Summary

Table of Content

Golf Putter Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Golf Putter Market Size

The global golf putter market was estimated at USD 3.5 billion in 2024. The market is expected to grow from USD 3.6 billion in 2025 to USD 5.1 billion in 2034, at a CAGR of 3.9%.

To get key market trends

At each hole, golfers use putters to get the ball into the cup. These clubs have a flat and almost parallel face which helps in striking the ball forward as opposed to upward. The increase in technology and product innovation is rapidly changing the market for golf putters along with other equipment. For example, the introduction of newer materials for clubhead and use of alignment aids is promoting growth within the industry. As indicated by the National Golf Foundation, there has been an increase in custom-made golf equipment at which putters are included. Golfers are now opting for customizable options such as the type of shaft, grip, and distribution of weight in the putter.

Golf Putter Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 3.9% |

| Market Size in 2034 | USD 5.1 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Other changes which help polish the accuracy with which golfers read cut greens includes alignment aids and adjustable features which such embedded sensors. Furthermore, other design modifications made within the putter include heavy clubheads with counter-weighted grips or shafts which aid in control and stability while taking the putting strokes. In aiding the advancement of sales and marketing strategies, the NGF affirms that alongside professional golfers or brands, putter manufacturers stepping into collaborations to create special artistic designs of putters have aided in promoting sales.

The golf sector has been impacted by the pandemic due to rising interest in golfing as an outdoor sport as well as changes in spending by consumers. According to the NGF, there has been a spike in the sale of golf items, such as putters, as customers shift towards online buying. These tendencies are likely to continue influencing the market in the following years, thereby propelling market growth.

Golf Putter Market Trends

- Market growth has been driven by major golf events, endorsements from professional players, and even changes amongst consumers. Also, the increased attention towards sustainability in the manufacturing of golf equipment is likely to benefit the industry.

- Furthermore, some other manufacturers are now adding sensors and data analytic technologies into their clubs to assist the golfers in improving their performance. There has been an increased demand for putters with effective alignment aids to help golfers achieve better accuracy. Different alignment aids based on contrasting colors, lines, and shapes on the putter head are being used by manufacturers.

- At the same time, golf putter manufacturers are incorporating new technologies aimed at improving the functions of the putters. This includes the use of advanced materials with milling steel, aluminum, and carbon fiber, in addition to face and control feel inserts, adjustable weight features for better feel and control, thereby propelling the market growth.

Golf Putter Market Analysis

Learn more about the key segments shaping this market

- The golf putter market by product type is segmented into face balanced putters and toe balanced putters.

- Face balanced putters held the dominant market of USD 2 billion in 2024 and is expected to reach USD 2.9 billion by 2034.

- This segment has a lot of Face balanced putters aids due to the demographic’s demand because Face balanced putters are generally associated with a more stable and straight-back, straight-through putting stroke which is expected to propel the segment market. Additionally, face balanced putters are often favored by golfers with a straight back, straight through putting stroke who usually have a low arc in their stroke which is aided by face balanced putters.

Learn more about the key segments shaping this market

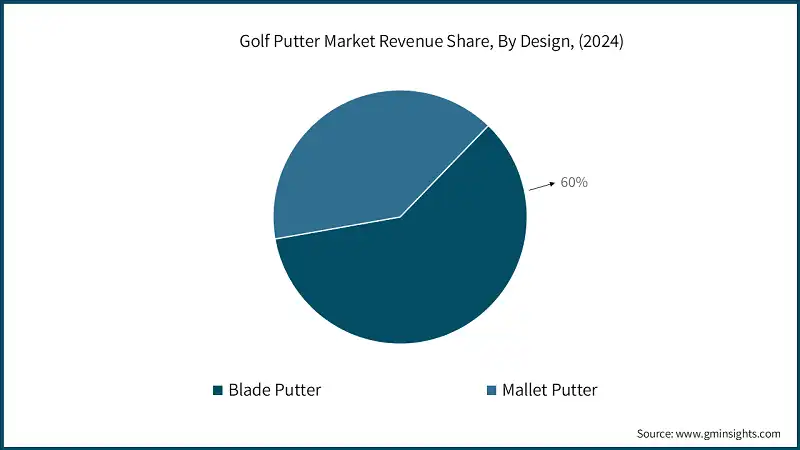

- The golf putter market by design is segmented into blade putter and mallet putter.

- The blade putter segment accounted for a market share of around 60% in 2024 and is projected to grow by 2034.

- Blade putters capture over 60% market share. Because of their light weight, blade-type putters are easy to align to the target. Some golfers appreciate the minimalistic design that is easy to use which is expected to drive the growth of the segment. Furthermore, blade putters are reputed to be superior in terms of feel and feedback, making it easier for golfers to sense the impact and distance control.

Looking for region specific data?

- In the U.S., the golf putter market is growing at a rate of 4% each year. American companies like Titleist (Scotty Cameron), Ping and Odyssey set the pace for the rest of the world in golf putters manufacturing and sales. Due to strong U.S. consumer culture, there is ample demand which compels American manufacturers to innovate in precision milling, advanced materials, and customization suitable for both amateur and professional golfers.

- Germany is one of the major countries in the European region's golf putter market and is growing at a rate of 3.7% each year. German engineering is synonymous with high precision which allows brands like Evnroll and BGT Stability to dominate the global market with their proprietary technology. These German branded putters skirt scientific weight distribution and stroke consistency which have mass appeal among premium buyers and competitive players.

- In China, the golf putter market is growing at a rate of 4% each year. There is a shift of power from established brands to new local brands in china. China’s ability to provide incorporate low-cost production with supply chain makes it a key player in the mid-tier to entry-level putter market.

Golf putter Market Share

The golf putter industry is fragmented, with prominent players, such as Adams Golf Inc., Bettinardi Golf, Bobby Grace Putters, Bridgestone Sports Ltd, Callaway Golf Company holding a market share of 30%-35%.

- In the golf putter market, Adams Golf Inc has the largest share due to its comprehensive product portfolio.

- With a strong brand reputation, advanced technology, and strategic partnerships, medals are expected to continue dominating the market. The Company is known for high performance putters due to the innovative face insert design, the perimeter weighting, and the balance’s adjustability which enhance precision and consistency. Furthermore, Adams, Inc. is also availed with great putter distribution networks through major golf retail stores, online sites, and even professional endorsements increasing market capture.

Golf Putter Market Companies

Major players operating in the golf putter industry are:

- Adams Golf Inc.

- Bettinardi Golf

- Bobby Grace Putters

- Bridgestone Sports Ltd

- Callaway Golf Company

- Cleveland Golf Company, Inc.

- Cobra Golf

- Fourteen Golf

- Henry Griffitts

- Honma Golf Ltd.

- Mizuno USA, Inc

- Rock Bottom Golf

- TaylorMade Golf Company, Inc.

- The Acushnet Holdings Company

- Vega Golf

Golf Putter Industry News

- In March 2023, Straumann diversifies its offerings by acquiring GalvoSurge Dental AG, a Swiss medical device manufacturer, to address peri-implantitis treatment. The Galvo Surge device will be accessible in the European market by June 2023 and is compatible with various dental implant systems, enhancing its industry-wide usability.

- In November 2021, TaylorMade Golf acquired Nassau Golf Co. Ltd, forming TM Golf Ball Korea as the third addition to its golf ball manufacturing facilities, alongside TM Golf Ball South Carolina and TM Golf Ball Taiwan. The financial details of this acquisition were not disclosed.

- On March 8, 2021, Callaway Golf Company ("Callaway") (NYSE: ELY) and Topgolf International, Inc. ("Topgolf") successfully concluded their previously disclosed merger, after receiving approval from shareholders of both entities. This merger has resulted in the formation of a consolidated technology-driven golf enterprise, offering top-tier golf equipment, apparel, and entertainment experiences, establishing an unmatched presence in the industry.

This golf putter market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Face Balanced Putters

- Toe Balanced Putters

Market, By Design

- Blade Putter

- Mallet Putter

Market, By Length

- Traditional Length (32-36 inches)

- Belly Putter (41-46 inches)

- Long Putter (48-52 inches)

Market, By Price Range

- Premium or High

- Economy or Mid-Range

Market, By End Use

- Professionals

- Amateur

Market, By Distribution Channel

- Direct Sales

- Indirect Sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

How much is the U.S. golf putter market worth in 2024?

The U.S. market of golf putter was worth over USD 550 million in 2024.

How big is the golf putter market?

The market of golf putter was valued at USD 3.5 billion in 2024 and is expected to reach around USD 5.1 billion by 2034, growing at 3.9% CAGR through 2034.

What will be the size of face balanced putters segment in the golf putter industry?

The face balanced putters segment is anticipated to cross USD 2.9 billion by 2034.

Who are the key players in golf putter industry?

Some of the major players in the industry include Adams Golf Inc., Bettinardi Golf, Bobby Grace Putters, Bridgestone Sports Ltd, Callaway Golf Company, Cleveland Golf Company, Inc., Cobra Golf, Fourteen Golf, Henry Griffitts, Honma Golf Ltd., Mizuno USA, Inc., Rock Bottom Golf.

Golf Putter Market Scope

Related Reports