Summary

Table of Content

Automotive Electric Vacuum Pump Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive Electric Vacuum Pump Market Size

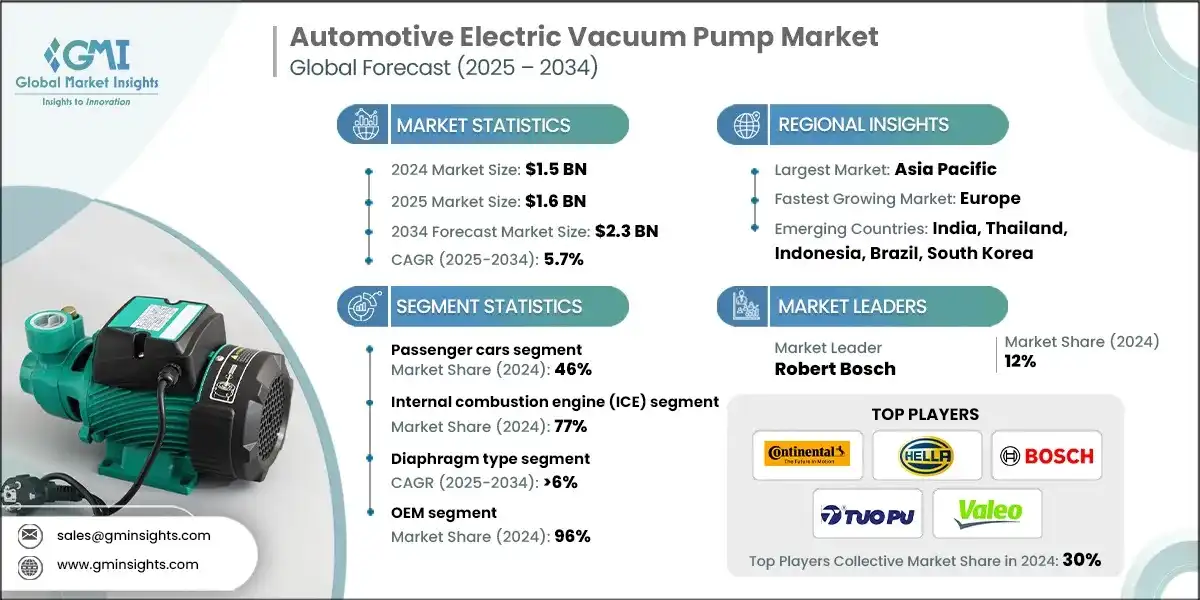

The global automotive electric vacuum pump market size was estimated at USD 1.5 billion in 2024. The market is expected to grow from USD 1.6 billion in 2025 to USD 2.3 billion in 2034, at a CAGR of 5.7%, according to latest report published by Global Market Insights Inc.

To get key market trends

- The automotive electric vacuum pump (EVP) market is integral to vehicle efficiency, emissions control, and electrification. Automakers are adopting EVPs to meet stringent emission standards and support hybrid and electric powertrains by ensuring a stable vacuum supply for critical systems.

- Rising environmental concerns and government mandates to reduce CO2 emissions are driving the adoption of Electric Vehicle Powertrains (EVPs). Consumers demand safer, energy-efficient vehicles, prompting OEMs to integrate EVPs to meet performance, regulatory, and sustainability goals globally.

- The global automotive electric vacuum pump market was valued at USD 1.1 billion in 2022 and is projected to exceed USD 2.1 billion by 2032, driven by stricter emissions regulations and growing demand for vehicle safety and efficiency.

- Post-pandemic, energy-efficient and low-emission mobility solutions have gained traction. By 2025, car manufacturers aim to introduce EVPs compatible with brake systems, regenerative braking, and ECUs to enhance safety and performance.

- Technology and innovation are transforming the EVP environment. Bosch, Continental AG, Denso Corporation, Pierburg, and Valeo are driving advancements in motor technologies, lightweight pump designs, and system integrations to enhance efficiency and performance.

- For instance, in March 2024, Denso Corporation collaborated with a leading European OEM to develop advanced EVPs. The focus was on intelligent motor control, adaptive vacuum control, and integrated electronic brake systems for improved safety and energy efficiency.

- Asia-Pacific leads the automotive EVP market due to rising vehicle production, electrification focus, and strict emissions regulations, with countries like China, India, and Japan adopting EVPs in hybrid and compact cars. In 2025, Bosch launched a modular EVP in India, featuring adaptive vacuum control, smart diagnostics, and integration with electronic brake and energy management systems.

- Europe is the fastest-growing market, driven by strict EU emission regulations, rising adoption of hybrid and electric vehicles, and a strong OEM network. In April 2025, Pierburg launched an electric vacuum pump in Germany to reduce CO2 emissions and enhance hybrid and brake systems.

Automotive Electric Vacuum Pump Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.5 Billion |

| Market Size in 2025 | USD 1.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 5.7% |

| Market Size in 2034 | USD 2.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Stringent emission and fuel economy regulations | OEMs are mandated to use electric vacuum pumps to ensure reliable breaking and lower emissions in hybrid and electric vehicles. |

| Rising adoption of hybrid and electric vehicles | Rising production of HEVs, PHEVs, and EVs is driving demand for EVPs to ensure consistent vacuum regardless of engine load. |

| Technological advancements in electric motors and sensors | High-efficiency motors, adaptive vacuum control, and intelligent diagnostics enhance system reliability and performance. |

| Consumer demand for enhanced safety and efficiency | End-users prefer vehicles with efficient brake systems and energy-saving technologies, driving EVP adoption. |

| Government incentives for electrification and green mobility | Subsidies, tax incentives, and emission reduction policies push OEMs to adopt EVPs as standard in new vehicle designs. |

| Pitfalls & Challenges | Impact |

| Reliability under extreme conditions | EVPs must deliver consistent vacuum performance to ensure braking efficiency and safety under varying conditions. |

| Integration complexity with vehicle systems | Integrating brake-by-wire systems with hybrid and EV powertrains is challenging, prolonging development timelines. |

| Opportunities: | Impact |

| Integration with hybrid and electric powertrains | EVPs ensure vacuum for breaking and efficiency in hybrid and electric vehicles. |

| Advancements in electric motor and pump technology | Enhanced motors, lightweight designs, and adaptive vacuum control drive EVP adoption. |

| Integration with advanced braking and safety systems | Break-by-wire, regenerative braking, and connected platforms enhance EV safety and efficiency. |

| Growing focus on regulatory compliance and emission reduction | Stringent emission norms and fuel mandates drive EVP adoption in vehicle designs. |

| Market Leaders (2024) | |

| Market Leaders |

12% Market Share |

| Top Players |

Collective market share in 2024 is Collective Market Share is 30% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Emerging Country | India, Thailand, Indonesia, Brazil, South Korea |

| Future Outlook |

|

What are the growth opportunities in this market?

Automotive Electric Vacuum Pump Market Trends

- In 2024, Bosch, Continental, and others integrated smart motor control and adaptive vacuum systems into EVPs, enhancing energy efficiency, braking stability, and performance.

- Fleet operators and OEMs are adopting EVPs with connected diagnostics, predictive maintenance, and remote monitoring, aiming to reduce downtimes and extend component lifespan by the late 2020s.

- As emission regulations tighten and sustainable mobility gains focus, EVPs are pivotal. Manufacturers adopt lightweight materials, while governments support energy safety technologies.

- Next-generation EVPs now feature predictive vacuum control, real-time monitoring, and advanced braking integration, with OEM-technology vendor alliances enhancing efficiency and reducing maintenance costs.

- EVPs are now tailored for hybrid, mild-hybrid, and fully electric vehicles, offering advisory warnings and improving braking and energy efficiency through vehicle control systems.

- Automakers and fleet operators are prioritizing energy-efficient pumps with reduced system wear and electrified powertrains. Sustainable and recyclable EVP designs are gaining traction as green mobility advances.

- Advancements in materials and manufacturing enable EVPs to perform reliably under high temperatures and loads across various vehicle segments, while allowing OEMs to design lighter, compact pumps.

- Collaboration among tech startups, component vendors, and car manufacturers is driving rapid EVP system innovations, with AI diagnostics and IoT connectivity emerging as key differentiators in electrified mobility.

Automotive Electric Vacuum Pump Market Analysis

Learn more about the key segments shaping this market

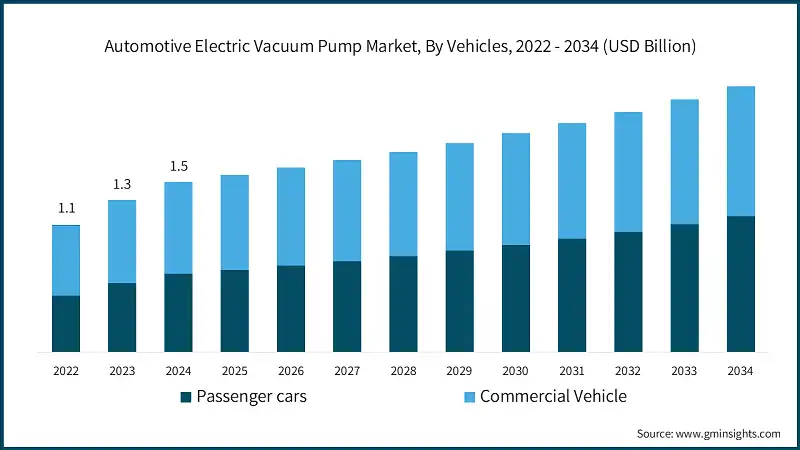

Based on vehicles, automotive electric vacuum pump market is divided into passenger cars and commercial vehicles. Passenger cars segment dominated the market, accounting for around 46% in 2024 and is expected to grow at a CAGR of over 7% from 2025 to 2034.

- In 2024, passenger cars lead the global EVP market due to their extensive use in compact cars, hatchbacks, and SUVs. EVPs enhance safety, ensure uniform vacuum distribution, and reduce reliance on engine vacuum.

- Europe, US, and Asia-Pacific regulatory mandates are pushing car manufacturers to harmonize EVPs among passenger car models. What makes the systems interesting to OEMs is the fact that they are cost-effective, easy to integrate, and compatible with conventional, hybrid, and electric vehicle architectures.

- For instance, in April 2025, Bosch introduced its next-generation EVP for passenger cars in Germany, featuring adaptive vacuum control, improved motor durability, and integration with connected vehicle platforms, aligning with the industry's shift to low-energy mobility solutions.

- Commercial trucks are advancing in delivery, logistics, and urban transport, prioritizing fuel efficiency and reduced pollution. Electric Vacuum Pumps (EVPs) enhance braking performance, supporting ESG goals and economic efficiency.

- EVPs are also finding their way into light-duty trucks and vans and hybrid commercial vehicles, with a forecasted CAGR of around 5% from 2025 to 2034. The use of advanced functions including predictive vacuum control, diagnostics, and commercial fleet integration is influencing adoption in commercial vehicle applications.

Learn more about the key segments shaping this market

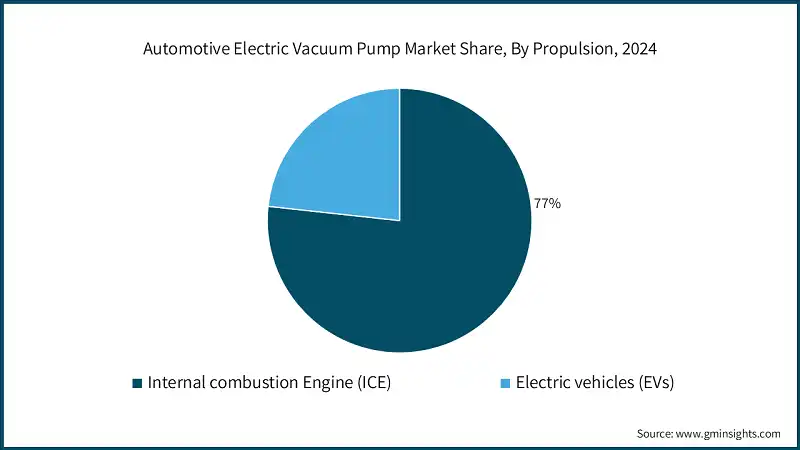

Based on propulsion, automotive electric vacuum pump market is segmented into internal combustion engine (ICE) and electric vehicles (EVs). The internal combustion engine (ICE) segment dominates the market with 77% share in 2024, and the segment is expected to grow at a CAGR of 4.5% from 2025 to 2034.

- In 2024, the ICE segment commands the largest share of the EVP market. As emission standards tighten and fuel efficiency regulations intensify, ICE vehicles are increasingly integrating EVPs. These systems ensure a consistent vacuum for brake boosters and other auxiliary components, reducing reliance on the engine vacuum.

- OEMs are adopting EVPs in ICE cars due to their affordability and ease of implementation. These systems, compatible with both conventional and mild-hybrid engines, enhance braking performance during engine start-stop cycles, in urban congestion, and heavy traffic scenarios.

- For instance, in March 2025, Continental AG unveiled a high-performance EVP for passenger ICEs in Europe, featuring adaptive vacuum control that boosts power efficiency and enhances safety via regenerative braking.

- The global shift to electrification, stricter emission norms, and rising EV adoption are driving rapid growth in the EV segment. Electric Vacuum Pumps (EVPs) are essential in electric powertrains to maintain brake system functionality and auxiliary operations.

- Automakers are also developing EVPs within EV platforms to improve the performance and maintenance of vehicles by including predictive vacuum systems, low power consumption motors and integration with vehicle telematics.

- For instance, In February 2025, Bosch added an intelligent EVP on EVs in Asia-Pacific, which relies on energy-efficient motors, real-time diagnostics and connected car integration to enable the vehicles to decelerate less and enhance the stability of operation.

- The global rise in EV adoption is driving faster growth of electric vehicle pumps (EVPs) in EVs compared to ICE vehicles. Driven by advancements in design and ADAS integration, with China, India, and Europe leading due to incentives and regulations.

Based on type, the market is segmented into swing piston, diaphragm and leaf. The diaphragm segment is expected to dominate the market due to its high reliability, consistent vacuum generation, compact design, and compatibility with conventional internal combustion engines as well as hybrid and mild-hybrid platforms.

- In 2024, The diaphragm type segment is expected to take over the EVP market with a CAGR of over 6% from 2025 to 2034, due to its reliability, compact design, low noise, operation, and vacuum supply consistency. These pumps can be used across a large range of conventional internal combustion platforms and hybrid and mild-hybrid platforms.

- OEMs prefer diaphragm EVPs due to their capability to ensure safety and performance in all conditions by maintaining constant brake booster vacuum levels in engine start-stop conditions, urban stop-and-go traffic, and changing load levels.

- For instance, in April 2025, Denso Corporation launched a diaphragm-type EVP in Asia-Pacific, featuring adaptive vacuum control for hybrid and ICE engines to improve braking and fuel efficiency.

- Swing piston EVPs are also being used in high vacuum flow rate and heavy-duty high-vacuum operations. These types of pumps are found in commercial vehicles and larger passenger vehicles where the sustained braking performance is important.

- OEMs are also incorporating swing piston pumps in combination with energy efficient motors and control algorithms to improve reliability and reduce noise as well as to offer better overall vehicle energy management.

- The niche applications that demand relatively small design and reduced vacuum capacity are generally designed with leaf type EVPs. They are not as common as diaphragm or swing piston versions but are used in special purpose passenger car and two-wheeler applications.

- To increase their penetration into a cost and size-sensitive vehicle market, manufacturers are working on better leaf type pump efficiency, durability and compatibility with hybrid and electric platform vehicles.

Based on sales channel, the automotive electric vacuum pump market is divided into OEM and aftermarket. OEM segment dominated the market accounting around 96% in 2024 and is expected to grow at a CAGR of 5.7% from 2025 to 2034.

- Stringent emissions and safety regulations in Europe, North America, and Asia-Pacific drive the OEM segment's dominance in the automotive EVP market. Automakers integrate EVPs to ensure reliable braking, energy efficiency, and regulatory compliance in modern powertrains.

- OEMs are deploying more EVPs to assist hybrid and electric cars, energy recovery systems, and advanced brake systems. These upgrades are attractive to safety- and efficiency-focused customers and fleet operators and enable connected vehicles and predictive maintenance.

- For instance, in March 2025, Bosch partnered with a leading EV OEM to develop an advanced EVP solution featuring adaptive vacuum control, predictive diagnostics, and integration with 48V mild-hybrid designs, supporting preventive maintenance and energy-efficient vehicles.

- Aftermarket segment is expanding, and the market is expected to reach a CAGR of about 7% by 2025 to 2034. To guarantee the reliability of braking, minimize the risk of maintenance, and improve the energy efficiency of older ICE, hybrid, and EV vehicles, vehicle owners and fleet managers are retrofitting them with modular EVPs.

- Modular designs, plug-and-play kits, and smart vacuum controllers drive aftermarket adoption, while manufacturers address challenges like system adaptation, electrical limitations, and installation with universal modules and consumer education.

Looking for region specific data?

Asia Pacific region dominated the global automotive electric vacuum pump market with a market share of 54% in 2024.

- In 2024, Asia Pacific led the global automotive EVP market, fueled by EV adoption and stringent emission regulations in China, Japan, and South Korea. Automakers in the region are integrating EVPs to enhance engine efficiency and reduce emissions.

- Asia Pacific has emerged as a dominant player in the EVP market, driven by robust industrial performance, supportive government policies, and a surge in the adoption of electric and hybrid vehicles, solidifying its status as a hub for technological innovation in the automotive sector.

- China, the region's largest automotive market, drives growth with innovations like electric vacuum pumps in hybrid and EV models, announced by major OEMs in March 2024. This highlights the focus on sustainable mobility and advanced technology in the automotive industry.

- The Asia Pacific market benefits from strong government support, including subsidies and EV adoption incentives. Countries like Japan and South Korea are driving demand for automotive electric vacuum pumps by advancing EV infrastructure and research.

- Electric vacuum pump (EVP) adoption is rising in the Asia Pacific due to a focus on vehicle safety and fuel efficiency. In June 2024, a Japanese supplier reported a 20% increase in EVP shipments, highlighting strong market demand.

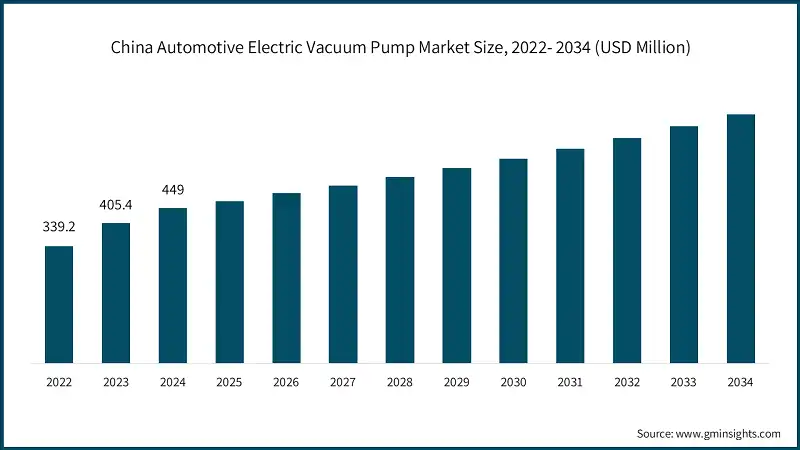

The China automotive electric vacuum pump market was valued at USD 286.5 million and USD 339.2 million in 2021 and 2022, respectively. The market size reached USD 449 million in 2024, growing from USD 405.4 million in 2023.

- China's automotive electric vacuum pump (EVP) market has seen consistent growth in recent years, driven by the swift uptake of electric and hybrid vehicles. As the demand for advanced automotive systems rises, it enhances both engine efficiency and overall vehicle functionality.

- Strict emission rules, government incentives, and rising domestic automotive production drive growth. Manufacturers increasingly use electric vacuum pumps in hybrid and electric cars for greener, economical solutions.

- For instance, in April 2024, a Chinese auto parts manufacturer introduced efficient electric vacuum pumps for hybrid and electric vehicles, targeting domestic and international markets. Such investments by key players are driving the growth of China's electric vacuum pump market.

- China is a key player in the automotive electric vacuum pump market, driven by its large consumer base, strong manufacturing sector, and government support for clean mobility. Regulatory and technological advancements will sustain growth in the coming years.

- In China, rising vehicle safety and performance demands drive electric vacuum pump (EVP) adoption, with automakers enhancing braking and efficiency in hybrid and electric vehicles through OEM and tech supplier collaborations.

Europe automotive electric vacuum pump market accounted for USD 312.8 million in 2024 and is anticipated to show lucrative growth of 6.1% CAGR over the forecast period.

- The European automotive electric vacuum pump (EVP) market is growing rapidly due to the adoption of electric and hybrid vehicles. Strict emission laws in Germany, France, and the UK are driving automakers to use EVPs to enhance engine performance and reduce emissions.

- Government support for sustainable mobility and European EV investments are boosting demand for electric vacuum pumps. Manufacturers are prioritizing efficient, lightweight, and compact designs to meet regulations and improve performance.

- For instance, in May 2024, a German auto supplier introduced an electric vacuum pump to improve energy management and braking in hybrid and electric vehicles, highlighting Europe's focus on advanced automotive technologies.

- Europe's automotive electric vacuum pump market is poised for strong growth, driven by supportive legislation, rising EV adoption, and technological advancements, establishing the region as a hub for innovative EVP solutions.

Germany dominates the European automotive electric vacuum pump market, showcasing strong growth potential, with a CAGR of 6.2% from 2025 to 2034.

- Germany leads the European electric vacuum pump market, driven by its advanced automotive industry, early adoption of electric vehicles, and strict emission standards encouraging energy-efficient technologies.

- Government policies and incentives are driving Germany's EV market growth. Increased EV infrastructure and R&D have boosted the adoption of efficient, compact Electric Vehicle Parts (EVPs) to meet regulations and customer needs.

- Germany leads the European automotive EVP market due to strong industrial capacities, regulations, and demand for electric and hybrid vehicles, driving growth and establishing it as a key automotive engineering hub.

- For instance, In June 2024, a German auto supplier launched a next-gen electric vacuum pump for hybrid and electric vehicles, focusing on improved braking and energy efficiency.

- In Germany, rising focus on vehicle safety and performance is driving demand for electric vacuum pumps (EVPs). Automakers are adopting EVPs to enhance braking, reduce engine load, and improve efficiency, while OEMs and tech suppliers collaborate to meet regulations and consumer needs.

The North America automotive electric vacuum pump market is anticipated to grow at the CAGR of 3.6% during the analysis timeframe.

- North America's automobile electric vacuum pump market is rapidly expanding, driven by a rising trend in hybrid and electric vehicles. U.S. and Canadian automakers are adopting EVPs, not only to meet stringent fuel economy and emission standards, but also to boost vehicle performance.

- Market growth is being fueled by innovation and technological advancements. Companies are developing compact, energy-efficient electric vacuum pumps that enhance braking systems and reduce engine load, leading to greater efficiency and reliability in vehicles.

- Strategic alliances between OEMs and component suppliers are driving market growth. For instance, in July 2024, a major U.S. automaker launched an electric vacuum pump for hybrid cars, highlighting the region's focus on advanced automotive solutions.

- Government incentives, regulatory pressures, rising EV demand, and technological advancements are driving electric mobility in North America, positioning the region as a key market for automotive electric vacuum pumps with strong growth potential.

- The U.S leads the North American automotive EVP market due to its strong EV and hybrid vehicle industry, advanced infrastructure, and focus on innovation. Canada benefits from government incentives, while Mexico grows with increased hybrid production and global automaker collaborations.

The automotive electric vacuum pump market in US is expected to experience significant and promising growth from 2025 to 2034.

- In the rapidly evolving US automotive electric vacuum pump market, hybrid and electric vehicles are taking the lead. Facing regulatory pressures and a growing consumer demand for eco-friendly vehicles, automakers are turning to electric vacuum pumps (EVPs) to enhance engine efficiency and bolster braking performance.

- This market focuses on technological innovation. Companies are launching lightweight, compact, and energy-efficient electric vacuum pumps for seamless integration with modern vehicle systems.

- For instance, in August 2024, a leading American automaker introduced an electric vacuum pump for hybrid models, improving energy efficiency and braking. This highlights the focus on innovative automotive solutions.

- Electric mobility is also supported by policy and incentives to encourage market growth. Programs at federal and state level promote EVs, which subsequently boosts the market of sophisticated automotive equipment such as electric vacuum pumps.

- In the future, the American market will grow rapidly as more consumers are willing to use hybrid and electric cars. Technological innovation, regulatory push and infrastructure development make the country a key center of automotive EVP developments in the future.

Brazil leads the Latin American automotive electric vacuum pump market, exhibiting remarkable growth of 6.4% during the forecast period of 2025 to 2034.

- Brazil leads the Latin American electric vacuum pump market, driven by its strong automotive industry and growing demand for hybrid and electric vehicles. Automakers are adopting electric vacuum pumps to improve engine efficiency, brake systems, and meeting stricter emission standards.

- Government support for clean mobility is promoting market expansion. Electric vehicle incentives and electric vehicle infrastructure, are providing an opportunity to develop advanced components in automotive, making Brazil a center of innovation in the region.

- Brazil leads Latin America in adopting electric and hybrid vehicles, driven by regulatory support, a strong industrial base, and consumer demand. The country also continues to secure global investments in automobile parts manufacturing.

- Brazil is poised to maintain its leadership position in the region as a growing number of individuals transition to hybrid and electric vehicles. With ongoing innovations, supportive policies, and a receptive market, Brazil emerges as a pivotal player in the Latin American automotive electric vacuum pump landscape.

South Africa to experience substantial growth in the Middle East and Africa automotive electric vacuum pump market in 2024.

- South Africa's automotive electric vacuum pump (EVP) sector is set to grow significantly, driven by a 1-billion-rand (54 million dollars) government investment announced in March 2025 to boost EV and battery production. This initiative aims to transition the sector to EVs by 2035, attract 30 billion rand in private investments, and drive economic and technological advancements.

- Foreign manufacturers like BYD, Chery Auto, and Great Wall Motor are expanding in South Africa, driven by rising EV component demand. They are launching new models, exploring local production, and leveraging government incentives to reduce costs, boosting the adoption of advanced parts like electric vacuum pumps.

- South Africa plans to introduce tax rebates and subsidies to boost its EV market. From March 1, 2026, producers can claim 150% of qualifying investments in electric and hydrogen vehicles. New policies for hybrids and plug-in hybrids aim to drive electric mobility, increasing demand for electric vacuum pumps.

- The expansion of South Africa's electric vehicle infrastructure is driving growth in the automotive EVP market. BYD plans to increase its dealerships from 13 to 30-35 by 2026, strengthening its position in Africa's largest car market. This expansion, coupled with more EVs and charging stations, is expected to boost demand for electric vacuum pumps and other key automotive components.

- South Africa's electric vacuum pump automotive sector is set for notable growth, driven by government incentives, foreign car manufacturers, and advancements in electric car infrastructure, solidifying its role in the regional automotive industry.

Automotive Electric Vacuum Pump Market Share

- The top 7 companies in the automotive electric vacuum pump industry are Robert Bosch, Continental, Hella, Tuopu, Valeo, Rheinmetall Automotive, and ZF Friedrichshafen contributed around 37% of the market in 2024.

- Bosch leads in electric vacuum pump technology, offering energy-efficient, durable, and low-noise EVP systems for electric and hybrid vehicles. Its global presence and focus on AI-driven diagnostics make it a trusted OEM supplier for reliable brake assist solutions.

- Continental offers electrified powertrain breaking and emission control solutions through advanced electric vacuum pumps. Known for intelligent control and ADAS compatibility, the company holds a strong market share in Europe and Asia, helping OEMs meet regulations while enhancing vehicle safety and efficiency.

- HELLA leads globally in original equipment vacuum pumps, offering diverse EVP models for electric and hybrid vehicles. Its lightweight, energy-efficient pumps with high vacuum performance integrate seamlessly with electronic control units, making it a preferred choice for automakers.

- Tuopu, a new entrant in the EVP industry, focuses on cost-effective electric vacuum pumps for electric and hybrid vehicles. Its growing presence in Asia-Pacific and alliances with Chinese OEMs drive EV adoption and braking system advancements in the region.

- Valeo's electrical vacuum pump solutions enhance brake assist and emissions control in micro-hybrid and electric vehicles. Designed for silent, fast operation, they integrate intelligent diagnostics and lightweight materials to boost energy efficiency. With strong European leadership and OEM collaborations, Valeo drives sustainable vehicle innovation.

- Rheinmetall, through its Pierburg brand, develops advanced electric vacuum pumps with single-stage and dual-stage EVP systems, ensuring durability, thermal efficiency, and precise vacuum control. Leveraging its expertise in emissions and system integration, it supports automakers in transitioning to low-emission and hybrid technologies.

- ZF delivers advanced EVP solutions for end-of-car electrification and safety. Its TRW-branded electronic brake boosters and vacuum systems integrate with electric powertrains and ADAS, focusing on modular design, aftermarket readiness, and predictive maintenance to enhance OEM innovation and vehicle reliability globally.

Automotive Electric Vacuum Pump Market Companies

Major players operating in the automotive electric vacuum pump industry are:

- Aisin

- Continental

- Hella

- Magna International

- Rheinmetall Automotive

- Robert Bosch

- Tuopu

- Valeo

- Youngshin Precision

- ZF Friedrichshafen

- Aisin, Continental, and HELLA are key players in electric vacuum pump innovation. Aisin focuses on compact, efficient EVP systems for hybrid and electric vehicles. Continental offers smart EVP platforms with low-noise operation, while HELLA provides reliable, self-lubricating pumps for versatile vehicle applications.

- Magna International, Rheinmetall Automotive, and Robert Bosch are key players in next-generation mobility solutions. Magna focuses on scalable EVP systems for hybrids and EVs, Rheinmetall (Pierburg) supports low-emission vehicles with advanced vacuum technologies, and Bosch offers compact EVP units compatible with electronic brake boosters.

- Tuopu, Valeo, and Youngshin Precision are driving the EVP market with cost-effective and reliable solutions. Tuopu focuses on scalable production for Chinese OEMs and global markets. Valeo emphasizes silent, eco-friendly EVP systems, while Youngshin Precision delivers consistent quality to OEMs and the aftermarket in Asia.

- ZF Friedrichshafen, at the forefront of innovation, integrates cutting-edge EVP systems into its advanced electronic brake control and electronic chassis systems. ZF's TRW solutions, featuring predictive diagnostics and a novel architecture, pave the way for precise and reliable autonomous driving and electrified powertrains.

Automotive Electric Vacuum Pump Industry News

- In July 2025, Valeo announced the opening of a new production facility in China to support the software-defined vehicle revolution. This facility is expected to enhance the company's capabilities in manufacturing advanced components, including electric vacuum pumps, to meet the growing demand in the Asian automotive market.

- In August 2024, Youngshin Precision launched its latest EVP series for passenger vehicles, focusing on cost-effective manufacturing and consistent vacuum delivery. The new line supports OEM and aftermarket channels, with strong demand projected across Southeast Asia.

- In May 2024, Bosch unveiled a new generation of electric vacuum pumps designed to enhance braking performance in hybrid and electric vehicles. These pumps are engineered for higher efficiency and reduced energy consumption, aligning with the industry's shift towards electrification and stringent emission standards.

- In May 2024, Continental announced a strategic collaboration with Qualcomm to integrate advanced computing platforms into automotive systems. This partnership aims to enhance the performance of electric vacuum pumps by leveraging high-performance computing for improved control and efficiency in braking systems.

The automotive electric vacuum pump market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Mn) and volume (Units) from 2021 to 2034, for the following segments:

Market, By Vehicles

- Passenger cars

- Hatchbacks

- Sedans

- SUVs

- Commercial vehicles

- Light commercial vehicle

- Medium commercial vehicle

- Heavy commercial vehicle

Market, By Propulsion

- Internal combustion engine (ICE)

- Electric vehicles (EVs)

- Battery electric vehicles (BEVs)

- Plug-in hybrid electric vehicles (PHEVs)

- Hybrid electric vehicles (HEVs)

Market, By Application

- Braking systems

- Emission control systems

- HVAC & climate control systems

- Engine management systems

- Others

Market, By Type

- Swing piston

- Diaphragm

- Leaf

Market, By Sales Channel

- OEM

- Aftermarket

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Portugal

- Croatia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the automotive electric vacuum pump industry?

Key players include Aisin, Continental, Hella, Magna International, Rheinmetall Automotive, Robert Bosch, Tuopu, Valeo, Youngshin Precision, and ZF Friedrichshafen.

Which region leads the automotive electric vacuum pump sector?

Asia Pacific leads the market with a 54% share in 2024, led by EV adoption and stringent emission regulations in countries like China, Japan, and South Korea.

What are the upcoming trends in the automotive electric vacuum pump market?

Trends include smart controls, adaptive vacuums, predictive maintenance, lightweight materials, AI diagnostics, IoT, and sustainable EVP designs for hybrid and electric vehicles.

What is the growth outlook for the OEM segment from 2025 to 2034?

The OEM segment, which held a 96% market share in 2024, is anticipated to showcase around 5.7% CAGR up to 2034.

What was the market share of the internal combustion engine (ICE) segment in 2024?

The ICE segment dominated the market with a 77% share in 2024 and is set to expand at a CAGR of 4.5% through 2034.

How much revenue did the passenger car segment generate in 2024?

The passenger car segment accounted for approximately 46% of the market in 2024 and is expected to witness over 7% CAGR till 2034.

What is the expected size of the automotive electric vacuum pump market in 2025?

The market size is projected to reach USD 1.6 billion in 2025.

What is the projected value of the automotive electric vacuum pump market by 2034?

The market is poised to reach USD 2.3 billion by 2034, driven by advancements in EVP technology, stringent emission regulations, and the rise of hybrid and electric vehicles.

What is the market size of the automotive electric vacuum pump in 2024?

The market size was USD 1.5 billion in 2024, with a CAGR of 5.7% expected through 2034. Increasing adoption of EVPs for vehicle efficiency, emissions control, and electrification is driving market growth.

Automotive Electric Vacuum Pump Market Scope

Related Reports