Summary

Table of Content

Automotive High Voltage Electric Capacitor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive High Voltage Electric Capacitor Market Size

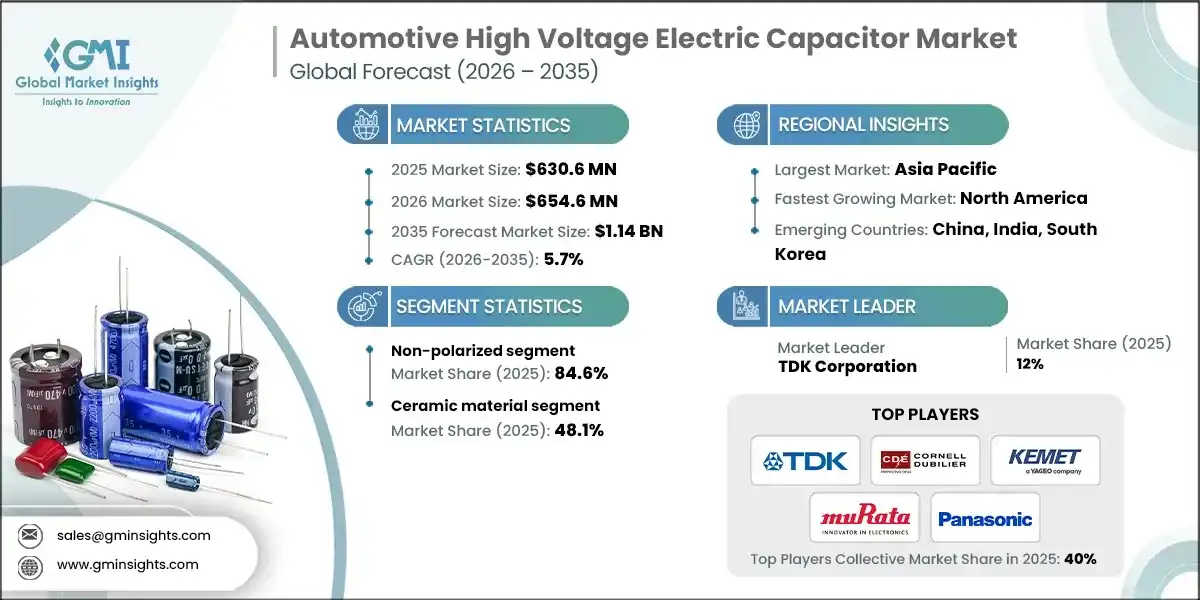

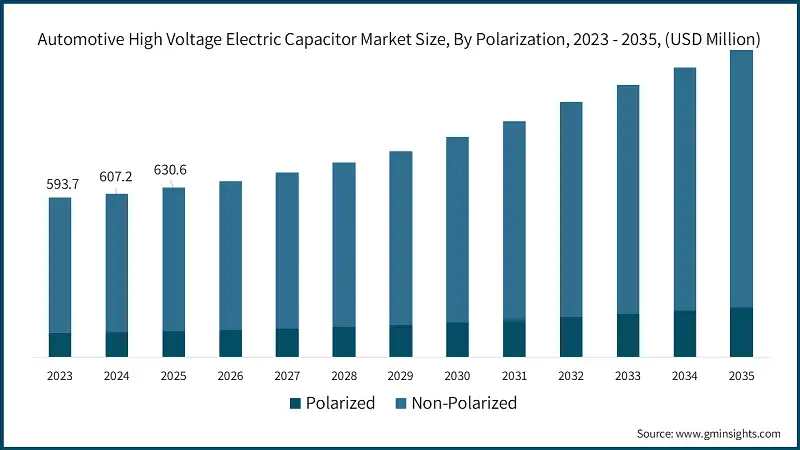

According to a recent study by Global Market Insights Inc., the automotive high voltage electric capacitor market was estimated at USD 630.6 million in 2025. The market is expected to grow from USD 654.6 million in 2026 to USD 1.14 billion in 2035, at a CAGR of 5.7%.

To get key market trends

- Increasing migration to 800-volt vehicle architectures is accelerating demand for high-voltage DC-link capacitors, in turn is complementing the industry dynamics. Automobile manufacturers are moving traction systems from ~400 V to 800 V to reduce current for a given power, cut cable mass, and enable faster charging.

- This migration increases the electrical stress on inverters and onboard chargers, which raises the importance of DC-link capacitors with low ESR/ESL, high ripple current capability, and robust thermal endurance. Higher battery voltages also widen switching frequency windows in SiC-based inverters, pushing capacitor designs toward tighter inductance control and better self-healing film technology.

- As more platforms adopt dual?motor AWD and bidirectional power features, DC-link capacitors will become central to power quality, EMI suppression, and regenerative braking stability. For instance, Hyundai stated, its E-GMP EV platform offers 800 V rapid charging capability, 10-80% in around 18 minutes and multi-charging without adapters, underscoring OEM momentum toward high-voltage systems.

- The rapid expansion of public DC fast charging is lifting peak power targets for passenger and commercial EVs. As sites standardize on higher-voltage, higher-current hardware, vehicle power electronics must handle sharper transients and larger ripple energy.

- This trend puts DC-link capacitors under heavier thermal and electrical loads and favors designs with proven endurance under humidity and temperature bias. It also tightens qualification to automotive standards and accelerates demand for compact, high-current modules that maintain low impedance at fast switching speeds.

- For instance, in January 2025, the U.S. Department of Transportation announced USD 635 million in charging & fueling infrastructure grants adding 11,500+ ports and advancing corridor/community fast charging, directly raising system power expectations for vehicles interfacing with these stations.

- Regulatory frameworks continue to tighten around HV safety, thermal propagation, isolation, and overcurrent resilience. For DC-link capacitors in battery and inverter assemblies, this means validated protection against electric shock, post-crash isolation, and durable performance under vibration, thermal shock, and water exposure.

- Revisions to electric power-train and REESS rules translate into explicit compliance activities for components integrated into HV buses, raising the importance of auditable test records and traceable design controls. For instance, in July 2024, the EU published UN Regulation No. 100 (2024/1955 in the Official Journal), detailing electrical safety and REESS requirements, including isolation resistance and water exposure verification, which OEMs and suppliers must satisfy for type approval.

Automotive High Voltage Electric Capacitor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 630.6 Million |

| Market Size in 2026 | USD 654.6 Million |

| Forecast Period 2026-2035 CAGR | 5.7% |

| Market Size in 2035 | USD 1.14 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising growth across automotive electronics | Increasing electronic content per vehicle, driven by powertrain electrification, ADAS, and infotainment, continues to boost demand for high-reliability automotive components. |

| Expanding autonomous driving technologies & EV adoption | Accelerating investments in electric and autonomous vehicles are driving the need for advanced power electronics and high-voltage components to support higher power density and system reliability. |

| Pitfalls & Challenges | Impact |

| Supply chain disruptions | Volatility in raw material availability, geopolitical tensions, and semiconductor supply constraints pose challenges to production continuity, pricing stability, and lead-time reliability. |

| Opportunities: | Impact |

| Shift toward 800‑V and next‑generation EV architectures | The transition from 400‑V to 800‑V battery platforms is creating strong demand for high‑voltage, high‑reliability capacitors with superior thermal and ripple‑current performance in traction inverters and onboard chargers. |

| Growing integration of wide‑bandgap semiconductors (SiC/GaN) | Increasing adoption of SiC and GaN power devices is opening opportunities for advanced capacitors designed for high‑frequency operation, ultra‑low ESR, and compact form factors in EV power electronics. |

| Market Leaders (2025) | |

| Market Leaders |

12% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | China, India, South Korea |

| Future Outlook |

|

What are the growth opportunities in this market?

Automotive High Voltage Electric Capacitor Market Trends

- Rising speeds procurement and platform reuse owing to formalization of DC-link capacitor qualification standards is increasingly aiding to the market growth. Standardized qualification frameworks for customized automotive DC-link film capacitors reduce ambiguity in supplier selection, shorten test cycles, and enable wider reuse across platforms.

- Clear requirements and test conditions, covering service life, environmental exposure, and electrical endurance, facilitate OEMs and Tier-1s harmonize validation plans, improve comparability, and de-risk sourcing. This codification benefits HV applications in traction inverters and 48 V intermediate circuits by aligning expectations between purchasing, engineering, and quality teams.

- For instance, in February 2024, IEC TS 63337:2024 defined basic qualification for automotive DC-link film capacitors, specifying general requirements, test conditions, and endurance tests tailored to HV and 48 V intermediate circuits in vehicles.

- Wide-bandgap (SiC/GaN) adoption in traction inverters is driving the demand for low-inductance, high-current capacitors across the automotive industry. Modular film capacitor designs that scale in parallel help engineers tailor capacitance and current to platform targets while maintaining compact footprints and thermal performance.

- As SiC and GaN devices replace IGBTs in traction inverters, switching edges become steeper and frequencies higher, increasing dv/dt stress and ripple currents. DC-link capacitors must combine low ESL/ESR, high RMS current capability, and strong self-healing to stabilize the DC bus and suppress voltage spikes.

- For instance, in October 2024, TDK introduced xEVCap, a modular DC-link capacitor family rated up to 920 V, designed for traction inverters and explicitly compatible with SiC/GaN power semiconductors, with low ESR/ESL and AEC-Q200/IEC TS 63337 compliance.

- OEM push toward ultra-fast charging ecosystems is raising HV transient management needs in vehicles, which in turn is augmenting the product deployment. Automakers are designing platforms that can accept ultra-fast charging, beyond 400 kW, and in some cases planning for megawatt-class interfaces for future products.

- This elevates surge handling, ripple absorption, and bus stability challenges inside the vehicle. DC-link capacitors become critical buffers for brief high-power intervals, aiding both fast charge acceptance and thermal management strategies in power converters.

- For instance, in March 2025, BYD unveiled its Super e-Platform with redesigned blade batteries and SiC power chips and presented 1,000 kW (1 MW) supercharging plans alongside 1,000 V capability, illustrating rising peak system stresses that cascade to HV passives.

- Breakthroughs in battery fast-charging (higher C-rates) amplify ripple and thermal stress on DC-link stages. DC link capacitors will dissipate higher ripple power while maintaining low losses and reliable capacitance under DC bias and elevated temperatures.

- The shift to LFP chemistries with improved energy density further broadens the vehicle set adopting fast charging, increasing the volume of platforms requiring robust HV capacitors. For instance, in April 2024, CATL announced Shenxing PLUS, an LFP battery claiming 4C ultra-fast charging and up to 1,000 km range, with 600 km added in 10 minutes, highlighting step-change charging dynamics that drive tougher DC-link requirements.

Automotive High Voltage Electric Capacitor Market Analysis Major players operating in the automotive high voltage electric capacitor industry are: Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Learn more about the key segments shaping this market

Learn more about the key segments shaping this market Looking for region specific data?

Looking for region specific data?Automotive High Voltage Electric Capacitor Market Share

Automotive High Voltage Electric Capacitor Market Companies

Automotive High Voltage Electric Capacitor Industry News

This automotive high voltage electric capacitor market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) and volume (‘000 Units) from 2022 to 2035, for the following segments:

Market, By Polarization

- Polarized

- Non-polarized

Market, By Material

- Film capacitor

- Ceramic capacitor

- Electrolytic capacitor

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- France

- Germany

- Italy

- Austria

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Latin America

- Brazil

- Argentina

- Chile

Frequently Asked Question(FAQ) :

Who are the key players in the automotive high voltage electric capacitor market?

Key players include TDK Corporation, Cornell Dubilier, KEMET, Murata, Panasonic, Aloe Capacitors, Austin Electrical Enclosures & Capacitors, United Chemi-Con, Elna, Havells, Kyocera AVX, Lelon Electronics, Nichicon Corporation, RUBYCON Corporation, Samsung Electro-Mechanics, Schneider Electric, Siemens, Taiyo Yuden, Vishay Intertechnology, and Yageo Group.

What are the upcoming trends in the automotive high voltage electric capacitor market?

Key trends include adoption of 800-1300V architectures, integration of SiC/GaN power semiconductors, modular DC-link capacitor designs, ultra-fast charging compatibility, hybrid capacitor stacks, and embedded digital monitoring capabilities.

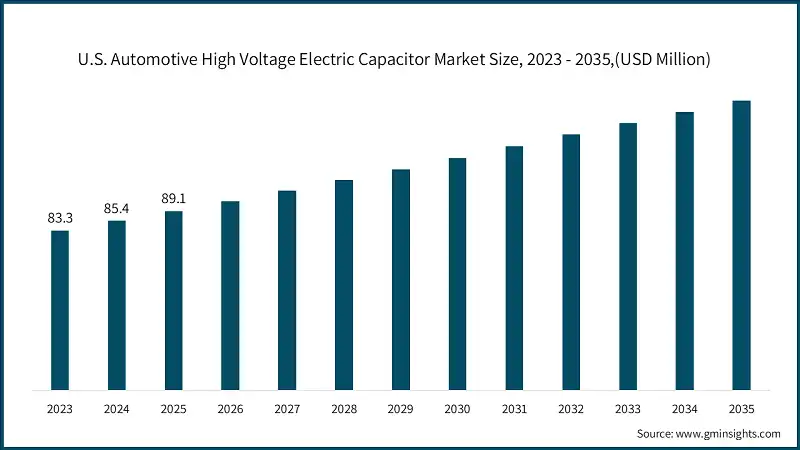

Which region leads the automotive high voltage electric capacitor market?

Asia Pacific is the largest market and is expected to reach USD 475 million by 2035, while North America is the fastest-growing market, driven by high-power charging corridor expansion.

What is the growth outlook for the polarized segment from 2026 to 2035?

The polarized segment will grow at a CAGR of 6.4% by 2035, seeing renewed relevance as bulk energy reservoirs on DC buses in EV traction systems and onboard chargers.

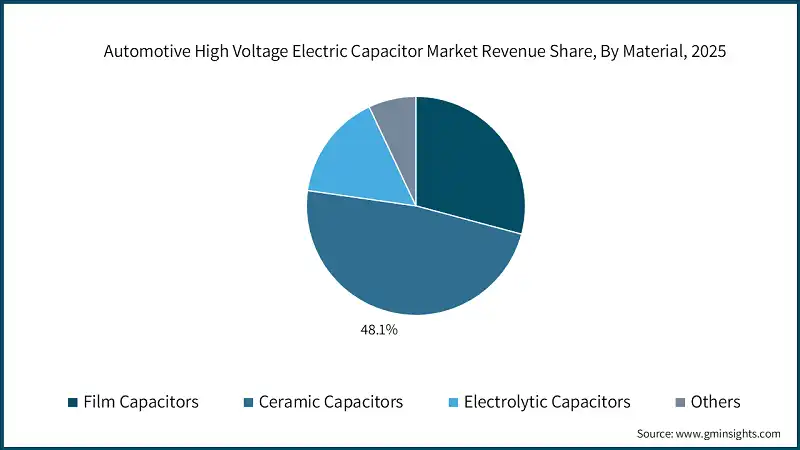

What was the market share of ceramic material segment in 2025?

The ceramic material segment held 48.1% market share in 2025 and will grow at a CAGR of 5.8% by 2035, advancing in EV HV power electronics requiring compact footprints and stable high-frequency performance.

What is the market size of the automotive high voltage electric capacitor in 2025?

The market size was USD 630.6 million in 2025, with a CAGR of 5.7% expected through 2035 driven by expanding autonomous driving technologies, EV adoption, and migration to 800-volt vehicle architectures.

What is the current automotive high voltage electric capacitor market size in 2026?

The market size is projected to reach USD 654.6 million in 2026.

How much market share did the non-polarized segment hold in 2025?

The non-polarized segment held 84.6% market share in 2025 and is projected to grow at a CAGR of 5.6% through 2035, driven by high-frequency decoupling requirements in EV traction inverters.

What is the projected value of the automotive high voltage electric capacitor market by 2035?

The automotive high voltage electric industry market is expected to reach USD 1.14 billion by 2035, propelled by shift toward 800-V platforms, wide-bandgap semiconductor integration, and ultra-fast charging infrastructure expansion.

Automotive High Voltage Electric Capacitor Market Scope

Related Reports