Summary

Table of Content

Food Extrusion Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Food Extrusion Equipment Market Size

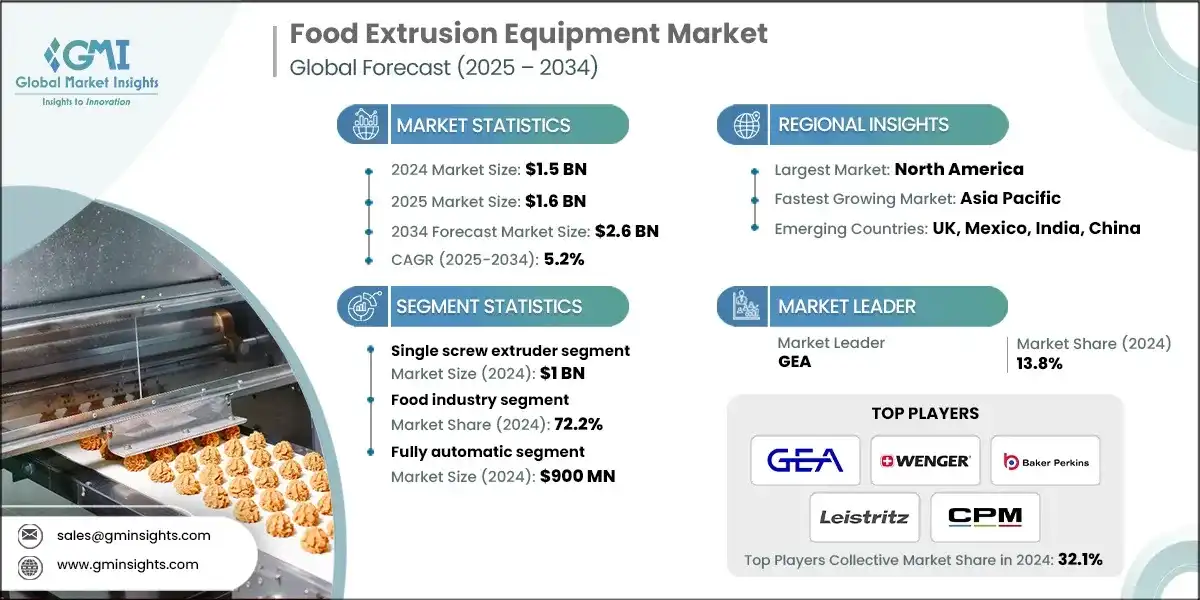

The food extrusion equipment market was estimated at USD 1.5 billion in 2024. The market is expected to grow from USD 1.6 billion in 2025 to USD 2.6 billion in 2034, at a CAGR of 5.2% according to latest report published by Global Market Insights Inc.

To get key market trends

The increasing demand for plant-based alternatives to meat and seafood is the biggest driver for specialized extrusion machines. High moisture extrusion cooking (HMEC) is the technology that leads to the fibrous, meat-like textures of products like plant-based chicken and plant-based fish. The rapid entrance of food companies and start-ups into the sector is growing the specialty market of twin screw extruders tailored for high moisture meat analogues (HMMA). Flexitarian consumption is driving these not just for vegans, but others searching for animal-free sustainable sources of protein.

Consumers increasingly want snacks that are not only delicious but also provide nutritional value. This is well-suited to extrusion technology. When manufacturers extrude food, they cannot only provide a low fat, high protein, and high fibre nutrients. The exacting controls of processing conditions and ingredients can allow for a variety of snacks to be produced including gluten-free pasta, fortified breakfast cereals, and protein puffs specifically targeting health-based consumer trends.

In a cost-driven food industry, extrusion presents compelling economic benefits. Extrusion is an efficient continuous process that combines several unit operations into one step. As a result, it uses less energy per ton, decreases water use, less floor space, and a faster up-time compared to a batch process. The ability to change on a single piece of equipment to create a wide array of products makes extrusion a valuable long-term investment for manufacturers looking to pivot product lines or innovate quickly.

Food Extrusion Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.5 Billion |

| Market Size in 2025 | USD 1.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.2% |

| Market Size in 2034 | USD 2.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| The plant-based revolution | The explosive growth in demand for plant-based meat and seafood alternatives is the single largest driver for advanced extrusion equipment. High Moisture Extrusion Cooking (HMEC) is the key technology used to create the fibrous, meat-like textures of products like plant-based chicken and fish. |

| Demand for better-for-you and functional snacks | Consumers are increasingly looking for snacks that are not just tasty but also offer nutritional benefits. Extrusion is the perfect technology for this. It allows manufacturers to create low-fat (puffed, not fried), high-protein (from pea, lentil, or soy isolates), and high-fiber products. |

| Operational efficiency and versatility | In a competitive food industry with tight margins, extrusion offers compelling economic advantages. It is a highly efficient, continuous process that combines multiple operations such as mixing, kneading, cooking, shaping, expanding into a single step. This leads to lower energy consumption per ton, reduced water usage, less floor space, and higher throughput compared to traditional batch processes. |

| Pitfalls & Challenges | Impact |

| High capital investment and operating costs | Food extrusion equipment, particularly sophisticated twin-screw systems for R&D or specialized products, represents a significant upfront capital investment. This can be a major barrier to entry for smaller companies or startups. |

| Operational complexity and skill gap | Extrusion is often described as both a "science and an art." Achieving the desired product texture, density, and shape require a deep understanding of thermodynamics, fluid dynamics, and ingredient chemistry. |

| Opportunities: | Impact |

| Integration of industry 4.0 (smart extrusion | There is a massive opportunity to embed IoT sensors, AI, and machine learning into extrusion equipment. "Smart extruders" could use real-time data on temperature, pressure, and motor torque to auto-adjust process parameters, compensating for ingredient variability without human intervention. |

| Development for novel ingredients and upcycling | The future of food involves new and sustainable inputs. This presents an opportunity for equipment manufacturers to design extruders specifically for challenging materials. This includes processing insect protein, algae, or mycelium into palatable food products. |

| Market Leaders (2024) | |

| Market Leaders |

13.8% market share |

| Top Players |

The collective market share in 2024 is 32.1% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | UK, Mexico, India, China |

| Future Outlook |

|

What are the growth opportunities in this market?

Food Extrusion Equipment Market Trends

The integration of IoT sensors, artificial intelligence, and cloud-based monitoring platforms is revolutionizing operations, transforming traditional reactive maintenance approaches into predictive, data-driven strategies.

- There is a noticeable change in the food extrusion equipment market. The equipment of choice has transitioned from the single-screw extruder to the twin-screw extruder due to its ability to mix more effectively, better temperature control, and ability to handle a broader spectrum of raw materials: high-moisture, high-fat, shear-sensitive, and other ingredients. Major manufacturers of food extrusion equipment, like Bühler, Clextral, and Baker Perkins are heavily investing in advanced twin-screw extrusion design, such as modular barrel equipment, laser-cut dieface systems, and precision process control designs that allow the operator to produce more consistent product quality while reducing waste of raw materials and energy use of up to 25% across the entire line.

- High-moisture extrusion (HME) and shear cell technology are quickly becoming a go-to standard in the industry for producing plant-based fibrous meat-like products from traditional protein sources like soy, pea, and wheat as well as from novel proteins like chickpea, fava bean, and algae. Equipment manufacturers are developing extrusion lines specifically for moisture content ranging from 40-80% and specialized cooling die systems that can texturize the material, and even inline flavoring systems could have the capability of taking soy and producing a fully finished meat alternative product at production rates of 1000 kg/hour or greater.

- Food extrusion equipment is changing quickly with the introduction of Industry 4.0 technologies, including IoT sensors, artificial intelligence, machine learning algorithms and predictive maintenance systems that are converting conventional extrusion lines into smart manufacturing platforms. Cloud-based control systems permit monitoring and operating multiple extrusion lines at different locations remotely, while artificial intelligence-based optimization algorithms can yield energy usage reductions of 15-20% and gain Overall Equipment Effectiveness (OEE) to greater than 85%.

- The new generation of extruders utilize enhanced heating and cooling systems employing heat recovery technology, variable frequency drives (VFDs) and utilize improved screw designs to produce a reduction of 25-35% in specific mechanical energy (SME) input relative to conventional systems.

- Equipment manufacturers are advancing solutions for producing gluten-free products, high-protein snacks, products with fiber-enriched cereals, and products for specialized diets targeting diabetic, keto, or senior nutrition. Technology’s capabilities can modify starch structure, improve protein digestibility, allow unique textures that likewise maintain nutritional value, and extrusion is the premier processing technology for functional foods with the extruded utilization market size projected to grow at an annualized rate of 8-10% reaching size and scale by 2030.

- Manufacturers are introducing compact, modular extrusion systems with production capacities ranging from 50-500 kg/hour, featuring tool-free die changes, automated cleaning systems, and recipe management software that can reduce changeover times from hours to under 30 minutes.

Food Extrusion Equipment Market Analysis

Learn more about the key segments shaping this market

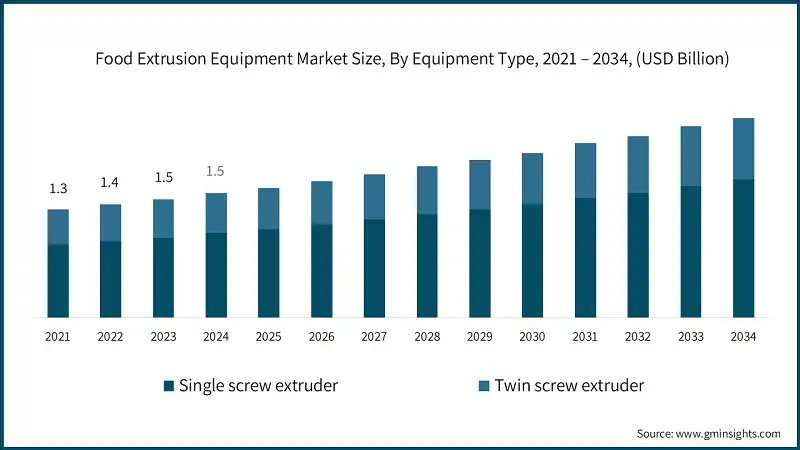

Based on type, the market is divided into single screw extruder and twin-screw extruder. In 2024, single screw extruder held the major market share, generating a revenue of USD 1 billion.

- A major factor driving growth in the single-screw extruder market is the relative cost savings and lower barrier to entry when compared to more complex types of systems. Single-screw extruders are a lower capital expenditure (CAPEX) investment, making their acquisition attainable for small to medium sized businesses (SME) and for companies in developing countries.

- Additionally, their fewer moving parts and simpler control systems (less complexity) translates to cost savings in operation (OPEX) by requiring less maintenance and requiring less energy per unit of output. This cost-friendly aspect continues to be the preferred technology for producing high volume, cost competitive products, which stimulates their adoption in cost-driven segments and enables new entrants to establish a foothold in the market.

- The continued growth globally in the convenience food industry, especially in direct-expanded snacks and breakfast cereals, continues to spur demand for single-screw extruders, as they have been specifically designed for optimal continuous processing of starch and grain-based formulations requiring basic expansion, forming and cooking.

- As urbanization and increasing disposable income in developing regions grow consumer demand for affordable, ready-to-eat products such as corn puffs, cheese curls and basic cereal shapes, the single-screw extruder continues to be the technology that does the bulk of the work. This machine provides the capacity to consistently manufacture these essential consumer products at high throughput rates, making it relevant and growing with global macroeconomic and dietary trends.

Learn more about the key segments shaping this market

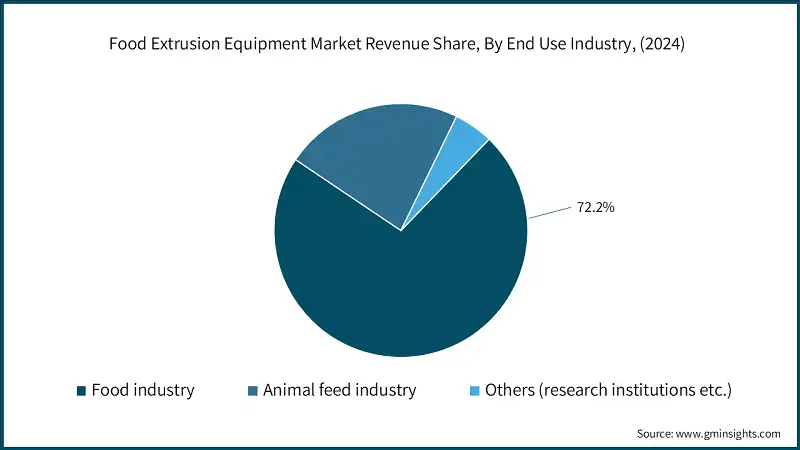

Based on end use industry, the food extrusion equipment market is segmented into food industry, animal feed industry, and others (research institutions, etc.). The food industry segment held around 72.2% of the market share in 2024.

- There is a change happening in the food world. A noteworthy upheaval in consumer values is reshaping the marketplace such as consumer preference shift towards products that prioritize health and wellness, sustainability, and ethics. U.S. organic food sales set a record of USD 61.9 billion in 2023, according to the Organic Trade Association (OTA), reinforcing the shift toward organic and "clean label" products (i.e., products with a straightforward ingredient list).

- Technology and digitalization are also disrupting the food value chain from production to consuming the food. The advent of e-commerce and direct-to-consumer (D2C) is transforming the retail and distribution process, creating new avenues for manufacturers to reach consumers. For the first time, according to the U.S. Department of Commerce, 2023, online grocery sales grew 20% year-over-year in 2023, and it appears consumers are using those online platforms more. In production, automation, IoT sensors, and data analytics, all models of Industry 4.0 improve manufacturing efficiencies, minimizing food waste and better ensuring food safety. According to a report by the Food and Agriculture Organization (FAO), precision agriculture techniques, including the use of drones and satellite imagery, have improved crop yields by up to 25% in certain regions, demonstrating the potential of agri-food tech to meet sophisticated consumer demands.

Based on the mode of operation, the food extrusion equipment market is segmented into manual, semi-automatic, and fully automatic. In 2024, fully automatic segment held a major market share, generating a revenue of USD 900 million.

- The utilization of fully automatic operational modes is a significant improvement in manufacturing performance, product consistency, and process control. With the integration of cutting-edge technologies such as sophisticated sensors, programmable logic controllers (PLCs), and real time monitoring, fully automatic extruders can control important production variables (e.g., temperature, pressure, feed rate, moisture content) accurately and consistently throughout the entire production process.

- In fully automatic production, operators are less likely to intervene because a high degree of automation has the potential to avert operator error and ensure that uniform products are produced consistently. This is especially important for manufacturers of snacks, breakfast cereals, pet food, and meat analogues where consistent and repeatable products are mission critical.

Looking for region specific data?

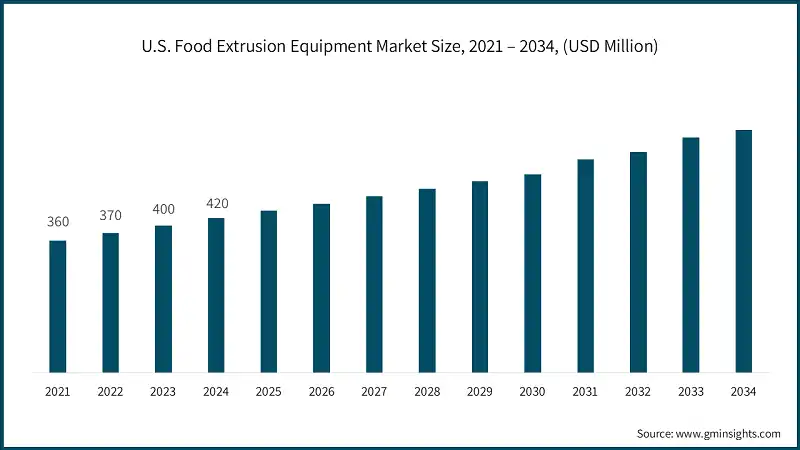

The U.S. food extrusion equipment market accounting for around 81.8% share in 2024, with generating around USD 420 million revenue.

- The U.S. market is characterized by technological sophistication, a strong focus on food safety, and a high degree of automation. Driven by the country’s robust processed food industry including snacks, breakfast cereals, pet food, and meat analogues manufacturers prioritize equipment that delivers consistent quality, high throughput, and compliance with stringent FDA and USDA regulations.

In Europe food extrusion equipment market, Germany leads with 19% share in 2024 and is expected to grow at 5.8% CAGR during the forecast period.

- Europe’s food extrusion equipment market is defined by its diversity, regulatory rigor, and emphasis on product innovation. The region’s mature food industry, spanning everything from traditional bakery goods to cutting-edge meat substitutes, drives demand for versatile and highly customizable extrusion solutions.

- Strict EU food safety and environmental standards push manufacturers to adopt hygienic design, energy-efficient systems, and traceability features.

The Asia Pacific leads the food extrusion equipment market. China leads with market share of around 32% in 2024 and is anticipated to grow with a CAGR of around 6.1% from 2025 to 2034.

- Asia Pacific represents the fastest-growing market for food extrusion equipment, propelled by rapid urbanization, rising disposable incomes, and a burgeoning middle class with evolving dietary preferences.

- The region’s dynamic food processing sector, especially in China, India, and Southeast Asia, is increasingly adopting extrusion technology to meet the surging demand for convenient, affordable, and shelf-stable foods such as instant noodles, snacks, and fortified products.

Middle East and Africa food extrusion equipment markets are growing at a CAGR of 4.5% during the forecast period.

- The food extrusion equipment market in the Middle East and Africa is emerging, shaped by a mix of economic development, population growth, and changing consumption patterns. While the market is less mature compared to other regions, there is growing investment in food processing infrastructure, particularly in the Gulf states and parts of North Africa, to support food security and reduce reliance on imports.

Food Extrusion Equipment Market Share

GEA is leading with 13.8% market share. GEA, Wenger, Baker Perkins, Leistritz, and CPM collectively hold around 32.1%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- GEA’s competitive edge in the food extrusion equipment market lies in its global scale, engineering excellence, and comprehensive process integration capabilities. As one of the world’s largest suppliers of food processing technology, GEA offers a broad portfolio of extrusion solutions that are seamlessly integrated with upstream and downstream processes, such as mixing, drying, and packaging.

- Wenger’s competitive advantage is rooted in its deep specialization and pioneering legacy in extrusion technology, particularly for pet food, aquafeed, and specialty human foods. With decades of experience and a reputation for innovation, Wenger is known for its custom-engineered extruders that deliver precise control over product texture, shape, and nutritional content.

Food Extrusion Equipment Market Companies

Major players operating in the food extrusion equipment industry are:

- B&P Littleford

- Baker Perkins

- Bausano

- Bonnot

- Bühler

- Coperion

- Cowin Extrusion

- CPM

- GEA

- Legris

- Leistritz

- Steer World

- Wenger

- Xinda Corp.

- Xtrutech

Baker Perkins distinguishes itself through its focus on high-value, niche segments such as breakfast cereals, snacks, and bakery products, where it is recognized for its process expertise and flexible, modular equipment designs. The company’s extruders are engineered for versatility, allowing food manufacturers to efficiently switch between product types and formulations.

Leistritz’s competitive edge in the food extrusion equipment market is built on its advanced twin-screw extrusion technology and engineering precision. Originally a leader in plastics and pharmaceutical extrusion, Leistritz has successfully leveraged its expertise to deliver high-performance food extruders capable of handling complex, high-moisture, and protein-rich formulations key for the fast-growing plant-based and functional foods sectors.

California Pellet Mill brings a legacy of robust, industrial-grade equipment and a reputation for reliability to the food extrusion equipment market, particularly in the production of animal feed, aquafeed, and pet food. Their competitive strength lies in heavy-duty extruders designed for high throughput and continuous operation, making them ideal for large-scale processors.

Food Extrusion Equipment Market News

- In June 2025, GEA launched its latest GEA Bake Extruder at IBA in Düsseldorf, targeting medium to large-scale biscuit producers. Engineered for high-volume, high-speed operations, the system offers exceptional flexibility, productivity, and hygienic standards. Its versatile design allows standalone or integrated deployment with downstream ovens, reflecting GEA’s commitment to innovation and efficiency in the evolving baking industry. This launch underscores GEA’s strategic focus on advanced, scalable solutions.

- In September 2025, Bausano launched Bausano Sphera, a real-time AI-powered control suite for extrusion lines. It includes predictive diagnostics and dynamic KPI monitoring for food-grade extruders.

- In June 2025, B&P Littleford promoted its horizontal plow mixer for high intensity mixing and drying, suitable for food applications. It offers pressurized reactions and serializing capabilities, with lab testing and rentals available.

- In July 2024, launched the Co-Ex Master-system, enabling twin-filled tubes for cereals, snacks, and pet treats. It allows manufacturers to add value with filled products like strawberry-cream or spicy curry-yogurt combinations.

The food extrusion equipment market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Equipment Type

- Single screw extruder

- Twin screw extruder

Market, By Mode of Operation

- Manual

- Semi-automatic

- Fully automatic

Market, By Capacity

- Below 3,000 kg/hr

- 3,000-10,000 kg/hr

- Above 10,000 kg/hr

Market, By Application

- Pet food & aqua feed

- Cereals & snacks

- Plant-based proteins

- Food ingredients

- Others (confectionery products, etc.)

Market, By End Use Industry

- Food industry

- Animal feed industry

- Others (research institutions, etc.)

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the food extrusion equipment market?

Key players include GEA, Wenger, Baker Perkins, Leistritz, CPM, B&P Littleford, Bausano, Bonnot, Bühler, Coperion, Cowin Extrusion, Legris, Steer World, Xinda Corp., and Xtrutech.

What are the upcoming trends in the food extrusion equipment market?

Key trends include integration of Industry 4.0 technologies with IoT sensors and AI, adoption of high-moisture extrusion for plant-based proteins, energy-efficient systems with 25-35% reduction in energy input, and development of compact modular systems with automated cleaning.

Which region leads the food extrusion equipment market?

The U.S. accounted for around 81.8% share in North America with USD 420 million revenue in 2024, characterized by technological sophistication and strong focus on food safety.

What was the valuation of the food industry end use segment in 2024?

The food industry segment held around 72.2% of the market share in 2024, driven by consumer preference shifts toward health, wellness, and sustainability.

What is the projected value of the food extrusion equipment market by 2034?

The food extrusion equipment market is expected to reach USD 2.6 billion by 2034, propelled by the plant-based revolution, demand for functional snacks, and operational efficiency needs.

What is the current food extrusion equipment market size in 2025?

The market size is projected to reach USD 1.6 billion in 2025.

How much revenue did the single screw extruder segment generate in 2024?

Single screw extruder segment generated USD 1 billion in 2024, led by cost savings and lower barriers to entry compared to complex systems.

What is the market size of the food extrusion equipment in 2024?

The market size was USD 1.5 billion in 2024, with a CAGR of 5.2% expected through 2034 driven by rising demand for plant-based meat and seafood alternatives.

Food Extrusion Equipment Market Scope

Related Reports