Summary

Table of Content

Battery Operated Nail Guns Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Battery Operated Nail Guns Market Size

The battery operated nail guns market was estimated at USD 509.9 million in 2024. The market is expected to grow from USD 540.1 million in 2025 to USD 924.2 million in 2034, at a CAGR of 6.2% according to latest report published by Global Market Insights Inc.

To get key market trends

- With the technological advances in battery-operated nail guns, both professionals and homeowners prefer battery-operated nailers. New batteries last longer, charge faster, and can provide a consistent runtime for all-day use. The motors inside have also greatly improved and are able to place nails accurately into many varying materials, even very dense hardwood. The nail guns themselves have reduced weight and made ergonomic improvements and continue to reduce vibration and wear and tear on users during extended operation. The development of smart electronics continues to optimize power consumption and reduce overheating, increasing the life and use of the battery. These advancements have impressed professional builders while completing their tasks quickly, at high rates of materials consumption. Construction workers have also appreciated the ease of use and portability of battery-operated nail guns. The construction industry has also adopted battery-operated nail guns; they recognize worker safety and project completion increase because of battery-operated nail guns.

- The increased demand for battery-operated nail guns continues, as evidenced by the construction industry growth. In 2023, construction spending in the United States will grow to $1.9 trillion according to the U.S. Census Bureau; it has grown consistently in residential, commercial, and industrial spending. As urban development continues to thrive and new constructions emerge, the need for portable and efficient tools has grown. Most notably, battery-powered nail guns are beneficial for the construction profession, as they do not require heavy air compressors or long electrical cords. Additionally, they are suitable for tight spaces, heights, and a lack of electricity. These tools are also particularly effective for use with new building materials and assembling modern prefabricated furniture, which now seems to be vogue in the construction process. Considering a renovation project typically means you will be moving around and working in different parts of the building, the applicability of these tools also adds to their adroitness or diversity.

- Clearly, the transition from an air compressor or corded nail guns to battery-operated nail guns is showing in the industry. The mobility of these tools is beneficial in spaces without light sources. Construction professionals or carpenters appreciate the efficiency of using these tools because there is no time wasted setting into place cords or air accessories. Even a home user finds it convenient just to plug in a charged battery and the tool is ready to use. Additionally, the elimination of cords from the worksite reduces tripping hazards. The tools themselves are becoming more powerful with a longer-lasting battery.

Battery Operated Nail Guns Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 509.9 Million |

| Market Size in 2025 | USD 540.1 Million |

| Forecast Period 2025 - 2034 CAGR | 6.2% |

| Market Size in 2034 | USD 924.2 Million |

| Key Market Trends | |

| Drivers | Impact |

| Advancements in technology | Enhanced battery life, brushless motors, and smart features are making nail guns more efficient, reliable, and user-friendly, boosting adoption across sectors. |

| Increased renovation and construction activities | Rising global infrastructure and home improvement projects are driving demand for fast, portable fastening tools like battery-operated nail guns. |

| Demand for cordless tools | Cordless nail guns offer mobility, safety, and convenience, making them ideal for both professionals and DIY users, fueling market expansion. |

| Pitfalls & Challenges | Impact |

| Elevated purchase and operational expenses | High upfront costs and maintenance of advanced models can deter budget-conscious buyers, especially in price-sensitive markets. |

| Constraints in battery life and performance | Limited runtime and power in some models restrict usage in heavy-duty applications, affecting productivity and user satisfaction. |

| Opportunities: | Impact |

| Incorporating smart technology features | Adding IoT-enabled diagnostics, auto-depth adjustment, and battery health monitoring can enhance user experience and tool longevity. |

| Designing tools for specialized tasks | Creating nail guns tailored for specific materials or industries (e.g., roofing, flooring) opens niche markets and boosts brand differentiation. |

| Market Leaders (2024) | |

| Market Leaders |

Market share of ~9% |

| Top Players |

Collective market share in 2024 is Collective market share of ~25% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America & Europe |

| Emerging Country | U.S., China, India, Saudi Arabia & Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Battery Operated Nail Guns Market Trends

The battery-powered nail gun market is going through major changes as customers want different features, technology keeps improving, and the construction and DIY industries continue to evolve. These changes are affecting how manufacturers make their products, how stores sell them, and how people use them.

- The trend is moving from traditional air-powered nail guns towards powder-actuated and battery-powered nail guns due to desire for more convenience and mobility. Construction workers and DIY users are starting to gravitate towards battery-powered nail guns since they do not have to deal with air hoses or compressors, meaning cut power and freely move around without having to be tethered to a power source. With the recent popularity surrounding battery-powered nail guns, manufacturers that previously solely developed air-powered nail tools are developing battery-powered nail guns to keep up with trends.

- As manufacturers seek to fulfil demand, there has been more investment in innovation to build nail guns that feel lighter, less tiring on the hands and more comfortable to operate. These innovations will be more advantageous to more professionals who depend on using these tools throughout each day out on the job or construction site. Some notable innovations include safety features that prevent accidental double-firing, vibration control features, and more distributed centre of weight on battery-powered nail guns. Improvements such as these will not only increase user comfort and safety but will foster loyalty for that customer, who may return to that brand in the future specifically due to their past experience with the battery-powered nail gun in hand.

- Furthermore, digital technology is playing an increasingly significant role in the evolution of the nail gun market. We are now seeing manufacturers of nail guns outfitting them with capabilities such as Bluetooth and companion smartphone applications and enabling users to track the maintenance status of their tool with notifications that include when to do maintenance and battery life. These capabilities provide users with history and statistics about their tools which will help them get the best use from the purchase while minimizing downtime. A benefit to manufacturers as this digital transition happens is the opportunity to enhance customer experience and deliver additional revenue associated with a digital ecosystem, for example, a subscription maintenance service and upgrades through an application.

Battery Operated Nail Guns Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is categorized into wood nailers, concrete nailers, specialty nailers and staplers. The wood nailers accounted for revenue of around USD 328.2 million in 2024 and is anticipated to grow at a CAGR of 6.4% from 2025 to 2034.

- These tools are essential for framing, cabinetry, flooring, and general carpentry, making them highly versatile and in demand across both professional and consumer segments. The shift toward cordless solutions has further amplified their appeal, as battery-powered wood nailers offer enhanced mobility, reduced setup time, and safer operation without the need for compressors or hoses. Technological advancements particularly in lithium-ion batteries and brushless motors have significantly improved speed, power efficiency, and tool durability, making wood nailers more reliable and productive.

- Additionally, the rise of e-commerce and retail availability has made these tools more accessible to hobbyists and contractors alike. As urbanization and renovation trends continue to grow, especially in emerging markets, wood nailers are expected to maintain strong momentum, supported by their practicality, ergonomic design, and evolving smart features.

Learn more about the key segments shaping this market

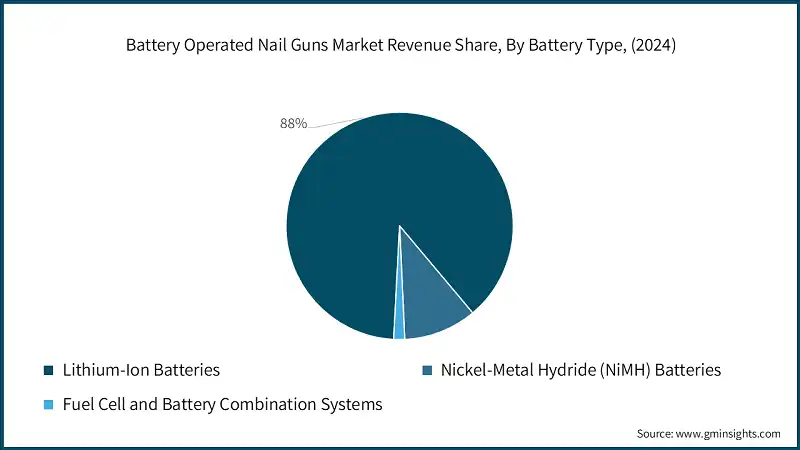

Based on battery type, battery operated nail guns market consists of lithium-ion batteries, nickel-metal hydride (NIMH) batteries and fuel cell and battery combination systems. The lithium-ion batteries emerged as leader and held 88% of the total market share in 2024 and is anticipated to grow at a CAGR of 6.3% from 2025 to 2034.

- Lithium-ion batteries offer a high energy density, which translates into longer runtime and more powerful performance for nail guns critical features for professionals in construction, woodworking, and renovation sectors. Their lightweight design enhances tool ergonomics, reducing user fatigue during extended use.

- Additionally, lithium-ion batteries have a low self-discharge rate and no memory effect, allowing for consistent performance and efficient recharging cycles. These characteristics make them ideal for cordless tools, which are increasingly preferred over pneumatic or fuel-powered alternatives due to their portability, ease of use, and reduced maintenance. The broader market trend toward cordless power tools, driven by the DIY movement and professional demand for mobility and efficiency, further amplifies the adoption of lithium-ion technology.

The price of battery operated nail guns market consists of low, medium & high. The medium priced emerged as leader and held 55% of the total market share in 2024 and is anticipated to grow at a CAGR of 6.3% from 2025 to 2034.

- The medium-priced segment in the battery-operated nail guns market is experiencing strong growth due to its optimal balance between affordability, performance, and advanced features. These tools are increasingly favored by both professional contractors and serious DIY users who seek reliable functionality without the premium cost of high-end models. Medium-priced nail guns often incorporate key innovations such as lithium-ion batteries, brushless motors, and ergonomic designs, which enhance tool efficiency, runtime, and user comfort. This segment benefits from the rising demand for cordless tools that offer mobility and ease of use, especially in construction, woodworking, and home improvement applications.

- Additionally, the surge in residential renovation projects and mid-scale commercial developments has created a robust market for tools that deliver professional-grade results at a manageable cost. The growth of online retail channels has also made medium-priced nail guns more accessible, allowing users to compare features and prices easily.

Looking for region specific data?

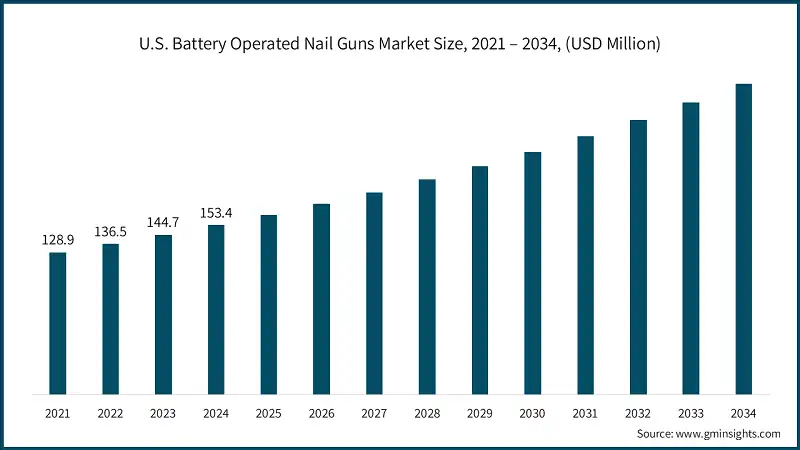

The U.S. dominates an overall North America battery operated nail guns market and valued at USD 153.4 million in 2024 and is estimated to grow at a CAGR of 6.3% from 2025 to 2034.

- The surge in residential and commercial construction projects, fueled by urban expansion, infrastructure upgrades, and a growing trend in home renovations. In 2023 alone, residential building permits in the U.S. rose by 2.6%, reflecting increased demand for efficient construction tools like battery-operated nail guns. These tools offer significant advantages over traditional pneumatic models, including portability, reduced setup time, and enhanced safety features that are particularly valued in fast-paced job sites and DIY environments.

- Moreover, the U.S. market benefits from rapid advancements in battery technology, especially lithium-ion batteries, which provide longer runtimes, faster charging, and lighter weight. This has made cordless nail guns more appealing to both professionals and hobbyists. The integration of brushless motors and smart features like depth adjustment and jam-clearing mechanisms further enhances tool performance and reliability.

In the European battery operated nail guns market, Germany held 20.6% share in 2024 and is anticipated to grow at a CAGR of 6.4% from 2025 to 2034.

- This growth is underpinned by the country's robust construction and manufacturing sectors, which consistently demand efficient, high-performance tools. Battery-operated nail guns are increasingly favored due to their cordless convenience, reduced setup time, and enhanced safety qualities that align well with Germany’s emphasis on precision engineering and productivity.

- Moreover, Germany’s strong DIY culture and rising home renovation trends contribute to the popularity of mid-range and premium cordless nail guns among consumers. The market is also benefiting from indirect sales channels, which dominate distribution and make these tools more accessible to both professionals and hobbyists. Technological advancements, particularly in lithium-ion battery efficiency and brushless motor integration, are further enhancing tool performance and reliability, making them suitable for a wide range of applications from residential carpentry to industrial framing.

The Asia Pacific battery operated nail guns market, the China held 35% revenue share in 2024 and is anticipated to grow at a CAGR of 8.3% from 2025 to 2034.

- The country’s aggressive urbanization and government-backed housing initiatives have created a strong demand for efficient, time-saving tools like battery-operated nail guns, which are increasingly preferred over traditional pneumatic models due to their portability, ease of use, and reduced setup requirements.

- China also benefits from being a global manufacturing hub, enabling domestic producers to innovate rapidly and offer competitively priced products with advanced features such as lithium-ion batteries, brushless motors, and ergonomic designs. These innovations cater to both professional contractors and the growing DIY segment, which is gaining traction due to rising disposable incomes and increased interest in home improvement.

In the Middle East and Africa battery operated nail guns market, South Africa is expected to experience significant and promising growth from 2025 to 2034.

- The country’s construction and renovation sectors are experiencing steady growth, fueled by urban development, infrastructure upgrades, and government-backed housing initiatives. These trends are creating a strong need for efficient, portable, and user-friendly tools qualities that battery-operated nail guns deliver, especially in environments where access to compressed air systems is limited.

- Moreover, South Africa’s broader battery technology market is undergoing rapid transformation, with advancements in lithium-ion and solid-state batteries enhancing the performance, runtime, and safety of cordless tools. The increasing popularity of electric vehicles and portable electronics is driving innovation and investment in battery manufacturing and energy storage systems, which indirectly supports the growth of battery-powered tools like nail guns.

Battery Operated Nail Guns Market Share

- In 2024, the prominent manufacturers in battery operated nail guns industry are Makita, Robert Bosch Tool Corporation, Hilti, Senco and Metabo collectively held the market share of ~25%.

- Makita maintains its competitive edge through continuous innovation in battery technology and tool ergonomics. It invests heavily in developing high-capacity lithium-ion batteries and brushless motors that extend runtime and reduce maintenance. Makita also focuses on expanding its 18V and 40V cordless platforms, offering compatibility across a wide range of tools, which enhances user convenience and loyalty.

- Bosch leverages its engineering excellence and sustainability focus to stay ahead. It integrates smart technologies like IoT-enabled diagnostics and multi-brand battery alliances (e.g., AmpShare and Power for All) to enhance tool versatility. Bosch also invests in eco-friendly packaging and materials, aligning with global sustainability goals while delivering high-performance cordless nail guns.

Battery Operated Nail Guns Market Companies

Major players operating in the battery operated nail guns industry include:

- Adolf Würth

- Bostitch

- Freeman

- Hilti Corporation

- Hitachi

- Makita

- Max Corporation

- Metabo

- Milwaukee

- Paslode

- Ridgid

- Robert Bosch

- Ryobi

- Senco

- Stanley Black & Decker

Hilti differentiates itself through premium-grade tools designed for industrial and commercial use. It emphasizes durability, precision, and safety, integrating advanced battery systems and smart features like depth control and jam-clearing mechanisms. Hilti also offers strong after-sales service and fleet management solutions, making it a preferred brand for large-scale contractors

Senco focuses on optimizing battery performance and tool reliability for framing and finishing applications. It is innovated by designing lightweight, maneuverable cordless nailers with enhanced safety features. Senco also emphasizes U.S.-based manufacturing and quality control, which appeals to professionals seeking dependable tools for demanding job sites

Battery Operated Nail Guns Industry News

- In February 2025, HiKOKI Power Tools launched a new series of cordless nailers, powered by the advanced MultiVolt 36V/18V dual-battery system. These tools deliver pneumatic-grade performance in a compact, hose-free design, catering to diverse professional needs. The lineup includes four key models: a framing nailer (offering 3,500 in./lbs torque and compatibility with 8d–12d nails), a brad nailer (optimized for 23ga micro-nails, ideal for trim applications), a finish nailer (16ga with adjustable depth control), and a versatile stapler designed for both roofing and upholstery tasks.

- In February 2025, KYOCERA SENCO introduced two state-of-the-art metal connector nailers, engineered to address the rigorous demands of modern construction. These specialized tools are designed to drive nails consistently and effectively into challenging materials, including dense engineered lumber, pressure-treated wood, and metal connector plates, ensuring reliable performance in tough structural applications.

- In May 2025, Makita U.S.A., Inc., a leading manufacturer of professional tools, power equipment, and accessories, announced the release of two new Framing Nailers for its LXT platform. Built for professional users, these nailers deliver exceptional power, dual firing modes, and adjustable nail depth settings, offering enhanced versatility and precision for framing tasks.

- In April 2024, Metabo HPT introduced the NT1850DG Brad Nailer, an 18V MultiVolt 18-Gauge Compact Cordless Brad Nailer. This innovative tool provides users with the flexibility to work without the limitations of hoses or compressors, making it a practical solution for various job sites.

The battery operated nail guns market research report includes in-depth coverage of the industry, with estimates & forecast in terms of revenue (USD Million) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Wood nailers

- Framing nailers

- 21-degree framing nailers

- 30-degree framing nailers

- Full round head framing nailers

- Clipped head framing nailers

- Finish nailers

- 15-gauge finish nailers

- 16-gauge finish nailers

- Brad nailers

- 18-gauge brad nailers

- Cordless brad nailer accessories

- Pin nailers

- 23-gauge pin nailers

- Micro pin nailers

- Framing nailers

- Concrete nailers

- Powder-actuated concrete nailers

- Gas-powered concrete nailers

- Battery-powered concrete nailers

- Specialty nailers

- Roofing nailers

- Flooring nailers

- Siding nailers

- Duplex nailers

- Palm nailers

- Fence nailers

- Staplers

- Heavy-duty staplers

- Fine wire staplers

- Crown staplers

- Narrow crown staplers

- Wide crown staplers

Market, By Battery Type

- Lithium-ion batteries

- 18V li-ion systems

- 20V li-ion systems

- Multi-volt li-ion systems

- Nickel-metal hydride (NIMH) batteries

- Fuel cell and battery combination systems

Market, By Battery Capacity

- Low capacity (1.5-3.0 Ah)

- Medium capacity (3.0-5.0 Ah)

- High capacity (5.0+ Ah)

Market, By Price

- Low

- Medium

- High

Market By Application

- Residential construction

- New home construction

- Home renovation and remodeling

- DIY home projects

- Commercial construction

- Office buildings

- Retail spaces

- Hospitality projects

- Others

- Industrial construction

- Manufacturing facilities

- Warehouses and distribution centres

- Infrastructure projects

- Specialty application

- Marine construction

- Automotive assembly

- Furniture manufacturing

Market, By End Use

- Professional contractors

- General contractors

- Specialty contractors

- Framing contractors

- Finish carpenters

- DIY enthusiasts

- Homeowners

- Hobbyist woodworkers

- Small project contractors

- Industrial users

- Manufacturing companies

- Maintenance teams

- Assembly line workers

Market, By Distribution Channel

- Offline distribution

- Home improvement centres

- Specialty tool stores

- Hardware stores

- Industrial distributors

- Online distribution

- E-commerce platforms

- Manufacturer direct sales

- B2B online portals

- Hybrid distribution models

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the battery operated nail guns market?

Key players include Adolf Würth, Bostitch, Freeman, Hilti Corporation, Hitachi, Makita, Max Corporation, Metabo, Milwaukee, Paslode, Ridgid, Robert Bosch, Ryobi, Senco, and Stanley Black & Decker.

What are the upcoming trends in the battery operated nail guns market?

Key trends include shift from pneumatic to battery-powered tools, integration of smart features like Bluetooth connectivity and smartphone apps, enhanced ergonomic designs with safety features, and AI-enabled diagnostics with precision control capabilities.

Which region leads the battery operated nail guns market?

Asia Pacific is the largest market, with China holding 35% revenue share in 2024 and anticipated to grow at 8.3% CAGR through 2034, supported by aggressive urbanization and government-backed housing initiatives.

What is the growth outlook for medium-priced segment from 2025 to 2034?

Medium-priced segment held 55% market share in 2024 and is projected to grow at 6.3% CAGR through 2034, due to optimal balance between affordability, performance, and advanced features appealing to professionals and DIY users.

What was the valuation of lithium-ion batteries segment in 2024?

Lithium-ion batteries held 88% market share in 2024, due to high energy density, lightweight design, and superior performance characteristics.

What is the current battery operated nail guns market size in 2025?

The market size is projected to reach USD 540.1 million in 2025.

How much revenue did the wood nailers segment generate in 2024?

Wood nailers generated USD 328.2 million in 2024, led by their versatility in framing, cabinetry, flooring, and general carpentry applications.

What is the projected value of the battery operated nail guns market by 2034?

The battery operated nail guns market is expected to reach USD 924.2 million by 2034, propelled by advancements in battery technology, increased renovation and construction activities, and growing demand for cordless tools.

What is the market size of the battery operated nail guns in 2024?

The market size was USD 509.9 million in 2024, with a CAGR of 6.2% expected through 2034 driven by technological advancements that make battery-operated nailers increasingly preferred by both professionals and homeowners.

Battery Operated Nail Guns Market Scope

Related Reports