Summary

Table of Content

Construction Valve Seat Insert Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Construction Valve Seat Insert Market Size

The construction valve seat insert market was valued at USD 741.9 million in 2024 and is projected to grow at a CAGR of 2.9% between 2025 and 2034. Increased investment in infrastructure development significantly drives market growth. Governments and private sectors worldwide are allocating substantial budgets to build and upgrade roads, bridges, railways, and commercial buildings. These large-scale projects require a wide range of construction equipment, such as excavators, bulldozers, and cranes, that rely on durable and efficient engine components, including valve seat inserts.

To get key market trends

For instance, in February 2025, according to the National Bureau of Statistics, China’s infrastructure investment grew by 5.8% year-on-year in the first quarter of 2025. Major builders like China Railway 24th Bureau Group Corp (CR24G) report that many projects are progressing on or ahead of schedule. Cities like Chengdu saw 5.9% growth in investment in million-yuan projects in Q1, contributing significantly to provincial growth.

Construction Valve Seat Insert Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 741.9 Million |

| Forecast Period 2025 - 2034 CAGR | 2.9% |

| Market Size in 2034 | USD 934.5 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The growth in construction activities is a significant driver for the construction valve seat insert market. As infrastructure projects and urbanization increase globally, particularly in emerging economies like India, China, and the UAE, there is a rising demand for construction machinery. These machines, including excavators, bulldozers, and backhoes, rely heavily on high-performance valve seat inserts to ensure engine efficiency and durability under extreme conditions.

For instance, according to Statista, the market size of the U.S. construction sector was valued at nearly 2 trillion U.S. dollars in 2023, and it was expected to keep rising in the next couple of years. By 2027, the overall value of construction put in place in the United States, which includes the residential, non-residential, and non-building segments, is forecast to reach nearly 2.24 trillion U.S. dollars.

Construction Valve Seat Insert Market Trends

- The industry is witnessing significant innovations in materials, such as alloyed steel, sintered metals, and beryllium copper, enhancing the durability and heat resistance of construction valve seat inserts. These advancements are crucial for meeting the demands of modern high-performance engines, ensuring longer service life and improved engine efficiency.

- The increasing emphasis on sustainability in the construction industry has driven the demand for eco-friendly valve seat inserts. Manufacturers are focusing on producing inserts with reduced environmental impact, such as using recyclable materials. This trend aligns with global sustainability goals and regulatory pressures on emissions and fuel efficiency.

- As the construction sector moves towards electrification and hybrid powertrains, valve seat inserts designed for these systems are becoming more relevant. These innovations aim to optimize engine performance, fuel efficiency, and emissions in electric and hybrid construction machinery, fueling demand for new valve seat technologies.

- For instance, in September 2024, the global electric construction equipment market was valued at USD 12.2 billion in 2023 and is estimated to grow at a CAGR of over 23.2% between 2024 and 2032, owing to the urbanization and global infrastructure initiatives.

Trump Administration Tariffs

- The imposition of 25% tariffs on steel and aluminum imports from countries like China, Canada, and Mexico has significantly increased the cost of raw materials essential for manufacturing valve seat inserts. This surge in material costs has led to higher production expenses, compelling manufacturers to either absorb the increased costs or pass them on to consumers, affecting the overall market dynamics.

- The tariffs have disrupted established global supply chains by making imported components more expensive and less predictable. Manufacturers relying on international suppliers for specific parts now face challenges in sourcing, leading to delays and increased lead times. This disruption necessitates finding alternative suppliers or reshoring production, both of which involve additional costs and logistical complexities.

- The unpredictable nature of tariff implementations has introduced significant uncertainty into the market. Manufacturers and construction firms find it challenging to forecast costs and plan long-term investments. This uncertainty can lead to postponed or canceled projects, reduced capital expenditure, and a cautious approach to expansion, stifling growth in the construction equipment sector.

Construction Valve Seat Insert Market Analysis

Learn more about the key segments shaping this market

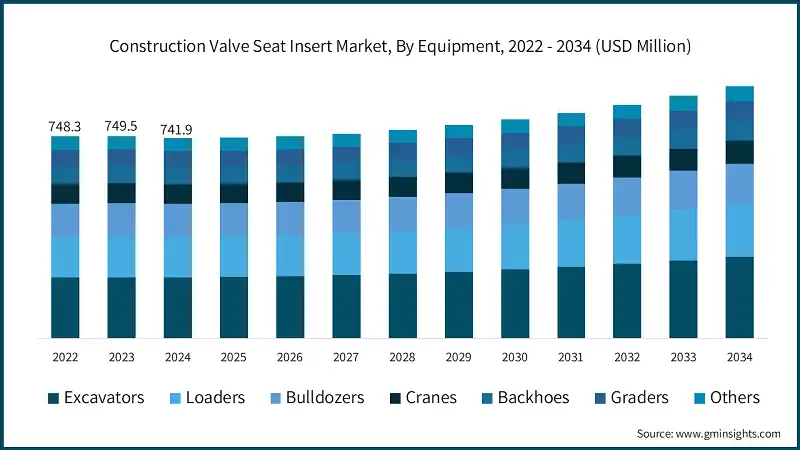

Based on equipment, the market is divided into excavators, loaders, bulldozers, cranes, backhoes, graders, and others. In 2024, the excavators segment dominated the market, accounting for around 30% share and is expected to grow at a CAGR of over 4.2% during the forecast period.

- The excavators segment holds the highest market share in the construction valve seat insert market due to its extensive and versatile usage across construction, mining, and infrastructure development projects. Excavators are essential for tasks such as earthmoving, trenching, and material handling, which are frequent and intensive operations that place significant stress on engine components like valve seat inserts.

- These machines often operate in harsh conditions and for prolonged hours, requiring durable and heat-resistant inserts to ensure engine longevity and performance. Additionally, increasing urbanization and large-scale infrastructure projects in developing regions have spurred demand for excavators, further driving the need for high-quality engine components.

- The regular wear and tear in excavator engines also creates a strong aftermarket for valve seat insert replacements, reinforcing their dominant market position within this equipment category.

- For instance, according to Statista, Canada imported over three billion U.S. dollars worth of excavators and shovel loaders in 2022. The imports of those products into Germany, Australia, and Indonesia were valued at over two billion U.S. dollars. Excavators and shovel loaders, also known as wheel loaders, are often used for construction.

Learn more about the key segments shaping this market

Based on engine, the market is segmented into gasoline engines, diesel engines, gas engines (natural gas, CNG, LPG), hybrid engines, and others. In 2024, the gasoline engines segment dominates the market with 43% of market share and is expected to grow at a CAGR of over 4% from 2025 to 2034.

- Gasoline engines hold the highest market share in the construction valve seat insert market due to their widespread use in light-to-medium construction equipment, such as backhoes, compact excavators, and small loaders. These machines are preferred for their lower upfront cost, ease of maintenance, and suitability for urban and residential construction sites where emissions and noise levels are regulated.

- Gasoline engines also provide a quicker throttle response and are ideal for applications requiring intermittent operations rather than continuous heavy-duty cycles. Moreover, developing regions in Asia-Pacific and the Middle East, including the UAE, favor gasoline-powered machinery for smaller infrastructure projects due to fuel accessibility and cost-efficiency.

- As emission norms tighten globally, manufacturers are improving gasoline engine efficiency and durability, further boosting the demand for high-performance valve seat inserts tailored to these engines.

Based on material, the construction valve seat insert market is segmented into iron alloys, steel, nickel-based alloys, cobalt-based alloys, and other, with the iron alloys category expected to dominate due to their excellent thermal stability, durability, and cost-effectiveness.

- Iron alloys, particularly cast iron and high-carbon steels, are widely used for construction valve seat inserts because they can withstand the extreme temperatures and pressures encountered in internal combustion engines. They also offer good wear resistance, essential for prolonged engine performance.

- Additionally, iron alloys are relatively easier to manufacture and can be produced at lower costs compared to other materials like ceramics or nickel-based alloys. Their versatility in meeting the demands of both light-duty and heavy-duty vehicles further drives their popularity.

- The growing automotive production, particularly in developing regions, and the need for high-performance yet affordable solutions in the aftermarket contribute to the dominance of iron alloys in the market.

Looking for region specific data?

In 2024, the China region in Asia Pacific dominated the construction valve seat insert market with around 39% market share and generated around USD 134.9 million in revenue.

- China plays a dominant role in the market due to its expansive construction equipment manufacturing base and strong infrastructure development activities. The country's growing urbanization and government-backed infrastructure projects drive consistent demand for heavy-duty engines, which in turn fuels the need for durable valve seat inserts.

- Additionally, increasing regulatory pressure for emissions compliance is pushing manufacturers to invest in advanced, high-performance inserts to meet evolving engine efficiency and environmental standards.

- For instance, according to Statista, in 2024, approximately 67 percent of the total population in China lived in cities. The urbanization rate has increased steadily in China over the last decades. Among the ten largest Chinese cities in 2021, six were located in coastal regions in East and South China.

The construction valve seat insert market in Germany is expected to experience significant and promising growth from 2025 to 2034.

- Germany holds a prominent position in the market due to its strong construction equipment manufacturing base and advanced engineering capabilities. The presence of key OEMs and tier-1 suppliers fosters high demand for durable and precision-engineered valve seat inserts.

- Moreover, Germany’s focus on smart manufacturing and sustainable construction practices encourages R&D in advanced materials, enhancing the competitiveness of valve seat insert producers in the region. Steady infrastructure investments further support long-term market growth.

- For instance, according to GTAI (Germany Trade & Invest), they reported that Germany’s M&E industry (Machine & Equipment) sector remains the world’s leading supplier of machinery and equipment – ahead of China and the USA. German manufacturers are the world leaders in 13 out of 31 M&E sectors in international comparison. In a further eight categories, German companies occupy second spot compared to their international rivals.

The construction valve seat insert market in the U.S. is expected to experience significant and promising growth from 2025 to 2034.

- The U.S. market is experiencing steady growth, driven by the country's robust infrastructure development and the demand for durable engine components in heavy-duty construction machinery. The increasing emphasis on fuel efficiency and stringent emission regulations has led to the adoption of advanced valve seat inserts that enhance engine performance and longevity.

- Technological advancements in material science, such as the development of heat-resistant and wear-resistant alloys, further contribute to the market's positive outlook. Overall, the U.S. market is poised for continued growth, reflecting broader trends in the North American region.

- For instance, according to Statista, in 2024, power construction spending in the U.S. was roughly USD 148 billion. The spending on highway, street construction, and other transportation projects rose from USD 137 billion in 2015 to USD 212 billion in 2024.

The construction valve seat insert market in the UAE is expected to experience significant and promising growth from 2025 to 2034.

- The UAE market is poised for growth, driven by the nation's ambitious infrastructure projects and economic diversification efforts. The UAE's "We the UAE 2031" vision aims to double its GDP to AED 3 trillion and generate AED 800 billion in non-oil exports, leading to increased construction activities and, consequently, a higher demand for construction machinery and components like valve seat inserts.

- Additionally, the UAE's commitment to stringent emission norms compels equipment manufacturers to adopt advanced valve seat inserts that enhance engine efficiency and reduce emissions. The presence of key industry players and a focus on technological advancements also contribute to the market's positive outlook.

- For instance, in October 2024, the United Arab Emirates initiated a comprehensive package of water infrastructure projects aimed at strengthening national resilience and supporting the UAE Water Security Strategy 2036. These efforts are designed to address the country’s arid climate, limited freshwater resources, and increasing demand due to population and industrial growth.

Construction Valve Seat Insert Market Share

- Top 7 companies of the construction valve seat insert industry are MAHLE, Tenneco, Eaton Corporation, Mitsubishi Materials Corporation, BorgWarner, Nippon Piston Ring, and L.E. Jones around 35% of the market in 2024.

- MAHLE focuses on advanced materials and precision manufacturing to enhance durability and thermal resistance in Construction Valve Seat Inserts. The company invests in R&D for lightweight and high-performance engine components, aligning with stricter emissions regulations. MAHLE also collaborates closely with OEMs to provide customized solutions and expand its presence in both ICE and hybrid powertrain applications globally.

- Tenneco leverages its Powertrain division (formerly Federal-Mogul) to supply high-quality Construction Valve Seat Inserts tailored for performance and longevity. The company emphasizes material innovation, particularly in sintered alloys, to meet the needs of downsized, turbocharged engines. Tenneco also targets growth in emerging markets and diversifies its product portfolio to support hybrid and alternative fuel engines, ensuring continued relevance amid shifting propulsion trends.

- Eaton focuses on precision-engineered Construction Valve Seat Inserts designed for durability in high-stress, high-temperature engine environments. The company emphasizes sustainability through fuel-efficient engine solutions and supports the transition to low-emission vehicles. Eaton leverages its strong OEM relationships and global manufacturing capabilities to remain competitive, while also expanding its offerings to support emerging engine technologies in both automotive and industrial sectors.

Construction Valve Seat Insert Market Companies

Major players operating in the construction valve seat insert industry are:

- MAHLE

- AVL List

- BorgWarner

- Eaton

- Forvia SE (Faurecia)

- GKN Automotive

- L.E. Jones

- Mitsubishi Materials

- Nippon Piston Ring

- Tenneco

The current market strategy in the construction valve seat insert market focuses on enhancing material durability, especially through advanced alloy and ceramic composites, to meet heavy-duty engine demands. Companies prioritize expanding regional manufacturing hubs near construction equipment OEMs, particularly in Asia-Pacific. Customization, compliance with emission norms, and strengthening aftermarket distribution networks are also key to capturing long-term equipment servicing and replacement demand.

Additionally, manufacturers are investing in R&D to innovate heat-resistant and wear-resistant valve seat inserts that can perform under extreme load and thermal conditions typical in construction machinery. Strategic partnerships with engine OEMs, along with digital inventory and supply chain optimization, help companies ensure timely delivery and reduce operational costs. There's also a growing focus on sustainability, with efforts to incorporate recyclable materials and eco-efficient manufacturing processes.

Construction Valve Seat Insert Industry News

- In January 2025, MAPAL introduced the HNHX indexable inserts specifically for valve seat machining, focusing on maximizing cost efficiency and machining performance. The standout feature of these inserts is the ability to offer up to 24 usable cutting edges, significantly reducing the cost per part in cylinder head production. The HNHX inserts are hexagonal like their HX predecessors but can be turned, doubling the number of available cutting edges from six to twelve. The inserts utilize PcBN (polycrystalline cubic boron nitride), known for its durability and ability to produce high-quality surfaces.

- In September 2024, the inaugural Valve World Expo India was held at the Bombay Exhibition Centre (BEC) in Mumbai. This event marked the launch of the India chapter of the global Valve World Expo series, which has been held since 2010 in Düsseldorf and expanded to other countries including China, the USA, and Singapore. The event focused on the industrial valves industry, including Construction Valve Seat Inserts, and featured around 80 international and Indian exhibitors. Key industry players and associations supported the expo, emphasizing its significance in the region.

- In May 2024, L.E. Jones Company was granted a U.S. patent US11988294B2 for a novel valve seat design that incorporates ceramic components. This patent covers an innovation in valve seat technology, specifically integrating ceramic materials into the valve seat structure. This innovation enhances the valve seat's durability and ability to withstand high temperatures, benefiting high-performance engines. The patent positions L.E. Jones Company as a leader in advanced valve seat technology, meeting evolving industry requirements for durability and performance.

- In February 2024, Cooper Machinery Services, a U.S.-based industrial equipment supplier, acquired Tucker Valve Seat Company for an undisclosed amount. Tucker Valve Seat Company, founded in 1957 and based in Odessa, Texas, is a well-established manufacturer of industrial alloy valve seats, serving critical applications in LP, gas, diesel, natural gas, and unleaded fuel engines. This acquisition aims to enhance Cooper's product offerings and technical expertise in valve technology, particularly in the area of Construction Valve Seat Inserts.

The construction valve seat insert market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) and shipment (Units) from 2021 to 2034, for the following segments:

Market, By Material

- Iron alloys

- Steel

- Nickel-based alloys

- Cobalt-based alloys

- Other

Market, By Equipment

- Excavators

- Loaders

- Bulldozers

- Cranes

- Backhoes

- Graders

- Others

Market, By Engine

- Gasoline engines

- Diesel engines

- Gas engines (Natural Gas, CNG, LPG)

- Hybrid engines

- Others

Market, By Sales Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in construction valve seat insert market?

Some of the major players in the construction valve seat insert industry include MAHLE, AVL List, BorgWarner, Eaton, Forvia SE (Faurecia), GKN Automotive, L.E. Jones.

How much construction valve seat insert market share captured by China in 2024?

The China construction valve seat insert market held around 39% share in 2024.

What will be the growth of gasoline engines segment in the construction valve seat insert industry?

The gasoline engines segment is anticipated to grow at a CAGR of over 4% from 2025 to 2034.

How big is the construction valve seat insert market?

The construction valve seat insert market was valued at USD 741.9 million in 2024 and is expected to reach around USD 934.5 million by 2034, growing at 2.9% CAGR through 2034.

Construction Valve Seat Insert Market Scope

Related Reports