Summary

Table of Content

Colorants and Auxiliaries Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Colorants and Auxiliaries Market Size

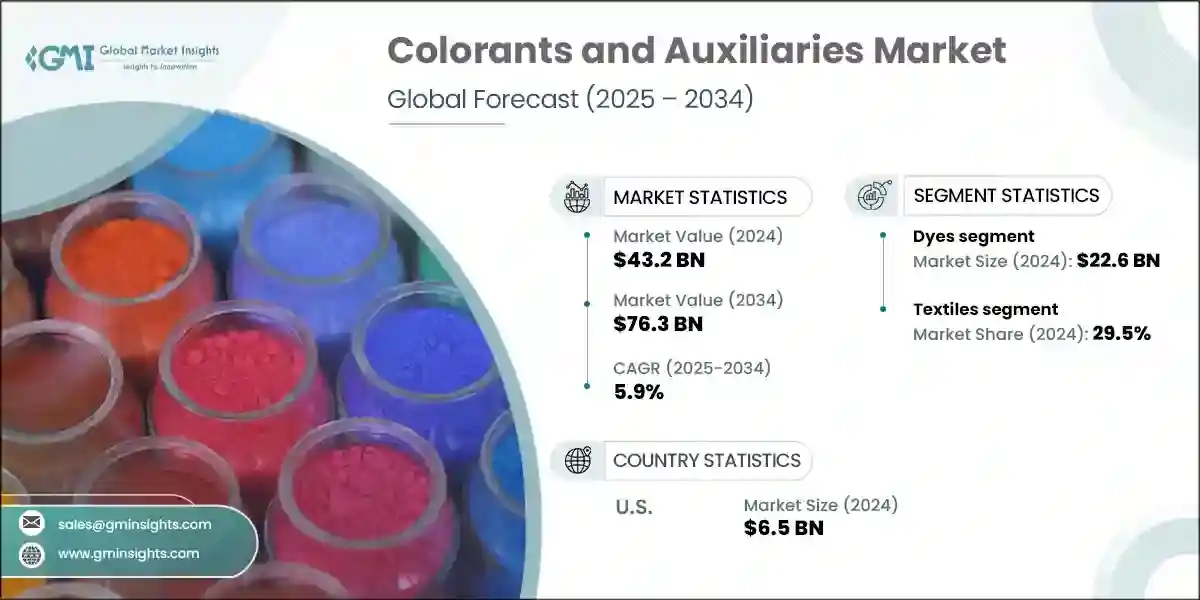

The global colorants and auxiliaries market size was valued at USD 43.2 billion in 2024. The market is expected to grow from USD 45.5 billion in 2025 to USD 76.3 billion in 2034, at a CAGR of 5.9%.

To get key market trends

- Colorants and auxiliaries play a crucial role for an extensive range of manufacturing sectors, such as plastics, textiles, automotive, and construction, upon which the functionality, appearance, and performance of the final goods depend. These include specialized additives such as pigments, dyes, dispersants, UV stabilizers, and processing aids, which improve color consistency, durability, and production efficiency.

- When sustainability and innovation are becoming the core pushes for industries, demands for environmentally safe and high-performance formulations have surged. Recent updates of the industry state that as a strategy, manufacturers now place a premium on bio-based and low-VOC (volatile organic compound) alternatives that would be following stricter regulations and environmental standards.

- Growing evolution and technology in the direction of smart manufacturing and advanced materials are also fueling innovations in this field, such as in digital coloration techniques and multifunctional additives. This is also addressed by the NIST and international frameworks for sustainability that emphasize resource efficiency and environmental impact reduction and thus encourage further adoption of next-generation colorant technologies.

- North America leads in the share of this market due to sophisticated industrial infrastructure, as well as regulations mandated for green chemistry with the Asia-Pacific region showing the fastest growing market owing to burgeoning textile production and the automotive and construction activities of emerging countries. The colorants and auxiliaries market gets ready for vigorous growth, which is currently sustained through incessant innovation and imperatives in sustainability as well as industrial modernization in the global sphere.

- The colorants and auxiliary business is very dynamic today, with both technology and environmental issues driving the change. As industries internationally advance towards greener and more efficient production technologies, demand for highly functional eco-friendly additives is expected to be ever increasing.

Colorants and Auxiliaries Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 43.2 Billion |

| Forecast Period 2025 – 2034 CAGR | 5.9% |

| Market Size in 2034 | USD 76.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Shift toward sustainable and eco-friendly products | Increased demand for bio-based, low-VOC, and non-toxic colorants and auxiliaries. |

| Rising demand in end-use industries (textiles, plastics, construction) | Innovation toward multifunctional additives that serve both decorative and functional purposes (e.g., UV resistance, flame retardancy). |

| Technological advancements in manufacturing and application processes | Emerging technologies like digital printing, high-throughput manufacturing, and smart coloration techniques are transforming how colorants and auxiliaries are used. |

| Pitfalls & Challenges | Impact |

| Raw material supply chain volatility | Heavily dependent on the availability of key raw materials such as pigments, solvents, and additives. |

| Intense price competition and margin pressure | Price wars can erode profit margins, particularly for manufacturers that focus on low-cost products rather than value-added, high-performance solutions. |

| Opportunities: | Impact |

| Integration of smart and functional additives | Incorporating advanced properties such as self-healing, UV resistance, flame retardancy, and antibacterial functions into their products. |

| Growing demand for eco-friendly and bio-based colorants | Significant opportunity for manufacturers to develop bio-based, low-VOC, and non-toxic colorants that align with environmental regulations and consumer preferences. |

| Market Leaders (2024) | |

| Market Leaders |

18% market share |

| Top Players |

Collective market share in 2024 is 49% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Middle East and Africa |

| Emerging country | India, Brazil, Mexico, Indonesia, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

Colorants and Auxiliaries Market Trends

- Demand for colorants and auxiliaries is booming as industries around the world turn to sustainability and innovation in production. As developments are made towards creating biodegradable and water-soluble colours, consumers who are increasingly environment-conscious and restrictions from laws also create need for such colours. The need for a custom design of colour solutions is arising from the demand for functional additives to improve properties such as scratch resistance, weather stability, and antibacterial effects in these key sectors: textiles, coatings, and plastics.

- For instance, the enlargement of government action with tax incentives, monetary assistance, and donations for research into new sustainable additives and smart colorant technologies has built an impetus to encourage green manufacturing. Also on the market growth path in the years ahead is rapid acceptance of the digital colour management systems and coating technologies- an opportunity that industries are pursuing to enhance efficiency and reduce environmental footprint.

- With new technologies enabling closer and more effective production method performance, the Colorants and Auxiliaries market has grown. The introduction of one very significant innovation into the colorants and auxiliaries scenario has been the entry of smart colorants and additives designed to bring in additional functions-such as self-healing coatings, anti-microbial finishes, and UV-resistant pigments. Industries like automotive, electronics, and packaging continue to show the importance of advanced performance in their lines. Additionally, future generation multi-functional colorants will meet the increasing demand for sustainable solutions, offering aesthetic and protective properties in a single product.

- Customize colour formulations have changed current consumer perceptions and expectations about colorants. Bio-based colorants are also bringing these industries toward a greener alternative of petroleum-based products. By nature, there is a trend toward bio-based instead of traditional petrochemical products. Such innovations are changing the colorants sector to become more responsive and adaptable to modern consumers and the environment.

- Colorants and auxiliaries market is dictated in terms of demand for sustainable innovative solutions and undergoes rapid evolution thereafter. Bio-based and smart colorants, digital colour management systems are being introduced to make products more efficient and smarter in industries like automotive and packaging. The growth of this market is being propelled by government support and changing consumer preferences towards eco-friendly products, giving it the opportunity for further innovations and adaptations to suit modern needs.

Colorants and Auxiliaries Market Analysis

Learn more about the key segments shaping this market

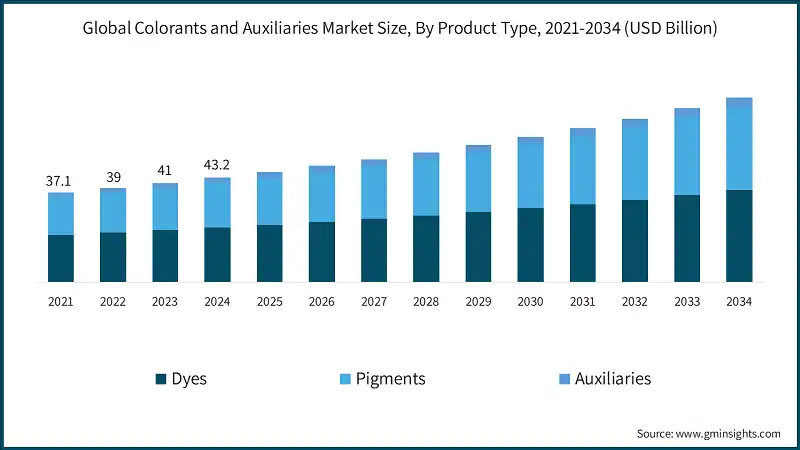

Based in product type, the market is segmented into dyes, pigments, auxiliaries. The dyes segment is generated USD 22.6 billion in 2024.

- The colorants and auxiliaries market is essentially propelled by the dependence on pigments and dyes, as well as auxiliaries across various industries. Pigments dominate this demand with rapidly growing CAGR of 6.5% through 2034, due to their intense coloration and numerous applications; they are applied in coatings, plastics, and textiles.

- Dyes, however, boast of an extensive application range in textiles and leathers due to their very bright application colors that are also easy to use.

- The market for Auxiliaries is rapidly growing, mostly because of dispersants, stabilizers, and binders that have become critical in enhancing the performance and stability of colorants in highly demanding applications. However, bio-based and eco-friendly colorants are slowly spreading within the market because of sustainability trends and the growing preference of consumers for green alternatives.

- Innovations are directed towards the development of highly performance-oriented colorants that are environmentally friendly to expand their scope and bring them to be used in several applications.

Learn more about the key segments shaping this market

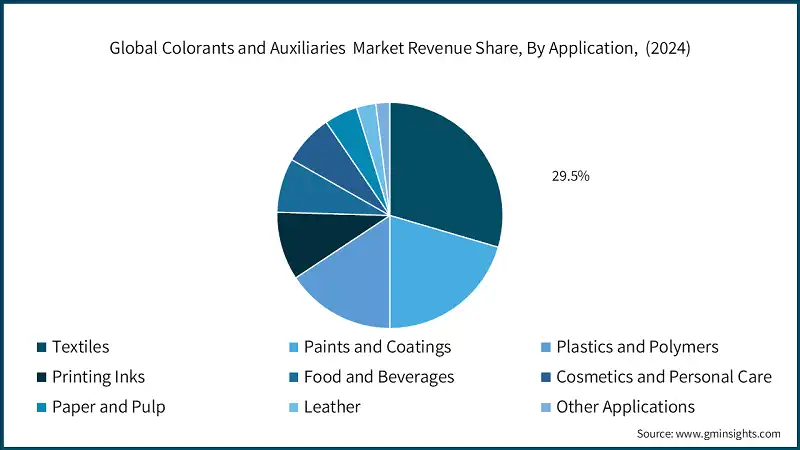

Based on application, the colorants and auxiliaries market is segmented into textiles, paints and coatings, plastics and polymers, printing inks, food and beverages, cosmetics and personal care, paper and pulp, leather, other applications. The textiles segment held about 29.5% of the market share in 2024.

- In textiles, colorants are among the most important components in the formulation of bright and strong dyes and finishes. In some instances, they are referred to as pigments or additives in paints and polymers, applying permanence, UV protection, and aesthetics.

- Plastics and polymers, particularly in consumer goods and automotive parts regarding aesthetics and performance. While printing inks segment is seeing growth with demand for eco-friendly inks and innovative printing techniques.

- Food and beverages also require food-safe, natural colorants that meet regulatory standards. Meanwhile, cosmetics and personal care are moving toward organic, safe colorants, driven by consumer health trends.

- The paper and pulp industry uses colorants for aesthetic purposes and product differentiation, while the leather industry requires dyes for durability and colour richness. Other niche applications continue to expand as specialized colorants and auxiliaries are developed for unique industry needs.

Based on end-use industry, the market is segmented into construction, automotive, packaging, healthcare & pharmaceuticals, electronics & electrical, agriculture, aerospace & defense, marine industry, other industries. Construction industry leads the market in 2024.

- Steady growth can be seen in construction, where colorants contribute to the aesthetic value and weather resistance of coatings and materials. Closely following is the automotive industry, which uses highly durable, heat-resistant pigments and additives to achieve advanced surface finishes.

- Packaging shows significant growth due to high demand for visually appealing, brand-driven, and sustainable color solutions. Biocompatible and non-toxic colorants are vital for medical devices, capsules, and packaging in healthcare and pharmaceuticals.

- Specialized additives are increasingly found in the electronics and electrical sectors to manage heat and offer flame retardancy. Aerospace and marine industries require advanced colorants with corrosion resistance and long durability under extreme conditions. The agricultural sector utilizes colorants for mulch films, seed coating, and packaging. As the demands of end users change, so does the need for more tailored, high-performance, and sustainable colorant solutions in all these sectors, fueling innovation and market expansion.

Based on form, the market is segmented into liquid form, powder form, granules, paste form, other forms. Liquid form leads the market in 2024.

- Formulators and chemical processors adopt both liquid and powder forms for ease of integration into continuous and batch production systems, depending on requirements for solubility, dispersion, and application efficiency. Granular and paste forms are favored by businesses seeking specialized flow characteristics or tailored dosing for high-precision manufacturing scenarios.

- Liquids for direct application and tinting, powders and granules for easy storage and bulk handling, and pastes for high-viscosity, high concentration applications. Advances in color fastness, environmental footprints, and novel applications have been redeemed from research institutions and technology providers to ensure edge solutions for next generation use. Public authorities, most especially with regard to health, food, and environmental regulation, establish market standards and promote safer and greener formulations, thereby affecting the behavior of procurements and usages all up and down the value chain.

Looking for region specific data?

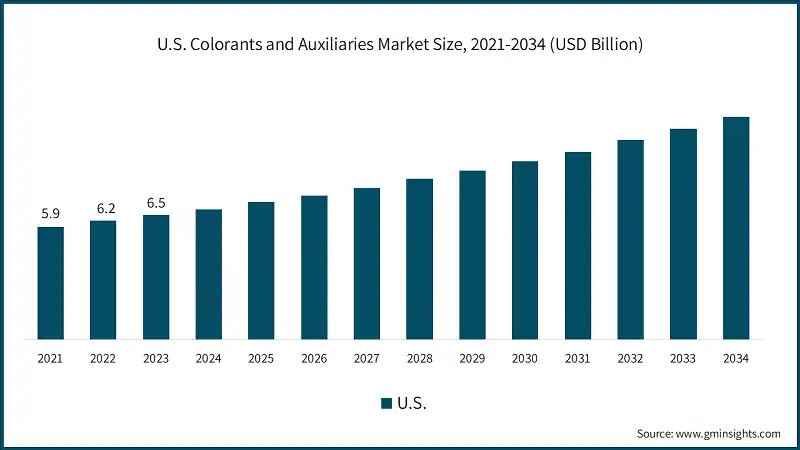

U.S. colorants and auxiliaries market was accounted for USD 6.5 billion in 2024.

- U.S. in North America marks the most important place in the market for colorants and auxiliaries. The U.S. market has an extensive range of international and domestic manufacturers, strong R&D capacities, and quick adoption of advanced colouring and application technologies across industries such as textiles, plastics, automotive, and food. The continuous improvement of performance and environmental safety along with novel product launches has been induced by the increasing consumer demand for sustainable and non-toxic colour solutions.

- Meanwhile, Canada is also showing a significant growth, driven by its dynamic manufacturing sector and continuous regulatory improvements that bolster safer use of cleaner chemicals. Canadian industries and government programs alike are pushing forward the switch to eco-friendly dyes and pigment substitutes and most efficient auxiliary chemicals. This regional focus on compliance, along with rising demand from specialty segments such as packaging and personal care, drives local innovation as well as increased collaboration with international suppliers, making North America a significant hub of the global colourants and auxiliaries landscape.

- Together, these factors are fostering a competitive and forward-looking market environment, ensuring that North America remains a pivotal region for both development and adoption of cutting-edge colorant and auxiliary technologies across a range of industries

The Germany colorants and auxiliaries market is expected to experience significant and promising growth from 2025 to 2034

- The market for colorants and auxiliaries in Europe is booming because of the long-standing commitment of the region to high levels of quality, sustainability, and technological innovation. Countries like Germany and France are evidently spearheading the development of advanced colorant formulations by the actions of their manufacturers and research institutes with attention to strict in-house EU environmental and safety regulations.

- The current movement of the European market towards bio-based and low-impact additives is appreciated by customers for its sustainability. Packaging, automotive, textile, and other important industries are now adopting these standards. The UK market remains very active about specialty demands concerning custom chemical auxiliaries due to a rise in demand for specialty coatings and high-performance materials.

- Among them, it is the tripartite collaboration between industry, academia and regulatory bodies across Europe that champions the entry of newer technologies in colorants that are safer, efficient, less environmentally harmful, thereby putting Europe's imprint as an innovator and a flagship global player in this area.

The Colorants and Auxiliaries market in China is expected to experience significant and promising growth from 2025 to 2034.

- In Asia-Pacific, the colorants and auxiliaries industry show significant growth due to rapid industrial and urban development as well as government support for projects. China is pushing ahead with modernization of its manufacturing plants with substantial investment in green chemistry and by adopting eco-friendly solutions of pigments and dyes relevant to plastics, textiles-packaging, and automotive applications. The trend among Chinese producers is to produce colorants of high quality yet low-cost prices, and compliant with regulations, especially for meeting both domestic and export market requirements.

- India's market is growing very rapidly, with a developing consumer base, a growing middle class, and an increased demand for brighter, stronger, and safer coloring agents in everyday consumer products. Rising global awareness about the environmental impact of products and related regulatory pressures in India are pushing industry players to adopt cleaner technologies and bio-based alternatives.

- India and China together has a strategic advantage with respect to international players for fast technology transfer as well as innovations. Overall, Asia-Pacific gives the huge, versatile, and cost-effective scope, placing the region among the strongest responsible markets for shaping the present and future of the global colorants and auxiliaries markets.

UAE market is expected to experience significant and promising growth from 2025 to 2034.

- The Middle East & Africa market for colorants and auxiliaries is growing rapidly due to industrialization, infrastructure development, and a strong emphasis on sustainability. The UAE and Saudi Arabia are two of the emerging key players, and back in the innovation of eco-friendly dyes, pigments, and chemical auxiliaries in the projects backed by the government to cater to the demands of booming sectors such as construction, automotive, textiles, and packaging.

- The UAE has a lead in investments in advanced formulation technology enhancing product performance and reducing environmental impact while in accordance with the UAE's very forward-looking vision of smart and sustainable urban development. Saudi Arabia shares the same focus on economic diversification, with ecological, bio-based colorants and auxiliaries being encouraged through the backing of regulations and partnerships formed with players from overseas.

- These dynamics are firming the promise of the Middle East as a growing market for color solutions that are sustainable and high-performance across a multitude of industries.

Brazil colorants and auxiliaries market is expected to experience significant and promising growth from 2025 to 2034.

- Increased production and consumption of chemical products mainly dyes and auxiliaries are gradually improving in Latin America countries, Brazil being an exception as opportunities abound from its growing textile, automotive, and packaging demand. The government's increased promotion of sustainable routes for the manufacture of eco-friendly dyes and pigments has gained momentum and fits within wider environmental objectives.

- Brazil is providing color solutions that are cheap and of high quality to support its expanding industrial base and export market while continuously R&D investing in innovating bio- and low-impact colorants. Another slowly advancing country in this region is Argentina, especially through pilot projects and partnerships that target product safety and sustainability standards.

Colorants and Auxiliaries Market Share

- Colorants and auxiliaries industry is moderately consolidated with players like BASF SE, Clariant AG, DuPont de Nemours, Inc., Huntsman Corporation, Archroma Management GmbH holding 49% market share.

- Leading players in the colorants and auxiliaries market maintain their competitive edge by undergoing continuous investment in research and development mainly focusing on the production of innovative, sustainable products in accordance with changing environmental regulations, as well as industry requirements.

- They are carrying out developing multifunctional colorants and auxiliaries which will have improved features such as improved durability of color, UV resistance, and biodegradability in response to ever-increasing demand for environment-friendly and high-performance solutions across textiles, plastics, coatings, and packaging industries. Being strategic collaborators with manufacturers, formulators, and regulatory bodies has helped in widening the global reach of these companies, particularly in emerging and matured markets of Asia-Pacific, North America, and Europe.

- However, partnerships and expansions will help in setting new benchmarks in terms of product innovation that would answer the dynamic needs of consumers, hence shaping the outlook of the colorants and auxiliaries industry in the years to come.

Colorants and Auxiliaries Market Companies

Major players operating in the colorants and auxiliaries industry are:

- BASF SE

- Clariant AG

- DuPont de Nemours, Inc.

- Huntsman Corporation

- Archroma Management GmbH

- DyStar Group

- LANXESS AG

- Evonik Industries AG

- The Chemours Company

- Ferro Corporation

BASF SE group contribute to the success of customers in nearly all sectors and almost every country in the world. The company focuses on to develop advanced pigments, dyes, and functional additives tailored for high-performance applications

Clariant AG is a Swiss multinational speciality chemical company, formed in 1995. The company specializes in developing custom pigments, dyes, and additive systems that enhance product functionality across sectors like textiles, plastics, and personal care.

DuPont de Nemours, Inc. developed many polymers such as Vespel, neoprene, nylon, Corian, Teflon, Mylar, Kapton, Kevlar, Zemdrain. DuPont focuses on creating high-performance colorants that offer superior durability, weather resistance, and color consistency in applications such as automotive coatings, plastics, and electronics

Huntsman Corporation is comprised of three divisions Polyurethanes, Advanced Materials, Performance Products. With a strong focus on high-performance additives, Huntsman provides customized pigment formulations that improve durability, color stability, and UV resistance in products like coatings, plastics, and textiles

Collectively, these companies illustrate a collaborative approach in driving innovation by focusing on sustainable, high-performance solutions that meet the diverse needs of industries like automotive, packaging, and textiles. These companies are working together to refine colorant technologies that enhance aesthetic appeal, durability, and environmental compliance.

Colorants and Auxiliaries Market News

- June 2025 - Zhejiang Longsheng Group Co., Ltd has acquired 37.5% of shares in DyStar Global Holdings (Singapore) Pte. Ltd which results in DyStar becoming a complete owned subsidiary.

- June 2023 - At the European Coatings Show in Nuremberg, Germany, Zschimmer & Schwarz will present its comprehensive portfolio of waterborne acrylics for wood and other coating applications as well as innovative polymer technologies.

- March 2022 - Colorants International AG completed the acquisition of 3.3% stake in Clariant Chemicals Limited from the public shareholders for approximately INR 380 million.

The colorants and auxiliaries market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and volume in terms of Units from 2021-2034 for the following segments:

Market, By Product Type

- Dyes Market Analysis

- Reactive Dyes

- Disperse Dyes

- Acid Dyes

- Direct Dyes

- Vat Dyes

- Sulfur Dyes

- Basic Dyes

- Other Dyes

- Pigments Market Analysis

- Inorganic Pigments

- Titanium Dioxide

- Iron Oxide

- Chrome Oxide

- Carbon Black

- Other Inorganic Pigments

- Organic Pigments

- Azo Pigments

- Phthalocyanine Pigments

- Quinacridone Pigments

- Other Organic Pigments

- Specialty Pigments

- Auxiliaries Market Analysis

- Surfactants

- Thickeners

- Dispersants

- Defoamers

- Wetting Agents

- Leveling Agents

- Other Auxiliaries

Market, By Application

- Textiles

- Cotton Textiles

- Synthetic Textiles

- Wool and Silk

- Technical Textiles

- Paints and Coatings

- Architectural Coatings

- Automotive Coatings

- Industrial Coatings

- Marine Coatings

- Powder Coatings

- Plastics and Polymers

- Packaging Plastics

- Automotive Plastics

- Construction Plastics

- Consumer Goods Plastics

- Printing Inks

- Offset Printing Inks

- Digital Printing Inks

- Flexographic Inks

- Gravure Inks

- Screen Printing Inks

- Food and Beverages

- Beverages

- Confectionery

- Bakery Products

- Dairy Products

- Processed Foods

- Cosmetics and Personal Care

- Paper and Pulp

- Leather

- Other Applications

Market, By End Use Industry

- Construction Industry

- Automotive Industry

- Packaging Industry

- Healthcare and Pharmaceuticals

- Electronics and Electrical

- Agriculture

- Aerospace and Defense

- Marine Industry

- Other Industries

Market, By Form

- Liquid Form

- Powder Form

- Granules

- Paste Form

- Other Forms

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Who are the major players in the colorants and auxiliaries market?

Major players include BASF SE, Clariant AG, DuPont de Nemours, Inc., Huntsman Corporation, Archroma Management GmbH, DyStar Group, LANXESS AG, Evonik Industries AG, The Chemours Company, and Ferro Corporation.

Which application segment leads the colorants and auxiliaries market?

Which application segment leads the colorants and auxiliaries market?

Which region leads the colorants and auxiliaries market?

The U.S. colorants and auxiliaries market was valued at USD 6.5 billion in 2024, led by strong R&D, rapid tech adoption, and widespread use across textiles, plastics, automotive, and food industries.

What was the market size of the colorants and auxiliaries in 2024?

The market size was USD 43.2 billion in 2024, with a CAGR of 5.9% expected through 2034, on account of the shift toward sustainable and eco-friendly products and rising demand in end-use industries.

What is the projected value of the colorants and auxiliaries market by 2034?

The global market for colorants and auxiliaries is expected to reach USD 76.3 billion by 2034, propelled by advancements in manufacturing technologies and increasing adoption of bio-based and non-toxic solutions.

What are the upcoming trends in the shaping the colorants and auxiliaries market?

Key trends include the shift toward sustainable and eco-friendly products, innovation in multifunctional additives, and advancements in digital printing and smart coloration technologies.

What is the growth outlook for the pigments segment from 2025 to 2034?

The pigments segment is projected to grow at a CAGR of 6.5% through 2034, owing to its intense coloration and wide-ranging applications in coatings, plastics, and textiles.

How much revenue did the dyes segment generate in 2024?

The dyes segment generated USD 22.6 billion in 2024, as its extensive use across industries such as textiles, plastics, and coatings.

Colorants and Auxiliaries Market Scope

Related Reports