Summary

Table of Content

Gas Insulated Power Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Gas Insulated Power Equipment Market Size

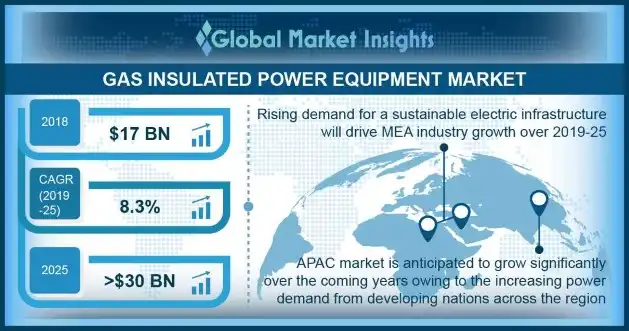

Gas Insulated Power Equipment Market size for 2018 was assessed over USD 17 billion and is anticipated to witness an annual growth rate of over 8% by 2025.

To get key market trends

To get key market trends

The gas insulated equipment market from GIS has been influenced by the significant rise in demand for compact substation units to curtail the overall project space, cost and maintenance requirements. Although, availability of an appreciable amount of conventional switchgear technologies including air, and vacuum insulated products have consistently been posing opposition to their adoption across the industry. However, persistent efforts to reduce costs, enhance operational performance and manufacture compact product specifications have favoured the adoption of these products.

Gas Insulated Power Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 17 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 8% |

| Market Size in 2025 | 30 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

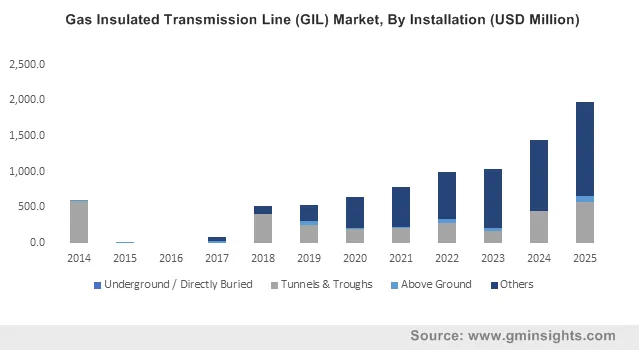

Gas Insulated Transmission Lines have gained significant impetus since first project commissioned in 1975 which consist of 100% SF6 gas insulation for voltage up to 400 kV and 0.7 km length. Enhanced insulation properties, welding feasibility and improved elastic bending capability are the key factors for the ongoing development with configurations of 80% N2 and 20% SF6 gas for 420 kV voltage and 100 km length. High voltage transmission capability, technology upgradation along with long operation life have led comprehensive ground for the establishment of upcoming 1,100 kV GIL project across China.

Gas Insulated Power Equipment Market Analysis

The rapid upscaling of renewable technology including wind energy will potentially lead to the demand for advance and competitive electrical infrastructure over the forecast timeframe. In addition, increasing plant size to sustain the upsurge in demand for energy with conventional electrical infrastructure acquiring more space and clearances have raised the overall project cost. Therefore, the integration of GIS technology provides significant scope for space and cost reduction along with enhanced operational performance which in turn will complement gas insulated power equipment market share.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

High overload capability, enhanced safety features, operational flexibility and low space requirement are some prime factors which will foster the global market size. In addition, the GIL offers high-power ratings, auto-reclosing functionality, high short-circuit withstand capability and low electromagnetic field emission. Moreover, the persistent efforts for the upgradation of HVAC and HVDC transmission technology along with integration of renewable grid networks will boost the product demand.

The Gas Insulated Transmission line (GIL) market has substantially been affected by regulatory shift toward reduction in transmission losses, enhanced transmission capacity and reliability of electricity grid network. Effective short-circuit withstand capability, low maintenance cost, minimal electrical ageing and non-flammable operational characteristics have positively swayed the product adoption. Furthermore, the manufacturers are allocating heavy fund for research and development activities associated to gas insulated transmission lines for reduction in the overall project cost and environmental hazards.

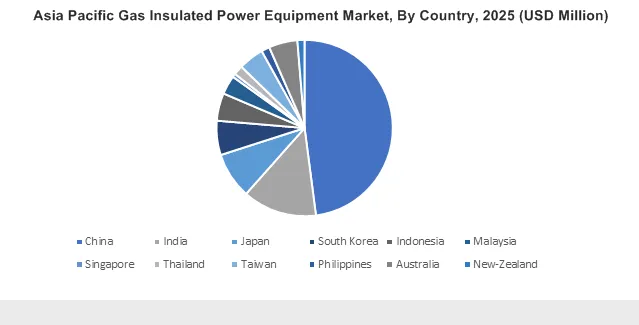

Asia Pacific will witness growth due to the growing power demand from emerging nations. Developing economies including India and China are considered as favourable countries as they continue to complement the conventional power infrastructure and capacities to meet the power demand. Changing electricity consumption patterns in corporations and households favoured by regulatory inclination towards the integration of effective grid infrastructure will propel the global market share.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Middle East and Africa are projected to witness growth across the industry due to the increasing demand for a sustainable electric infrastructure. Lack of electricity grid infrastructure along with the rising electricity demand will boost the global market size. Growing private investments from financial institutions consisting of the World Bank, the Asian Development Bank and the IFC, toward electrification will stimulate the business landscape. Furthermore, the re-establishment of electrical grid infrastructure across the war-affected nations will considerably proliferate the industry growth.

Gas Insulated Power Equipment Market Share

Major participants in the gas insulated power equipment market include

- ABB

- Toshiba

- Schneider Electric

- Siemens AG

- General Electric

- Mitsubishi Electric

- BHEL

- Crompton Greaves

- Larsen and Toubro

- Ormazabal

- Hyundai Electric & Energy System

- Hitachi

- Fuji Electric

- Iljin Electric

- Chint Group

- Hyosung

- Xi'an XD Switchgear Electric

- AZZ

- Meidensha Corporation

Geographical Expansion, Product Launch & Acquisitions have been the prime strategic inferences as adopted by the prominent industry players.

Gas Insulated Power Equipment Industry Background

GIS is the apparatus used for regulating, switching, and controlling on or off the electric circuit in the electricity system. The switchgear system is linked directly to the electricity supply system. It is integrated in both the low and high voltage area of the power transformer.

Gas-insulated transmission lines are the flexible and safe alternative when compared to overhead lines and occupy less space while offering the same electricity transmission. Since GIL hardly affect the landscape with minimized electromagnetic radiation approve their applicability in close to, or within buildings or residential areas.

Frequently Asked Question(FAQ) :

How much is the global gas insulated power equipment industry share forecast to surpass by 2025?

As per estimates, gas insulated power equipment market would record a revenue share of $30 billion in 2025.

How much growth rate is gas insulated power equipment industry expected to witness during the forecast period?

gas insulated power equipment market is forecast to exhibit a crcr of 8% through 2025.

Gas Insulated Power Equipment Market Scope

Related Reports