Summary

Table of Content

Data Center Server Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Data Center Server Market Size

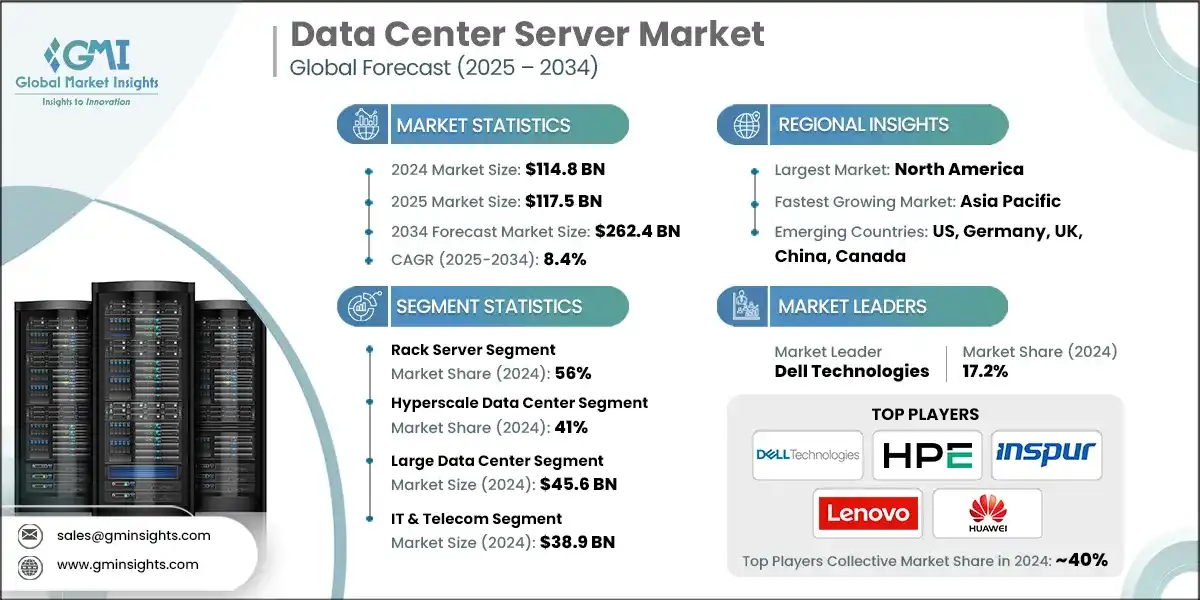

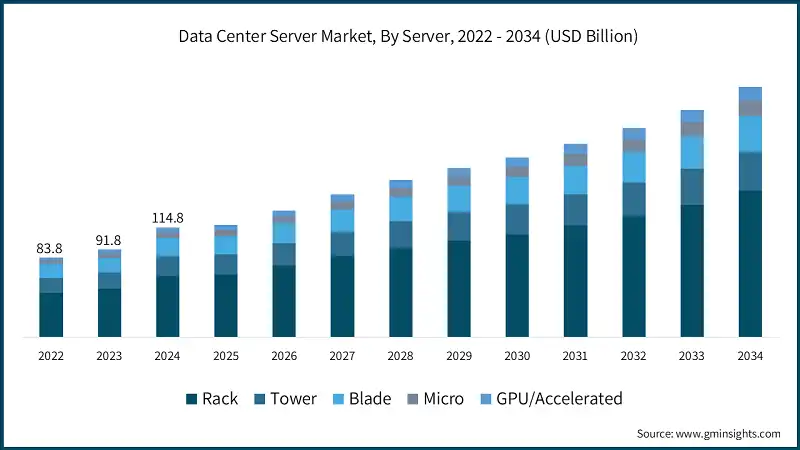

The global data center server market was valued at USD 114.8 billion in 2024 and is set to expand from USD 117.5 billion in 2025 to USD 262.4 billion by 2034, growing at an 8.4% CAGR over 2025–2034, according to latest report published by Global Market Insights Inc.

To get key market trends

The more computationally heavy workloads of AI, particularly large language model training and inference, demand high-performance GPUs and accelerated servers. Because of this, there is an unparalleled demand for the hardware needed to run AI applications, including NVIDIA HGX systems, AMD Instinct accelerators, and custom ASIC-based servers from cloud providers. Similarly, HPC clusters in research, pharma, and oil & gas drive adoption of high-density compute servers in national labs. In turn, this means that the server market will increasingly shift toward GPU-rich configurations, with corresponding higher power and cooling requirements as AI adoption accelerates across industries.

The massive growth of data from IoT devices, mobile usage, enterprise apps, industrial automation, and digital platforms is forcing companies to expand their compute capacity. The industries of telecom, BFSI, healthcare, and retail create very massive datasets, which need to be stored, processed, and analyzed with real-time decision-making. This increasing data footprint translates directly into growing requirements for servers, both for processing-compute and for hosting data-intensive applications.

Organizations modernize legacy IT systems and move towards hybrid and multi-cloud architectures. Resilient, scalable server infrastructure is needed for digital-first strategies in banking, insurance, manufacturing, and media. Enterprises replace older servers with more efficient x86, ARM, and GPU-based systems to further optimize performance and reduce operating costs. This modernization trend drives recurring refresh cycles for servers every 3–5 years.

Hyperscaler & cloud expansion drives North America's server demand. Major operators are continuously building and refreshing enormous data-centre campuses to support cloud, AI, and content delivery. Enterprise digital transformation and multi-cloud adoption keep refresh cycles and demand for high-performance x86 and GPU server’s steady. The region also leads in AI/HPC deployments, driving large purchases of GPU-accelerated racks and specialized cooling/power infrastructure. Incremental on-prem and regionally isolated capacity arises from regulatory and security needs, while sustainability goals and high electricity costs push buyers to invest in energy-efficient servers and advanced cooling.

Microsoft announced in 2024 giant AI-driven data-center expansions across Iowa, Wisconsin, Georgia, and Virginia, among other states, driven by the high demand in AI training, aka Azure OpenAI, cloud capacity, and enterprise SaaS workloads. The deployments include tens of thousands of GPU servers like NVIDIA H100/H200 and AMD MI300X along with high-density rack systems to power generative AI services.

Acceleration of cloud migration, e-commerce scale-up, and 5G/IoT rollouts across APAC markets from China, India, Japan, and Korea to Southeast Asian hubs and Australia/Singapore drives demand for servers across hyperscale, colocation, and edge sites. Large regional cloud players drive appetite for commodity x86 servers, while telco-driven edge initiatives also drive the need for growing numbers of GPU/accelerated deployments for AI use cases such as local LLMs, image/video analytics, etc.

Data-localization and national security policies in several APAC markets also drive localized builds, increasing the number of smaller regional facilities. Pricing sensitivity, site and power constraints, plus a fragmented vendor landscape mean APAC sees broad demand across form factors from high-density racks in hyperscale campuses to modular micro-data centers at the edge.

Data Center Server Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 114.8 Billion |

| Market Size in 2025 | USD 117.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.4% |

| Market Size in 2034 | USD 262.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid Growth of Cloud Computing & Hyperscale Expansion | Massive capacity additions from hyperscalers (AWS, Azure, Google, Meta) structurally raise demand for high-density rack servers, GPU-accelerated systems, and scalable compute platforms. Continuous cloud region expansion accelerates multi-year server refresh cycles and drives volume demand for x86, ARM, and accelerator-based server fleets. |

| Explosion of AI, Machine Learning & High-Performance Computing (HPC) | AI/ML and HPC workloads trigger outsized demand for GPU-rich, high-power server architectures, increasing deployment of advanced thermal solutions (liquid cooling) and high-bandwidth interconnect servers. |

| Increasing Data Generation Across Industries | Growing data volumes from IoT, telecom, BFSI, healthcare, and industrial systems push enterprises to scale compute clusters and analytics platforms, driving incremental server deployments across both cloud and on-prem environments. |

| Rising Cloud-Based Services | The expansion of SaaS workloads (Salesforce, SAP Cloud), PaaS frameworks, and OTT platforms (Netflix, Disney+, gaming) increases global demand for backend compute, accelerating purchases of application-optimized servers and content-delivery infrastructure. |

| Pitfalls & Challenges | Impact |

| Power & Cooling Constraints Limit High-Density Server Deployments | Insufficient power availability and thermal capacity restrict data center operators from adding GPU-rich or high-density racks, slowing AI server adoption and forcing operators to delay or redesign expansion plans. This bottleneck increases deployment costs, extends build timelines, and pushes demand toward more energy-efficient architectures or alternative regions with better power infrastructure. |

| Rising Energy Costs Pressure TCO and Server Refresh Decisions | High and volatile electricity prices significantly increase operational costs for both enterprise and hyperscale operators. This raises TCO for running dense compute clusters, often delaying server refresh cycles and shifting purchasing preferences toward energy-efficient CPUs/GPUs and advanced cooling (liquid/immersion) to mitigate long-term operating expenses. |

| Opportunities: | Impact |

| Accelerated Adoption of AI-Optimized and GPU-Accelerated Servers | Surging interest in generative AI, enterprise LLMs, autonomous systems, and high-performance analytics creates a long-term structural uplift for GPU-accelerated and specialized AI servers. This shifts market value toward higher ASP (average selling price) systems, expands demand for advanced interconnects (NVLink, PCIe Gen5/Gen6, CXL), and accelerates innovation in dense server architectures, making AI servers one of the highest-growth revenue pools. |

| Growth of Edge Computing Opens New Server Deployment Footprints | Mass rollouts of 5G, IoT, industrial automation, and smart-city infrastructure create new demand for ruggedized, micro, and edge-optimized servers. This expands the addressable market beyond traditional data centers into telecom towers, retail chains, manufacturing floors, and autonomous-vehicle zones. Vendors gain new revenue streams in compact, low-latency server form factors. |

| Market Leaders (2024) | |

| Market Leaders |

17.2% market share |

| Top Players |

Collective market share in 2024 is ~40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | US, Germany, UK, China, Canada |

| Future outlook |

|

What are the growth opportunities in this market?

Data Center Server Market Trends

The rapid ascendance of generative AI and machine learning is forcing a structural shift toward GPU-accelerated and specialized AI servers. Vendors are focusing their efforts on architecture centered around NVIDIA, AMD, and emerging AI ASICs, as well as advanced interconnects such as NVLink, PCIe Gen5/Gen6, and CXL. These servers carry much higher power density and require optimized thermal designs, driving data centers toward liquid cooling. Demand for AI clusters is also changing CapEx priorities for hyperscalers and making accelerated servers one of the fastest-growing product segments.

Server power densities are driving past the thermal limits of conventional air-cooled racks for many AI and HPC deployments. Consequently, the industry is moving rapidly to liquid cooling including direct-to-chip cold plates and immersion systems that will support 40–80kW racks and beyond. The transition is driving heavy retrofit investments in hyperscale and enterprise sites, with new demands for server chassis, materials, and cooling-ready designs. Liquid-cooled servers also pave the way for higher operational efficiency and compact computing clusters that support more sustainable operations.

In 2024, Meta (Facebook) announced large-scale AI infrastructure expansions, deploying tens of thousands of NVIDIA H100 GPU-accelerated servers across its U.S. data centers. These clusters power Llama models, generative AI workloads, and recommendation systems, representing one of the largest GPU server deployments globally. The project reflects the industry trend of adopting AI-optimized, high-density server architectures, pushing Meta to redesign rack layouts, adopt liquid cooling, and upgrade power distribution systems.

As power and efficiency become critical constraints, ARM processors and custom silicon solutions are gaining traction across hyperscalers and cloud platforms. Solutions like AWS Graviton, Ampere Altra, and NVIDIA Grace CPU offer superior performance-per-watt. As a result, they have gained more traction as alternatives to x86 servers. This is driving an increasingly diversified processor ecosystem and reducing reliance on traditional CPU suppliers. Hyperscalers are designing their chips to better optimize performance for cloud-native and AI workloads, accelerating the trend toward hardware-software co-optimization.

Thus, edge computing is scaling rapidly due to 5G deployments, the growth in IoT, and real-time analytics across industries including telecom, manufacturing, retail, and transportation. This shift is creating demand for microservers, ruggedized edge servers, and compact high-density compute nodes designed for distributed, low-latency environments. These servers need to support local processing, AI inference, and secure connectivity while operating in space- and power-constrained locations. In this respect, as organizations adopt hybrid edge-cloud strategies, OEMs are developing scalable architectures that integrate seamlessly with core data centers.

Data Center Server Market Analysis

Learn more about the key segments shaping this market

Based on server, the market is divided into rack, tower, blade, micro and GPU/accelerated. The rack server segment dominated the market accounting for 56% in 2024 and is expected to grow at a CAGR of 8.8% from 2025 to 2034.

- Rack servers offer an ideal balance between compute density and flexibility, making them suitable for both small enterprises and hyperscale data centers. They allow operators to scale capacity simply by adding additional units into standardized racks. This modularity aligns well with modern cloud and virtualized environments. Because density increases without drastically increasing complexity, rack servers remain the default choice for scalable infrastructure.

- The industry-wide adoption of standard 19-inch racks ensures broad compatibility across vendors, cooling systems, and networking equipment. This standardization reduces integration challenges and lowers deployment costs for operators. Data centers can easily mix different generations or brands of rack servers within the same environment. This interoperability creates economies of scale and simplifies upgrades, making rack servers more attractive than blade or tower alternatives.

- Modern workloads such as AI/ML training, virtualization, big data analytics, and HPC require high power density and advanced cooling both of which rack servers support efficiently. Rack-based platforms accommodate GPU clusters, PCIe expansions, and high-bandwidth interconnects more effectively than tower or microservers. Their chassis can be optimized for liquid cooling, airflow, and heavy compute loads.

- Oracle Cloud Infrastructure (OCI) recently deployed large clusters of NVIDIA DGX and HGX rack-mounted GPU servers to power its AI Supercluster expansion across the U.S. and Europe. These servers are built specifically for high-density AI/ML workloads and require advanced cooling and power configurations that rack servers support exceptionally well. OCI uses these GPU-dense rack systems to run enterprise LLM workloads, scientific computing, and high-throughput analytics.

Learn more about the key segments shaping this market

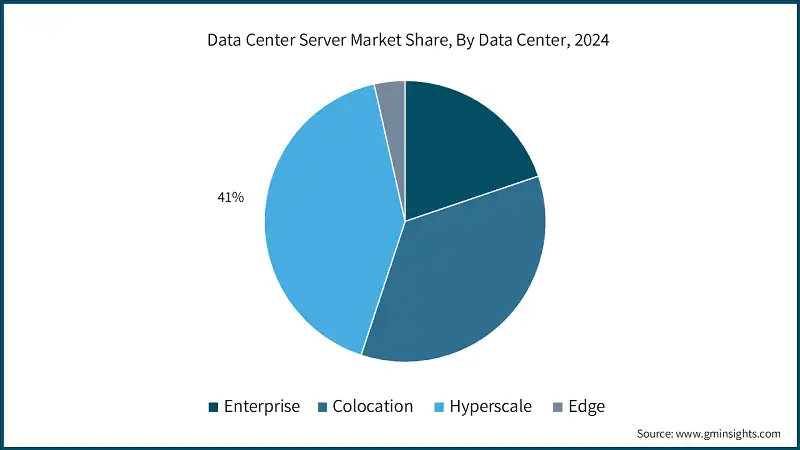

Based on data center, the data center server market is categorized into enterprise, colocation, hyperscale and edge. Hyperscale data center segment dominated the market with around 41% share in 2024, and the segment is expected to grow at a CAGR of 9.1% between 2025 and 2034.

- Hyperscale operators like AWS, Azure, Google, Meta, and Alibaba deploy hundreds of thousands of rack servers for each new region or cluster expansion. Their expansion cycles are faster and larger than any enterprise segment, making them the single biggest consumers of rack servers globally. The cloud-first workloads support virtualization, storage, and analytics are inherently optimized for rack-based infrastructure. This enormous scale of procurement naturally makes hyperscalers the dominant buyers.

- Hyperscalers lead AI innovation and deploy vast GPU rack clusters for training LLMs, recommendation systems, and computer vision models. These workloads require dense racks with advanced interconnects (NVLink, InfiniBand) and specialized cooling, which only rack servers can accommodate reliably. Rack-based GPU nodes have become the core building blocks of hyperscale AI data centers. As AI workloads surge, hyperscalers’ demand for high-density rack servers grows exponentially.

- In 2024, Google deployed thousands of high-density rack-based GPU servers across its U.S. and European hyperscale data centers to train and run its Gemini AI models. These racks integrated NVIDIA H100 and TPU v5 accelerators, requiring advanced liquid cooling, high-bandwidth networking, and power-dense rack layouts capabilities only achievable with rack server architectures.

- Hyperscalers rely on standardized rack designs (like OCP-compliant servers) to simplify deployment, streamline maintenance, and reduce procurement costs. This uniformity allows them to deploy servers at massive scale with minimal customization, reducing both CapEx and OpEx. Rack servers fit perfectly into these highly standardized architectures, reinforcing their dominance in hyperscale environments. The efficiency benefits hyperscalers achieve through standard rack units cannot be matched by blade or tower formats.

Based on data center size, the data center server market is divided into small, medium and large data centers. Large data center dominate the market and was valued at USD 45.6 billion in 2024.

- Large data centers run mission-critical cloud, enterprise, and digital workloads that require thousands of servers operating simultaneously. Their high and predictable compute demand makes rack servers the most efficient form factor for scaling infrastructure. Because large data centers refresh hardware in multi-year cycles, they consistently purchase servers in high volumes.

- Large data centers must maximize every square foot of space while handling rising rack power densities driven by AI, analytics, and virtualization. Rack servers provide the optimal format for scaling compute, network, and storage within strict power and cooling envelopes. Their modularity allows operators to expand or replace servers quickly without disrupting facility design. Large data centers depend on these high-density layouts to achieve operational efficiency.

- Standardized rack units allow consistent deployment across multiple halls, buildings, or regions, drastically reducing integration complexity. This uniformity simplifies procurement, installation, maintenance, and monitoring at scale. Rack servers align perfectly with these standardized architectures, unlike tower or blade servers which introduce variability.

- In 2024, Microsoft expanded its Iowa data center campus to support massive AI workloads for Azure OpenAI Services. The expansion included deployment of rack-based GPU clusters using NVIDIA H100 systems requiring advanced liquid cooling and high-bandwidth networking. These large halls were redesigned with dense rack layouts to handle AI training and inference workloads at scale.

Based on applications, the data center server market is divided into IT & Telecom, BFSI, government & defense, healthcare, retail & e-commerce, manufacturing and others. The IT & Telecom segment dominates the market and was valued at USD 38.9 billion in 2024.

- IT & Telecom companies operate the backbone of global cloud, connectivity, and digital services, requiring continuous expansion of computing capacity. Their workloads virtual machines, cloud platforms, network management, and real-time service delivery run most efficiently on scalable rack server architectures. Rack servers support the high-density and always-on requirements of telecom networks. This makes them the default choice for large-scale infrastructure deployments.

- Telecom operators are rapidly deploying edge data centers to support 5G, IoT, and low-latency applications. These edge nodes rely heavily on compact, standardized rack servers that can be deployed across thousands of distributed locations. Rack servers provide the necessary balance of performance, scalability, and ruggedness needed at the network edge. As 5G adoption increases, telecom operators expand both core and edge compute footprints.

- Major IT service providers including AWS, Azure, Google Cloud, Oracle Cloud, IBM Cloud, and SaaS platforms build their entire compute infrastructure on rack servers. Their continuous scaling of cloud regions, data centers, and SaaS workloads drives consistent, high-volume procurement of rack systems. Rack servers allow uniformity across global deployments, enabling predictable performance, standardized maintenance, and rapid expansion.

- Telecom and IT operators handle enormous volumes of internet traffic, streaming content, enterprise apps, and digital services. To maintain performance and low latency, they deploy dense clusters of rack servers in core data centers and CDN nodes. Rack architectures support high bandwidth, multi-CPU/GPU configurations, and efficient cooling ideal for large-scale traffic management. As video streaming, gaming, and OTT platforms grow, IT & Telecom infrastructure expands rapidly.

Looking for region specific data?

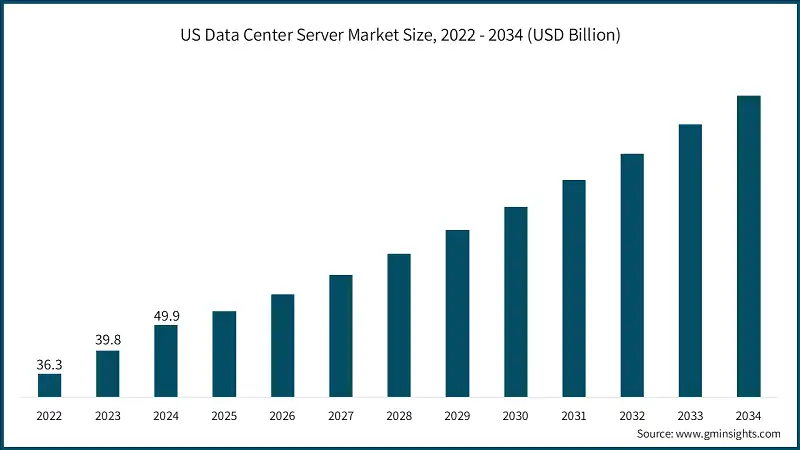

US dominated North America data center server market with revenue of USD 49.9 billion in 2024.

- U.S. hosts the highest number of hyperscale data centers globally, driven by companies like AWS, Microsoft, Google, Meta, and Oracle. These hyperscalers deploy hundreds of thousands of rack servers annually, far exceeding any other region’s demand. The massive scale of cloud services, AI clusters, and high-density compute makes rack servers the default architecture. U.S. hyperscale expansions continuously increase rack server consumption.

- Amazon Web Services announced a USD 35 billion investment to expand its hyperscale data-center footprint in Virginia its largest cloud region globally. This expansion includes multiple new campuses, each deploying tens of thousands of rack servers to support cloud, AI, ML, and enterprise workloads. The project strengthens the U.S.’ position as the world’s leading rack-server consumer because AWS builds almost entirely on standardized, high-density rack architectures.

- U.S. leads global innovation in AI, machine learning, and high-performance computing with companies such as NVIDIA, OpenAI, Anthropic, and national research labs. These organizations require GPU-rich rack server clusters, liquid-cooling-ready systems, and advanced interconnect architectures. The explosive growth of generative AI workloads in the U.S. is driving unprecedented investment in AI-optimized rack servers.

- U.S. benefits from abundant land, strong fiber connectivity, and more robust power infrastructure than most global markets. This enables large data-center campuses and multi-building expansions that depend heavily on rack-based compute infrastructure. Investment incentives, stable regulations, and technology-friendly policies further support rapid facility growth. Major states like Virginia, Texas, Iowa, and Oregon continue to attract billion-dollar data center investments.

Germany data center server market will grow tremendously with CAGR of 10% between 2025 and 2034.

- Germany is seeing rapid expansion from major cloud providers such as AWS, Microsoft Azure, Google Cloud, and Oracle Cloud each building new availability zones to meet rising domestic demand. These new and expanded data-center campuses rely heavily on high-density rack server deployments. As enterprises accelerate digital transformation and move workloads to the cloud, hyperscalers scale up their server fleets within Germany.

- Germany has some of the strictest data protection regulations in Europe, forcing enterprises and cloud providers to host data locally. This results in the build-out of region-specific data centers, all of which require large volumes of rack servers for compliance-driven workloads. Sectors like BFSI, government, and healthcare prefer in-country infrastructure, further increasing local server demand, as more industries adopt EU-aligned data localization frameworks, the need for domestic rack-based compute intensifies.

- Frankfurt (DE-CIX) is Europe’s busiest internet exchange point, attracting hyperscalers, telecom operators, and colocation providers to build large-scale facilities. This connectivity advantage makes Germany a preferred location for high-density rack server deployments supporting cloud, AI, and enterprise workloads. New data-center capacity around Frankfurt continues to expand rapidly due to its strategic fiber and network ecosystem as traffic volumes grow, operators require more rack servers to handle increased compute and network workloads.

- Germany’s enterprise sector especially automotive, engineering, logistics, and manufacturing is rapidly adopting cloud, AI, IoT, and Industry 4.0 solutions. These transformations require modern server infrastructure, driving demand for rack-based systems in enterprise data centers and edge environments. Companies like BMW, Mercedes-Benz, Siemens, and Bosch increasingly rely on data-intensive workloads that rack servers support efficiently.

The data center server market in China will experience robust growth during 2025-2034.

- China’s cloud giants Alibaba Cloud, Tencent Cloud, Huawei Cloud, and Baidu AI Cloud are aggressively expanding their data center footprints across major provinces. These hyperscale data center require huge volumes of rack servers to support cloud computing, fintech, e-commerce, gaming, and AI workloads. Domestic cloud adoption among enterprises and government agencies is rising at double-digit rates, amplifying server demand. Large-scale digital ecosystems in China consume compute capacity faster than most global markets.

- China is rapidly scaling AI infrastructure to support LLM training, smart-city deployments, autonomous driving, and industrial AI. Companies like Baidu, Alibaba, Tencent, ByteDance, and SenseTime are building GPU-dense rack server clusters for training Chinese-language foundation models. Even with export restrictions, Chinese OEMs are accelerating the deployment of domestic AI accelerators (Huawei Ascend, Biren chips) within rack architectures.

- China hosts some of the largest server manufacturers in the world, including Inspur, Huawei, Lenovo, and Sugon, which offer competitive pricing and rapid production capabilities. This domestic ecosystem ensures stable supply, short lead times, and low-cost access to rack server hardware advantages the rest of the world struggles to match. Chinese OEMs dominate shipments to local cloud providers and government agencies, reinforcing regional growth.

- Baidu expanded its data center clusters in Beijing and Hebei to support the training of ERNIE 4.0, one of China’s largest LLMs. The company deployed thousands of rack-based GPU servers built around domestic accelerators such as Huawei Ascend 910B due to export controls on NVIDIA A100/H100 chips. These dense AI racks required upgraded power distribution, advanced cooling, and high-bandwidth fabric interconnects—demonstrating China’s rapid scale-up of AI infrastructure.

The data center server market in Brazil will experience significant growth between 2025 & 2034.

- Latin America holds a 4.5% share of the data center server industry in 2024 with a significant CAGR of 2.7%. Brazil is experiencing aggressive expansion from major cloud players such as AWS, Microsoft Azure, Google Cloud, Oracle, and IBM. These companies are building new regions and availability zones to serve fast-growing enterprise and consumer digital markets. Each new cloud cluster requires thousands of rack servers, making hyperscale expansion the strongest growth driver. Local cloud providers like UOL Diveo and Locaweb further add to demand.

- Brazil has one of the world’s fastest-growing digital economies, with massive usage of e-commerce, digital banking, streaming platforms, and ride-sharing services. These platforms rely heavily on scalable rack-based compute to process high transaction volumes and real-time analytics. Fintech leaders like Nubank, Stone, and PagBank are building more backend infrastructure locally to support millions of new users. As digital services surge, demand for rack servers grows rapidly to maintain performance and availability.

- Brazil’s colocation market is growing rapidly, with major players like Equinix, Ascenty (Digital Realty), Scala Data Centers, and Odata expanding aggressively. Telecom operators rolling out 5G are also deploying distributed edge sites that depend on compact rack-based compute nodes. These expansions require high-density, scalable rack servers to support cloud connectivity, enterprise workloads, and low-latency regional services. The combination of colocation growth and edge deployments significantly boosts national rack server demand.

The data center server market in Saudi Arabia is expected to experience robust growth between 2025 & 2034.

- Saudi Arabia’s Vision 2030 initiative is driving unprecedented investments in digital infrastructure, attracting global cloud providers and local operators to build large data centers. The government is supporting multi-billion-dollar projects in smart cities, fintech, AI, and e-government services, all of which require scalable rack-based compute. These national digitalization programs create a structural, long-term uplift in server demand. As public and private sectors modernize IT, rack servers become the backbone of new data center deployments.

- Saudi initiatives like NEOM, the Red Sea Project, and national AI programs require advanced compute platforms capable of running large-scale analytics, digital twins, and AI applications. These next-generation workloads rely heavily on GPU-accelerated rack servers and dense compute clusters. Enterprises across energy, logistics, retail, and banking are also adopting AI and IoT solutions that drive demand for high-performance rack systems.

- Saudi Arabia enforces strict data residency laws, requiring sensitive data government, BFSI, telecom, healthcare to be stored and processed within the country. This compels enterprises and cloud providers to expand domestic data centers using standardized rack servers. Cybersecurity frameworks further require robust, scalable compute infrastructure for monitoring and threat detection. These regulatory conditions accelerate the build-out of localized server clusters across the nation.

Data Center Server Market Share

The top 7 companies in the market are Dell Technologies, HPE, Inspur Power Systems, Lenovo, Huawei, Supermicro and Cisco Systems. These companies hold around 50% of the market share in 2024.

- Dell’s vertically integrated supply chain helps reduce costs and improve reliability, making it a top choice for large data center procurements. Dell’s focus on AI-ready server architectures, liquid cooling, and modular scalability aligns well with cloud and AI workload growth.

- HPE provides strong solutions for HPC, AI clusters, and edge deployments, increasing its relevance in modern data center environments. Advanced cooling technologies, sustainability initiatives, and high security standards make HPE a preferred vendor for regulated industries.

- Inspur specializes in high-density, AI-optimized rack servers and collaborates closely with Intel, AMD, and domestic chipmakers. Competitive pricing and flexible ODM-style customization make Inspur a major supplier for large cloud and enterprise projects.

- Lenovo’s growth comes from its energy-efficient ThinkSystem servers, strong manufacturing capability, and global supply-chain flexibility. It leads in liquid cooling and HPC solutions, making it highly attractive for AI and high-density workloads. Lenovo has built strong market share in both APAC and Europe, supported by partnerships with hyperscalers, telcos, and governments.

- Huawei servers are optimized for AI, cloud, and large-scale telco workloads, making them widely used across Asia, Middle East, and emerging markets. Huawei’s domestic chip ecosystem (e.g., Ascend AI processors) gives it strategic resilience amid global supply constraints.

- Supermicro ability to deliver custom, high-density, liquid-ready rack servers faster than major OEMs makes it a top choice for hyperscalers and AI startups. Supermicro’s modular building block architecture and U.S.-based manufacturing enable quick adaptation to new chips and technologies.

- Cisco’s AI-driven networking and software-defined infrastructure gaining traction, Cisco’s end-to-end data center ecosystem is becoming increasingly valuable. Cisco serves large enterprise and telco environments that rely on tightly integrated compute & network stacks.

Data Center Server Market Companies

Major players operating in the data center server industry include:

- Dell Technologies

- HPE

- Inspur Power Systems

- Lenovo

- Huawei

- Supermicro

- Cisco Systems

- Fujitsu

- IBM

- Sugon

- Dell dominates because it offers a fully integrated data-center stack—servers, storage, networking, virtualization, and lifecycle management—in a single ecosystem. This eliminates multi-vendor complexity for enterprises and cloud operators, giving Dell a strategic advantage in large tenders. Its OpenManage and automation platforms allow customers to run, monitor, and optimize thousands of rack servers with minimal manual effort.

- HPE’s deep penetration in mission-critical industries like government, aerospace, BFSI, energy, and healthcare. These sectors require exceptionally stable, secure, and high-availability server platforms—an area where HPE has decades of unmatched expertise. Its iLO management engine and silicon root of trust give enterprises airtight security, making HPE the trusted vendor for regulated workloads.

- Inspur designs custom, ultra-optimized servers specifically for hyperscalers like Alibaba, Tencent, Baidu, and ByteDance. Its ability to rapidly design, test, and mass-produce tailor-made server architectures gives it a unique advantage over traditional OEMs. Inspur’s co-engineering approach allows hyperscalers to optimize for power, density, and AI performance at scale.

- Lenovo leadership in sustainable, energy-efficient server designs particularly its Neptune liquid-cooling technology, which reduces energy consumption by up to 40%. Governments, hyperscalers, and enterprises prioritize Lenovo to meet carbon-neutral and ESG requirements. Its engineering strength in thermally optimized systems positions Lenovo as a preferred vendor for dense data center deployments.

- Huawei controls the full stack chips (Kunpeng CPUs, Ascend accelerators), servers, storage, networking, and cloud allowing tight optimization and cost efficiency. This vertical integration enables Huawei to deliver high-performance, AI-ready rack servers at extremely competitive price-performance ratios. Many countries seeking digital sovereignty prefer Huawei because it offers a self-reliant and locally supported compute ecosystem.

- Supermicro brings new server platforms especially GPU servers to market months faster than Dell or HPE. This speed is critical in the AI era, where hardware generations shift rapidly. Its Building Block Solutions® architecture allows ultra-fast reconfiguration of server designs. This unmatched agility makes Supermicro the preferred supplier for AI startups, research labs, and hyperscalers seeking bleeding-edge compute.

- Cisco integrating compute with its global leadership in networking and automation. Its UCS architecture provides unique advantages in throughput, east-west traffic optimization, and software-defined management critical for cloud, telco, and hybrid environments. Cisco’s dominance in networking gives it a built-in customer base that prefers unified compute-network stacks.

Data Center Server Industry News

- In March 2024, Meta began constructing an $800 million AI-focused data center in Jeffersonville, Indiana. The facility is designed to house next-generation GPU rack clusters to support Meta’s AI workloads, including Llama model development and recommendation engines.

- In June 2024, Equinix announced new xScale hyperscale data centers in Frankfurt and Osaka to serve cloud giants like AWS, Google, and Microsoft. These campuses require massive deployments of standardized rack servers to support regional cloud workloads. The expansion reflects the strong growth of colocation and hyperscale demand in Europe and APAC.

- In January 2024, ByteDance expanded its Singapore data center footprint with large GPU-accelerated rack clusters to power TikTok’s real-time recommendation engine. The deployment includes high-bandwidth interconnects optimized for video processing and AI inference. This move reinforces Southeast Asia as a fast-growing destination for AI-driven data center investments.

- In April 2024, Oracle Cloud Infrastructure opened a major cloud region in Montreal equipped with NVIDIA GPU Superclusters. These servers are configured in liquid-cooled racks designed for high-power AI and enterprise workloads. The expansion supports Canada’s rising adoption of generative AI and hybrid cloud services.

- In February 2024, G42 launched massive AI infrastructure clusters in Abu Dhabi, deploying GPU-dense rack servers for national AI programs, healthcare analytics, and digital government initiatives. These facilities use advanced thermal designs and high-bandwidth fabrics to support regional AI model growth. The UAE’s ambition to become an AI hub is significantly boosting server consumption.

The data center server market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Bn) and shipment (Units) from 2021 to 2034, for the following segments:

Market By Server

- Rack

- Tower

- Blade

- Micro

- GPU/Accelerated

Market By Data Center

- Enterprise

- Colocation

- Hyperscale

- Edge

Market By Data Center Size

- Small data center

- Medium data center

- Large data center

Market By Application

- IT & Telecom

- BFSI

- Government & Defense

- Healthcare

- Retail & E-commerce

- Manufacturing

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Indonesia

- Singapore

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the data center server market?

Key players include Dell Technologies, HPE, Inspur Power Systems, Lenovo, Huawei, Supermicro, Cisco Systems, Fujitsu, IBM, and Sugon. These companies dominate due to strong server portfolios, advanced cooling technologies, and deep integrations across cloud and enterprise ecosystems.

Which region leads the data center server market?

The U.S. leads North America with USD 49.9 billion in 2024, making it the largest regional market. Leadership is supported by dense hyperscale presence, AI-driven server demand, and strong power/fiber infrastructure.

What are the upcoming trends in the data center server industry?

Key trends include rapid transition to GPU-accelerated servers, adoption of liquid cooling, diversification into ARM-based architectures, and growth of edge data center deployments. AI-driven compute clusters, CXL-based architectures, and high-density rack systems are reshaping the market landscape.

What is the growth outlook for the hyperscale data center segment from 2025 to 2034?

The hyperscale data center segment is forecast to grow at a 9.1% CAGR through 2034. Rapid cloud region expansion, AI infrastructure build-outs, and standardized rack architectures drive segment acceleration.

What was the valuation of the large data center segment in 2024?

Large data centers generated USD 45.6 billion in 2024. Their dominance stems from massive cloud, AI, and enterprise workloads requiring high-volume rack server deployments.

What is the market size of the data center server industry in 2024?

The market size for data center server was valued at USD 114.8 billion in 2024 driven by cloud computing expansion and accelerated adoption of AI and HPC workloads.

What is the current data center server market size in 2025?

The market size is projected to reach USD 117.5 billion in 2025. Growth is supported by modernization of IT infrastructure and rising deployment of x86, ARM, and GPU-based servers.

What is the projected value of the data center server market by 2034?

The data center server industry is expected to reach USD 262.4 billion by 2034, growing at a CAGR of 8.4%, fueled by hyperscale data center expansion, AI cluster build-outs, and high-density computing needs.

How much revenue did the rack server segment generate in 2024?

Rack servers accounted for 56% share in 2024. Rack servers dominate due to their high density, scalability, and compatibility with GPU clusters and modern workloads.

Data Center Server Market Scope

Related Reports