Summary

Table of Content

Dodecanedioic Acid (DDDA) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Dodecanedioic Acid Market Size

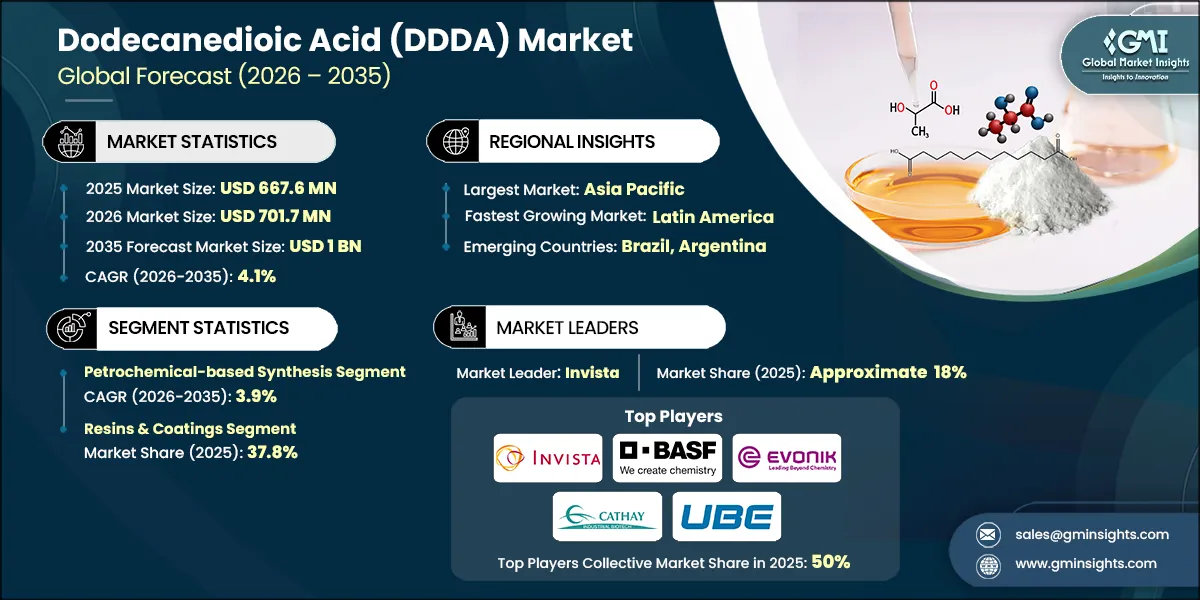

The global dodecanedioic acid market was valued at USD 667.6 million in 2025. The market is expected to grow from USD 701.7 million in 2026 to USD 1 billion in 2035, at a CAGR of 4.1% according to latest report published by Global Market Insights Inc.

To get key market trends

- Consumer demand for lightweight automotive components exhibiting greater fuel economy is at the forefront of growth. Lugdows DDDA, which is the major monomer in the nylon612 compound, is gradually replacing both metal and legacy polymers in the manufacture of these components due to nylon612's improved mechanical properties, ductility, thermal stability, and durability, particularly under extreme frictional conditions such as those present in an engine bay. In addition, due to the high level of emphasis on vehicle weight reduction, DDDA-based nylons are being used in electric vehicle components and increasing the range efficiency of the electric vehicle.

- Furthermore, DDDA-based esters are becoming increasingly accepted in the formulation of synthetic lubricants for a variety of industrial applications such as marine, aerospace, construction, and large-scale machinery. Synthetic esters prepared from DDDA offer high oxidative stability, a high viscosity index (the measure of viscosity variation with temperature), and very low volatility, allowing them to be more readily available for use in the next generation of biodegradable synthetic lubricants.

- Additionally, in recent years, several major regulatory bodies in Europe and North America have implemented stricter regulations on the amount of volatile organic compounds (VOCs) allowed in lubricant formulations and the biodegradability of synthetic lubricants. As a result, lubricant formulators will be compelled to utilize cleaner, high-performance base oils derived from DDDA as their primary source to produce synthetic lubricants.

- There is a major market change, with a move from petroleum-based DDDA production to bio-based DDDA production, as evidenced by Cathay Biotech from China and Verdezyne from the United States. Through developing fermentation processes that use renewable materials as feedstocks (e.g. vegetable oils and carbohydrates derived from plants), companies are addressing some of the environmental issues associated with petroleum-derived DDDA and are embracing the worldwide trend to decrease carbon emissions.

Dodecanedioic Acid (DDDA) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 667.6 Million |

| Market Size in 2026 | USD 701.7 Million |

| Forecast Period 2026 - 2035 CAGR | 4.1% |

| Market Size in 2035 | USD 1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Demand for Nylon 612 in Lightweight Automotive | Fuels market volume as OEMs seek durable, high-performance plastic alternatives |

| Expansion of Synthetic Esters in Industrial Lubricants | Boosts DDDA consumption due to demand for biodegradable, high-viscosity lubricants |

| Regulatory Pressure on Petrochemical Substitutes | Encourages switch to DDDA-based materials in eco-label certified applications |

| Pitfalls & Challenges | Impact |

| High Production Costs for Bio-Based DDDA | Limits competitiveness compared to petroleum-derived counterparts, especially in price-sensitive markets |

| Supply Chain Fragmentation in Feedstocks | Creates bottlenecks for consistent and quality raw material availability across regions |

| Opportunities: | Impact |

| Growing Use in Antimicrobial Additives | Opens doors in medical coatings, hygienic packaging, and surface protection sectors |

| Market Gap in High-Purity DDDA for Electronics | Provides niche prospects in high-spec electronics and semiconductors industries |

| Market Leaders (2025) | |

| Market Leaders |

Approximate Market Share of 18% in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Argentina |

| Future outlook |

|

What are the growth opportunities in this market?

Dodecanedioic Acid Market Trends

- The traditional petrochemical supply chain methods utilized to create DDDA are experiencing a major shift towards bio-based production methods. The traditional methods for the synthesis of DDDA include chemical oxidization and biomanufacturing through fermentation processes. The emergence of companies such as Cathay Biotech and formerly Verdezyne has led to developments in the biomanufacturing of DDDA at commercial scale using renewable feedstock materials called vegetable oils and glucose. This method will not only mitigate the issues pertaining to volatile pricing of the raw materials used to create DDDA, but it will also address the environmental consequences associated with producing DDDA through petrochemical processes.

- As the demand for high-performance polyamides (including Nylon 612, PA610, and PA1212) derived, at least partially, from DDDA continues to grow, new applications will appear as manufacturers gain access to high-performance polyamides for use throughout the industry. Polyamides provide high levels of abrasion resistance, flexibility, and dimensional stability compared to nylon, making them well-suited for automotive fuel lines and electrical insulation, among other uses.

- Global production capacity for Nylon 612 is expected to increase at a compound annual growth rate (CAGR) of more than 6% through 2020, with an increasing amount of Nylon 612 being incorporated into electric vehicles (EVs) due to their excellent weight-to-strength ratios and thermal stability. As a result, there is an increasing value link between Nylon innovation and the demand for DDDA.

- North Africa and Europe have enacted more stringent VOC limits, Compliance to REACH, and the EPA to comply with the new Industrial Lubricants Coatings & Flame Retardant Polymers regulations, which are causing the demand for new chemicals. Biodegradable DDDA (Dodecane Diol Dimethyl Ester) based esters replaced the conventional mineral and aromatic oils in hydraulic fluids and gear lubricants. DDDA’s biodegradability, oxidative stability and low volatility of DDDA & its derivatives make it very desirable for practical applications throughout the entire spectrum of industrial lubricants.

- In addition to the current industrial lubricant market accelerating due to the newly introduced European Green Deal and the Reregulation of the Toxic Substances Control Act, much of the anticipated incremental growth of this market will be driven by the new renewable feedstocks (green) for DDDA and its derivatives, especially in marine and aerospace lubricant systems.

- The adoption of new technologies: catalyst optimization, continuous flow chemistry, and precision fermentation for DDDA manufacturing have resulted in improvements in yield, purity levels, and energy efficiency. These new methods allow DDDA producers to target and adapt DDDA characteristics to specific end uses that currently do not exist within the clinical hygiene, advanced textiles and food packaging markets. A current example is the growing usage of High purity DDDA (≥99%) in the manufacturing of Medical Grade Polyamides. This is a highly specialized segment but is evolving very quickly and can only be serviced by advanced manufacturers, who can comply with the regulatory demands.

Dodecanedioic Acid Market Analysis

Learn more about the key segments shaping this market

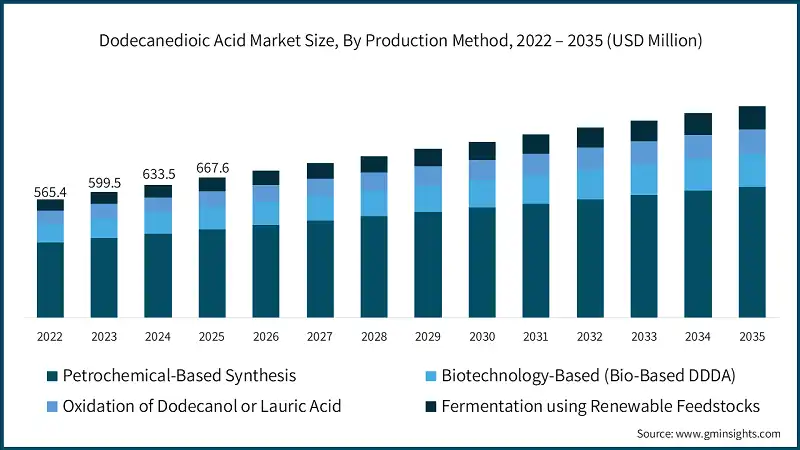

Based on production method, the market is segmented into petrochemical-based synthesis, biotechnology-based (Bio-Based DDDA), oxidation of dodecanol or lauric acid, fermentation using renewable feedstocks. Petrochemical-based synthesis dominated the market with an approximate market share of 63.2% in 2025 and is expected to grow with a CAGR of 3.9% by 2035.

- It is due to the maturity of this production technology, due to the cost-effective and scalable production process that uses petrochemical feedstocks (butadiene, dodecanol, and lauric acid) that are available in industrial quantities.

- The continued lead of the petrochemical-based synthesis segment is due to its established supply chain and infrastructure. Petrochemical routes have been improved over the years through decades of industrial optimization. This has allowed major manufacturers including BASF, UBE Corporation, and Evonik to continue to manufacture and supply large quantities of high-purity (>98%) resins, polyamides, and esters.

- From an engineering perspective, the petrochemical-based synthesis process produces consistent length and high-temperature stability of the engineering plastics such As Nylon 612 and PA1212. Therefore, the petrochemical-based synthesis process has produced the most reliable materials for high friction and high heat applications, including in the automotive and industrial sectors.

- In addition, the petrochemical process produces more affordable products than alternative sources, particularly in Asia Pacific, where suppliers have access to low-cost petrochemical feedstocks and economies of scale. This allows manufacturers to produce Petro synthesized DDDA at a lower cost in price-sensitive markets, including textiles, paints, and coatings.

Learn more about the key segments shaping this market

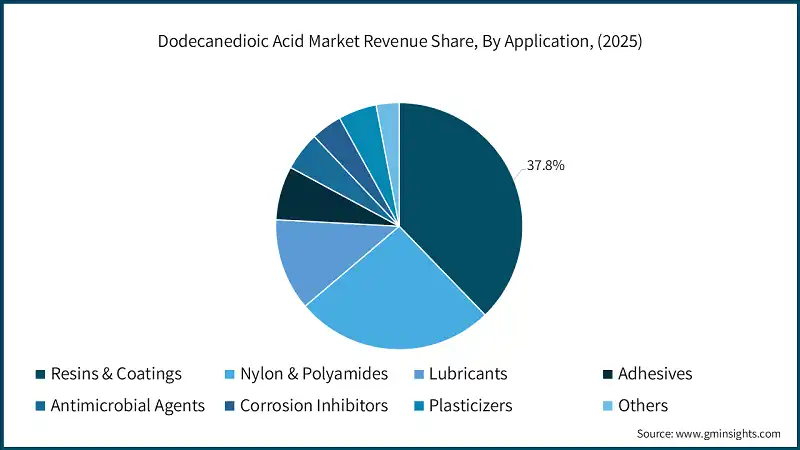

Based on application, the dodecanedioic acid market is segmented into resins & coatings, nylon & polyamides, lubricants, adhesives, antimicrobial agents, corrosion inhibitors, plasticizers, others. Resins & coatings held the largest market share of 37.8% in 2025 and is expected to grow at a CAGR of 3.9% during 2026-2035.

- DDDA's strength, when used in coatings, can be identified through its enhancement of the overall chemical resistance, flexibility, and cross-link density of the final product. These characteristics are most important for coatings that must withstand extreme applications such as powder coatings, marine coatings, and automotive original equipment manufacturer coatings.

- The development of technological advancements in UV cure and Solvent-Free Resin formulations has created additional growth opportunities for DDDA to be incorporated into environmentally friendly coatings, as DDDA-based coatings enable the lowering of VOC (Volatile Organic Compound) emissions when compared to other types of high-performance resins, while still maintaining high durability, thereby supporting the trend toward tightening environmental regulations in both Canada and Europe.

- Additionally, the use of DDDA as part of the resin system allows for the incorporation of long-chain aliphatic backbone structures that enhance the resin's weatherability and non-yellowing characteristics when applied to architectural coatings and heavy-duty industrial paints. Both markets continue to show stable growth in the post-COVID marketplace due to the increase in construction activities and infrastructure projects.

Looking for region specific data?

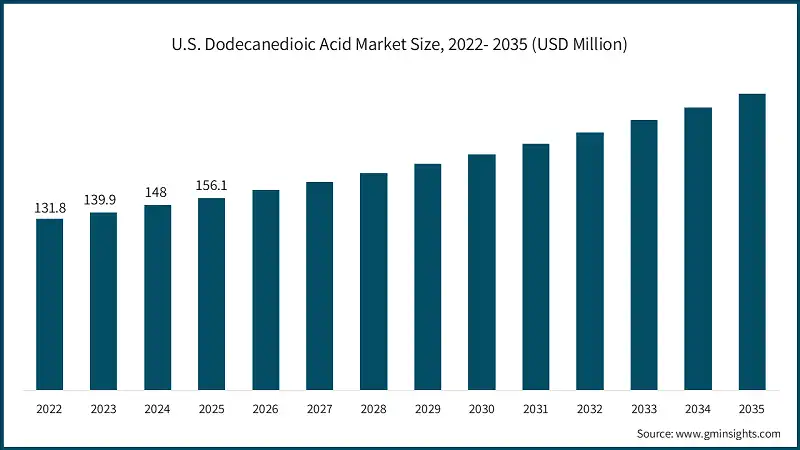

The North America dodecanedioic acid market is growing rapidly on the global level with a market share of 28.9% in 2025.

- Strong growth is occurring in North America in the DDDA market for specialty applications, including high-end lubricants and coatings (e.g., paints, varnishes) as well as bio-based nylons. Demand is largely driven by the region's strong regulatory emphasis on compliance with Environmental Protection Agency (EPA) requirements for biodegradability and low VOC levels; as a result, there is increasing demand for esters derived from DDDA for use in industrial lubricants and environmentally conscious coatings.

U.S. dominates the North America dodecanedioic acid market, showcasing strong growth potential.

- The U.S. market for DDDA remains a high-value market with ongoing research and development activities focused on creating products from the fermentation of DDDA, however, previous attempts by companies such as Verdezyne to enter the DDDA production market were unsuccessful due to difficulty scaling production for commercial use.

Europe dodecanedioic acid market leads the industry with revenue of USD 112 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- The European DDDA market is influenced by a variety of legislation aimed at promoting low toxicity and sustainable inputs into the chemical supply chain, including REACH, the European Union (EU) Green Deal and the European Circular Economy goals. As a result, there is increasing interest from users of DDDA for applications in corrosive protection coatings, powder coatings, and in bio polyester applications. The fastest growing regions of DDDA in Europe are currently located within Germany, France, and Northern Europe.

The Asia Pacific market is anticipated to grow at a CAGR of 4.3% during the analysis timeframe.

- Asia Pacific region has large, inexpensive feedstocks, integrated petrochemical complexes, and large, growing manufacturing cities in China, India, South Korea, and Taiwan. China is the largest market for DDDA in both volume and production capacity, due to the many government initiatives supporting production of high-performance materials and export substitution.

Latin America dodecanedioic acid market accounted for 10.7% market share in 2025 and is anticipated to show highest growth over the forecast period.

- Latin America’s general DDDA market is still emerging; however, increased investment in localized manufacturing by companies in Brazil and Mexico is creating new downstream uses for DDDA. In addition to the need for DDDA in their domestic markets (in automotive parts, industrial coatings, and textile treatment), manufacturers in both Brazil and Mexico have increased their use of DDDA through imports from the USA and Asia.

Middle East & Africa dodecanedioic acid accounted for 8% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- Although the MEA region is still at a relatively undeveloped stage of growth in terms of the DDDA market when comparing this region to other regions (e.g., Europe, North America), there are some encouraging indicators due to the rapidly growing industrial base (especially with regards to infrastructure expenditures) in the GCC nations. There are examples of significant increases in the Oil & Gas sector, especially Corrosion Inhibitor coatings being implemented there. The Marine Coatings segment appears to be growing as well. And due to these factors, DDDA’s highly durable characteristics provide them with a significant competitive advantage compared to other products.

Dodecanedioic Acid Market Share

The global DDDA market is moderate consolidated the largest five players accounting for more than 50% of the total global market share and include firms such as Invista, BASF SE, Evonik Industries, UBE Corporation, and Cathay Biotech. A significant reason for the dominance of these firms in the DDDA market are their vertical integration of production operations, advanced technologies of production, and supply chains to source feedstock.

Invista and BASF SE are two of the largest global suppliers of DDDA and have the capability to produce a large volume of high-purity DDDA through their large-scale petrochemical infrastructure. Invista and BASF SE have created competitive advantages through their ability to create cost-efficiencies, maintain consistent product quality, and form long-term supply partnerships with manufacturers of nylon and coatings.

- Invista: As a division of Koch Industries, Invista is among the largest manufacturers of DDDA globally, primarily utilized within Nylon 612 and performance polymers. The company’s ownership of its production facilities provides it with vertical integration, as well as inexpensive access to petrochemicals within North America. Invista prioritizes long-term contracts and invests in the reliability of its production processes to consistently produce high-purity DDDA for customers in the industrial nylon marketplace.

- BASF SE: Headquartered in Germany, BASF is a major player in the engineering plastics and polyamide value chain of the market through its intermediates. The firm manufactures DDDA as a member of its Intermediates division, serving customers in several industries including coatings, lubricants and plastics. Through its large global footprint and extensive integrated R&D facilities, BASF concentrates on developing custom grades of DDDA to support its customer base and improve supply chain resilience, particularly in the EU and Asia-Pacific markets.

- Evonik Industries: Evonik focuses specifically on producing specialty grades of DDDA for applications requiring enhanced thermal and mechanical performance. Examples of these applications include synthetic esters and protective coatings resistant to corrosion. Evonik places importance on collaborating with customers and aiding in developing the proper formulation for their needs in order to provide effective solutions. The firm also invests heavily in utilizing green chemistry techniques for production of its C4 derivatives in support of environmentally aware market segments.

- UBE Corporation: UBE Corporation is a leader in high-performance aliphatic polyamides, focusing on producing products with DDDA as the base monomer, and concentrates on producing high-purity materials for both the automotive and electronics polymer sectors. UBE’s strategy for developing high-purity polymer materials is supported by extensive investments in research and development (R&D) to provide manufacturers in Asia-Pacific with reliable products.

- Cathay Biotech: As a company using microbial fermentation as its production method to supply renewable monomers made from bio-based DDDA, Cathay Biotech is also the first company in the world to create bio-based DDDA products. They are headquartered in China, aligned with China's government-sponsored sustainable development strategies, and market their business to customers who are looking for low-carbon and biodegradable products. Through strategic alliances and investments in specialized biological-refining complexes, Cathay Biotech is increasing its manufacturing capacity.

Dodecanedioic Acid Market Companies

Major players operating in the dodecanedioic acid industry include:

- Alfa Aesar

- BASF SE

- BOC Sciences

- Cathay Biotech Inc.

- Evonik Industries AG

- Hairui Chemical Industry Co., Ltd.

- Henan Junheng Industrial Group Biotechnology Co., Ltd.

- Invista

- Merck KGaA

- Santa Cruz Biotechnology, Inc.

- Shanghai Kaleys Holding Co., Ltd.

- Shanghai Sebacic Acid Co., Ltd.

- Sigma-Aldrich

- SynQuest Labs, Inc.

- TCI Chemicals

- UBE Corporation

- UBE Industries, Ltd.

- Yufeng Biotechnology Co., Ltd.

- Zhengzhou Yibang Industry & Commerce Co., Ltd.

- Zibo Guangtong Chemical Co., Ltd.

Dodecanedioic Acid Industry News

- In October 2025, Cathay Biotech's Shanghai plant successfully scaled up production of their second-generation bio-derived DDDA (diacetyl-3,4-dihydroxy-2-pyrimidinone), increasing the output of the system after having doubled the production capacity of this system to keep pace with the increasing demand for sustainable nylon.

- In August 2025, BASF SE introduced a new premium grade of high-purity DDDA to meet the rising demand for Powder Coating Formulations for the electronics and appliance industry, which has come mainly from Asia and Europe.

- In June 2025, Evonik Industries finished a pilot project in Germany to incorporate renewable energy into their DDDA production process, reducing their scope 1 emissions by approximately 18%.

- In March 2025, UBE Corporation signed a Strategic Partnership Agreement with a top Korean Nylon Manufacturer to grow their Polyamide Market for DDDA in Southeast Asia.

- In September 2024, Cathay Biotech received E.U. Regulatory Approval for its bio-DDA-based medical polymer, allowing it to expand into Biomedical Coatings and Hygiene Packaging.

This dodecanedioic acid market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Production Method

- Petrochemical-Based Synthesis

- Biotechnology-Based (Bio-Based DDDA)

- Oxidation of Dodecanol or Lauric Acid

- Fermentation using Renewable Feedstocks

Market, By Product Form

- Pellets

- Powder

- Liquid/Solution

Market, By Application

- Resins & Coatings

- Powder Coatings

- Liquid Coatings

- UV-Curable Resins

- Polyesters

- Nylon & Polyamides

- Nylon 612

- Polyamide 1212

- Engineering Thermoplastics

- High-Performance Fibers

- Lubricants

- Synthetic Esters

- Industrial Gear Oils

- Compressor Oils

- Automotive Lubricants

- Adhesives

- Structural Adhesives

- Hot Melt Adhesives

- Pressure-Sensitive Adhesives

- Antimicrobial Agents

- Hygiene Products

- Medical Device Coatings

- Antibacterial Materials

- Corrosion Inhibitors

- Metal Surface Treatment

- Marine Applications

- Oil & Gas Pipelines

- Plasticizers

- Polyvinyl Chloride (PVC) Applications

- Flexible Plastics

- Cable & Wire Insulation

- Others

- Water Repellents

- Textile Finishes

- Cosmetics / Personal Care Ingredients

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the market size of the dodecanedioic acid market in 2025?

The market size was valued at USD 667.6 million in 2025 and is expected to grow at a CAGR of 4.1% through 2035, supported by rising demand for nylon 612 and high-performance materials across automotive and industrial applications.

What is the current dodecanedioic acid industry size in 2026?

The market is projected to reach USD 701.7 million in 2026 as consumption increases across specialty chemicals, lubricants, and engineered polymer applications.

What is the projected value of the dodecanedioic acid market by 2035?

The market is expected to reach USD 1 billion by 2035, expanding at a CAGR of 4.1% due to growing adoption of bio-based DDDA, lightweight automotive components, and sustainable lubricant formulations.

How much revenue did the resins & coatings application segment generate in 2025?

Resins & coatings accounted for the largest share of the DDDA market with 37.8% in 2025, driven by demand for high-durability, low-VOC, and chemically resistant coating formulations.

What was the valuation trend of the petrochemical-based production segment in 2025?

Petrochemical-based synthesis dominated the dodecanedioic acid industry with a 63.2% market share in 2025, supported by cost-effective production, established infrastructure, and consistent product quality.

What is the growth outlook for bio-based dodecanedioic acid through 2035?

Bio-based DDDA production is expected to witness strong growth through 2035 due to regulatory pressure on petrochemical substitutes, rising sustainability mandates, and advances in fermentation-based manufacturing.

Which region leads the dodecanedioic acid market?

North America accounted for 28.9% of the global dodecanedioic acid industry in 2025. Growth is driven by strong U.S. demand for high-value applications such as specialty lubricants, coatings, and bio-based nylons, supported by stringent EPA regulations.

What are the key trends shaping the dodecanedioic acid market?

Major trends in the dodecanedioic acid industry include the shift toward bio-based production, increasing use in nylon 612 for lightweight vehicles, and rising adoption in biodegradable synthetic lubricants.

Who are the key players in the dodecanedioic acid market?

Key companies operating in the dodecanedioic acid industry include Invista, BASF SE, Evonik Industries AG, Cathay Biotech Inc., and UBE Corporation, supported by strong vertical integration and advanced production technologies.

Dodecanedioic Acid (DDDA) Market Scope

Related Reports