Summary

Table of Content

Circular Economy Chemicals Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Circular Economy Chemicals Market Size

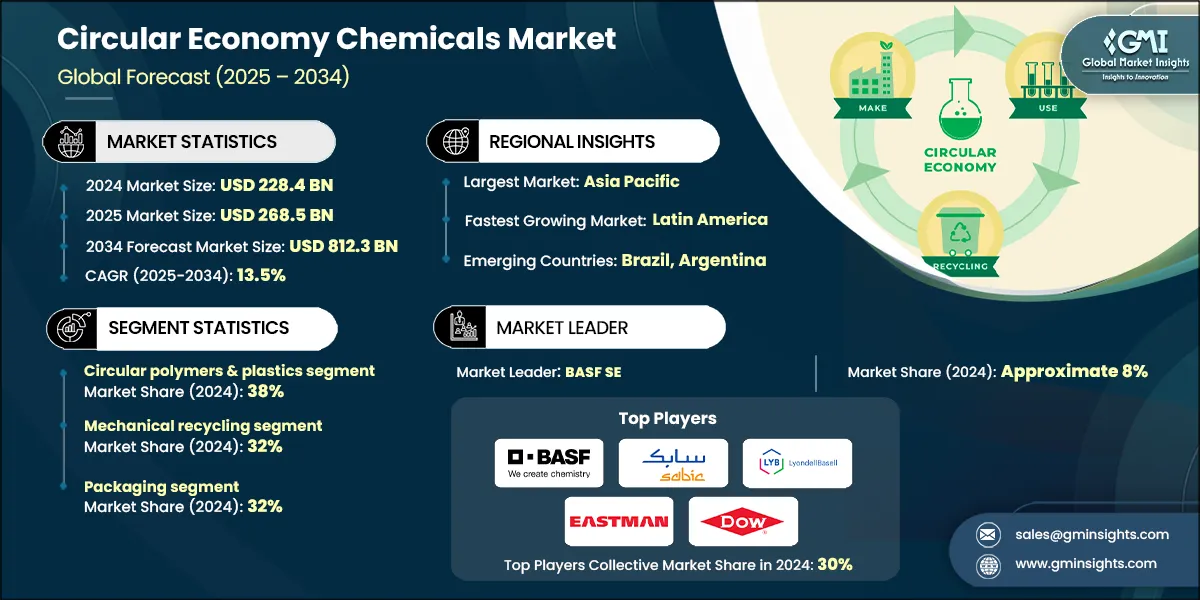

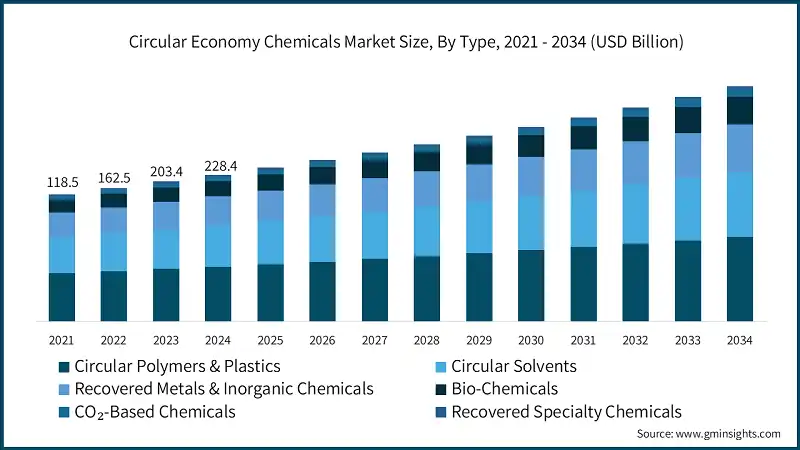

The global circular economy chemicals market was valued at USD 228.4 billion in 2024. The market is expected to grow from USD 268.5 billion in 2025 to USD 812.3 billion in 2034, at a CAGR of 13.5%, according to latest report published by Global Market Insights Inc.

To get key market trends

- The circular economy chemicals industry includes polymers, resins, basic organic and inorganic chemicals, specialty chemicals, and intermediate chemicals from bio-based feedstocks, chemical recycling, mechanical recycling, and industrial waste recovery processes. These evolving markets are influenced by the alignment of regulatory demands, corporate sustainability commitments, and technology maturity in the context of advanced recycling and bio-based production technologies.

- The circular economy chemicals sector is undergoing three transformative trends that are changing the competitive dynamics and value chain. First, the scaling up of advanced recycling and chemical recycling technologies for plastics and complex waste streams is starting to advance globally, with over 9 million tons per year of announced pyrolysis capacity under development, with Europe and North America leading the way.

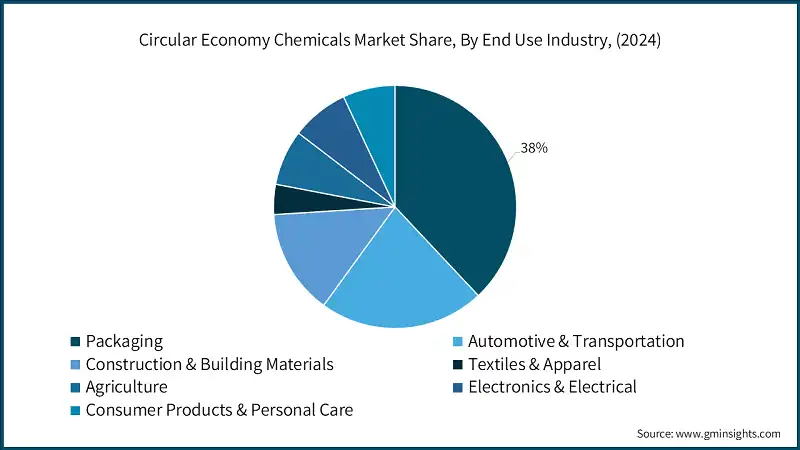

- The transition to closed-loop and circular business models is creating new pools of demand for circular chemicals in packaging, automotive, and electronic sectors. The packaging sector is expected to represent the largest end-use application at 38% of the market for circular economy chemicals in 2024, and brand owner commitment and regulatory pressure is driving the demand. The demand for high-quality recycled content in packaging applications could be as high as 20 to 25 million tons per annum by 2030.

Circular Economy Chemicals Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 228.4 Billion |

| Market Size in 2025 | USD 268.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 13.5% |

| Market Size in 2034 | USD 812.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Stringent Regulatory Frameworks (EU Green Deal, carbon taxes, recycling mandates) | Enforces circular production standards across chemical-intensive industries. |

| Corporate Net-Zero and ESG Commitments | Pushes companies to shift toward low-impact, recyclable, and reusable chemicals. |

| Technological Advancements in Depolymerization and Solvent Recovery | Make circular processes economically and technically viable for mass adoption. |

| Pitfalls & Challenges | Impact |

| High Cost and Complexity of Circular Chemical Infrastructure | Hinders adoption, especially among small-to-medium enterprises (SMEs). |

| Limited Access to Quality and Consistent Recycled Feedstock | Leads to manufacturing inefficiencies and supply risks. |

| Opportunities: | Impact |

| Emerging Markets in Asia-Pacific with High Plastic Waste Generation | Presents large-scale adoption potential for circular chemicals solutions. |

| Collaboration Between Chemical Companies and Consumer Brands | Drives demand for sustainable ingredients like rPET, bio-surfactants, and bio solvents. |

| Market Leaders (2024) | |

| Market Leaders |

Approximate Market Share of 8% in 2024 |

| Top Players |

Collective market share in 2024 is 30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Argentina |

| Future outlook |

|

What are the growth opportunities in this market?

Circular Economy Chemicals Market Trends

- The shift of advanced recycling technologies from pilot and demonstration scale to commercial scale is the largest technology trend impacting the circular economy chemicals sector. As of 2023, chemical recycling capacity within the European Union is at 150 kilotons, with pyrolysis accounting for most of the supply. Over 9 million tons per annum of pyrolysis capacity has been announced for development, almost all located in Europe and North America. Chemical producers are making large capital investments to commercialize proprietary and licensed technologies.

- The absorption of bio-based and renewable feedstock into main chemical production is an emerging trend to advanced recycling, and an additional source of reduced reliance on fossil feedstock. Global production of bio-based chemicals and polymers stood at around 90 million tons in 2021. The bioplastics sector is experiencing rapid growth, projected to increase from 1.1 million tons in 2024 to 7.3 million tons by 2034, at a CAGR of 20.4%. European Bioplastics estimates global bioplastics production capacity to increase from 2.5 million metric tons in 2024 to approximately 5.7 million metric tons in 2029.

- The increasing adoption of mass balance approaches and third-party certification systems is an essential trend enabling for the commercialization of circular economy chemicals, offering the accounting frameworks and mechanisms for credibility to attribute circular feedstock content and sustainability benefits across complex chemical value chains.

- In the chemical sector, ISCC PLUS and REDcert2 are the leading certification schemes that are accepted for mass balance approaches. BASF has certified ~240 mass-balanced cycled products under REDcert2 or ISCC PLUS. SABIC operates ~20 ISCC PLUS certified locations globally in the Asia Pacific, Europe Middle East Africa, and North America.

- An essential trend as chemicals for the circular economy transition from niche applications to the mainstream is the development of closed-loop value chains through collaboration across sectors. These partnerships span the entire value chain from collection and sorting of waste to manufacturing chemicals and producing the end-product, with the engagement of brand owners.

- A multi-stakeholder partnership within chemistry, converters, recyclers, and brand owners is represented by the Cefic 100% Circular plastic initiative which is a partnership to advance collection and sorting, scale advanced recycling, develop food-contact specifications, establish chain-of-custody and traceability, and engage regulatory and commercial systems.

Circular Economy Chemicals Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is segmented into circular polymers & plastics, circular solvents, recovered metals & inorganic chemicals, bio-chemicals, co2-based chemicals, recovered specialty chemicals. Circular polymers & plastics dominated the market with an approximate market share of 38% in 2024 and is expected to grow with a CAGR of 13.5% by 2034.

- This is largely driven by the size and volume of Plastics that are used around the world across a variety of industries such as packaging, automotive, building & construction, electronics and consumer goods, and the growing necessity to recycle and repurpose Waste Plastics to help overcome the challenges posed by increasing environmental concerns.

- Product innovation plays an important role in the success of this Segment. New advanced Recycling Technologies based on Chemical Depolymerisation, Pyrolysis and Gasification now enable the breakdown of Mixed and/or Contaminated Plastics into Virgin Equivalent Resins. Therefore, the levels of Recycled Content / Usability are significantly higher than those of the traditional Mechanical Recycling Process and make Circular Polymers more commercially attractive to Manufacturers interested in complying with Recycled Content Mandates.

- Another Key Trend Driven by Performance is the development of High-Quality rPET (Recycled PET), rHDPE (Recycled HDPE) and Bio-Based Alternatives such as Polyethylene Furanoate (PEF) which now meet the demanding Performance Standards required for Food Packaging, Automotive and Medical Applications which have historically limited the use of these materials due to Quality and Regulatory Concerns.

Based on process, the circular economy chemicals market is segmented into mechanical recycling, chemical recycling, biological/enzymatic processing, co2 capture & utilization (CCU), biorefining, solvent recovery & purification. Mechanical recycling held the largest market share of 32% in 2024 and is expected to grow at a CAGR of 11.8% during 2025-2034.

- Mechanical Recycling is expected to have the largest market share owing to the extensive share for the mechanical recycling segment is the cost of mechanical recycling. Additionally, because of the relatively simple technology and methods employed by the Mechanical Recycling methodology, the method can be applied successfully and affordably to most end-use applications for wasted post-consumer and post-industrial plastics.

- Mechanical Recycling involves the physical manipulation of plastics through shredding, washing, sorting, and remelting without changing the chemical properties of the plastics. As such, mechanical recycling is readily available and practical to both developed and developing countries globally.

- Compared to chemical recycling technology and methods such as pyrolysis and enzymatic depolymerization, capital investment in the Mechanical Recycling process is much less of a barrier to entry for recycling. Essentially, mechanical recycling is well-established in locations with strong waste collection and segregation systems, particularly throughout Europe and in parts of Asia. In addition, because commissioning times and return on investment for mechanical recycling facilities is significantly shorter than for other recycling processes, mid- and small-scale recyclers are increasingly attracted to mechanical recycling, specifically in developing markets.

- Mechanically recycled resins (rPET, rHDPE, and rPP) are used to support compliance with packaging and recycled content regulations, such as in food and beverage containers, industrial packaging, and in textiles.

Learn more about the key segments shaping this market

Based on end use industry, the circular economy chemicals market is segmented into packaging, automotive and transportation, construction and building materials, textiles and apparel, agriculture, electronics and electrical, and consumer products and personal care. Packaging held the largest market share of 38% in 2024 and is expected to grow at a CAGR of 12.8% during 2025-2034.

- The packaging market constitutes the greatest volume of plastic consumption in the market, which correlates to the regulatory attention to single-use plastics and a commitment for brand owners to implement recycled content. The European Union has a goal for all plastic packaging to be recyclable by the year 2030.

- Automotive & transportation represents 16% of market share in 2024. Key drivers for this segment are automotive lightweighting to improve fuel economy and reduce emissions, end-of-life vehicle regulatory requirements, such as the EU ELV directive to achieve 95% recyclability, and OEM sustainability commitments. One development is SABIC's STAMAX long glass fiber polypropylene resin containing 25% of the mechanically recycled content used in the structural dashboard carrier of the CUPRA Terramar. This represented one of the industry's first uses of LGF-PP with recycled content in safety-critical applications.

- Construction & building materials makes up 14% of the total market CAGR of 11%. This segment covers circular chemicals for use in insulation, pipes, profiles, flooring, coatings, adhesives, and sealants. An innovation includes the Covestro Circular Foam project involving 22 partners across 9 countries, which involves using chemolysis and smart pyrolysis technology for expansion of rigid polyurethane foams. Combined this is expected to have an estimated value of 1 million tons of waste and 2.9 million tons of CO2 emissions avoidance by 2040.

Looking for region specific data?

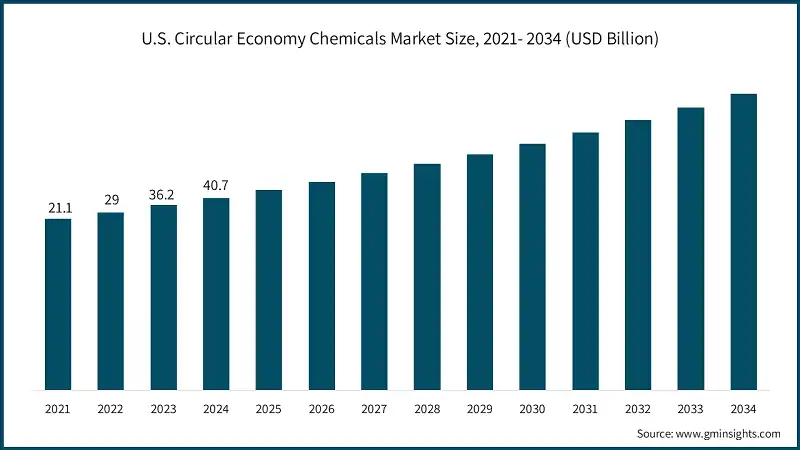

The North America circular economy chemicals market is growing rapidly on the global level with a market share of 22% in 2024. The U.S. market generated a revenue of USD 40.7 million in 2024. The U.S. market is projected to grow at a CAGR of 11.4% in the upcoming period.

- The U.S. has dominant recycling technology, significant corporate interest in sustainability, and supportive regulations at the state level. Eastman's facility for molecular recycling in Kingsport, Tennessee has an annual capacity of 110,000 metric tons.

Europe circular economy chemicals market held substantial market share of the industry with revenue of USD 61.7 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- Europe has the most comprehensive regulatory framework for circular economy, highest levels of adoption of the circular economy principles, and significant infrastructure for waste collection and recycling. The European Union's Green Deal and Circular Economy action plan contain ambitious targets such as committing to recycling 65% of municipal waste and ensuring that all plastic packaging is recyclable by 2030.

The Asia Pacific circular economy chemicals market is anticipated to grow at a CAGR of 12.8% during the analysis timeframe.

- Asia Pacific is the largest regional market, accounting for 38% of total global market share in 2024. Asia Pacific's dominance is understood with rapid industrialization, heightened environmental awareness, high consumption of plastics and waste generation, and increasing policy support across major economies such as China, India, Japan, and South Korea.

Latin America circular economy chemicals accounted for 7% market share in 2024 and is anticipated to show highest growth over the forecast period.

- In Latin America, the momentum toward circular economy chemicals is ramping up, particularly in Brazil, Chile, and Colombia, where governments are incentivizing plastic recycling and sustainable agriculture practices. Brazil's National Solid Waste Policy and regulatory extended producer responsibility (EPR) are pushing chemical companies to invest in recycled polymers and bio-based inputs from sugarcane and other regional biomass.

Middle East & Africa circular economy chemicals market accounted for 6% market share in 2024 and is anticipated to show lucrative growth over the forecast period.

- In the Middle East & Africa, increased industrialization in the context of water scarcity and dependency on petrochemicals is causing interest in circular water treatment chemicals and waste to chemicals solutions. The UAE and Saudi Arabia are beginning to launch green chemistry policies under their sustainability visions, and South Africa's emerging recycling infrastructure is supporting regional development of circular plastic and fertilizer chemicals.

Circular Economy Chemicals Market Share

The circular economy chemicals industry exhibits a moderately concentrated competition structure, with the five leading firms representing about 30% of the global market in 2024 and the other 70% accounted for by many regional and specialized producers. This market structure is a function of the capital-intensive nature of chemical production, the technological sophistication of circular economy processes, and the importance of circular economy capabilities for maintaining a competitive position in the changing landscape of the chemical industry.

- BASF SE: BASF SE is a diversified chemical company that has implemented circular economy initiatives across its entire portfolio through the Loop Solutions and ChemCycling initiatives. It has set a sales target of USD 10 billion associated with Loop Solutions by 2030. BASF launched ChemCycling in the United States in February 2024 at its Port Arthur, TX facility, using pyrolysis oil from plastic waste and end-of-life tires and mass-balance approach to produce chemical products.

- Braskem S.A.: Braskem S.A. is the largest producer of thermoplastic resins in the Americas and a global leader in the production of bio-based polyethylene. Braskem achieved the operating capacity of 275,000 tons per year of I'm green bio-based polyethylene in 2025, an increase of 37%, with a strategic target of reaching 1 million tons per year by 2030.

- Covestro AG: Covestro AG is a leading producer of high-performance polymers and has an extensive strategy for implementing a circular economy. In November 2025, Covestro received final approvals for regulatory approval for their strategic partnership with XRG, including USD 1.1 billion in capitalization. Covestro is also targeting almost USD 1 billion in Capital Expenditure for circular economy projects in the coming ten years.

- Eastman Chemical Company: Eastman Chemical Company is establishing itself as a leader in the space of molecular recycling through its polyester renewal technology. In March 2024, Eastman began the commercial production of its polyester renewal technology at its plant in Kingsport Tennessee, one of the world's largest molecular recycling facilities with an annual capacity of 110,000 metric tons. By June 2025, the facility had recycled over 100 million pounds of plastic through methanolysis.

- LyondellBasell Industries N.V.: LyondellBasell Industries N.V. is commercializing its proprietary MoReTec catalytic advanced recycling technology. In 2024 LyondellBasell produced 200,000 tons of circular polymers. In September 2024, LyondellBasell laid the foundations for its first industrial-scale advanced recycling plant at Wesseling, Germany. The Wesseling plant is expected to have a capacity of 50,000 tons per year, offer approximately 80% yield like the MoReTec production pathway, and a lower carbon footprint versus conventional routes.

Circular Economy Chemicals Market Companies

Major players operating in the circular economy chemicals industry include:

- BASF SE

- Borealis AG

- Braskem S.A.

- Carbios SA

- Covestro AG

- Dow Inc.

- DSM-Firmenich

- Eastman Chemical Company

- Evonik Industries AG

- INEOS Group

- LG Chem Ltd.

- Loop Industries Inc.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals, Inc.

- Neste Oyj

- Reliance Industries Limited

- SABIC

- Solvay S.A.

- Veolia Environnement S.A.

Circular Economy Chemicals Industry News

- In January 2025, SABIC introduced that its STAMAX long glass fiber polypropylene resin with 25% mechanically recycled content was used in the structural dashboard carrier of the CUPRA Terramar.

- In January 2025, Bayer and Neste announced a memorandum of understanding (MoU) in which the two companies will collaborate to develop a feedstock ecosystem based on winter canola in the Southern Great Plains of the United States that will be used in renewable fuel manufacture, including sustainable aviation fuel and renewable diesel. The winter canola will be a rotational crop and support regenerative agricultural practices. Bayer expects to launch hybrid TruFlex winter canola in 2027.

- In December 2024, Neste announced the commercialization of co-processed renewable Neste RE feedstock. Neste RE is the result of co-processing renewable raw materials with fossil crude oil at its Porvoo refinery and uses a mass-balance approach to allocating renewable input and sustainability benefits.

- In May 2025, NOVA Chemicals began operations at its SYNDIG01 polyethylene film mechanical recycling plant in Indiana, which has a processing capacity of 145,000 bales.

- In December 2024 - Attero and SABIC announced a cooperation agreement to supply SABIC with post-consumer recycled feedstock to support SABIC's circular economy initiatives.

- In March 2024, Eastman Chemical Company commenced commercial operations at its molecular recycling plant in Kingsport, Tennessee, which is among the largest in the world and has a capacity of 110,000 metric tons per year. The facility uses methanolysis technology to de-polymerize polyester into dimethyl terephthalate and ethylene glycol, achieving approximately an 85% yield to food-grade material.

This circular economy chemicals market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2025 to 2034, for the following segments:

Market, By Type

- Circular polymers & plastics

- Circular solvents

- Recovered metals & inorganic chemicals

- Bio-chemicals

- CO2-based chemicals

- Recovered specialty chemicals

Market, By Process

- Mechanical recycling

- Chemical recycling

- Biological/enzymatic processing

- CO2 Capture & Utilization (CCU)

- Biorefining

- Solvent recovery & purification

Market, By End Use Industry

- Packaging

- Flexible packaging

- Rigid packaging

- Industrial & transport packaging

- Compostable & biodegradable packaging

- Automotive & transportation

- Interior components

- Exterior & structural components

- Under-the-hood & powertrain

- Electrical & electronic systems

- Coatings & surface protection

- Construction & building materials

- Insulation materials

- Structural & finishing materials

- Adhesives, sealants & coatings

- Piping & infrastructure

- Textiles & apparel

- Fashion & apparel

- Home textiles & furnishings

- Technical & industrial textiles

- Agriculture

- Agricultural films

- Fertilizers & soil amendments

- Crop protection & agricultural chemicals

- Irrigation & water management

- Electronics & electrical

- Consumer electronics

- Industrial electronics & equipment

- Energy storage & batteries

- Wire, cable & electrical infrastructure

- Consumer products & personal care

- Personal care products

- Household cleaning products

- Consumer goods packaging

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the circular economy chemicals industry?

Key trends include mass-balance certification, expansion of chemical recycling, and rapid scaling of bio-based chemicals. Closed-loop partnerships and technology-driven recycling innovations are reshaping the competitive landscape.

Who are the key players in the circular economy chemicals market?

Key players include BASF SE, SABIC, LyondellBasell Industries N.V., Eastman Chemical Company, Dow Inc., Covestro AG, Braskem S.A., INEOS Group, LG Chem Ltd., and Veolia Environnement S.A. These companies lead through proprietary recycling technologies, strong ESG strategies, and vertically integrated circular value chains.

What is the market size of the U.S. circular economy chemicals market in 2024?

The U.S. market generated USD 40.7 million in 2024. Growth is driven by strong corporate sustainability programs and investments in advanced recycling facilities like Eastman’s Kingsport plant.

What is the growth outlook for chemical recycling from 2025 to 2034?

Chemical recycling is expected to grow in line with the industry CAGR of 13.5% through 2034. Its rise is driven by commercial-scale pyrolysis, depolymerization advances, and growing demand for high-quality recycled polymers.

What was the valuation of the mechanical recycling process segment in 2024?

Mechanical recycling accounted for 32% market share in 2024. Its dominance is fueled by its lower cost, simpler technology, and widespread applicability across end-use industries.

How much revenue did the circular polymers & plastics segment generate in 2024?

Circular polymers & plastics held 38% market share in 2024. This segment leads due to high global plastics usage and accelerating shift toward advanced recycling technologies.

What is the projected value of the circular economy chemicals market by 2034?

The market is expected to reach USD 812.3 billion by 2034. Rapid scaling of chemical recycling, bio-based production, and mass balance certification drives the long-term market outlook.

What is the market size of the circular economy chemicals industry in 2024?

The market size for circular economy chemicals was USD 228.4 billion in 2024, with a CAGR of 13.5%, driven by rising adoption of circular production models and strong regulatory initiatives such as the EU Green Deal, carbon taxes, and recycling mandates.

What is the current circular economy chemicals market size in 2025?

The market size is projected to reach USD 268.5 billion in 2025. Growth is supported by expanding advanced recycling technologies and increasing demand for sustainable chemical feedstocks.

Circular Economy Chemicals Market Scope

Related Reports