Summary

Table of Content

Dental Care Products Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Dental Care Products Market Size

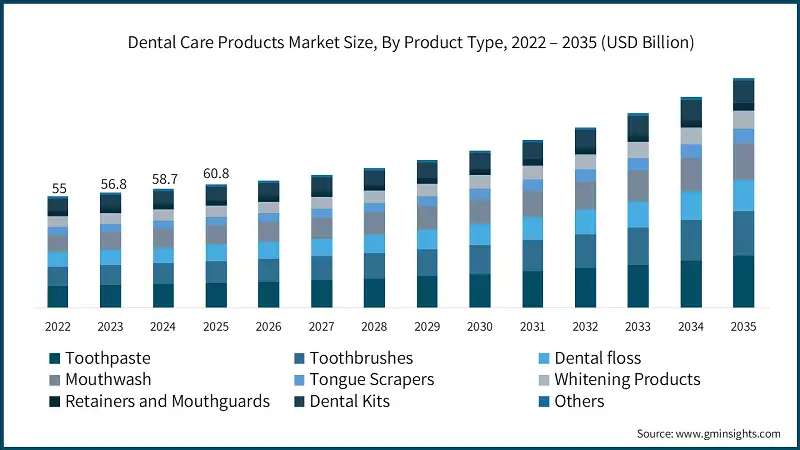

The global dental care products market size is estimated at USD 60.8 billion in 2025. The market is expected to grow from USD 62.9 billion in 2026 to USD 113.5 billion in 2035, at a CAGR of 6.8% according to latest report published by Global Market Insights Inc.

To get key market trends

Increasing consumer awareness about oral health is a significant factor driving the growth of the market. This trend is reinforced by the link between oral health and overall well-being, including cardiovascular and metabolic health. As a result, consumers are investing in advanced oral care products beyond basic toothpaste and toothbrushes, such as mouthwash, floss, and whitening solutions. The emphasis on early prevention and aesthetic appeal is creating sustained demand, particularly in emerging economies where awareness is rapidly increasing.

Educational initiatives by health organizations, such as the American Dental Association (ADA), and the widespread availability of information through digital platforms have encouraged a shift in consumer behavior toward preventive oral care. According to the Centers for Disease Control and Prevention (CDC), nearly 47% of adults aged 30 years and older in the United States have some form of periodontal disease, highlighting the critical need for preventive measures. This growing awareness has led to a surge in demand for advanced oral care products.

Dental Care Products Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 60.8 Billion |

| Market Size in 2026 | USD 62.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 6.8% |

| Market Size in 2035 | USD 113.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Awareness of Oral Hygiene | Greater awareness leads to increased adoption of preventive dental care products, expanding the market for advanced solutions like floss and mouthwash. This trend boosts revenue for both mass and premium segments, compelling manufacturers to invest in education-driven marketing strategies to capture health-conscious consumers globally. |

| Technological Advancements | Innovation creates premium product categories, driving higher margins and brand differentiation. Smart devices and eco-friendly materials attract tech-savvy and sustainability-focused consumers, reshaping competitive dynamics. Companies leveraging R&D effectively can secure leadership positions, while laggards risk losing relevance in a rapidly evolving market landscape. |

| Expansion of E-Commerce | Digital channels enhance accessibility and consumer engagement, accelerating product penetration in urban and rural markets. Subscription models and personalized recommendations foster customer loyalty, while social media marketing amplifies brand visibility. This shift reduces dependency on traditional retail, favoring agile brands with strong online strategies. |

| Pitfalls & Challenges | Impact |

| High Cost of Advanced Products | Premium pricing limits adoption among cost-sensitive consumers, particularly in emerging economies. This creates a market skew toward basic products, slowing growth in high-margin categories. Manufacturers must innovate cost-efficient solutions or risk losing share of affordable alternatives and local competitors. |

| Regulatory Compliance | Strict regulations increase operational complexity and cost, delaying product launches and limiting innovation speed. Smaller players face entry barriers, consolidating market power among established brands. Non-compliance risks reputational damage and financial penalties, making regulatory expertise a critical success factor. |

| Opportunities: | Impact |

| Demand for Natural & Sustainable Products | Eco-friendly and herbal solutions enable brands to tap into premium, health-conscious segments. This trend fosters differentiation and brand loyalty, creating long-term growth potential. Companies investing in sustainable innovation can command higher pricing and strengthen their competitive positioning. |

| Expansion in Emerging Economies | Rising incomes and urbanization in Asia-Pacific and Latin America unlock significant growth potential. Affordable product lines and localized marketing strategies can drive rapid adoption. Early movers gain a competitive edge, establishing strong distribution networks and brand presence in high-growth regions. |

| Market Leaders (2025) | |

| Market Leaders |

25% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | France, Canada |

| Future outlook |

|

What are the growth opportunities in this market?

Innovations in dental care products are playing a pivotal role in driving market growth, with advancements such as electric toothbrushes, smart oral care devices, and eco-friendly materials redefining consumer expectations. These developments emphasize convenience, efficiency, and sustainability, aligning with the preferences of tech-savvy and environmentally conscious consumers. According to the American Dental Association (ADA), approximately 50% of adults in the United States use electric toothbrushes, highlighting the growing adoption of advanced oral care solutions.

The integration of artificial intelligence (AI) and the internet of things (IoT) into oral care devices is further transforming the market. Smart toothbrushes equipped with AI can analyze brushing patterns and provide personalized feedback, while IoT-enabled devices allow users to track their oral health metrics via mobile applications. For instance, manufacturers like Philips and Oral-B have introduced AI-powered toothbrushes that offer real-time guidance, enhancing user experience and oral hygiene outcomes. These innovations not only improve product performance but also create premium product segments, enabling manufacturers to achieve higher profit margins.

Additionally, the shift toward eco-friendly materials in dental care products is gaining momentum. Biodegradable toothbrushes made from bamboo and refillable toothpaste options are increasingly popular among environmentally conscious consumers. The global push for sustainability, supported by initiatives such as the United Nations’ Sustainable Development Goals (SDGs), has encouraged manufacturers to adopt greener practices, further driving market growth.

According to the Global Burden of Disease Study 2019, oral diseases affect nearly 3.5 billion people worldwide, underscoring the critical need for effective dental care solutions. This growing awareness of oral health, coupled with technological advancements, has positioned the dental care market as a dynamic and lucrative segment within the broader personal care industry. The market’s evolution continues to attract significant investments, fostering innovation and competitive differentiation among key players. As consumer demand for advanced, sustainable, and personalized oral care solutions rises, the dental care market is expected to witness robust growth during the forecast period.

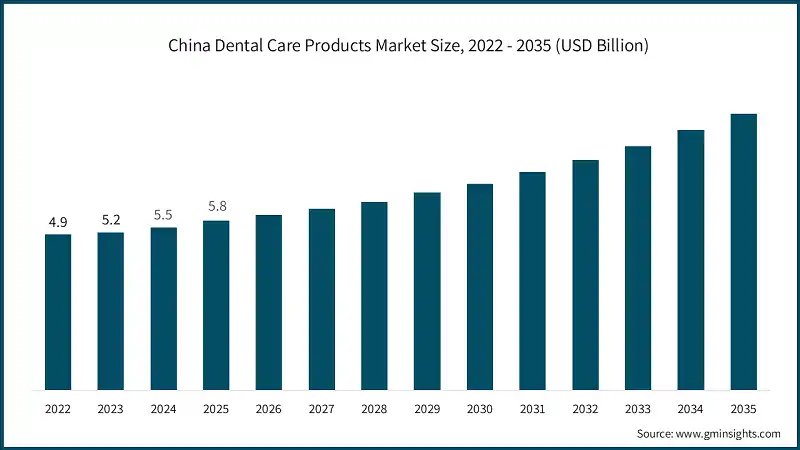

Additionally, the emphasis on early prevention and aesthetic appeal is driving sustained demand, particularly in emerging economies. Countries in Asia-Pacific, such as India and China, are witnessing rapid growth in the market due to increasing disposable incomes, urbanization, and heightened awareness of oral hygiene. For example, the Indian Dental Association has been actively promoting oral health awareness campaigns, contributing to a rise in the adoption of advanced dental care products in the region.

Overall, the dental care products market is poised for significant growth, driven by increasing consumer awareness, the rising prevalence of oral health issues, and the growing demand for innovative and aesthetic oral care solutions. Manufacturers are expected to continue investing in research and development to cater to evolving consumer preferences and expand their market presence globally.

Dental Care Products Market Trends

The market is evolving rapidly, driven by shifting consumer preferences, technological innovation, and sustainability concerns. Emerging trends reflect a growing emphasis on personalized solutions, eco-friendly materials, and digital engagement. These developments are reshaping competitive strategies and creating new growth opportunities across global and regional markets.

- Consumers increasingly demand personalized dental care experiences, leading to the rise of smart oral care devices integrated with AI and IoT. These products offer real-time feedback, customized brushing patterns, and oral health tracking, enhancing user engagement. Brands adopting this trend gain a competitive edge by delivering tailored solutions that improve compliance and outcomes. The integration of technology not only elevates convenience but also positions oral care as part of a broader wellness ecosystem. This trend is expected to accelerate premium segment growth, attracting tech-savvy consumers and fostering long-term brand loyalty.

- Environmental consciousness is reshaping product development in the dental care industry. Consumers are increasingly opting for biodegradable toothbrushes, refillable mouthwash containers, and herbal toothpaste formulations. This shift reflects a broader commitment to reducing plastic waste and chemical exposure. Brands that prioritize sustainable sourcing and packaging can command premium pricing and strengthen brand equity. Regulatory pressures and corporate sustainability goals further reinforce this trend, making eco-friendly innovation a strategic imperative. As sustainability becomes a key purchase driver, companies that fail to adapt risk losing relevance in an increasingly green-conscious market.

- E-commerce platforms and subscription-based services are transforming how consumers purchase dental care products. Online channels offer convenience, competitive pricing, and personalized recommendations, driving higher engagement and repeat purchases. Subscription models ensure consistent product availability, fostering customer loyalty and predictable revenue streams. Social media marketing and influencer collaborations amplify brand visibility, particularly among younger demographics. This trend reduces reliance on traditional retail and enables brands to capture data-driven insights for targeted campaigns. As digital adoption accelerates globally, companies investing in robust online strategies will gain a significant competitive advantage.

Dental Care Products Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is divided into toothpaste, toothbrushes, dental floss, mouthwash, tongue scrapers, whitening products, retainers and mouthguards, dental kits, and others. In 2025, toothpaste held the major market share, generating revenue of USD 12.3 billion.

- The toothpaste segment continues to dominate the global market, accounting for the largest share due to its essential role in daily oral hygiene routines. Its widespread adoption across all demographics and geographies ensures consistent demand, making it a cornerstone of industry. Growth is fueled by product diversification, including specialized variants for whitening, sensitivity relief, and herbal formulations, catering to evolving consumer preferences. Additionally, aggressive marketing strategies and brand loyalty reinforce its market leadership. Emerging trends such as natural ingredients and fluoride-free options further expand the segment’s appeal. With affordability and accessibility driving penetration, toothpaste remains the most resilient and revenue-generating category in the dental care market.

Learn more about the key segments shaping this market

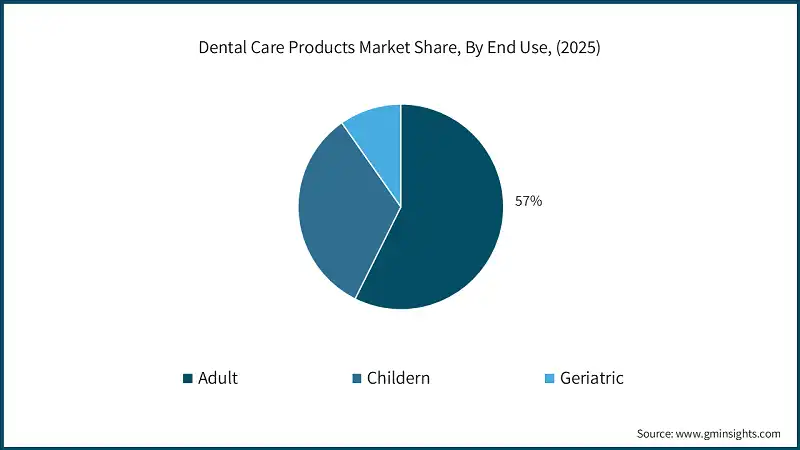

Based on end use, the dental care products market is segmented into adult, children, and geriatric. The adult segment held the largest share, accounting for 57% of the global market in 2025.

- The adult segment dominates the global market, primarily due to its large population base and heightened awareness of oral health. Adults exhibit strong purchasing power and a preference for advanced solutions such as whitening products, electric toothbrushes, and specialized toothpaste for sensitivity or gum care.

- Lifestyle factors, including increased consumption of processed foods and beverages, have amplified the need for preventive and restorative oral care among this demographic. Additionally, aesthetic concerns drive demand for premium products, particularly in urban markets. With rising health consciousness and disposable income, the adult segment remains the most lucrative category, ensuring sustained growth for manufacturers targeting innovation and personalization.

Based on distribution channel, the dental care products market is segmented online and offline. In 2025, offline segment held a major market share, with more than 60% of market revenue.

- The offline channel continues to dominate the global market, primarily due to strong consumer trust in physical retail and the convenience of immediate product availability. Supermarkets, hypermarkets, and pharmacies remain key distribution points, offering a wide range of products and enabling direct brand visibility.

- In-store promotions and discounts further drive impulse purchases, particularly for essential items like toothpaste and toothbrushes. Additionally, offline channels cater to consumers who prefer personal interaction and assurance before buying healthcare-related products. Despite the rise of e-commerce, offline retail maintains its leadership due to established networks and consumer habits, especially in emerging markets where digital penetration is still evolving.

Looking for region specific data?

Asia Pacific Dental Care Products Market

The Asia Pacific held market share of around 30% in 2025 and is anticipated to grow with a CAGR of around 8.1% from 2026 to 2035.

- China dominates the Asia-Pacific market, driven by its large population base, rising disposable incomes, and growing awareness of oral health. Urbanization and lifestyle changes have increased demand for both basic and premium oral care products, including whitening solutions and electric toothbrushes.

- The country’s strong e-commerce ecosystem further accelerates market penetration, with online platforms offering convenience and competitive pricing. Additionally, local and global brands are investing heavily in digital marketing and influencer-led campaigns to capture younger consumers. Government initiatives promoting oral health and the popularity of herbal and natural formulations also contribute to sustained growth, positioning China as a critical hub for innovation and expansion in the APAC region.

North America Dental Care Products Market

In 2025, the U.S. dominated the North America market, accounting for around 60% and generating around USD 10.3 billion revenue in the same year.

- The U.S. dominates the North American market, driven by high consumer awareness, advanced healthcare infrastructure, and strong purchasing power. The country exhibits robust demand for both basic and premium oral care products, including whitening solutions and electric toothbrushes.

- Lifestyle factors, such as increased consumption of sugary foods and beverages, further amplify the need for preventive oral care. Additionally, the presence of leading global players like Colgate-Palmolive and Procter & Gamble ensures widespread availability and aggressive marketing. Technological innovation and digital commerce adoption also contribute to market growth, positioning the U.S. as a key hub for product launches and premium segment expansion.

Europe Dental Care Products Market

Europe market held 22% share in 2025 and is expected to grow at 7.3% during the forecast period.

- Germany dominates the European market, supported by its advanced healthcare infrastructure, high oral health awareness, and strong consumer preference for premium products. The country exhibits significant demand for specialized solutions such as whitening toothpaste, electric toothbrushes, and eco-friendly oral care items.

- A well-established network of pharmacies and supermarkets ensures easy product accessibility, while digital commerce adoption is steadily increasing. Additionally, Germany’s emphasis on sustainability and natural formulations aligns with evolving consumer trends, driving innovation among leading brands. With rising disposable incomes and a focus on preventive care, Germany remains a critical growth hub for both global and regional players in Europe.

Middle East and Africa Dental Care Products Market

Middle East and Africa market is growing at a CAGR of 4% during the forecast period.

- Saudi Arabia dominates the Middle East and Africa market, supported by rising oral health awareness, increasing disposable incomes, and a strong preference for premium products. The country’s growing urban population and lifestyle changes have amplified demand for advanced oral care solutions, including whitening products and electric toothbrushes.

- Government-led health initiatives and educational campaigns further encourage preventive dental care practices. Additionally, the presence of international brands and expanding retail infrastructure, including pharmacies and supermarkets, ensures easy product accessibility. With digital commerce gaining traction and consumers showing interest in natural and halal-certified formulations, Saudi Arabia remains a strategic growth hub for global and regional players in the MEA market.

Dental Care Products Market Share

The market presents a dynamic and multifaceted competitive landscape dominated by global players such as Colgate-Palmolive, Procter & Gamble Co., Unilever, Johnson & Johnson, and GlaxoSmithKline PLC. These players leverage strong brand equity, extensive distribution networks, and continuous innovation to maintain leadership positions.

Intense competition drives aggressive marketing, R&D investments, and strategic partnerships, with digital channels and emerging markets becoming critical battlegrounds for future growth. Additionally, rising consumer demand for personalized and eco-friendly products is prompting these companies to accelerate innovation and adopt sustainability-driven strategies, ensuring long-term relevance and competitive advantage in an evolving global market.

Colgate-Palmolive focuses on product diversification and affordability to maintain its global leadership. The company invests heavily in R&D for specialized toothpaste variants, including herbal and sensitivity solutions. Sustainability is a core strategy, with initiatives to reduce plastic usage and promote recyclable packaging. Colgate also leverages strong digital marketing and e-commerce partnerships to enhance consumer engagement, ensuring dominance in both mature and emerging markets.

P&G emphasizes premiumization and technological innovation through brands like Oral-B and Crest. The company invests in smart oral care devices integrated with AI for personalized solutions. Aggressive advertising campaigns and influencer collaborations strengthen brand visibility. P&G also prioritizes sustainability, introducing eco-friendly packaging and refill systems, while expanding its presence in online channels to capture tech-savvy consumers globally.

Unilever adopts a sustainability-driven approach, focusing on natural and herbal oral care products under brands like Pepsodent and Closeup. The company targets emerging markets with affordable solutions while promoting premium offerings in developed regions. Digital engagement and social responsibility campaigns enhance brand equity. Unilever’s strategy includes localized manufacturing and distribution to optimize costs and strengthen regional competitiveness.

Dental Care Products Market Companies

Major players operating in the dental care products industry are:

- 3M

- Align Technology

- Church & Dwight

- Colgate-Palmolive

- Danaher

- Dentsply Sirona

- GC Corporation

- GlaxoSmithKline

- Henry Schein

- Ivoclar Vivadent

- Johnson & Johnson

- Kao

- Patterson Companies

- Procter & Gamble

- Straumann Holding

- Sunstar Suisse

- Unilever

Johnson & Johnson leverages its healthcare expertise to position oral care products as part of holistic wellness. The company focuses on therapeutic solutions, such as mouth rinses for gum health, supported by clinical research. Strategic partnerships with dental professionals and healthcare institutions reinforce credibility. J&J also invests in digital education campaigns to promote preventive care, aligning with its health-centric brand image.

GSK emphasizes science-backed oral care solutions, targeting consumers with specialized needs like sensitivity and enamel protection. The company invests in clinical trials and product innovation to maintain trust and differentiation. Marketing strategies highlight efficacy and safety, appealing to health-conscious buyers. GSK also strengthens its presence in pharmacies and healthcare channels, while gradually expanding into e-commerce for broader accessibility.

Dental Care Products Industry News

- In February 2025, Colgate-Palmolive launched the Colgate Total® Active Prevention System, a three-step oral care lineup including toothpaste, foaming toothbrush, and mouthwash designed to combat the root causes of oral disease with 15× greater effectiveness. It combines stabilized stannous fluoride, high-density bristles, and CPC and zinc-based protection to fight sensitivity, cavities, plaque, and gingivitis. This integrated system emphasizes preventive care and positions Colgate as a leader in innovation-driven oral health. [prnewswire.com]

- In August 2024, Lewie, a new brand in oral health and beauty, focused on boosting your confidence with expert-approved, portable products for a bright smile. Lewie has created a line of sustainable products with simple but effective formulas. Each product features an ergonomic design, modern look, and eco-friendly materials, promoting healthy smiles and protecting the planet. Lewie is committed to offering a smarter, more sustainable way to care for your teeth, helping you achieve your best smile responsibly.

- In January 2024, Dr. Dento developed an innovative line of electric toothbrushes, toothpaste, and mouthwash that are GMP-certified and blend advanced technology with natural ingredients. The range features powerful components such as nHAp, Coconut Extract, Theobromine, Amaranth Solution, Papain Enzyme, Hyaluronic Acid, and Aloe Vera, offering a holistic approach to oral health. Additionally, the products are enriched with the nourishing benefits of Vitamin C and Vitamin E, providing comprehensive care for both your teeth and gums.

- In November 2024, Prevest Denpro Limited, a prominent leader in dental care solutions, unveiled its groundbreaking oral care product line, Oradox, at the World Dental Show. Oradox marks a significant leap forward in oral health, reflecting Prevest's dedication to providing innovative and effective dental care solutions. The Oradox brand introduces a revolutionary range of products designed to enhance the quality of oral care. By seamlessly integrating science and innovation, Oradox addresses the diverse needs of both dental professionals and consumers, setting a new standard in the field of dental health.

The dental care products market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) & volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Product Type

- Toothpaste

- Toothbrushes

- Dental floss

- Mouthwash

- Tongue scrapers

- Whitening products

- Retainers and mouthguards

- Dental kits

- Others (electric toothbrush heads, etc.)

Market, By Application

- Home

- Dental clinic

- Hospitals

- Others (schools, elderly care homes, etc.)

Market, By End Use

- Adult

- Children

- Geriatric

Market, By Distribution Channel

- Online

- E-commerce

- Company websites

- Offline

- Pharmacies/drugstores

- Supermarkets/hypermarkets

- Others (specialty stores, convenience stores, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the dental care products market?

Major players include Colgate-Palmolive, Procter & Gamble Co., Unilever, Johnson & Johnson, GlaxoSmithKline PLC, 3M, Danaher, Dentsply Sirona, Henry Schein, and Straumann Holding.

What is the fastest-growing region in the dental care products market?

Asia Pacific is also the fastest-growing region, projected to grow at a CAGR of about 8.1% through 2035, supported by strong demand for both basic and premium oral care products.

Which distribution channel leads the dental care products market?

The offline distribution channel led the market, accounting for over 60% of revenue in 2025, supported by strong consumer trust in pharmacies, supermarkets, and hypermarkets.

Which region leads the dental care products market?

Asia Pacific is the largest regional market, holding around 30% share in 2025, driven by population growth, and increasing awareness of oral hygiene in countries such as China and India.

Which end-use segment dominates the dental care products market?

The adult segment dominated the market with a 57% share in 2025, driven by higher purchasing power, growing aesthetic concerns, and strong adoption of advanced oral care solutions.

Which product type segment generated the highest revenue in 2025?

The toothpaste segment generated the highest revenue in 2025, accounting for USD 12.3 billion, owing to its essential role in daily oral hygiene.

What is the market size of the dental care products market in 2025?

The global dental care products market was valued at USD 60.8 billion in 2025, driven by rising awareness of oral hygiene.

What is the projected value of the dental care products market by 2035?

The dental care products market is expected to reach USD 113.5 billion by 2035, growing at a CAGR of 6.8% from 2026 to 2035, supported by technological innovation.

What will be the market value of the dental care products market in 2026?

The market is projected to reach USD 62.9 billion in 2026, reflecting steady early growth driven by increased consumer spending on advanced and preventive oral care products.

Dental Care Products Market Scope

Related Reports