Summary

Table of Content

Electric Motorcycle & Scooters Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Electric Motorcycle & Scooters Market Size

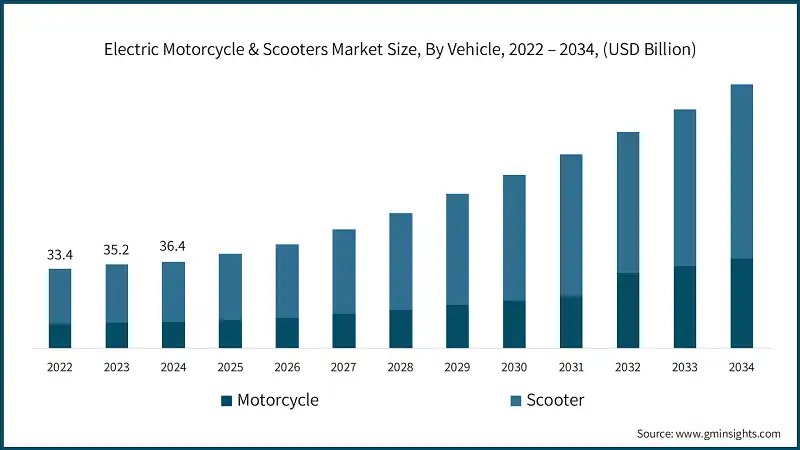

According to a recent study by Global Market Insights Inc., the global electric motorcycle & scooters market was valued at USD 36.4 billion in 2024. The market is expected to grow from USD 39.6 billion in 2025 to USD 110.6 billion in 2034, at a CAGR of 12.1%.

To get key market trends

- The electric motorcycle and scooter market is undergoing strong growth supported by significant government policies and investment in infrastructure. Electric motorcycles and scooters are represented as an accessible and sustainable alternative to gasoline-powered two-wheelers in an environment of increased urbanization and traffic congestion. The International Energy Agency (IEA) estimates have indicated in 2024 over 250,000 E2Ws were sold in reference to the India FAME III program and similar NEV and subsidy policies in China.

- Government policy and support has been pivotal to facilitating this shift with government control over subsidies, concessions and providing low-emission zones to encourage uptake. China, India and even Europe have led the charge, where China has been the traditional leader in manufacturing and sales, whereas India has emerged as an explosive growth environment due to aggressive electrification targets. Policy making including supply-side incentives under the Production Linked Incentive (PLI) scheme, Goods and Service Tax (GST) and Regional Transport Office (RTO) tax concessions, and India's offer a Go Electric program, have all helped improve shares of electric 2W uptake in initial public offers (IPOs).

- The worldwide electric motorcycles and scooter market proved to be resilient in the face of COVID-19 which impacted demand in 2020. In 2021, following disruptions in 2020, the electric two-wheelers sales in India had surpassed the previous year’s sales. In the initial COVID-19 lockdown, the electric two-wheelers (E2W) sales of 152,000 vehicles in 2020 surpassed the sales during 2019 with 126,000 vehicles overall. Despite initial challenges around the pandemic, overall demand for electrical two-wheelers has grown following heightened environmental concerns and urban mobility trends.

- Asia Pacific Electric Scooter market is growing to build up upon the foundational work of larger players, as well as other players working together through supportive policies and incentives to spur the adoption of electric vehicles, including e-scooters/mopeds and e-motorcycles as two and three-wheelers. Additionally, larger players are investing R&D into improving the performance and range of e-scooters to serve different market needs.

- India, the most noted or praised region regarding electric two-wheeler adoption, experienced little to no issues adopting electric two-wheelers as the policies established have stimulated policy support for deployment, like the FAME II measure, which was first introduced in 2019 as a three-year purchase incentive policy. In March 2024, the FAME II program will stop and at that time it will be replaced with a new four-month extension scheme called the Electric Mobility Promotion Scheme (EMPS) which allocates over USD 60 billion worth in subsidies towards the purchase of electric 2/3Ws.

- Growing economies in Latin America and Africa are likely to become relevant growth markets supported by native manufacturing and infrastructure development. The four challenges to achieving sustainable long-term growth are battery recycling, raw material supply chain constraints, and the eventual elimination of the subsidies. According to the IEA (International Energy Agency), Viet Nam is the most dynamic electric 2W market amongst ASEAN countries, with 9% of 2W sales.

Electric Motorcycle & Scooters Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 36.4 Billion |

| Forecast Period 2025 - 2034 CAGR | 12.1% |

| Market Size in 2034 | USD 110.6 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Advancements in battery technology | Extended range, faster charging, and improved durability accelerate adoption. |

| Lower operating costs | Reduced fuel and maintenance expenses make electric two-wheelers more economical than ICE vehicles. |

| Growing urban mobility trends | Rising congestion and demand for last-mile solutions boost e-scooter/motorcycle use in cities. |

| Increased technology and connectivity | Smart features (GPS, IoT, app integration) enhance convenience, safety, and user experience. |

| Pitfalls & Challenges | Impact |

| Limited range and charging infrastructure | Range anxiety and sparse charging stations hinder adoption, especially in rural and developing regions. |

| High initial cost | Higher upfront prices compared to conventional vehicles deter budget-conscious consumers, despite long-term savings. |

| Opportunities: | Impact |

| Expansion of battery-swapping networks | Growing adoption of standardized battery-swapping systems eliminate range anxiety and charging downtime, especially for commercial fleets and delivery services. |

| Integration with renewable energy & smart grid | Solar-powered charging stations and vehicle-to-grid (V2G) technology can enhance sustainability and reduce reliance on fossil-fuel electricity. |

| Market Leaders (2024) | |

| Market Leaders |

3% market share |

| Top Players |

Collective market share in 2024 is 10% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | Türkiye, France, Brazil, Vietnam, Indonesia |

| Future Outlook |

|

What are the growth opportunities in this market?

Electric Motorcycle & Scooters Market Trends

- The electric motorcycle & scooters industry is experiencing an influx of competition from established automotive manufacturers including generating interest especially in high growth markets such as India and Southeast Asia. The growing activity, combined with traditional manufacturers taking advantage of their own production know-how and product trust to capture potential market share in the rapidly electrifying last mile mobility market.

- Key players of the market treating production locations as a place to invest localized manufacturing to benefit from regional product demand and government provided incentives such as India's incentive program FAME III. The manufacturers are also exercising a long-term vision by investing in new production lines solely dedicated to EV manufacturing, instead of updating and modifying existing facilities.

- As an example, In March 2025, Honda announced and delivered its first electric scooter manufactured in India at its Karnataka plant. Honda is localizing its manufacturing to compete with companies such as Ola Electric while also being able to benefit from India's FAME III subsidies. This perspective included by Honda, captures an industry move to establish dominance in developing markets that are not only price sensitive, but also broader high-volume markets that seem tailored for early-stage electric product concepts such as India, and Southeast Asia.

- Commercial operators are starting to adopt electric scooters as part of the last-mile delivery process due to lower operating costs and corporate sustainability mandates. Logistic start-ups collaborating with e-commerce companies in deploying big fleets of electric scooters, focusing on higher payload capacity and range, is another major consideration impacting urban deliveries. With heavy populations concentrated in dense cities and booming gig economies across Asia providing an opportunity for electrified last-mile solutions.

- For example, Zypp Electric has partnered with e-Sprinto to deploy 30,000 potential high-speed e-scooters over three years, starting in December 2024. This pilot location will target cities including Delhi and Bangalore, which have strong food, e-commerce, and mobility markets, allowing EVs to reduce direct costs by approximately 40% when compared to service delivery by petrol bikes. Zypp Electric's subscription model will prove useful by providing gig workers access to a fully electric e-scooter without direct pressure of upfront costs and ensuring a high level of cognitive adoption.

- Manufacturers are capitalizing on the enthusiast market for alternatives to conventional dirt bikes and dual sports that have better torque and are lower maintenance, which is clearly a larger trend of diversification in the E2W market, as brands develop new products for recreational riders in rugged chassis with swappable batteries and improved suspension. North America and Europe remain the leaders in this market, but emerging markets are developing towards recreational use, especially as charging infrastructure improves.

- For example, Zero Motorcycles launched the 2025 Zero XE and XB electric motorcycles for the U.S. market in November 2024, which illustrates this trend towards recreational riding. While the XE is an electric bicycle for trail riding with lightweight frames and swappable batteries, the XB is for supermoto hobbyists with instantaneous torque delivery. These launches come on the heels of the increasing demand for recreational EVs in the U.S., supported by Harley Davidson's spinoff of LiveWire and Triumph's TE-1 project.

Electric Motorcycle & Scooters Market Analysis

Learn more about the key segments shaping this market

Based on vehicles, the electric motorcycle & scooters market is divided into motorcycles and scooters. The motorcycle segment dominated the market accounting for around 30% in 2024 and is expected to grow at a CAGR of over 13% between 2025 & 2034.

- The electric motorcycle segment, collaboration is occurring between fiercely traditional competitors, as they come together to resolve the common problems of high R&D costs and supply chain difficulties. Companies are looking to share production, platforms, batteries and other capabilities to reach the market quickly and mitigate risk in a time of uncertainty with regulations. This collaboration between OEMs is primarily seen among Japanese manufacturers, as their collective knowledge and insight into technology will now allow them to compete with the nimble startups and Chinese manufacturers dominating the e-mobility segment.

- In August 2024, Honda’s announcement to supply small electric motorcycles to Yamaha was a graphic example of this type of collaboration. The agreement will include small models for the Asian and European markets, enabling both companies to share in the development costs and comply with future emissions deadlines. The significance of using the same platform is that Honda’s will deploy a modular battery system and Yamaha will provide their light chassis experience, which could even reinvent the cost elements of East level e-moto.

- The electric scooter sector is evolving quickly as more traditional manufacturers shift aggressively to electric scooters due to pressure from emissions regulations and changing urban markets. Typically aggregated into "low-speed 2-wheelers," electric scooters are touted as the future of urban transportation, and the traditional manufacturers are all making mega investments in R&D and production capacity to compete with the EV-native brands in especially high-growth markets like India, where government initiatives like the FAME scheme are subsidizing the cost of many electric scooters.

- For example, in June 2023, Hero MotoCorp announced it will invest USD 181.6 million for the development of electric scooters and premium bikes, as the Indian giant acknowledges it will have to defend its position against competitors, such as Ola Electric.

Learn more about the key segments shaping this market

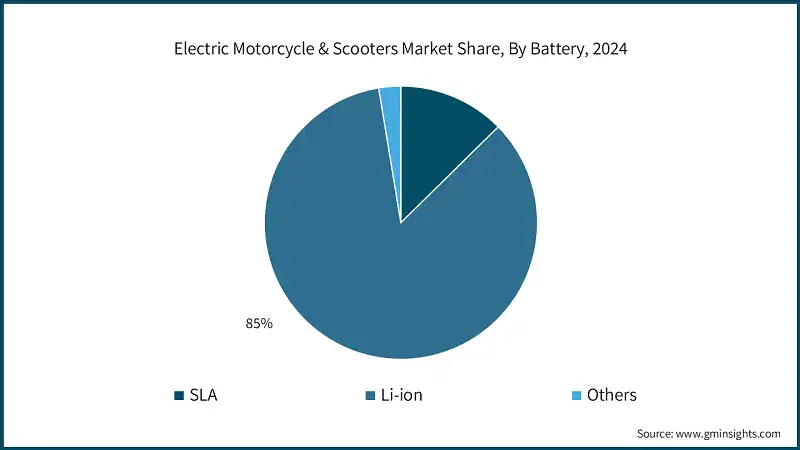

Based on battery, the electric motorcycle & scooters market is categorized into SLA, lithium-ion, and others. The lithium-ion segment dominates the market with 85% share in 2024, and the segment is expected to grow at a CAGR of over 10% from 2025 to 2034.

- The lithium-ion (Li-ion) battery segment is rapidly changing as suppliers seek to make complex energy storage solutions more available for the mass market, especially for electric scooters. Suppliers, particularly improving battery management systems (BMS), are seeking to improve safety and thermal performance of the Li-ion batteries, that users in scooters are increasingly addressing in relation to overheating and degradation.

- The example of this trend was represented by Maxvolt Energy's announcement in December 2024 that it is expanding into the Eco Series Lithium Battery for electric scooters. Its Eco Series is designed for battery users to basically change the battery with no issues or changes needed, just performance. Maxvolt Energy combined high performance with affordability and set its sights on the huge mass market segment of budget riders. Eco Series is designed modularly so that Eco Series can be easily retrofitted in existing models resulting in lower switching costs.

- Other battery technologies, including sodium-ion (Na-ion), solid-state, and batteries based on graphene, which will typically be cheaper, safer, and not reliant on critical minerals that are not easily accessible such as lithium and cobalt. Sodium-ion batteries are proving with many advantages by the low cost and a thermal stability manner. The reliable companies CATL and Faradion are involved in these technologies, and both are discussing plans for mass production by 2026 for low-cost e-scooters.

Based on technology, the electric motorcycle & scooters market is divided into plug-in and battery. The battery segment dominates the market and was valued at USD 32.8 billion in 2024.

- The electric motorcycle & scooters market is witnessing rapid technology convergence in battery development, as manufacturers compete to establish market leadership through superior energy density, charging speed, and cost optimization. Start-ups and established players alike are pouring every cent they have into overcoming obstacles related to distance, charge times, and cost. New cutting-edge advances in battery chemistry, thermal management systems, and modular designs are allowing for lighter, higher-performing, and longer-lasting energy to be stored.

- This innovation, which is needed, is especially necessary when knowing that the electric motorcycle market is geared at premium, high-end products, meaning riders expect an aesthetic motorcycle, while companies also want to remain cost competitive. In January 2024 Cleveland, Ohio-based Land Moto made its own announcement by raising an additional $3 million focused solely on battery R&D following a $7 million increase in 2023. Their focus with this funding is on optimizing the power system for their flagship District electric motorbike, which offers a bridge between e-bikes and full-size motorcycles.

- Plug in charging is the fastest growing solution for electric scooters and motorcycles when it comes to charging, benefiting the convenience of home, public, and fast-charging infrastructure. Recent developments include smart charging systems, app connectivity to inform better power management decisions and bidirectional charging capabilities, which enable vehicle-to-grid (V2G).

Based on end use, the electric motorcycle & scooters market is divided into individual consumers and commercial users. The individual consumers segment dominates the market and was valued at USD 24.9 billion in 2024.

- The retail or B2C segment is the new growth category for the electric motorcycle & scooters market particularly in large price sensitive markets like India, urban commuters are utilizing electric scooters as a response to high fuel prices and traffic congestion. Manufacturers are ambitiously focused on building a retail network, using benefits such as affordable financing options, extended vehicle warranties, and local service experience, as well as building the ownership experience for consumers.

- For instance, In December 2024, Ola Electric, for example, had an industry record opening of 3,200 stores in one day to provide 4,000 retail touchpoints in India. The retail strategy also includes targeting Tier 2/3 cities, where 60% of new demand is derived, and ability to offer scooter demo rides and service at the consumer's doorstep, as there remains a hesitancy in infrastructure from consumers, particularly in Tier 2/3 cities.

- The commercial or B2B segment of the electric two-wheeler market is rapidly growing largely from large scale adoption from the e-commerce and logistics sector, who are embracing the two-wheeler electric vehicle, to lower operational costs and show sustainability. This has led to an opportunity for OEMs to build more partnerships to work with commercial customers on electric scooters, optimized for things like durability, mileage, and payload options.

- For example, the partnership between Amazon India and TVS Motor to deploy 10,000 iQube electric scooters for delivery in India by 2025 demonstrates the strategic shift. The deal, part of Amazon’s global Climate Pledge, highlights how OEMs tailor products for commercial use, featuring extended-range batteries and ruggedized designs for delivery workloads.

Looking for region specific data?

The China dominated the Asia-Pacific electric motorcycle & scooters market with around 55% market share and revenue of USD 14.5 billion in 2024.

- China supported the largest volume of demand globally due to its scale and capacity for high-volume production. About 54 OEMs operate in the country, posing greater competition to cost-effective models. Global battery specifications dominating the China market, coupled with China's supply chain integration, likely lends a competitive pricing edge. Many Chinese brands - Yadea, AIMA, and NIU - continue to dominate both local and global markets taking advantage of low production costs manufacturable on a large scale, and sophisticated battery technologies.

- India's electric motorcycle and scooter market is rapidly mechanizing and fragmented; at least 220 OEMs, operating in the space by 2024, increased from 180 in 2023. Government initiatives now support FAME-III subsidies as well as various state-specific incentives to stimulate deployment and sales of E2W's in an affordability structure.

- While various startups cater to mass-market OEM riders seeking fast electric motorcycles, some still service monthly battery-swapping to ensure drivetrain affordability is met. Timescales vary but all change is progress. Japan's E2W remains a niche market, also growing, evolving around urban mobility and avenues for traditional OEM automakers finding mechanisms with various Michigan-based automakers to build stronger electric motorcycle models.

- Southeast Asia is becoming an important new growth region with Vietnam leading the way at nearly 10% electric 2W penetration in sales, at nearly 250,000 units in 2024, followed by Indonesia and the Philippines as indicated by the International Energy Agency (IEA). The market in Indonesia nearly doubled, while going from 1% to just under 2% EVs as a percentage of total sales indicates that there is plenty of room to grow.

- While challenges of charging infrastructure apart from gas stations and consumer preference towards cheap ICE vehicles still hold true, governments have reacted with tax breaks and local domestic production incentives. As Chinese brands like Yadea expands into these markets and domestic manufacturers ramp their own production, Southeast Asia may close quickly on the next battleground for affordable electric mobility.

France electric motorcycle & scooters market will grow tremendously between 2025 and 2034.

- France remains Europe’s largest market with a comprehensive adoption infrastructure developed through subsidies and urban low-emission zones (ZFE). However, growth paused in 2024 with electrification rates remaining flat, around 6% of total 2W sales, as government incentives and a limited number of models hampered widespread adoption. However, Paris and Lyon are still on top in shared e-scooter services. French brands such as Étric focus on premium e-motorcycles. As the maturity of the market and infrastructure suggest, the market is primed for a resurgence if cost barriers are reduced.

- Türkiye became the fastest growing E2W market in Europe in 2024, with more than 50,000 year-on-year sales volume supported by local manufacturing. A growing young urban resident population, and government incentives such as VAT exemptions have all supported E2W adoption. The growing demand has been triggered by Istanbul’s traffic congestion and increases in fuel costs with delivery fleets making up 40% of the total sales. Türkiye’s competitive cost of manufacturing and central location between Europe and Asia position it as a potential E2W export hub, similar its automotive industry.

The electric motorcycle & scooters market in Brazil will experience prosperous growth during 2025-2034.

- Latin America contributes more than 5% of the market, making it the fastest growth region with a projected CAGR of 5%. Brazil is the biggest electric motorcycle & scooters market by size and sales in the region, but still far from tapped due to urban density coupled with a strong motorcycle culture, limited charging infrastructure, and high tariffs on imports on EVs. With high fuel prices and congested roads, E2W are expected to proceed at a faster rate. Local-assembly efforts such as Voltz Motors, as well as incentives offered at the state-level such as tax breaks from São Paulo are improving access. The untapped market is for last-mile delivery fleets and affordable models designed for the lower-middle class in Brazil.

- Mexico has emerged as the regional E2W hotspot, with a growth trajectory fueled by ride-hailing company DiDi's MX$1 billion (US$58M) investment to get 100,000 EVs on the road, including electric scooters for its delivery partners, by 2030. While Argentina has the lithium mining sector boom, which provides the incentive for EV manufacturing, it is also attracting local manufacturers to develop and produce low-emission motorcycles, mostly in the form of e-motorcycles from companies like Corven Motors. Urbanization and increasing fuel prices favor both markets, however lack of policy consistency and access to financing is a challenge.

The electric motorcycle & scooters market in UAE is expected to experience strong growth between 2025 and 2034.

- The UAE, with Dubai and Abu Dhabi leading, is far ahead of the rest of the Middle East in electric motorcycle & scooters market adoption driven by smart city initiatives, high disposable income, and sustainability goals supported by the government. In November 2024, a significant collaboration was initiated between MANTRA and Pyse to fund electric motorcycles used for delivery services, starting with a fleet of pink EVs in Dubai. This hints at a growing reliance on tech-driven mobility solutions in the UAE, including the RWA tokenization for financing EVs. Given the developed nature of the UAE's charging infrastructure and the luxury market development, the UAE is a natural location for premium e-motorcycles while last mile delivery fleets like Talabat and Deliveroo create volume.

- Outside of the UAE, Saudi Arabia is the other market to watch out for with their Vision 2030 strategy to boost EV adoption, as they plan for local production and offer logistical assistance for local EV purchases, and significantly expand the EV charging infrastructure in the Kingdom. In Africa as well, electric 2W sales reached 40% growth YoY in 2024, but they only had 0.5% as a percentage of overall two-wheeler sales. Some countries leading the charge include Kenya (Roam), Rwanda (Ampersand), and Nigeria (Spiro), with Spiro opening a 100,000 unit/year factory in Nigeria, signifying a 100x growth from its current factories in Togo and Benin, according to the International Energy Agency (IAE).

Electric Motorcycle & Scooters Market Share

The top 7 companies in the market are Hero Motor, Yadea, BMW Motorrad, Ola Electric, Honda Motor, NIU Technologies, and Gogoro. These companies hold around 10% of the market share in 2024.

- Hero MotoCorp, the largest two-wheeler manufacturer in India, is rapidly pursuing electric vehicle (EV) expansion within its "Vida" brand. Hero controls India’s affordable E2W space through a vast 5000+ dealer network and direct-to-consumer EV categories, with market share-focused products like the Vida V1 electric scooter. Hero is also targeting exports to markets like Nepal and Bangladesh and new segments in Latin America, positioning Hero as a prominent global player in affordable and mass-market two-wheeler EVs.

- Yadea is currently the world's largest electric two-wheeler brand by volume, dominating the Chinese and Southeast Asian two-wheeler markets with ultra-affordable, high-volume models. Known for its vertically integrated supply chain, Yadea produces over 10 million units each year. Yadea is rapidly expanding into Europe and India competing on low purchase price and reliability of service. The brand’s G5 and F6 electric scooters promote long-distance travel and fast charging, a must-have feature for urban commuters.

- Ola Electric is India's fastest growing electric two-wheeler (E2W) startup and has disrupted the two-wheeler market with direct-to-consumer (DTC) sales and hyper-local service hubs. Ola Electric's S1 Pro and S1 Air electric scooters mix performance with advanced technology like MoveOS software updates. The company is eyeing expansion into Latin America and Europe, relying on highly competitive pricing and becoming a leader in swappable battery options in these markets.

- Honda, a global leader in ICE two-wheelers, is transitioning cautiously but decisively into EVs. In India, it launched the Honda Activa Electric to rival Ola and Ather, while in Japan, it focuses on premium e-motorcycles like the CB350 Electric. Honda’s strength lies in hybrid tech integration and leveraging existing ICE supply chains for cost efficiency.

Electric Motorcycle & Scooters Market Companies

Major players operating in the electric motorcycle & scooters industry include:

- Harley-Davidson

- Hero Motor

- Honda Motor

- Kawasaki Motors

- Ola Electric

- Energica Motor

- Triumph Motorcycles

- Yadea

- Yamaha Motor

- Zero Motorcycles

- The electric motorcycle & scooters market is full of competition, with Chinese brands taking volume sales and Indian players owning emerging markets. Premium segments are owned by Western brands and Japanese OEMs which produce high-performance e-motorcycles. Europe and North America showcase growth in the luxury/adventure E2Ws, while the Asia-Pacific region thrives on the affordability of urban scooters. Factors like battery-swapping networks and government subsidies further shape regional dynamics.

- Kawasaki prides itself through the ICE transition to EVs, developing models like Ninja e-1 and Z e-1 that targets performance enthusiasts in Japan, Europe, and the U.S. Kawasaki continues to develop partnerships with the likes of Yamaha and Honda, collaborating on swappable batteries to standardize new charging infrastructure.

- Triumph’s TE-1 prototype indicates it plans to join the premium e-motorcycle segment of the market, showcasing British engineering and urban design with over 100 mph speeds. It specifically targets adventure riding, which seeks ICE-like performance, primarily in Europe and North America.

- Harley may have the single most enduring brand with its LiveWire brand of premium e-cruisers such as LiveWire One and Del Mar targeting both North America and Europe. As with many products, the high price may not be sustainable versus competition from other new entrants.

- Yamaha balances mass-market e-scooters (E01, Neo’s) in Asia with performance e-bikes (MT-09e) for Europe. Its joint ventures with Honda and Kawasaki for battery swaps strengthen its ecosystem play. Similarly, Energica Motor Company, the Italian electric motorcycle manufacturer with a strong U.S. presence, has carved out a niche in the high-performance electric motorcycle segment. The company targets enthusiasts and premium buyers with models like Energica Experia and Ribelle RS.

Electric Motorcycle & Scooters Industry News

- In January 2025, Suzuki Motorcycle India formally enter the crowded EV market in India and build on its global electrification strategy with the launch of its first electric scooter, the e-Access, along with two other models, at the Bharat Mobility Expo 2025. By doing so, Suzuki expected to compete with the many incumbents in India by having a focus on reliability and trust in their brand.

- In November 2024, Hero MotoCorp entered a partnership with California-based Zero Motorcycles for the development of a mid-sized performance electric motorcycle targeting India's premium segment-level performance market through the utilization of Zero's expertise in high-performance EVs, and Hero's mass market reach concentrating on a competitive price-to-performance ratio.

- In November 2024, Harley-Davidson's LiveWire brand expanded beyond the cruiser format to release the livewire electric maxi-scooter. The maxi-scooter is designed to tap into urban mobility in both Europe and Asia (attractive markets) and combines the utility of practical urban commuting with Harley's iconic aesthetic. The maxi-scooter is designed to compete with the BMW CE-04 and Yamaha E01.

- In May 2024, EMCO e-scooter manufacturer, acquired Berlin-based start-up UNU, to consolidate its market position in Europe. The acquisition maintains UNU's name and technology, e.g., the swappable battery system that consumers know from UNU, while maximising production capacity in addition to expanding their retail network across Europe.

The electric motorcycle & scooters market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue and volume ($ Mn & Units) from 2021-2034, for the following segments:

Market, By Vehicle

- Motorcycle

- Cruiser

- Sport

- Touring

- Standard/Naked

- Adventure/Dual-Sport

- Off-Road/Dirt

- Scooters

- Maxi

- Moped-Style

Market, By Battery

- SLA

- Li-ion

- Others

Market, By Voltage

- 24V

- 36V

- 48V

- Others

Market, By Technology

- Plug-In

- Battery

Market, By End Use

- Individual consumers

- Commercial users

Market, By Sales Channel

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Türkiye

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the market size of the individual consumers segment in 2024?

The individual consumers segment was valued at USD 24.9 billion in 2024.

Which region leads the electric motorcycle and scooters sector?

China leads the Asia-Pacific market, holding a 55% share and generating USD 14.5 billion in revenue in 2024, led by strong domestic demand and government incentives.

What was the market size of the electric motorcycle and scooters in 2024?

The market size was USD 36.4 billion in 2024, with a CAGR of 12.1% expected through 2034. The growth is driven by government policies and infrastructure investments.

What is the projected value of the electric motorcycle and scooters market by 2034?

The market is poised to reach USD 110.6 billion by 2034, supported by advancements in electric vehicle technology, urbanization, and traffic congestion solutions.

How much revenue did the motorcycle segment generate in 2024?

The motorcycle segment accounted for approximately 30% of the market in 2024 and is expected to witness over 13% CAGR till 2034.

Who are the key players in the electric motorcycle and scooters industry?

Major players include Harley-Davidson, Hero Motor, Honda Motor, Kawasaki Motors, Ola Electric, Energica Motor, Triumph Motorcycles, Yadea, Yamaha Motor, and Zero Motorcycles.

What are the upcoming trends in the electric motorcycle and scooters market?

Trends include local manufacturing, swappable-battery EVs, last-mile delivery use, and high-speed urban scooters.

What was the valuation of the lithium-ion battery segment in 2024?

The lithium-ion battery segment dominated the market with an 85% share, valued at USD 32.8 billion in 2024.

Electric Motorcycle & Scooters Market Scope

Related Reports