Summary

Table of Content

Endobronchial Ultrasound Biopsy Device Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Endobronchial Ultrasound Biopsy Device Market Size

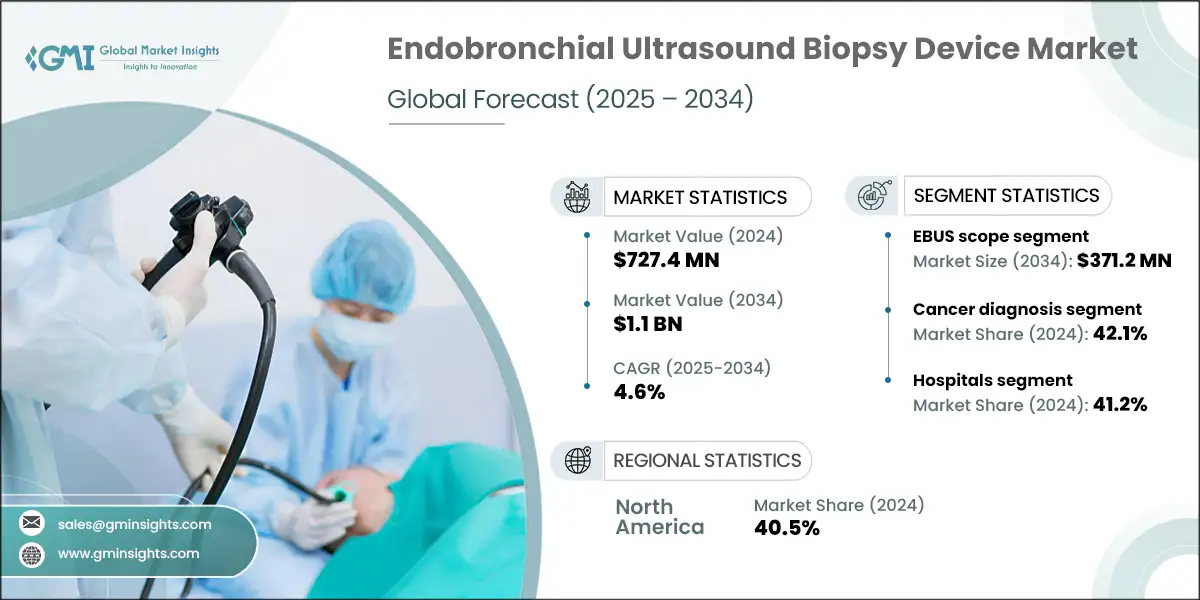

The global endobronchial ultrasound biopsy device market size was estimated at USD 727.4 million in 2024. The market is expected to grow from USD 755 million in 2025 to USD 1.1 billion in 2034, growing at a CAGR of 4.6%. The market is experiencing steady growth by the growing number of geriatric population, increasing prevalence of respiratory disorders, rising demand for minimally invasive procedures and technological advancements in biopsy devices.

To get key market trends

Endobronchial ultrasound biopsy devices are specialized tools designed to perform minimally invasive biopsies of lung tissue and nearby lymph nodes using ultrasound guidance. These devices are crucial for diagnosing and staging conditions such as lung cancer, tuberculosis, and other thoracic diseases. Their ability to reach deep and sensitive areas without requiring open surgery makes them a preferred choice in hospitals, cancer centres, and diagnostic facilities.

Major companies in this market include Boston Scientific Corporation, GE Healthcare, Siemens Healthineers, Olympus Corporation, and Fujifilm Corporation. The market primarily focuses on products such as transbronchial aspiration needles, biopsy forceps, cytology brushes, and convex or radial probe ultrasound systems. These innovations aim to improve diagnostic accuracy, reduce risks during procedures, and enhance clinical efficiency for healthcare providers.

Endobronchial Ultrasound Biopsy Device Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 727.4 Million |

| Forecast Period 2025 - 2034 CAGR | 4.6% |

| Market Size in 2034 | USD 1.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising geriatric population | The aging population is more susceptible to lung cancer, COPD, and other pulmonary conditions. This drives demand for early, accurate, and minimally invasive diagnostics. |

| Increasing prevalence of respiratory disorders | Fuels demand for accurate, minimally invasive diagnostic tools such as EBUS, especially for early-stage detection. |

| Rising demand for minimally invasive procedures | EBUS-guided biopsies offer a non-surgical alternative to traditional thoracic procedures. This aligns with the healthcare shift toward outpatient care, reducing hospital stays, complications, and costs, while improving patient comfort and diagnostic speed. |

| Technological advancements in biopsy devices | Enhances precision and real-time visualization during biopsies, improving diagnostic yield. |

| Pitfalls & Challenges | Impact |

| High cost of equipment | Limits accessibility in low-resource settings and slows adoption in emerging markets. |

| Lack reimbursement policies in developing countries | Low-income countries have limited access in comparison to high-income regions due to slow market penetration despite clinical demand. |

| Opportunities: | Impact |

| Growing adoption in specialty clinics for targeted biopsies. | Improves precision diagnostics, especially for molecular profiling and cancer staging. |

| Market Leaders (2024) | |

| Market Leaders |

15% Market Share |

| Top Players |

Collective Market Share in 2024 is 55% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

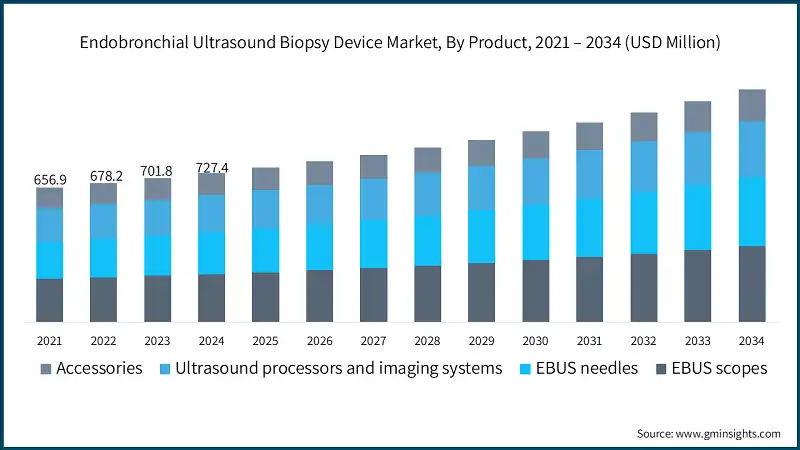

The market increased from USD 656.9 million in 2021 to USD 701.8 million in 2023. This growth is largely driven by the increasing need for accurate and minimally invasive diagnostic procedures for lung cancer and other thoracic diseases. The rising prevalence of respiratory conditions and advancements in biopsy technologies have significantly boosted the adoption of endobronchial ultrasound biopsy devices. Continuous innovations, such as AI-assisted navigation, elastography-enabled probes, and hybrid ultrasound systems, have improved diagnostic precision, reduced risks during procedures, and led to better patient outcomes. Additionally, the healthcare sector's focus on early disease detection, streamlined clinical workflows, and shorter hospital stays has further fueled the market's expansion.

The increasing prevalence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), pneumonia, and lung cancer are further accelerating the growth of the market. For instance, according to data from the World Cancer Research Fund, in 2022, lung cancer was one of the most common cancer worldwide, with an estimated 2.5 million new cases diagnosed globally. Thus, this statistics highlights the need for advanced diagnostic tools such as endobronchial ultrasound biopsy devices, which enable early and accurate detection of lung-related conditions through minimally invasive procedures.

Additionally, the endobronchial ultrasound biopsy device market is seeing significant growth due to ongoing advancements in biopsy technology. These innovations are making diagnostics more accurate, reducing risks during procedures, and improving patient outcomes. For example, AI-assisted navigation systems, elastography-enabled probes, and hybrid ultrasound platforms are transforming pulmonary diagnostics into highly precise and minimally invasive processes. For instance, Olympus Corporation offers EBUS devices such as the BF-UC190F and EU-ME2 ultrasound processor, which provide real-time imaging, better needle guidance, and compatibility with advanced biopsy tools. These features help healthcare professionals make more accurate diagnoses and minimize complications during lung and lymph node sampling.

Endobronchial ultrasound biopsy device is a specialized medical instrument which is used in pulmonary diagnostics to obtain tissue samples from the lungs and surrounding lymph nodes through a minimally invasive bronchoscopic procedure. It combines ultrasound imaging with real-time needle guidance, allows healthcare providers to accurately target and biopsy lesions or lymph nodes without the need for open surgery.

Endobronchial Ultrasound Biopsy Device Market Trends

With the global population growing and aging, there is an increasing need for diagnostic procedures to detect age related pulmonary conditions, many of which require minimally invasive techniques such as EBUS-guided biopsy for accurate diagnosis and staging.

- For instance, the World Health Organization (WHO) projected that by 2030 the population of individuals belonging to the age group 60 years will reach 1.4 billion from one billion in 2020, further the population of this age group will reach 2.1 billion by 2050. Moreover, by 2050 two third of this population will be part of middle- and low-income countries.

- Thus, this rising aging population stimulates the need for advanced endobronchial ultrasound biopsy devices (EBUS), which are essential for diagnosing lung cancer, COPD, tuberculosis, and other respiratory diseases that are more prevalent in older adults, thereby promoting market growth.

- Moreover, the expanding geriatric population is emerging as a key force driving the growth of the global EBUS biopsy device market. As aging is strongly associated with increased susceptibility to a range of chronic respiratory diseases such as lung cancer, which remains the leading cause of cancer-related deaths worldwide.

- Therefore, the steady rise in the elderly population globally is contributing to a growing demand for minimally invasive diagnostic solutions. Thus, the increasing incidence of age-related conditions, the need for early stage disease detection, and the shift toward outpatient and preventive care has created an urgent need for innovative EBUS biopsy systems solutions, that are safe, efficient, and tailored to meet the needs of geriatric patients.

Endobronchial Ultrasound Biopsy Device Market Analysis

Learn more about the key segments shaping this market

The global market was valued at USD 656.9 million in 2021. The market size reached USD 727.4 million in 2024, from USD 678.2 million in 2022.

Based on the product, the market is segmented into EBUS scopes, EBUS needles, ultrasound processors and imaging systems, and accessories. The EBUS scope segment led this market in 2024, accounting for the highest market share because of its ability to provide real-time guidance, minimally invasive access, and multimodal functionality. This segment was valued at USD 235.2 million in 2024 and is projected to reach USD 371.2 million by 2034, growing at a CAGR of 4.7%. This growth is because of the rising ambulatory surgical centers and outpatient care models, demand for minimally invasive diagnostics, and rising lung cancer cases. In comparison, the EBUS needle segment, valued at USD 204.3 million in 2024, is expected to grow to USD 336.5 million by 2034, with a slightly higher CAGR of 5.2%, supported by its different variety in gauge size and echogenic tip.

- EBUS scopes come with features such as flexible bronchoscopy integrated with ultrasound probes, commonly referred to as radial or convex. These devices allow real-time visualization of lymph nodes and lesions near the airway, making them crucial tools for diagnosing and staging lung cancer.

- Additionally, EBUS scopes enable transbronchial needle aspiration (TBNA), a technique that helps healthcare professionals collect tissue samples from lymph nodes and masses close to the airways without requiring surgery. This procedure, performed through the bronchoscope, minimizes patient discomfort, shortens recovery time, and lowers procedural risks.

- For instance, Olympus BF-UC190F, a convex probe EBUS bronchoscope, offers high-resolution ultrasound imaging and improved angulation for accessing difficult-to-reach lymph nodes.

- Further, advancements in EBUS technology, such as elastography, cryobiopsy, and miniforceps, have significantly improved diagnostic accuracy. These tools enhance tissue characterization and sampling efficiency, which is especially helpful for diagnosing complex conditions. These benefits are driving the growth of the EBUS market.

Based on the application, the endobronchial ultrasound biopsy device market is segmented into cancer diagnosis, infection diagnosis and other applications. The cancer diagnosis segment accounted for the highest market share of 42.1% in 2024.

- The growth of the segment is highly attributed due to the growing prevalence of cancer diagnosis, significantly accelerating the demand of advanced endobronchial ultrasound biopsy devices.

- For instance, according to the data from American Cancer Society, in 2022, approximately twenty million cancer cases were diagnosed and 9.7 million people died from the disease worldwide. By 2050, the number of cancer cases is predicted to increase to thirty-five million based solely on projected population growth.

- Therefore, as the prevalence of these cancer conditions increases, so does the need for diagnostic tools such as EBUS scopes, transbronchial aspiration needles, and elastography-enabled probes, which play a crucial role in early detection, staging, and treatment planning, thereby fostering the growth of the segment.

- Moreover, technological advancements are transforming diagnostic workflows. Innovations such as AI-assisted navigation, cryo-biopsy techniques, and advanced imaging platforms are speeding up turnaround times while improving patient safety and comfort. These advancements are encouraging the adoption of EBUS biopsy devices in both hospitals and ambulatory care settings.

Learn more about the key segments shaping this market

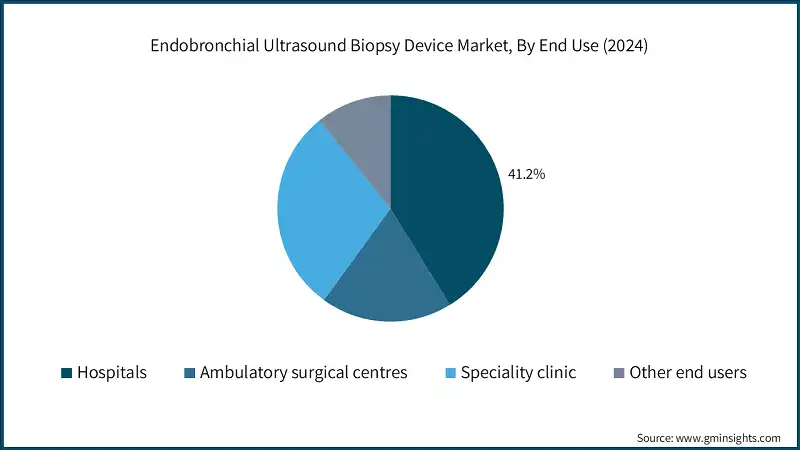

Based on end use, the endobronchial ultrasound biopsy device market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and other end users. In 2024, hospitals hold the largest share of 41.2%.

- The growing number of hospitals in both developed and developing countries, driven by factors such as population growth, the rising prevalence of chronic respiratory diseases, and advancements in endobronchial ultrasound biopsy technologies, is fueling the demand for advanced EBUS devices in both new and existing healthcare facilities.

- Moreover, the rising healthcare infrastructure especially in the developing regions such Middle East and Africa and Asia Pacific is boosting the adoption of advanced technology pertaining to EBUS devices in the hospital settings.

- For instance, the UK's Department of Health and Social Care spending around EURO 15 million from its Official Development Assistance (ODA) budget in order to expand the healthcare infrastructure in the countries such as Kenya, Ghana, and Nigeria, this investment is spanning from the year 2022-25, with a major aim to expand the healthcare infrastructure and medical workforce in these African countries.

- Thus, such investment in healthcare infrastructure is anticipated to propel the adoption of EBUS devices in the hospitals settings.

Looking for region specific data?

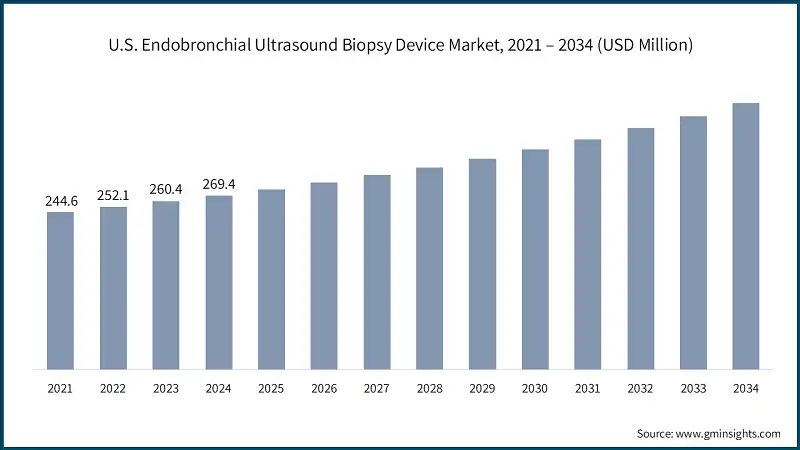

North America dominated the global endobronchial ultrasound biopsy device market with the highest market share of 40.5% in 2024. The region has advanced healthcare infrastructure, and a growing focus on early and accurate diagnosis. Further, there is an increasing prevalence of lung cancer and COPD in the U.S. and Canada, thus propelling the growth of this market.

- The U.S. market was valued at 244.6 million and USD 252.1 million in 2021 and 2022, respectively. In 2024 the market size reached USD 269.4 million from USD 260.4 million in 2023.

- This growth is largely attributed due to the rising prevalence of chronic respiratory condition such as lung cancer, COPD, and tuberculosis in the country. For instance, according to the American Lung Association, in 2022, 11.7 million people, or 4.6% of adults, reported a diagnosis of chronic obstructive pulmonary disease (COPD), chronic bronchitis, or emphysema.

- Similarly, according to the data obtained from National Cancer Institute, in 2022, there were an estimated 635,547 people living with lung and bronchus cancer in the U.S. These numbers indicate the growing need for EBUS devices for early diagnosis and detection.

- Moreover, the process of regulatory approvals is regularized in the country and also has high public awareness and robust R&D investment, which support the continuous rollout of innovative EBUS solutions.

Europe endobronchial ultrasound biopsy device market accounted for USD 161.6 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- Rising prevalence of respiratory diseases in the region, coupled with the increasing government initiatives to enhance healthcare infrastructure, is anticipated to spur the growth of the market.

- Moreover, the presence of key market players in the region reinforces Europe’s strength in the market. These companies are actively participating in innovation through the development of innovative solutions, thereby aiding market growth.

Germany endobronchial ultrasound biopsy device industry is projected to experience steady growth between 2025 and 2034.

- The market in Germany is expanding steadily, driven by rising lung cancer incidence and strong healthcare infrastructure. For instance, according to the data from World Cancer Research Fund, in 2022 approximately 62,025 new cases of lung cancer are reported annually, with 36,871 among men and 25,154 among women, highlighting a significant increase in cases over the years.

- Germany’s robust healthcare infrastructure and public-private initiatives including lung cancer screening programs and national cancer registries are further catalysing the adoption of minimally invasive biopsy technologies such as EBUS, especially in the country.

The Asia Pacific region is projected to be valued at USD 180 million in 2024 and is expected to reach USD 291.5 million by 2034.

- The endobronchial ultrasound biopsy device market in the Asia Pacific region is expanding rapidly due to the growing burden of chronic respiratory diseases, rising health awareness, and continuous advancements in endobronchial ultrasound biopsy device.

- Countries such as China, India and Japan are adopting advanced technology driven by growing demand for advanced diagnostic solutions and expanding access to healthcare services.

- Additionally, rapid growth in the number of hospitals and specialty clinics along with government policies aimed at improving diagnostic capabilities is further contributing to the growth of the market in the region.

China endobronchial ultrasound biopsy device market is poised to witness lucrative growth between 2025 - 2034.

- The country as one of speediest aging population which necessities frequent health monitoring.

- For instance, as per the estimates from the World Health Organization (WHO) in 2019, approximately 254 million people of age group 65 and above were residing in the country. This number is projected to rise significantly, with 402 million people expected to be over the age of sixty by 2040.

- The individuals of these age group are at high risk of developing chronic health condition such as lung cancer, COPD, tuberculosis, among others. This growing elderly population necessitates the use of advanced diagnostic tools particularly endobronchial ultrasound biopsy devices to ensure timely, accurate, and effective disease detection and management, thereby fueling the growth of the market.

Brazil is experiencing significant growth in the endobronchial ultrasound biopsy device industry, driven by increasing burden of cancer incidences.

- The rising prevalence of lung cancer is contributing to the growth of the market in the country. For instance, according to the data from World Cancer Research Fund, in 2022 approximately 44,213 new cases of lung cancer are reported annually.

- Additionally, there has been growing awareness about the benefits of early disease detection and prevention, driven by public health initiatives and education campaigns encouraging individuals to undergo health check-ups. This trend is expected to foster market growth.

The endobronchial ultrasound biopsy device market in Saudi Arabia is expected to experience significant and promising growth from 2025 to 2034.

- The government of Saudi Arabia is significantly investing in the healthcare infrastructure, to incorporate advanced medical devices such endobronchial ultrasound biopsy device within the hospitals setting to provide utmost care to the individuals suffering from the chronic condition in the country.

- According to the Saudi Ministry of Health, in 2023, the government had allocated around USD 50.4 billion budget for healthcare infrastructure and social development.

- Such investment is anticipated to enhance the accessibility and quality of medical services, among the individuals of the country, accelerating the market growth in the country.

Endobronchial Ultrasound Biopsy Device Market Share

- The top five players, such as Boston Scientific, GE Healthcare, Siemens Healthineers, Olympus Corporation, and Fujifilm Holdings Corporation collectively held 55% of the total market share. These players are continuing to strengthen their positions through innovation, regulation, and strategic collaborations. Players are investing substantially in technology by introducing next-generation device biopsy tools by enhancing their precision, real-time imaging, and minimally invasive procedures.

- Boston Scientific continues to lead in the EBUS segment with its iNod system, which integrates radial and linear ultrasound guidance for peripheral lung biopsies. The company is investing in tablet-based consoles, rotatable shafts, and ramped needles to enhance procedural control and diagnostic yield.

- Manufacturers are adopting value-based pricing strategies to penetrate cost-sensitive markets, particularly in emerging economies. Leading players are addressing clinical needs by launching compact, mobile EBUS platforms with AI-assisted navigation, real-time lesion targeting, and high-resolution imaging, enabling broader access to lung cancer diagnostics in outpatient settings.

- Emerging trends in the EBUS biopsy device market include the development of imaging systems, biopsy tools with enhanced needle control, and workflow-integrated platforms tailored for precision oncology, which is estimated to reach 866.1 billion by 2034. These innovations are being driven by the rising demand for early-stage lung cancer detection, minimally invasive procedures, and the global shift toward decentralized healthcare delivery models.

Endobronchial Ultrasound Biopsy Device Market Companies

Few of the prominent players operating in the endobronchial ultrasound biopsy device industry include:

- Argon Medical Devices

- ACE Medical Devices

- B. Braun

- Boston Scientific

- Cook Medical

- Clinodevice

- Fujifilm Holdings

- GE Healthcare

- Hobbs Medical

- Koninklijke Philips

- Medtronic

- Medi-Globe

- Olympus Corporation

- Praxis Medical

- Siemens Healthineers

- GE HealthCare Technologies

GE HealthCare Technologies has a strong global workforce of approximately 51,000+ employees, which enables the company to drive innovation, and deliver high-quality solutions.

- Boston Scientific

Boston Scientific has a robust geographical presence, which enables it to enhance its market reach. Boston Scientific operates in more than one hundred countries, thus comprising of a strong distribution network.

- Fujifilm Holdings

Fujifilm holds a significant share in the market through its comprehensive endobronchial solutions' portfolio. Fujifilm emphasizes R&D and product development offerings biopsy tools with enhances tensile strength and handling properties.

Endobronchial Ultrasound Biopsy Device Industry News:

- In February 2023, Fujifilm expanded its endoscopy solutions portfolio by launching the PB2020-M2 compact ultrasonic probe system, designed to deliver real-time ultrasound imaging of peripheral lung lesions with improved efficiency. The launch strengthened Fujifilm’s market position, increased adoption among pulmonologists, and showcased its commitment to minimally invasive diagnostic technologies, ultimately boosting brand recognition and expanding its global footprint in respiratory care.

- In May 2021, Olympus launched its upgraded EBUS bronchoscope, the BF-UC190F. This model brought significant improvements in ultrasound resolution, needle control, and scope angulation, designed to enhance diagnostic precision for lung cancer staging and lymph node sampling.

The endobronchial ultrasound biopsy device market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- EBUS scopes

- EBUS needles

- Ultrasound processors and imaging systems

- Accessories

Market, By Application

- Cancer diagnosis

- Infection diagnosis

- Other applications

Market, By End Use

- Hospitals

- Ambulatory surgical centers (ASCs)

- Specialty clinics

- Other end use

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What is the market size of the endobronchial ultrasound biopsy device market in 2024?

The market size was estimated at USD 727.4 million in 2024, supported by the rising geriatric population and demand for minimally invasive diagnostics.

What is the projected value of the endobronchial ultrasound biopsy device industry by 2034?

The market is expected to reach USD 1.1 billion by 2034, growing at a CAGR of 4.6% from 2025 to 2034 due to technological advancements and early-stage cancer diagnostics.

What is the market size forecast for 2025?

The global endobronchial ultrasound biopsy device market is projected to reach USD 755 million in 2025, reflecting steady year-on-year growth.

How much revenue did the EBUS scope segment generate in 2024?

The EBUS scope segment generated USD 235.2 million in 2024, leading the market due to real-time imaging, and growing adoption in outpatient settings.

What is the growth outlook for the EBUS needle segment through 2034?

The EBUS needle segment is projected to grow at a CAGR of 5.2%, from USD 204.3 million in 2024 to USD 336.5 million by 2034, driven by advancements in needle design.

Which application segment led the market in 2024?

The cancer diagnosis segment led with a 42.1% market share in 2024, fueled by the rising global cancer burden and demand for early, precise lung cancer diagnosis.

What was the market share of hospitals in 2024?

Hospitals held the largest market share at 41.2% in 2024, supported by growing infrastructure, adoption of EBUS technologies, and increased investment in diagnostic equipment.

Which region dominated the endobronchial ultrasound biopsy device market in 2024?

North America dominated with 40.5% share in 2024, led by high COPD and lung cancer prevalence, robust healthcare infrastructure, and early adoption of advanced diagnostics.

Who are the leading players in the market?

Top players include in endobronchial ultrasound biopsy device market are Boston Scientific, GE Healthcare, Olympus Corporation, Siemens Healthineers, and Fujifilm Holdings Corporation.

Endobronchial Ultrasound Biopsy Device Market Scope

Related Reports