Summary

Table of Content

Cementitious Grouts Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cementitious Grouts Market Size

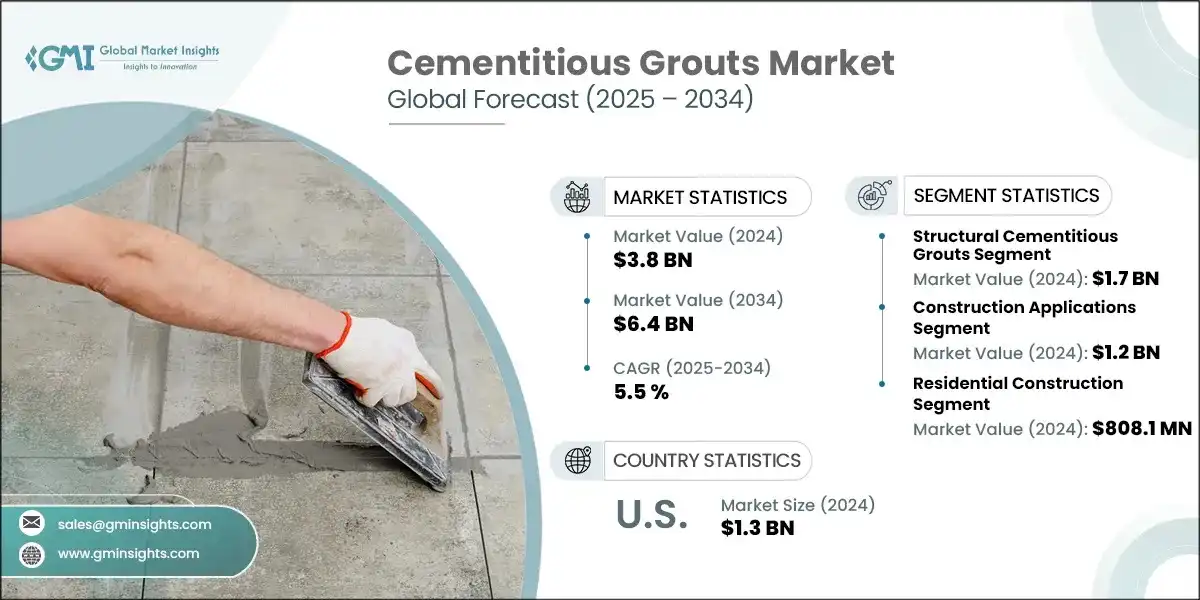

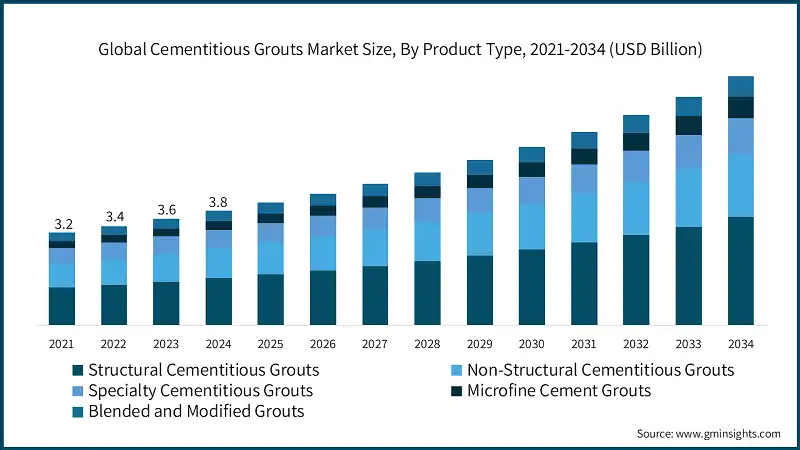

The global cementitious grouts market size was estimated at USD 3.8 billion in 2024 and is estimated to reach USD 6.4 billion by 2034, with 5.5% CAGR from 2025 to 2034.

To get key market trends

- Cementitious grouts industry worldwide is undergoing a structural shift with the increasing demand in infrastructure strengthening, geotechnical stabilizing, tunneling, and high-performance construction uses. As more investments in megaprojects go into Asia-Pacific, Middle East and Eastern Europe, the use of precision-engineered cementitious solutions is gaining momentum.

- Structural grouts which are known to dominate the market on a volume basis still exist because of their compressive strength and dimension stability. Nonetheless, chemical resistance modified cementitious grouts, especially the ones specifically adapted to shrinkage compensation, rapid set cementitious grout and seismic retrofit have recently gained the ground, especially in tunnel grouting and earthquake damage retrospective.

- Complex geologies are also seeing widespread replacement of regular cement grouts with microfine cement grouts, which are used in soil consolidation and repair of fine cracks. It is reported that these microfine variants are earning nearly 10% of the total cementitious grout market without facing any specific difficulties and are posing promising growth rates because of the capability of penetrating in ultra-fine pore space and enhancing substrate edging in geotechnical construction.

- The use of blended and polymer-modified cementitious grouts is rapidly gaining pace especially in situations where the grout is to experience even flowability and longer service life in severe conditions. These composites, frequently containing supplementary cementitious materials (SCMs) and special auxiliary additives are currently gaining cementitious grouts market share and as sulfate and chloride resistance becomes better they are also finding use in marine and offshore applications.

- Furthermore, advancement in the chemistry of admix is allowing new products that require less water, have less permeability and need to be cured at faster rates in accordance with the rapid urbanization plans. The application practice is also under the influence of digitalization, as the robotic grouting platforms with automation mixers are implemented in the high-precision construction of tunnels and dams in APAC and Europe.

Cementitious Grouts Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.5% |

| Market Size in 2034 | USD 6.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Infrastructure Development and Modernization | Drives consistent demand for high-performance grouting solutions in large-scale civil projects. |

| Growing Construction Industry Demand | Boosts volume consumption across residential, commercial, and industrial construction segments. |

| Tunneling and Mining Expansion | Increases specialized grout usage for structural reinforcement and ground stabilization. |

| Pitfalls & Challenges | Impact |

| High Initial Investment Costs | Limits adoption among small- and medium-scale contractors. |

| Technical Expertise Requirements | Restricts usage in projects lacking skilled labor or advanced application knowledge. |

| Opportunities: | Impact |

| Emerging Market Penetration | Opens avenues for growth through infrastructure investments in Asia-Pacific, Africa, and Latin America. |

| Green Building and Sustainable Construction | Drives demand for eco-friendly, low-emission grout solutions in compliance with global sustainability standards. |

| Market Leaders (2024) | |

| Market Leaders |

15% market share |

| Top Players |

Collective market share in 2024 is 54% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, Germany, Brazil and UAE |

| Future Outlook |

|

What are the growth opportunities in this market?

Cementitious Grouts Market Trends

- The changing cementitious grout demand environment is experiencing a change due to the increased complexity of infrastructure requirements, heavy duty industrial floors and sub-base design in large span transportation structures. With major portion taking place in the Asian Pacific and Middle East region. Higher spend of the government on urban transport systems, bridges, and dig tunnels using hydropower have enhanced the demand level of non-shrinking, flowable, and quick-setting solutions in the civil engineering sectors.

- Sustainability-related product formulation innovations are also being determined by regional carbon intensity standards, with low alkali grouts or SCM-blended versions taking increasing precedence in low carbon-tax jurisdictions based on Western Europe. The procurement strategies have become more aligned with EN 1504-6 and ASTM C1107 compliance and the firms have adapted towards green public infrastructure by introducing bagged grouts with fly ash, GGBFS, or calcined clay. The entries of manufacturers like Sika AG and Holcim are harmonizing supplies side decarbonization standards with the introduction of cementitious products applicable in the LEED coursed constructions.

- The need to place microfine grouts at high pressures and low bleed demands in geotechnical and tunneling applications is also stimulating research investments in this cementitious grout, especially in the US, with current usage estimated to be 8-10% of total cementitious grout consumption and extensive application in deep shaft lining, diaphragm walls and fractured rock stabilization. Recent statistics indicates a boom in the usage of grouts involving particle sizes less than 6 micrometer, which match with ultrafine grouting criteria.

- The long-term shift of prepackaged dry grout systems is gathering speed among large-scale construction projects that demand mix-design concurrence, supply less inconsistency in-site batching, and ample labor-savings. The placement of these systems is in prefabrication yards, offshore wind turbine grouting and placement of bridge bearing plate among others where the reduction of the downtime is a key consideration during procurement. Indian and UAE regional results indicate that factory-controlled, ready-to-use cementitious grout systems with rheology modifiers and plasticizing agents are also becoming more preferred.

Cementitious Grouts Market Analysis

Learn more about the key segments shaping this market

Based on product type, the market is segmented into structural cementitious grouts, non-structural cementitious grouts, specialty cementitious grouts, microfine cement grouts and blended and modified grouts. The structural cementitious grouts segment was valued at USD 1.7 billion in 2024.

- Structural cementitious grouts have a prevailing share of consumption at worldwide level especially in civil infrastructure and transport engineering schemes at high scale. They are the most preferred compressive strength material used in bridges bearing, column bases and precast elements because of their high compressive strength, stability in volume and resistance against dynamic loads stress.

- The extremely high urban infrastructure development rates in Asia-Pacific region particularly India and China are creating contract-based contracts of structural grouts, even surpassing the forecasted demands of metro rails and expressways. Top suppliers are also launching non-shrink and sulfate-resistant combinations to facilitate long-lasting performance in harsh settings.

- Non-structural grouts are mostly used in gap filling, sealing, and non-load bearing purposes but have increasingly been used in interior renovation and remodeling of homes. Their performance levels are below those of structural products, although the products are increasing in demand in the form of pre-mixed variants that have greater pumpability and shorter set times. Small to medium renovation contractors in Western Europe and Japan are witnessing moderate yet consistent demand in these grouts owing to their Usage of the product that are LEED or BREEAM certification controlled.

- Specialty Cementitious Grouts have grouts that have improved chemical resistance, high-temperature resistance, or those that can be under sea or marine construction. These are grouts that must be customized to specific situations like oil and gas refineries, desalination plant or hydropower installations. The ultra-low permeability and micro-expansive properties are generating new ways of innovation in this area as producers are researching the use of lithium-silicate and nano-SiO2 additives to enhance longer-term behavior. According to demand, it is mostly concentrated in the regions of the Middle East and Southeast Asia whose service environment is aggressive.

- Precise injection is possible in rock damping, soil consolidation, and the conservation of heritage structures due to the establishment of fine particle cement grouts, known as microfine cement grouts. They are essential in tunnelling projects, dam rehabilitation and retrofitting projects due to their ability to infiltrate in microcracks and porous substrates. Expansions to the underground metros and new dam safety projects in Europe and Latin America are the factors that sustain the growth. Better rheological control is being introduced by advanced formulations that include the dispersing agents and anti-bleed additives.

- Blended and Modified Grouts contains cementitious grouts mixed with polymers, fly ash, slag, silica fume or other mineral additives to enhance particular features including shrinkage control, flow, or set time. The section is witnessing an intensified interest in geotechnical projects as well as green building.

Based on applications, the cementitious grouts market is segmented into Construction Applications, Mining and Tunneling, Infrastructure Projects, Marine and Offshore Applications, Industrial Applications and Geotechnical Applications. The construction applications section was valued at USD 1.2 billion in 2024.

- The cementitious grouts application is led by the global construction industry with more than 38% share of the overall application of cementitious grouts in 2024 as high-rise buildings, precast technologies, and reinforcement anchoring of concrete structures call upon high-performance structural grouting industry to embed their high load and diverse weather conditions.

- In tunnel and mining, cementitious grouts especially the microfine and special type varieties are widely applied in void filling and ground stabilizing and ground water infiltrations. The underground infrastructure is becoming more widespread in Latin America and Asia-Pacific and the segment is projected to increase at a CAGR of 6.3% till 2030.

- High flow blended and modified grouts are finding applications more and more in infrastructure projects such as dam constructions and repairs, tunnels, bridges, and rail and metro stations, especially in regions whose respective governments are undertaking large national infrastructure projects, especially in India, the UAE and Southeast Asia.

- Sulfate-resistant, non-shrink cementitious grouts have been used in marine and offshore applications to encapsulate and anchor piles and reinforce them against corrosion by underwater attachment. With increasing number of offshore wind power installations and port development in Europe and East Asia, the segment is experiencing a new build up in formulation optimization and flow control investment.

- Precision grouts that have high compressive strength and chemical resistance are required in industrial applications, particularly in foundation work in heavy machinery, in the chemical plant and process industries. Investments in brownfield modernization and manufacturing sector CAPEX recovery in North America and Western Europe are channels of support to growth.

- Microfine cement unit grouts are increasingly being used as geotechnical tools in reducing the soil permeability, slope stabilization, and ground improvement. Increases in usage are noted in seismic prone locations and in areas of urban development in which strengthening foundations and installation of a barrier to ground water contamination is essential.

Learn more about the key segments shaping this market

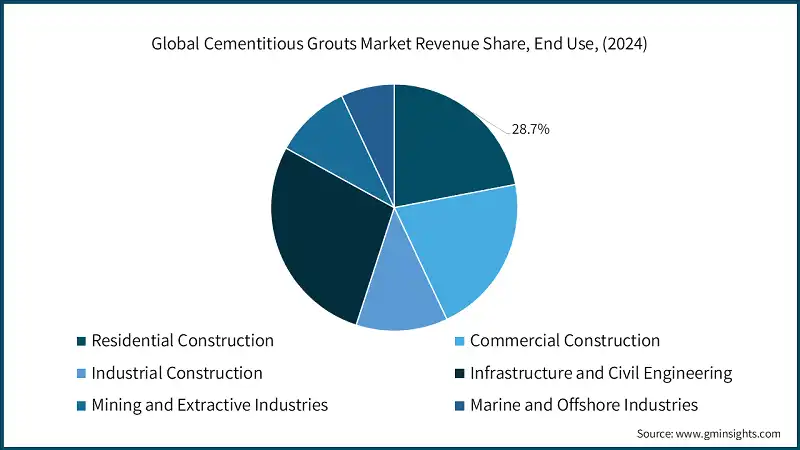

Based on end use, the cementitious grouts market is segmented into residential construction, commercial construction, industrial construction, infrastructure and civil engineering, mining and extractive industries, and marine and offshore industries. The residential construction was valued at USD 808.1 million in 2024.

- Residential construction takes about 21.3% revenue in cementitious grout usage worldwide, especially in developing economies that are rapidly growing through urbanization. Grouts are also widely used in anchoring, filling gaps as well as tiling. The increase in this segment is due to the increase in multi-family housing development and affordable housing policies of the government in markets like India, Indonesia and some market in Sub-Saharan Africa.

- The commercial construction which consists of office complex, shopping malls, hotels, and institutional buildings has about 20.5% of the total market share. Desire in the segment is shifting more and more to structural column base plate and connections and pre-cast elements through non-shrink and flowable grouts. Regulatory requirements on building structural safety and fixing of older commercial premises are also enhancing demand in developed markets such as the U.S, Germany and Japan.

- Cementitious grouts used in industrial constructions takes up 11.8% share in 2024 and provide high compressive strength, anti-corrosive against oil or chemicals and have a low shrinkage behavior, particularly in equipment foundations and machine bases. The segment is experiencing demand boost with reference to investments in clean energy infrastructure, petrochemicals as well as process manufacturing in North America, China and the Middle East.

- Infrastructure and civil engineering continue to be the largest end use sector playing the major share of more than 28.7% on the global market. The long-term government infrastructure programs promote high-volume use of bridges, tunnels, dams, and in the construction of highways. Use of grout in high load as well as geotechnically demanding applications is a major distinguishing aspect in this sector.

- Cementitious grouts are used in mining and extractive industries has a share of 10.2% in 2024, where they are employed in consolidating the ground, sealing the shafts and stabilizing the support structure. Specialty and microfine cement type formulations are desirable in deep penetration and water ingress resistant situations.

- Durable and sulfate-resistant cementitious grout is used in relation to marine and offshore industries in grouting of subsea piles, wind turbine foundations, and repair of structural members in saltwater. The development of new techniques of using underwater technologies and a long operational span is becoming a matter of strategic importance among solution providers.

Looking for region specific data?

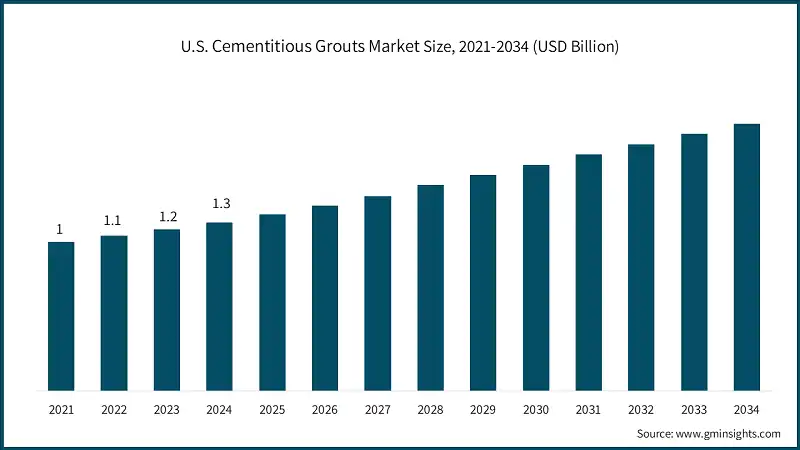

With over 82% market share, U.S. is leading the cementitious grouts market that is valued at USD 1.3 billion in 2024.

- This leadership status is explained by a long-term process of updating infrastructures, new funding at the federal level in the framework of the Infrastructure Investment and Jobs Act (IIJA), and extensive use of new construction materials based on renewable raw materials to comply with durability combined with the policy of environmental responsibility.

- Cementitious grouts, especially those used in tunnel construction as lining grouts, bridge bearings, precast bond, and ground stabilization, are getting steamed into the market in niche areas with a high level of mechanical strength requirements, low permeability, as well as long-range chemical resistance.

- Federal and state incentives to seismic retrofits plus rehabilitation of aging water and wastewater systems are leading to increased grout usage in structural and non-structural void structural applications. Moreover, increased investment in the development of public transport and especially metro, rail corridors, and port developments are boosting the consumption of the high-performance flowable grouts in great volumes within the Northeast, Midwest, and Western states.

- The construction industry of a commercial nature and particularly, taller buildings, data center buildings, logistics parks are using the self- compacting grout and shrinkage-compensated grouts in the engineering aspects such as base plate installations, anchoring and post-tensioning especially in seismic-prone areas such as California. The emerging trend to precast building systems and modular buildings is strengthening the use of grout in pre-grouted holes in anchor brackets and structural connecting systems.

- Oil & gas pipelines, power plants and chemical storage terminals in the industrial segment are using grouts to base plates on their equipment as well as to level their tanks, and are growing primarily in the Texas, Louisiana and the Gulf Coast. The mining business, chiefly in Nevada, Arizona, and, Utah, is also playing an important role in contributing to the demand used in ground consolidation, shaft lining and backfilling.

- Sustainability factors such as LEED certification requirements and reduction of VOCs are driving the use of low-chromate, non-toxic cementitious grout mix designs. A number of American producers have also been investing in grout system R&D at the same time as optimizing workability, pumpability and long-term dynamic load supports.

The cementitious grouts market in the Germany is expected to experience significant and promising growth from 2025 to 2034.

- Non-shrink and self-leveling grouts are available and being picked up at an ever increasing pace within the residential and commercial areas to meet new DIN EN requirements. The demand is further triggered calling energy-efficient retrofitting initiatives on existing housing stock through the German funded in green KfW spending plans that comprise waterproofing, and the basement fortification and sealing under slab areas.

- The large number of automotive and manufacturing centers, especially in Baden-Wurttemberg, Bavaria and North Rhine-Westphalia, is influencing the demand of grout in Germany as well. Cementitious grout that has good performance is finding use in the heavy duty flooring jobs, machine foundations, and vibration sensitive bases. Performance demands that are becoming stringent in compressive strength, flexural performance, and chemical resistance are promoting the trend of polymer modification and high strength formulations, particularly in those types of environments that are engineering intensive.

- Technological changes are also being witnessed in market in terms of packaging and application of grouts, as there is increased availability of pre-mixed dry bagged grouts and automated injection systems amongst specialty contractors. To keep up with the narrow construction deadlines and counter the environmental degradation, the modular structures, including railway stations, bridges, tunnels, and wastewater treatment plants, are more than ever turning to the variants of rapid-setting and sulfate-resistant technology.

- Major suppliers are also under pressure due to Germany committing itself to the so-called the Circular Economy Action Plan and the EU Green Deal. Major market players are also utilizing the concept of Life Cycle Assessments (LCA) of grout systems in order to fulfilling institutional tender prerequisites, as well as customer Environmental, Social, and corporate Governance (ESG) evaluation ratings, particularly in public-private partnership (PPP) infrastructure schemes.

The cementitious grouts market in the China is expected to experience significant and promising growth from 2025 to 2034.

- The high pressure on labor cost and time constraints builds the broad use of self-leveling grouts in modular construction systems in Tier 1 and Tier 2 cities within the commercial business as well as the mixed-use developments. In the meantime, there is an increasing demand in geotechnical and tunneling sectors where injection grouts are produced to enhance the safety of metros, slope stabilization, foundation strengthening, etc., most significantly within the context of megaprojects such as that of Greater Bay Area expansion.

- The industrial construction of China, especially in the projections of the provinces such as Jiangsu and Guangdong is shifting to fluid microfine grouts coupled with cement-polymer hybrids into their machine bases, thermal plants, and chemical containment zones as national regulations on the compressive strength and permeability resistance are made tighter.

- The operation of digital convenience at a job site is also driving the uptake of pre-batched grout systems having QR coded compliance tracking, especially government-controlled projects and clusters of industrial parks.

The cementitious grouts market in the Brazil is expected to experience significant and promising growth from 2025 to 2034.

- Industrial-grade grouts are becoming increasingly specified in the southern and the southeast regions in baseplate grouting and structural infill within automotive, packaging, and agro-processing plants. The construction of municipal infrastructures, especially water and sanitation infrastructure line networks in the outskirts of cities and flood-protection facilities are driving the demand towards low-permeability and corrosion-resistant versions.

- Despite market fluctuations in the cost of raw materials and shipping expenses, Brazil is experiencing increased curiosity of environmentally compatible formulations. ABNT NBR certifications are influencing the purchase of low-chromate and alkali-controlled grouts in long term public works departments.

The cementitious grouts market in the UAE is expected to experience significant and promising growth from 2025 to 2034.

- Mega infrastructure projects under UAE Vision 2031, including Etihad Rail, port terminals, desalination facilities, and green hydrogen hubs, are increasingly specifying high-strength, fluidity-controlled, and non-shrink grouts for critical anchoring and foundation purposes.

- In commercial construction across Dubai and Abu Dhabi, aesthetic and rapid-curing grouts are being adopted in premium-grade floorings and vertical structural elements, particularly in hospitality and high-rise segments. The offshore and oilfield-linked segments are showing preference for epoxy-modified and ultra-durable cementitious grouts for underbase and joint applications.

- Material suppliers in the UAE are responding to ESMA certification compliance, with growing focus on pre-blended, dust-free grout packaging and temperature-adaptive mix designs suited for arid climates and fast-paced construction schedules.

Cementitious Grouts Market Share

- As of 2024, the leading 5 players in the cementitious grouts industry across the globe, namely, Sika AG, MAPEI S.p.A, LafargeHolcim (Holcim Group), Fosroc International Limited and BASF SE occupy a total of around 46-51% of the total market share. These are players who have had dominance in both structural and non-structural grout uses and their situation is backed by combination of global coverage, product technology, and construction specific technical services.

- The region-based players in Asia-Pacific and Latin America, especially in India, China, Brazil, and Mexico, are also emerging in the market due to their infrastructural growth, and smart city initiatives enabled by the government. These players have been keen on providing price competitive blended grout options that suit the areas of high-humidity and tropical constructions.

- Price pressure will result in the commoditization of general-purpose cementitious grouts and leading market players are increasingly turning to value-added types of grouts which include microfine grouts, sulfate-resistant grouts and shrinkage compensated products. Sustainability certifications, adherence to ASTM/EN code and local production are gaining the centre stage as it relate to the retention of market share both in developed and developing economies.

- The medium-tier manufacturers are forcing their way in the market in China, Turkey and Brazil setting up local productions, keep costs low through sourcing and also partnership in emerging labels and the goods are offered at lower costs. The growing need of high performance grouts with compatibility with the current building systems and post tensioning applications and the seismic reinforcement, especially in the earthquake prone areas and high moisture areas, is also transforming product development models of the leaders.

- Constant coordination with institutes of civil engineering, infrastructure contractors, and construction innovation clusters is becoming an essential part of a market playbook of major players. Technological adaptations of formulations to work under aggressive sulfate conditions, marine exposure and high-fluidity injection grouting are being given more regulatory and technical acceptance throughout Europe, the GCC and Southeast Asia.

- The market giants are also boosting their presence through acquiring grout experts operating in certain regions, developing dry mix batching facilities, and also integrating IoT-based quality management systems, which are supposed to advance uniformity in the performance of mixes within mega construction projects.

Cementitious Grouts Market Companies:

The top cementitious grouts companies are:

- Sika AG: Sika AG is the dominant market player globally; the company has an estimated share of 13 - 15% in 2024. The well-established product range of the company includes structural, non-shrink, and high-performance grouts in infrastructure, industrial, and commercial construction. The other ways in which Sika maintains its leadership is with aggressive R&D, quick localization processes, and a robust merger pipeline in Asia and Latin America.

- MAPEI S.p.A: With a market share of around 9% globally, MAPEI is the market leader as far as specialty cementitious grouts are concerned due to its expertise in formulation in terms of high-flow, fiber-reinforced and sulfate-resistant grouts. The brand commands market dominance in Southern and Eastern Europe regions and increasing resonance in the Middle East and others in the ASEAN market.

- LafargeHolcim (Holcim Group): Lafargeholcim has approximately 7% market share and it uses the backbone of its cement industries to manufacture blended and microfine grouts to suit geotechnical, tunneling, and offshore environments. Market penetration of the company in North America and Western Europe is intensive with new investments being made in modular manufacturing in Sub-Saharan Africa and Southeast Asia which is meant to promote decentralized supply capability.

- Fosroc International Limited: The company has a dominant market share of 6 - 8%, which is of good repute in its high-powered range of shrinkage-compensated, precision, and marine-grade grouts. Its brand name to date is widely used throughout the infrastructure, power as well as extractive sectors, particularly in South Asia and the Middle East. Its intimate relationship with its EPC companies, local contractors gives it the opportunity of creating product formulations that are in line with EN, ASTM and BS standards in a difficult construction environment.

- BASF SE: BASF has a market share in the range of 5-7% and its strength is its specialty admixture technology and value add grouts under Master Builders Solutions brand. Although they have had historical performance success in Europe and North America, BASF is now pursuing Latin America and Africa with sulfate-resistant and early-strength grouts in mining and deep foundation applications. Low-carbon and alkali-activated binders innovation at the company are also inclined towards procurement based on ESG in massive governmental projects.

Cementitious Grouts Market News

- In June 2025, Sika AG acquired Gulf Additive Factory LLC in Qatar, broadening its capacity in the Middle East market.

- In June 2025, LafargeHolcim (Holcim Group) acquired Langley Concrete Group Inc. in Canada, expanding its precast concrete and related grout solutions capability.

- In May 2025, MAPEI S.p.A Launched a new product line dedicated to wind turbine installations, including high-performance grouts and corrosion-resistant admixtures.

- In February 2025, Sika AG acquired Elmich Pte in Singapore, enhancing its Asia-Pacific footprint in construction chemicals and greening systems.

- In August 2024, BASF SE (Master Builders Solutions) launched the unified global Master Builders Solutions brand in North America, consolidating multiple specialty product lines including high-performance grouts and admixtures.

The cementitious grouts market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Structural cementitious grouts

- High-performance structural grouts

- Standard structural grouts

- Rapid-setting structural grouts

- Non-structural cementitious grouts

- General purpose grouts

- Void filling grouts

- Sealing and waterproofing grouts

- Specialty cementitious grouts

- Ultra-high performance grouts

- Marine and offshore grouts

- High-temperature resistant grouts

- Chemical resistant grouts

- Microfine cement grouts

- Blended and modified grouts

- Polymer-modified grouts

- Fiber-reinforced grouts

- Mineral admixture enhanced grouts

Market, By Application

- Construction applications

- Foundation and base plate grouting

- Anchor bolt installation

- Precast element connections

- Structural repairs and rehabilitation

- Mining and tunneling

- Ground consolidation and stabilization

- Water ingress control

- Rock mass reinforcement

- Shaft and tunnel lining

- Infrastructure projects

- Bridge construction and repair

- Dam and reservoir applications

- Highway and transportation infrastructure

- Utility and pipeline projects

- Marine and offshore applications

- Port and harbor construction

- Offshore wind turbine installations

- Underwater structural repairs

- Industrial applications

- Equipment foundation grouting

- Floor and pavement applications

- Chemical plant and facility construction

- Geotechnical applications

- Soil stabilization

- Ground improvement

- Slope stabilization

Market, By End Use

- Residential construction

- Single-family housing

- Multi-family housing

- Renovation and remodeling

- Commercial construction

- Office buildings

- Retail and shopping centers

- Hospitality and entertainment

- Industrial construction

- Manufacturing facilities

- Warehouses and distribution centers

- Power generation facilities

- Infrastructure and civil engineering

- Transportation infrastructure

- Water and wastewater treatment

- Energy infrastructure

- Mining and extractive industries

- Coal mining

- Metal and mineral extraction

- Oil and gas operations

- Marine and offshore industries

- Shipbuilding and repair

- Offshore energy projects

- Port and terminal development

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the cementitious grouts market?

Major key players include Fosroc International Limited, Euclid Chemical Company, LafargeHolcim (Holcim Group), CEMEX S.A.B. de C.V., CRH plc, HeidelbergCement AG, Arkema Group, UltraTech Cement Limited, Perma Construction Aids Pvt. Ltd.

What are the upcoming trends in the cementitious grouts market?

Key trends include development of high-performance self-healing and ultrafast-set grouts, emphasis on eco-friendly and low-carbon solutions, and advanced formulation science for faster construction cycles without compromising structural integrity.

Which region leads the cementitious grouts market?

North America leads with over 82% market share and USD 1.3 billion valuation in 2024. Infrastructure modernization, federal funding through the Infrastructure Investment and environmental compliance drive the region's dominance.

How much revenue did the structural cementitious grouts segment generate in 2024?

Structural cementitious grouts generated USD 1.7 billion in 2024, due to their high compressive strength and stability in civil infrastructure projects.

What was the valuation of construction applications segment in 2024?

Construction applications held 38% market share and generated USD 1.2 billion in 2024, owing to high-rise buildings, precast technologies, and concrete structure reinforcement needs.

What is the market size of the cementitious grouts in 2024?

The market size was USD 3.8 billion in 2024, with a CAGR of 5.5% expected through 2034 driven by infrastructure development, construction industry growth, and tunneling expansion.

What is the projected value of the cementitious grouts market by 2034?

The cementitious grouts market is expected to reach USD 6.4 billion by 2034, propelled by infrastructure investments in Asia-Pacific, Middle East, and Eastern Europe, along with demand for high-performance construction solutions.

Cementitious Grouts Market Scope

Related Reports