Elm, Pottery Barn), Wayfair and Ethan Allen control approximately 25–30% of the U.S. materials and products ecosystem.

- Companies are choosing to develop strategies to diversify sourcing away from China. Some furniture companies have shifted production from China to Vietnam and Mexico and are now moving back to U.S. production in some cases. Also, domestic upholstery manufacturers like STI Fabrics are benefiting from high tariffs (up to 145%) on Chinese imports and effectively helping to bring back local supply chains.

- Market concentration remains moderate: even though there are leading brands, the overall U.S. furnishing-materials supplier market segment is still fragmented with several regional mills and distributors. M&A has been strong for leading firms targeting premium/sustainable/modular material occasion lines for diversification.

Home Furnishing Materials Market Share

- The top 5 companies in the home furnishing materials industry are IKEA Group, Ashley Furniture Industries LLC, Mohawk Industries Inc., Saint-Gobain, and Weyerhaeuser Company contributing around 32% of the market in 2024. These leaders can leverage their existing manufacturing networks, global supply chains, and brand portfolios to remain at the top.

- IKEA is undoubtedly the global leader, holding shares of about 11% in market value, underwriting its competitive advantage with a large-scale vertically integrated structure, along with direct retailing and a strong private-label ecosystem. Its cost-effective structure with an engineering focus around flat-pack methodologies, combined with its capital invested in renewable and recycled materials is setting the pace for price and sustainability leadership.

- Ashley Furniture Industries is at about 6% to 7% in share, with strong upstream control towards wood processing and upholstery. It maintains its competitiveness with cross-country manufacturing in the U.S., China, and Vietnam, protecting its business model from disruptions within single geographical regions, while operating a dynamic pricing strategy across confirmed domestic and export markets.

- In flooring and textile materials, Mohawk Industries and Shaw Industries have about 8%-9% in market share, competing through advanced engineered wood, luxury vinyl, and sustainable carpet technologies. Their strategy involves acquisitions to broaden their material and product capabilities. Mohawk, for example, has recently consolidated certain ceramic businesses across Europe and North America, and is leading sustainable products with cost in mind.

Home Furnishing Materials Market Companies

- IKEA: IKEA remains the undisputed leader in home furnishings materials globally as a very vertically integrated company with control over its design, material sourcing, manufacturing, and direct retailing. The key element of IKEA's integrated strategy is to offer low cost to the consumer in exchange for its costs associated with mass production and efficiencies of flat packing, which began blended with increased investment in recycled materials and renewed materials to meet the eco-friendly consumer purchasing habits.

- Ashley Furniture Industries: Ashley is the leading furniture brand in North America, where it has a large vertical integration in the marketplace. Ashley controls wood processing and upholstery production upstream from furniture assembling and sales. Control over product upstream allows nearly immediate pricing response by Ashley in the environment of supply chain volatility. Ashley is also increasing its exposure in e-commerce and franchise growth to address younger consumer generations and remodel traditional markets, all while hedging supply chain fluctuations by sourcing globally from manufacturing partners in China and Vietnam.

- Mohawk Industries: Mohawk, as a flooring company, has differentiated its offerings from competitors by emphasizing ceramic tiles in addition to its engineered wood and luxury vinyl products. Mohawk provides limited durable flooring options with acceptable aesthetics, to both residential and commercial customers. Mohawk has consistently scaled from aggressive acquisition activity and is also investing in installing automated environments in the manufacturing plants, so it has margin resiliency to protect against fluctuations in raw material prices.

- Saint-Gobain: Saint-Gobain is a global leader in the design, manufacture, and distribution of high-performance building materials and solutions for home improvement. Through its extensive portfolio of brands such as CertainTeed, Gyproc, ISOVER, Weber, and Norton, the company offers a wide range of products including insulation, drywall, roofing, plaster, adhesives, sealants, and abrasives. These materials are designed to enhance comfort, energy efficiency, and sustainability in residential construction and renovation. Saint-Gobain’s MyHome initiative focuses on providing integrated solutions tailored to every stage of home building—from structural materials to interior finishes—ensuring quality, durability, and aesthetic appeal. With a strong presence in North America, Europe, and emerging markets, Saint-Gobain continues to innovate in eco-friendly and performance-driven home improvement materials

Home Furnishing Materials Market News

- In January 2025, Ingka Group invested USD 1 billion into recycling companies that focus on textiles, mattresses, plastic, and wood to improve circularity in its furnishing supply chain.

- In February 2025, the CEO of Ingka Group reaffirmed IKEA’s goal of cutting carbon emissions by 50% by 2030 and then tested a peer to peer “IKEA Pre owned” platform in Spain and Norway, allowing for increased product reuse.

- In April 2025, IKEA launched its STOCKHOLM 2025 collection which included 96 new pieces using rattan, leather, linen, curved wood and bouclé, making it the largest STOCKHOLM offering to date.

- In June 2025, IKEA hosted its Democratic Design Days where it unveiled new material advancements – bio based glues (cutting emissions by 30%), recycled aluminum tableware, and seaweed based materials, further demonstrating its commitment to sustainable design.

- In May 2025, Al Futtaim IKEA in the UAE reported on its sustainable milestones during 202 it had - earned LEED Gold certification for three stores; sourced clean energy using Clean Energy Certificates; and doubled sales of sustainable products during its “Earth Weeks” initiative.

The home furnishing materials market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Bn) and volume (Units) from 2021 to 2034, for the following segments:

Market, By Material Type

- Wood-based materials

- Solid wood

- Hardwood segments

- Softwood segments

- Engineered wood products

- Wood composites

- Plywood and veneers

- Particleboard and OSB

- MDF and HDF

- Wood-plastic composites (WPC)

- Solid wood

- Textile materials

- Natural fibers

- Cotton and cotton blends

- Linen and hemp

- Wool and silk

- Synthetic fibers

- Polyester and nylon

- Acrylic and polypropylene

- Technical textiles

- Home textile applications

- Upholstery fabrics

- Curtains and draperies

- Carpets and rugs

- Bedding and linens

- Natural fibers

- Metal materials

- Steel and iron components

- Aluminum and alloys

- Brass and bronze

- Specialty metals

- Polymer and plastic materials

- Thermoplastics

- Thermosets

- Bio-based plastics

- Recycled plastic materials

- Ceramic and glass materials

- Traditional ceramics

- Advanced ceramics

- Tempered and safety glass

- Decorative glass

- Composite and advanced materials

- Fiber-reinforced composites

- Smart materials

- Nanomaterials

- Bio-based composites

Market, By Application

- Furniture manufacturing

- Seating furniture

- Tables and storage

- Bedroom furniture

- Kitchen and dining furniture

- Office furniture

- Outdoor furniture

- Flooring applications

- Hardwood flooring

- Laminate and vinyl flooring

- Carpet and textile flooring

- Ceramic and stone flooring

- Window treatments

- Curtains and drapes

- Blinds and shades

- Shutters and screens

- Wall coverings and decor

- Wallpapers and wall textiles

- Decorative panels

- Wall art and accessories

- Soft furnishings

- Cushions and pillows

- Throws and blankets

- Decorative accessories

- Lighting applications

- Lamp shades and fixtures

- Decorative lighting components

Market, By End Use

- Single family homes

- Multi-family housing

- Luxury and premium segment

- Mid-market segment

- Economy segment

- Commercial sector

- Office buildings and corporate spaces

- Hospitality industry

- Hotels and resorts

- Restaurants and cafes

- Healthcare facilities

- Educational institutions

- Retail and shopping centers

- Industrial and institutional

- Government buildings

- Industrial facilities

- Religious and community centers

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for flooring applications in the home furnishing materials market?

The flooring applications segment held approximately 25.9% market share in 2024 and is projected to grow at a 6.5% CAGR from 2025 to 2034, driven by remodeling in retail and hospitality sectors.

Who are the key players in the home furnishing materials market?

Key players include Ashley Furniture Industries LLC, BASF SE, Blum Inc., Dow Inc., Guardian Glass, Herman Miller Inc., Hettich Group, IKEA Group, Interface Inc., International Paper Company, Lectra SA, Mohawk Industries Inc., Oppein Home Group Inc., Saint-Gobain, Shaw Industries Group.

What was the market value of China home furnishing materials in 2024?

China led the Asia Pacific market with USD 179.8 billion in revenue in 2024, backed by urbanization, e-commerce growth, and millennial consumer demand for smart and adaptive furniture.

Which application segment dominated the home furnishing materials market in 2024?

Furniture manufacturing was the leading application segment, contributing about 39.8% of the market share in 2024, driven by demand for modular and ergonomic furniture.

What is the projected market value of the home furnishing materials market by 2034?

The global market for home furnishing materials is expected to reach USD 1.9 trillion by 2034, propelled by sustainable material adoption, modular furniture trends, and smart furnishing solutions.

What was the market share of the wood-based materials segment in 2024?

Wood-based materials accounted for around 35% share of the home furnishing materials market in 2024, with strong demand for engineered wood, plywood, and composites.

What is the market size of the home furnishing materials market in 2024?

The market size was USD 1.01 trillion in 2024, with a CAGR of 6.6% expected through 2034, led by rising urbanization, home renovations, and growing consumer spending on home upgrades.

Which region holds the largest share in the home furnishing materials market?

Asia Pacific is the largest regional market, representing nearly 43.2% of the global value, fueled by housing starts, disposable income, and a strong renovation trend in countries like China and India.

Home Furnishing Materials Market Scope

Related Reports