Summary

Table of Content

Cellulose Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cellulose Market Size

Cellulose Market size was valued at USD 211.68 billion in 2019 and is estimated to exhibit 2.9% CAGR from 2020 to 2026. The rising paper production along with increasing adoption of the cellulose fiber in textile industry in the emerging economics is expected to drive the market growth.

Cellulose has long been used to make clothing products in the textile industry such as rayon, for which is manufactured from pulp or cellulose. Cellulose fibers can also be produced by an industrial process, by the extraction of cellulose from plant materials, dissolution, and regeneration.

To get key market trends

The most important raw material used is wood; therefore, these fiber types are also summarized as wood-based fibers. Moreover, cellulose acetate is also utilized in the manufacturing of the paper or nonwoven polymers, which can be used in the textile industry as a fiber to manufacture clothing, which will further strengthen the cellulose market share.

Cellulose Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 211.6 Billion (USD) |

| Forecast Period 2020 to 2026 CAGR | 2.9% |

| Market Size in 2026 | 238.99 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Cellulose Market Analysis

Learn more about the key segments shaping this market

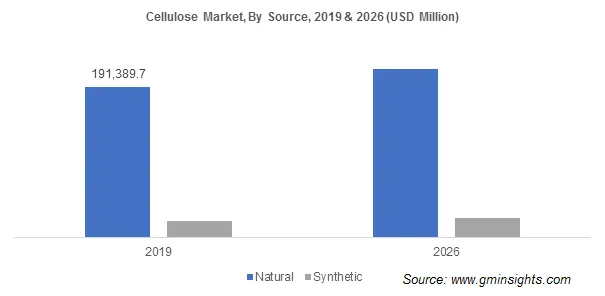

The natural source cellulose segment is estimated to hold over USD 190 billion of the total cellulose market. Over the past few years, many manufacturers are producing cellulose from non-edible plant materials, which include grass, stalks of cereal crops, and wood, to develop natural & bio-bridgeable solutions. It is also easily soluble in seawater, which is expected to solve the marine plastic waste problem as it decomposes in seawater twice as fast as conventional products.

Furthermore, processing of naturally sourced cellulose is easy and is also used in various end-use industries such as packaging and textiles, among others. The superior durability along with the ability to withstand superior compressive force will enhance the cellulose market penetration.

In 2019, the unmodified segment held over 90% share in cellulose market. Unmodified cellulose is a biodegradable & compostable compound used in numerous applications in food, pharmaceutical, cosmetics & personal care, and paints & coating industries. The growing COVID cases across the world have adversely impacted cellulose production and its related end-use industries over past few months, however, many manufacturers are using this event as an opportunity as nano cellulose-based bio sensors can be used to manufacture COVID 19 test kits.

According to the American National Institute of Health, the proposed test kit can identify spike proteins from insulating antibodies of people. The cellulose-based device is called point-of-care molecular device. These products are low-cost, lightweight, hydrophilic, and porous and it is also developed with renewable materials which is expected to positively influence the cellulose market expansion in the future.

Learn more about the key segments shaping this market

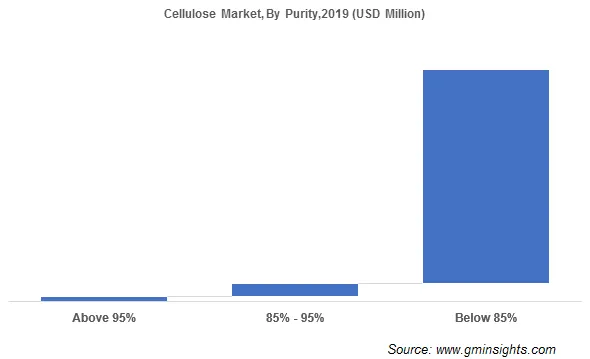

The below 85% segment will witness over 2.5% CAGR in cellulose market size, as these are used for the paper and clothing’s production owing to higher presence of cellulose in the pulp. Moreover, these types of pulp grade also used to produce paper packaging, the growing implementation of paper and flexible packaging across the FMCG sector is likely to create substantial opportunities for the paper packaging, further strengthening the product penetration.

Paper applications will witness over 3% CAGR through 2026 owing to the high usage of cellulose in paper production. It helps to reduce the drying time of the paper. It improves the paper quality, making it is less porous & translucent with higher printing quality. The cellulose also requires lesser raw materials and energy to produce paper. The cellulose will also support light weighting, improving energy efficiency in transportation.

Cellulose foams are being used in the production of packaging reels to substitute polystyrene-based products. The key advantage of using cellulose instead of wood-based pulp fibers is that CNF can reinforce the thin cells in the starch foam, replacing polymer reels manufactured using fossil fuels with a renewable material that decreases weight. This will have a positive effect on cellulose market growth.

Looking for region specific data?

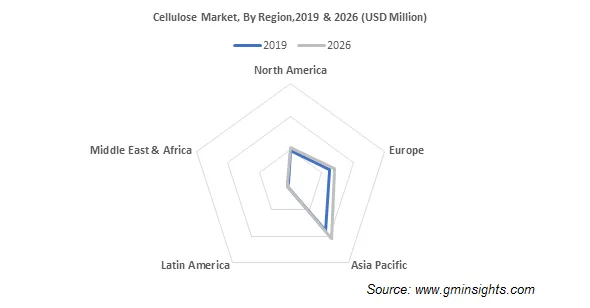

Asia Pacific will witness over 3% CAGR through 2026 in cellulose market. A substantial demand for printed books, clothing’s, pharmaceutical products and packaging, especially in essential goods, owing to the rising disposable income and standard of living will essentially contribute toward the high revenue generation. Moreover, Asia Pacific has seen significant growth in the textile industry owing to increasing in consumer inclination towards the comfortable clothing, which result in increasing the demand for high-value fabrics such as hemp, silk and viscose.

The regional paper and paperboard industry gained a significant share during the last few years, holding 47.4% of the production in 2016 and reaching 48.1% in 2019. Moreover, improvements in the education system and the growing demand for printed books across developing countries including India and Thailand will propel the cellulose market revenue over the forecast span.

Cellulose Market Share

The global cellulose market was highly fragmented with the presence of multiple small & large market participants across the globe, offering identical products. Prominent industry participants are doing substantial investments in new product development to strengthen their expertise in cellulose materials and gain an edge over their competitors.

With increasing demand for eco-friendly, biodegradable and water-soluble products, many manufacturers are investing in these technologies to gain a competitive advantage. In January 2020, Daicel Corporation introduced an environmental-friendly form of cellulose acetate. The new product is expected to solve the marine plastic waste problem as it decomposes in seawater, twice as fast as conventional products.

Some of the key manufacturers of the cellulose industry are

- Shin-Etsu Chemical Co., Ltd.

- Eastman Chemical Company

- Dupont De Nemours, Inc.

- Daicel Corporation

- NEC Corporation

- Celanese Corporation

- Bracell

Some of the key strategies adopted by these manufacturers are backward integration, acquisition, production capacity expansion and new product development.

The cellulose market report includes in-depth coverage of the industry with estimates & forecast in terms of volume in Million Tons and revenue in USD million from 2016 to 2026 for the following segments

By Source

- Natural

- Crops

- Cotton

- Jute

- Hemp

- Flax

- Corn

- Wheat

- Others

- Fruits

- Apple

- Peaches

- Strawberries

- Others

- Treewood

- Hardwood

- Softwood

- Crops

- Synthetic

By Modification

- Unmodified

- Modified

- Microcrystalline Cellulose (MCC)

- Cellulose ethers

- Oxidized

- Others

By Manufacturing Process

- Viscose

- Acid Sulfite

- Prehydrolysis Kraft

- Others

- Cellulose ethers

By Purity

- Above 95%

- 85% - 95%

- Below 85%

By Application

- Food

- Pharmaceuticals

- Paper

- Cosmetics

- Textiles

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Frequently Asked Question(FAQ) :

How is the global cellulose industry revenue expected to flourish in the Asia Pacific region?

The Asia Pacific share is projected to expand at over 3% CAGR through 2026 owing to the mounting demand for printed books, clothing, pharmaceutical products, and packaging.

How will paper applications influence the growth of the global cellulose market share?

The paper application is estimated to grow at over 3% CAGR through 2026 due to the growing use of cellulose in paper production as it reduces the paper

Why will naturally source cellulose help increase the global cellulose industry share?

The naturally sourced cellulose revenue is valued at USD 190 billion in 2019. As it is easy to process and used in numerous end-use industries like textile and packaging, the segment is expected to witness substantial growth.

What factors will boost the growth of the global cellulose market size through 2026?

The global cellulose industry size valued at USD 211.68 billion in 2019 and is poised to grow at 2.9% CAGR through 2026 owing to the rising paper production coupled with increasing adoption of cellulose fiber in the textile industry in developing economies.

Cellulose Market Scope

Related Reports