Summary

Table of Content

Europe Grease Gun Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Europe Grease Gun Market Size

The Europe grease gun market was estimated at USD 336.2 million in 2024. The market is expected to grow from USD 349 million in 2025 to USD 531.1 million in 2034, at a CAGR of 4.8% according to latest report published by Global Market Insights Inc.

To get key market trends

The growth of automated tools across manufacturing, automotive, and heavy engineering industries is a key driver for grease gun demand in Europe. Automated systems require consistent and accurate lubrication to ensure optimal performance and to avoid downtime. Grease guns, especially sophisticated cordless and pneumatic grease guns, are an effective means of ensuring precise direction for grease application and leveraging predictive maintenance paradigms. As industries enter industry 4.0, they are demanding reliable lubrication accessories that can support equipment life and manage operational costs. In summary, it is evident that grease guns are becoming important tools in modern industrial ecosystems and thus will continue to drive demand and the market.

As per the European Automobile Manufacturers Association (ACEA), Europe produced a total of 14.8 million motor vehicles in 2023, highlighting the scale of operations requiring efficient lubrication solutions. Similarly, the manufacturing and heavy engineering sectors are increasingly adopting automated machinery, further driving the need for reliable grease guns. These tools not only enhance equipment longevity but also contribute to cost savings by reducing unplanned maintenance and operational disruptions.

As a world leader in innovation and manufacturing, Europe’s automotive sector has a major role in the demand for grease guns. Grease guns are critical to vehicle assembly lines, maintenance shops and fleet services. Because of these uses, grease guns must be used to lubricate parts for performance and safety. The overall vehicle market is becoming more complicated, especially as electric vehicles (EVs) come to market. For example, new bearing and chassis systems in EVs will require specialized lubrication. In addition, various newer laws under the EU have added new challenges in vehicle efficiency and durability. This increased level of vehicle demand and EU laws and regulations have added to the demand for high-quality products for lubrication. With these segments of the market growing additionally after-market service presents a strong base of demand for advanced technologies in grease guns.

As per the European Environment Agency (EEA), Registrations of new battery-only electric passenger cars (BEVs) in the EU increased by 48.5% in 2023 compared to 2022, underscoring the rapid growth of this segment. This shift necessitates the development and deployment of grease guns capable of addressing the unique lubrication needs of EVs.

Germany has taken a prominent position in the Europe grease gun market owing to the country’s strong industrial base, advanced automotive sector, and emphasis on precision engineering. With a higher rate of maintenance tools utilization in the manufacturing and transportation industries, Germany has been the most consistent user of grease guns in the region. Moreover, the growth of automation and predictive maintenance engineering in the country has added significantly to the demand of grease guns as a reliable lubrication method and form of equipment lubrication. Lastly, Germany has some of the most established and well-connected distribution networks but also leads with technological and lubrication design innovation of grease guns that adds to the market share growth of grease guns in Europe.

Hand-operated grease guns continue to represent the largest section due to their cost-effectiveness, ease of use, and popularity within smaller operations and maintenance workshops. Manual grease guns are still a preferred solution for routine lubrication tasks across many industries, despite any technology improvements, given their reliability and operational dependability. Their inexpensive cost makes them an attractive option for smaller-sized enterprises (SME) and aftermarket companies, leading to a stable demand for grease guns. The manual grease gun segment allows continued market growth by meeting the needs of a wide user base, especially in regions focused on gradual automation procedures.

Europe Grease Gun Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 336.2 Million |

| Market Size in 2025 | USD 349 Million |

| Forecast Period 2025 - 2034 CAGR | 4.8% |

| Market Size in 2034 | USD 531.1 Million |

| Key Market Trends | |

| Drivers | Impact |

| Rising Industrial Automation | The increasing adoption of automated machinery across manufacturing, automotive, and heavy engineering sectors is a major driver for grease gun demand in Europe. |

| Growth in Automotive and Transportation Sector | Europes automotive industry, a global leader in innovation and production, significantly influences grease gun demand. Vehicle assembly lines, maintenance workshops, and fleet services rely on grease guns for critical lubrication tasks to ensure performance and safety. |

| Emphasis on Sustainability and Eco-Friendly Lubrication | Environmental regulations and corporate sustainability goals are reshaping lubrication practices in Europe. Manufacturers increasingly prefer grease guns compatible with biodegradable and low-toxicity lubricants to meet EU environmental standards. |

| Pitfalls & Challenges | Impact |

| High Initial Cost of Advanced Models | The adoption of battery-operated and pneumatic grease guns is often hindered by their higher upfront cost compared to manual alternatives. While these advanced models offer efficiency and precision, small and medium-sized enterprises (SMEs) may find investment challenging, especially in cost-sensitive markets. |

| Availability of Alternative Lubrication Systems | Automated centralized lubrication systems are increasingly preferred in large-scale industrial operations, reducing reliance on handheld grease guns. These systems offer continuous lubrication with minimal human intervention, improving productivity and reducing maintenance errors. |

| Opportunities: | Impact |

| Rising Adoption of Smart and Connected Lubrication Tools | The growing trend toward Industry 4.0 and predictive maintenance creates a significant opportunity for manufacturers to introduce smart grease guns with IoT integration, digital monitoring, and data analytics capabilities. |

| Increasing Demand for Eco-Friendly Lubrication Solutions | Stringent EU environmental regulations and corporate sustainability goals are driving demand for grease guns compatible with biodegradable and low-toxicity lubricants. Manufacturers that innovate in precision delivery systems to minimize waste and contamination can gain a competitive edge. |

| Market Leaders (2024) | |

| Market Leaders |

15% market share |

| Top Players |

The collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Germany |

| Fastest Growing Market | Eastern Europe |

| Emerging Country | Poland |

| Future Outlook |

|

What are the growth opportunities in this market?

Europe Grease Gun Market Trends

The Europe grease gun industry is undergoing a transformative phase driven by technological innovation, sustainability imperatives, and evolving industrial practices. Manufacturers are increasingly focusing on cordless solutions, smart connectivity, and eco-friendly lubrication systems to meet the demands of modern maintenance strategies. These trends reflect a shift toward efficiency, precision, and compliance with stringent environmental regulations, positioning grease guns as integral tools in automated and sustainable industrial ecosystems.

- Shift toward cordless and battery-powered solutions: There is a notable shift in the market from traditional manual grease guns to more modern cordless, battery-powered versions. This change is motivated by the desire for efficiency, ease of mobility, and less fatigue for operators in both industrial and automotive settings. Battery-driven grease guns provide reliable pressure and accurate lubrication, aligning well with contemporary maintenance techniques. Manufacturers are making significant investments in innovative lithium-ion technologies and ergonomic designs to meet this growing demand. As businesses emphasize productivity and time efficiency, cordless options are increasingly favored, indicating a lasting evolution in product development and market strategy.

- Integration of smart and digital features: The incorporation of intelligent and digital capabilities is transforming lubrication methods, including grease guns. The emergence of smart grease guns that come with pressure sensors, digital displays, and Bluetooth connectivity is becoming increasingly popular. These advancements allow for precise grease application, real-time tracking, and data logging to support predictive maintenance. Such developments align well with the goals of Industry 4.0, where interconnected tools boost operational visibility and minimize downtime. By incorporating IoT features, manufacturers are developing enhanced solutions that attract large industrial users, making smart grease guns essential in automated maintenance systems.

- Increasing demand for environmentally friendly lubrication solutions: The push for environmental sustainability is shaping product design and user behavior in the grease gun market. Due to strict EU regulations and corporate commitments to Environmental, Social, and Governance (ESG) goals, there's a growing preference for grease guns that work with biodegradable and low-toxicity lubricants. This shift is encouraging manufacturers to create precision delivery systems that reduce waste and prevent contamination. Adopting eco-friendly lubrication practices not only helps businesses meet regulatory requirements but also improves their brand image among eco-conscious consumers. As sustainability becomes essential for business operations, this movement is likely to drive innovation and alter competitive strategies significantly.

Europe Grease Gun Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is divided into manual grease guns, pneumatic grease guns, and battery-powered grease guns. The manual grease guns exceeded USD 169 million in 2024.

- Manual grease guns continue to dominate the Europe grease gun market primarily due to their affordability, simplicity, and widespread applicability across various industries. These tools are favored by small and medium-sized enterprises (SMEs) and maintenance workshops where cost efficiency and ease of use are critical. Unlike battery-operated or pneumatic models, manual grease guns require minimal maintenance and no external power source, making them ideal for on-site and remote applications.

- Their reliability in delivering precise lubrication for routine tasks ensures consistent demand. This dominance supports market growth by catering to a broad user base, particularly in regions where automation adoption remains gradual, reinforcing manual grease guns as a cornerstone of lubrication practices.

Learn more about the key segments shaping this market

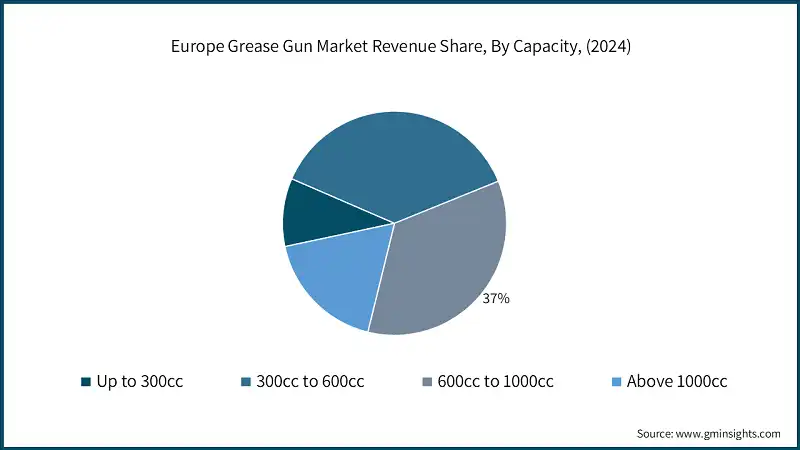

Based on capacity, the Europe grease gun market is segmented into Up to 300cc, 300cc to 600cc, 600cc to 1000cc, and above 1000cc. The 300cc to 600cc segment held around 37% market share in 2024.

- The Europe grease gun exchange has a dominant market share in the capacity range of 300cc to 600cc for its performance across a range of industries including industrial or automotive applications. The capacity range strikes a favorable balance of portability and adequate grease volume, which is useful for many maintenance situations that require frequent but controlled lubricating intervals.

- Manufacturing, transportation, and agriculture industries prefer this category due to its ability to mitigate downtime associated with constantly refilling the grease gun while being lightweight enough to not hinder the user. The popularity is further highlighted by application to manual and elevated grease gun models, so their usage is consistent across various workplace environments. Overall, this category has the market share because it ultimately achieves three key trends in market growth: efficiency, convenience, and cost savings.

Based on distribution channel, the market is segmented direct and indirect. The indirect sales accounted for more than 70% of the market share in 2024.

- Indirect sales channels are leading in the Europe grease gun market due to the significant presence of distributers, wholesalers and retailers that can serve different industrial types and automotive customers. This channel affords manufacturers a thorough market reach while allowing them to avoid investing in the infrastructure of direct selling and facilitates a more cost-effective and efficient use of resources.

- Distributors also have value added services such as providing technical support, managing inventory, and providing local delivery which is important in the convenience and trust factors. In addition, indirect channels can facilitate a stronger penetration of fragmented markets where SMEs rely on suppliers for their purchases. This indicates the value of partners and distribution channels to drive sales and maintain growth in the market.

Looking for region specific data?

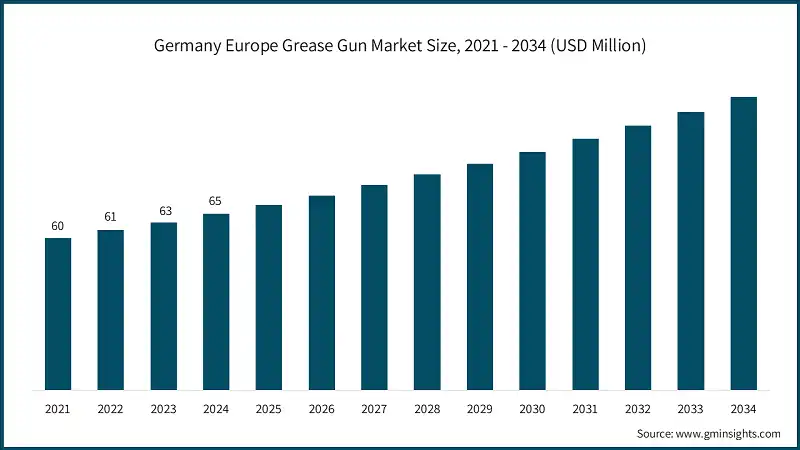

In 2024, the Germany dominated the Europe grease gun market, accounting for around 20% share and generating around USD 65 million revenue in the same year.

- Germany holds a leading position in the Europe grease gun industry, driven by its robust industrial infrastructure and advanced automotive sector. The country’s strong manufacturing base, coupled with high adoption of precision maintenance tools, ensures consistent demand for grease guns across various applications.

- German industries prioritize efficiency and reliability, which aligns with the use of high-quality lubrication equipment. Additionally, the presence of major OEMs and well-developed distribution networks further strengthens Germany’s market share. Its commitment to technological innovation and sustainability also accelerates the adoption of advanced grease gun models, making Germany a key growth engine for the regional market.

Europe Grease Gun Market Share

Pressol are leading with 15% market share. Würth Group, SKF Group, Lincoln Electric, Alemite (Stewart Warner), and Pressol collectively hold around 45%, indicating moderately fragmented market concentration.

Würth is strengthens its position in the marketplace via product differentiation and a broad distribution network. They provide a variety of lubricating tools including manual and battery-operated grease guns for automotive and industrial sectors. Their strategy is to focus on accessibility through retail and wholesale distribution, plus after-sales services and training programs. Their approach enhances customer loyalty and establishes Würth as a complete maintenance solution.

SKF prioritizes growth influenced by technology using smart lubrication systems and predictive maintenance solutions. The company is investing in automation and digitalization with the introduction of connected grease guns and centralized lubrication systems which meet the criteria of Industry 4.0. To expand their capabilities, the company has undertaken strategic acquisitions. The company is also committed to sustainability through initiatives such as their goals of achieving carbon neutrality, which enhances their sustainability efforts with eco-friendly lubrication solutions.

Pressol employs a cost-competitive method and innovation-driven mindset, supplying a wide range of manual and pneumatic grease guns. The company also promotes precision lubrication technology and compliance to EU standards across its range of products to target environmentally conscious consumers. Digital catalogs and e-commerce investments offer additional accessibility while strong ties to core distributors help with reach to the market.

Europe Grease Gun Market Companies

Major players operating in the Europe grease gun industry are:

- Alemite (Stewart Warner)

- Anti-Seize Technology

- Chicago Pneumatic

- CRC Industries

- Groz Tools

- Hiwin Corporation

- Hopkins Manufacturing Corporation

- Kinequip

- Lincoln Electric

- Macnaught

- Milwaukee Tool

- Pressol

- SAE Products

- SKF Group

- Würth Group

Lincoln Electric adopts an innovation-led strategy, prioritizing battery-operated grease guns for sectors demanding portability and efficiency. The company invests in ergonomic designs and advanced battery technology to improve user convenience. Continuous product upgrades and strong distribution partnerships enable Lincoln to penetrate emerging markets and maintain leadership in industrial maintenance solutions.

Alemite focuses on premium, custom-engineered lubrication solutions for heavy-duty applications. Its strategy emphasizes product reliability and compliance with rigorous quality standards. Alemite expands its portfolio with advanced grease guns and fluid handling systems while leveraging global distribution networks. This commitment to tailored solutions and technical support strengthens its position among industrial clients.

Europe Grease Gun Market News

- FUCHS Lubricants – The strategic partnership with BOSS Lubricants in February 2024 and the acquisition of IRMCO, a metal forming specialist, in April 2025 marked significant developments in expanding industrial capabilities. These business moves enhanced the specialty lubricant portfolio by incorporating advanced metal forming technologies and expertise. The combined strengths of both companies contributed to substantial industrial growth through improved product offerings and expanded market reach.

- In June 2023, Groz Tools introduced the RGG/12L USB rechargeable grease gun, featuring an industry-first integrated battery system, represents a significant advancement in cordless technology. This innovative product development targets the professional market segment by combining enhanced functionality with convenient USB charging capabilities, establishing new standards in portable lubrication equipment.

- In October 2025 KAJO expanded its biodegradable product line by obtaining European Ecolabel certifications, which demonstrates its commitment to environmental sustainability. This strategic expansion helps meet increasingly stringent environmental regulations and growing customer demands for sustainable products, while establishing a competitive advantage over traditional lubricant manufacturers who primarily focus on conventional products.

- MATO has positioned itself as a leader in battery and automated lubrication technology through the development of its 18V Accu-Greaser series in September 2023, eHybrid systems in April 2022, and LubeJet-eco spray technology in April 2020. These innovations not only enhance operational efficiency but also address the growing demand for advanced solutions in industrial digitalization. By integrating cutting-edge technology into its product offerings, the company is effectively meeting the evolving needs of industries transitioning toward more automated and sustainable practices.

The Europe grease gun market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Manual grease guns

- Lever-type

- Pistol grip

- Pneumatic grease guns

- Battery-powered grease guns

Market, By Capacity

- Up to 300cc

- 300cc to 600cc

- 600cc to 1000cc

- Above 1000cc

Market, By Pressure

- Low (below 5000 psi)

- Medium (5000 to 10,000 psi)

- High (above 10,000 psi)

Market, By Pricing

- Low

- Medium

- High

Market, By End Use Industry

- Automotive

- Agricultural

- Construction

- Industrial manufacturing

- Others

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following countries:

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Frequently Asked Question(FAQ) :

What is the market size of the Europe grease gun in 2024?

The market size was USD 336.2 million in 2024, with a CAGR of 4.8% expected through 2034, driven by increasing industrial automation and demand from the automotive sector.

What is the projected value of the Europe grease gun market by 2034?

The Europe grease gun market is expected to reach USD 531.1 million by 2034, propelled by advancements in smart lubrication tools and eco-friendly solutions.

What is the current Europe grease gun market size in 2025?

The market size is projected to reach USD 349 million in 2025.

How much revenue did the manual grease gun segment generate in 2024?

Manual grease guns generated over USD 169 million in 2024, maintaining their dominance due to affordability and simplicity.

What was the market share of the 300cc to 600cc capacity segment in 2024?

The 300cc to 600cc segment held approximately 37% market share in 2024.

Which country leads the Europe grease gun market?

Germany led the 20% of the market share in 2024 and generating around USD 65 million in revenue, supported by its strong industrial and automotive sectors.

What are the upcoming trends in the Europe grease gun market?

Key trends include the adoption of smart grease guns with IoT integration, increasing demand for eco-friendly lubrication solutions, and alignment with Industry 4.0 standards.

Who are the key players in the Europe grease gun market?

Key players include Würth Group, SKF Group, Lincoln Electric, Alemite (Stewart Warner), Pressol, and others.

Europe Grease Gun Market Scope

Related Reports