Summary

Table of Content

Casing Centralizer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Casing Centralizer Market Size

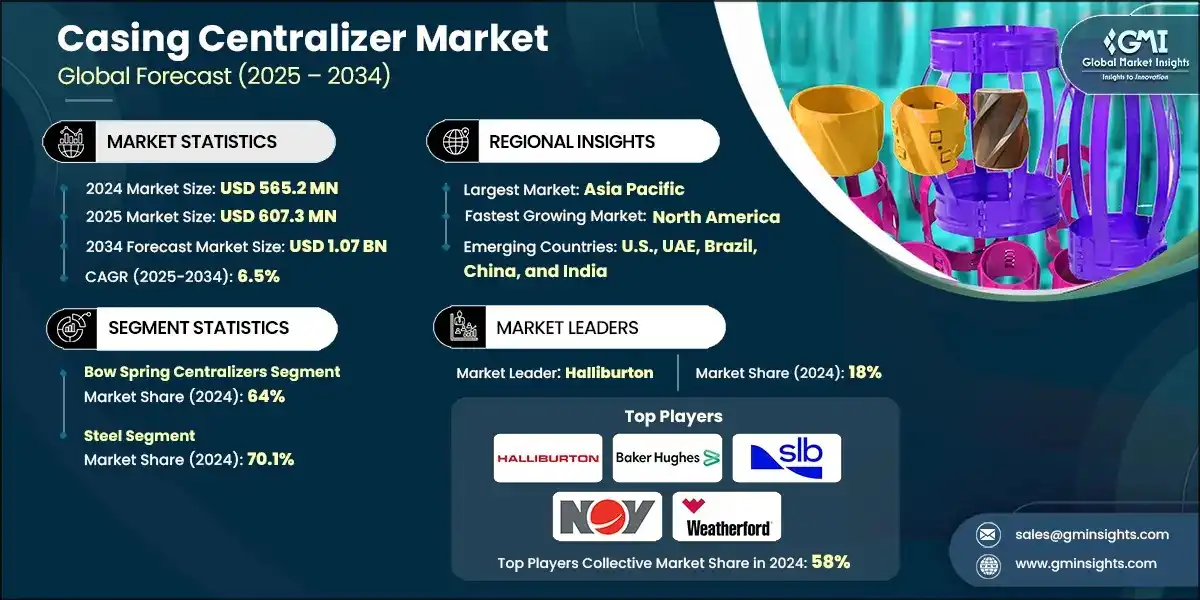

According to a recent study by Global Market Insights Inc., the casing centralizer market was estimated at USD 565.2 million in 2024. The market is expected to grow from USD 607.3 million in 2025 to USD 1.07 billion in 2034, at a CAGR of 6.5%.

To get key market trends

- Rising energy security imperatives are driving significant investment opportunities across global oil and gas operations along with increasing requirement for critical drilling infrastructure components further complementing industry landscape. Expansion of unconventional resource development through horizontal drilling and shale projects has created unprecedented demand for precise casing centralization solutions to ensure optimal wellbore integrity and effectiveness, positively influencing industry outlook.

- Continuous technological advancements are enhancing premium centralizer design and performance capabilities, enabling operators to achieve superior operational outcomes in increasingly complex drilling environments. Rising deployment of these units to ensure the reliable performance of well operations, drilling initiatives and reducing cost will further augment product deployment.

- For instance, in August 2024, GCE Contractors deployed Kwik-ZIP HDX-90 spacers for a complex slip-lining project involving large-diameter pipes. The spacers’ load-sharing design and engineered thermoplastic construction ensured reliable performance and protected pipe coatings during installation. Integrated grip pads prevented slippage, while the tool-free setup simplified operations.

- Operators are redefining well construction and completion practices through enhanced drilling optimization and strategic cost avoidance, driving significant improvements in operational efficiency. Rising demand for high-performance centralizers in quality-critical applications to enhance productivity and long-term asset value will positively influence business dynamics. Integrated service offerings, combining multiple solutions, clear value ensuring immediate operational gains and long-term well integrity assurance are some of the pivotal factors shaping the industry dynamics.

- Asia Pacific holds a dominant share in the casing centralizer industry driven by expanding oil and gas exploration activities in countries like China, India, and Indonesia. Rising energy demand, government-backed drilling initiatives, and increasing investments in unconventional resources are driving industry growth. Additionally, infrastructure development and technological advancements in well construction are boosting adoption of centralizers to ensure well integrity, especially in challenging geological formations.

- For instance, in October 2025, ONGC is launching a large-scale onshore drilling project in Andhra Pradesh, targeting 172 wells across multiple lease blocks. The initiative supports India’s energy independence and infrastructure modernization. With environmental clearance secured, ONGC will invest nearly USD 977 million, including allocations for environmental planning and public commitments. Annual environmental management costs are estimated at USD 11 million.

- North America is the fastest growing market in casing centralizer industry and is anticipated to grow owing to robust shale gas and tight oil production across the U.S. and Canada. The region’s mature drilling infrastructure, focus on horizontal and extended-reach wells, and stringent regulatory standards for well integrity will augment industry outlook. Technological innovation to enhance casing placement and reduce operational risks driven by increased investment in unconventional resource development will positively influence business dynamics.

- For instance, in August 2024, Kwik-ZIP’s HDXT-58W spacers were deployed on a key section of Canada’s Trans Mountain Pipeline Expansion to support HDD casing protection at entry and exit points. Faced with 15-degree slopes, the contractor relied on Kwik-ZIP’s engineered solution to prevent casing damage. This successful application highlights Kwik-ZIP’s expertise in delivering tailored spacer systems for complex pipeline installations.

Casing Centralizer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 565.2 Million |

| Market Size in 2025 | USD 607.3 Million |

| Forecast Period 2025 - 2034 CAGR | 6.5% |

| Market Size in 2034 | USD 607.3 Million |

| Key Market Trends | |

| Drivers | Impact |

| Increasing oil & gas exploration operations | Rising global exploration, especially in deepwater and shale reserves, boosts demand for advanced centralizers to ensure wellbore stability and efficient casing placement |

| Rising cementing operations to maintain well integrity | Expanded cementing activities in unconventional wells require precise centralization, driving adoption of high-performance centralizers for improved zonal isolation and long-term well integrity |

| Stringent environmental regulations pertaining to oil and gas operations | Strict regulations mandate enhanced well integrity, prompting use of eco-friendly and precision-engineered centralizers to prevent leaks, reduce environmental risks, and meet compliance standards |

| Pitfalls & Challenges | Impact |

| High initial investment | High upfront costs may deter small operators, slow adoption of advanced centralizers and limiting market penetration in cost-sensitive regions. |

| Opportunities: | Impact |

| Expansion in offshore drilling | Growing offshore exploration, especially in deepwater fields, drives demand for robust centralizers that withstand extreme conditions, enhance integrity and cement efficiency. |

| Adoption of composite materials | Use of lightweight, corrosion-resistant composites improves durability and reduces friction, enabling smoother casing runs and expanding centralizer applications in unconventional wells |

| Technological advancements in design | Innovations in centralizer geometry and materials enhance performance in complex wellbores, supporting better standoff, reduced drag, and improved cement placement |

| Rising demand in unconventional wells | Increased drilling in shale and extended-reach wells boosts need for high-performance centralizers that ensure casing alignment and long-term wellbore stability. |

| Market Leaders (2024) | |

| Market Leaders |

18% market share |

| Top Players |

Collective market share in 2024 is 58% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | U.S., UAE, Brazil, China, and India |

| Future outlook |

|

What are the growth opportunities in this market?

Casing Centralizer Market Trends

- The casing centralizer industry is anticipated to witness significant growth owing to the adoption of advanced drilling technologies to enhance well performance and asset longevity along with increasing unconventional resource development. Innovations in centralizer design, coupled with a growing emphasis on operational efficiency and well integrity across diverse drilling environments will further strengthen industry outlook.

- The rising need for dependable well construction solutions across both onshore and offshore drilling operations to enhance drilling and completion efficiency across varied drilling environments, supporting operational reliability and long-term asset value. Operators are responding with advanced bow spring and rigid centralizer designs, utilizing specialized materials that ensure superior durability and performance further accelerating product deployment.

- For instance, in May 2025, NIDC has finalized drilling operations for 20 onshore wells early in the Iranian calendar year, showcasing its operational strength and strategic planning. The wells span development, appraisal, and completion categories, with most located in fields managed by national subsidiaries. Enhanced drilling depth and rig relocations highlight the company’s focus on efficiency and resource optimization.

- The adoption of smart centralizer systems technologies is enhancing well construction by enabling remote monitoring and real-time performance analysis. Growing inclination toward analyzing critical insights into placement accuracy, load distribution, and operational conditions, ensuring optimal centralization and improved reliability is positively influencing industry outlook. Moreover, data-driven approach for predictive maintenance strategies, helping operators enhance system longevity, reduce downtime, and maintain consistent well integrity across diverse drilling environments.

- For instance, in September 2025, Halliburton introduced Turing control system, an upgrade to its SmartWell technology, enhancing oil & gas flow management for improved reservoir output. Equipped with built-in sensors, it enables fast, accurate well performance adjustments, reducing setup time and operational risks. Integrated with the Clariti digital suite, it offers real-time insights to boost well productivity and optimize field operations, supporting efficient and cost-effective drilling strategies.

- Rising global oil and gas demand and increased drilling activities for exploration of hydrocarbons have led to increase the demand for casing centralizer solutions. Centralizers play a critical role in ensuring proper alignment during cementing, enhancing well integrity and preventing failures. Technological advancements have led to more durable and efficient designs, supporting reliable performance across diverse drilling environments.

Casing Centralizer Market Analysis

Learn more about the key segments shaping this market

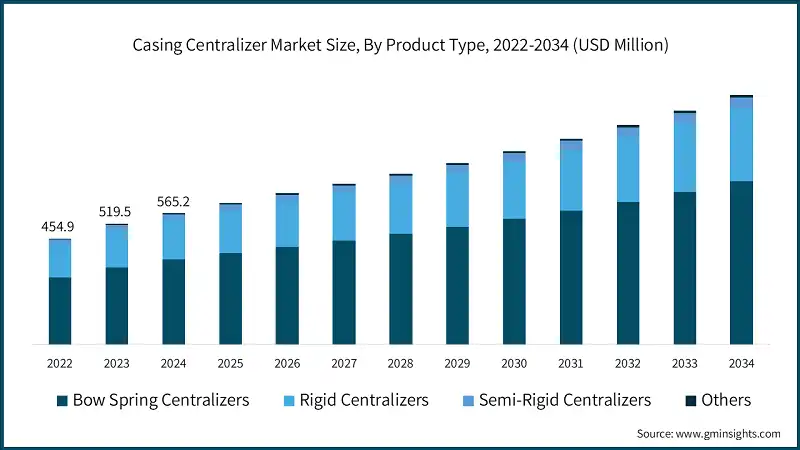

- Based on product type, the market is segmented into bow spring centralizers, rigid centralizers, semi-rigid centralizers and others. The bow spring centralizers segment dominated about 64% of market share in 2024 and is set to grow at a CAGR of over 6.5% through 2034.

- Increasing demand for reliable wellbore integrity solutions along with ongoing technological advancements in metallurgy and design to significantly improve durability and performance will accelerate product demand. Their adaptability and strong restoring force, ideal for vertical and slightly deviated wells along with spring mechanisms accommodate wellbore irregularities are some of the pivotal factors augmenting product deployment.

- For instance, in October 2024, Weatherford secured multiple strategic contracts across the Middle East, including a three-year Corporate Procurement Agreement with Aramco and drilling, liner hanger, MPD, fishing, and completion equipment contracts with regional NOCs. These agreements, spanning up to five years, reinforce Weatherford’s role in advancing operational efficiency, deploying innovative technologies, and supporting unconventional and deep drilling projects.

- Rigid centralizers segment is anticipated to observe a CAGR of above 6% from 2025 to 2034. The ability to offer superior stability and support in demanding wellbore conditions, especially in horizontal and deviated wells will accelerate product demand. Constructed from cast steel or aluminum, they feature straight or spiral vanes for full 360° coverage and beveled ends to reduce running resistance. Continuous innovations to enhance their reliability and performance and development in robust design to ensure consistent standoff and minimal drag during casing operations, will augment product deployment across high-load applications and complex well geometries.

- Semi-rigid centralizers market was evaluated at a revenue of around USD 23 million in 2024. Semi-rigid centralizers are increasingly preferred in specialized drilling applications for their optimal balance of flexibility and strength. The ability to perform reliably in wells with moderate deviation or irregular shapes, where rigid centralizers may be too inflexible and bow spring types lack adequate support will augment product deployment. Continuous innovations in hybrid design to enhance adaptability and ensure effective centralization for challenging wellbore conditions will augment business dynamics.

- The continued expansion of shale resource development, well-established infrastructure, streamlined logistics, and reduced operational expenditures compared to offshore projects will complement the industry dynamics. Onshore drilling operations encompass a range of techniques including vertical, directional, and horizontal well development, particularly in unconventional resource extraction. Operators are increasingly prioritizing longer lateral sections, multi-stage completions, and advanced recovery strategies, all of which require precise casing alignment and reliable centralization further augmenting industry outlook

- For instance, in September 2025, ReconAfrica is advancing its Kavango West 1X well toward the Otavi reservoir in Namibia’s Damara Fold Belt. The well is drilling through a significant structural closure and is expected to reach total depth by late November. A full evaluation will follow, with results expected around year-end. This well represents a critical test of Namibia’s onshore oil potential and could validate extensive geological modeling, complement offshore discoveries.

- Offshore segment is projected to expand with over 8% CAGR till 2034. Ongoing investment in offshore exploration underscores the need for durable and high-performance centralization solutions that meet rigorous technical standards and support long-term operational success will positively influence business dynamics. Offshore drilling demands centralizers engineered for extreme conditions, including high pressure, temperature, and corrosive marine environments. These tools must perform reliably throughout prolonged operations, ensuring well integrity in deepwater and complex offshore establishments.

- For instance, in October 2025, Halliburton has been awarded contracts by Petrobras which are set to begin in 2026, to deliver completion and stimulation services for Brazil’s deepwater fields. The scope includes SmartWell technology for real-time reservoir management in Búzios, EcoStar safety valves for Sépia and Atapu, and stimulation services via the Stim Star Brasil vessel. These solutions aim to enhance safety, efficiency, and production performance.

Learn more about the key segments shaping this market

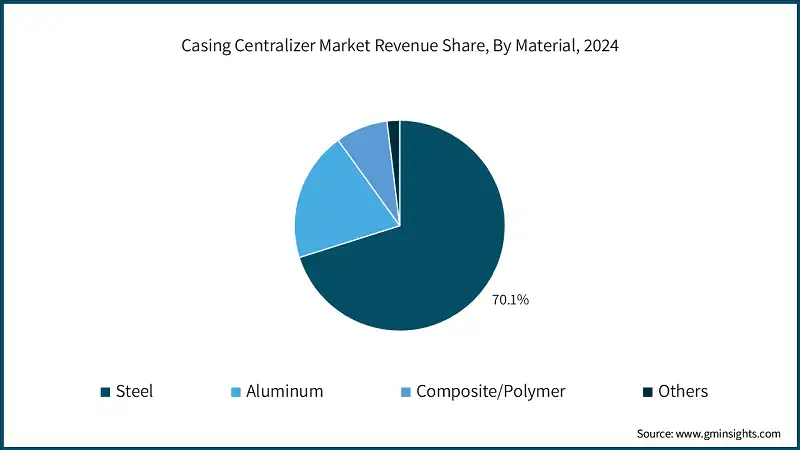

Based on material, the market is segmented into steel, aluminum, composite/polymer, and others. The steel segment dominated around 70.1% of the casing centralizer market share in 2024 and is set to grow at a CAGR of over 6% through 2034.

- Steel segment is anticipated to witness a CAGR of over 6% from 2025 to 2034. Steel centralizers provide a cost-effective option for conventional drilling applications. They deliver strong mechanical performance at a lower material cost, making them suitable for large-scale operations. Technological improvements in coatings and surface treatments have enhanced their corrosion resistance and extended their service life.

- Aluminum centralizers are gaining significant momentum owing to their lightweight characteristics and suitability for specialized drilling scenarios. Their reduced weight helps minimize string loads, which is particularly beneficial in deepwater and extended-reach drilling. Modern aluminum alloys offer improved strength while preserving weight advantages, enabling their use in more demanding applications. Their contribution to operational efficiency and weight management will augment their deployment in complex well designs.

Looking for region specific data?

Looking for region specific data?

U.S. dominated the casing centralizer market in North America with around 82% share in 2024 and generated USD 463.3 million in revenue. The U.S. market is shaped by robust oil and gas exploration, particularly in shale formations and unconventional wells. Advanced drilling techniques like horizontal drilling and hydraulic fracturing require precise casing placement, driving demand for high-performance centralizers.

Innovations in casing centralizer design including polymer-based materials and adjustable configurations are enhancing well integrity and cementing precision across U.S. drilling operations. Favorable regulatory policies and the need for dependable zonal isolation are further accelerating adoption of advanced centralization technologies across conventional and unconventional wells.

For instance, in October 2025, the Trump administration has significantly accelerated the approval of oil and gas drilling permits, surpassing the pace of both the Biden and previous Trump terms. Between January and October, over 4,400 permits were issued for federal and tribal lands, however, low crude prices may delay actual drilling activity, as companies may hold permits until market conditions improve.

The North America casing centralizer market is anticipated to reach over USD 400 million by 2034, driven by U.S. shale development and Canadian oil sands operations. along with advanced drilling technologies, well-established infrastructure, and supportive regulatory frameworks that encourage continued energy exploration. Drilling activity remains concentrated in key unconventional formations such as the Permian Basin, Eagle Ford, and Bakken, driving demand for high-performance centralizers to ensure well integrity and optimize cementing operations.

Europe casing centralizer market is anticipated to witness a CAGR of over 4.5% through 2034. Strong focus on offshore North Sea operations, maintenance drilling, and the transition to renewable energy along with active drilling efforts aimed at maximizing recovery from existing fields and tapping remaining hydrocarbon reserves is augmenting industry outlook. Ongoing demand for reliable centralization solutions that enhance the well integrity, operational efficiency and reduce additional cost will further complement industry landscape.

For instance, in October 2025, Eni has completed the UK’s first carbon storage appraisal well on the Hewett field, part of the Bacton CCS project. Drilled by Valaris 72, the well underwent core sampling and nitrogen testing before being plugged and abandoned. The data will guide future development, supporting Eni’s goal to store 10 million tonnes of CO2 annually from the Bacton and Thames Estuary areas.

Asia Pacific accounted for over 26% of the market share in 2024. Growing energy infrastructure development along with rising energy consumption leading to domestic resource exploration in emerging economies are fueling drilling activities, further positively influencing business dynamics. Governments across the region are investing in energy security and infrastructure coupled with increasing demand for reliable centralization solutions to enhance well integrity and performance across diverse drilling environments is augmenting industry outlook.

For instance, in March 2025, CNPC Offshore Engineering Co Ltd has entered Southeast Asia’s offshore drilling market with its largest international contract—Indonesia’s JUB project, valued at over USD 140 million. Spanning four years, the initiative marks a strategic expansion into high-end offshore services amid rising global demand for deepwater exploration, reinforcing China’s offshore sector as a key energy growth driver.

The Middle East & Africa casing centralizer market is set to grow at above 6.5% CAGR by 2034. The availability of extensive oil reserves, increasing investments in modernization, growing integration of automation and digital technologies into well is streamlining processes, improving efficiency, and supporting long-term growth shaping business dynamics. Exploration of vast hydrocarbon reserves and active field development initiative along with efforts to maintain production capacities and explore new discoveries are driving consistent drilling activities augmenting industry outlook.

For instance, in February 2025, BP has finalized all contractual terms with the Government of Iraq to redevelop major oil fields in Kirkuk. The agreement, pending final ratification, includes oil, gas, power, and water infrastructure, with exploration potential. A new operating entity comprising personnel from North Oil and North Gas Companies, along with BP secondees will assume operations. BP plans to establish a joint venture to hold its interests in this strategic redevelopment initiative.

Latin America casing centralizer market is gaining significant momentum, fueled by offshore developments in Brazil, unconventional resource exploration in Argentina, and ongoing conventional drilling across the region. Abundant hydrocarbon reserves and flourishing foreign investments across regional energy projects are driving consistent demand for advanced drilling equipment in enhancing well integrity and cementing efficiency across diverse exploration environments.

Casing Centralizer Market Share

The top 5 casing centralizer companies operating across the industry are Halliburton, Weatherford, SLB, Baker Hughes, and NOV. These companies contribute a market share of approximately 58% in 2024.

Leading manufacturers in the global casing centralizer market are driving innovation through investments in advanced materials, automation, and digital technologies. Companies such as Baker Hughes,

Halliburton, NOV, SLB, and Weatherford are modernizing their product portfolios by integrating smart systems like real-time monitoring, predictive analytics, and AI-based design optimization. These advancements aim to improve centralizer performance, reduce installation time, enhance well integrity, and support sustainable drilling practices across both conventional and unconventional oil and gas operations.

Over recent years, the casing centralizer market has shown consistent growth, demonstrating resilience amid evolving energy trends and regulatory shifts. By 2023 & 2024, improvements in supply chain logistics and a renewed emphasis on well integrity and energy security accelerated the adoption of advanced centralizer technologies. By 2025, infrastructure upgrades in major oil and gas regions, along with global efforts to enhance drilling efficiency and reduce environmental impact, are expected to further drive demand for innovative casing centralization solutions.

Baker Hughes offers a range of solutions including 3-arm and 4-arm roller centralizers for varied applications, with contoured designs for smooth entry into restrictions. The easy-entry variant minimizes closing force, while the springbow centralizer is ideal for open hole completions and compromised casing, ensuring reliable performance across challenging well conditions.

Halliburton’s Protech II centralizer significantly reduces frictional resistance, enabling reliable depth attainment in extended laterals and rigid casing environments to achieve optimal standoff, vital for effective zonal isolation. Its ultra-low friction design maintains positive standoff without restricting flow area, enhancing cement placement and overall efficiency in challenging wellbore conditions.

Weatherford centralizers are crucial to maintain the well integrity across global operations. With a comprehensive portfolio including welded, non-welded, and the latest one-piece bow-spring designs, it delivers tailored solutions for effective cement placement in diverse well conditions. From routine completions to extreme environments, these centralizers ensure consistent performance and support long-term reliability in wellbore construction.

NOV offers coiled tubing bow-spring centralizer which is engineered for reliable performance in restricted bore environments. Designed for coiled tubing tool-strings and downhole gauge deployment, it expands into the casing liner to maintain tool clearance from the casing wall. Proven effective in logging, fishing, camera operations, and liner-lap transitions, it ensures precise centralization while supporting smooth tool conveyance in complex wellbore conditions.

SLB offers clamp-on roller centralizer from the Peak Family enhances wireline tool performance in high-angle deviated wells. Designed for compact casing environments, it securely positions tools like the SCMT slim cement mapping tool for improved logging accuracy. Its innovative clamp-on roller assembly ensures reliable centralization and tool access, even in challenging well geometries.

Casing Centralizer Market Companies

Major players operating in the casing centralizer industry are:

- Amroc Bremse Oil Tools Pvt. Ltd.

- Avantgarde Oil Services Limited

- Baker Hughes

- Centek

- Crimson Oil Tools

- Drilling Tools International

- Equip Outlet Inc.

- Ferro-Tube Oil Tools Co, L.P.

- Halliburton

- JC Petro

- Kwikzip

- Lake Petro

- Maxwell Oil Tools GmbH

- NeOz Energy

- NOV

- Oilmec Middle East

- Shaanxi United Mechanical Co., Ltd.

- SLB

- Summit Casing

- Weatherford

In 2025, Baker Hughes reported half-year revenue of USD 13.3 billion, reflecting continued operational strength. For the full year 2024, the company achieved total revenue of USD 27.8 billion. The company’s springbow centralizer is specifically engineered for use in open-hole completions and wells with compromised casing, offering reliable centralization in challenging downhole environments.

Halliburton RED-X single-piece centralizers are designed to enhance casing run efficiency, particularly in demanding well conditions. These centralizers provide reliable support and alignment, contributing to smoother operations and improved performance during casing deployment. The company reported a revenue of USD 10.9 billion for the first half of 2025, and USD 22.9 billion for complete year 2024, reflecting steady performance across its global operations.

Weatherford continues to advance centralization technology by engineering precision, consistency, and reliability into every VariForm casing centralizer. Designed to perform in challenging well conditions, these centralizers support optimal cementing outcomes and long-term well integrity. The company ensures each product delivers dependable performance, helping operators meet demanding operational requirements with confidence and efficiency. Weatherford reported total revenue of USD 4.29 billion for the first half of 2025 and USD 5.51 billion revenue for full year 2024.

SLB offers centralizer that is designed to effectively position SCMT and other wireline tools within deviated, narrow-diameter casings where traditional spring centralizers may fall short. It minimizes friction between the toolstring and casing or tubing, enhancing operational efficiency. The company reported a revenue of USD 17 billion for fist 6 months of 2025 and full year revenue of USD 36.2 billion in 2024, increasing 10% from last year.

NOV fluted centralizer is designed to enhance tool stability within tubing and assist in locating equipment during fishing operations. Available in various lengths and standard sizes, the product offers versatility across different well configurations while maintaining reliable performance in challenging environments. The company recorded a revenue of USD 4.2 billion for the first 6 months of 2025 and full year revenue of USD 8.8 billion in 2024.

Casing Centralizer Market News

In October 2025, Weatherford launched its Industrial Intelligence platform at FWRD 2025, offering advanced digital tools for energy operations. The Synsera Unified Data Model enables structured, cross-asset data integration, while the WFRD Software Launchpad centralizes access to Weatherford and partner applications. Designed to improve efficiency, decision-making, and automation, the portfolio supports scalable operations and empowers users with real-time insights and simplified workflows.

In August 2025, Kwik-ZIP’s HDXT-153 casing spacers were deployed in South Wales’ A465 Heads of the Valley infrastructure upgrade, supporting safe pipe installation through precast concrete tunnels. Trusted globally for engineered spacer systems, Kwik-ZIP continues to deliver responsive service and adaptable solutions for civil, mining, and utility sectors across Europe, North America, the Middle East, and Asia-Pacific. The project involved four crossings with varying pipe and casing dimensions.

In July 2025, Centek, Inc. hosted the CIOK group to its U.S. facility, showcasing its commitment to lean practices and operational excellence. The event featured plant tours, peer discussions, and employee-led demonstrations, emphasizing Centek’s focus on team-driven improvement. The session highlighted visual management and customer-centric strategies. Centek’s approach goes beyond cost savings, aiming to enhance employee experience and deliver meaningful value to customers through continuous innovation.

In October 2023, Summit Casing Equipment acquired Scepter Supply to expand its cementation product line and market presence. The deal adds Scepter’s high-performance composite centralizers to Summit’s portfolio and strengthens its customer base. Scepter’s team joins Summit, enhancing technical capabilities and service quality. This strategic move supports Summit’s goal of delivering innovative solutions and reliable equipment to oil and gas operators across the U.S. and international markets.

The casing centralizer market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) from 2021 to 2034, for the following segments:

Market, By Product Type

- Bow Spring Centralizers

- Rigid Centralizers

- Semi-Rigid Centralizers

- Others

Market, By Material

- Steel

- Aluminum

- Composite/Polymer

- Others

Market, By Application

- Onshore

- Offshore

- Market, By Drilling Type

- Unconventional

- Conventional

The above information is provided for the following regions and countries:

North America

- U.S.

- Canada

Europe

- UK

- Norway

- Netherlands

- Russia

Asia Pacific

- China

- India

- Indonesia

- Australia

- Thailand

- Malaysia

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Egypt

Latin America

- Brazil

- Argentina

- Mexico

Frequently Asked Question(FAQ) :

How much revenue did the bow spring centralizers segment generate in 2024?

Bow spring centralizers dominated approximately 64% of the market share in 2024, supported by their adaptability, strong restoring force, and suitability for vertical and slightly deviated wells.

What was the market share of the steel material segment in 2024?

The steel segment held approximately 70.1% market share in 2024, favored for its cost-effectiveness, strong mechanical performance, and enhanced corrosion resistance through improved coatings and surface treatments.

What is the growth outlook for North America from 2025 to 2034?

North America is the fastest growing market and is anticipated to reach over USD 400 million by 2034, driven by robust shale gas and tight oil production, advanced drilling technologies, and stringent regulatory standards for well integrity.

What is the market size of the casing centralizer in 2024?

The market size was USD 565.2 million in 2024, with a CAGR of 6.5% expected through 2034 driven by rising energy security priorities and growing demand for critical drilling infrastructure components across global oil and gas operations.

What are the upcoming trends in the casing centralizer market?

Key trends include adoption of smart centralizer systems with real-time monitoring capabilities, use of lightweight composite materials for reduced drag, innovations in centralizer geometry and design, and digitalization trends enabling automated drilling operations.

Which region leads the casing centralizer market?

Asia Pacific held the largest market share with over 26% in 2024, led by expanding oil and gas exploration activities in countries like China, India, and Indonesia, coupled with government-backed drilling initiatives and infrastructure development.

What is the current casing centralizer market size in 2025?

The market size is projected to reach USD 607.3 million in 2025.

What is the projected value of the casing centralizer market by 2034?

The casing centralizer market is expected to reach USD 1.07 billion by 2034, propelled by increasing oil & gas exploration operations, rising cementing operations to maintain well integrity, and expansion in offshore drilling activities.

Who are the key players in the casing centralizer market?

Key players include Amroc Bremse Oil Tools Pvt. Ltd., Avantgarde Oil Services Limited, Baker Hughes, Centek, Crimson Oil Tools, Drilling Tools International, Equip Outlet Inc., Ferro-Tube Oil Tools Co, L.P., Halliburton, JC Petro, Kwikzip, Lake Petro, Maxwell Oil Tools GmbH, NeOz Energy, NOV, Oilmec Middle East, Shaanxi United Mechanical Co., Ltd., SLB, Summit Casing, and Weatherford.

Casing Centralizer Market Scope

Related Reports