Summary

Table of Content

High-Performance Thermoplastics in Aerospace Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

High-Performance Thermoplastics in Aerospace Market Size

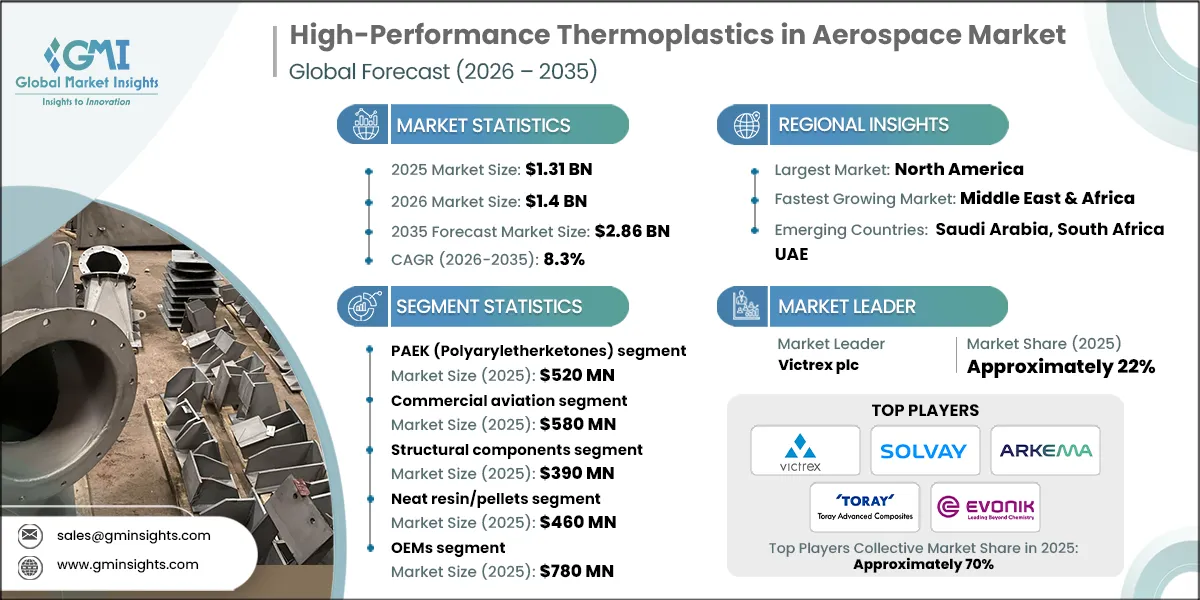

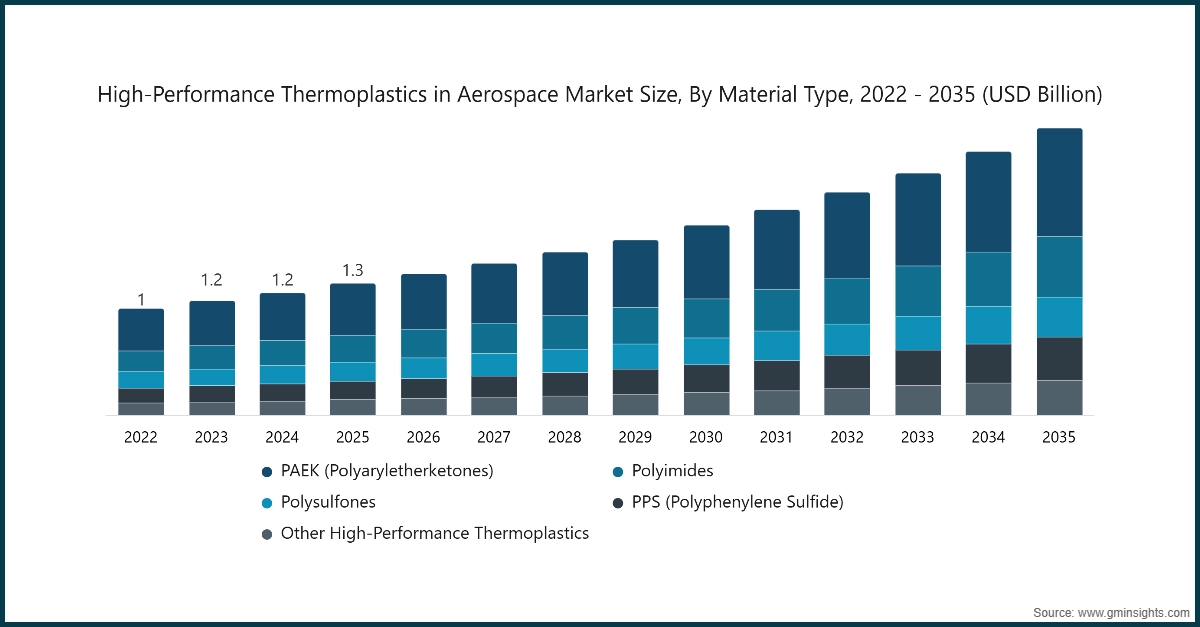

The global high-performance thermoplastics in aerospace market was valued at USD 1.31 billion in 2025. It is projected to grow from USD 1.4 billion in 2026 to USD 2.86 billion by 2035, representing 8.3% CAGR from 2026 to 2035, according to latest report published by Global Market Insights Inc.

To get key market trends

There has been a steady growth of the high-performance thermoplastics (HPT) market segment in the aerospace industry that has evolved due to the high demand of lightweight and high-performance materials in the industry. High-performance thermoplastics are also becoming a choice of aerospace manufacturers to minimize the total weight of an aircraft, which subsequently leads to enhanced fuel efficiency and the reduced operating cost. The development of the science of polymers has increased the thermal stability and mechanical qualities of such materials, and they can be applied in structural elements of critical importance. Consequently, commercial and defense aerospace uses of the traditional metals and thermosets are increasingly being replaced with thermoplastics.

The other need is that the aerospace industry is concerned with sustainability and emissions reduction. The pressure on the regulators to reduce carbon footprint and airline obligation to minimize carbon has led to an increase in the adoption of high-performance thermoplastics that can be recycled and whose lifecycle has less environmental impact. The fact that such polymers can sustain elevated temperatures and corrosive conditions without losing its functionality allows the polymers to have increased service life and less maintenance cycles. This is forcing the suppliers to expand production capacity and develop new formulations to accommodate the changing aerospace requirements.

The flexibility of high-performance thermoplastics in terms of design also benefits manufacturers in terms of complex geometries and complex functions which could be difficult or expensive to create in metal alloys. This flexibility of design contributes to the realization of the next-generation aircraft with the optimization of aerodynamics and integration of systems. Also, advanced thermoplastic components are further increased in their market as the needs in unmanned aerial vehicles (UAVs) and urban air mobility platforms are continuously increasing, because of the positive strength-weight ratios and the flexibility to fast manufacturing.

The reinvention of global aerospace production following the pandemic and the increased defense spending is increasing the demand of high-performance thermoplastics. During a time when commercial aviation activity is plummeting and military modernization programs advance, aerospace OEMs and suppliers at the top-tier (tier-1) are increasing adoption of materials to drive performance and competitiveness. Customized solutions to meet the individual performance needs are also being nurtured by strategic alliances between material suppliers and aerospace manufacturers, and this supports the long-term growth trend of the high-performance thermoplastics market in aerospace.

High-Performance Thermoplastics in Aerospace Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.31 Billion |

| Market Size in 2026 | USD 1.4 Billion |

| Forecast Period 2026-2035 CAGR | 8.3% |

| Market Size in 2035 | USD 2.86 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Lightweighting for fuel efficiency and emissions compliance | Cuts operating costs and supports stricter CO and NO targets |

| Faster manufacturing via welding, thermoforming, automation | Shortens cycle times and supports higher build rates |

| High heat/chemical resistance for advanced propulsion | Expands material use in hotter, harsher zones |

| Part consolidation and design integration potential | Reduces part count, touch labor, and recurring costs |

| Pitfalls & Challenges | Impact |

| High resin and CF-TP prepreg material costs | Pressures program budgets and narrows business cases |

| Lengthy qualification and certification timelines | Slows platform adoption and revenue realization |

| Supply constraints for monomers and intermediates | Creates schedule risk and price volatility for programs |

| Opportunities: | Impact |

| Electric air taxis, UAVs, and regional e-aircraft | Unlocks new volumes needing lightweight, FST-compliant parts |

| Recyclability and circularity for thermoplastic scrap | Improves sustainability metrics and material utilization |

| Metal and thermoset replacement in interiors/2° structures | Lowers weight while maintaining safety and performance |

| Additive manufacturing with PEEK/PEKK for spares | Accelerates MRO responsiveness and reduces inventory risk |

| Market Leaders (2025) | |

| Market Leader |

Market Share Approximately 22% |

| Top Players |

Collective Market Share Approximately 70% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Middle East & Africa |

| Emerging countries | Saudi Arabia, South Africa, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

High-Performance Thermoplastics in Aerospace Market Trends

One of the market trends in the high-performance thermoplastics aerospace market is the prevalent use of additive manufacturing technologies. The industry of aerospace manufacturing is shifting towards 3D printing of complex thermoplastic assemblies in a more precise and less wastage manner. The advantage of this trend is that it allows designs to be lighter and easier, as well as more efficient, and also facilitates shorter production cycles than the traditional fabricating techniques. With the maturation of the additive processes, an increased number of structural and non-structural components are being qualified to thermoplastic materials.

The other important trend is the substitution of thermoset composites with thermoplastic composites in structural and interior applications. The benefits of thermoplastic materials include the properties of reheating and reshaping, decreased use of adhesives and more effective assembly. This change favors high throughput production and is in line with what the industry needs scalable production. Flexibility in design and cost-effectiveness are also improved due to the possibility of combining various functions into one thermoplastic piece.

The aerospace industry is progressively being affected by sustainability factors in the choice and evolution of materials. On the one hand, recyclable thermoplastic resin systems, thermoplastic materials based on lower-carbon or bio-based feedstocks are subject to growing interest. Aerospace industry is reconsidering the life-cycle impacts in a stricter way, and this is pushing the investments into materials and processes that lead to less waste and contribute to the environmental objectives. This is a sustainability agenda that is influencing the procurement practices and long term material innovation agenda in the value chain.

The market trends are also being influenced by regional dynamics and global supply chain realignment. The aerospace manufacturing activities in Asia-Pacific and other emerging markets are growing, which is causing increased demand in the localized production and material sourcing capacities. The aerospace OEMs with thermoplastic manufacturers are also forming strategic alliances that are developing regional supply chains and augmenting responsiveness to supply. These geographical changes are broadening of markets and increasing the pace of adaptation of high-level thermoplastic solutions to various aircraft programs.

High-Performance Thermoplastics in Aerospace Market Analysis

Learn more about the key segments shaping this market

High-performance thermoplastics in aerospace market based on material type is segmented into PAEK (Polyaryletherketones), Polyimides, Polysulfones, PPS (Polyphenylene Sulfide), and other high-performance thermoplastics. The PAEK (Polyaryletherketones)segment was valued at USD 0.52 billion in 2025, and it is anticipated to expand to 7.8% of CAGR during 2026-2035.

The PAEK materials are also becoming popular in aerospace designs where the higher operating temperature and the demanding mechanical environment of the aerospace are the driving forces. The fact that they can be maintained strongly in both thermal and chemical conditions contributes to their increased application in structural and semi-structural aircraft components. Polyimides are also experiencing increased use in areas where there is a need for extreme heat resistance and stability in dimensions especially around engines and high-temperature areas. Polysulfones and PPS are becoming popular in systems and interior constituents with balanced performance, chemical resistance, and processability, whereas other high performance thermoplastics are being taken to fill the niche performance and cost demands.

Material diversification, in which aerospace manufacturers are choosing polymers on particular performance-cost trade-offs and not one material strategy, is driving the market. The constant development of material is enhancing resistance to fatigue, flame-resistance, and ease of integration with automated production. The newer grades are becoming certified and are being incorporated into additional aircraft programs as time goes by. This material level enhancement is enabling increased penetration of thermoplastics in primary and secondary aerospace applications.

High-performance thermoplastics in aerospace market based on aircraft platform is segmented into commercial aviation, military & defense aviation, business & general aviation, space applications, and others. The commercial aviation segment was valued at USD 0.58 billion in 2025, and it is anticipated to expand to 7.9% of CAGR during 2026-2035.

Growth in the commercial aviation industry is facilitated by increasing aircraft manufacturing rates, and efficiency and durability fleet modernization programs. Airframes, interiors, and systems are all being fit out with high-performance thermoplastics in order to aid in weight loss and reduce build speed. Aviation in military and defense sectors is also fueling its adoption by requirement of materials which are resistant to the harsh operating conditions and long-service lives. Advanced thermoplastics are also being used in the business and general aviation platforms to boost performance as they combat the complexity of manufacturing.

The high-performance thermoplastics are also finding more use in space applications because of their resistance to radiation, elevated temperature and chemical exposure. Such materials are used to reinforce the lightweight satellite structures and parts that have high reliability demands. The concept of unmanned aerial systems and advanced air mobility is an additional emerging platform that is increasing the range of application. This platform level diversification is playing a role in stabilized market growth in various aerospace markets.

High-performance thermoplastics in aerospace market based on component type is segmented into structural components, interior components, engine & propulsion components, electrical & electronic housings, transparencies & windows, and leading edges & aerodynamic surfaces. The structural components segment was valued at USD 0.39 billion in 2025, and it is anticipated to expand to 8% of CAGR during 2026-2035.

More and more structural components are using high-performance thermoplastics because their mechanical reliability and fatigue performance is now being trusted. Their application helps with the modular designs and welded assemblies that minimize the number of parts and time to assemble them. The use of thermoplastics by interior components is also growing by fire safety compliance, the flexibility imposed by aesthetics and reduced maintenance requirements. These materials are also being used as housings, ducts and secondary parts that are exposed to elevated temperatures of engine and propulsion components selectively.

The insulation and resistance to chemicals properties of thermoplastics are finding application in electrical and electronic housings, which is why aircraft systems are becoming increasingly electrified. Transparencies and windows are being developed with better impact resistance and optical stability. The trend is also towards the use of thermoplastics on leading edges and aerodynamic surfaces as the processing technologies can now allow smaller tolerances and more intricate forms. The expansion component by component is increasing the overall material area of the aircraft architectures.

High-performance thermoplastics in aerospace market based on product type is segmented into neat resin/pellets, prepregs, semi-finished products, and finished parts/components. The neat resin/pellets segment was valued at USD 0.46 billion in 2025, and it is anticipated to expand to 8.5% of CAGR during 2026-2035.

Neat resins and pellets have wide applications such as injection molding, extrusion, and compounding base materials, which facilitate flexibility on production paths. Their demand is increasing because processors tailor down formulations to fit certain aerospace needs. Prepregs are being used in automated layup operations, which guarantees uniformity and shorter production lines. Semi-finished goods like sheets, laminates and profiles are sustaining effective downstream manufacture and less waste of materials.

Ready-to-assemble parts and components are increasingly becoming significant as the aerospace OEMs and suppliers shift towards integrated supply models. This change facilitates the reduction of lead-time and quality control with the help of specialized manufacturing partners. The necessity to synchronize the material form and the strategies of automated and high-rate production causes the product-level evolution. The combination of these product types is helping to promote the use of thermoplastics on various aircraft programs in a scalable way.

High-performance thermoplastics in aerospace market based on manufacturing process is segmented into automated fiber placement (AFP) & automated tape placement (ATP), compression molding & stamp forming, thermoforming, injection molding, additive manufacturing (AM), welding & joining technologies, and continuous compression molding (CCM). The automated fiber placement (AFP) & automated tape placement (ATP)segment was valued at USD 0.39 Billion in 2025, and it is anticipated to expand to 7.7% of CAGR during 2026-2035.

Automated fiber placement and automated tape placement are being used to aid in the manufacture of large, complex thermoplastic composite structures with great repeatability. Compression molding and stamp forming are on the rise since they are applicable in mass production of components. Thermoforming is being adopted in the manufacture of lightweight interior and system part with effective cycle times. Injection molding still backs up high-precision components and complicated shapes particularly in electrical and system enclosures.

Additive manufacturing is facilitating quick-prototyping and low-volume manufacturing of complicated thermoplastic components to aid designs iteration and personalization. The use of welding and joining technologies is increasingly becoming a substitute for mechanical fasteners to allow the implementation of integrated assemblies, as well as reduction of weights. Continuous compression molding is also growing in the case of long and constant profile that are used in the structural and semi structural uses. Innovation in manufacturing processes is directly contributing to increased efficiency production and increased material usage.

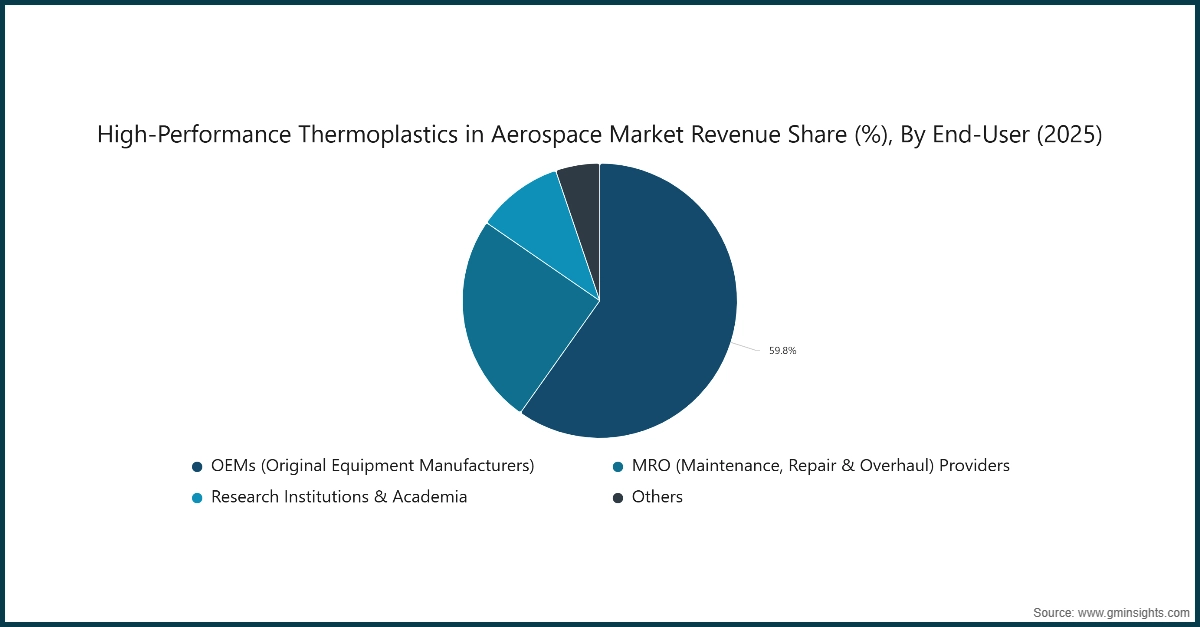

Learn more about the key segments shaping this market

OEMs are incorporating thermoplastics with high performance into aircraft design phases in order to be able to optimize weight, manufacturability, and the performance of the life cycle. The initial material intervention enables conformity to automated production and certification specifications. The use of thermoplastic parts in repairing and replacing is also gaining momentum among MRO providers because of its strength and straightforwardness to process. This assists in lessening the time lost during aircraft maintenance and maintenance life.

The research academia and institutions are playing their part by developing materials, testing, and optimization of processes, which is long term technological development. Crowdfunding is expediting new material and production method qualifications. Other end-users such as tier suppliers and system integrators are extending greater capabilities to support changing OEM requirements. Diversification of end-users is enhancing the entire ecosystem and long-term expansion of the market.

Looking for region specific data?

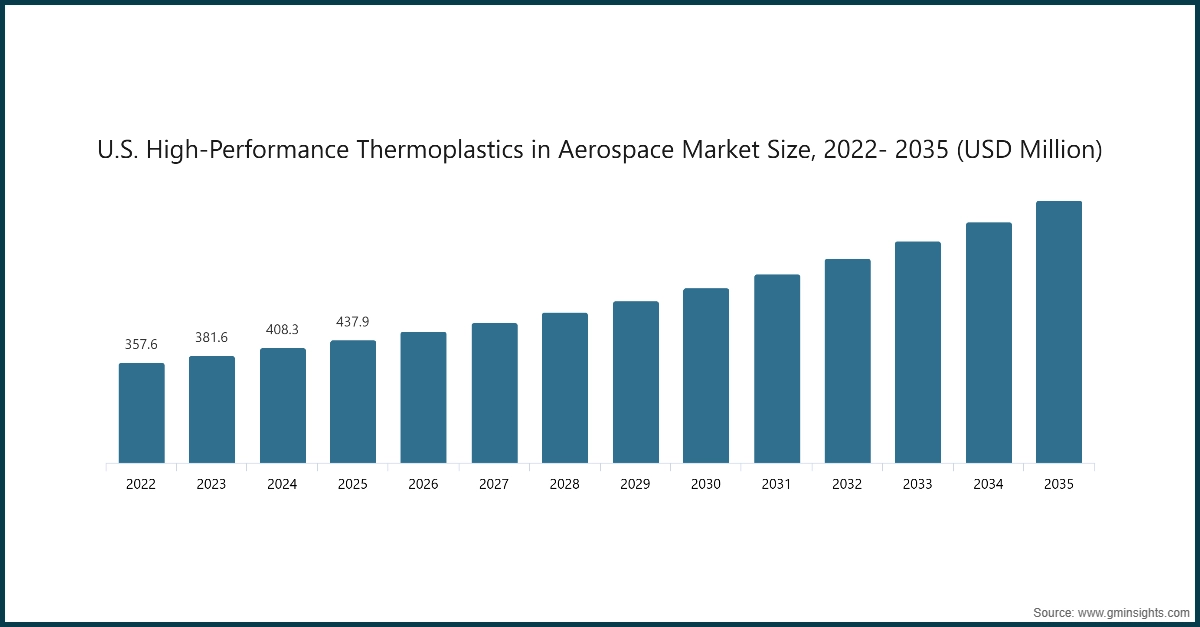

The North America high-performance thermoplastics in aerospace market accounted for USD 0.49 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

The thermoplastics used in high-performance by aerospace in North America are relatively expanding with the intensive production of aircrafts, improved material developments in terms of research and development, and the early usage of automated manufacturing technologies. The region is enjoying an established aerospace supply chain and unending investment in next generation aircraft programs. The U.S. is growing at a higher rate in the region, which is enabled by the increasing commercial aircraft deliveries, military modernization processes, and application of lightweight materials in the structural components and system components. Material integration in the civil, defense and space aerospace platforms is also being assisted by continuous investment in additive manufacturing, thermoplastic composites, and space programs.

The Europe high-performance thermoplastics in aerospace market accounted for USD 0.42 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

The aerospace thermoplastics market is growing steadily in Europe due to the focus on the sustainable aviation industry, lightweight constructions, and precise manufacturing. Firms in the aerospace industry and their tier suppliers are moving towards the use of thermoplastics to ensure that it is recyclable, modular, and efficient. Germany is the fastest expanding nation in the region with the high base of aerospace engineering, polymer research, and concentration on industrial automation. Expanding application of thermoplastic composite and components is aided by increased involvement in commercial aircraft programs, defense upgrades and space programs, especially in interiors, electrical systems and semi-structural.

Asia Pacific high-performance thermoplastics in aerospace market accounted for 24.2% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

Asia-Pacific is a high-growth segment with aerospace thermoplastics because of the growth of aircrafts, the increase in air passenger travel and the rise in localization of aerospace manufacturing. The domestic aircraft programs and supply chain development are being supported by regional governments providing opportunities for advanced materials. China is the most rapidly developing state, which is supported by massive investments into commercial aviation, military-defense platforms, and space exploration projects. The increased emphasis on material self-sufficiency, cost-effective production, as well as on the implementation of automated operations is increasing the rate of application of high-performance thermoplastics in structural, interior, and system-level aerospace parts.

Latin America high-performance thermoplastics in aerospace market is anticipated to grow at a CAGR of 9.2% during the analysis timeframe.

The aerospace thermoplastics market in Latin America is expanding at a low pace, with the growth aided by local aircraft production, export of components, and the growing involvement of the region in global aerospace supply chain. There is an increasing need to have lightweight and tough materials that will facilitate efficient manufacturing and maintenance of aircrafts. Brazil is the fastest developing country because it has already developed aerospace manufacturing base and regional and business aviation. The growing investments in aircraft development, system integration and MRO processes are driving the use of high-performance thermoplastics, especially material used as interior components, housings, as well as semi-finished parts that are utilized in various aircraft platforms.

Middle East & Africa high-performance thermoplastics in aerospace market is expected to grow at a CAGR of 10% during the analysis timeframe.

The Middle East & Africa region is experiencing increasing application of aerospace thermoplastics with the countries investing in aviation facilities, military forces, and domestic production. Airlines are adding fleets, which have necessitated the use of sophisticated materials that facilitate life cycle and reduction of life cycle costs. The most rapidly developing country is Saudi Arabia with the national aerospace development programs, defense procurement programs, and the desire to localize aircraft maintenance and production. Gradual penetration of high-performance thermoplastics in components, systems, and support structures in the regional aerospace ecosystem is being supported by investments in MRO facilities, military aviation, and projects related to space.

High-Performance Thermoplastics in Aerospace Market Share

- Victrex plc, Solvay Special Chemicals, Arkema S.A., Toray Advanced Composites, and Evonik Industries AG are a significant part of the global high-performance thermoplastics in aerospace industry and with further standing of being highly consolidated with the top five players steadily holding 70% market share in the year 2025.

- The firms retain their market status through their recurring investment on advanced polymer research as a way of enhancing the thermal resistance, strength-to-weight ratio and durability of the high-performance thermoplastics. The innovation focus enables them to be well aligned with the changing aerospace performance and safety demands.

- Good relationship with aerospace OEM and tier suppliers helps to achieve early material qualification and incorporate into new aircraft programs. These players impact the choice of materials and integrate their solutions into extended production processes by participating at the design level.

- Long-term contracts can be achieved by companies with the use of extensive certification experience and adherence to the high standards of compliance in the field of aerospace. The ability minimizes switching risks to the customers and enhances the customer position as reliable material partners to the critical applications.

- Several airline companies also use automated and scalable production capacities to promote high-rate production of aircrafts. The investments in the latest processing technologies guarantee the uniformity of quality, cost-effectiveness, and the preparedness to the future increase of volumes.

- These players are able to cover a wide and diversified product portfolio to cover various applications in structural, interior, electrical, and system components. This lowers reliance on one platform of aircraft and normalizes revenue.

- Localized production and strategic geographic presence assists companies in assisting aerospace programs worldwide. Close proximity to major manufacturing centers enhances reliability of supply as well as reactiveness to customer demands.

- The innovation of continuous processes, such as welding, joining, and additive manufacturing ability, allows customers to reshape assemblies, and decrease the number of parts. This reinforces the value proposition to material supply only.

- Next-generation material development: Long-term collaborations with research centers and technological centers facilitate next-generation material and process development. Such partnerships are useful in creating aerospace material roadmaps and industry standards in the future.

- These companies have a great emphasis on lifecycle performance, recyclability, and sustainability which places them in an advantageous position as aerospace shifts to environmental accountability. This effect enhances wider use of thermoplastics in place of conventional materials.

High-Performance Thermoplastics in Aerospace Market Companies

The major players operating in high-performance thermoplastics in aerospace industry include:

- Victrex plc

- Solvay Special Chemicals

- Arkema S.A.

- Toray Advanced Composites

- Evonik Industries AG

- Others

- Victrex plc has maintained its position through the consistent improvement of PAEK-based materials in the field of aerospace structural and system applications. The company collaborates with manufacturing firms of aircrafts in order to aid in the qualification of materials, optimization in processing and reliability in supply in the long term so that it could be integrated into the next generation aircrafts.

- Solvay Special Chemicals continues to remain in the market with a wide range of high performance thermoplastics and composites products that are used in the aerospace industry where the environment poses intense demands. It focuses on prominent level of processing technologies, early collaboration with OEM, and certification assistance to incorporate its materials in its commercial and defense aircraft platforms.

- Arkema S.A. also enhances its position by increasing the high-performance polymer solutions that assist in lightweighting and efficient production in the aerospace industry. The firm is engaging in material innovation and scalable production and match products with automated processing as well as sustainability needs in aircraft elements.

- Toray Advanced Composites has maintained its status by combining material science knowledge with the ability to manufacture composite materials. It specializes in thermoplastic composite structures that are compatible with high rate production processes and allow aerospace consumers to enhance structural efficiency and complexity in assembly.

- Evonik Industries AG remains in the position by producing specialty thermoplastics which meet thermal stability, chemical resistance, and durability requirements in aerospace systems. The company assists customers by developing applications, providing processing direction, and long-term material stability to reinforce the adoption in the variety of applications in its aircrafts.

High-Performance Thermoplastics in Aerospace Market News

- In July 2025, Arkema with affiliate PI Advanced Materials, promoted the Zenimid brand of high-performance polyimide products, which serve aerospace applications, which require high thermal stability and mechanical performance.

- In October 2024, Envalior introduced an extended series of Tepex continuous fiber-reinforced thermoplastic composites, with new matrixes such as polyetherimide, polyphenylene sulfide, polyamide 4.6 and 4.10, and thermoplastic copolymer elastomers, and introduced them at Fakuma 2024.

- In March 2024, Solvay and GKN Aerospace signed an extension to their collaboration agreement of 2017 with the objective of increasing the applications of thermoplastic composite materials in aerospace structures. According to this agreement, the two companies generated a joint roadmap on thermoplastic composites to seek new materials and novel production processes.

The high-performance thermoplastics in aerospace market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) & (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Material Type

PAEK (Polyaryletherketones)

PEEK (Polyetheretherketone)

PEKK (Polyetherketoneketone)

LM-PAEK (Low-Melt PAEK)

Polyimides

PEI (Polyetherimide/Ultem)

PAI (Polyamideimide)

Polysulfones

PPS (Polyphenylene Sulfide)

Other high-performance thermoplastics

Market, By Aircraft Platform

Commercial aviation

Narrow-body aircraft

Wide-body aircraft

Military & defense aviation

Fighter aircraft

Military transport aircraft

Military helicopters

Business & general aviation

Space applications

Others

Market, By Component Type

Structural components

Primary structures

Secondary structures

Interior components

Seats & seat frames

Galleys & lavatories

Overhead stow bins

Sidewall & ceiling panels

Window reveals & trim

Engine & propulsion components

Nacelles & engine cowlings

Thrust reversers

Ducts & air management systems

Fan blades & acoustic liners

Electrical & electronic housings

Radomes & antenna housings

Avionics enclosures

Cable management systems

EMI/RFI shielding requirements

Transparencies & windows

Aircraft windows & windshields

Canopies (military applications)

Polycarbonate vs. Acrylic analysis

Leading edges & aerodynamic surfaces

Wing leading edges

Control surfaces

Aerodynamic fairings

Market, By Product Type

Neat resin/pellets

Prepregs

Unidirectional (UD) tape

Woven fabric prepregs

Semi-finished products

Sheets & laminates

Films & membranes

Profiles & extruded shapes

Finished parts/components

Market, By Manufacturing Process

Automated fiber placement (AFP) & automated tape placement (ATP)

Compression molding & stamp forming

Thermoforming

Injection molding

Additive manufacturing (AM)

Welding & joining technologies

Resistance welding

Induction welding

Ultrasonic welding

Laser welding

Continuous compression molding (CCM)

Market, By End-User

OEMs (original equipment manufacturers)

MRO (maintenance, repair & overhaul) providers

Research institutions & academia

Others

The above information is provided for the following regions and countries:

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

India

Japan

South Korea

Australia

Rest of Asia Pacific

Latin America

Brazil

Mexico

Argentina

Rest of Latin America

MEA

UAE

Saudi Arabia

South Africa

Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What was the market size of the high-performance thermoplastics in aerospace market in 2025?

The market size was USD 1.31 billion in 2025, with a CAGR of 8.3% projected from 2026 through 2035, driven by advancements in additive manufacturing and the shift from thermoset to thermoplastic composites.

What is the projected value of the global high-performance thermoplastics in aerospace industry by 2035?

The market is expected to reach USD 2.86 billion by 2035, fueled by the increasing adoption of thermoplastic composites in structural and interior applications and the growing use of 3D printing technologies.

What is the projected size of the global high-performance thermoplastics in aerospace market in 2026?

The market is expected to grow to USD 1.4 billion in 2026.

What was the market share of the PAEK (Polyaryletherketones) segment in 2025?

The PAEK segment was valued at USD 0.52 billion in 2025 and is projected to grow at a CAGR of 7.8% from 2026 to 2035.

What was the market share of the commercial aviation segment in 2025?

The commercial aviation segment was valued at USD 0.58 billion in 2025 and is anticipated to grow at a CAGR of 7.9% from 2026 to 2035.

Which component type dominated the market in 2025?

The structural components segment led the market with a valuation of USD 0.39 billion in 2025, growing at a CAGR of 8% from 2026 to 2035.

Which region leads the global high-performance thermoplastics in aerospace market?

North America was the largest market in 2025, with an estimated value of USD 0.49 billion. The region is expected to show lucrative growth over the forecast period, driven by advancements in aerospace manufacturing technologies.

What are the upcoming trends in the global high-performance thermoplastics in aerospace industry?

Key trends include the increased adoption of additive manufacturing for precise and efficient production, the transition from thermoset to thermoplastic composites for scalability, and the integration of multifunctional designs to enhance cost-effectiveness and flexibility.

Who are the key players in the global high-performance thermoplastics in aerospace market?

Major players include Victrex plc, Solvay Special Chemicals, Arkema S.A., Toray Advanced Composites, Evonik Industries AG, and others.

High-Performance Thermoplastics in Aerospace Market Scope

Related Reports