Summary

Table of Content

Coated Paper Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Coated Paper Market Size

Coated Paper Market size was valued at over USD 45 billion in 2018 and is projected to achieve over 3% CAGR from 2019 to 2026.

To get key market trends

Coated paper is treated with a mixture of chemicals and materials to improve surface properties such as gloss, weight, smoothness, and ink retention. The coating materials typically used are clay, calcium carbonate, kaolinite, bentonite, and talc. Polymers, such as polyethylene and polyolefin, are used to impart waterproof and tear strength characteristics. Moreover, the coating material is mixed with certain chemical additives, such as resins and dispersants, to enhance wet strength and UV resistance. The coating makes the base paper less porous, which is ideal for printing applications.

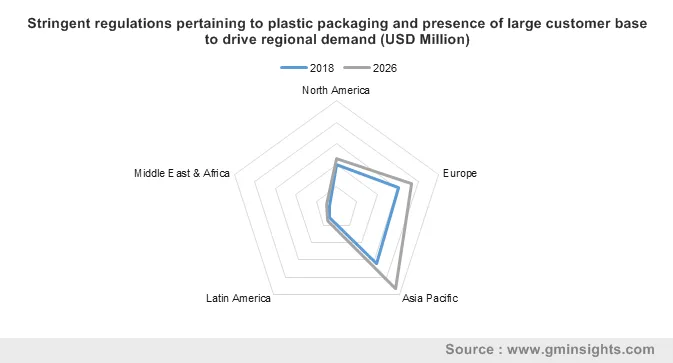

Proliferating internet trade and the e-commerce industry are the prime factors driving the market growth. Rising popularity of home delivered food and household products creates an upsurge in packaging, which will drive the product demand in the upcoming years. Increasing demand for paper bags, grocery bags, waterproof bags for milk & fruit juice, and shopping bags are likely to augment the market growth over the forecast timeframe. Also, stringent regulations pertaining to plastic packaging are creating a radical shift toward paper packaging, further boosting the industry share.

Coated Paper Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 45.49 Billion (USD) |

| Forecast Period 2019 to 2026 CAGR | 3.0% |

| Market Size in 2026 | 59.26 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Coated Paper Market Trends

The volatility in wood pulp prices may have an adverse impact on the growth of coated paper market during the forecast timespan. Economic cycles and global supply & trade disturbances cause a major shift in the prices of wood pulp. Moreover, the requirement for huge capital investment may hinder the market growth in the future. This investment covers costs associated with land, setting of production plant, necessary equipment, permits, etc.

Additionally, constraints related to locations having plenty of forest reserves, environmental clearances, and water availability may pose difficulties for coated paper manufacturers. However, major players are aligning their business models and adopting vertical integration strategies for improving their production output and enhancing efficiency of the overall process.

Coated Paper Market Analysis

Learn more about the key segments shaping this market

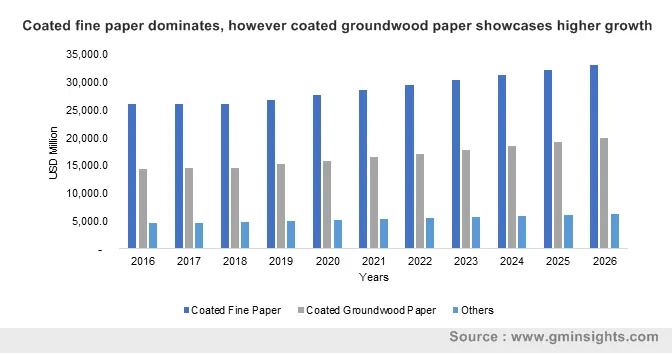

Coated fine paper will account for a significant share in the coated paper market share over the study period. Coated fine paper is produced from chemically bleached pulp and contains lesser amount of mechanical pulp. The growth in the adoption of such papers can be attributed to its high grammage and excellent brightness of up to 96%. It is prominently used for offset printing applications to produce annual reports, magazines, advertising materials, and catalogues.

Coated groundwood paper is expected to be the fastest-growing segment owing to its smooth surface with significant reduction of ink absorbency capabilities. These papers are generally lightweight, finding applications in magazines, brochures, and catalogues. In addition, coated groundwood paper is eco-friendly and cost-effective. It also offers high stiffness and thickness required for printing books, calendars, and business communications.

Clay will hold the majority share as a popular coating material in the coated paper market over the study period. This can be attributed to the provision for a wide range of finishes based on the customer requirements. The finish ranges from high or dull gloss to matte finishes. Moreover, the brightness of the paper can also be altered, thereby boosting the segment share over the study period.

Online calendering will showcase the highest growth over the projected timeframe. This can be credited to the technological advancements along with faster calendaring process compared to the online calenders. Moreover, online calenders are available in a wide range of types including hard nip, soft nip, and multi nip calenders among others making them ideal for a wide range of applications.

Learn more about the key segments shaping this market

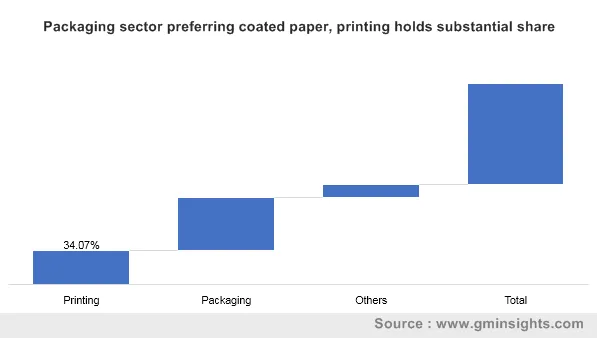

Packaging gained a significant market share and is likely to register the highest CAGR during the review period. This is largely due to an upsurge in the demand for such paper in flexible packaging for food, medical, and cosmetic products. Increasing consumer awareness regarding single-use plastic is creating a shift towards paper packaging in home delivered products and consumer goods, thereby driving the segment demand.

Printing held a substantial market share in 2018 and is likely to grow at a healthy CAGR in the upcoming years. This is mainly due to the growing advertisement sector and the increasing demand for printed magazines, financial reports, brochures, and direct mails by business corporate offices. Coated paper offers superior gloss and thickness, which are considered as preferred features for printing applications. It offers a smooth surface for printing books and calendars with sharp images and reduced ink absorption.

Looking for region specific data?

The Asia Pacific coated paper market dominated with the largest market share in 2018 and is likely to grow at a significant rate in the upcoming years. This is largely due to the expanding end-use industries for the packaging sector such as food & beverages, pharmaceutical manufacturing, personal care products, and online retail. The booming e-commerce sector and internet trade have led to rising consumption of such papers in the packaging of home delivered products. China and Japan are the key countries contributing to the regional market growth on account of significant consumer base, affordable labor, and regulations pertaining to plastic packaging. Also, the printing sector is expanding in the region owing to an upsurge in printed packaging products and the developing advertisement sector.

Coated Paper Market Share

The companies have adopted various strategies, such as partnerships and collaborations for enhancing their market share. For instance, in October 2019, Sappi Europe signed a collaboration agreement with HP Indigo to print media in its wood-free coated paper using HP Indigo’s digital imaging technologies. The coated paper market is consolidated with presence of large number of manufacturers across the globe. Some of the key manufacturers in the market are

- South African Pulp and Paper Industries Limited (Sappi Ltd.)

- UPM, Ltd

- Verso Corporation

- BURGO GROUP SPA

- Stora Enso

by Product

- Coated Fine Paper

- Coated Groundwood Paper

- Others

by Coating Material

- Clay

- Calcium Carbonate

- Talc

- Others

by Finishing Process

- Online Calendering

- Offline Calendering

by Application

- Printing

- Packaging

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- Australia

- Indonesia

- India

- Malaysia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- GCC

Frequently Asked Question(FAQ) :

Who makes coated papers?

South African Pulp and Paper Industries Limited (Sappi Ltd.), UPM, Ltd, Verso Corporation, BURGO GROUP SPA and Stora Enso are key companies operating in the global industry for coated paper.

What are the key factors driving the coated paper market?

Rising demand for flexible paper packaging along with escalating online sales activities are the major driving factors for market growth.

What challenges are set to impact global coated paper industry through 2026?

Major challenges likely to impact the global coated paper industry outlook include capital and energy intensive manufacturing process of coated paper and volatility in the wood pulp prices.

How big is the coated paper market?

The global coated paper industry is expected to achieve $64 billion by 2026 and is poised to record over 3% CAGR.

Coated Paper Market Scope

Related Reports