Summary

Table of Content

China Continuous Glucose Monitoring Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

China Continuous Glucose Monitoring Market Size

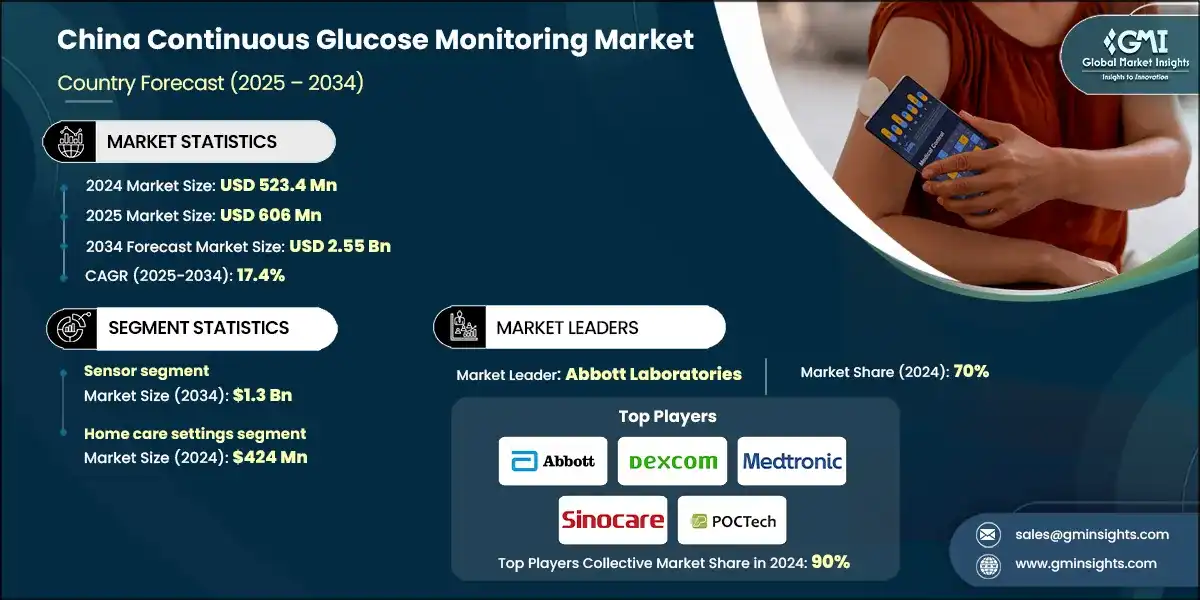

The China continuous glucose monitoring market size was valued at USD 523.4 million in 2024 and is expected to reach from USD 606 million in 2025 to USD 2.55 billion in 2034, growing at a CAGR of 17.4% from 2025 to 2034, according to the latest report published by Global Market Insights Inc.

To get key market trends

This steady growth is stimulated by various factors such as rising prevalence of diabetes in China, technological advancements in continuous glucose monitoring devices, increasing government initiatives to promote awareness regarding diabetes, and increasing geriatric population base across the country. Continuous glucose monitoring (CGM) is an advanced diagnostic device used to track blood glucose levels continuously throughout the day and night. These systems use a small sensor inserted under the skin to measure interstitial glucose levels. Major companies in the industry include Abbott Laboratories, Dexcom, Medtronic, and Sinocare.

The market increased from USD 345.8 million in 2021 to USD 453.3 million in 2023. The high prevalence of diabetes in China is a significant factor accelerating the market growth. For instance, according to the International Diabetes Federation, in 2024, China had the largest adult diabetes population globally, with an estimated 147,981,200 cases representing a prevalence of 11.9% among adults’ population of the country. This rising trend has created a growing demand for better diagnostic technologies, earlier detection methods, and more effective monitoring options. Thus, as the number of affected individuals increases, healthcare providers and industry leaders in the country are stepping up their efforts and investments to address this urgent medical challenge, fostering market growth.

Additionally, China's rapidly aging population further strengthens market development. For instance, the World Health Organization (WHO) data indicates that the proportion of people aged 60 and above will reach 28% by 2040 due to increased life expectancy. This demographic transition correlates with higher chronic disease rates, including diabetes, particularly among older adults. Thus, as this population requires consistent monitoring and care, the demand for reliable and user-friendly continuous glucose monitoring devices continues to increase.

Continuous glucose monitoring (CGM) is a medical technology used to track glucose levels in the body continuously throughout the day and night. Unlike traditional blood glucose monitoring that requires fingerstick blood samples, CGM systems use a small sensor inserted under the skin to measure interstitial glucose levels in real time.

China Continuous Glucose Monitoring Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 523.4 Million |

| Market Size in 2025 | USD 606 Million |

| Forecast Period 2025 - 2034 CAGR | 17.4% |

| Market Size in 2034 | USD 2.55 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising diabetes prevalence across China | Drives strong demand for continuous glucose monitoring solutions to manage chronic conditions effectively. |

| Technological advancements in continuous glucose monitoring devices | Enhances accuracy and usability, boosting adoption among patients and healthcare providers. |

| Increasing government initiatives to promote awareness regarding diabetes | Promotes early diagnosis and monitoring, expanding the CGM user base. |

| Increasing geriatric population | Raises the need for non-invasive, real-time glucose monitoring due to higher diabetes risk in older adults. |

| Pitfalls & Challenges | Impact |

| Stringent regulatory scenario | Slows down product approvals and market entry, limiting the availability of CGM devices. |

| High cost of CGM devices | Reduces affordability and adoption, especially among middle- and low-income patient groups. |

| Opportunities: | Impact |

| Integration of AI and predictive analytics to provide personalized alerts | Drives development of smart CGM platforms that offer real-time insights, trend forecasting, and automated alerts, enhancing user engagement and proactive diabetes management. |

| Market Leaders (2024) | |

| Market Leaders |

70% market share |

| Top Players |

Collective Market Share is 90% |

| Competitive Edge |

|

| Future outlook |

|

What are the growth opportunities in this market?

China Continuous Glucose Monitoring Market Trends

- Continuous glucose monitoring devices have undergone a remarkable transformation in recent years, fuelled by technological innovation that has significantly accelerated the market growth. These advancements have enhanced the accuracy, usability, and overall experience of CGM systems, making them more important for patients and healthcare professionals.

- A significant advancement is the enhanced accuracy and extended lifespan of sensors. Modern CGM devices now offer long wear duration and greater stability.

- Moreover, the integration of smart technology has enhanced CGM functionality, many devices now deliver real-time glucose readings directly to smartphones, smartwatches, and other connected platforms, allowing users to conveniently monitor their levels and share data instantly with healthcare providers. For instance, Abbott FreeStyle Libre includes optional real-time alerts through mobile devices.

- Additionally, the combination of artificial intelligence and machine learning in continuous glucose monitoring, which is estimated to reach USD 47.1 billion by 2034, systems is helping to provide personalised insights and predictive analytics. These features help users and clinicians identify glucose patterns, anticipate future trends, and inform decisions, which stimulates the adoption and growth of CGM technology in the foreseeable future.

China Continuous Glucose Monitoring Market Analysis

Learn more about the key segments shaping this market

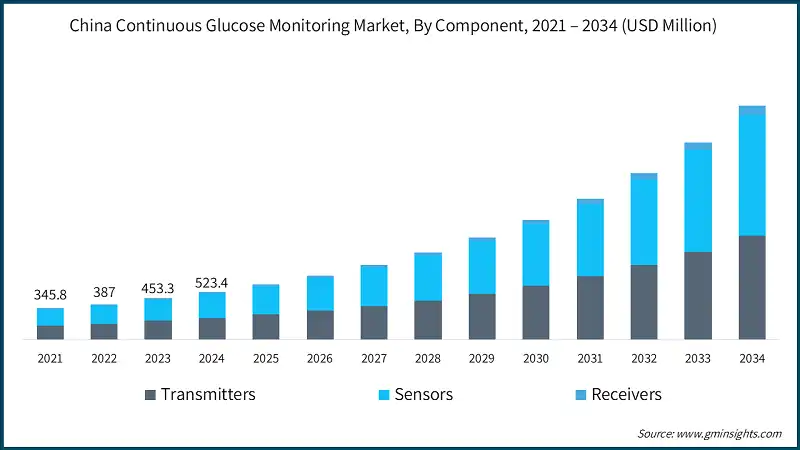

The China market was valued at USD 345.8 million in 2021. The market size reached USD 453.3 million in 2023, from USD 387 million in 2022. Based on the component, the China continuous glucose monitoring industry is segmented into transmitters, sensors, and receivers. The sensor segment led this market in 2024, accounting for the highest market share because of its non-invasive nature and extended wear duration. This segment was valued at USD 265.5 million in 2024 and is projected to reach USD 1.3 billion by 2034, growing at a CAGR of 17.5%. This growth is due to the shift toward home-based care and personalized treatment. In comparison, the transmitter segment, valued at USD 236.8 million in 2024, is expected to grow to USD 1.1 billion by 2034, with a CAGR of 17.2%, supported by wireless data transmission and cloud connectivity.

- In continuous glucose monitoring (CGM) systems, transmitters are devices that attach to sensors to collect glucose readings and send data to receivers, smartphones, or other connected devices. The transmitter functions as the connection between the sensor and user interface, enabling continuous wireless transmission of glucose data.

- Transmitters enhance CGM system functionality by enabling real-time monitoring, decreasing the need for fingerstick tests, and facilitating remote monitoring by healthcare providers. These capabilities improve patient convenience and treatment adherence, supporting proactive diabetes management.

- For instance, SinoCare's iCan i3 CGM transmitters use Bluetooth technology to connect with their companion app, requiring initial pairing before system use. This enables continuous monitoring and glucose trend analysis. The system's smartphone integration increase accessibility, particularly in developing markets such as China.

- Therefore, the transmitter segment continues to grow due to developments in digital health tools, mobile health applications, and wearable technology. This evolution is accelerating the demand for technologically advanced transmitter, supporting segment expansion.

Learn more about the key segments shaping this market

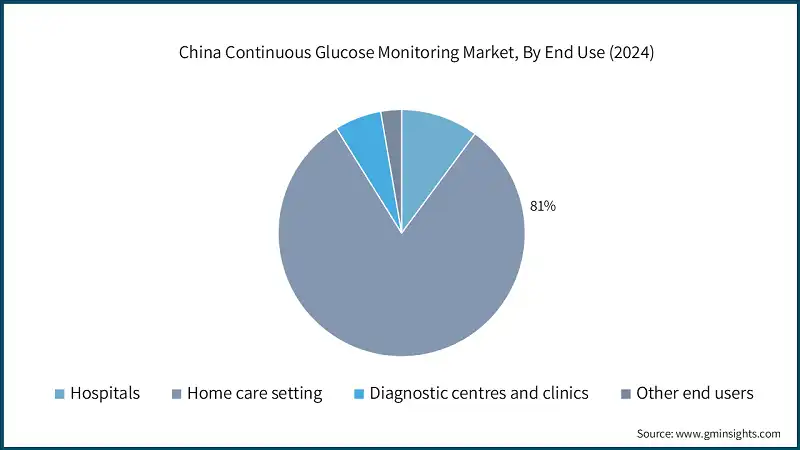

Based on end use, the China continuous glucose monitoring market is bifurcated into hospitals, home care settings, diagnostic centres and clinics, and other end users. The home care settings segment held a significant revenue of USD 424 million in 2024 with a revenue share of 81%.

- The increasing prevalence of diabetes across the country has heightened the demand for continuous glucose monitoring devices (CGMs) for use at home. These devices provide real-time readings and alerts, enabling patients to manage their condition from home without frequent clinical visits.

- Technological improvements in CGM systems have enhanced their accuracy, comfort, and ease of use, broadening their appeal. The integration of these devices with smartphones and digital platforms enables users to monitor glucose levels and share data with healthcare providers efficiently.

- Moreover, the COVID-19 pandemic accelerated the adoption of home-based healthcare solutions, including CGM devices. Thus, as patients sought to minimize hospital visits and clinical exposure, CGM systems became vital tools for managing diabetes at home, contributing to market expansion.

- Therefore, the home care segment represents the fastest-growing portion of the CGM market, stimulated by the increasing development of user-friendly devices designed for personal use.

China Continuous Glucose Monitoring Market Share

- The top five players in the China continuous glucose monitoring industry, namely Abbott Laboratories, Dexcom, Medtronic, Sinocare, and Zhejiang POCTech collectively hold a 90% share of the China market. These companies are reinforcing their market position through ongoing innovation, compliance with Chinese regulatory frameworks, and strategic partnerships. Their efforts are focused on delivering advanced CGM technologies with extended wear time, enhanced accuracy, and seamless digital integration to support both clinical and home-based diabetes management across the country.

- Manufacturers are increasingly launching real-time CGM solutions that provide continuous glucose monitoring, predictive alerts, and cloud-enabled data sharing. These features are aimed at minimizing diabetes-related complications and improving glycemic outcomes by facilitating proactive, data-driven decision-making and remote patient care across diverse population segments. Moreover, emerging players in China’s CGM market are gaining traction through innovation, affordability, and strategic partnerships. Companies are launching AI-powered, cost-effective CGM systems with longer wear times and smart features.

China Continuous Glucose Monitoring Market Companies

Some of the eminent market participants operating in the China continuous glucose monitoring industry include:

- Abbott Laboratories

- Dexcom

- Jiangsu Yuyue Medical Equipment & Supply

- Med Trust

- Medtronic

- Medtrum Technologies

- Senseonics

- Sinocare

- Zhejiang POCTech

Abbott Laboratories features a strong and diverse product lineup that fuels broad adoption and drives substantial growth in the CGM market. Its range of continuous glucose monitoring solutions is widely acclaimed for their cutting-edge innovation and accessibility.

Dexcom maintains a strong commitment to research and development, consistently pushing the boundaries of CGM technology.

Medtronic capitalizes on its vast global footprint, operating in over 150 countries with a strong distribution network to expand its market presence. Its CGM product portfolio supports comprehensive diabetes management, offering integrated solutions for patients and healthcare providers alike.

China Continuous Glucose Monitoring Industry News

- In December 2024, A. Menarini Diagnostics signed an exclusive distribution agreement with Chinese CGM manufacturer Sinocare. The deal allowed Menarini to market Sinocare’s third-generation continuous glucose monitoring system across over 20 European countries. This collaboration marked a major step in China-Europe medical technology cooperation, showcasing the global trust in Chinese innovation for diabetes care.

The China continuous glucose monitoring market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Component

- Transmitters

- Sensors

- Receivers

Market, By End Use

- Hospitals

- Home care setting

- Diagnostic centres and clinics

- Other end use

Frequently Asked Question(FAQ) :

Who are the key players in the China continuous glucose monitoring market?

Key players include Abbott Laboratories, Dexcom, Medtronic, Sinocare, Zhejiang POCTech, Medtrum Technologies, Senseonics, Med Trust, and Jiangsu Yuyue Medical Equipment & Supply.

What are the upcoming trends in the China continuous glucose monitoring market?

Key trends include AI-powered predictive insights, integration with smartphones and smartwatches, non-invasive monitoring solutions, and government-backed diabetes awareness campaigns.

What is the growth outlook for sensors from 2025 to 2034?

The sensor segment is projected to grow at a CAGR of 17.5% through 2034.

What is the projected value of the China continuous glucose monitoring market by 2034?

The China CGM industry is expected to reach USD 2.55 billion by 2034, driven by technology advancements, government awareness programs, and the country’s growing elderly population.

How much revenue did the sensor segment generate in 2024?

The sensor segment generated USD 265.5 million in 2024, leading the market due to its extended wear duration and non-invasive technology.

What was the valuation of the transmitter segment in 2024?

The transmitter segment was valued at USD 236.8 million in 2024.

What is the market size of the China continuous glucose monitoring market in 2024?

The market size was USD 523.4 million in 2024, with a CAGR of 17.4% expected through 2034 driven by rising diabetes prevalence across China.

What is the current market size of the China continuous glucose monitoring market in 2025?

The market size is projected to reach USD 606 million in 2025.

China Continuous Glucose Monitoring Market Scope

Related Reports