Summary

Table of Content

Fiber Optic Components Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Fiber Optic Components Market Size

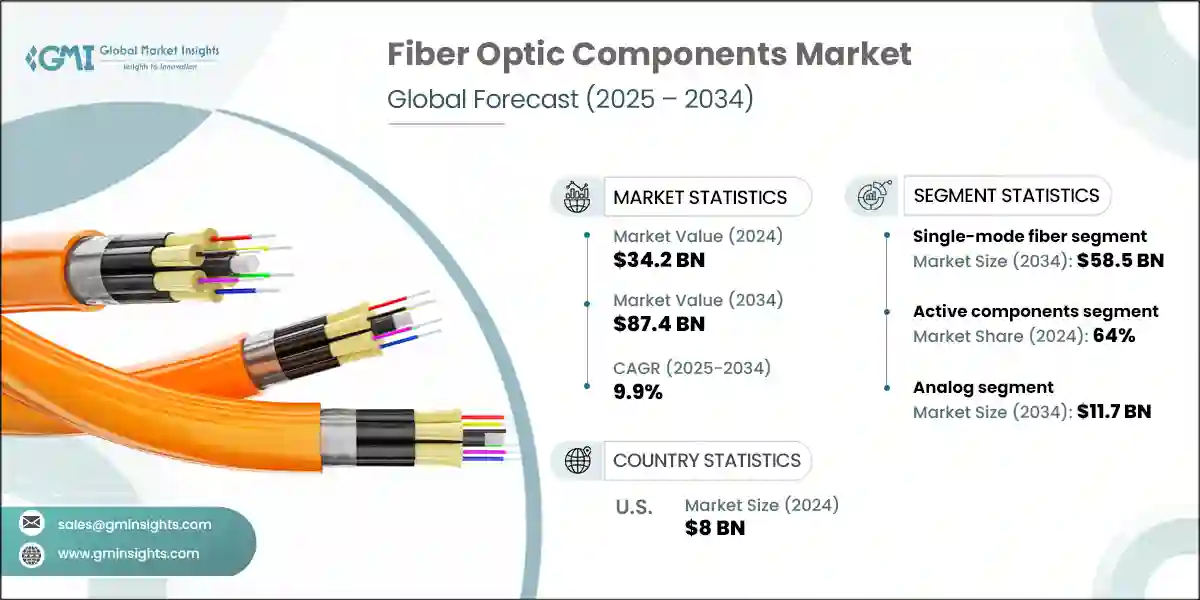

The global fiber optic components market was valued at USD 34.2 billion in 2024 and is projected to reach USD 59.4 billion by 2030 and USD 87.4 billion by 2034 growing at a CAGR of 9.9% during the forecast period 2025–2034.

To get key market trends

- The growth of the fiber optic components market is attributed to the rapid expansion of data centers and cloud computing services as well as the growing adoption of IoT and connected devices.

- The growing investment in data centers and cloud computing is one of the foremost factors advancing fiber optic components adoption. For instance, Amazon announced its plans to invest about USD 13.5 billion for data center expansion, operation, and maintenance in Australia between 2025 and 2029. In addition to this, Microsoft plans to invest approximately USD 80 billion in fiscal year 2025 to build out AI-enabled data centers globally, with more than half of this investment targeted in the United States. As a result of these major infrastructure advancements, fiber optic transceivers, cables, connectors, and optical amplifiers are becoming essential to meet such rising bandwidth and performance requirements.

- The increasing integration of IoT devices and connected devices is propelling the demand for fiber optic components, driven by the need for high-speed, low-latency data transmission infrastructure. According to Ericsson report, the total number of cellular IoT connections reached 4 billion at the end of 2024 and is projected to surpass 7 billion by 2030, growing at a CAGR of approximately 11%. In emerging economies, this trend has been particularly notable. This growth highlights fiber optics' crucial role in providing seamless connectivity and supporting high-bandwidth applications across industries, businesses, and consumer activities.

- Asia Pacific held the largest share of 39.9% of the fiber optic components market in 2024. The Asia Pacific region dominated the market for fiber optic components because of the rapid expansion of telecom infrastructure, high internet penetration, increasing 5G deployments, and huge manufacturing hubs in countries like China, Japan, and South Korea. According to GSMA report, 5G penetration in Asia Pacific is expected to increase to over 45% by 2030 as compared to over 10% in 2023.

Fiber Optic Components Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 34.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 9.9% |

| Market Size in 2034 | USD 87.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing penetration of IoT and connected devices | Drives demand for fiber optic components by over 30% as connected device density continues to scale across industrial and consumer ecosystems. |

| Expansion of 5G infrastructure globally | Boosts fiber optic backhaul requirements by nearly 45% due to escalating needs for low-latency, high-capacity network infrastructure. |

| Growth in data centers and cloud computing services | Increases demand for high-speed optical transceivers and interconnects by up to 35% in response to rising hyperscale and edge data center deployments. |

| Proliferation of smart cities and smart grids | Accelerates fiber optic integration in urban infrastructure by approximately 28%, supporting real-time communication across utilities, mobility, and surveillance systems. |

| Growing demand from military and aerospace applications | Expands adoption of ruggedized fiber components by nearly 25%, driven by mission-critical communication and sensing needs in extreme environments. |

| Pitfalls & Challenges | Impact |

| High initial deployment and installation costs | Acts as a barrier to entry for smaller operators and delays large-scale fiber rollouts in cost-sensitive markets. |

| Complexity in network infrastructure management | Increases operational challenges and maintenance overhead, limiting scalability and slowing adoption in fragmented or legacy network environments. |

| Opportunities: | Impact |

| Emerging demand in developing economies | Creates new revenue streams for fiber optic vendors as governments and private sectors accelerate broadband and digital infrastructure investments. |

| Integration of fiber optics in 5G and beyond technologies | Opens long-term growth avenues by positioning fiber as the core enabler of ultra-low-latency, high-capacity next-generation network architectures. |

| Growing need for high-bandwidth applications (AR/VR, streaming, AI) | Drives increased adoption of advanced optical components to support seamless, real-time data transmission across consumer and enterprise ecosystems. |

| Adoption of fiber optics in defense and aerospace sectors | Expands application scope for high-performance, rugged fiber solutions in secure communications, avionics, and battlefield networks. |

| Market Leaders (2024) | |

| Market Leaders |

Top 2 companies hold 18.4% market share. |

| Top Players |

Collective market share in 2024 is 29.9% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | Mexico, India, Brazil, Indonesia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Fiber Optic Components Market Trends

- One of the major trends in the fiber optic component market is the growth in demand of fiber optic components fueled by global 5G network deployment. The trend began in early 2018 with early 5G deployments and has kept increasing as telecommunication operators build out fronthaul and backhaul infrastructure requiring fiber optic component to support the ultra-low latency and capacity requirements of high data. Fiber optics serve as the foundation for 5G deployments as operators update networks to accommodate growing bandwidth demands. According to GSMA, the global 5G subscriptions will rise from 1.6 billion by the end of 2023 to 5.5 billion by 2030, with the most rapid acceleration occurring through 2028 as comprehensive 5G frameworks are completed across principal geographies.

- Smart city development is contributing to widespread adoption of fiber optic components, enabling high-speed connectivity for IoT networks, surveillance systems, and public service platforms. The need for strong fiber infrastructure is being driven by government-led initiatives, especially in emerging economies. According to PIB, the Smart Cities Mission in India, for instance, has completed 7,380 of 8,075 projects as of 2024. This trend is anticipated to peak by 2027, aligning with the completion of large-scale digital infrastructure initiatives globally.

- A major trend shaping the fiber optic component market is the rising demand of fiber optic transceivers, cables, and multiplexing systems fueled by cloud computing platforms and hyperscale data centers. This trend began intensifying around 2020 with the rapid shift toward cloud-native operations. Fiber optics are essential in attaining high-speed data transmission with low latency as companies transition to cloud-native operations. This trend is expected to accelerate by 2025 as legacy networks are further strained by big data analytics, artificial intelligence, and machine learning. Peak deployment is anticipated to occur by 2027–2028 as major cloud service providers complete for capacity scaling.

- As the manufacturing and logistics sectors embrace digital control systems and real-time data exchange, the use of fiber optic components in IIoT and industrial automation applications is increasing steadily. Fiber optics provide the high transmission rates, resilience to electromagnetic interference, and durability required in demanding industrial settings. With the widespread implementation of Industry 4.0 systems, this trend is anticipated to gain momentum through 2026 and reach its peak penetration between 2026 and 2029.

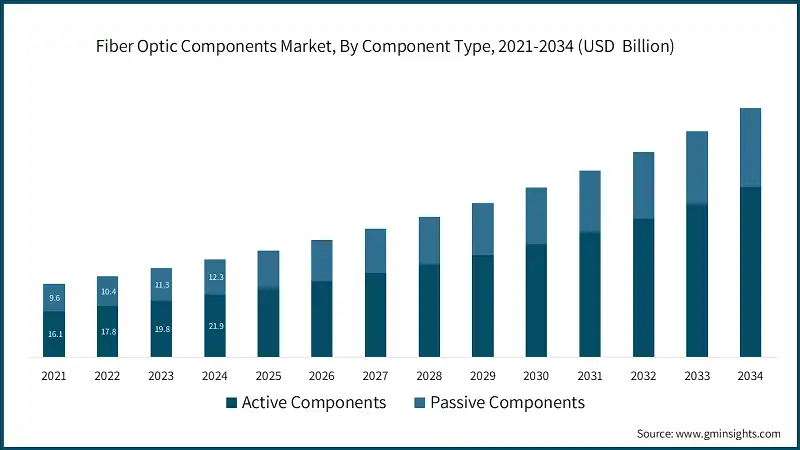

Fiber Optic Components Market Analysis

Learn more about the key segments shaping this market

- The active components segment dominated the market with a market share of 64% in 2024. The requirements for 5G infrastructure, hyperscale data centers, and metropolitan networks are fueling the need for active components of fiber optics such as transceivers, modulators, and optical amplifiers. Active components are also required to keep pace with the ongoing industry shifts towards miniaturization as well as energy efficiency.

- Companies in the optical networking sector need to prioritize funding directed toward next-generation coherent optical transceivers, fully integrated photonic platforms, and state-of-the-art tunable laser modules. Moreover, to retain a durable market advantage, firms must embed interoperability into the very first design iteration and align their product roadmaps with the evolving body of international standards. This proactive alignment will ensure that new solutions are market-ready upon standard ratification and can be seamlessly deployed in heterogeneous ecosystems.

- The passive components segment is anticipated to grow at a CAGR of 8.5% during the forecast period. Passive optical devices such as splitters, attenuators, connectors, and couplers are experiencing robust demand from the accelerating worldwide adoption of FTTH, smart city infrastructure, and the modernization of telecommunications networks. These components are essential in expanding access networks, where cost-effectiveness, durability, and minimal signal loss are paramount.

- To satisfy the surging, bandwidth-sensitive traffic, manufacturers ought to emphasize economical fabrication processes while maintaining stringent standards for insertion loss and structural robustness. The adoption of modular, tool-free assembly configurations will enhance operational efficiency in field installations, especially in rural areas.

Learn more about the key segments shaping this market

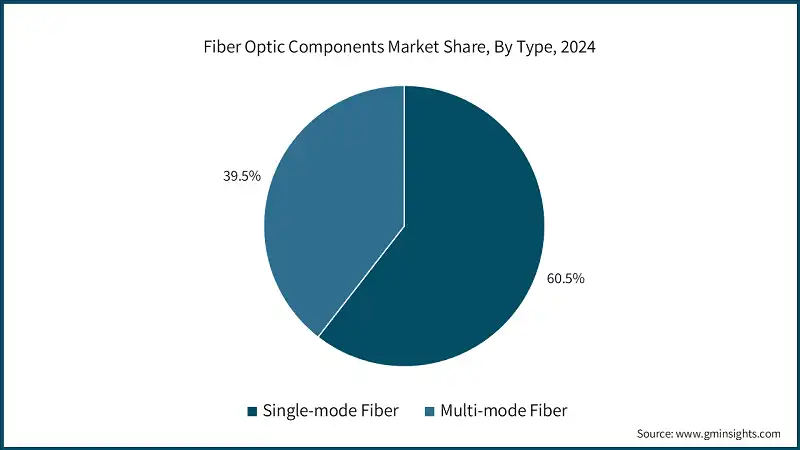

On the basis of type, the fiber optic components market is divided into single-mode fiber and multi-mode fiber.

- The single-mode fiber segment is anticipated to reach USD 58.5 billion by 2034. Single-mode fiber optic cables continue to dominate long-haul, metro, and core network segments due to their superior distance capability and attenuation characteristics. The surge in deployment of 5G backhaul networks and expanded submarine cable systems, in addition to the development of smart grid infrastructure, have further enhanced the relevance of the domain, especially as network operators start deploying bandwidth-consuming applications.

- Manufacturers ought to prioritize the upscaling of ultra-low-loss and bend-insensitive single-mode fiber to meet the demands of changing deployment environments. Coordinated partnerships with telecom operators and equipment vendors are essential to ensure that infrastructure investments are aligned for bandwidth-intensive future applications.

- The multi-mode fiber market is anticipated to grow at a CAGR of 7.9% during the forecast period 2025 - 2034. Multi-mode fiber remain essential to enterprise local area networks, short-reach data center interconnects, and edge computing ecosystems. The swift uptake of 100G and 400G standards is testing the upper performance boundaries of multi-mode platforms, especially those relying on VCSEL launch architectures.

- Manufacturers should prioritize the development of OM4 and OM5 fibers that leverage wideband multimode propagation. Delivering products that retain compatibility with legacy systems while significantly curtailing modal dispersion will be critical for meeting the demanding bandwidth and distance requirements of densely populated data center corridors and other space-limited settings.

On the basis of technology, the market is segmented into analog fiber optic components and digital fiber optic components.

- The analog fiber optic components market is anticipated to reach USD 11.7 billion by 2034. Analog fiber optic components, though limited to niche markets, are witnessing stable demand from aerospace, defense, and industrial automation sectors. These applications place a high priority on signal integrity and long-distance immunity to electromagnetic interference (EMI), two characteristics for which analog optical links excel.

- Manufacturers should offer highly customized, ruggedized solutions tailored for mission-critical applications. Developing temperature-hardened analog links with low noise and high linearity will create differentiation, particularly in sectors with stringent reliability requirements.

- The digital fiber optic components market is projected to register a CAGR of 10.5% during the forecast period 2025 - 2034. Digital fiber optic components are at the forefront of modern telecommunications and cloud infrastructure, particularly as networks migrate to 100G, 200G, and 400G links. With the growing importance of AI workloads, edge computing, and virtualization, demand for high-speed, low-latency digital transmission is intensifying.

- Manufacturers should ramp up production of compact, high-performance transceivers using standards such as QSFP-DD and OSFP. Emphasis should be placed on thermal management, power efficiency, and interoperability with AI-driven data center fabrics.

Looking for region specific data?

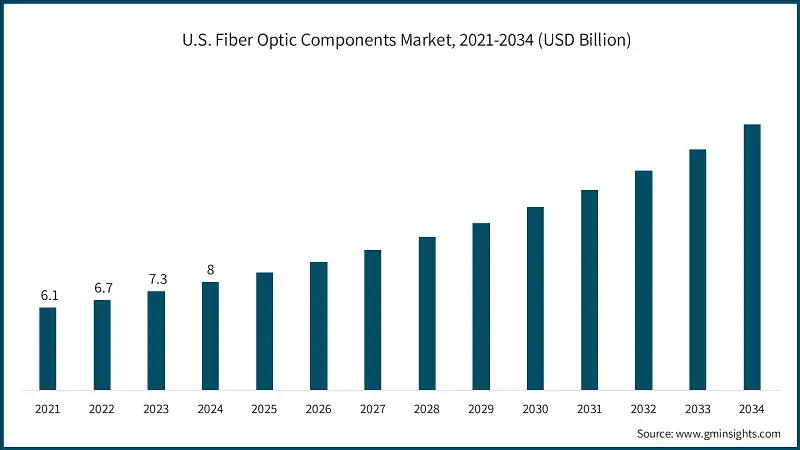

North America held a market share of 26.8% in 2024 and is anticipated to grow at a CAGR of 9.3% during the forecast period 2025 - 2034. Fiber optic deployment in North America is advancing rapidly, driven by the expansion of 5G networks, smart city programs, and accelerating digitalization in numerous sectors.

- U.S. dominated the fiber optic components market, accounting for USD 8 billion in the year 2024. The U.S. is witnessing exponential growth in fiber optic component demand, due to hyperscale data center expansion, AI workload integration, and cloud migration. In 2025, the U.S. data center market is expected to generate over USD 171.90 billion in revenue, according to Statista, underscoring the necessity of expanding the nation's optical infrastructure.

- Domestic manufacturers are advised to focus on low-latency, high-bandwidth fiber solutions specifically engineered for AI-optimized data centers. Concurrently, they must improve interoperability across subsystems and advance thermal efficiency in all component architectures.

- Canada is expected to grow at a 7.9% CAGR during the forecast period 2025 - 2034. Canada is advancing toward nationwide IoT integration propelled by hybrid connectivity solutions. In March 2025, Terrestar Solutions and Monogoto announced a collaboration to deliver uninterrupted IoT connectivity across the country by combining cellular and satellite networks, marking a decisive move toward universal network accessibility.

- Canadian manufacturers should develop fiber components optimized for integration into satellite-assisted IoT networks, emphasizing ruggedness, reliability, and low signal degradation in remote deployments.

Europe accounted for 22.9% of the global fiber optic components market in 2024 and is anticipated to grow with a CAGR of 8.8% during the forecast period. The development of Europe’s fiber optic component sector is being propelled by digital policy alignment, robust fiber-to-the-home programmes, and a surging demand for secure, ultra-fast connectivity. Concurrently, the development of energy-efficient digital infrastructure is being driven by the European Union's Green Deal.

- Germany is anticipated to grow at a 9% CAGR during the forecast period 2025 - 2034. Germany is expanding its fiber footprint to support Industry 4.0, high-performance computing, and telecom modernization. Mission-critical connectivity requirements are driving fiber optic demand as a result of continuous investments in smart factories and industrial AI.

- German manufacturers should align products with industrial-grade requirements, offering EMI-resistant and low-latency optical components for automation and manufacturing environments.

- UK's fiber optic components market is anticipated to grow at a 9.7% CAGR during the forecast period. The UK is witnessing a major transformation in digital infrastructure, driven by government initiatives such as Project Gigabit and increased private-sector investments in full-fiber broadband. The increasing uptake of fiber optic infrastructure in FTTP, data centers, and enterprise networks is generating sustained demand for fiber optic components.

- UK manufacturers should prioritize the design of scalable, low-loss fiber solutions that can be seamlessly deployed in both urban and rural settings. Additionally, they should ensure that product line roadmaps are synchronised with the specifications of Openreach and other national last-mile deployment initiatives.

Asia-Pacific held a share of 39.9% in the global fiber optic components market and is the fastest-growing region with a 11.2% CAGR during the forecast period. The Asia-Pacific region is at the forefront of fiber optic network expansion, driven by robust investments in telecom infrastructure, extensive deployment of 5G technology, and coordinated governmental policies in leading economies.

- The fiber optic components market in China is anticipated to reach USD 16 billion by the year 2034. To support domestic digitalization and AI advancement, China is rapidly expanding its data center and cloud infrastructure. According to Statista, by 2025, the data center market in China is anticipated to surpass USD 103.19 billion, reflecting the nation's commitment to digital leadership.

- Chinese manufacturers should scale production of ultra-high-capacity fiber transceivers and active optical cables in order to address surging requirements from hyperscale data centers as well as from expanding enterprise networks.

- Japan's fiber optic components market was valued at USD 2.1 billion in 2024. Fiber-optic networks are being strategically installed in Japan to support future urban infrastructure and smart city initiatives. For example, Japan's Cabinet Office reports that the government will allocate USD 225 million in FY2025 to support advanced smart city technologies, with a substantial amount of additional funding from the public and private sectors.

- Japanese manufacturers should prioritize compact, high-reliability fiber solutions tailored for urban IoT networks, intelligent transport systems, and high-density residential infrastructure.

- India's fiber optic components market is anticipated to grow at a CAGR of over 12.8% during the forecast period. Telecom densification, FTTH expansion, and national digital inclusion initiatives are driving demand for fiber optics components in India. Large-scale infrastructure buildout opportunities are being created by ongoing public and private investments.

- Indian manufacturers should focus on scalable, cost-effective fiber components to serve rural broadband and smart city deployments while aligning with BharatNet and Digital India initiatives.

Latin America held 5.8% market share in 2024 and is anticipated to grow at a 8.4% CAGR during the forecast period. The region is witnessing growing fiber deployment in urban areas, supported by digital economy expansion and efforts to bridge the connectivity gap in underserved communities.

In 2024, the Middle East and Africa held a share of 4.5% and is anticipated to grow at a 7.9% CAGR during the forecast period 2025 - 2034. MEA is seeing increasing interest in fiber optic technologies, driven by smart city development, 5G trials, and digital economy ambitions, especially in the Gulf and select African economies.

- Saudi Arabia accounted for an 28.7% market share in 2024. Saudi Arabia is investing heavily in digital transformation that supports Vision 2030. Nationwide fiber-optic installations are foundational to megaprojects like The Line and NEOM and are also enabling advanced e-governance platforms.

- Manufacturers should focus on premium-grade, high-temperature fiber optic solutions suitable for harsh environments and large-scale smart infrastructure deployments.

- The South Africa market is anticipated to grow at a CAGR of 7.5% during the forecast period. South Africa is working to improve its broadband access in both urban and underserved rural areas through fiber-to-the-home and national connectivity initiatives like SA Connect. Private Internet service providers are broadening their fiber-optic footprints in response to increasing demand for bandwidth-intensive applications.

- South African manufacturers should develop cost-effective, easy-to-install fiber solutions, with a focus on passive components for rapid deployment in varied geographies.

- The UAE accounted for a share of 23.2% in the market in 2024. The United Arab Emirates is advancing its fiber-optic network to underpin artificial intelligence, cloud computing, and digital government services, and it has one of the highest rates of FTTH penetration in the world. Concurrently, the demands of smart city applications requiring extensive bandwidth are expanding in both Abu Dhabi and Dubai.

- UAE-based manufacturers should prioritize compact, high-density fiber components optimized for smart buildings, surveillance systems, and urban IoT frameworks.

Fiber Optic Components Market Share

The key players in the fiber optic components are Corning Incorporated, Broadcom Inc., Lumentum Holdings Inc., Fujikura Ltd. and Cisco Systems Inc. Together, these companies held more than 70% of the market share in 2024.

- Corning Incorporated lead the fiber optic components market with 9.8% market share in 2024. The company pursues growth driven by continual innovation, broadening its optical communications portfolio with proprietary fiber technologies, notably bend-insensitive and ultra-low-loss fibers. Corning directs its efforts toward telecommunications, data centers, and hyperscale customers, while simultaneously enhancing supply-chain capabilities to support the extensive rollouts of fiber-to-the-home (FTTH) and 5G networks worldwide, with particular emphasis on North America and Asia.

- Broadcom held 8.6% of the market share in 2024. Broadcom applies its semiconductor and optical technology proficiency to deliver high-performance transceivers and optical integrated circuits for data centers and cloud infrastructure. The company emphasizes vertically integrated solutions optimized for hyperscale and artificial intelligence workloads, facilitating bandwidth scalability via PAM4 and coherent optical methods.

- Lumentum Holdings held a market share of 2.6% in 2024. Lumentum concentrates on advanced photonic systems, specifically in three-dimensional sensing, datacom, and telecom markets. Its growth strategy comprises selective acquisitions and sustained R&D spending to strengthen its coherent transceiver and tunable laser offerings. By targeting leading Tier 1 original equipment manufacturers, Lumentum seeks to serve as a critical catalyst in the progression of next-generation optical networks, especially those incorporating 400G and higher data rates.

- Fujikura held a market share of 4.1% in 2024. Fujikura prioritizes product innovation alongside strategic geographic expansion, delivering an extensive range of fiber optic cables, fusion splicers, and optical subsystems. The firm enables telecommunications and enterprise clients to deploy sophisticated solutions for 5G networks and fiber-to-the-home initiatives. To meet surging worldwide infrastructure demand, it continues to allocate resources to automate manufacturing processes and enhance production capacity.

- Cisco Systems held around 4.8% of the fiber optic components market in 2024. Cisco strategy focuses on embedding fiber optics into its overall networking ecosystem, offering optical transceivers, switches, and software-defined networking solutions. By a combination of targeted acquisitions and internal development, the company strengthens its ability to address metro, edge, and cloud-scale architectures. The objective is an integrated optical infrastructure that is engineered for seamless scalability, robust security, and automated operational efficiency.

Fiber Optic Components Market Companies

Major players operating in the fiber optic components industry are:

- 3M

- Accelink Technologies

- Amphenol

- Broadcom

- Broadex Technologies

- Ciena

- Cisco Systems

- CommScope

- Corning

- Fujikura

- Furukawa Electric

- Broadcom, Cisco Systems, Corning, Fujikura, and Lumentum Holdings are considered leaders in the fiber optic components market due to their strong global presence, advanced R&D capabilities, and comprehensive product portfolios catering to high-speed telecom, data center, and enterprise applications.

- Ciena, Huawei Technologies, ZTE, Sumitomo Electric, TE Connectivity, and Prysmian Group emerge as challengers, each capitalizing on considerable expertise in niche geographies or discrete market segments while advancing targeted investments in cutting-edge innovation.

- CommScope, Viavi Solutions, Amphenol, Molex, Senko, and Furukawa Electric are identified as followers, providing dependable, standardized fiber optic components. Their products support the ongoing expansion of legacy and emerging infrastructure, yet they do not introduce the disruptive innovations or extensive global market reach exhibited by the top quartile of competitors.

- 3M, Accelink Technologies, Broadex Technologies, Luxshare-ICT, and Optosun Technology are classified as niche players. These companies focus on narrow product segments or particular regional markets, delivering specialized solutions in photonics, passive components, or consumer-grade connectivity. While they excel in their selected domains, their overall global market reach remains constrained.

Fiber Optic Components Industry News

- In April 2025, Lumentum introduced new 400/800G ZR+ pluggable transceivers, specifically in the L-band, which will double the capacity of existing fiber infrastructure for data center interconnect, metro, and long-haul networks.

- In June 2025, TE Connectivity Unveils MULTIGIG Transceiver Platform for Improved Data Transmission. This highly modular solution offers design engineers in aerospace, defense and marine applications more flexibility to place fiber optic transceivers for optimal performance.

The fiber optic components market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Component Type

- Active components

- Transmitters

- Receivers

- Optical amplifiers

- Passive components

- Fiber optic cables

- Connectors & adapters

- Couplers & splitters

- Optical Switches

- Others

Market, By Type

- Single-mode fiber

- Multi-mode fiber

Market, By Data Transfer Rate

- Less than 10 GBPS

- 10 to 40 GBPS

- 40 to 100 GBPS

- More than 100 GBPS

Market, By Technology

- Analog fiber optic components

- Digital fiber optic components

Market, By Application

- Telecommunications & data communication

- Long-haul transmission networks

- Metro/core networks

- Access networks

- Mobile backhaul / fronthaul

- Enterprise networks (LAN/WAN)

- Others

- Data centers & cloud infrastructure

- Intra-data center connectivity

- Inter-data center

- High-speed transceivers

- Storage area networks (SAN)

- Others

- Military & defense

- Secure tactical communication networks

- Radar & sensor systems

- Command and control systems

- Avionics and naval communication systems

- Others

- Medical & healthcare

- Medical imaging systems

- Laser delivery systems

- Biomedical sensors & instrumentation

- Hospital network infrastructure

- Others

- Industrial automation

- Factory automation and process control networks

- Robotics & machine vision systems

- Remote sensing and monitoring

- Industrial ethernet

- Others

- Broadcasting & video transmission

- Live event broadcasting infrastructure

- Studio-to-transmitter links (STL)

- Cable TV & IPTV distribution networks

- Outside broadcast (OB) vans & mobile production

- Others

- Oil & Gas

- Downhole fiber optic sensing

- Subsea communication links

- Pipeline monitoring & leak detection systems

- Remote site connectivity

- Others

- Aerospace

- Avionics data networks

- Satellite ground station connectivity

- In-flight entertainment (IFE) systems

- Spacecraft optical communication systems

- Others

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the fiber optic components industry?

Key trends include 400G+ optical transceivers, smart city fiber infrastructure, and IIoT integration in industrial automation.

How much revenue did the U.S. fiber optic components market generate in 2024?

The U.S. dominated the fiber optic components market, generating USD 8 billion in 2024.

What is the growth outlook for digital fiber optic components from 2025 to 2034?

Digital fiber optic components are expected to grow at a 10.5% CAGR through 2034.

What was the valuation of single-mode fiber segment in 2024?

The single-mode fiber segment is projected to reach USD 58.5 billion by 2034.

How much revenue did the active components segment generate in 2024?

Active components generated 64% of total market revenue in 2024.

What is the projected value of the fiber optic components market by 2034?

The market size for fiber optic components is expected to reach USD 87.4 billion by 2034, fueled by IoT proliferation, hyperscale cloud investments, and smart city initiatives.

What is the market size of the fiber optic components market in 2024?

The market size was USD 34.2 billion in 2024, with a CAGR of 9.9% expected through 2034 driven by expansion of 5G infrastructure and data center demand.

Who are the key players in the fiber optic components market?

Key players include Corning, Broadcom, Lumentum Holdings, Fujikura, Cisco Systems, Huawei, ZTE, Ciena, CommScope, and TE Connectivity.

Fiber Optic Components Market Scope

Related Reports