Summary

Table of Content

Cryogenic Valve for Industrial Gas Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cryogenic Valve for Industrial Gas Market Size

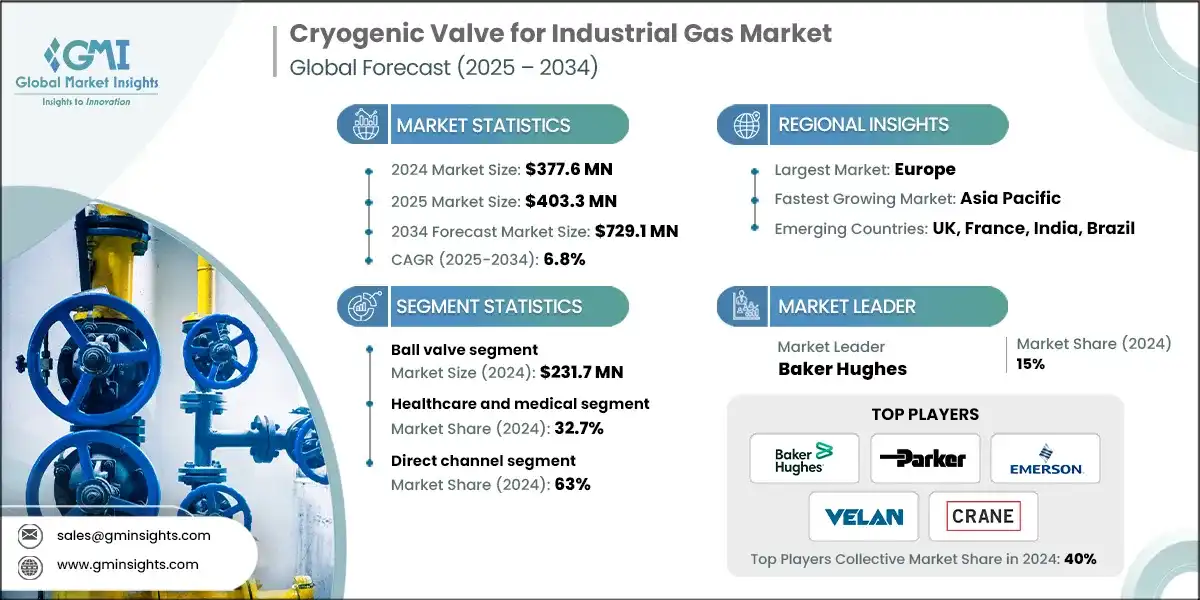

The cryogenic valve for industrial gas market was estimated at USD 377.6 million in 2024. The market is expected to grow from 403.3 million in 2025 to USD 729.1 million in 2034, at a CAGR of 6.8%, according to latest report published by Global Market Insights Inc.

To get key market trends

The expansion of the cryogenic valve market for industrial gases is growing rapidly due to structural changes, such as increasing demand for speciality gases like oxygen, nitrogen, and argon to support ferrous and non-ferrous metallurgy processes. Special high-performance valves are needed to handle these gases in cryogenic conditions as a basis for industrial gas systems. Major manufacturers including Parker Hannifin, Velan and Samson AG are responding with work on new valve designs that meet the newest specifications in the field. Parker Hannifin reported a twelve percent increase in cryogenic product sales in 2023 as measured year over year, confirming global manufacturing’s continued trend to cryogenic applications.

The spread of cryogenic technologies has accelerated since 2023, with both the European Industrial Gases Association (EIGA) and the U.S. Environmental Protection Agency (EPA) dedicated to the reduction of emissions from industry and improving energy efficiency; EIGA indicated that cryogenic technologies contributed to a fifteen percent reduction in emissions in the European industrial market in 2023. Overall, these developments suggest an increase in demand for cryogenic valves in the industrial gas market.

In addition, Air Separation Units (ASUs) play an important role to produce high-purity gases which are used in industries including steelmaking, electronics, and healthcare. As an example, in 2024, China produced more than 1,005 million tons of crude steel all due to its steel industry, which uses and needs ASUs and oxygen, consuming more than 55 billion cubic meters of oxygen consumed in one year. Importantly need for ASUs and more importantly oxygen, is now consuming large amounts of oxygen and cryogenic valves. As a result, companies such as Crane Company, Tecnocryo, and Flowserve, and many other cryogenic valve manufacturers expanded their product offerings to support infrastructure upgrades.

The progress in cryogenic valve design looks to enhance industry hurdles. Manufacturers, such as Samson AG and Parker Bestobell are redesigning their cryogenic valve designs to have a fresh look, notably extended bonnets, metal bellows seals, and top-entry, to be more serviceable and limit heat leak. These designs are very important to keep ASUs and the specialty gas distribution networks up and running for industrial applications.

Cryogenic Valve for Industrial Gas Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 377.6 million |

| Market Size in 2025 | USD 403.3 million |

| Forecast Period 2025 - 2034 CAGR | 6.8% |

| Market Size in 2034 | USD 729.1 million |

| Key Market Trends | |

| Drivers | Impact |

| Foodservice industry growth | Industrial gases such as oxygen, nitrogen, and argon play a vital role in industries like electronics, metallurgy, and healthcare. Their cryogenic properties necessitate valves that can operate efficiently at extremely low temperatures, driving a consistent demand for precision-engineered cryogenic valves |

| Agricultural waste utilization | These facilities depend heavily on cryogenic valves to ensure the safe extraction and distribution of gases. Since valve performance directly impacts plant efficiency and uptime, this growth is fueling a steady demand for high-integrity valve systems worldwide. |

| Sustainability push | Ensuring operational safety and efficiency is a top priority for industrial gas systems, which must prevent leaks and maintain reliable flow under cryogenic conditions |

| Pitfalls & Challenges | Impact |

| High costs | Compliance with stringent global standards, such as ISO and ASME, requires extensive testing, which significantly increases R&D and production costs. These challenges are particularly burdensome for smaller manufacturers. |

| Durability & limited functionalityE-commerce expansion | The maintenance and handling of cryogenic systems require specialized expertise, but a shortage of trained technicians poses operational risks. |

| Opportunities: | Impact |

| E-commerce expansion | The medical sector places a strong emphasis on reliability, hygiene, and regulatory compliance, creating niche opportunities for manufacturers to develop specialized valve designs and materials tailored to these needs. |

| Strategic partnerships with foodservice chains | Digitalization is revolutionizing valve operations through the integration of sensors, IoT, and remote diagnostics. Smart cryogenic valves enable real-time monitoring and predictive maintenance, enhancing safety and operational efficiency. |

| Market Leaders (2024) | |

| Market Leaders |

15% market share |

| Top Players |

The collective market share in 2024 is 40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | Europe |

| Fastest growing market | Asia Pacific |

| Emerging countries | UK, France, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Cryogenic Valve for Industrial Gas Market Trends

Technological advancements have significantly reshaped the market, driving innovation in cryogenic valve for industrial gas.

- The cryogenic valve market is evolving with smart cryogenic valve technologies that utilize sensors, actuators, and digital controllers. Smart technologies are reducing downtime, in addition to safety and reliability across the market, while having features such as real-time diagnostics, remote operations, speed, and predictive maintenance solutions. For example, in 2023, Air Products and Chemicals, Inc. made the announcement that their implementation of smart valve systems led to a reduction of operational disruption by 15% in their gas business.

- Manufacturers are also using more advanced alloys and composites to create cryogenic valves that can withstand extreme conditions. Emerson, for example, has created amazing valve solutions for high-purity gas systems, including the ASCO 264 cryogenic solenoid valve, which is crucial in the medical and semiconductor industries. To further indicate ongoing market demand, reliability, and lasting cryogenic valve solutions, compliance with ISO 21011 standards increased by 12% in 2023, according to the International Organization for Standardization (ISO).

- Additive manufacturing (3D printing) is transforming the cryogenic valve manufacturing environment by enabling faster prototyping and more precise customization of parts. This new technology optimizes manufacturing practices to take advantage of shorter lead times and significantly less waste in material. It also offers manufacturers unprecedented design flexibility, allowing them to meet the industry's unique needs, such as aerospace and energy. In working to create specialized high-performance applications, 3D printing promotes innovation and efficiency. This position helps companies address customers’ needs and remain competitive in the shifting landscape of these important markets.

Cryogenic Valve for Industrial Gas Market Analysis:

Learn more about the key segments shaping this market

Based on valve type, the market is segmented into ball valve, control valve, gate valve, check valve, butterfly valve and others. The ball valve segment held the dominant market share, generating a revenue of USD 231.7 million in 2024. This dominance is due to its sealing capabilities as well as the efficiency in performance in extremely cold conditions, making it the best possible choice over other types.

Ball valves are favoured for their ability to withstand low temperatures and high pressures, ensuring operational safety and efficiency. According to the International Gas Union (IGU), the global industrial gas market is projected to grow at a CAGR of 5.8% during the forecast period, fuelled by rising demand in sectors like healthcare, energy, and manufacturing. This growth has directly influenced the adoption of cryogenic ball valves, which are critical for maintaining system integrity in these applications.

- Major manufacturers such as Emerson Electric Co., Flowserve Corporation, and Schlumberger Limited have been actively innovating and developing new technology to meet the changing standards. For instance, Emerson’s specialized ball valves are designed to meet stringent cryogenic standards, ensuring reliability in high-demand applications. Companies like Air Liquide and Linde PLC have also integrated advanced ball valves into their operations to enhance efficiency and safety in industrial gas handling.

- In the production and storage of hydrogen, government initiatives are helping the market grow for the ball valves, for instance, the U.S. Department of Energy, throughout the period of 2021-2023 allocated USD 8 billion investment for the creation of domestic clean hydrogen hubs under the Infrastructure Investment and Jobs Act, highlighting the importance of robust valve systems for the safe handling of hydrogen and other industrial gases. Together, these elements underscore the pivotal role of the ball valve segment in propelling the cryogenic valve market for industrial gas applications.

- On the other hand, the butterfly valve accounted for 25.3% market share, due to their compact design, versatile application in handling high pressure as well as temperature and their cost effectiveness. According to the American Water Works Association (AWWA), the water infrastructure investment showcased a 7% annual increase, further driving demand for these valves in water and wastewater treatment. These factors highlight the valve's growing adoption across industries.

Learn more about the key segments shaping this market

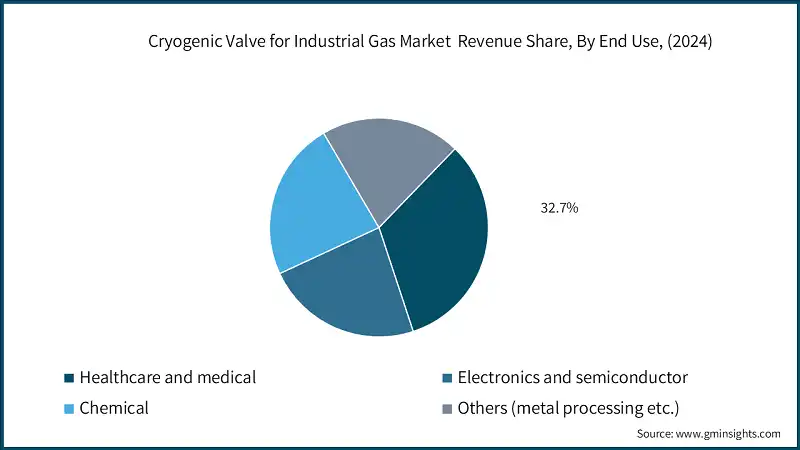

Based on end use, the market is segmented into healthcare and medical, electronics and semiconductors, chemical and others (metal processing etc.). The healthcare and medical segment held about 32.7% of the cryogenic valve for industrial gas market share in 2024. This is due to the rising demand for medical oxygen in hospitals and emergency care facilities, driven by the increasing prevalence of respiratory diseases and chronic illnesses.

- For instance, the U.S. government allocated over USD 1.7 trillion to healthcare in 2023. This shows a strong investment in medical infrastructure. Companies like Emerson Electric Co. are developing cryogenic valves designed for medical gas systems to meet the sector's strict requirements.

- The increased use of cryogenic valves in medical imaging and cryotherapy further strengthens the healthcare sector. Governments around the world are raising healthcare budgets to improve access to medical technologies.

- For example, India raised its healthcare spending by 13% in 2023 to improve its medical infrastructure. In response, Parker Hannifin Corporation is focusing on research and development to create durable and efficient cryogenic valves that meet the specific needs of medical applications.

- After Covid-19, regions worldwide have revamped their oxygen production capacity and production plants. This has led to a surge in demand for cryogenic valves that can handle the efficiency needed for oxygen production. For instance, Brazil's Ministry of Health allocated USD 0.28 billion in 2021 to expand oxygen production and distribution infrastructure. Companies like Cryostar are introducing new valve solutions to help maintain a steady supply of medical gases.

Based on distribution channels, the market is segmented into direct and indirect channels. The direct channel accounted for 63% of the cryogenic valve for industrial gas market share in 2024.

- Industrial gas users often demand tailored valve solutions to meet their specific operational needs. Direct access to manufacturers ensures expert guidance for installation, regulatory compliance, and ongoing maintenance. This personalized approach minimizes operational risks and enhances system efficiency. By addressing unique requirements, manufacturers build trust and foster long-term partnerships with their clients. Such collaboration is particularly critical in industries where precision and reliability are non-negotiable.

- Direct procurement channels eliminate unnecessary intermediaries, enabling faster delivery and improved quality control. This efficiency is vital for industries like healthcare and semiconductors, where delays or substandard components can have significant consequences. Reliable supply chains ensure that businesses can maintain uninterrupted operations and meet stringent industry standards. By streamlining the procurement process, manufacturers demonstrate their commitment to delivering value and supporting critical sectors. This approach not only enhances customer satisfaction but also strengthens market competitiveness.

Looking for region specific data?

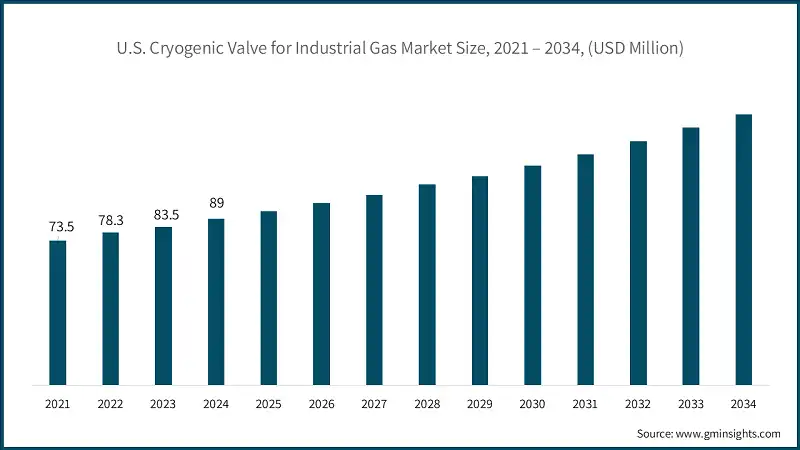

In 2024, the U.S contributed significantly to the cryogenic valve for industrial gas market growth in North America, accounting for 79% share in the region.

- This growth is supported by government policies such as the Inflation Reduction Act of 2022, which allocated USD 369 billion for clean energy and climate initiatives, including hydrogen production and storage. Manufacturers such as Air Products and Chemicals Inc. have been actively investing in hydrogen infrastructure projects, furthering the demand for cryogenic valves in the industrial gas sector.

- Moreover, the U.S. Department of Energy's Hydrogen Shot initiative, launched in 2021, aims to reduce the cost of clean hydrogen by 80% to $1 per kilogram by 2030. This initiative has encouraged companies like Linde plc and Chart Industries to expand their operations in cryogenic technologies. Such policies and corporate investments are key factors contributing to the U.S.'s significant share in the North American cryogenic valve market for industrial gases.

Asia Pacific market in 2024 is the fastest growing market in the region and is expected to grow at 7.2% during the forecast period.

- The Asia Pacific cryogenic valve market for industrial gases is growing rapidly in 2024 due to increasing industrialization and urbanization, particularly in countries like China and India. For instance, China's industrial gas market is expanding significantly, with the country accounting for over 30% of the global industrial gas demand with increasing applications in sectors such as healthcare and energy. Additionally, government investments in infrastructure and energy projects, such as India's National Infrastructure Pipeline, are further boosting the market.

Europe cryogenic valve for industrial gas market is the largest market and is expected to grow at 6.9% during the forecast period.

- The growth of the cryogenic valve market for industrial gases in Europe is driven by the increasing demand for industrial gases across sectors such as healthcare, food and beverage, and energy. In 2023, Europe accounted for approximately 30% of the global medical oxygen consumption.

- Additionally, the region's focus on renewable energy, particularly hydrogen-based energy systems, has further fueled the market. The European Union's Hydrogen Strategy aims to install at least 40 GW of electrolyzers by 2030, creating substantial opportunities for cryogenic valves.

Middle East and Africa cryogenic valve for industrial gas market is expected to grow at 5.3% during the forecast period.

- This is due to the expansion of industrial gas infrastructure, particularly in energy and healthcare sectors. Governments and private players are investing in LNG terminals, medical oxygen plants, and hydrogen projects, and driving demand for reliable cryogenic flow control solutions in the region.

Cryogenic Valve for Industrial Gas Market Share

The top companies in the cryogenic valve for industrial gas industry include Baker Hughes, Parker Hannifin, Emerson, Velan and Crane Company and collectively hold a share of 40% in the market. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Baker Hughes creates high-performance cryogenic valve solutions that address the needs of industrial gas applications, such as oxygen, nitrogen, and hydrogen. Their “Masoneilan” control valves and consolidated pressure relief valves manage ultra-low temperatures. These valves provide better sealing, reduce emissions, and offer long-lasting reliability. They also ensure safety and compliance in air separation units and gas transport systems. The design maximizes lifecycle efficiency and is supported by a robust global network of authorized service centers.

- Parker Hannifin, through its Bestobell brand, offers a wide range of cryogenic valves for storing, transporting, and producing industrial gas. Their lineup includes manual and actuated globe, gate, and ball valves, along with safety relief, thermal relief, and pressure regulators. Designed to handle extreme thermal changes, Parker's valves have extended bonnets, PTFE/PCTFE seals, and anti-blowout stems. Certified to ASME B31.3 and BS EN 1626 standards, these valves provide leak-tight performance and a long service life in oxygen, nitrogen, and argon systems.

- Emerson is a company in cryogenic valve innovation, offering solutions such as the Vanessa Series 30,000 triple offset valves and AEV C-ball valves, designed for industrial gas applications that requires zero leakage and high reliability. These valves incorporate extended bonnets compliant with BS6364 standards, metal-seated designs, and materials specifically selected for cryogenic resilience. Widely deployed in air separation and gas purification plants, Emerson’s solutions deliver exceptional emission control, safety, and operational efficiency. The company supports its offerings with global engineering expertise and its “Project Certainty” framework, ensuring reliable performance and customer satisfaction.

Cryogenic Valve for Industrial Gas Market Companies

Major players operating in the global cryogenic valve for industrial gas industry are:

- Baker Hughes

- Bray International

- Crane Company

- Emerson

- Flowserve

- Herose

- Kitz

- Microfinish

- Parker Hannifin

- PK Valve and Engineering

- Powell Valves

- Rego

- Swagelok

- Trimteck

- Velan

Velan, a global manufacturer in cryogenic valve technology, offers a wide range of forged and cast steel gate, globe, check, ball, and butterfly valves designed to operate at ultra-low temperatures as low as –272°C (–457°F). These valves are specifically made for industrial gas applications, including oxygen, nitrogen, and argon systems. Key features include extended bonnets, solid CoCr alloy wedges, and bellows seals, ensuring leak-tight performance and thermal resilience.

Crane Company provides high-performance cryogenic valve solutions tailored for industrial gas applications, particularly in hydrogen, oxygen, and nitrogen systems. Its product portfolio includes bellows seal globe valves, lift-check valves, and vacuum jacketed piping systems, all designed to withstand extreme cryogenic conditions. These solutions deliver zero-leakage performance, minimal heat transfer, and high-cycle durability.

Cryogenic Valve for Industrial Gas Industry News

- In October 2025, Baker Hughes announced the acquisition of Chart Industries in an all-cash deal. The acquisition is set to close by mid-2026, pending regulatory approvals. This move significantly strengthens Baker Hughes’ cryogenic and industrial gas capabilities, integrating Chart’s expertise in valves, tanks, and process equipment for hydrogen, oxygen, and carbon capture. The combined entity expands its Industrial & Energy Technology division. Chart will continue as a distinct brand, enhancing Baker Hughes’ reach across the full lifecycle of industrial gas infrastructure.

- In February 2025, Flowserve introduced a new series of floating ball valves designed for cryogenic services in industrial gas applications. These valves offer enhanced sealing, modular design, global compliance, target oxygen, nitrogen, and hydrogen systems. Backed by Flowserve’s global service network, the launch aligns with its decarbonization strategy and reinforces its leadership in clean energy and industrial gas infrastructure.

- In November 2024, Crane Company acquired Technifab Products, a specialist in cryogenic fluid control systems. This strategic acquisition enhances Crane’s CRYOFLO product line and strengthens its position in clean energy markets. By leveraging Technifab’s expertise, Crane expands its capabilities in industrial gas and hydrogen infrastructure, particularly in air separation and hydrogen fueling systems, aligning with the growing demand for sustainable energy solutions

The cryogenic valve for industrial gas market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue and volume (USD Million) (Thousand Units) from 2021-2034, for the following segments:

Market, By Valve Type

- Ball valves

- Floating ball valves

- Trunnion mounted ball valves

- Specialized oxygen service ball valves

- Control valves

- Globe-style control valves

- Characterized control valves

- Pressure reducing valves

- Gate Valves

- Flexible wedge gate valves

- Bellows-sealed gate valves

- Others

- Check valves

- Spring-loaded check valves

- Swing check valves

- Lift check valves

- Others

- Butterfly valves

- Other

Market, By Valve size

- Less than 1 inch

- Between 1.5 to 4 inches

- Between 5 to 6 inches

- More than 6 inches

Market, By Gas type

- Liquid Nitrogen

- Liquid Oxygen

- Liquid Argon

- Hydrogen

- Carbon Dioxide

- Others (Helium etc.)

Market, By Application

- Isolation valves

- Flow control valves

- Check/non-return valves

- Pressure relief functions

- Others

Market, By End Use Industry

- Healthcare and medical

- Electronics and semiconductors

- Chemical

- Others (metal processing etc.)

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the cryogenic valve for industrial gas market?

Europe is the largest market and is expected to grow at 6.9% CAGR through 2034, due to increasing demand for industrial gases across sectors such as healthcare, food and beverage, and energy.

What are the upcoming trends in the cryogenic valve for industrial gas market?

Key trends include adoption of smart cryogenic valve technologies with IoT and sensors, use of advanced alloys and composites for extreme conditions, additive manufacturing (3D printing) for customization, and integration of automation and digital control systems.

Who are the key players in the cryogenic valve for industrial gas market?

Key players include Baker Hughes, Bray International, Crane Company, Emerson, Flowserve, Herose, Kitz, Microfinish, Parker Hannifin, PK Valve and Engineering, Powell Valves, Rego, Swagelok, Trimteck, and Velan.

How much revenue did the ball valve segment generate in 2024?

Ball valves generated USD 231.7 million in 2024, leading the market due to their superior sealing capabilities and efficiency in extremely cold conditions.

What was the valuation of healthcare and medical end-use segment in 2024?

Healthcare and medical segment held 32.7% market share in 2024, supported by rising demand for medical oxygen in hospitals and emergency care facilities.

What is the growth outlook for Asia Pacific cryogenic valve for industrial gas market from 2025 to 2034?

Asia Pacific is the fastest growing market and is projected to grow at 7.2% CAGR through 2034, owing to increasing industrialization and urbanization, particularly in countries like China and India.

What is the market size of the cryogenic valve for industrial gas in 2024?

The market size was USD 377.6 million in 2024, with a CAGR of 6.8% expected through 2034 driven by rising demand for specialty gases such as oxygen, nitrogen, and argon in ferrous and non-ferrous metallurgy.

What is the current cryogenic valve for industrial gas market size in 2025?

The market size is projected to reach USD 403.3 million in 2025.

What is the projected value of the cryogenic valve for industrial gas market by 2034?

The cryogenic valve for industrial gas market is expected to reach USD 729.1 million by 2034, propelled by expansion of air separation units, technological advancements, and focus on operational safety and efficiency.

Cryogenic Valve for Industrial Gas Market Scope

Related Reports