Summary

Table of Content

Cinnamic Aldehyde Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cinnamic Aldehyde Market Size

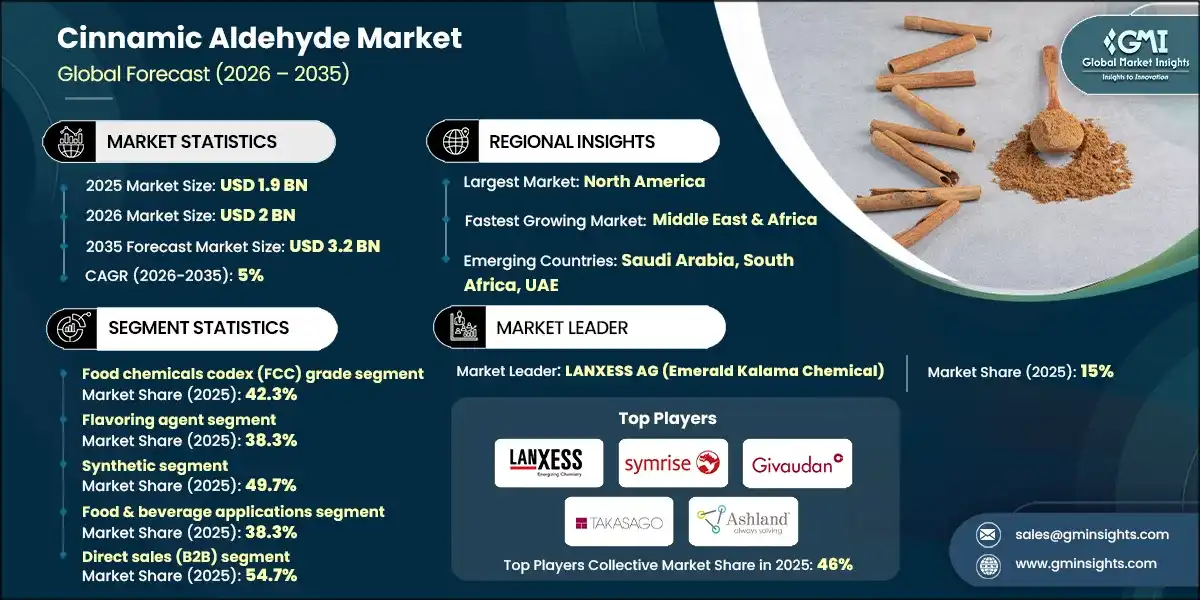

The global cinnamic aldehyde market was valued at USD 1.9 billion in 2025. The market is expected to grow from USD 2 billion in 2026 to USD 3.2 billion in 2035, at a CAGR of 5% according to latest report published by Global Market Insights Inc.

To get key market trends

- Growth in the global market for cinnamic aldehyde derives steadily, pursuing varied applications in food, fragrant items, pharmaceuticals, and industries. Demand remains from both natural and synthetic parks, with the natural variety carrying a high premium due to its derivation from cassia and cinnamon bark oils. This premium positioning thus affirms that consumers show a strong inclination toward natural materials in the high-end applications.

- Expansion of the market experiences a balance from flavoring and fragrance sections along with rapidly emerging opportunities in pharmaceuticals, agriculture, and specialty chemicals. While end-use industries such as food and beverages, personal care, and healthcare remain dominant, industrial and crop protection applications are also gaining. On the other hand, pricing dynamics vary widely with respect to grades and sources, creating clear segmentation that can assist suppliers in addressing various performance and cost requirements.

- Rapid growth in the Asia Pacific is expected to be translated into a key driver for favorable commercial development with respect to demand in the developing economy and burgeoning manufacturing. This transition shall appear to be a long-term trend of diversification, ushered by innovation along with the changing preferences of consumers.

Cinnamic Aldehyde Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.9 Billion |

| Market Size in 2026 | USD 2 Billion |

| Forecast Period 2026 - 2035 CAGR | 5% |

| Market Size in 2035 | USD 3.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing global demand for natural and clean-label food ingredients | Accelerating consumer shift toward natural, organic, and clean-label food products is fundamentally driving cinnamic aldehyde market expansion |

| Expanding use as natural antimicrobial agent in food preservation and packaging | Driven by food industry efforts to reduce synthetic preservatives and extend product shelf life through natural solutions |

| Rising pharmaceutical applications and healthcare product development | Supported by extensive scientific validation of its therapeutic properties, are creating significant growth opportunities in high-value market segments |

| Pitfalls & Challenges | Impact |

| Skin sensitization concerns and regulatory restrictions in personal care applications | Potential to cause skin sensitization and allergic contact dermatitis represents a significant restraint on market growth |

| Price volatility of natural raw materials and supply chain constraints | Particularly cassia oil and cinnamon bark oil, which are subject to agricultural production variability and geopolitical factors |

| Opportunities: | Impact |

| Accelerating shift toward natural and bio-based cinnamic aldehyde production | Driven by consumer preference for clean-label ingredients and sustainability concerns |

| Expanding regulatory approval and application scope in food preservation | Supported by favorable regulatory frameworks and growing consumer rejection of synthetic preservatives |

| Market Leaders (2025) | |

| Market Leaders |

15% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Middle East & Africa |

| Emerging countries | Saudi Arabia, South Africa, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Cinnamic Aldehyde Market Trends

- The cinnamic aldehyde industry is poised to undergo significant changes due to changes in production procedures and extensions into new application areas. Certainly, biotechnological manufacture is proving to be a disruptive force in the performance of metabolic engineering and fermentation technologies to obtain the product from renewable feedstocks. This will offer a lot more in terms of sustainability, resilience in the supply chain, and independence from agriculture or petrochemical sources. This creates a future potential growth engine for bio-based production despite costs not being competitive and still regulatory approvals in the way.

- This compound is rapidly being applied in antimicrobial uses as a food-inhibiting agent with natural antimicrobial properties. By incorporating the specific compound into films, coatings, and encapsulated systems, manufacturers can offer consumers easily understood clean-label solutions capable of extending product shelf life while using less preservatives. This fits within the general trends of using fewer preservatives internationally and diversifying food waste reduction initiatives with stricter regulations on packaging. Thus, this provides a strong motivation for companies developing packaging and food brands to adopt cinnamic aldehyde technologies.

- In health care, cinnamic aldehyde has captured attention on its therapeutic potency against metabolic disorders and chronic inflammation. Research has put emphasis on its anti-inflammatory pathway modulation and improved insulin sensitivity, paving the way for pharmaceutical formulations targeting diabetes and inflammatory conditions.

- The development is still at the beginning stage, but should successful commercialization be realized, then cinnamic aldehyde might eventually be pushed as a high-value ingredient in specialized therapies, completing its revolution from being a traditional aroma chemical into one multifunctional component of advanced healthcare solutions.

Cinnamic Aldehyde Market Analysis

Learn more about the key segments shaping this market

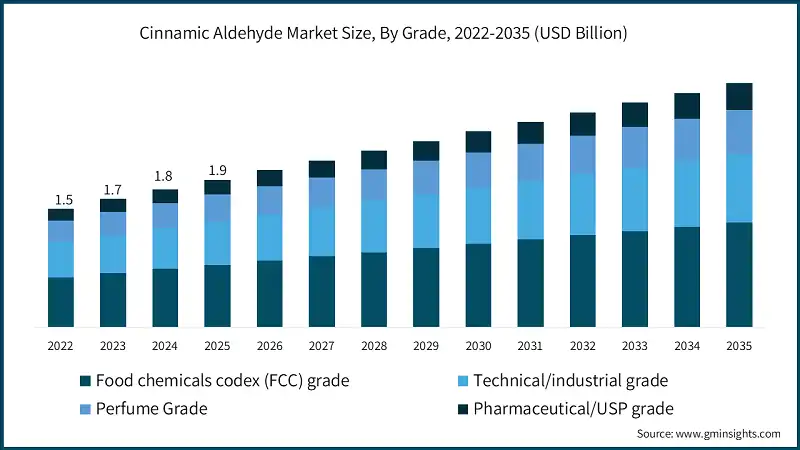

Based on grade, the market is segmented into food chemicals codex (FCC) grade, technical/industrial grade, perfume grade, pharmaceutical/USP grade. Food chemicals codex (FCC) grade dominated the market with an approximate market share of 42.3% in 2025 and is expected to grow with a CAGR of 5.2% by 2035.

- Food Chemicals Codex (FCC) grade takes preference over other grades, given its importance in flavoring applications in bakery, confectionery, beverage, and other food items. This grade requires the strict purity and safety specifications, thus making it the grade of choice for food manufacturers and flavor houses across the globe that prioritize compliance and consistency.

- Technical or industrial grade caters to applications with price sensitivity, e.g., agrochemicals, corrosion inhibitors, and specialty chemical synthesis. Because of its less stringent specifications, this grade competes well in price and benefits from steady consumption in quite mature industrial sectors. Though growth is modest, it is essential for suppliers optimizing production volumes and maintaining baseline revenues.

Learn more about the key segments shaping this market

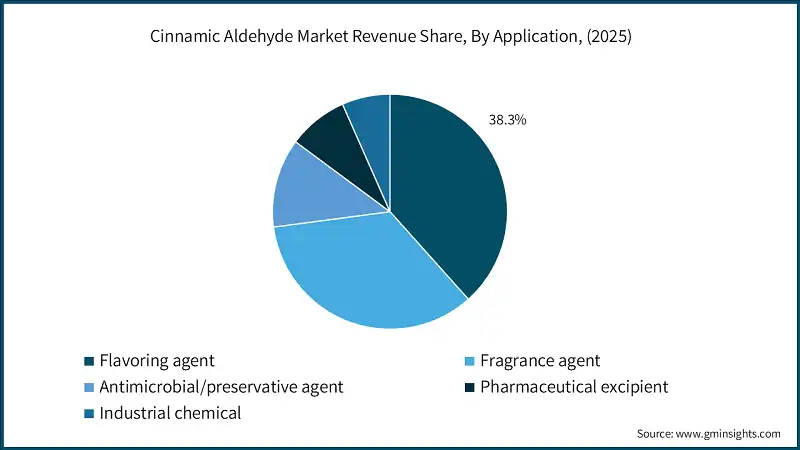

Based on application, the cinnamic aldehyde market is segmented into flavoring agent, fragrance agent, antimicrobial/preservative agent, pharmaceutical excipient, industrial chemical. Flavoring agent held the largest market share of 38.3% in 2025 and is expected to grow at a CAGR of 5.2% during 2026-2035.

- Flavors are the most developed category, widely used in food and beverage products to deliver authentic cinnamon in taste across bakery, confectionery, beverages, dairy, and savory products. Such segments will be benefitted by regulatory approvals and consumer preference for natural flavoring solutions coupled with innovation in flavor delivery systems and by increasing demand for processed and convenience food worldwide.

- The second-largest segment is fragrance applications, utilizing the unique warm, spicy character of this component in fine perfumes, personal care, and home care products. Despite concentration restrictions by regulation on skin-contact formulations, the ingredient remains vital and irreplaceable for certain fragrance profiles, especially those classified under seasonal and oriental blends.

- Emerging applications in antimicrobial and pharmaceutical segments would count among the new growth areas. Proven antimicrobial properties have led to the incorporation of cinnamic aldehyde in active food packaging, edible coatings, and natural preservative systems, thereby conforming to clean-label trends and sustainability objectives.

Based on source, the cinnamic aldehyde market is segmented into synthetic, natural, bio-based/fermentation. Synthetic i.e. chemically manufactured dominated the market with an approximate market share of 49.7% in 2025 and is expected to grow with the CAGR of 3.7% by 2035.

- Synthetic production is distinctly dominant in its economics, quality consistency, and scalability, which makes it suitable for industrial and price-sensitive applications. On the other hand, this segment comes under increasing scrutiny from rising demands for sustainability and changing consumer preferences toward the use of natural ingredients in food and personal care applications, thus limiting its luxurious positioning in those markets.

- Natural ones include almost exclusively cassia oil and cinnamon bark oil, and position all three types for clean-label and premium products. Cinnamic aldehyde derived from cassia oil caters to conventional natural applications with well-established supply chains. Natural ones include almost exclusively cassia oil and cinnamon bark oil, and position all three types for clean-label and premium products. Cinnamic aldehyde derived from cassia oil caters to conventional natural applications with well-established supply chains.

Based on end use, the cinnamic aldehyde market is segmented into food & beverage applications, oral care & dental, fragrances & personal care, agriculture & crop protection, pharmaceutical & healthcare, industrial applications. Food & beverage applications segment dominated the market with an approximate market share of 38.3% in 2025 and is expected to grow with the CAGR of 5.2% by 2035.

- Food and beverages segment gains momentum because of the strong consumer preference for authentic cinnamon flavors, requisite regulatory approvals for food safety, and global trends supporting natural ingredients. Besides, the growth is aided by innovations in flavor delivery systems and increased consumption of processed and convenience food, especially in emerging markets.

- Applications related to oral care and personal care are gradually increasing as consumers seek natural antimicrobial solutions. This property makes it valuable part of oral care products entity because of its antibacterial and flavor-packed value in toothpaste, mouthwash and dental gels. The fragrance application holds up to be significant due its unique warm and spicy character in perfumes and home care products, however regulatory conditions against skin contact formulations limit growth.

Based on distribution channel, the cinnamic aldehyde market is segmented into direct sales (B2B), distributors & traders, online B2B platforms. Direct sales (B2B) dominated the market with an approximate market share of 54.7% in 2025 and is expected to grow with the CAGR of 4.9% by 2035.

- B2B direct selling through channel distribution to target a majority of its end-users, which are large food, beverage, flavor, fragrance, and pharmaceutical companies. This mode of distribution has several solid benefits, including direct customer relationships, customized support on technology, and less complicated compliance documentation.

- Online B2B portals stand as the fastest-growing channel, thanks to digitalization and using the feasibility of online procurement. In fact, they justify the price, open the gates to many suppliers, and ease the transaction processes.

Looking for region specific data?

The North America cinnamic aldehyde industry is growing rapidly on the global level with a market share of 38.8% in 2025.

- The region benefits from well-defined regulatory frameworks, which give certainty to manufacturers in the region, to allow them to focus on innovation in food applications and compliance-driven product development. The market is moderately expanding through consumer demand for natural and clean-label ingredients, efforts to produce premium and organic food, and advances in food preservation technologies.

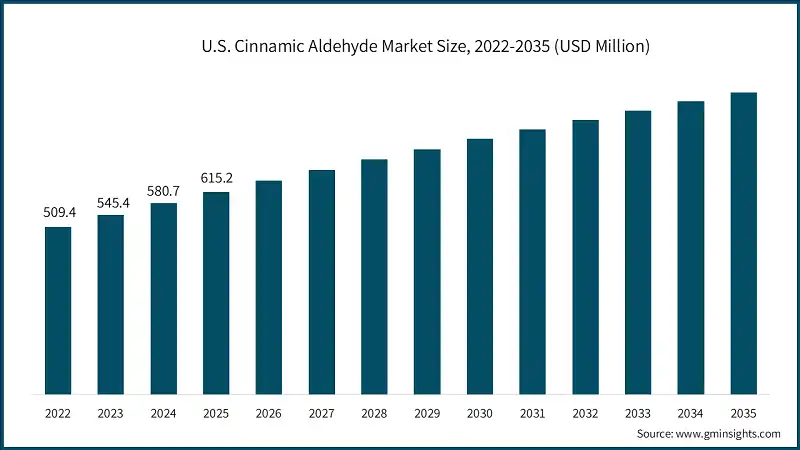

U.S. dominates the North America cinnamic aldehyde market with revenue of USD 615.2 million in 2025, showcasing strong growth potential.

- The U.S. is another major country in North America with considerable presence in the large-scale manufacturing of processed and flavored products. The growth of these markets is being supported by the players in the field who have local manufacturing capability and ensure reliability along with compliance to the regulations in the region.

Europe market leads the industry with revenue of USD 339 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe signifies an evolved market for cinnamic aldehyde with moderate growth opportunities and consumer preference for natural and organic favored by heavy regulation. The region has a rather complicated regime around food additives and flavoring substances, where the providers face both hurdles and opportunities, for compliance and certification have become key to market entry.

Germany dominates the European cinnamic aldehyde market, showcasing strong growth potential.

- Germany stands out as the leading European market with its strong flavor and fragrance industry, advanced pharmaceutical sector, and demand for quality-certified natural products.

The Asia Pacific market is anticipated to grow at a CAGR of 5.7% during the analysis timeframe.

- Asia Pacific is one of the largest and most fast-growing regions for cinnamic aldehyde due to its dominant market share for natural cinnamon and expanding industries in food and beverages.

China cinnamic aldehyde market is estimated to grow with a significant CAGR in the Asia Pacific region.

- China is the leader of the regional market. It is also the key source for high volume cost-effective as well as premium-grade cinnamic aldehyde with its flourishing demand-based production facility and increasing demand for natural ingredients. Food processing expansions and pharmaceutical manufacturing are what have made India one of the high-growth markets.

Latin America Cinnamic Aldehyde accounted for 4.2% market share in 2025 and is anticipated to show highest growth over the forecast period.

- Latin America is region with much potential growth, backed by its increasing food and beverage industry, growing middle-class populations, and demand for flavored and convenience products. Conforming with the pattern, the region has been very progressive as far as the inclusion of natural ingredients in food formulations and growth in pharmaceutical applications have been concerned.

Brazil leads the Latin American cinnamic aldehyde market, exhibiting remarkable growth during the analysis period.

- Brazil is the largest national market within the regional context, primarily because of its well-established food processing industry and a growing consumer base, as well as an expanding pharmaceutical sector in the country.

Middle East & Africa cinnamic aldehyde accounted for 3.4% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East & Africa is fast becoming one of the strongest growing markets for cinnamic aldehyde, driven by rapid evolution of food processing infrastructure, natural flavoring and preservation technology demand, and the buoyancy of the halal-certified food industry.

Saudi Arabia cinnamic aldehyde industry to experience substantial growth in the Middle East and Africa market in 2025.

- Saudi Arabia is shaping up as one of the major growth drivers in this regional horizon, taking advantage of the country's agenda for industrial transformation to incorporate large volumes of food imports, and government-led investments in local food processing capacities.

Cinnamic Aldehyde Market Share

The top 5 companies in Cinnamic Aldehyde industry include LANXESS AG (Emerald Kalama Chemical), Symrise AG, Givaudan SA, Takasago International Corporation, Ashland Global Holdings Inc. These are prominent companies operating in their respective regions covering approximately 46% of the market share in 2025. These companies hold strong positions due to their extensive experience in cinnamic aldehyde market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- LANXESS AG (Emerald Kalama Chemical) specializes in chemicals with aroma being part of the specialty chemicals portfolio through its Emerald Kalama branch. The business is directed towards food, and personal care, while its main industrial activity rests on flavor and fragrance ingredients among consumer goods.

- Symrise AG is a world supplier of flavors, fragrances, and cosmetics ingredients. Its activities cover several segments such as aroma molecules and functional ingredients among other applications directed to the industries of food, beverage, personal care, and household products.

- Givaudan SA is a multinational company in the field of flavors, fragrances, and active cosmetic ingredients. It provides solutions for consumer goods and industrial applications, with a focus on aroma chemicals and specialty compounds for diverse end-use markets.

- Takasago International Corporation develops and manufactures flavors, fragrances, and aroma chemicals for countries all over the world. Its product range for different categories of foods, beverages, personal care, and household products, emphasizes chemical synthesis and forming know-hows that combine practical creativity with science.

- Ashland Global Holdings Inc. is a specialty chemicals company providing unique ingredients and solutions for personal care and pharmaceutical coatings and industrial applications. Its portfolio also includes aroma chemicals and functional additives fulfilling the performance and formulation requirements.

Cinnamic Aldehyde Market Companies

Major players operating in the cinnamic aldehyde industry include:

- LANXESS AG (Emerald Kalama Chemical)

- Takasago International Corporation

- Aurochemicals (Group)

- Symrise AG

- Givaudan SA

- Cassia Co-op

- Wuxi Zhufeng Fine Chemical Co., Ltd.

- Ashland Global Holdings Inc.

- Vigon International, Inc.

- Advanced Biotech

Cinnamic Aldehyde Industry News

- In November 2024, LANXESS AG announced completion of operational efficiency improvements at its Emerald Kalama Chemical facility in Port Angeles, Washington, including process optimization initiatives that increased cinnamic aldehyde production capacity by approximately 8% while reducing energy consumption and environmental impact.

- In October 2024, Symrise AG expanded its natural ingredient sourcing partnership with Ceylon cinnamon producers in Sri Lanka with a five-year supply agreement for certified organic cinnamon bark oil, fully traceable from the farm to the final product.

These cinnamic aldehyde market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Grade

- Food chemicals codex (FCC) grade

- Technical/industrial grade

- Pharmaceutical/USP grade

- Perfume grade

Market, By Application

- Flavoring agent

- Fragrance agent

- Antimicrobial/preservative agent

- Pharmaceutical excipient

- Industrial chemical

Market, By Source

- Synthetic

- Natural

- Bio-based/fermentation

Market, By End Use

- Food & beverage

- Bakery & confectionery

- Beverages (alcoholic & non-alcoholic)

- Chewing gum

- Breakfast cereals

- Meat products & condiments

- Others

- Oral care & dental

- Toothpaste

- Mouthwash

- Others

- Fragrances & personal care

- Fine fragrances

- Soaps & detergents

- Others

- Agriculture & crop protection

- Fungicides

- Insecticides

- Algaecides

- Others

- Pharmaceutical & healthcare

- Drug formulations

- Allergenic patch tests

- Industrial applications

- Rubber manufacturing

- Electroplating

- Oil & gas

- Others

Market, By Distribution Channel

- Direct sales (B2B)

- Distributors & traders

- Online B2B platforms

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the cinnamic aldehyde market?

Major players include LANXESS AG (Emerald Kalama Chemical), Symrise AG, Givaudan SA, Takasago International Corporation, and Ashland Global Holdings Inc. These companies focus on sustainable sourcing, product innovation, and expansion of high-value application segments.

What are the upcoming trends in the cinnamic aldehyde industry?

Key trends include bio-based and fermentation-derived production, increased use in active food packaging, growing pharmaceutical research for therapeutic applications, and rising demand for natural antimicrobial agents across industries.

Which region leads the cinnamic aldehyde market?

North America led the global market with a 38.8% share in 2025. Market leadership is driven by advanced food processing industries, strong regulatory frameworks, and high demand for natural and clean-label ingredients.

What is the cinnamic aldehyde market size in 2025?

The cinnamic aldehyde industry is valued at USD 1.9 billion in 2025. Strong demand for natural and clean-label food ingredients, along with rising applications in flavoring and fragrance formulations, is supporting market growth.

What is the market size of the cinnamic aldehyde industry in 2026?

The market size for cinnamic aldehyde reached USD 2 billion in 2026, reflecting steady expansion driven by increasing adoption in food preservation, personal care, and pharmaceutical applications.

What is the projected value of the cinnamic aldehyde market by 2035?

The market size for cinnamic aldehyde is expected to reach USD 3.2 billion by 2035, growing at a CAGR of 5%. This growth is fueled by rising demand for bio-based ingredients, antimicrobial food solutions, and expanding pharmaceutical use.

What was the valuation of the flavoring agent application segment in 2025?

The flavoring agent segment held 38.3% market share in 2025. Growth is driven by consumer preference for authentic cinnamon flavors and increased consumption of processed and convenience foods.

How much revenue did the food chemicals codex (FCC) grade segment generate in 2025?

The FCC grade segment accounted for approximately 42.3% of the market in 2025. Its dominance is supported by strict food safety requirements and strong demand from bakery, confectionery, and beverage manufacturers.

Cinnamic Aldehyde Market Scope

Related Reports