Summary

Table of Content

Combat Drones Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Combat Drones Market Size

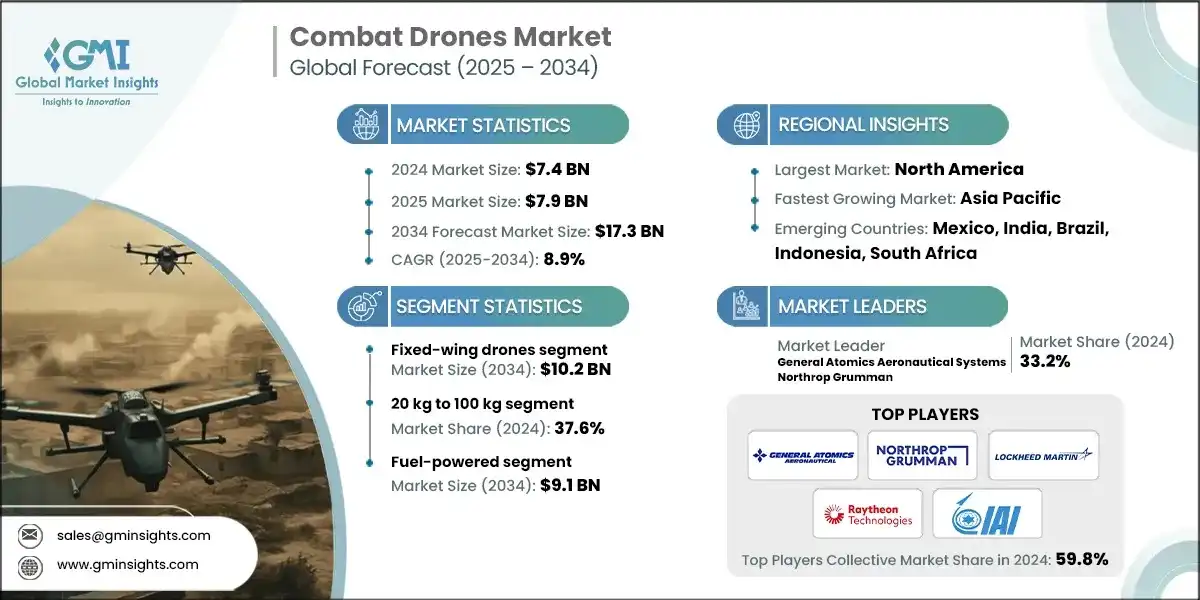

The global combat drones market was valued at USD 7.4 billion in 2024 with a volume of 3,647 units. The market is expected to grow from USD 7.9 billion in 2025 to USD 11.8 billion by 2030 and USD 17.3 billion by 2034 with a volume of 7,833 units, growing at a value CAGR of 8.9% and volume CAGR of 8.1% during the forecast period of 2025-2034.

To get key market trends

- The increasing modernization of forces, growing defense expenditure and the accelerated technological progress in AI, sensors, and autonomy are driving the demand of combat drones.

- Defense modernization is being emphasized in emerging economies, with considerable resources being devoted to the development of unmanned aerial combat. The increase in military expenditures allows the acquisition of high-tech drone systems and the maintenance of technological balance with the major powers. As an example, IBEF estimates that the defense budget of India will grow by 9.5 percent, increasing from USD 71.42 billion to USD 78.32 billion in 2025-26. This budgetary increase highlights the increasing readiness of developing countries to invest in next-generation combat drones to enhance the readiness of forces and strategic deterrence.

- Sustained innovation in artificial intelligence, sensor fusion, and autonomous flight is transforming the combat drone industry. These inventions are increasing mission success, survivability and accuracy in complex combat environments. In July 2025, Auterion received a USD 50 million Pentagon contract to deliver 33,000 AI-controlled drone strike kits to Ukraine. The Skynode system developed by the company transforms the manual drones into autonomous weapons that are jam-resistant and have a 1 km range with an AI-driven targeting system. This underscores the rapid implementation of AI-enabled autonomy in combat drones, which solidifies their strategic contribution to contemporary warfare.

- As of 2024, North America held a 35.5% share of the combat drones market. The North American market is the largest in combat drones due to robust defense budgets, developed research and development, and the introduction of next-generation UCAVs. In December 2024, Kratos managed to fly its Thanatos stealthy UCAV, which is to be used in high-risk missions, including reconnaissance, electronic warfare, and precision attacks, which further enhances the technological edge of the region.

Combat Drones Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 7.4 Billion |

| Market Size in 2025 | USD 7.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.9% |

| Market Size in 2034 | USD 17.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Force modernization and rising defense spending | Drives combat drones demand by over 35% due to force modernization and rising defense spending, enabling militaries to acquire advanced unmanned systems for enhanced operational readiness. |

| Rapid technological advancements in AI, sensors, and autonomy | Boosts market growth by approximately 30% through rapid technological advancements in AI, sensors, and autonomy, improving mission efficiency, precision, and adaptability in complex operational environments. |

| Escalating security threat landscape and geopolitical instability | Supports market expansion by around 25% in response to escalating security threats and geopolitical instability, prompting the deployment of UAVs for reconnaissance, surveillance, and strategic strike operations. |

| Regulatory shifts and export liberalization | Enhances market opportunities by roughly 20% through regulatory shifts and export liberalization, facilitating broader international adoption and cross-border defense collaborations. |

| Strategic alliances and supply-chain expansion | Drives market development by about 15% via strategic alliances and supply-chain expansion, enabling faster production, technology sharing, and global deployment of advanced combat UAVs. |

| Pitfalls & Challenges | Impact |

| High development and procurement costs | Acts as a market restraint due to high development and procurement costs, limiting the adoption of advanced combat drones and requiring significant defense investment. |

| Stringent regulatory and export control restrictions | Constrains market growth because of stringent regulatory and export control restrictions, restricting cross-border sales, technology transfer, and international deployment of UAV systems. |

| Opportunities: | Impact |

| Integration of artificial intelligence and machine learning | Drives market growth through the integration of artificial intelligence and machine learning, enabling autonomous operations, enhanced decision-making, and improved mission efficiency in complex environments. |

| Expansion of swarm drone capabilities | Boosts operational effectiveness by expanding swarm drone capabilities, allowing coordinated deployment of multiple UAVs for reconnaissance, strike, and electronic warfare missions. |

| Growing adoption of hybrid and stealth technologies | Supports market development with the growing adoption of hybrid and stealth technologies, enhancing survivability, operational range, and the ability to penetrate advanced air defense systems. |

| Export potential to emerging defense markets | Enhances market opportunities through export potential to emerging defense markets, facilitating wider adoption of modern UAV solutions and strengthening national security capabilities. |

| Market Leaders (2024) | |

| Market Leaders |

Top 2 players held 33.2% market share |

| Top Players |

Collective market share in 2024 is 59.8% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | Mexico, India, Brazil, Indonesia, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Combat Drones Market Trends

- The use of stealth and low-observable technologies on combat drones is gaining momentum as the defense forces are in increasing need of platforms that can perform in high-threat conditions. The drones are intended to avoid being detected by advanced air defense systems, allowing operations in contested or hostile areas with less risk. In the coming decade, the stealth-capable UAVs are likely to be a common place in military armories. The use of stealth combat drones will most likely rise in 2025-2030.

- Combat drone operations are being revolutionized by the integration of artificial intelligence and autonomous strike capabilities, which enable unmanned systems to operate with a minimal human presence. AI supports decision-making in real-time, optimal route planning, and mission adaptability, even in contested or electronically denied environments. The autonomous combat drones will be the leading defense strategies in the future, with the military increasingly demanding platforms that minimize the risks associated with their operations and increase responsiveness and accuracy. These systems are anticipated to be in high demand by 2030.

- Swarm drone operations are gaining popularity as the military forces acknowledge the strategic advantages of using multiple inexpensive, coordinated UAVs to infiltrate and eliminate advanced enemy defenses. Swarm-based systems support shared operations, real-time intelligence exchange, and the implementation of complex surveillance or strike operations that could not be achieved through single platforms. The development of AI-based coordination and communication is likely to make these systems part of operational planning. Swarm drones are expected to become an extensive defense concept in North America, Europe, and Asia by 2028, improving operational efficiency and mission agility.

- The expansion of dual-use combat drones is providing new operational opportunities in logistics and resupply missions. In addition to strike and reconnaissance capabilities, unmanned systems are being modified to provide the necessary supplies, such as ammunition, medical assistance, and rations, directly to the conflict or inaccessible areas. These improvements increase the sustainability of the battlefield, as well as the range of operations and reduce the risk to the personnel. Within the next ten years, 2025-2035, combat drones enabled by logistics are likely to become a standard, part of military support operations and humanitarian aid in conflict or disaster-impacted areas.

Combat Drones Market Analysis

Learn more about the key segments shaping this market

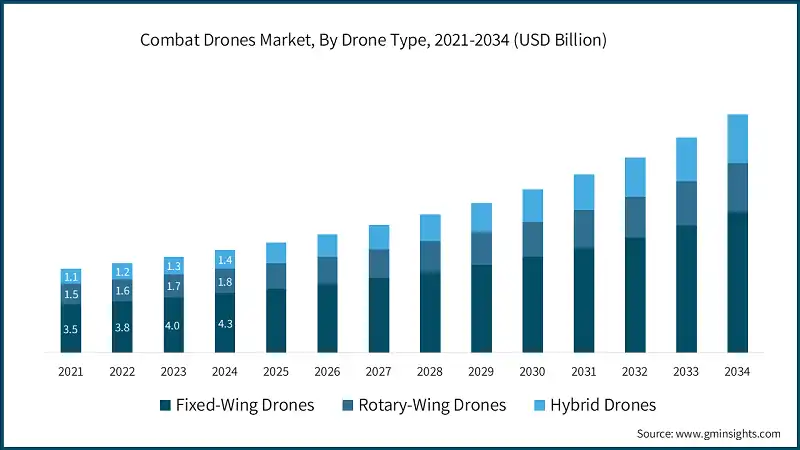

On the basis of drone type, the market is segmented into fixed-wing drones, rotary-wing drones, and hybrid drones.

- The fixed-wing drones segment is anticipated to reach USD 10.2 billion by 2034. Fixed-wing combat drones are experiencing a high adoption rate as these drones have long endurance, a larger payload capacity, and are suitable in long-range strike and surveillance operations. They are favored by militaries in mass operations and border patrol particularly in North America and Asia.

- To remain competitive in fixed wing platforms, manufacturers of drones should consider improving stealth capabilities and integrating advanced ISR payloads.

- The hybrid drones segment is anticipated to grow at a CAGR of 10.2% during the forecast period 2025 - 2034. Hybrid drones are on the rise due to their flexibility in vertical takeoff and landing (VTOL) with fixed-wing endurance. This maneuverability renders them appealing in city warfare and maritime operations. Such platforms are being rapidly deployed in emerging markets.

- Manufacturers of drones must invest in optimization of VTOL and modular designs to meet the needs of defense forces requiring multipurpose mission profiles.

Learn more about the key segments shaping this market

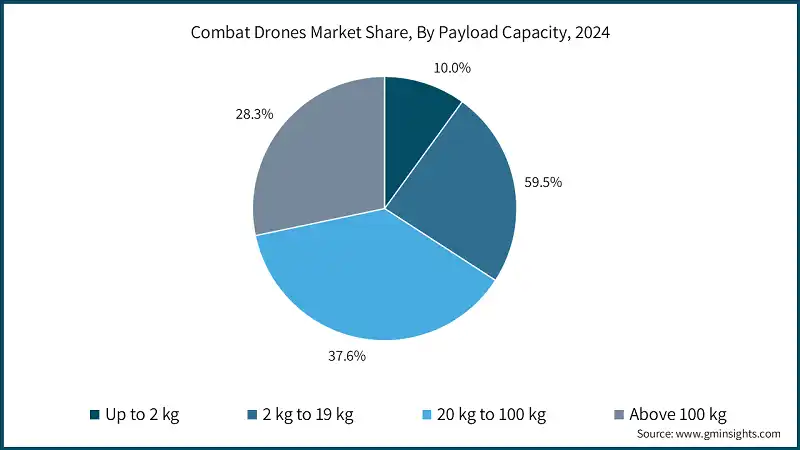

On the basis of payload capacity, the combat drones market is divided into up to 2 kg, 2 kg to 19 kg, 20 kg to 100 kg and above 100 kg.

- The 20 kg to 100 kg segment dominated the market with a market share of 37.6% in 2024. Combat drones in the 20–100 kg range are being increasingly employed in tactical operations such as precision attacks and reconnaissance as they are portable and affordable. This type is especially attractive to developing countries that are modernizing their armies with small budgets.

- Manufacturers need to produce light, AI-powered systems that have affordable components to appeal to budget-conscious defense markets.

- The above 100kg segment is anticipated to grow at a CAGR of 10.1% during the forecast period 2025 - 2034. Long-endurance and high-payload missions, such as strike, ISR, and electronic warfare, are dominated by heavy combat drones of over 100 kg. There is increased demand in sophisticated armies like the U.S., China and NATO allies where drones act as force multipliers.

- Manufacturers must aim at incorporating sophisticated stealth, swarm compatibility and modular weapon systems to enhance their adoption by major defense forces.

On the basis of power source, the combat drones market is segmented into battery powered, hybrid-powered and fuel-powered.

- The fuel-powered market is anticipated to reach USD 9.1 billion by 2034. Hybrid-powered drones are becoming a popular option in terms of endurance and fuel efficiency, allowing them to perform longer missions without frequent refueling. They are especially applicable in reconnaissance and electronic warfare missions where persistence is paramount.

- Manufacturers ought to focus on R&D of hybrid propulsion technologies to provide greater efficiency, reliability, and operational flexibility.

- The hybrid-powered market is anticipated to grow at a CAGR of 10.3% during the forecast period 2025 - 2034. Drones that are fuel-powered still prevail in heavy combat categories because of reliability, increased payload capacity, and capability of supporting long-range missions. They are likely to continue to be used in countries with advanced air combat requirements.

- Manufacturers must improve fuel efficiency and install sophisticated cooling mechanisms to increase performance under various combat conditions.

Looking for region specific data?

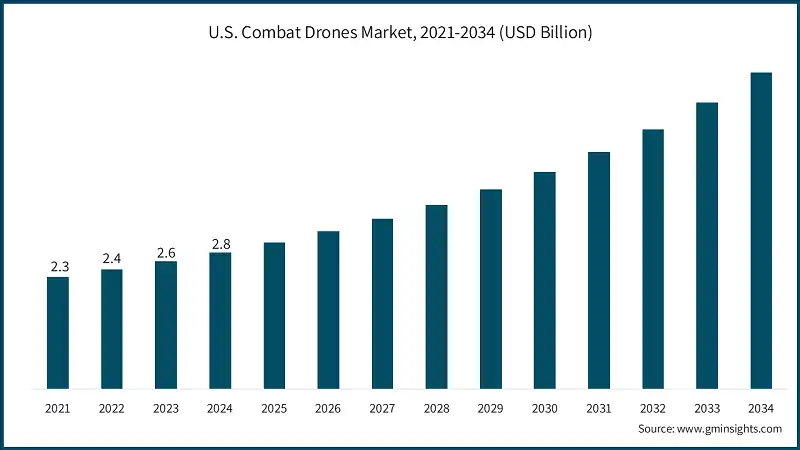

North America held a market share of 40.8% in 2024 and is anticipated to grow at a CAGR of 8.8% during the forecast period 2025 - 2034. North America continues to be the most prominent market in combat drones due to high defense expenditure, early adoption of new technologies, and its ongoing investment in R&D. The region focuses on stealth-capable, AI-driven UCAVs to retain air dominance in the globe and to sustain multi-domain operations.

- U.S. dominated the combat drones market, accounting for USD 2.8 billion in the year 2024. The US dominates the regional market due to its strong defense budget, wide use of combat drones, and the development of next-generation UCAVs. Its technological superiority is further reinforced by programs such as the Loyal Wingman, high-level swarm tests, and AI-based autonomy.

- Drones manufacturers should be in line with U.S. modernization programs and focus on scalable drone systems that can be incorporated into current and future air combat plans.

- Canada is anticipated to grow at a 7.7% CAGR during the forecast period 2025 - 2034. In July 2025, Canada progressed with plans to procure combat drones to complement and increase the fighting capability of its future fleet of F-35 fighter jets. The Department of National Defence had already embarked on research to consider UAV solutions that could be used with F-35s, highlighting its transition to drone-enabled force multipliers.

- Manufacturers of drones need to pursue the Canadian market with interoperable UCAVs capable of integrating well with F-35s with a focus on compatibility, multi-role capabilities, and NATO-standard systems.

Europe accounted for 21.2% of the global combat drones market in 2024 and is anticipated to grow with a CAGR of 8.2% during the forecast period 2025 - 2034. The combat drones industry in Europe is steadily growing due to the growing modernization of the defence sector, cross-border co-operations, and the growing use of AI-enabled UCAVs. Regional operations aim at reinforcing multi-domain operations and increasing ISR capabilities.

- Germany is anticipated to grow at a 9.8% CAGR during the forecast period 2025 - 2034. The combat drone market in Germany is driven by strategic emphasis on the integration of UAVs on the large scale and multi-role operational capability. The German military acquired around 8,300 drone systems by 2029 in August 2025, including unmanned aerial systems, interceptors, loitering munitions and other such systems.

- Drone producers must aim to provide a wide range of interoperable UAVs, loitering munitions and support systems to meet the requirements of Germany large-scale procurement and multi-mission operations.

- UK's combat drones market is anticipated to grow at a 8.3% CAGR during the forecast period. The UK combat drone market is being fuelled by the push to develop air dominance and ISR operations. The country is also investing on stealth, AI, and autonomous drone initiatives to enhance domestic defense and NATO operations.

- Drone manufacturers should offer platforms with high autonomy, secure communication links, and multi-role payload flexibility to meet UK defense modernization goals.

Asia-Pacific held a share of 31.2% in the global combat drones market and is the fastest-growing region with a 9.8% CAGR during the forecast period. Rising defense modernization initiatives, territorial disputes, and the adoption of AI-enabled UCAVs are driving the Asia Pacific market. The nations are progressively investing on local drone initiatives and cross-border partnerships to advance ISR and attack capabilities.

- The combat drones market in China is anticipated to reach USD 2.5 billion by the year 2034. The combat drone market in China is being driven by strategic focus on the modernization of its forces and technological independence. The nation is increasing its local UCAV manufacturing to serve national defense and export to partner states.

- The drone manufacturers should consider collaborating with the Chinese defense companies to incorporate advanced autonomy, AI and stealth technologies into the local platforms.

- Japan's combat drones market was valued at USD 325.2 million in 2024. The necessity to enhance territorial defense and ISR capabilities is increasing the use of combat drones in Japan. Japan is also targeting long-range UAVs and swarm-based technology to defend maritime and critical infrastructure.

- Drone manufacturers should prioritize maritime-adapted UAVs and interoperability with existing Japanese defense systems.

- India's market is anticipated to grow at a CAGR of over 10.9% during the forecast period. The combat drones market in India is expanding due to increasing modernization of defence and the emphasis on improving multi-domain capabilities. As part of its overall defense policy, the country is investing in UAV programs to enhance surveillance, reconnaissance and strike operations.

- The manufacturers of drones should supply interoperable UCAVs and multi-role platforms that respond to the changing defense needs in India.

Latin America held 1.9% market share in 2024 and is projected to grow with a 7.2% CAGR during the forecast period 2025 - 2034. The demand of combat drones in Latin America is rising as a result of increased investment in border security and counter-insurgency operations. The nations are also concentrating on ISR and tactical strike options to regulate internal security threats effectively.

In 2024, the Middle East and Africa held a share of 4.9% and is anticipated to grow at a 7.9% CAGR during the forecast period 2025 - 2034. The use of combat drones to carry out ISR, strike, and swarm missions is being fueled by geopolitical tensions and heavy defense spending in the MEA region. Countries are incorporating drones into regular armies to deter and have operational superiority.

- Saudi Arabia accounted for an 34.6% market share in 2024. The Saudi Arabian market is being driven by increasing focus on modernization of air forces and the acquisition of next-generation combat drones. The nation is also investing in the local projects and overseas acquisitions.

- Drone manufacturers should focus on high-performance, long-range drones with integrated electronic warfare and ISR capabilities tailored to Saudi operational requirements.

- The South Africa market is anticipated to grow at a CAGR of 7.1% during the forecast period. In South Africa, the combat drone market is driven by the efforts to enhance defense capabilities and assist in the operations of regional security. The areas of focus are ISR and drones of tactical strikes to be used both on national and regional defense.

- Drone companies must provide low priced, durable drones that are programmed to serve multi-mission tasks in harsh African conditions.

- The UAE accounted for a share of 29.6% in the market in 2024. The strategic defense programs and regional security issues are raising the investment of UAE in the development of advanced UCAVs and autonomous drone systems. UAE is focused on AI-enhanced, long-range surveillance and strike platforms.

- Drone manufacturers should develop high-endurance, AI-driven drones with multi-role adaptability to meet UAE’s sophisticated operational requirements.

Combat Drones Market Share

The key players in the combat drones industry are General Atomics Aeronautical Systems, Northrop Grumman, Lockheed Martin, Raytheon Technologies (RTX), and Israel Aerospace Industries. These companies occupied more than 59.8% of the market share in 2024.

- In 2024, General Atomics Aeronautical Systems held 18.5% of the market share. General Atomics Aeronautical Systems is a prominent manufacturer of military drones, including long-range, medium-altitude UAVs like the MQ-9 Reaper and Gray Eagle. The business specializes in offering multi-purpose, dependable, and affordable unmanned aerial systems for surveillance, reconnaissance, and combat.

- Northrop Grumman held 14.6% of the market share in 2024. Northrop Grumman is a key competitor in the combat drone industry, focusing on high-tech unmanned systems for military use. The company has technological expertise in its UAVs, such as high-altitude and long-endurance models, which are meant to serve strategic missions, intelligence collection, and maritime surveillance.

- Lockheed Martin held a market share of 12.5% in 2024. Lockheed Martin develops and designs autonomous and unmanned systems for the defense sector. Its UAVs are designed to serve complicated military operations, such as reconnaissance, aerial refueling, and operational support, with an emphasis on innovation and integration with sophisticated defensive technologies.

- In 2024, Raytheon Technologies held 8.7% market share. Raytheon Technologies is active in the combat drone sector, emphasizing advanced avionics and unmanned systems for military operations. The company aims at improving situational awareness, efficiency in operations, and flexibility in missions with a view to supporting intelligence, surveillance, and reconnaissance needs worldwide.

- Israel Aerospace Industries held a market share of 5.4% in 2024. Israel Aerospace Industries is known to provide a wide variety of UAVs in intelligence, surveillance, reconnaissance, and combat missions. Its unmanned systems have been appreciated due to their versatility, reliability, and adaptability in different operational environments serving military customers worldwide.

Combat Drones Market Companies

Major players operating in the combat drones industry are:

- Northrop Grumman

- Raytheon Technologies (RTX)

- Israel Aerospace Industries (IAI)

- General Atomics Aeronautical Systems

- AeroVironment

- The Boeing Company

- Airbus

- Elbit Systems

- Leonardo

- Northrop Grumman Corporation, Raytheon Technologies Corporation (RTX), Israel Aerospace Industries Ltd. (IAI), General Atomics Aeronautical Systems, Inc., and Lockheed Martin Corporation are considered as leaders in the combat drones market. These companies have developed advanced, high-endurance, and multi-mission UAVs while establishing strong relationships with defense and government sectors. Their technical expertise, experience in operations and the capability to provide sophisticated unmanned systems make them the pioneers of combat drone ecosystem.

- AeroVironment, The Boeing Company, Airbus, Elbit Systems, Leonardo, and QinetiQ Group are considered as challengers in this market. These businesses are diversifying their UAVs and are concentrating on both tactical and strategic missions. Although they might not be the best in high-end combat or long-range drones, their engineering, international relationships, and military contracts positions them as competitors in the changing market.

- Kratos Defense & Security Solutions, Griffon Aerospace, Sistemas de Control Remoto (SCR), Turkish Aerospace Industries (TAI), and BAE Systems are considered as followers in this market. These are companies that offer specialized UAV solutions and support services to niche defense and surveillance applications. Their role in regional operations and their capacity to supplement larger UAV programs make them followers with specific capabilities.

- Anduril Industries, Inc., Safran SA, Textron Inc., and Thales Group are considered as niche players in this market. These businesses target new technologies, autonomous systems, and mission profiles like intelligence, surveillance, and electronic warfare. Their niche and new solutions enable them to cater to different sectors of the combat drone ecosystem.

Combat Drones Market News

- In February 2025, Garuda Aerospace showcased 8 advanced drones at Aero India 2025, including systems for rocket launching, mine detection, logistics, firefighting, loitering munitions, life-saving rescue, a military VR simulator, and Thales Garuda UTM for defense and safety operations.

- In July 2025, India built US-origin combat drones, specifically the advanced V-BAT vertical take-off and landing (VTOL) combat drones, domestically through a rare full technology transfer deal with US-based company Shield AI. This contract allowed India to obtain and produce the V-BAT drones as a joint venture with JSW Defence.

The combat drones market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) & volume (Units) from 2021 to 2034, for the following segments:

Market, By Drone Type

- Fixed-wing drones

- Rotary-wing drones

- Single-rotor

- Multi-rotor

- Hybrid drones

Market, By Payload Capacity

- Up to 2 kg

- 2 kg to 19 kg

- 20 kg to 100 kg

- Above 100 kg

Market, By Power Source

- Battery-powered

- Hybrid-powered

- Fuel-powered

Market, By Technology

- Remotely operated drones

- Semi-autonomous drones

- Fully autonomous drones

Market, By Application

- Lethal combat drones

- Stealth drones

- Loitering munition drones

- Target drones

- Others

Market, By Launching Mode

- Vertical take-off and landing (VTOL)

- Automatic take-off and landing (ATOL)

- Catapult-launched drones

- Hand-launched drones

Market, By End Use Application

- Military operations

- Strategic surveillance

- Tactical combat

- Reconnaissance missions

- Training & simulation

- Combat training

- Target practice

- Border & maritime security

- Coastal surveillance

- Border patrol

- Counter-terrorism & law enforcement

- Urban surveillance

- Tactical interventions

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What is the market size of the combat drones industry in 2024?

The market size was USD 7.4 billion in 2024, with a CAGR of 8.9% expected through 2034 driven by force modernization and rising defense spending.

What is the current combat drones market size in 2025?

The market size is projected to reach USD 7.9 billion in 2025.

What is the projected value of the combat drones market by 2034?

The market size for combat drones is expected to reach USD 17.3 billion by 2034, fueled by AI integration, stealth advancements, and rising geopolitical security threats.

How much revenue did the fixed-wing drone segment generate in 2024?

Fixed-wing combat drones are anticipated to reach USD 10.2 billion by 2034, driven by high endurance, larger payload capacity, and suitability for long-range strike and surveillance operations.

What was the valuation of the 20–100 kg payload capacity segment in 2024?

The 20–100 kg payload segment held 37.6% market share in 2024, with growing adoption in tactical operations due to affordability, portability, and effectiveness in reconnaissance and precision attacks.

What is the growth outlook for hybrid-powered combat drones from 2025 to 2034?

Hybrid-powered combat drones are projected to grow at a CAGR of 10.3% till 2034, supported by their endurance, fuel efficiency, and adaptability for reconnaissance and electronic warfare missions.

Which region leads the combat drones market?

The U.S. market was valued at USD 2.8 billion in 2024, making North America the leading region with 40.8% market share. This dominance is driven by high defense budgets, advanced UCAV programs, and the integration of AI-driven and stealth-capable UAVs into multi-domain operations.

What are the upcoming trends in the combat drones industry?

Key trends include AI-enabled autonomy, swarm drone operations, stealth and low-observable UAV technologies, and the expansion of dual-use drones for logistics and resupply missions.

Who are the key players in the combat drones market?

Key players include General Atomics Aeronautical Systems, Northrop Grumman, Lockheed Martin, Raytheon Technologies, and Israel Aerospace Industries (IAI), together holding 59.8% market share in 2024.

Combat Drones Market Scope

Related Reports