Summary

Table of Content

Ethylene-Vinyl Alcohol Copolymer (EVOH) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ethylene-Vinyl Alcohol Copolymer Market Size

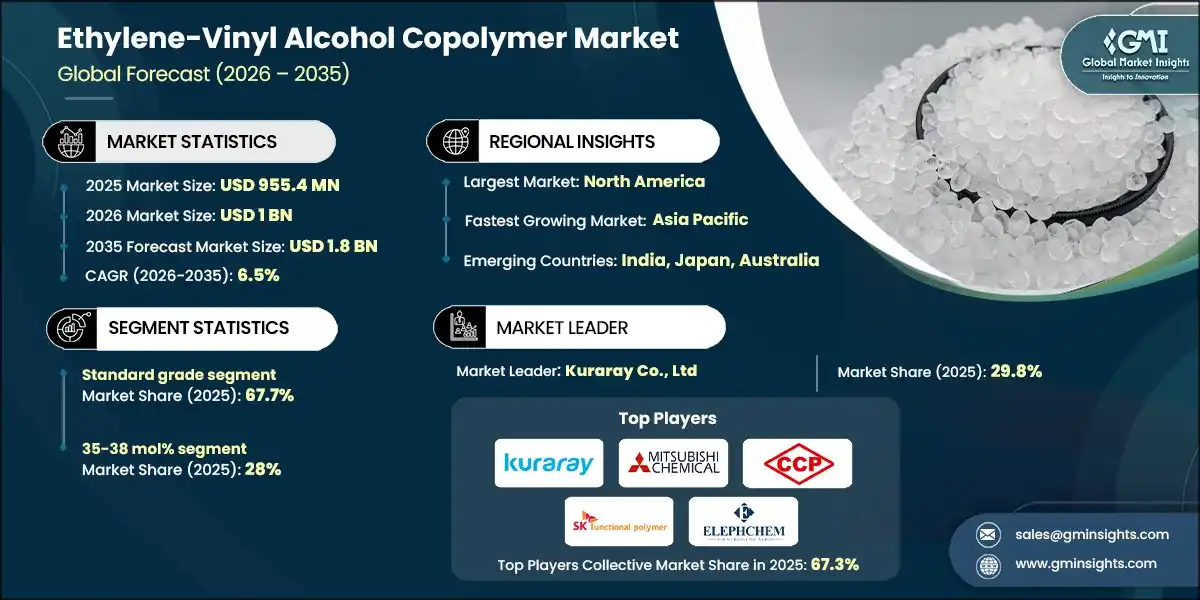

The global ethylene-vinyl alcohol copolymer market was valued at USD 955.4 million in 2025. The market is expected to grow from USD 1 billion in 2026 to USD 1.8 billion in 2035, at a CAGR of 6.5% according to latest report published by Global Market Insights Inc.

To get key market trends

- Ethylene-vinyl alcohol copolymer (EVOH) is a thermoplastic copolymer known to be high-performing with excellent barrier properties against gases, aromas, and moisture, thus offering great utility in packaging, automotive, and healthcare applications. The first major factor driving the EVOH market is the increasing requirement for longer shelf-life in food packaging. Consumers and manufacturers alike demand more freshness and safety in products, which has been made possible by the development of advanced barrier materials like EVOH.

- Countries all over the world have taken specific efforts to put in place strict food safety and packaging regulations because of this, which encourage the use of such novel barrier materials to fulfill safety standards and reduce food waste.

- Regulatory frameworks in North America such as the Food and Drug Administration emphasize good packaging solutions for market growth. Environmental regulations fuel permeation that the automotive sector compel manufacturers to use EVOH materials in different fuel systems due to vapor transmission control and environmental standards established. The U.S. Environmental Protection Agency (EPA) has passed regulations that eventually push the automotive industry toward innovative barrier designs and that propel EVOH demand.

- Concurrently, the expansion of pharmaceutical packaging, which is increasing due to the need for better healthcare, rapid change, and safety standards, has in turn enhanced the use of EVOH since it offers better barrier properties against gases and moisture, thus protecting sensitive medicines.

- North America now leads the global market for EVOH owing to its highly advanced manufacturing infrastructure, much consumer awareness, and draconian regulations where such materials are used. However, Asia Pacific is set to be the fastest-evolving market due to rapid industrialization and increasing investments in healthcare and food sectors together with favorable government policies promoting sustainable packaging solutions.

Ethylene-Vinyl Alcohol Copolymer (EVOH) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 955.4 Million |

| Market Size in 2026 | USD 1 Billion |

| Forecast Period 2026 - 2035 CAGR | 6.5% |

| Market Size in 2035 | USD 1.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand for extended shelf life in food packaging | Increased demand for food preservation drives higher EVOH consumption due to its superior barrier properties |

| Stringent automotive fuel permeation regulations | Tighter regulations boost EVOH utilization in fuel systems to reduce permeation and emissions |

| Growth in pharmaceutical packaging demand | Expanding pharmaceutical packaging needs elevate EVOH usage for its excellent barrier against gases and moisture |

| Pitfalls & Challenges | Impact |

| High moisture sensitivity of low ethylene EVOH | Moisture sensitivity limits EVOH’s application scope, potentially restraining market growth in humid environments |

| Premium pricing vs commodity barrier materials | Higher costs of EVOH compared to alternatives may hinder its broader adoption, impacting market expansion |

| Opportunities: | Impact |

| Bio-based EVOH market development | Development of bio-based EVOH offers sustainable alternatives, opening new markets and applications |

| Emerging applications in medical devices | Growing use in medical devices enhances EVOH’s market penetration in specialized, high-value segments |

| Market Leaders (2025) | |

| Market Leaders |

29.8% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Japan, Australia |

| Future outlook |

|

What are the growth opportunities in this market?

Ethylene-Vinyl Alcohol Copolymer Market Trends

- New developments in polymer chemistry have enabled developing next-generation EVOHs with moisture resistance, thermal stability, and processability. These advances allow the manufacture to provide more flexible packaging applications, broadening the application of EVOH in other areas. New copolymer formulations are allowing EVOH applications in high-temperature conditions, which was previously a limitation. These technological advances are backed by ceaseless research and development done to increase the performance while keeping the cost low, thereby meeting the ever-increasing demand from the end-use industries including food, automotive, and healthcare.

- Increased environmental awareness and stringent sustainability regulations are pushing companies toward developing bio-based, recyclable EVOH variants. These developments intend to lower the carbon footprint and comply with circular economic principles. The shift toward bio-derived ethylene sources has been influenced by consumer inclination toward green products and regulatory pressure to minimize fossil fuel dependency. Progress toward sustainable EVOH is further aided by innovations in processing technologies for renewable raw materials, increasingly rendering green options viable and market ready.

- The introduction of industry 4.0 technologies, like automation, IoT, and AI quality control, to EVOH manufacturing is changing everything. These smart factories provides greater efficiencies, lower waste, and overall consistency in the product-more than essential to meet quality specifications at a low price. This trend also catalyzes rapid customization and innovation cycles and allows the producers to make tailor-made EVOH solutions for certain applications.

Ethylene-Vinyl Alcohol Copolymer Market Analysis

Learn more about the key segments shaping this market

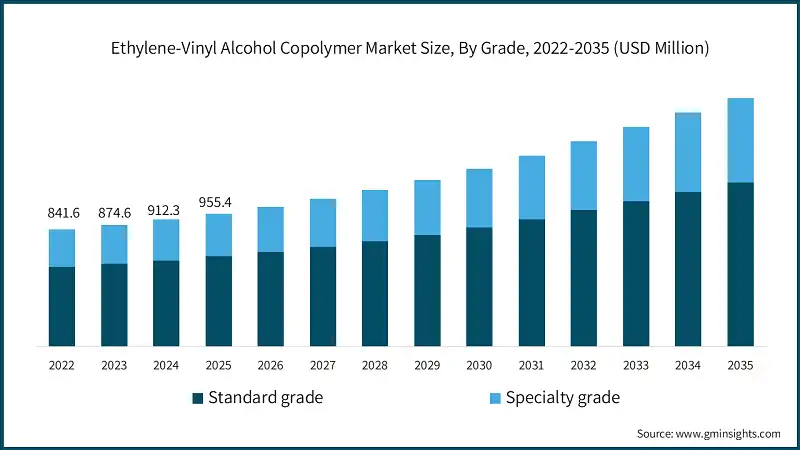

Based on grade, the market is segmented into standard grade and specialty grade. Standard grade dominated the market with an approximate market share of 67.7% in 2025 and is expected to grow with a CAGR of 6.2% by 2035.

- The market for EVOH is dominated by standard grade, because this category can find a wide range of applications across varied industries including food packaging, which offers a low-cost option during. Thus, it is extensively used by manufacturers who are searching for reliable but cost-effective solutions; it has also been proven to work in diverse packaging environments.

- The high-end applications that require superior barrier properties, thermal stability, or chemical resistance in assistance push the demand for specialty grade. The specialty types of EVOH are usually found in medical packaging, where even superior functionality is provided, required by stricter regulation and compliance.

Learn more about the key segments shaping this market

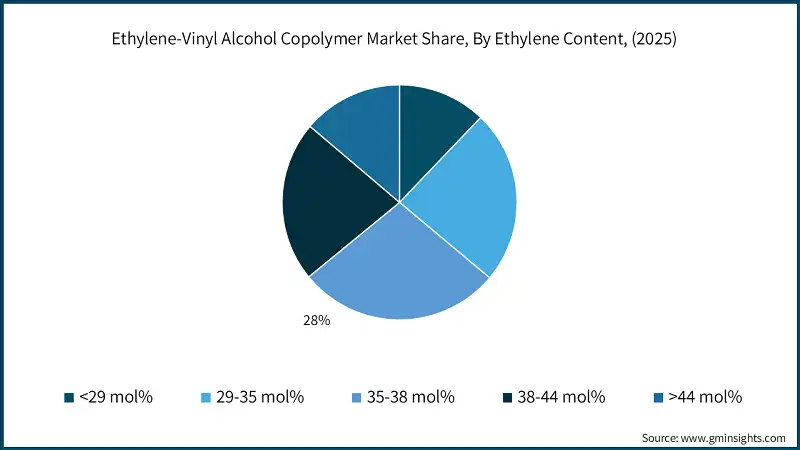

Based on ethylene content, the ethylene-vinyl alcohol copolymer market is segmented into <29 mol%, 29-35 mol%, 35-38 mol%, 38-44 mol% and >44 mol%. 35-38 mol% held the largest market share of 28% in 2025.

- The segment of 35-38 mole% is the strongest in the EVOH market, due to its balanced property between barrier and processability, which makes it extremely versatile for varied applications. This grade boasts an excellent gaseous barrier property, which makes it adequate for food packaging, particularly for prolonged shelf-life types of food, in addition to automotive and healthcare packaging where functionality and durability unquestionably matter.

- The <29 mol% is richer in ethylene and is applied primarily in most flexible applications, whereas moisture resistance is most required, presenting a narrower application profile. 29 - 35 mol% "grade" is one grade below the "high-grade" portion. They often get themselves into specialized packaging and industrial applications that require medium-grade barriers.

- 38-44 mol% and >44 mol% are not produced much due to their supposed compromise on barrier performance for the sake of flexibility and easy processing. These grades are used in specific niche applications like multilayer films, where barrier requirements are less stringent.

Based on application, the ethylene-vinyl alcohol copolymer market is segmented into food & beverages, agricultural, automotive, cosmetics, pharmaceuticals, construction and others.

- The segment of food and beverages is dominating because of its unusual barrier properties, adding considerably to the shelf life of perishable food items; hence meeting consumers' demands for safer and long-lasting packaging.

- Automotive applications are increasing for EVOH in fuel vapor barriers and internal components with strict emission norms and a need for lightweight, yet durable materials, thus encouraging continuous innovations.

- In pharmaceuticals, harnessing the unique gas and moisture barrier properties of EVOH is critical for protecting sensitive medicines and vaccines-growing regulatory frameworks boost demand for high-performance packaging.

- The area of cosmetics is favored by EVOH in preventing contamination and maintaining product integrity, while growing consumer preference for eco-friendliness and premium choices of packaging aids in further adoption.

- Other applications in agriculture include the packaging of fertilizers and pesticides due to the good barrier functions of EVOH against spoilage thus prolonging product storage and transport life without loss of efficacy.

Looking for region specific data?

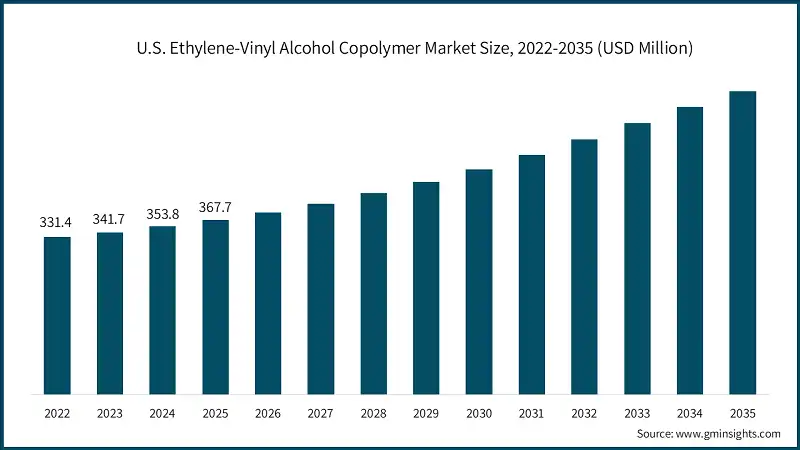

The ethylene-vinyl alcohol copolymer market in North America will grow at a CAGR from approximately 5.8% between 2026 and 2035.

- Increasing demand for sustainable packaging solutions driven by rising consumer awareness of environmental impacts, pushing manufacturers to adopt eco-friendly EVOH-based materials for food and beverages packaging.

- Innovations in recycling technologies and bio-based formulations of EVOH are gaining ground with the region focusing on principles of circular economy, reducing plastic wastes, and biotechnology.

- Stringent regulatory standards and government initiatives are further fuelled towards encouraging investment in bio-based EVOH production processing and positive growth of the market.

The ethylene-vinyl alcohol copolymer (EVOH) markets in Europe, especially in a few countries like Germany, are expected to grow with a rapid pace in the coming years.

- Strong emphasis on both environmental legislation and circular economy principles is stimulating the development of sustainable EVOH solutions, such as bio-based and biodegradable variants.

- Consumer preference for clean-label, allergen-free, and vegan products is pushing investments into environmentally friendly processing technologies and bio-based formulations of EVOH.

The ethylene-vinyl alcohol copolymer market in China and India is expected to have lucrative growth between 2026 and 2035, with CAGR 7.5% in the Asia Pacific region.

- Growing urbanization and disposable incomes among people are thereby enhancing the demand for quality preservation solutions with many levels of comfort and convenience for food mainly using EVOH along with sustainable packaging.

- Significant investments in recycling and biopolymer technologies are also attracted due to such governmental policies towards waste and renewable energy management as well as towards eco-friendly manufacturing.

- The healthcare, wellness, and organic product segments are projected to broaden the application of EVOH in pharmaceutical, dietary supplement, and natural extract packaging.

Between 2026 and 2035, the ethylene-vinyl alcohol copolymer market in the Middle East is projected to grow significantly during this period.

- Increasing tourism hospitality demand together with trends in wellness is propelling the need for eco-friendly packaging and food waste solutions, both based on EVOH.

- Regional government initiatives towards sustainable practices and healthier lifestyles help to adopt the EVOH into food, cosmetics, and dietary supplements industries.

- Advanced biological, thermal, and recycling technologies are expected to mitigate costs and improve the sustainability profile of applications based on EVOH.

Between 2025 and 2035, a promising expansion of the ethylene-vinyl alcohol copolymer (EVOH) sector is foreseen in Latin America.

- With increasing awareness of environmental sustainability and benefits of waste recycling, industries have taken to adopting more bio-based packaging with use of EVOH. Such industries include cosmetics and functional foods.

- Favorable legislation for sustainable farming and green extraction methods is virtually enhancing applications of EVOH in natural and organic product packaging.

- With increased disposable incomes and continuous scientific research on natural extracts, the use of EVOH as an eco-friendly packaging solution among many consumer products continues to increase.

Ethylene-Vinyl Alcohol Copolymer Market Share

Ethylene-vinyl alcohol copolymer (EVOH) market is moderately consolidated with players like Kuraray Co., Ltd, Mitsubishi Chemical Corporation, Chang Chun Petrochemical Co., Ltd, SK Functional Polymer and Elephchem accounts for 67.3% market share in 2025.

The ethylene-vinyl alcohol copolymer (EVOH) market consists of such leading companies operating mostly in their regional areas. Their long years of experience with ethylene-vinyl alcohol copolymer (EVOH) allow these companies to maintain a strong market position worldwide. Their product offerings are diverse and majorly supported by production capacities and distribution networks, which can serve the increasing demand for ethylene-vinyl alcohol copolymer (EVOH) in various regions.

Ethylene-Vinyl Alcohol Copolymer Market Companies

Major players operating in the ethylene-vinyl alcohol copolymer (EVOH) market includes:

- Bouling Chemical Co., Limited

- Chang Chun Petrochemical Co., Ltd

- Dow Chemical Company

- Elephchem

- Exxon Mobil Chemical

- Kuraray Co., Ltd

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Mondi Group

- SK Functional Polymer

Kuraray Co., Ltd.: Kuraray is a worldwide leader when it comes to specialty chemicals, as it manufactures top-of-the-line performance EVOH resins known for their barrier properties. The company believes strongly in providing uncompromised alternatives and innovations at the back end-primarily meeting the demands of the packaging, automotive, and electronics industries. With reliance on e(R2)CP chemical aptitude, Kuraray endeavors to enhance materials' advance application usage in one more dimension.

Mitsubishi Chemical Corporation: A worldwide leading supplier of chemicals and the foremost EVOH products for food packaging, medical-use, and for industrial uses. The Triple-I vision ensures not only sustainable growth through innovative and high-performance products but also ensures heavy investment in R&D towards the development of an eco-friendly alternative to EVOH which is biodegradable.

Chang Chun Petrochemical Co., Ltd: Technically qualified polymer producer with EVOH production for food and pharmaceutical packaging. They addressed issues of environmental responsibility, sustainable manufacturing, and technology enhancement of the barrier properties and application abilities of EVOH.

SK Functional Polymer: SK Functional Polymer is a developer and provider of high-performance EVOH copolymers for packaging, industrial insulation, and automobiles. A great deal of attention is paid to sustainability, where focus is laid upon eco-friendly methodology and bio-based EVOH solutions in order to lessen the environmental impact while maintaining an ideal level of barrier and mechanical properties.

Elephchem: One of the big companies for EVOH resins, Elephchem offers numerous products for packaging, laminates, and any other packaging purpose. The major strengths of the company are quality, innovation, and customer-centric, investing in research to produce “greener” EVOH variants, matching the implications of worldwide sustainability trends and regulatory standards.

Ethylene-vinyl Alcohol Copolymer Industry News

- In October 2025, the multilayer films with Mitsubishi Chemical SoarnoL EVOH resins, approved by RecyClass for up to 10% weight, in compatibility for PE recycling. The assessment validated the viability of sustainable packaging applications that can support a circular economy and the recyclability of EVOH-based films.

- In July 2025, a new laboratory was inaugurated by Kuraray India, targeting support for the rapidly growing packaging industry in India. This will ensure the provision of localized technical services to customers using Kuraray's EVOH (ethylene vinyl alcohol copolymer), branded as EVAL, with shorter response time.

- In August 2022, Mitsubishi Chemical increased the production of EVOH in the UK by an increase in its annual capacity of 21,000 metric tons at Saltend. This was intended to meet the emerging demand for eco-friendly, recyclable packaging materials at 39,000 tons per annum.

This ethylene-vinyl alcohol copolymer market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Grade

- Standard grade

- Specialty grade

Market, By Ethylene Content

- <29 mol%

- 29-35 mol%

- 35-38 mol%

- 38-44 mol%

- >44 mol%

Market, By Application

- Food & beverages

- Fresh meat & poultry packaging

- Dairy products

- Processed foods & ready-to-eat meals

- Snacks & confectionery

- Condiments, sauces & dressings

- Bakery products

- Others

- Pharmaceuticals

- Blister packs

- IV bags & infusion solutions

- Drug pouches & sachets

- Others

- Automotive

- Agriculture

- Silage films

- Greenhouse films

- Mulch films

- Others

- Cosmetics & personal care

- Skincare product packaging

- Haircare product packaging

- Fragrance & perfume packaging

- Others

- Construction

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the ethylene-vinyl alcohol copolymer (EVOH) market size in 2025?

The global ethylene-vinyl alcohol copolymer market is valued at USD 955.4 million in 2025. Rising demand for extended shelf life in food packaging and superior barrier materials is supporting steady market growth.

What are the upcoming trends in the EVOH industry?

Key trends include development of bio-based and recyclable EVOH materials, improved moisture-resistant formulations, adoption of Industry 4.0 technologies in manufacturing, and growing use of EVOH in medical and pharmaceutical packaging.

What is the projected value of the EVOH market by 2035?

The market size for ethylene-vinyl alcohol copolymer is expected to reach USD 1.8 billion by 2035, growing at a CAGR of 6.5%. This growth is fueled by advancements in barrier materials, rising food safety regulations, and increasing adoption in sustainable packaging.

What is the market size of the EVOH industry in 2026?

The EVOH market is estimated to reach USD 1.0 billion in 2026, reflecting continued expansion driven by growing applications in packaging, automotive, and pharmaceutical sectors.

Who are the key players in the ethylene-vinyl alcohol copolymer market?

Key players include Kuraray Co., Ltd., Mitsubishi Chemical Corporation, Chang Chun Petrochemical Co., Ltd., SK Functional Polymer, Elephchem, Dow Chemical Company, and Mitsui Chemicals. These companies focus on innovation, sustainability, and expanding high-performance EVOH applications.

What is the growth outlook for the ethylene-vinyl alcohol copolymer (EVOH) market in North America?

The market in North America is projected to grow at a CAGR of approximately 5.8% between 2026 and 2035, supported by rising demand for sustainable packaging, advancements in barrier materials, and strong regulatory emphasis on food safety and emissions control.

How much market share did the standard grade segment hold in 2025?

The standard grade segment accounted for approximately 67.7% of the market in 2025, making it the dominant grade category. Its leadership is supported by cost-effectiveness and widespread use in food packaging applications.

What was the market share of the 35–38 mol% ethylene content segment in 2025?

The 35–38 mol% ethylene content segment held around 28% market share in 2025. Its balanced barrier performance and processability make it highly suitable for food, automotive, and healthcare packaging.

Ethylene-Vinyl Alcohol Copolymer (EVOH) Market Scope

Related Reports