Summary

Table of Content

Cable Fault Locator Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Cable Fault Locator Market Size

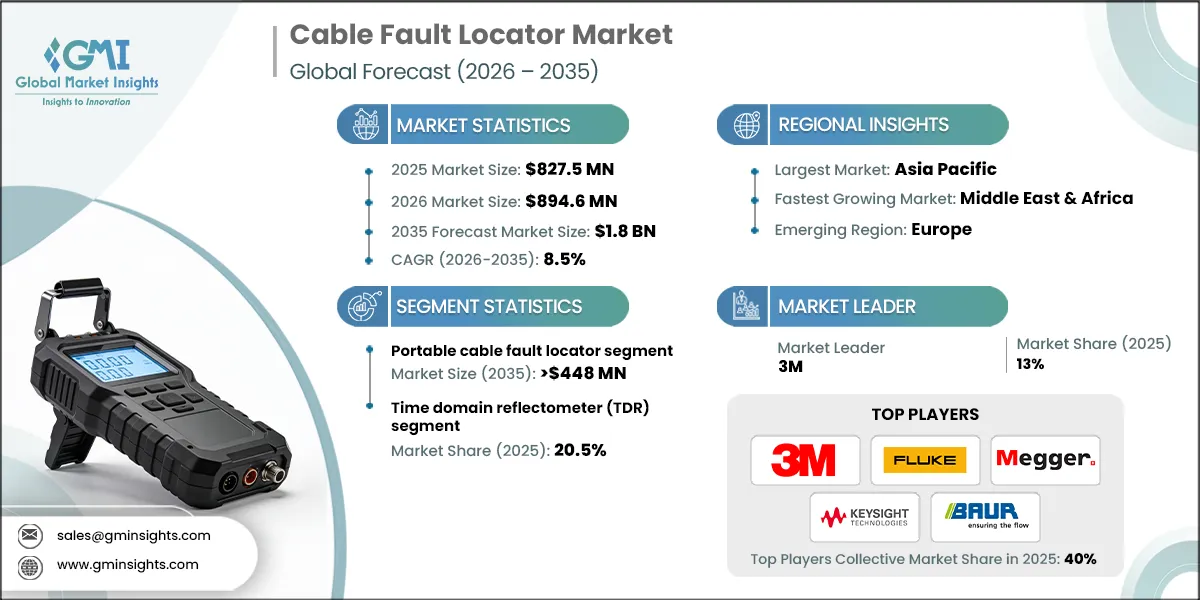

The global cable fault locator market was estimated at USD 827.5 million in 2025. The market is expected to grow from USD 894.6 million in 2026 to USD 1.8 billion in 2035, at a CAGR of 8.5%.

To get key market trends

- The cable fault locator market is witnessing robust growth globally, driven by the increasing need for reliable, efficient, and resilient power infrastructure. As electricity demand surges and grids become more complex, utilities and industrial operators are prioritizing technologies that minimize downtime and enhance operational efficiency. Cable fault locators play a critical role in identifying faults quickly and accurately, reducing outage durations and maintenance costs.

- Government initiatives are further accelerating adoption. India’s Smart Grid Mission, under the Ministry of Power, has allocated significant funding for grid modernization, including digital fault detection systems, to reduce outages and improve reliability. Similarly, China’s State Grid Corporation announced plans to invest over USD 70 billion in grid upgrades, which include advanced cable fault locators for high-voltage transmission networks. These projects highlight how infrastructure development and renewable integration are fueling market growth.

- Governments worldwide are investing heavily in upgrading electricity networks. For example, the EU plans approximately Euro 584 billion in electricity infrastructure investment from 2020–2030, including digital grid optimizations creating a substantial demand for diagnostics tools like cable fault locators. Meanwhile, in India, smart grid initiatives and 5G fiber rollout are accelerating underground network expansion, positioning India as the fastest-growing national market through 2035.

- In the U.S., federal broadband programs such as BEAD and CPF have allocated over USD 52 billion to enhance high-speed internet access. Utilities and telecommunication operators are under pressure to attach new fiber to existing poles efficiently, thereby increasing the demand for precise cable fault locators to avoid service disruptions during large-scale deployments.

- Rapid urban expansion is shifting power and data distribution underground, increasing the complexity of maintenance. The International Energy Agency reports approximate investment of USD 60 billion in electrical network infrastructure in emerging economies, supporting underground grid development, thereby boosting demand for cable fault detection solutions.

Cable Fault Locator Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 827.5 Million |

| Market Size in 2026 | USD 894.6 Million |

| Forecast Period 2026-2035 CAGR | 8.5% |

| Market Size in 2035 | USD 1.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising adoption of smart grid technology | Smart grids integrate advanced monitoring and control systems, requiring reliable power distribution. Cable fault locators become essential for quick fault detection and restoration, minimizing downtime. As utilities modernize infrastructure for efficiency and resilience, demand for accurate fault location tools grows significantly. |

| Expansion of telecommunication networks | The rapid growth of telecom networks involves extensive underground and overhead cabling. Faults in these cables can disrupt connectivity, making precise fault detection critical. Cable fault locators help operators maintain service reliability, reduce repair time, and support large-scale network expansions globally. |

| Pitfalls & Challenges | Impact |

| Complexity in real-time monitoring of the fault in cables | Real-time fault monitoring in cables is challenging due to the need for continuous data acquisition, signal processing, and interpretation across vast networks. Variations in cable types, environmental conditions, and interference complicate accurate fault detection. |

| Opportunities: | Impact |

| Advancement in Technology | Innovations such as AI-based diagnostics, IoT-enabled sensors, and automated fault detection systems enhance accuracy and speed in locating cable faults. These advancements reduce downtime, improve predictive maintenance, and lower operational costs. |

| Market Leaders (2025) | |

| Market Leader |

13% market share |

| Top 5 Players |

Collective market share of 40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Middle East & Africa |

| Emerging countries | Europe |

| Future outlook |

|

What are the growth opportunities in this market?

Cable Fault Locator Market Trends

- The cable fault locator industry is experiencing significant growth as global power infrastructure undergoes modernization to meet rising electricity demand and integrate renewable energy sources. Utilities and industrial operators are increasingly adopting advanced fault location technologies to ensure grid reliability and minimize downtime.

- Traditionally, fault detection was a manual and time-consuming process, but the latest trends emphasize automation, digitalization, and predictive maintenance. These innovations are transforming cable fault locators from basic diagnostic tools into intelligent systems that enhance operational efficiency and reduce costs.

- One of the most prominent trends is the integration of IoT-enabled sensors and smart monitoring systems into cable fault locators. These devices provide real-time data on cable health, enabling utilities to detect faults proactively and reducing outage durations. IoT connectivity allows remote monitoring and diagnostics, which is particularly valuable for underground and high-voltage networks where manual inspection is challenging.

- For example, utilities in Europe have deployed IoT-based fault locators to monitor critical transmission lines, reducing fault detection time from hours to minute. This trend aligns with the broader push toward smart grids, where real-time visibility and automation are essential for managing distributed energy resources (DERs).

- Modern cable fault locators are increasingly leveraging IEC 61850 protocols and fiber-optic communication systems to enhance interoperability and reduce wiring costs. Fiber optics can cut installation costs by up to 70% compared to traditional copper wiring, making digital fault location systems more cost-effective and scalable for large networks.

- European utilities, for example, have implemented cybersecurity frameworks in fault locator systems to comply with EU regulations, safeguarding grid operations from potential cyberattacks. This trend reflects the growing importance of security in an era of interconnected and automated power systems.

- The rising demand for renewable energy is also increasing demand for multiple electrical infrastructure, thereby increasing the demand for cable fault locators. In 2025, the U.S. saw massive solar and wind additions, with forecasts pointing to over 30 GW of solar and more than 7 GW of wind, together dominating new power capacity, reaching nearly 90%+ of all new additions by late 2025.

Cable Fault Locator Market Analysis

Learn more about the key segments shaping this market

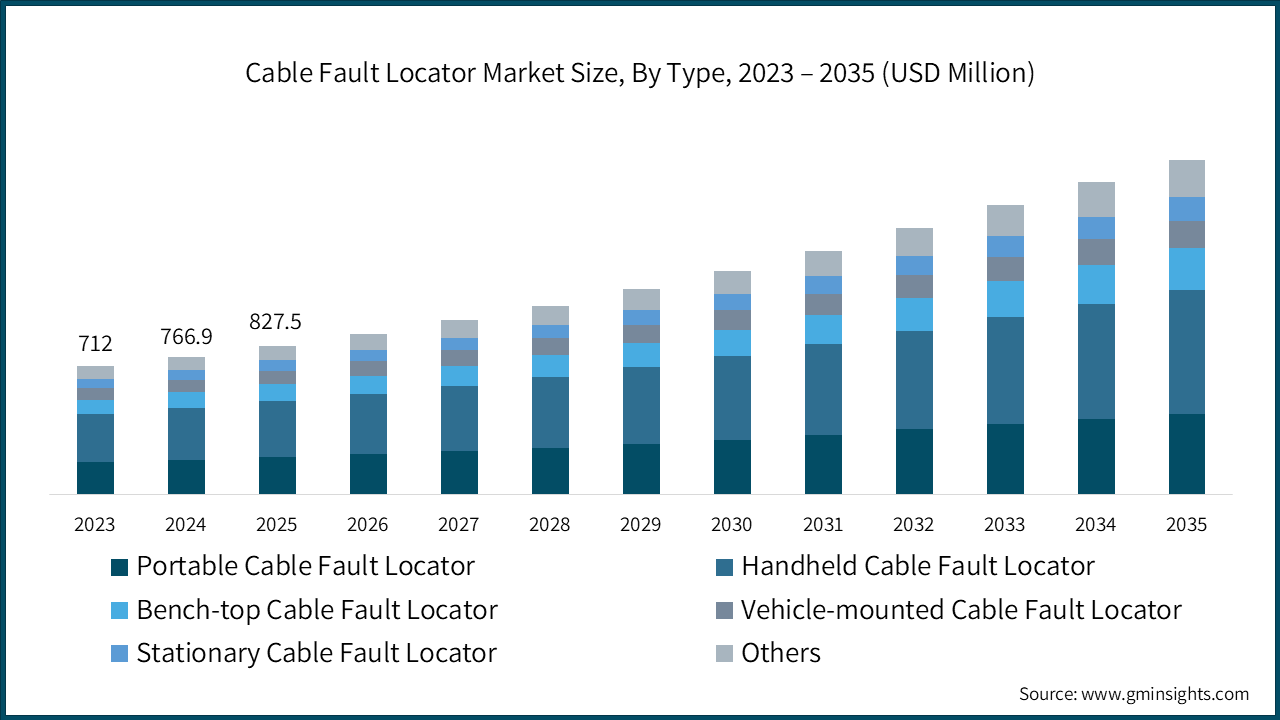

- Based on type, the portable cable fault locator segment is anticipated to exceed USD 448 million by 2035, due to its flexibility, ease of use, and ability to address urgent maintenance needs across diverse environments. Unlike fixed systems, portable fault locators are designed for quick deployment in field conditions, making them indispensable for utilities, contractors, and industrial operators who need to restore power rapidly after a fault occurs.

- One of the primary reasons portable fault locators are important is their ability to provide on-site fault detection and troubleshooting. Power outages caused by cable faults can lead to significant economic losses and service disruptions. Portable devices allow technicians to locate faults accurately without dismantling entire cable networks, reducing downtime and repair costs. For example, during storm-related outages in rural areas, portable fault locators enable quick restoration of electricity without waiting for heavy equipment or centralized systems.

- With the global trend toward underground cabling for urban aesthetics and reliability, fault detection has become more challenging. Portable fault locators are particularly valuable in these scenarios because they can be transported easily to confined spaces or remote locations where fixed systems are impractical. Countries like India and China, which are aggressively expanding underground power networks under programs such as the Revamped Distribution Sector Scheme (RDSS), rely heavily on portable solutions for maintenance and emergency repairs.

- Portable cable fault locators offer a cost-effective alternative for smaller utilities and contractors who cannot invest in large-scale diagnostic systems. These devices are versatile, supporting multiple fault detection techniques such as time domain reflectometry (TDR), insulation resistance testing, and high-voltage surge methods. Their adaptability makes them suitable for low-, medium-, and high-voltage applications across power distribution, telecom, and industrial sectors.

- As smart grids and renewable energy projects expand, portable fault locators are increasingly used for commissioning and maintenance of distributed energy resources (DERs). For instance, solar farms and wind parks often span large areas where cable faults can disrupt generation. Portable locators enable quick fault isolation, ensuring uninterrupted power flow and compliance with reliability standards.

Learn more about the key segments shaping this market

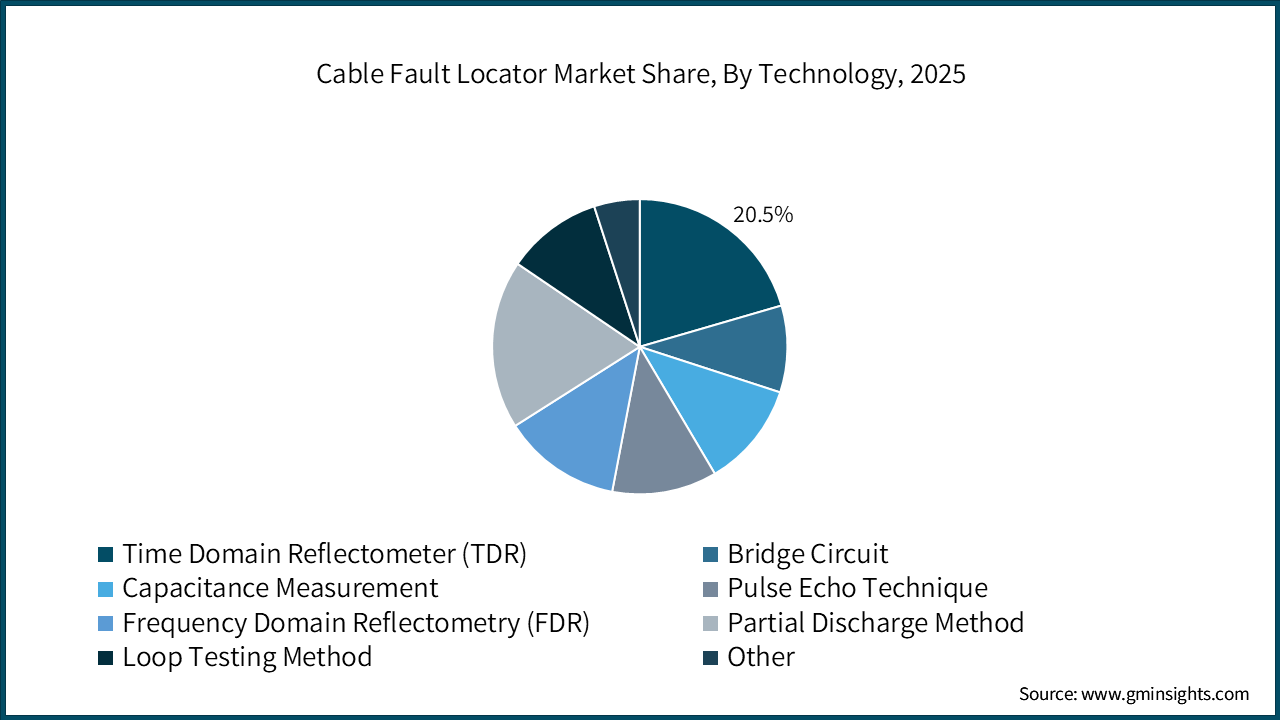

- Based on technology, the time domain reflectometer (TDR) segment holds a market share of 20.5% in 2025 and is expected to grow at a CAGR of over 8% by 2035. Global infrastructure modernization and urbanization are driving the adoption of underground cabling systems for improved reliability and aesthetics. Fault detection in underground cables is challenging, and TDR provides an efficient solution by pinpointing fault locations without excavation.

- TDR devices are portable, lightweight, and relatively affordable compared to high-voltage surge generators or complex diagnostic systems. This makes them ideal for field technicians and smaller utilities that require quick fault detection without investing in large-scale equipment. Their ability to test multiple cable types of power, telecom, and coaxial, further enhances their market appeal.

- Modern TDR systems are increasingly integrated with digital interfaces, cloud connectivity, and IoT-enabled monitoring, enabling real-time data sharing and predictive maintenance. Utilities can now combine TDR readings with GIS mapping and asset management systems, improving operational efficiency and reducing downtime.

- The bridge circuit segment is also anticipated to cross USD 163 million by 2035. It is considered as a fundamental in cable fault location technology because it provides a highly accurate method for detecting and pinpointing faults in electrical cables. Bridge circuits, such as Wheatstone or Murray loops, operate on the principle of resistance measurement, comparing the resistance of faulted and healthy cable sections to determine the exact fault distance. This precision is critical for minimizing downtime and repair costs in power distribution and telecommunication networks.

- Bridge circuits are particularly valuable for low-voltage and medium-voltage cable systems, where insulation faults, short circuits, or open circuits can disrupt operations. Their simplicity, reliability, and cost-effectiveness make them widely adopted in utility maintenance and industrial applications. Unlike complex digital systems, bridge circuits require minimal electronic components, making them ideal for field use in remote areas.

- With the growing trend of underground cabling and smart grid deployment, the demand for accurate fault location methods is increasing. Bridge circuits remain relevant because they offer a proven, efficient solution for fault detection without requiring advanced infrastructure. As utilities and telecom operators seek affordable yet precise tools, the bridge circuit segment continues to hold strategic importance in the market.

Looking for region specific data?

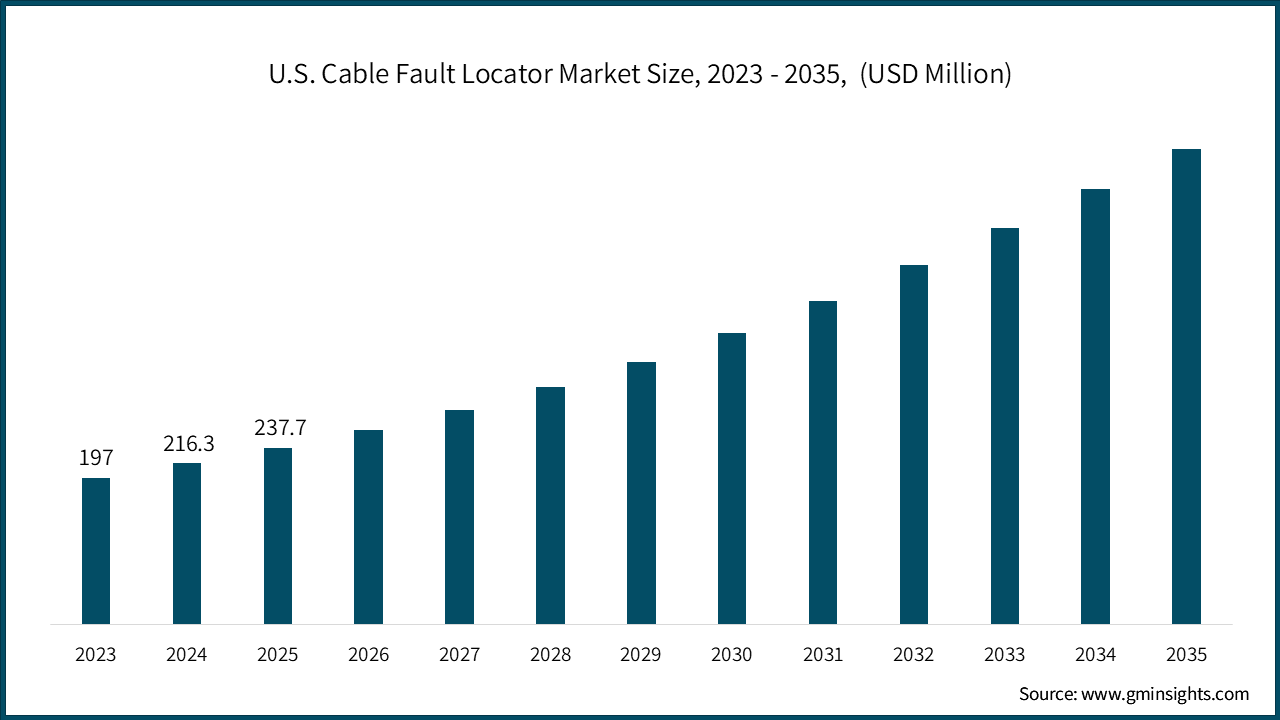

- The U.S. cable fault locator market is anticipated to exceed USD 639 million by 2035. The U.S. plays a pivotal role in the global market due to its extensive power infrastructure, aggressive grid modernization programs, and strong regulatory framework for reliability and safety.

- With one of the largest and most complex transmission and distribution (T&D) networks in the world, the U.S. faces significant challenges in maintaining grid resilience, reducing outages, and integrating renewable energy sources. These factors create a strong demand for advanced cable fault location technologies.

- The U.S. Department of Energy (DOE) has committed substantial funding toward upgrading aging infrastructure and deploying smart grid technologies. Under the Grid Resilience and Innovation Partnerships (GRIP) Program, the DOE announced USD 3.5 billion in funding for projects aimed at improving grid reliability and resilience. These initiatives include underground cabling and advanced fault detection systems, which directly boost demand for cable fault locators.

- Additionally, the Infrastructure Investment and Jobs Act (IIJA) allocate USD 65 billion for power infrastructure improvements, including transmission upgrades and digital monitoring systems. As utilities transition to underground networks and high-voltage systems, portable and automated fault locators become essential for maintenance and emergency repairs.

- The U.S. is rapidly expanding renewable energy capacity, with DOE reporting that solar and wind accounted for over 16% of electricity generation in 2023. Large-scale renewable projects require extensive cabling for grid interconnection, making fault detection critical for uninterrupted power flow. For example, offshore wind farms along the East Coast involve high-voltage submarine cables, where advanced fault locators are indispensable for quick fault isolation and repair.

- Europe is a critical region for the cable fault locator market due to its aggressive energy transition policies, extensive underground cabling projects, and stringent reliability standards. With ambitious climate targets and a strong focus on renewable integration, European countries are investing heavily in modernizing transmission and distribution (T&D) networks. These developments create significant demand for advanced cable fault location technologies to ensure grid resilience and operational efficiency.

- The European Union (EU) has committed substantial funding to upgrade aging infrastructure and support the transition to clean energy. Under the EU Green Deal, Europe aims to achieve climate neutrality by 2050, which requires massive investments in smart grids and underground cabling.

- The Connecting Europe Facility (CEF) program allocates billions of euros for cross-border electricity projects, including fault detection systems. For example, the EU announced USD 5.8 billion in energy infrastructure funding in 2023, focusing on grid reliability and renewable integration, both of which depend on accurate cable fault location.

- Asia-Pacific (APAC) is a key growth driver for the cable fault locator market due to rapid urbanization, industrialization, and large-scale electrification projects. Countries like China, India, and Japan are investing heavily in smart grid development and underground cabling to improve reliability and integrate renewable energy.

- For instance, China’s State Grid Corporation announced over USD 70 billion for grid upgrades, while India’s Revamped Distribution Sector Scheme (RDSS) focuses on underground cabling and digital monitoring. APAC’s expanding telecom infrastructure for 5G networks and renewable projects such as solar and wind farms further boost demand for portable and advanced fault locators, making the region critical for market growth.

Cable Fault Locator Market Share

- The top 5 companies in the cable fault locator industry are Fluke Corporation, Megger, Keysight Technologies, BAUR GmbH, and 3M. They are contributing around 40% of the market in 2025.

- These leading companies play a pivotal role in the global cable fault locator market due to their technological expertise, extensive product portfolios, and innovative solutions. These corporations also contribute significantly through their global presence and extensive service networks, enabling them to undertake large-scale projects across diverse regions such as the Middle East, Asia Pacific, and Europe.

Cable Fault Locator Market Companies

- In May 2025, Siemens Energy reported USD 17 billion in orders, marking a 52.3% year-over-year increase on a comparable basis, driven by significant growth in grid technologies and record-high quarterly order in energy services.

- 3M Company (MMM) is a globally diversified tech innovator focusing on materials science, delivering solutions across industries with Q3 2025 showing strong recovery.

Major players operating in the cable fault locator industry are:

- 3M

- AFL

- BAUR GmbH

- Edgcumbe Instruments Ltd.

- ETL Systems

- Exfo Inc.

- Fluke Corporation

- Greenlee (Textron Inc.)

- HIOKI E.E. Corporation

- Hubbell Incorporated

- Keysight Technologies

- KomShine Technologies Limited

- Megger

- Metrotech Corporation

- Nanjing Dajiang Electronic Equipment Co., Ltd.

- Radiodetection Ltd.

- Ripley Tools LLC

- SebaKMT

- Sumitomo Electric Lightwave

- Telemetrics Equipments Private Limited

- Tempo Communications

- Tessco Technologies

- Trotec

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

Cable Fault Locator Industry News

- In May 2025, Synaptec launched Greenlight, a monitoring solution designed specifically to address high-voltage cable failures, stemming from faults in cable joints and terminations. Greenlight provides continuous, automated visibility of all joints and terminations in a cable network, delivering early warnings of emerging faults before they become failures. Designed for offshore wind farms and high-voltage power grids, it replaces manual inspection and reactive maintenance with a smarter, safer, and far more cost-effective approach to asset management.

- In May 2023, Ensto launched the LYNX 4425, a current fault detector designed for medium voltage underground cable networks ranging from 10 to 24 kV. This device aims to enhance the efficiency of the distribution grid by quickly detecting and locating faults. By minimizing the time and cost associated with fault management, the LYNX 4425 helps reduce the frequency and duration of power outages.

The cable fault locator market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2022 to 2035, for the following segments:

Market, By Type

- Portable cable fault locator

- Handheld cable fault locator

- Bench-top cable fault locator

- Vehicle-mounted cable fault locator

- Stationary cable fault locator

- Others

Market, By Technology

- Time domain reflectometer (TDR)

- Bridge circuit

- Capacitance measurement

- Pulse echo technique

- Frequency domain reflectometry (FDR)

- Partial discharge method

- Loop testing method

- Others

Market, By Application

- Underground cables

- Overhead cables

- Submarine cables

- Indoor wiring

- Others

Market, By Cable Type

- Power cables

- Optical fiber cables

- Coaxial cables

- Twisted pair cables

- Others

Market, By End Use

- Power industry

- Telecommunications

- Mining

- Transportation

- Oil & gas

- Construction

- Aerospace & defense

- Marine

- Data centers

- Residential

- Commercial

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- France

- Germany

- Italy

- Russia

- Spain

- Asia Pacific

- China

- Australia

- India

- Japan

- South Korea

- Middle East & Africa

- Saudi Arabia

- UAE

- Turkey

- South Africa

- Egypt

- Latin America

- Brazil

- Germany

Frequently Asked Question(FAQ) :

Who are the key players in the cable fault locator market?

Key players include 3M, Fluke Corporation, Megger, Keysight Technologies, BAUR GmbH, AFL, Exfo Inc., Greenlee, HIOKI E.E. Corporation, Hubbell Incorporated, Radiodetection Ltd., SebaKMT, VIAVI Solutions Inc., and Yokogawa Electric Corporation.

Which region is the fastest growing in the cable fault locator market?

The U.S. market is anticipated to exceed USD 639 million by 2035, driven by grid modernization programs, renewable energy expansion, and Infrastructure Investment and Jobs Act funding.

What are the upcoming trends in the cable fault locator market?

Key trends include integration of IoT-enabled sensors, AI-based diagnostics, automated fault detection systems, and adoption of IEC 61850 protocols for enhanced interoperability and real-time monitoring.

What was the market share of the time domain reflectometer (TDR) segment in 2025?

TDR technology held 20.5% market share in 2025 and is expected to grow at over 8% CAGR by 2035.

How much revenue did the portable cable fault locator segment generate by 2035?

Portable cable fault locators are anticipated to exceed USD 448 million by 2035, leading due to flexibility, ease of use, and ability to address urgent maintenance needs.

What is the market size of the cable fault locator in 2025?

The market size was USD 827.5 million in 2025, with a CAGR of 8.5% expected through 2035 driven by increasing need for reliable power infrastructure and smart grid adoption.

What is the current cable fault locator market size in 2026?

The market size is projected to reach USD 894.6 million in 2026.

What is the projected value of the cable fault locator market by 2035?

The cable fault locator market is expected to reach USD 1.8 billion by 2035, propelled by grid modernization, renewable energy integration, and expansion of telecommunication networks.

Cable Fault Locator Market Scope

Related Reports