Summary

Table of Content

Bulk Material Handling Equipment Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Bulk Material Handling Equipment Market Size

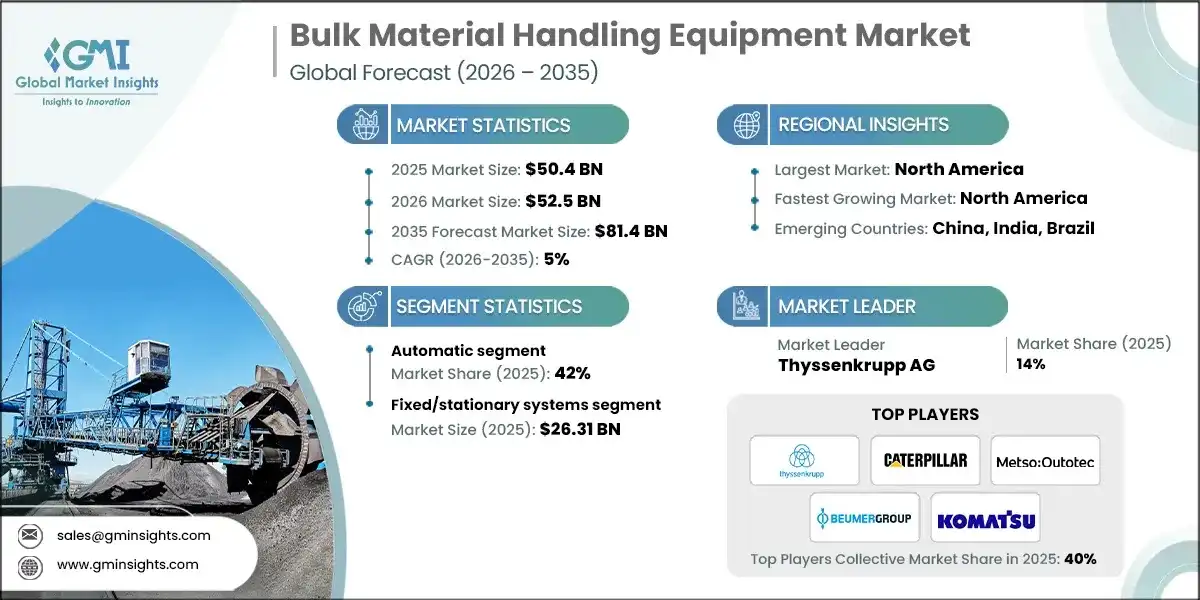

The bulk material handling equipment market was estimated at USD 50.4 billion in 2025. The market is expected to grow from USD 52.5 billion in 2026 to USD 81.4 billion in 2035, at a CAGR of 5% according to latest report published by Global Market Insights Inc.

To get key market trends

The automated handling of bulk material constitutes a major impetus for transformation through several changes. Traditionally, automation was seen as being applied to big industries, however, the modern era has transformed that concept into what meets the needs of today's demand for supply chains. In today's world, automation is not simply a method for reducing labor expenses, but rather it has evolved to be an integral part of enhancing operational efficiency, improving safety, and decreasing downtime, whilst the implementation of smarter automated solutions is allowing enterprises to create a robust and flexible supply chain that accommodates the ebbs and flows of demand and allows them to be consistent in their operations.

The rapid growth of the eCommerce sector has radically modified the market for bulk material handling. Bulk material handling once limited to the mining, shipping and manufacturing sectors, has now become an essential component of the logistics infrastructure supporting eCommerce and its vast array of goods and services. Advanced equipment is needed to handle large volumes of packaging materials with speed and precision in warehouses. This shift has extended the role of bulk handling systems as key components in the seamless working of modern commerce and logistic networks.

Sustainability has become one of the key innovation drivers in the bulk material handling industry. The responsibility for taking care of the environment is becoming no longer just optional but has now become an obligation for how manufacturing and operating are conducted. Companies are increasingly committed to investing in energy-efficient and greenhouse gas-reducing equipment, pursuing material flow optimization, as well as incorporating environmentally friendly materials into their operations. As this continues, the evolution of electric-powered conveyors, closed-loop recycling systems, and other technologies will become the foundation for the future of the bulk material handling sector. The integration of automation, eCommerce, and sustainability represents a strategic opportunity to establish bulk material handling as an essential advantage to all businesses and supply chains.

Bulk Material Handling Equipment Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 50.4 Billion |

| Market Size in 2026 | USD 52.5 Billion |

| Forecast Period 2026-2035 CAGR | 5% |

| Market Size in 2035 | USD 81.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid Industrialization and Infrastructure Development | Growing construction, mining, and manufacturing activities worldwide are increasing the demand for efficient bulk material handling systems. |

| Automation and Technological Integration | Adoption of automated conveyor systems, robotics, and IoT-enabled monitoring enhances operational efficiency and reduces labor dependency. |

| Expansion of Mining and Energy Sectors | Rising extraction of minerals and energy resources, coupled with the need for large-scale material transport, is fueling equipment demand. |

| Pitfalls & Challenges | Impact |

| High Capital Investment and Maintenance Costs | Advanced bulk handling systems require significant upfront investment and ongoing maintenance, which can limit adoption among smaller enterprises. |

| Environmental and Regulatory Compliance | Strict regulations on dust control, emissions, and noise in material handling operations pose challenges for manufacturers and operators. |

| Opportunities: | Impact |

| Integration of Smart Technologies and Predictive Analytics | Increasing use of AI, IoT, and predictive maintenance solutions offers opportunities for improved efficiency and reduced downtime. |

| Sustainability and Energy-Efficient Solutions | Growing demand for eco-friendly and energy-saving equipment creates a market for innovative designs and green certifications. |

| Market Leaders (2025) | |

| Market Leaders |

14% market share |

| Top Players |

Collective market share in 2024 is Consolidate share of 40% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | North America |

| Emerging Country | China, India, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Bulk Material Handling Equipment Market Trends

The bulk material handling equipment industry is crucial for industries moving large quantities of raw materials and finished products efficiently.

- With the rapid integration of automation and digitization into bulk material handling, more use of advanced robotics, IoT sensors, and automated predictive maintenance based on AI is becoming the way of business for many companies to continue improving operations, minimizing human errors, and having access to real-time data for improved decision making on highly complex systems.

- There is a notable movement in manufacturing to utilize sustainable and energy-efficient designs and equipment. This is inclusive of lower power standard motors, regenerative braking systems, and designs that minimize material spillage while also reducing the environmental footprint and operational expenses of manufacturing by incorporating greener solutions into material handling processes.

- The use of modularized and reconfigurable equipment is another growing trend manufacturers are discussing with customers to provide greater flexibility in regard to future site layouts, production requirements, and product types. Providing modular and reconfigurable equipment allows the manufacturer to adapt to the changing needs of customers without requiring complete redesigning of the equipment and allowing for an easier expansion of modular solutions.

- Safety remains one of the most important concerns for manufacturers and customers. As such, manufacturers are introducing the adoption of advanced safety solutions such as collision avoidance systems, emergency stop features, remotely operated systems for material handling, which not only protect employees, but also prevent any form of material damage from occurring and maintain compliance with Osha and other related safety regulations.

- The use of smart sensors for predictive maintenance along with analytical software to monitor equipment performance and operate efficiently will continue to grow as manufacturers seek ways to remain competitive in the future.

Bulk Material Handling Equipment Market Analysis

Learn more about the key segments shaping this market

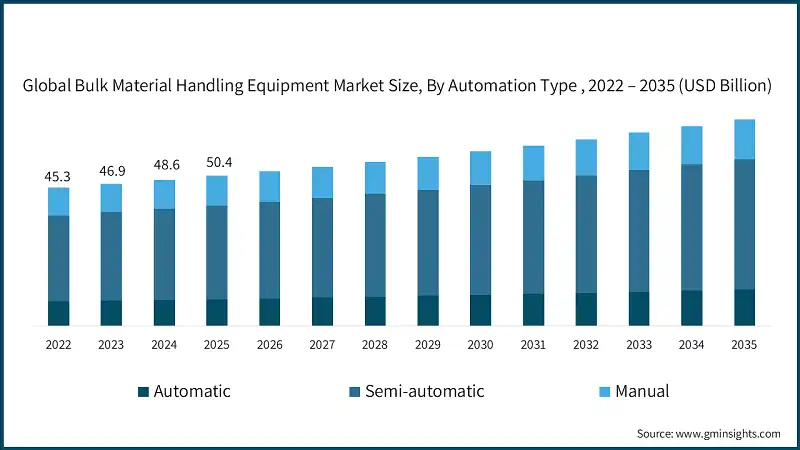

Based on the automation type, the market is divided into automatic, semi-automatic, and manual. The automatic segment held around 42% of the market share in 2025.

- Automated equipment is dominating the bulk handling equipment sector due to its ability to improve overall efficiency and to reduce overall operational costs. automated systems (robotic conveyor systems, automated guided vehicles, smart sorters) streamline material handling operations through the sequencing and delivery of materials accurately.

- They also reduce the potential for human error in operational processes, enabling continuous operation at maximum speeds, which is critical to achieving throughput in the various industries of mining, logistics, and manufacturing. proactive asset management, along with a focus on reducing the risk of equipment failure, contribute to the cost savings derived from the life cycle of equipment.

- Stakeholders increasingly focus on workplace safety and compliance, and therefore, many organizations are embracing automation technology as a solution to address these needs. By utilizing an automated process to physically handle heavy or hazardous materials, automation mitigates the risk to workers and promotes compliance with workplace safety standards. This trend not only fosters safer working conditions but also supports corporate governance and public expectations in terms of automated processes being viewed as a priority for many organizations.

- While there are several benefits associated with automation, there are also challenges facing organizations in implementing automated equipment. Safety risks and operational liabilities derived from improper use and/or malfunctioning of automated equipment must be carefully considered by companies before implementing automated processes. to take full advantage of the benefits offered by automated systems, companies will need to invest in comprehensive training programs, regular equipment maintenance, and advanced safety protocols.

Learn more about the key segments shaping this market

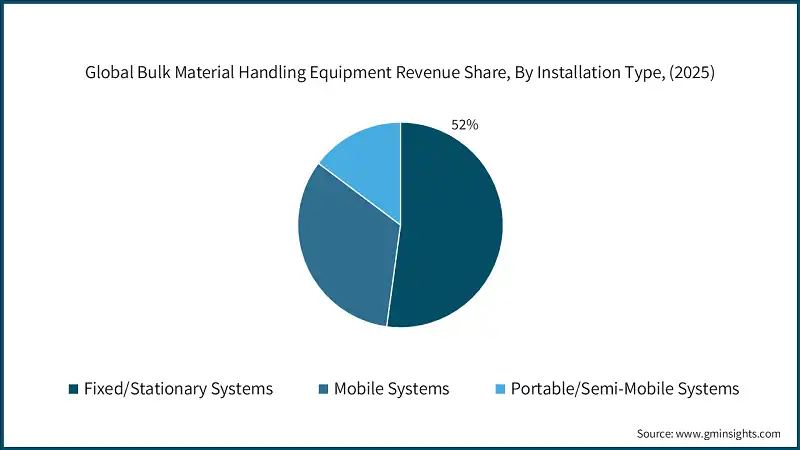

Based on the installation type, the market is segmented into fixed/stationary systems, mobile systems, and portable/semi-mobile systems. The fixed/stationary systems held a major market share of 52%, generating revenue of USD 26.31 billion in 2025.

- The fixed/stationary systems sector leads the bulk material handling equipment market because they are ubiquitous in high-volume, continuous processes; for example, these systems are used in mining, cement, and port terminals. fixed/stationary systems, including conveyor belts, stackers, and hoppers, allow high volumes of materials to be moved over extended durations with no need to change position, a necessity in most processing applications.

- Fixed/stationary systems have a long service life and can be designed and built to suit applications of almost any volume of material, they have a strong market share based on their utility. While many specialized systems can be designed to work more efficiently based on unique operational situations, fixed/stationary systems are optimal in throughput-based businesses that integrate into a long-term infrastructure program, which will only reinforce their presence in both mature and developing economies.

- The fixed/stationary systems sector leads the bulk material handling equipment market because they are ubiquitous in high-volume, continuous processes; for example, these systems are used in mining, cement, and port terminals.

- Fixed/stationary systems, including conveyor belts, stackers, and hoppers, allow high volumes of materials to be moved over extended durations with no need to change position, a necessity in most processing applications. because fixed/stationary systems have a long service life and can be designed and built to suit applications of almost any volume of material, they have a strong market share based on their utility. While many specialized systems can be designed to work more efficiently based on unique operational situations, fixed/stationary systems are optimal in throughput-based businesses that integrate into a long-term infrastructure program, which will only reinforce their presence in both mature and developing economies.

Based on the distribution channel, the market is segmented into direct sales and indirect sales. The direct sales dominate the market by holding high market share in 2025.

- The largest portion of the global bulk material handling segment is accounted for by direct (i.e. No intermediate) supply systems. This is primarily due to the benefits of speed, simplicity and cost savings that owning a direct supply system provides for businesses in this sector.

- Docking tunnel systems, conveyor bridge systems, and stacking platforms are similar direct supply systems that move your materials from point a to point b. Because of their lack of complicated routing and no intermediate storage, direct supply systems greatly reduce the number of operational steps in transporting bulk materials as well as shorten the time for handling material. This means that for companies in the mining, ocean freight and electric power generation industries, direct supply systems offer the most efficient way of transporting the largest amounts of material continually.

- Another segment that is rapidly growing in this sector is the automated and integrated supply systems. The growth of this segment can be attributed to the increasing demand for more flexible supplies and real-time control of the operation of a supply chain.

- The continued growth of digital technologies and the emphasis on sustainable production is driving the development of integrated supply solutions that allow operators to visualize, analyze, and change, in real-time, the route of their products throughout the supply chain. Integrated supply solutions are essentially a network of connected devices consisting of conveyors, feeders, and smart sensors that predict maintenance and reduce waste of additional energy resources.

- The development of e-commerce continues to further catalyze the growth of this segment within this sector as companies are increasingly looking for automated solutions that efficiently process many different types of materials and meet the required environmental standards. In summary, automation is producing a change in the process of handling bulk materials, moving forward from being purely mechanical to becoming a key enabler of sustaining business growth while also enhancing productivity and sustainability.

Looking for region specific data?

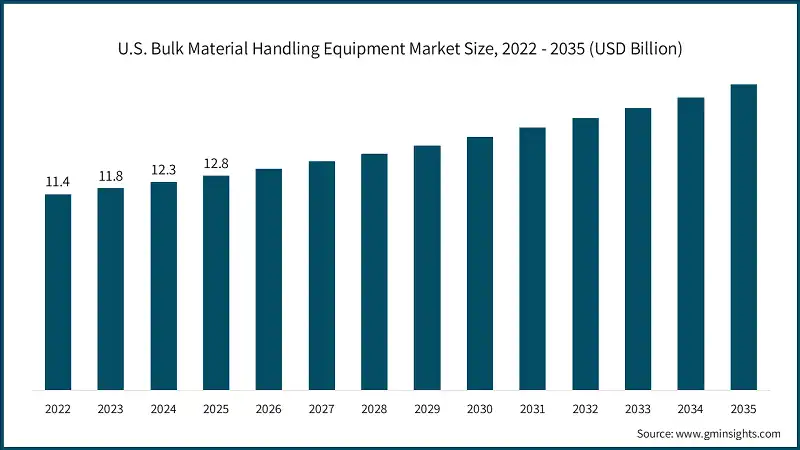

The U.S. dominated the North America bulk material handling equipment market, which was valued at USD 486.4 million in 2025 and is estimated to grow at a CAGR of 5% from 2026 to 2035.

- The North American region has been a leader in market growth across the globe. The U.S.'s industrial base as well its high adoption rates of automation have increased significantly in North America due to investment into new technology as well as the enhancement of overall operational efficiency and the reduction of waste.

- The demand for product supply from several different industries (i.e. Mining, construction, and logistics) has contributed to it being one of the largest and fastest-growing businesses in the North American region.

Europe is the second-largest market estimated at USD 432.3 million in 2025 with a projected growth rate of 4.6% through 2035. The bulk material handling equipment market in Germany is expected to experience significant and promising growth at a CAGR of 4.8% from 2026 to 2035.

- The European region, overall, is the second-largest marketplace with a strong emphasis on sustainability and precision engineering. Environmental laws have encouraged manufacturers to switch to more energy efficient equipment and sustainable, recyclable material handling equipment.

- Germany is the leader in boosting the growth of automated and digitalized bulk material handling equipment due to its established industrial infrastructure and environment for high-volume manufacturing. There will be stable growth in Europe, but continued focus on quality and innovation will keep Europe relevant in the Marketplace for High-Value Applications.

Asia Pacific is the third-dominant region in the market. It has an estimated market value of USD 629.5 million in 2025 with a projected growth rate of 5.4% from 2026 to 2035.

- Growth in the Asia Pacific continues to move extremely quickly due to urbanization and expansion of e-commerce as well as companies that can produce products in bulk at low cost.

- The area is dominated by many of the largest and fastest-growing countries in the world, like China and India, that are known for manufacturing products in large volumes and developing new technologies rapidly.

- In response to these opportunities, many companies around the world have allocated significant resources to the Asia Pacific region to take advantage of this rapid growth. With a focus on automation and scalability within their operations, the Asia Pacific region is recognized as a prominent area for the future of industry growth.

Bulk Material Handling Equipment Market Share

In 2025, ThyssenKrupp AG is leading with 14% market share Caterpillar Inc., Komatsu Ltd., Metso Outotec Corporation, thyssenkrupp AG, BEUMER Group GmbH & Co. KG collectively hold around 40%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Thyssenkrupp is a global manufacturer that offers an extensive portfolio of the Industrial Sector, including OEM Systems solutions for the mining, cement and material handling sectors in addition to providing complete systems solutions in the areas of mining, cement and material handling. they provide integrated and comprehensive engineering solutions for large-scale industrial projects, which provides them with a superior edge over competition.

- Metso Outotec is primarily focused on providing technology and services to the aggregates, mineral processing and metal refining sectors. they offer a wide array of products (crushers, screens, grinding mills, conveyor systems) that allow users to process and transport bulk materials in a sustainable manner and they are a leader in the industry.

- Komatsu manufactures construction and mining equipment, including the best heavy equipment available today for the movement of bulk materials, including excavators, dozers, haul trucks. by providing innovative technology, a significant market share in heavy equipment, and an extensive global support network, they will have a large presence in future large-scale material handling projects.

Bulk Material Handling Equipment Market Companies

Major players operating in the bulk material handling equipment industry are:

- KOCH Solutions GmbH

- Caterpillar Inc.

- Komatsu Ltd.

- Metso Outotec Corporation

- thyssenkrupp AG

- Sandvik AB

- BEUMER Group GmbH & Co. KG

- AUMUND Group

- TAKRAF GmbH

- CITIC Heavy Industries Co., Ltd.

- Tenova S.p.A.

- Siwertell AB

- Vigan Engineering S.A.

- Liebherr Group

- Continental AG

Caterpillar is an internationally recognized manufacturer of diverse heavy equipment such as earthmoving equipment, bulldozers and large-scale excavation and mining trucks required when handling large amounts of bulk materials in the mining and construction industries. Caterpillar also has a very large number of customers globally as well as being one of the leading suppliers of high productivity, high-capacity machines.

BEUMER Group provides unique systems for intralogistics, including the technologies that move, load, palletize, and package bulk materials. The knowledge of BEUMER in the development of automated and integrated systems to support the industries of cement, mining, and port operations have allowed BEUMER's continued growth in this industry by providing innovative and efficient solutions for the movement of goods.

Bulk Material Handling Equipment Industry News

- In March 2025, thyssenkrupp Nucera announced a €3.5 billion all-share merger with FLSmidth, creating an integrated mining technology and materials handling leader with combined €7 billion revenue and 24,000 employees globally. This is going to help the companies in offering end-to-end mining solutions from ore extraction to processing, leveraging thyssenkrupp's electrolysis technology with FLSmidth's bulk handling expertise, and strengthening competitiveness in sustainable mining equipment markets

- In September 2024, BEUMER Group opened a new 42,000 m² automated high-bay warehouse at its Beckum, Germany headquarters, featuring 18,000 pallet spaces, automated storage/retrieval systems, and integrated production logistics. This is going to help the company in optimizing intralogistics for bulk material handling equipment manufacturing, reducing lead times, improving parts availability for global projects, and demonstrating automation capabilities to customers in mining, cement, and port industries.

- In July 2024, Terex Materials Processing completed acquisition of Giporec International SA (Switzerland), a mobile crushing and screening equipment manufacturer with Gipo and Recydia brands serving aggregates and recycling markets. This is going to help the company in expanding its mobile crushing portfolio, strengthening its European presence particularly in Switzerland and neighboring markets, and enhancing capabilities in construction waste recycling and circular economy applications.

- In July 2024, Konecranes and Cargotec completed their merger, creating the new Cargotec Corporation with approximately €7.5 billion revenue, 25,000 employees, and combined leadership in port equipment, container handling, and bulk material handling cranes. This is going to help the company in offering integrated cargo handling solutions from ship-to-shore cranes to inland material handling, achieving €80 million annual synergies, and strengthening global service networks for ports, terminals, and heavy industries.

The bulk material handling equipment market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035, for the following segments:

Market, By Equipment Type

- Conveyor systems

- Belt conveyor systems

- Pipe conveyor systems

- Drag chain conveyor systems

- Screw conveyor systems

- Stacker-reclaimer systems

- Circular stacker-reclaimers

- Linear stacker-reclaimers

- Combined stacker-reclaimers

- Shiploader & shipunloader systems

- Continuous shiploaders

- Grab-type shipunloaders

- Pneumatic shipunloaders

- Bucket wheel excavators

- Lignite mining applications

- Iron ore applications

- Overburden removal applications

- Feeders & feeding equipment

- Vibratory feeders

- Belt feeders

- Apron feeders

- Crushers & size reduction equipment

- Jaw crushers

- Cone crushers

- Impact crushers

- Hammer mills

- Screening & separation equipment

- Vibrating screens

- Classifiers & separators

- Storage systems

- Hoppers & bins

- Silos & storage facilities

- Auxiliary & support equipment

- Belt cleaners & scrapers

- Take-up systems

- Transfer equipment & chutes

- Dust collection systems

- Magnetic separators

Market, Capacity

- Small capacity systems (under 1,000 tph)

- Medium capacity systems (1,000-5,000 tph)

- High-capacity systems (5,000-8,000 tph)

- Ultra-high-capacity systems (8,000+ tph)

Market, By Installation Type

- Fixed/stationary systems

- Mobile systems

- Portable/semi-mobile systems

Market, By Automation Type

- Manual

- Semi-automatic

- Automatic

Market, By Commodity Type

- Iron ore

- Coal

- Copper

- Fertilizers & chemicals

- Multi-commodity systems

- Other bulk commodities

Market, By End Use

- Mining operations

- Port & terminal operations

- Power generation

- Cement manufacturing

- Steel & metals processing

- Agriculture & food processing

- Construction & aggregates

- Logistics & distribution centers

- Other end-use industries

Market, By Distribution Sales

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for the Asia Pacific bulk material handling equipment market from 2026 to 2035?

Asia Pacific market is projected to grow at a 5.4% CAGR through 2035, with a market value of USD 629.5 million in 2025, supported by rapid urbanization, e-commerce expansion, and low-cost bulk production.

Which region leads the bulk material handling equipment market?

The U.S. dominated the North America bulk material handling equipment market with USD 486.4 million in 2025 and is projected to grow at a 5% CAGR through 2035.

Who are the key players in the bulk material handling equipment market?

Key players include thyssenkrupp AG, Caterpillar Inc., Metso Outotec Corporation, BEUMER Group GmbH & Co. KG, Komatsu Ltd., Sandvik AB, AUMUND Group, TAKRAF GmbH, CITIC Heavy Industries Co., Ltd., Tenova S.p.A., Siwertell AB, Vigan Engineering S.A., Liebherr Group, Continental AG, and KOCH Solutions GmbH.

What are the upcoming trends in the bulk material handling equipment market?

Key trends include integration of AI and IoT for predictive maintenance, adoption of energy-efficient and sustainable designs, modular and reconfigurable equipment solutions, and advanced safety systems including collision avoidance and remote operation capabilities.

What is the market size of bulk material handling equipment in 2025?

The market size was USD 50.4 billion in 2025, with a CAGR of 5% expected through 2035 driven by rapid industrialization, automation integration, and expansion of mining and energy sectors.

How much revenue did the fixed/stationary systems segment generate in 2025?

Fixed/stationary systems generated USD 26.31 billion in 2025, leading the market with 52% share.

What was the market share of the automatic segment in 2025?

The automatic segment held 42% market share in 2025, driven by efficiency improvements and operational cost reduction.

What is the current bulk material handling equipment market size in 2026?

The market size is projected to reach USD 52.5 billion in 2026.

What is the projected value of the bulk material handling equipment market by 2035? The

bulk material handling equipment market is expected to reach USD 81.4 billion by 2035, propelled by smart technology adoption, sustainability initiatives, and infrastructure development.

Bulk Material Handling Equipment Market Scope

Related Reports