Summary

Table of Content

Europe Mid to High Range Home Decor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Mid to High Range Home Decor Market Size

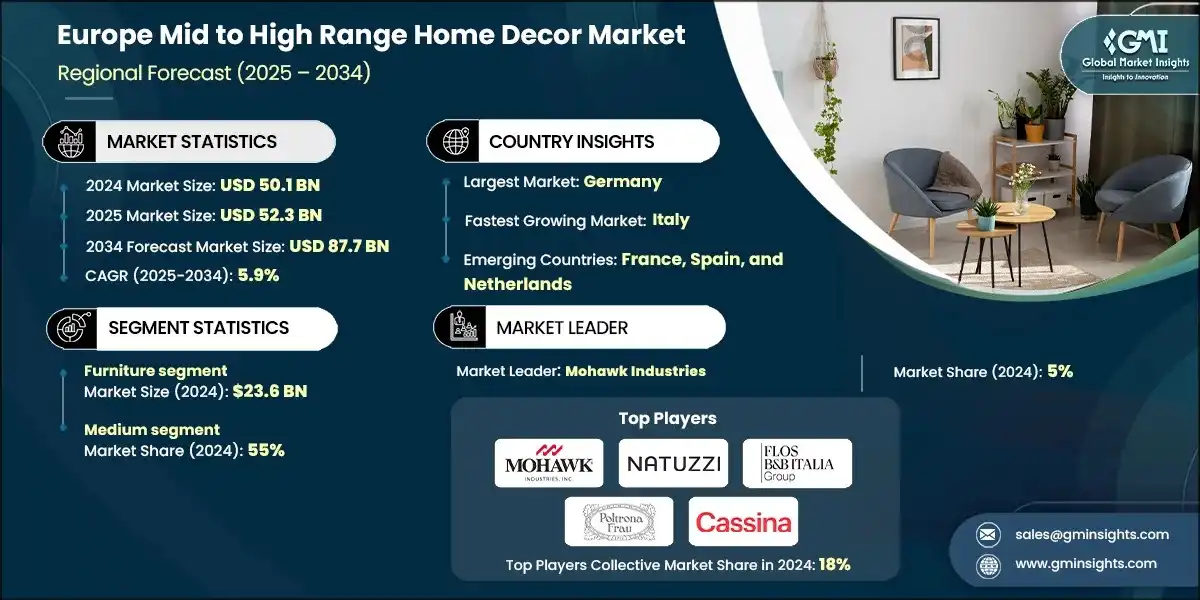

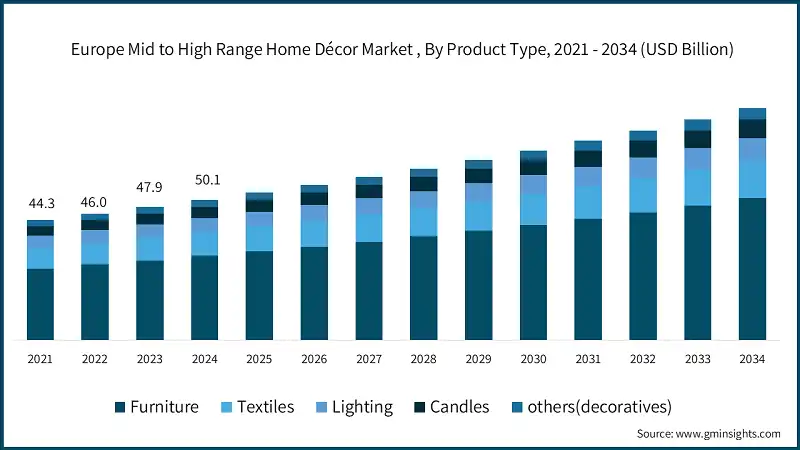

The Europe mid to high range home decor market was estimated at USD 50.1 billion in 2024. The market is expected to grow from USD 52.3 billion in 2025 to USD 87.7 billion in 2034, at a CAGR of 5.9% according to latest report published by Global Market Insights Inc.

To get key market trends

The mid to high-range home décor market is increasingly a place where style meets substance. Today's consumer is looking for more than just functionality; they're looking for pieces that reflect their personality, enhance the comfort of their living space, and give them a sense of timelessness in their homes. This segment thrives on quality craftsmanship, premium materials and design that feels as beautiful as it functions. The luxury tier may occasionally rely on exclusivity to bolster interest, while mid to higher-tier décor represents aspirational value that has a sophisticated layer, but can be experienced by a more extensive audience.

Rising disposable income, urban lifestyles, and being more fascinated with design conditions that are curated is contributing to this demand. Influencer-driven and social media trends are contributing to the blanket demand, for our statement furniture, textured fabrics and articles, and accent lighting. Sustainability is also a driving factor, with 'eco' at the core of the selling proposition and materials & sourcing becoming a strong driver. Brands in this space are balancing contemporary aesthetics with conventional, as their collections cater to contemporary and classic tastes.

Retail strategy surrounds omnichannel experiences, where inspiration occurs online, followed by the real-life sensory experience of an in-store environment. Differentiation is now about customization, such as consumer-directed color, finish, and size. Overall, this market is much more than putting pretty in a room-it's about making a space personal, stylish, and long-lasting. For companies, the opportunity exists in offering designs that emotionally connect, yet remain quality and affordable, cementing their position as trusted allies in the art of living well.

Europe Mid to High Range Home Decor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 50.1 Billion |

| Market Size in 2025 | USD 52.3 Billion |

| Forecast Period 2025 – 2034 CAGR | 5.9% |

| Market Size in 2034 | USD 87.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Disposable Income and Urbanization | Increasing affluence and urban lifestyle trends in Europe are driving demand for premium and aesthetically appealing home décor products. |

| Growing Focus on Interior Aesthetics and Personalization | Consumers are prioritizing unique, customizable designs to reflect personal style, boosting mid-to-high range décor purchases. |

| Expansion of E-Commerce and Omnichannel Retailing | Online platforms and hybrid retail models are making premium décor products more accessible, enhancing convenience and variety for consumers. |

| Pitfalls & Challenges | Impact |

| High Price Sensitivity Amid Economic Uncertainty | Inflationary pressures and fluctuating economic conditions can limit spending on non-essential luxury décor items. |

| Supply Chain Disruptions and Raw Material Costs | Dependence on imported materials and global logistics challenges increase production costs and impact timely delivery. |

| Opportunities: | Impact |

| Sustainability and Eco-Friendly Décor Solutions | Growing consumer preference for sustainable materials and ethically sourced products creates opportunities for brands to differentiate. |

| Integration of Smart Home Features in Décor | Demand for tech-enabled décor items, such as smart lighting and multifunctional furniture, is opening innovation avenues. |

| Market Leaders (2024) | |

| Market Leaders |

5% market share |

| Top Players |

Consolidate share of 18% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Germany |

| Fastest growing market | Italy |

| Emerging countries | France, Spain, and Netherlands |

| Future outlook |

|

What are the growth opportunities in this market?

Europe Mid to High Range Home Decor Market Trends

The European mid to high-range home decor market is a dynamic landscape, reflecting a blend of timeless sophistication and innovative design. Consumers in this segment prioritize quality, unique aesthetics, and increasingly, ethical considerations, driving several key trends that shape contemporary interiors across the continent. Here are some key trends in Europe's mid to high-range home decor market:

- Sustainability and Natural Materials: Eco-conscious design is a growing trend, and consumers are curious about its source through its physical materiality. Reclaimed wood, organic fabrics, travertine, and linen are sought after to connect interiors with nature and justify environmental concerns.

- Warm Minimalism: This style embraces clean lines and empty space combined with warm, natural textures and gentle shapes. Neutral hues, often including creams, whites, and beiges, create soothing, livable environments that convey understated luxury and are not cold and sterile.

- Art-Inspired Interiors / Sculptural Elements: Decoration is looking to art for inspiration, which includes bold forms, abstract art, and furniture that dissolves the boundary of form and function. Lighting will be especially sculptural and dramatic, while becoming a major design element.

- Retro Styles with New Materials: European designers are taking inspiration from the mid-century and 1970's periods, as well as Art Deco, and refreshing the elements with new materials and clean lines. This melding of historic silhouettes with today's details creates an updated interpretation of retro, fresh and full of the character and history of the forms.

- Emphasis on Materiality and Texture: One of the main points is the conscious employment of a variety of textures to create depth and interest. Juxtaposing materials like smooth glass against rich textiles or natural wood tones against metals creates an added depth to the senses and gives a unique, sophisticated atmosphere.

Europe Mid to High Range Home Decor Market Analysis

Learn more about the key segments shaping this market

Based on product type, the Europe mid to high range home decor market is divided into furniture, textiles, candles, lightning, and others (decorative accessories etc.). In 2024, furniture held the major market share, generating a revenue of USD 23.6 billion.

- The furniture segment is dominant in the market due to the nature of its higher average selling price and critical function it plays in home and office functionality. The beds, sofas, and tables are purchased as long-term investments, which creates huge revenue despite the lower unit sales. This trend is further driven by growing urbanization and increasing disposable income: given the choice, consumers will put more focus on buying durable and functional furniture before more decorative ones. Furthermore, furniture brands maintain higher margins and strong branding strategies, enabling them to secure more retail space and online visibility.

- Other factors that trigger this demand are urbanization and an increase in disposable incomes, where customers' preference for durable and functional furniture precedes a focus on decoration aspects. Furniture brands enjoy higher margins and strong branding policies, enabling them to acquire more retail space and online visibility.

- Textiles are complementary products in completing the look and feel of homes. These products appeal to style-conscious consumers and have a shorter replacement cycle. However, their lower price points limit their overall revenue contribution compared with furniture. Textiles are usually purchased after major furniture decisions are made, so they are secondary in the buying hierarchy.

- These dynamic positions furniture as the dominant segment in the market, while textiles act as an accessory category to support personalization and align with evolving design trends. Together, these segments satisfy both functional and aesthetic consumer needs that drive the overall market growth.

Learn more about the key segments shaping this market

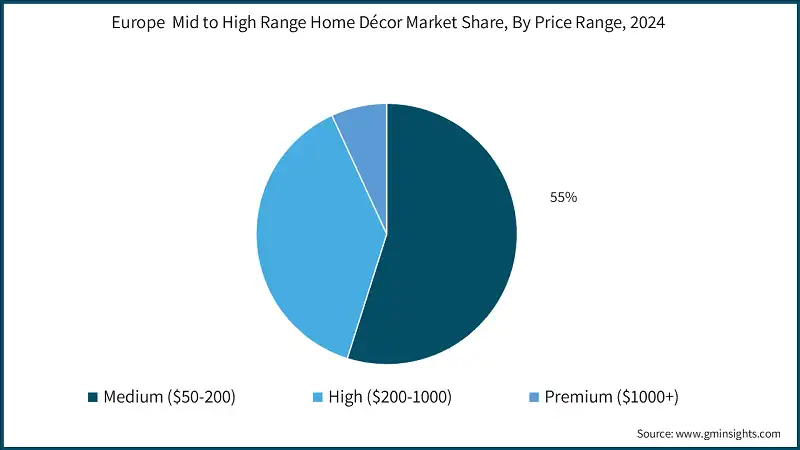

Based on usage, the Europe mid to high range home decor market is segmented into medium ($50-200), high ($200-1000), and premium ($1000+). The medium segment held the largest share, accounting for 55% of the market in 2024.

- Medium-priced products, generally in the range of $50-$200, present an optimum balance between affordability and perceived quality. Consumers in this segment are very much conscious of durability and style but try to avoid the premium prices commanded by higher categories. This price range has a strong appeal to middle-income households and urban buyers seeking value for money, thus driving mass-market adoption. Retailers and brands often focus their promotional efforts in this segment, as it has the potential for good sales volume with acceptable levels of profitability.

- The medium range is aspirational but attainable: It coincides with the contemporary trend among consumers for functionality and equipped luxury. E-commerce and omnichannel retailing have made it easier to access and compare medium-ranged products because of convenience. The ability to access and compare medium-ranged products establishes this segment as an option that can appeal to the widest consumer base.

- In categories such as furniture and textiles, the medium price band consistently captures the largest market share. This becomes highly competitive and consumer-preferred, as the medium price band succeeds in bringing together quality, affordability, and style. It indicates that this dominance meets the needs and expectations of a very diversified audience.

- In general, the medium price segment remains that sweet spot both for consumers and businesses. Its strategic relevance in driving volume sales, therefore, ensures the persistence of profitability, hence remaining the cornerstone of the mass market.

Based on the distribution channel, the Europe mid to high range home decor market is segmented into online and offline. In 2024, online dominates the market by holding most of the market share.

- In the mid-to-high range of home decor markets in Europe, the predominance of online sales will continue their development. Although relevant offline channels exist, especially for high-value purchases, this is slowly changing today, faster than before. Traditionally, brick-and-mortar stores have remained the top choice when it came to luxury items; modern convenience and ease of access mean the opposite. High internet penetration and smartphone ownership in most parts of Europe further accelerate the transformation process.

- E-commerce websites can showcase a wider range of products than physical stores, from niche products to international brands. Prices remain competitive due to reduced overhead; thus, consumers can consider unusual items and evaluate options more conveniently. Besides, technological innovations-AR tools and room visualizers, for example-enable customers to virtually place items in their homes, further enriching the digital shopping experience. Personalized recommendations and engaging content marketing methods will further enhance user satisfaction.

- Social media platforms, including Instagram and Pinterest, are leading influences in consumer preferences, causing people to take on home decoration and renovation projects. D2C brands distribute through online channels, offering customers products unavailable elsewhere at lower prices. This digital exposure is enabling consumers to consider and buy home décor online, further feeding their rising interest in spaces that are personalized, beautiful, and sustainable.

- Although e-selling is on its rise, offline channels have their relevance in high-value purchase categories for which physical inspection is preferred. The overall trend, however, suggests that online channels are driving growth in Europe's middle-to-premium home decor market to meet the evolving demands and preferences of consumers.

Looking for region specific data?

Europe Mid to High Range Home Decor Market

The market, Germany leads the market 20% share in 2024 and is expected to grow at 6% during the forecast period.

- Germany enjoys a dominant position in the mid-to-high price segment of home décor in the EU market thanks to a strong manufacturing base, highly skilled craftsmen and women, and a brand reputation for quality design and manufacture.

- German brands provide durability, functionality and contemporary aesthetics to meet the consumer demand for value-for-money. An affluent consumer market, coupled with resurgent home renovation activities, supports, and even drives, demand for décor items priced at the higher end of the spectrum. This pricing structure reinforces Germany's position as a market leader.

- Key points that in turn support Germany's market position include sustainability and environmentally friendly materials. Germany is a leader in both these areas, on the back of a generational shift in consumer preferences towards environmentally sensitive products. The focus on sustainability, in both urban and residential décor products, enhances Germany's competitive edge and allows for its reputation for quality and innovation within shared living and home décor to exist as well.

- Italy is the second country in this mid-to-high home décor market, well-known for its luxury and artistic designs in furniture, lighting, and decoration accessories. Italian home décor speaks of elegance and exclusivity, and consumers who value aesthetics flock to Italian products. Its massive export network and influence on European trends in interior design further boost its status in this category.

- However, Italy's higher price positioning and luxury niche orientation limit its overall market share against the broader appeal of Germany. While Italy is very strong on design innovation and craftsmanship, its premium pricing model limits its expansion to an exclusive consumer base, giving Germany the advantage in a wider market.

Europe Mid to High Range Home Decor Market Share

Mohawk Industries is leading with 5% market share. Mohawk Industries, Natuzzi S.p.A., Flos B&B Italia Group, Poltrona Frau, Cassina collectively hold around 18%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Mohawk Industries is the leading flooring manufacturer worldwide. They offer carpets, rugs, ceramic tiles, laminates, wood, and luxury vinyl tiles. They have a leading position in the mid-to-high price range in Europe, providing a diversified portfolio of high-quality flooring products with an emphasis on design (and therefore are critical in establishing the base and feel of interior spaces in this price band).

- Natuzzi S.p.A. is an Italian manufacturer of upholstered furniture, including sofas, armchairs, and beds that has worldwide recognition for its design and craftsmanship. The group was one of the major players in the Europe mid-price and high-price segment home furnishing market, focusing on comfort, Italian style, and a mix of tradition and modernity in premium furniture.

- Flos B&B Italia Group (i.e. Flos, B&B Italia, Louis Poulsen, etc.) represents iconic Italian and Danish design and specializes in high-end contemporary furniture and innovative lighting. They are major players due to their history of working with world-renowned designers in the creation of quality excellence and timeless pieces that help define luxury interior space.

Europe Mid to High Range Home Decor Market Companies

Major players operating in the Europe mid to high range home decor industry are:

- Mohawk Industries

- Natuzzi S.p.A.

- Flos B&B Italia Group

- Poltrona Frau

- Cassina

- Kartell

- Rolf Benz

- Duresta

- Ligne Roset

- Herman Miller

- BoConcept

- Vitra

- Kinnarps

- Sedus Stoll

- Actiu

Poltrona Frau is an Italian firm grounded in the production of leather furniture, including armchairs, sofas, and beds, which often bear evidence of exquisite craftsmanship. Its strong position is based on classic, elegant designs supported by using high-quality materials, above all its characteristic Pelle Frau leather, appreciated by increasingly exacting European customers seeking quality furniture that lasts.

Cassina is an Italian manufacturer of modern and contemporary furniture, famous for its innovative designs and re-editions of masterpieces by iconic architects and designers. Their significance in the mid-to-high range market of Europe is due to the commitment that the brand must design heritage, avant-garde pieces, and make furniture that will merge art, craft, and industrial innovation.

Europe Mid to High Range Home Decor Industry News

- In December 2024, Bernardaud acquired 100% of Haviland, uniting two historic Limoges porcelain makers to preserve French artisanal craftsmanship in luxury tableware. This is going to help the company in combining skills and resources while maintaining distinct brand identities and protecting premium proof for high-end home decor markets.

- In October 2024, Nemo Group acquired Italian premium design brands Driade (furniture) and Fontana Arte (lighting and glass furniture) from Italian Creation Group. This is going to help the company in expanding from lighting into premium furniture and glass design while benefiting from synergies and strengthening global positioning across luxury segments.

- In June 2024, Poltrona Frau acquired majority stake in UK-based KJ Ryan Ltd, marking its first foreign acquisition to strengthen bespoke luxury vehicle and yacht interiors. This is going to help the company to become a European leader in bespoke luxury interiors, increasing capacity and acquiring technological know-how for high-end customization markets.

- In January 2024, Hettich Group acquired Italian FGV Group, a specialist in premium furniture hardware and fittings for high-end furniture segments. This is going to help the company in strengthening its position in Europe's premium furniture supply chain and accessing Italian manufacturing capabilities and technologies.

- In May 2024, Westwing Group SE expanded into Portugal as its 12th European market, offering 200 premium design brands targeting mid-to-high-end customers. This is going to help the company in capturing Portugal's USD 2.4 billion home market and strengthening its position as Europe's leading premium Home & Living e-commerce platform.

The Europe Mid to High Range Home Decor Market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Million Square Meter) from 2021 to 2034, for the following segments:

Market, By Product Type

- Furniture

- Sofa set

- Dining furniture

- Others (wardrobes, storage furniture, etc.)

- Textiles

- Bedroom linen

- Bathroom linen

- Carpets and floor coverings

- Curtains and drapes

- Others (kitchen linen decorative textiles, etc.)

- Candles

- Floating candles

- Scented candles

- Container candles

- Decorative candles

- Others (soy candles etc.)

- Lightning

- Ceiling lights & chandeliers

- Light bulbs & fittings

- Others (portable lamps etc.)

- Others (decorative accessories etc.)

- Object Design (vases, sculptures, art pieces)

- Home Accessories (functional decorative items)

- Decorative Items (figurines, seasonal décor)

- Wall Art & Mirrors

Market, By Price Range

- Medium segment ($50-200)

- High segment ($200-1000)

- Premium segment ($1000+)

Market, By Usage

- Interior

- Exterior

Market, By Distribution Channel

- Online

- E-commerce

- Company owned website

- Offline

- Supermarkets and hypermarkets

- Specialty stores

- Others (individual stores etc.)

The above information is provided for the following regions and countries:

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

Frequently Asked Question(FAQ) :

Who are the key players in the Europe mid to high-range home decor market?

Key players include Mohawk Industries, Natuzzi S.p.A., Flos B&B Italia Group, Poltrona Frau, Cassina, Kartell, Rolf Benz, Duresta, Ligne Roset, Herman Miller, and BoConcept.

What are the upcoming trends in the Europe mid to high-range home decor market?

Key trends include the adoption of sustainable and natural materials, such as reclaimed wood and organic fabrics, and the rise of warm minimalism, characterized by neutral tones and natural textures.

Which country leads the Europe mid to high-range home decor market?

Germany led the market with a 20% share in 2024 and is projected to grow at a rate of 6% during the forecast period.

What was the market share of the medium usage segment?

The medium usage segment accounted for 55% of the market share in 2024, making it the largest segment by usage.

How much revenue did the furniture segment generate?

The furniture segment generated USD 23.6 billion in 2024, holding the largest market share among product types.

What is the projected size of the Europe mid to high-range home decor market in 2025?

The market is expected to reach USD 52.3 billion in 2025.

What is the market size of the Europe mid to high-range home decor market in 2024?

The market size was USD 50.1 billion in 2024, with a CAGR of 5.9% expected through 2034, driven by increasing demand for quality, aesthetics, and sustainable home decor products.

What is the projected value of the Europe mid to high-range home decor market by 2034?

The market is expected to reach USD 87.7 billion by 2034, fueled by trends such as sustainability, warm minimalism, and growing consumer interest in premium home decor.

Europe Mid to High Range Home Decor Market Scope

Related Reports