Summary

Table of Content

Europe Lithium-Ion Battery Recycling Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Lithium-Ion Battery Recycling Market Size

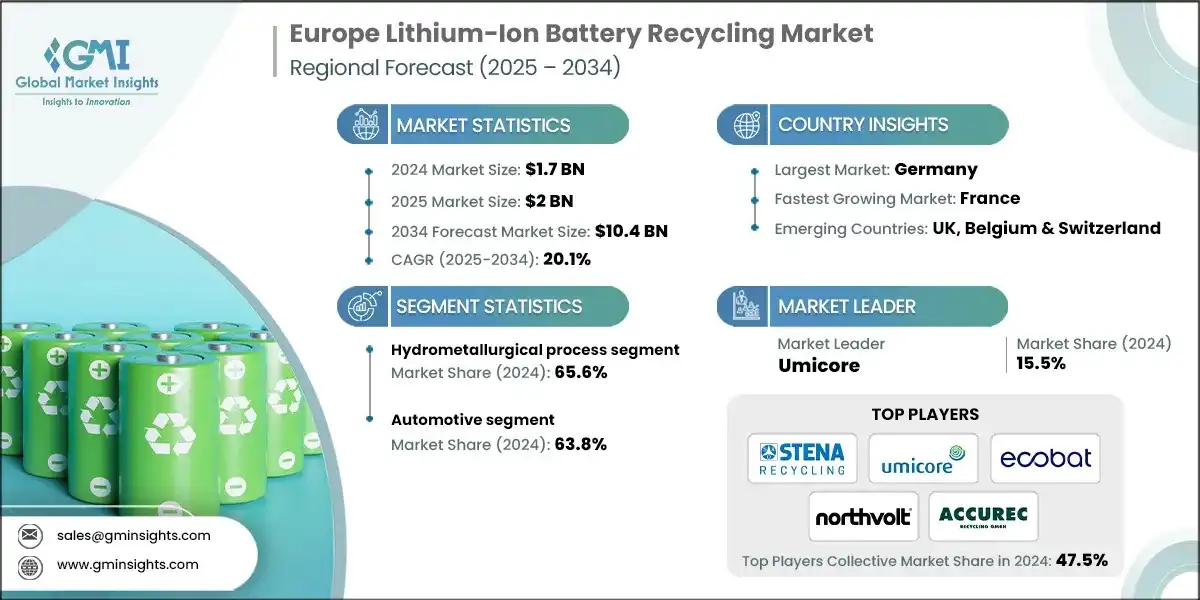

The Europe lithium-ion battery recycling market size was estimated at USD 1.7 billion in 2024. The market is expected to grow from USD 2 billion in 2025 to USD 10.4 billion in 2034, at a CAGR of 20.1% according to Global Market Insights Inc.

To get key market trends

- Rapid surge in EV industry in Europe is generating a significant volume of end-of-life lithium-ion batteries. According to the European Environment Agency, EV sales in the EU increased by over 60% in 2023, and over 1.5 million tonnes of battery waste are expected annually. These rising statistics are creating immense demand for the adoption of recycling solutions, leading to uplift the business scenario.

- The rising adoption of renewable energy sources, including solar and wind, is fueling demand for efficient energy storage systems, particularly lithium-ion batteries. As these systems scale, the volume of used batteries is expected to grow substantially, driving the need for robust recycling solutions to recover valuable materials and support a circular, sustainable energy ecosystem.

- Growing regulatory push on battery waste management will favor the adoption of lithium-ion battery recycling units. For instance, the EU Battery Regulation (2023/1542) marks a major shift toward sustainability and circularity in battery use. Effective from August 2023, it replaces the older directive and mandates recycled content targets, carbon footprint declarations, and battery passports for traceability. It applies to all battery types, including EV and industrial batteries, and enforces removability, replaceability, and due diligence in raw material sourcing, thus favoring the industrial growth.

- The Europe lithium-ion battery recycling market was valued at USD 427.9 million in 2021 and grew at a CAGR of 59.1% through 2024. The growing emphasis on reducing carbon emissions and environmental impact is accelerating the expansion of the lithium-ion battery recycling market. As governments and industries intensify efforts to meet sustainability targets, there is a strong push for advanced recycling technologies that minimize waste and preserve critical resources. This shift toward eco-conscious practices is expected to drive demand for efficient battery recycling solutions, which play a vital role in lowering the environmental footprint of discarded batteries and supporting a more sustainable energy future.

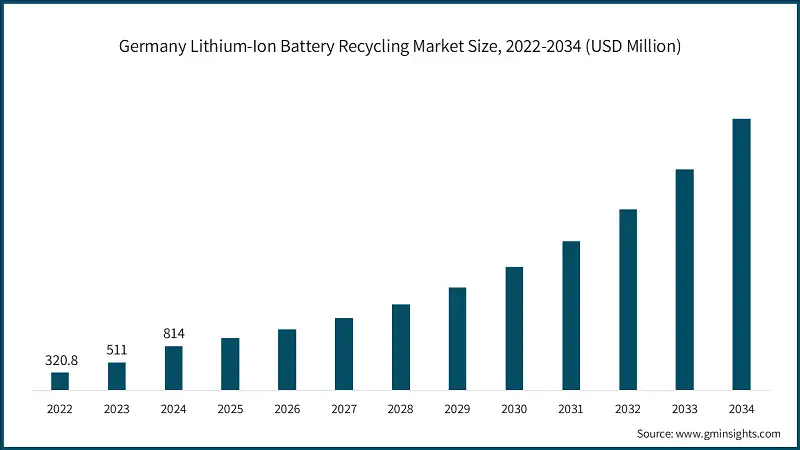

- Germany is among the dominant countries, primarily driven by a rapid transition to EVs, with BEVs and PHEVs expected to exceed 50% of total vehicle sales by 2030. This surge is generating a growing volume of end-of-life batteries, necessitating efficient recycling to recover critical materials including cobalt, nickel, and lithium. Furthermore, Germany’s commitment to the EU Green Deal and its own climate targets is pushing industries toward circular economy models. Recycling lithium-ion batteries reduces the carbon footprint associated with mining and supports sustainable resource use.

- Growing government funding for small players for establishing recycling units is expected to improve the industry outlook. For instance, in September 2025, in North Rhine-Westphalia (NRW), the European Union's ERDF/JTF programme has granted USD 30.2 million to battery recycling firm Cylib. This funding will aid in establishing one of Europe's largest lithium-ion battery recycling plants at CHEMPARK Dormagen. Furthermore, the country’s strong waste management culture and public awareness of recycling are boosting participation. However, expanding infrastructure for battery collection and processing remains a priority to meet future demand.

- France is the fastest-growing region in the market. The push toward decarbonization is driving demand for electric vehicles (EVs) and renewable energy storage, both of which rely heavily on lithium-ion batteries. Thus, growing EV adoption also improves the volume of spent batteries requiring sustainable disposal, leading to create lucrative prospects for lithium-ion battery recycling market. Additionally, the growth is also fueled by regulatory alignment with EU circular economy principles and increasing collaboration between automakers and recyclers to create closed-loop systems for battery materials.

Europe Lithium-Ion Battery Recycling Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.7 Billion |

| Market Size in 2025 | USD 2 Billion |

| Forecast Period 2025 - 2034 CAGR | 20.1% |

| Market Size in 2034 | USD 10.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| EU regulatory push | Mandated recycling targets and traceability standards accelerate infrastructure development and industry compliance across member states. |

| Surge in EV demand and battery waste | Growing EV adoption increases spent batteries, driving an urgent need for recycling to recover materials and reduce pollution. |

| Pitfalls & Challenges | Impact |

| Limited recycling infrastructure | Insufficient facilities hinder large-scale processing, slowing material recovery and compliance with EU recycling targets. |

| Complex battery chemistries | Diverse compositions complicate recycling processes, increasing costs and reducing efficiency in recovering valuable metals. |

| Opportunities: | Impact |

| Technological innovation | Advances in hydrometallurgical processes improve metal recovery rates, making recycling more efficient and economically attractive. |

| Circular economy integration | Recycling supports closed-loop systems, enabling the reuse of recovered materials in new batteries and reducing environmental impact. |

| Market Leaders (2024) | |

| Market Leaders |

15.5% |

| Top Players |

Collective market share in 2024 is 47.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Germany |

| Fastest Growing Market | France |

| Emerging Country | UK, Belgium & Switzerland |

| Future Outlook |

|

What are the growth opportunities in this market?

Europe Lithium-Ion Battery Recycling Market Trends

- Growing investments in expanding lithium-ion battery recycling infrastructure by both new and existing players are set to influence the business trend in the forecasted period. For instance, in July 2025, Fortum Battery Recycling is set to expand its hydrometallurgical battery recycling facility in Harjavalta, Finland, with the help of a generous grant of USD 99.4 million from Business Finland.

- While the grant's disbursement hinges on the project's ongoing progress and is tied to incurred expenses, it's worth noting that a definitive investment decision remains pending. Furthermore, high reliance of Europe on imports for critical battery materials such as lithium, cobalt, and nickel drives the industry growth in domestic facilities. Recycling helps reduce dependency on volatile global supply chains and geopolitical risks. By recovering materials domestically, Europe can enhance its strategic autonomy in the clean energy transition.

- Ongoing investments in advanced recycling technologies, including hydrometallurgical and direct recycling methods, offering higher recovery rates and lower environmental impact compared to traditional pyrometallurgy, strengthen the industry outlook. Research hubs, including RWTH Aachen’s Circularity Hub, are developing automated disassembly and material recovery systems. Innovation is also driving specialization, with startups focusing on niche areas such as lithium recovery or black mass refinement, contributing to a more diversified and resilient recycling ecosystem.

- Rising cross-industry collaboration, such as automotive, energy, and waste management, working together to build a closed-loop battery recycling ecosystem, will further augment the industry growth. Ongoing EV adoption and gigafactory development accelerate the partnership between recyclers, OEMs, and material suppliers. This collaboration ensures efficient collection, processing, and reuse of battery materials, while also aligning with EU sustainability goals. Companies are forming joint ventures and long-term contracts to secure feedstock and scale operations, creating a more resilient and integrated value chain.

- Surging advancements in recycling technologies are projected to significantly improve material recovery efficiency, supporting market growth. For instance, in July 2024, Novocycle Technologies unveiled its state-of-the-art battery recycling innovations. The company's technique boasts a remarkable graphite recovery rate of 99.9%, surpassing the industry's benchmark of 80%. Additionally, growing awareness of the environmental and social impacts of raw material extraction, such as child labor in cobalt mining and water-intensive lithium production, is pushing Europe toward ethical recycling practices, leading to strengthening the future growth prospects.

- Growing digital and AI-driven solutions are transforming battery recycling operations. AI-driven sorting systems, digital battery passports, and blockchain-based traceability tools are improving material recovery rates and compliance. These technologies enable recyclers to identify battery chemistries, optimize disassembly, and track materials across the supply chain. As regulations tighten, digital tools will play a critical role in ensuring transparency, efficiency in recycling processes and boosting the growth prospects.

Europe Lithium-Ion Battery Recycling Market Analysis

Learn more about the key segments shaping this market

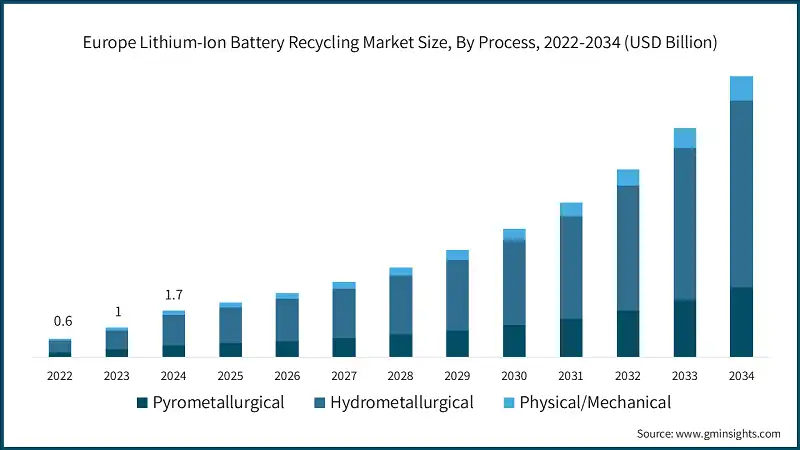

Based on the process, the industry is segmented into pyrometallurgical, hydrometallurgical, and physical/mechanical categories. The hydrometallurgical process dominated the Europe lithium-ion battery recycling market, accounting for 65.6% in 2024 and is expected to grow at a CAGR of 20.2% through 2034.

- Rising shift towards cleaner alternative to traditional pyrometallurgical methods, producing fewer emissions and enabling selective recovery of critical metals such as lithium, cobalt, and nickel is set to influence the process growth. This aligns with Europe’s stringent environmental regulations and carbon neutrality goals. Furthermore, the process enables recovery of up to 95% of valuable metals, making it economically attractive. As battery volumes grow, hydrometallurgy supports scalable, high-yield recycling, essential for meeting EU targets on recycled content and reducing reliance on imported raw materials.

- The pyrometallurgical market will grow at a CAGR of 20% by 2034 due to its well-established market with existing infrastructure across Europe, making it easier to scale quickly. It handles mixed battery chemistries without extensive sorting, offering operational flexibility for recyclers, leading to propel the process growth. Additionally, the process efficiently recovers high-value metals, including cobalt, nickel, and copper, which are crucial for battery manufacturing. Though lithium recovery is limited, pyrometallurgy remains economically viable due to strong demand for these metals and its ability to process large volumes of battery waste, which uplift the process adoption.

- The physical/mechanical process is likely to grow at a CAGR of 19% from 2025 to 2034 due to its low energy consumption, making it cost-effective and environmentally friendly, aligning with Europe’s sustainability goals. Companies' growing expansion of recycling projects will further support the process growth. For instance, in October 2024, Mercedes-Benz opened Europe’s first integrated lithium-ion battery recycling plant in Germany. Using Primobius technology, the facility will recover cobalt, nickel, lithium, and other materials to produce over 50,000 battery modules annually for its all-electric models.

Learn more about the key segments shaping this market

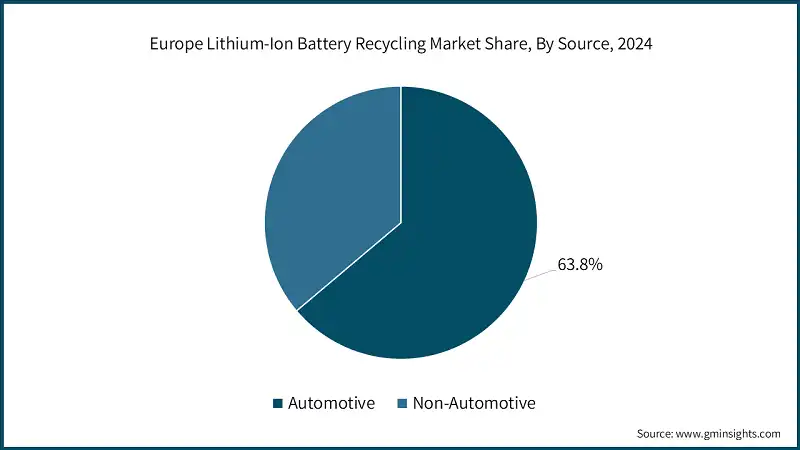

- Based on the source, the Europe lithium-ion battery recycling market is segmented into automotive and non-automotive segments. The automotive dominates the market with a 63.8% share in 2024, and the segment is expected to grow at a CAGR of 19.8% from 2025 to 2034.

- Surge in EV adoption is a major factor for the growth of the recycling industry. As per Arthur D. Little analysis, 70% of new passenger vehicles are expected to be battery-powered by 2030. This growth is generating vast volumes of end-of-life batteries, creating urgent demand for recycling to recover critical materials and reduce environmental impact.

- The increasing generation of scrap materials from new battery production facilities during ramp-up phase, acts as a major source of recyclable material, especially before large volumes of retired EV batteries enter the waste stream. Recycling this scrap helps manufacturers reduce waste and reclaim valuable metals, thus improving the process growth. Additionally, automotive OEMs are also prioritizing supply chain decarbonization, making recycling essential for meeting climate goals and securing ethical, local sources of raw materials, thereby driving the business scenario.

- Non-automotive is set to grow at a CAGR of 20.5% by 2034 on account of the widespread use of lithium-ion batteries in smartphones, laptops, and wearable devices, generating significant battery waste. These small-format batteries often end up in landfills, prompting stricter EU regulations and increased recycling efforts to recover valuable metals and reduce environmental harm. Moreover, advancements in recycling technologies are significantly improving the recovery rates of valuable materials, which in turn is accelerating the growth of the lithium-ion battery recycling across Europe.

Looking for region specific data?

- Germany dominated the lithium-ion battery recycling market in Europe with around 47.3% share in 2024 and is expected to generate over USD 5 billion in revenue by 2034. Rising stringent environmental regulation, including the implementation of a take-back system for batteries under its battery law, which ensures that battery producers and importers are responsible for collecting and recycling spent batteries, creates immense opportunities for the proliferation of the recycling industry.

- Furthermore, a surge in EV adoption, with nearly 380,609 registrations in 2024, resulted in a growing stockpile of used and soon-to-be-retired EV batteries. This trend is catalyzing the need for effective recycling infrastructure to handle used EV batteries and recover valuable materials for reuse in battery manufacturing, leading to augment the business trend.

- In UK lithium-ion battery recycling market is anticipated to grow to over USD 1 Billion by 2034. UK’s strategic focus on energy security and reducing reliance on imported critical minerals such as lithium, cobalt, and nickel is encouraging the development of domestic recycling capabilities. Initiatives such as the UK Battery Industrialization Centre and investments in urban mining technologies are helping close the loop on battery materials.

- Moreover, rising innovations in hydrometallurgical and mechanical recycling processes to make lithium-ion battery recycling more efficient and economically viable in the UK will complement the business growth. These advancements are attracting private sector investments and research collaborations, fostering a thriving recycling ecosystem that supports green jobs and a low-carbon economy.

- France is set to grow at a CAGR of 21.6% by 2034. The country’s aim to ban the sale of internal combustion engine vehicles by 2035 will improve EV adoption to generate a substantial volume of used lithium-ion batteries. This projected growth is propelling investments in battery recycling infrastructure to recover critical materials such as lithium, cobalt, and nickel. Additionally, government support in the form of subsidies and industrial policy, such as the France 2030 investment plan, will encourage the development of domestic battery value chains, including recycling.

- The Belgium market is expected to be valued at USD 650 million by 2034. Belgium’s central location in Europe and well-developed logistics infrastructure make it an ideal collection and processing hub for used lithium-ion batteries from neighboring countries. The geographic benefits encourage companies to establish recycling plants in the country. For instance, in November 2023, Avesta Battery & Energy Engineering chosen Dour, Belgium, as the site for its upcoming BE-VOLT Battery Recycling Plant. The facility, dedicated to recycling lithium iron phosphate batteries, will have a processing capacity of 20,000 tonnes annually once fully operational.

Europe Lithium-Ion Battery Recycling Market Share

- The top 5 companies, including Stena Recycling, Umicore, Ecobat, Northvolt, and Accurec Recycling, account for around 47.5% market share. Companies are integrating recycling with battery manufacturing to create closed-loop supply chains. This ensures consistent feedstock, reduces reliance on raw material imports, and supports EU circular economy goals. Recovered materials are reused in new batteries, improving sustainability and cost-efficiency while meeting regulatory requirements for recycled content.

- Furthermore, firms are investing in hydrometallurgical and direct recycling technologies to improve recovery rates and reduce environmental impact. These innovations allow selective extraction of lithium, cobalt, and nickel with lower energy use. Advanced automation and AI-driven sorting also enhance operational efficiency and scalability across diverse battery chemistries.

- Additionally, to meet rising demand, companies are expanding across Europe, especially in Central and Eastern regions. Strategic partnerships with OEMs, energy firms, and logistics providers help secure battery waste streams and optimize collection networks. This regional diversification strengthens supply chain resilience and market reach.

- Businesses are also aligning operations with EU Battery Regulation targets, including recovery rates and carbon footprint disclosures. By adopting transparent, eco-friendly practices, they enhance brand value and attract ESG-focused investors. Compliance also opens access to public funding and incentives, accelerating growth in a highly regulated market.

Europe Lithium-Ion Battery Recycling Market Companies

Eminent players operating in the Europe lithium-ion battery recycling industry are:

- Accurec Recycling

- Altilium Metals

- Batrec AG

- Cylib

- Cellcycle

- Ecobat

- Eramet

- Fortum

- Glencore

- Northvolt

- Redwood Materials

- Recyclus Group

- Revatech

- Re.Lion.Bat

- Stena Recycling

- Stibat Service

- SungEel Hitech

- Saft Group

- Tozero

- Umicore

- Stena Recycling operates advanced battery recycling facilities across Europe, focusing on safe collection, dismantling, and material recovery. It emphasizes circularity by reintegrating recovered metals into manufacturing, supporting OEMs and sustainability goals.

- Umicore is a pioneer in battery recycling, using proprietary pyro-hydro processes to recover cobalt, nickel, and lithium. It integrates recycling with battery material production, enabling closed-loop supply chains and low-carbon operations.

- Ecobat specializes in lithium-ion battery recycling through black mass recovery. With facilities in Germany and the UK, it focuses on scalable, safe processing and supports circular economy initiatives across the automotive and electronics sectors.

- Northvolt, combines battery manufacturing and recycling through its Revolt Ett facility. It recovers up to 95% of metals and aims to use 50% recycled content in new batteries by 2030, promoting full circularity.

- Accurec Recycling leads in hydrometallurgical innovation, offering high-purity lithium recovery. It operates industrial-scale facilities in Germany and focuses on energy-efficient, low-emission processes aligned with EU recycling and sustainability regulations.

Europe Lithium-Ion Battery Recycling Industry News:

- In September 2023, Redwood Materials acquired Germany-based Redux Recycling to establish a strategic foothold in Europe and scale its lithium-ion battery recycling operations. The Bremerhaven facility, with a 10,000-ton annual capacity, enables Redwood to process diverse battery types and chemistries while enhancing material recovery using complementary mechanical and hydrometallurgical technologies.

- In May 2023, Glencore and Li-Cycle announced a joint study to repurpose Glencore’s Portovesme facility in Italy into Europe’s largest recycling hub for battery-grade lithium, nickel, and cobalt. The project aims to establish a fully closed-loop system processing 50,000–70,000 tonnes of black mass annually.

- In February 2022, Umicore introduced its next-generation Li-ion battery recycling technology through a strategic partnership with Automotive Cells Company (ACC) to support ACC’s pilot plant in Nersac, France. The advanced process achieves over 95% recovery of lithium, cobalt, nickel, and copper, delivering battery-grade materials with minimal waste. This collaboration reinforces a closed-loop model and strengthens Europe's sustainable EV battery value chain.

Europe lithium-ion battery recycling market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in “(USD Million)” & volume (Thousand Tons) from 2021 to 2034, for the following segments:

Market, By Chemistry

- Lithium nickel manganese cobalt oxide (NMC)

- Lithium iron phosphate (LFP)

- Lithium cobalt oxide (LCO)

- Others

Market, By Process

- Pyrometallurgical

- Hydrometallurgical

- Physical/Mechanical

Market, By Source

- Automotive

- Non-automotive

The above information has been provided for the following countries:

- UK

- France

- Belgium

- Switzerland

- Germany

Frequently Asked Question(FAQ) :

Who are the key players in the Europe lithium-ion battery recycling industry?

Key players include Accurec Recycling, Altilium Metals, Batrec AG, Cylib, Cellcycle, Ecobat, Eramet, Fortum, Glencore, Northvolt, Redwood Materials, and Recyclus Group.

What are the upcoming trends in the Europe lithium-ion battery recycling market?

Key trends include advanced recycling tech, cross-industry collaborations, ethical practices, AI-driven solutions, and closed-loop ecosystems.

Which country led the Europe lithium-ion battery recycling sector?

Germany led the market with a 47.3% share in 2024 and is expected to generate over USD 5 billion in revenue by 2034, led by stringent environmental regulations and the implementation of a take-back system for batteries.

What was the market share of the automotive segment in 2024?

The automotive segment held a 63.8% share in 2024 and is anticipated to expand at a CAGR of 19.8% from 2025 to 2034.

What was the market share of the hydrometallurgical process in 2024?

The hydrometallurgical process dominated the market with a 65.6% share in 2024 and is expected to witness over 20.2% CAGR through 2034.

What is the expected size of the Europe lithium-ion battery recycling market in 2025?

The market size is projected to reach USD 2 billion in 2025.

What is the projected value of the Europe lithium-ion battery recycling market by 2034?

The market is poised to reach USD 10.4 billion by 2034, driven by advancements in recycling technologies, cross-industry collaborations, and stringent environmental regulations.

What is the market size of the Europe lithium-ion battery recycling in 2024?

The market size was estimated at USD 1.7 billion in 2024, with a CAGR of 20.1% expected through 2034. The rapid growth of the EV industry and increasing battery waste are driving the market expansion.

Europe Lithium-Ion Battery Recycling Market Scope

Related Reports