Summary

Table of Content

Corrugated Box Making Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Corrugated Box Making Machine Market Size

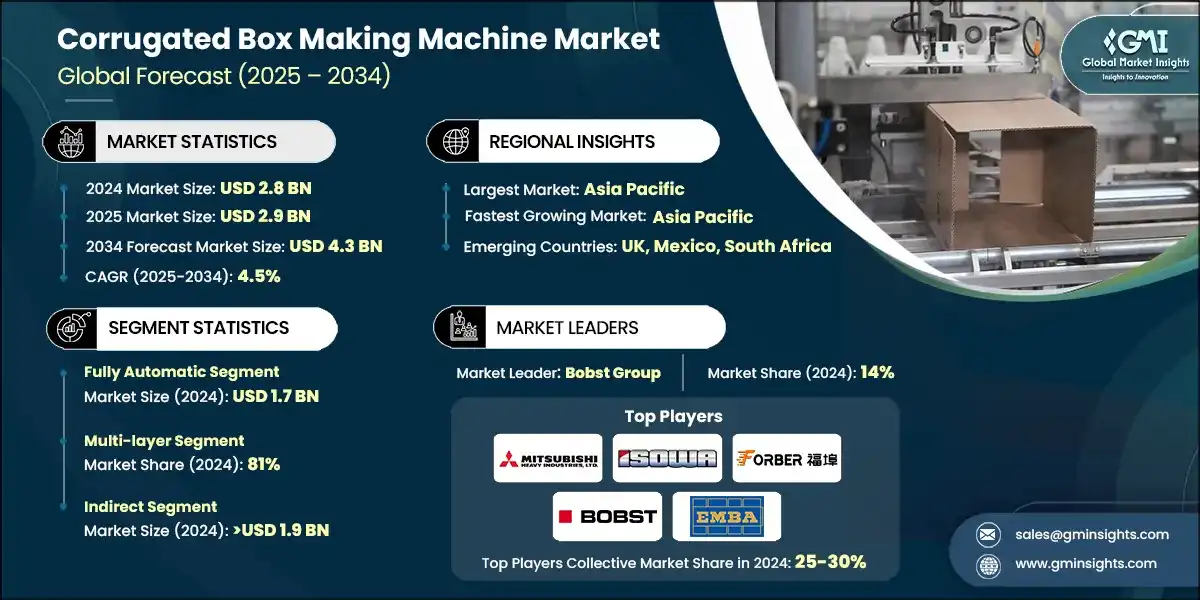

The corrugated box making machine market was estimated at USD 2.8 billion in 2024. The market is expected to grow from USD 2.9 billion in 2025 to USD 4.3 billion in 2034, at a CAGR of 4.5% according to latest report published by Global Market Insights Inc.

To get key market trends

The global boom in manufacturing consumer goods - focusing on food & beverage, electronics, personal care, and pharmaceuticals - is a key driver of the corrugated box making machine marketplace. Corrugated boxes are clearly the main solution due to their strength, lightweight, and recyclability. This trend is prominently present in developing economies in the world, as they continue to develop through industrialization and urbanization, which is resulting in a greater demand for their packaging machinery that supports fast, multi-format boxes.

In addition, the increase in the variety of consumer goods ranges from fragile electronics to perishables, which has led to a demand for customized packaging formats. Therefore, there is on the market machinery for production of multi-layered, die-cut, and printing for corrugated boxes. As such, manufacturers are investing in modular machines with advanced packaging capabilities which is causing innovation and competition in the box making machine market.

The rapid expansion of e-commerce has fundamentally changed packaging requirements by making corrugated boxes essential in logistics and last mile delivery. Online vendors must have packaging that adequately protects the contents, is capable of being branded and branded affordably. Corrugated boxes perfectly fit all of these and consequently demand for them has escalated with the boom of e-commerce platforms like Amazon, Flipkart and Alibaba. The boom in e-commerce has also contributed to substantial investment in their production by corrugated box manufacturers to automate, exceed traditional speed, and provide customizable manufacturing capabilities to meet customers' ever evolving needs at e-commerce fulfillment centers.

In addition, the focus on sustainability and the customer experience in e-commerce has created new opportunities for the development of machines. The demand for machines that facilitate digital printing, short-run production, and recyclable materials has increased. The continued expansion of e-commerce in rural to semi-urban markets, especially in Asia-Pacific and Latin America, will also contribute to greater demand for local packaging, thus supporting more compact, semi-automatic, and more energy-efficient box making machines.

Corrugated Box Making Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.8 Billion |

| Market Size in 2025 | USD 2.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.5% |

| Market Size in 2034 | USD 4.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing consumer goods production | As the production of consumer goods increases, manufacturers need more corrugated boxes for packaging and onward distribution. This promotes demand for high-speed/high-efficiency box-making machines that can carry out large volume, continuous operations. |

| E-commerce expansion | Increasing demand for customized, durable corrugate packaging, primarily due to the growth of online shopping, accelerates innovation in box-making machines by anticipating flexibility, fast changeovers, as well as the ability to produce different box sizes, types, and/or styles. |

| Automation & smart manufacturing | Automation and smart technologies are transforming the corrugated box industry through real-time monitoring, predictive maintenance, and streamlined workflows. Machine manufacturers are embedding IoT and AI into their operations to widen productivity, reduce waste, and support sustainable production. |

| Pitfalls & Challenges | Impact |

| High initial investment costs | This constrains new market penetration for small- and medium-sized businesses, diminishing usage of advanced equipment and overall potential market growth. |

| Maintenance and repair costs | Frequent service and maintenance schedules may disrupt production schedules and increasing operating costs, ultimately affecting company profitability and multi-year machine life. |

| Opportunities: | Impact |

| Industry 4.0 integration | Smart technologies support predictive maintenance, real-time monitoring, and process efficiency, allowing machinery to perform more effectively with less down time, enhancing competitive capabilities. |

| Sustainability and ecofriendly packaging | An increasing demand for green packaging is also leading to machine innovation, which encourages machine manufacturers to simply develop new systems that are energy efficient and that follow the waste management standards put forth by the environmental regulators and consumers. |

| Market Leaders (2024) | |

| Market Leaders |

14% market share |

| Top Players |

The collective market share in 2024 is 25-30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | UK, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Corrugated Box Making Machine Market Trends

The corrugated box manufacturing machinery industry is experiencing a dynamic shift, due to changing packaging requirements associated with various industries including e-commerce, food and beverage, electronics, and pharmaceuticals. Global consumption is anticipated to increase, and, as sustainability emerges as a priority, manufacturers are looking to promote efficient manufacturing through modernized machines that can produce at higher speeds, and flexibility and are natural-based or recyclable.

- Manufacturers are adopting automated corrugated box making machinery to increase production speeds, decrease labor reliance, and provide standardized product quality. These machineries are equipped with programmable logic controllers (PLCs) programming, touch-screen controls, and monitoring programs. Smart technologies and computer applications using IoT and AI technologies enable predictive maintenance of machinery and optimization of a machinery process during run time and will be more efficient in cost.

- With the growth of e-commerce and the rise of niche products, the universal need for customization in packaging is promoting demand for machinery. Businesses need a box that represents their brand identity, fits products of various dimensions, and meets their promotional campaigns. The demand for machinery is increasing, to manufacture boxes in short run, where the machine can manage flexible production with quick changeovers and digital printing options, without loss of time.

- The concerns regarding the environment have impacted on packaging of both materials and machines. More companies are looking for machines which can convert recycled paper into products, reduce energy usage, and reduce waste. The equipment manufacturers are developing machinery to accommodate eco-friendly manufacturing practices that support sustainability efforts and regulations in countries throughout the world. This similar push for environmental awareness is leading to an uptick in the utilization of water-based inks and biodegradable adhesives in box manufacturing.

- Countries with expanding manufacturing capacities are experiencing increased demand for corrugated packaging. This is leading to increased machine sales in these areas, particularly for small and medium-sized enterprises (SMEs) substantiating reasonably inexpensive semi-automatic machines. The demand for local production, and growing consumer demand, also provides opportunities for machine manufacturers to position themselves and provide regional solutions.

Corrugated Box Making Machine Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is divided into semi-automatic and fully automatic. The fully automatic segment crossed USD 1.7 billion in 2024.

- Fully automatic machines are intended to run at very high speeds, often dispensing hundreds of boxes each minute. Characteristics of these machines are crucial for industries requiring the production of numerous boxes, such as e-commerce, food & beverage, and logistics. Automation helps to maintain consistent box dimensions, folding, and gluing to help prevent defect issues and increases overall product quality.

- The most important advantage of fully automatic machines is their capability to have limited human intervention. Fully automatic systems range and are capable of handling raw material feeding, printing, cutting, folding, and stacking completed boxes. This limits the need for skilled operators, which reduces labor costs in the long run. In addition, automating machine operations reduce human error, lessen the time to complete the full production cycle, and operate continuously with little supervision.

- Fully automatic machines are equipped with features like programmable logic controllers, touch-screen interfaces, and modular components. The presence of these components allows manufacturers to change box sizes, styles, and even printing formats without excessive downtime. Furthermore, when considering that digital printing, die-cutting, and gluing modules can all be integrated into a machine, it contributes an entirely different level of versatility in the modern manufacturing landscape.

Learn more about the key segments shaping this market

Based on box type, the corrugated box making machine market is segmented into single layer and multi-layers. The multi-layer segment held about 81% share of the global corrugated box making machine market in 2024.

- Multi-layer corrugated boxes feature two or more fluted layers, resulting in increased strength and superior protection. They are suitable for heavy, fragile, or high-value products and are often used for packaging items such as electronics, automotive parts, industrial equipment, etc. High-speed machinery for producing multi-layer boxes is becoming increasingly popular, particularly in past few years, which is particularly true in industries where product safety during transport is important.

- Due to their strength and load capability, multi-layer boxes are ideal for export packaging and bulk shipments. In international trade industries, products are packaged using multi-layer boxes to help products endure long-distance shipping as well as the challenges of transport and handling. As a result, the need for high-speed machinery that will produce multi-layer boxes in high capacity is growing, enabling capabilities such as automatic layering, gluing, and die-cutting to global packaging specifications for product safety.

- Multi-layer boxes provided additional space and structure stability for printing. Companies are using this capability to provide high-quality printing and branding, particularly B2B and retail packaging. Manufacturers have begun utilizing machines capable of multi-color flex-printing with customization options.

Based on the distribution channel, the corrugated box making machine market is segmented into direct and indirect. The Indirect segment exceeded USD 1.9 billion in 2024.

- Indirect distribution makes it easy for manufacturers to increase their geographical reach, by using the networks from dealers, agents, and other third-party distributors. Third-party distributors usually have in-depth knowledge of the local market, they may have existing customer relationships, and they have the logistical capabilities to allow machine manufacturers to seek access to a new local geography; particularly in emerging markets without requiring the machine manufacturers to establish direct sales offices.

- By utilizing sales, service, and even installations via a third party/partner, manufacturers reduce overhead costs from a larger fixed-cost in-house sales and the support staff. This leads the company to focus on research and development or product development.

- Indirect channels also provide opportunities for strategic partnerships with packager solution providers, industrial equipment resellers, and regional trade associations and networks, and can increase the brand's image and exposure in local markets.

Looking for region specific data?

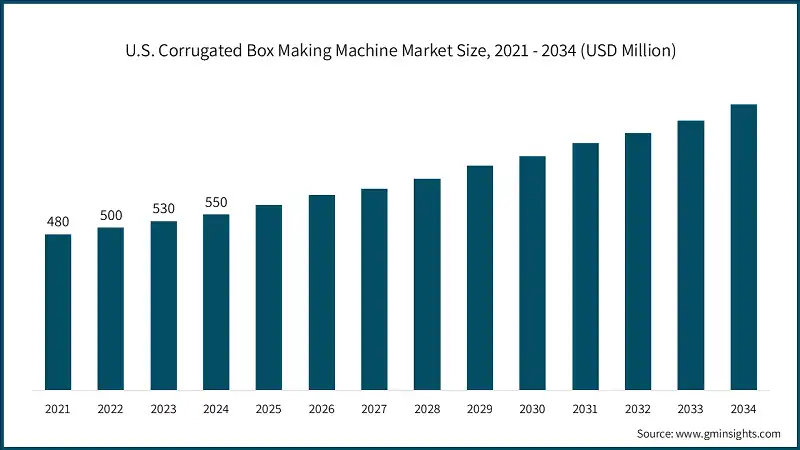

In 2024, the U.S. dominated the North America corrugated box making machine market, accounting for around 88.7% and generating around USD 550 million revenue in the same year.

- The U.S. leads the North American market for corrugated box making machines, benefitting from a leading manufacturing environment, strong standards for packaging, and a vibrant demand from key sectors such as food & beverage, and the electronics industry, as well as e-commerce. The U.S. has an established industrial ecosystem paired with a strong automation and innovation boom which has created an ecosystem that is supportive of high-speed and fully automatic machine adoption. Additionally, companies in the U.S. are increasingly demonstrating a greater willingness to acquire and invest in smart, energy-efficient, and digitally integrated equipment.

- The growth of the North American region with respect to corrugated box making machines is supported primarily through its diverse industrial base, key supply chains, and well-established distribution networks. Offline channels for machine purchasing by independent dealers and industrial supply chains remain as key access points for equipment, while online channels for research, comparative pricing, and procurements are beginning to gain traction.

- The mixed purchasing behavior for packaging machinery is aided by strong after-sale service and an ability to customize machines for regional/national standards, which is now allowing both large manufacturers and small/medium enterprises ("SMEs") to gain access to advanced packaging machinery across North America.

Europe corrugated box making machine market, Germany leads the market with 22.8% share in 2024 and is expected to grow at 5% during the forecast period.

- Europe is expanding in the market for corrugated box making machinery, due to significant focus on sustainability practices, stringent manufacturing legislation, and the increased demand for sustainable packaging in major industries. The movement toward recyclable materials and carbon neutral earnings is motivating manufacturers to consider easier and energy efficient and low-waste machinery. The presence of established packaging companies and a robust logistics network in Europe encourage the distribution of automated and modular box making machines across Europe.

- Germany is the largest market for corrugated box making machinery in Europe, due to its highly developed base industry, precision engineering disciplines, and demand from automotive, electronics and export driven industries. Germany also favors automation and innovation in industries, which has led to high-volume fully automatic machines to produce multi-layer and custom design boxes. German producers also consider quality and efficiency, which make the market suitable for advanced machines with embedded digital control and sustainability traits.

The Asia Pacific leads the corrugated box making machine market, China holds a market share of around 30.7% in 2024 and is anticipated to grow with a CAGR of around 5.4% from 2025 to 2034.

- The corrugated box making machine market in the Asia-Pacific region is rising primarily due to the region's rapid industrial development, growth in e-commerce, and increased need for cost-effective packaging solutions. The region has a large manufacturing base with rising consumer products to produce, which leads to higher demand for higher speed, scalable box making machines. In addition, many small and medium-sized enterprises exist across countries (e.g., India, Vietnam, and Indonesia) developing a demand for semi-automatic and modular machines as they can be a flexible solution at an affordable price.

- China is the leader in the corrugated box making machine market in the Asia-Pacific region due to its massive manufacturing capacity and an active export market, in addition to its leadership in global logistics of e-commerce. Moreover, with the motivation towards automation and development of infrastructure to support growth, China is in a strong position to innovate and adopt new machines. Chinese manufacturers are beginning to realize new machines capable of multi-layer boxes, digital printing, and eco-friendly materials that comply with domestic country and world packaging requirements.

Latin America corrugated box making machine market is growing at a CAGR of 3.6% during the forecast period.

- The corrugated box making machine market in Latin America is being driven by the increases in manufacturing, agriculture, and consumer goods sectors across countries like Brazil, Mexico and Colombia. The rising demand for economic, yet durable, packaging in the region is raising interest in semi-automatic and fully automatic machines. Moreover, the growth in e-commerce platforms and export-based industries in the region is prompting investment in scalable machinery that utilizes multi-layer box production and customizable flexibility.

- The corrugated box making machine market in Latin America is benefiting by way of technology transfer, skill development and investment in modern packaging infrastructure as a result of local partnerships and government initiatives. Local manufacturers, international suppliers and public entities are providing advanced machinery to the market, especially to small and medium enterprises. This allows for modernization of the packaging sector in Latin America and contributes to competitiveness in local and export markets.

Corrugated Box Making Machine Market Share

Bobst Group is leading with 14% market share. Bobst Group, Mitsubishi Heavy Industries, ISOWA Corporation, EMBA Machinery, and Fosber Spa collectively hold around 25-30%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Bobst is a global leader in the supply of machinery and services to packaging and label manufacturers. With an established history of innovation and engineering, Bobst provides solutions for multiple packaging sectors including folding carton, corrugated board, and flexible materials. The company is recognized for its commitment to quality, automation, and sustainability, supporting its customers to compete and improve productivity while lowering the impact to the environment through digitization and advanced technologies.

- Fosber designs and manufactures machinery for the corrugated board industry, complete corrugator lines and single units to meet customer requirements. Fosber is known for its dedication to innovation, reliability, and quality customer service by providing solutions for production efficiency and flexibility. Fosber systems are designed to provide high-speed/high-quality output with minimal downtime and maintenance when used properly.

Corrugated Box Making Machine Market Companies

Major players operating in the corrugated box making machine industry are:

- ACME Machinery

- Bobst Group

- EMBA Machinery

- Fosber

- ISOWA

- KOLBUS

- Mitsubishi Heavy Industries

- Packsize International

- Saro Packaging Machine Industries

- Serpa packaging Solutions

- Shanghai Printyoung International Industry

- Hebei Shengli Carton Equipment

- Shrink Machine

- Wenzhou Zhongke Packaging Machinery

- Zemat Technology Group

KOLBUS is a German engineering firm recognized for its precision and craftsmanship in the manufacturing of packaging machinery for many decades. KOLBUS is solely focused on supplying machines and equipment for the conversion of paperboard and corrugated materials into high quality packaging products. KOLBUS produces sustainable and modular equipment based on solid construction that is best suited for industries that require both performance and cosmetic excellence in their packaging.

EMBA Machinery is a Swedish firm designing and manufacturing high-performance converting machines for the corrugated packaging industry. Known for non-crush technology and energy-efficient systems that deliver rapid speed, precision and saving materials, EMBA supports customers around the world with a strong service network and innovators of box-making technology.

Corrugated Box Making Machine Market News

- In September 2025, EMBA Machinery made its name in the Indian market back in 2011 when it was the earliest to bring inline flexo folder gluers (FFGs). EMBA provided a commitment to a continuous innovative spirit at the IndiaCorr Expo 2025 by debuting its latest technologies. As a long-valued partner of the ICCMA, EMBA sold the audience on its ULTIMA series machines manufactured in the USA. With patented non-crush technology, twin feed for dual boxes, and a liquid creaser system, all made for the best solution to try to solve real-world problems that converters address.

- In September 2025, At IndiaCorr Expo 2025, Fosber Group presented its premium high-performance corrugation machinery as a luxury brand with a well-earned reputation for quality and high-level specification, highlighting underlying engineers' design, reliable machines, and engineering-based originality and performance. Referring to leading automotive brands, Fosber showcased its pasteurization plants tailored for automation and premium performance, highlighting its dedication to an evolving India - a marketplace looking to increase automation, machine performance, and environmental improvements with greater demand coming from India.

- In November 2024, the Mitsubishi Heavy Industries Americas (MHIA) Corrugating Machinery Division announced the successful installation of North America's first MPF-MII Prefeeder, showcasing a strong push in front-end automation for corrugated box plants, The unit is worth noting as it can work cohesively with the high-speed flexo folder gluers such as the EVOL 84 and EVOL 100. The trolling and stable sheet feeding operation optimizes performance. Other operating functions such as swing conveyor, middle hopper and sheet-reversing lift, help maximize machine uptime and operating throughput with speed and accuracy.

- In September 2024, The BOBST Group has increased its global presence with the new R&D and manufacturing facility in Busan, South Korea, reinforcing its commitment to supporting customers in Asia and across the globe. The production site will manufacture machines for the corrugated board industry, significantly including the recently introduced NOVAFFG and VISIONFFG, and sees BOBST return to the large-format machinery sector alongside the JUMBO. Located in a region of rapid growth for packaging, the new site strengthens the regional capability for innovation and local services, while being part of a global portfolio of demand ownership.

The corrugated box making machine market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Type

- Semi-automatic

- Fully automatic

Market, By Box Type

- Single layer

- Multi-layer

Market, By Capacity

- Low (1-3 tons)

- Mid (3-5 tons)

- High (above 5 tons)

Market, By End Use

- Food & beverage

- Electronics & consumer goods

- Home & personal goods

- Textile goods

- Others

Market, By Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the corrugated box making machine market?

Key players include ACME Machinery, Bobst Group, EMBA Machinery, Fosber, ISOWA, KOLBUS, Mitsubishi Heavy Industries, Packsize International, Saro Packaging Machine Industries, Serpa packaging Solutions, Shanghai Printyoung International Industry, Hebei Shengli Carton Equipment, Shrink Machine, Wenzhou Zhongke Packaging Machinery, and Zemat Technology Group.

What is the growth outlook for Germany's market from 2025 to 2034?

Germany is expected to grow at 5% CAGR through 2034, driven by its highly developed industrial base, precision engineering, and strong demand from automotive and electronics sectors.

Which region leads the corrugated box making machine market?

China holding around 30.7% market share in 2024 and anticipated to grow at a CAGR of 5.4% from 2025 to 2034, driven by massive manufacturing capacity and e-commerce growth.

What are the upcoming trends in the corrugated box making machine market?

Key trends include Industry 4.0 integration with IoT-enabled machines and AI-based diagnostics, focus on sustainable and eco-friendly packaging solutions, automation with smart technologies, and customization capabilities for short-run production with digital printing.

What was the market share of the multi-layer box type segment in 2024?

Multi-layer boxes held 81% of the global corrugated box making machine market in 2024, driven by demand for superior strength and protection for heavy and fragile products.

How much revenue did the fully automatic segment generate in 2024?

Fully automatic machines generated USD 1.7 billion in 2024, holding the major market share due to high-speed production capabilities and minimal human intervention requirements.

What is the current corrugated box making machine market size in 2025?

The market size is projected to reach USD 2.9 billion in 2025.

What is the market size of the corrugated box making machine in 2024?

The market size was estimated at USD 2.8 billion in 2024, with a CAGR of 4.5% expected through 2034 driven by increasing consumer goods production, e-commerce expansion, and automation in manufacturing.

What is the projected value of the corrugated box making machine market by 2034?

The corrugated box making machine market is expected to reach USD 4.3 billion by 2034, propelled by sustainability initiatives, smart manufacturing adoption, and growing demand for customized packaging solutions.

Corrugated Box Making Machine Market Scope

Related Reports