Summary

Table of Content

Biopesticides Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Biopesticides Market Size

The global biopesticides market was valued at USD 3.5 billion in 2024, with expectations to reach USD 8.7 billion by 2034, growing at a CAGR of 9.3%.

To get key market trends

Biopesticides are the natural pesticide that are derive from organism and their role includes crop protection and pest control. These are derived from bacteria, fungi, viruses, plant extract and pheromones. The application of these biopesticides is very diverse, as they are used in agriculture, horticulture and forestry. The main benefits of these biopesticides are that they are used in organic farming and integrated pest management.

Biopesticides Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.5 Billion |

| Forecast Period 2025 – 2034 CAGR | 9.3% |

| Market Size in 2034 | USD 8.7 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Increasing health concerns among people is a great contributor to the biopesticides market because, today, consumers prefer organic products. This, in turn, increases the demand for organic farming as consumers are more aware regarding pesticide residues on regular produce and organic farming relies heavily on biopesticides for pest management. Furthermore, organic farming and clean label foods is becoming increasingly in the demand and is encouraging other agricultural producers to use biopesticide products. In addition to the factors powered by consumers, polices and support from the government adds more boom to the market. Because of health issues and environmental protection, governments around the world are tightening regulations on the use of synthetic pesticides, which is good for adopting biopesticides.

Further adoption is being driven by subsidies, grants, and other policies that support sustainable agriculture. The U.S. Environmental Protection Agency (EPA) and The European Food Safety Authority (EFSA) are further facilitating the new product marketing biopesticide approval through a simpler approach and rapid authorization of biopesticides permits. Related to developments, in Asia and Latin America biopesticides are being integrated through agriculture changes.

For instance, in the course of five years, India has experienced increasing demand and consumption for biopesticides. In 2018-19, the demand of biopesticides stood at 9,725 metric tonnes with consumption at 7,203 metric tonnes. By 2022-23, the demand and consumption had increased to 11,211 and 7,248 metric tonnes respectively.

Biopesticides Market Trends

The global market is anticipated to grow due to the need for sustainable farming solutions, increased issues from chemical pesticides and the regulations allowing the use of green alternatives. One of the major changes is the technological advancement with regards to the development of microbial biopesticides such as Bacillus thuringiensis (Bt), Trichoderma, and Pseudomonas which are gaining attention for their effectiveness and environmental friendliness. Moreover, RNA interference (RNAi) based biopesticides along with biochemical pesticides like phytochemicals and pheromones are equally wonderful, created innovations in bioremediation.

For example, bacterial biopesticides account for 74% of the share of the gross biopesticides market and production around the world, followed by 10% for fungal biopesticides, and non-microbial-based biopesticides account for only 11% of the global market regarding pesticide production.

Among these prospects, the growth of organic farming stands out because of the increased consumer demand for grown food without pesticide additives. Moreover, integrated pest control (IPC) is increasing the uptake of biopesticides in North America and Europe where these practices are supported by biological legislation. There is also large potential in the Asia-Pacific region owing to the increasing government initiative toward sustainable farming and decreased use of pesticides.

Addressing these challenges with technology and innovation as well as with carefully scoped business partnerships will be important for future development. In general, the demand for biopesticide products will be increasing tremendously as regulations strengthen and the preference for eco-friendly solutions for managing pests increases.

Biopesticides Market Analysis

Learn more about the key segments shaping this market

The biopesticides market by product is segmented into bio herbicides, bio insecticides, bio fungicides, others. The bio insecticides accounted for 48.7% of the market share in 2024 and is expected to grow with the CAGR of 9.2% in 2034.

The bio insecticide market dominates the market due to efficient benefit in the agriculture sector. Microorganisms such as Bacillus thuringiensis (Bt), fungal organisms such as Beauveria bassiana, and various plant-based compounds aid in biopesticide synthesis and these organisms aid in pest control with low environmental consequences. The increased awareness among farmers about the ill effects of chemical insecticides has increased the acceptance of bioinsecticides, especially in organic farming and integrated pest management (IPM) systems.

Stricter regulations on synthetic pesticides, along with increased consumption of pesticide-free products is driving the biopesticides market. Moreover, rapid development in the field of microbial formulations and nano delivery systems has enhanced the performance and shelf life of bioinsecticides, thus improving their acceptance over traditional pesticides. Bioinsecticides have a growing scope in cereals, fruits, vegetables, and commercial crops and thus, continue to lead the market, presenting wide-ranging opportunities for implementation of novel and biomimetic approaches to sustainable pest management strategies.

For instances, bacterium B. thuringiensis has been utilized for pest control and occupies nearly 2% of the global insecticidal market while dominating 90% of the global bacterial biopesticides industry.

Learn more about the key segments shaping this market

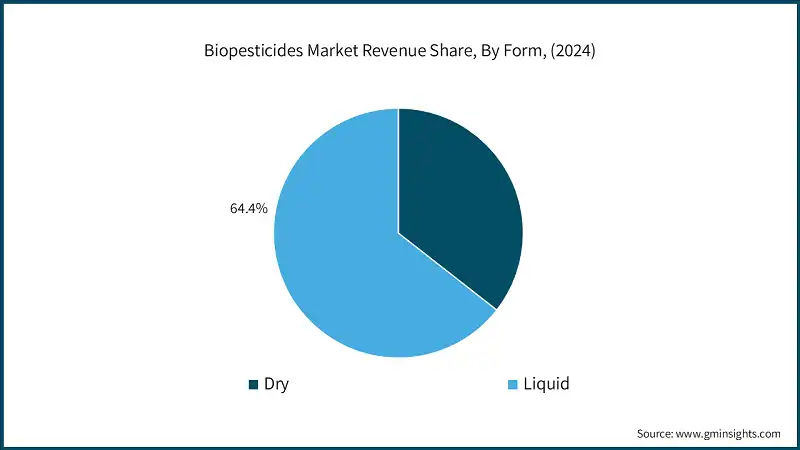

The biopesticides market is segmented into dry and liquid based on form. Liquid form holds the market size of USD 2.3 billion in 2024 and expected to grow at a faster rate of 9.4% CAGR.

The liquid form of market is characterizes by ease of use, greater efficacy and higher shelf stability which makes it more suitable than dry formulations. Liquid biopesticides almost always include suspension concentrates, emulsifiable concentrates, and soluble liquids which support easy dispersal, and higher attachment to host surfaces which enables them to be more effective against target pests and diseases. Their compatibility with conventional spraying equipment further encourages their widespread adoption among farmers. Liquid formulations also increase the stability of microbial biocontrol agents by improving their shelf life and performance in the field.

For instance, BioWest Ag Solutions launched Battalion Pro, a liquid bioherbicide targeting invasive annual grass weeds, exemplifying the industry's shift towards liquid biopesticide products.

The increasing importance of integrated pest management (IPM), as well as organic farming, has increased the use of these biopesticides because of their non-toxic nature. With the continued increase in regulatory support and the adoption of sustainable agriculture practices, liquid biopesticides still remain the most dominant product in the market.

The biopesticides market by source is segmented into microbial, biochemical and others. The microbial segment accounted for 54.1% of the market share in 2024.

The microbial segment leads the global biopesticide market share because of its unparalleled effectiveness including environmental safety and compatibility with integrated pest management systems (IPM). Microbial biopesticides manufactured from the bacteria, fungi, viruses, and protozoa allow for strategic targeted pest management while reducing adverse effects to the ecosystem. These include crops that allow the use of insecticides based on Bacillus thuringiensis (Bt), Beauveria bassiana fungi, and Trichoderma species for disease control that are common in various crops.

Under the market conditions of stringent regulations on the use of synthetic biocide coupled with rising preference for organically produced food, a shift towards more microbial-based solutions has become more prominent. Furthermore, improvements in fermentation technology and formulation of microbial biopesticides have resulted in the increased shelf-life, bio-efficacy, scalability, and reduced overall costs compared to chemical pesticides. Due to these benefits, continuous R & D will ensure that the microbial sector will remain a leader.

Based on crop the biopesticides market is segmented into grain & oil seeds, fruit & vegetables and others. Fruits & vegetables segment accounts for market size of USD 2.5 billion in 2024 and expected to grow at a faster rate of 9.4% CAGR to reach a larger target market.

Fruits and vegetables dominate the biopesticide market as they are very prone to suffers from pests and diseases, along with a growing market for chemical-free crops. These crops are also heavy users of pest control management which makes biopesticides a favourable option compared to traditional synthetic chemicals. The stringent restrictions on pesticide residues in fresh produce also accelerated the acceptance of biopesticides in fruits and vegetables farming. In addition, the increasing supply of organic food has compelled farmers to use biopesticides as part of environmentally friendly agriculture. Biopesticides in the form of bio fungicide, bio insecticide, and bio herbicide can effectively mitigate pathogens such as powdery mildew, downy mildew, and insect pests on beneficial organisms.

The efficiency and the rate of adoption of biopesticides have also been dramatically improved by novel formulations like microbial based sprays and extracts from plants. The United States, India, China, and Brazil are among the top producers of fruit and vegetables and these are the countries that seem to be more liberal with the use of biopesticides. With increasing concern on health and supportive regulations, the fruit and vegetable industry remains dominant in the biopesticide industry.

The Food and Agriculture Organization (FAO) states that India is the second largest producer of fruits and vegetables in the world. From the year 2018-19 to 2021-22 India’s fruit yields surged by a CAGR of 3% to reach 107.10 million tonnes, while the yield of vegetables production raised by 3.8% CAGR to 204.61 million tonnes. The increasing output of fruits and vegetables is steadily increasing the demand for biopesticides as the farmers are trying to follow the new regulations for lowering the amount of chemicals used and assisting the organic farming movement.

Based on application the biopesticides market is segmented by seed treatment, foliar spray and soil spray. The foliar spray segment holds a significant share of 80.5% of the market in 2024.

Foliar spray is presumed to be one of the most effective methods of delivering nutrition to the plant. It is the dominating technique because it provides quick absorption due to the liquid format and helps in pest control in the more effective way. In comparison of other way, it provides more coverage which maximize the effect of biopesticide. As precision agriculture practices and sustainability increase, the biopesticide market is still dominated by foliar spray application.

Seed treatment and soil spray are also relevant in pest control measures in biopesticides market. Seed treatment uses biopesticides which greatly enhances the seed and crop protection at its early stages. Coating the seeds with biopesticides helps in seed germination and protects from soil-borne pests and pathogens. Soil spray aids in the direct attacking of diseases, soil born nematodes, and root pests which, in turn, complements plant health by raising nutrient uptake and microbial activity. These two methods go further in assisting foliar sprays and aid in the Integrated Pest Management (IPM) System which increases crop productivity while fostering sustainable agricultural practices.

Looking for region specific data?

In the biopesticides market North America dominated the market by accounting USD 1.3 billion in 2024 and is expected to grow at a CAGR of 9% in 2034.

North America leads the biopesticide industry due to the major investments in agricultural biotechnology throughout the region, especially in the United States, as well as in Canada with the adoption of sustainable agriculture practices along with the growing organic farming industry. The United States has advanced farming techniques and high rates of integrated pest management farming which helped it in gaining a stronger market share in North America. The rise in consumer awareness in regard to the impacts of pesticide residue along with other environmental factors has also influenced the biopesticide industry to focus more on ecofriendly approaches in pest control measures. The North America region also enjoys increased government support through the policies made by EPA towards the selection of biopesticides that promote commercialization and innovation.

In October 2023, the United States based bioinsecticides company Vestaron Corporation funded USD 10 million in biopesticide R&D and development plans. This type of investment can lead to the market development of biopesticide and bioinsecticide market in U.S.

Biopesticides Market Share

In March 2022, Marrone Bio Innovations Inc. and Bioceres Crop Solutions Corp announced a definitive agreement to combine the companies in an all-stock transaction. This transaction will combine Bioceres expertise in bio nutrition and seed care products with MBI's leadership in the development of biological crop protection and plant health solutions, creating a global leader in the development and commercialization of sustainable agricultural solutions.

In September 2023, Croda launched the new product Atlox BS-50, a delivery system which specifically meets the needs of the growing biopesticides market.In February 2023, one of the leading manufacturers of peptide-based bioinsecticides, Vestaron, launched Spear RC, the newest member of the Spear product line. The product is meant to help combat lepidopteran pests like the armyworm, soybean looper, and the cotton bollworm. It is designed for a variety of crops such as rice, soybean, and cotton.

In January 2022 NemaTrident and UniSpore, two next generation bioinsecticides, were purchased by Syngenta Crop Protection AG from Bionema Limited. From the new range, customers will benefit from additional and complementary technologies to manage insect pests and resistance more effectively.

Biopesticides Market Companies

Some of the eminent market participants operating in the biopesticide materials industry include:

- BASF SE

- Bayer AG

- Syngenta AG

- UPL Limited

- FMC Corporation

- Marrone Bio Innovations

- Novonesis

- Nufarm

- Isagro S.p.A

- Certis USA L.L.C.

- Koppert Biological Systems

- Biobest Group NV

- Valent BioSciences

- STK Bio-Ag Technologies

Biopesticide Industry News

- In April 2023, when a UK-based agritech company, SOLASTA Bio, received an investment of USD 4.95 million which was to be used for the development of nature-inspired pesticides and expansion of the US-UK operations.

- In May 2023, Biobest, the world leader in biological control and pollination, purchased BioWorks Inc., which is a leading biorational control and nutrition products manufacturing company located in the United States.

- In January 2024, An Indian multinational company UPL Limited introduced a novel bioinsecticide named Tackler which contains the fungus Beauveria bassiana. The new product helps the control of pests in a variety of crops.

The biopesticides market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2021 – 2034 for the following segments:

Market, By Product

- Bio herbicides

- Bio insecticides

- Bio fungicides

Market, By Form

- Dry

- Liquid

Market, By Source

- Microbial

- Biochemical

- Others

Market, By Crop

- Grain & oil seeds

- Fruit & vegetables

- Apples

- Grapes

- Potatoes

- Others

- Others

Market, By Application

- Seed treatment

- Foliar spray

- Soil spray

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What is the size of liquid form segment in the biopesticides industry?

The liquid form segment generated over USD 2.3 billion in 2024.

How much is the North America biopesticides market worth in 2024?

The North America market was worth over USD 1.3 billion in 2024.

Who are the key players in biopesticides industry?

Some of the major players in the industry include BASF SE, Bayer AG, Syngenta AG, UPL Limited, FMC Corporation, Marrone Bio Innovations, Novonesis, Nufarm, Isagro S.p.A.

How big is the biopesticides market?

The market size of biopesticides was valued at USD 3.5 billion in 2024 and is expected to reach around USD 8.7 billion by 2034, growing at 9.3% CAGR through 2034.

Biopesticides Market Scope

Related Reports