Summary

Table of Content

Automotive Data Logging & Analytics Hardware Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Automotive Data Logging & Analytics Hardware Market Size

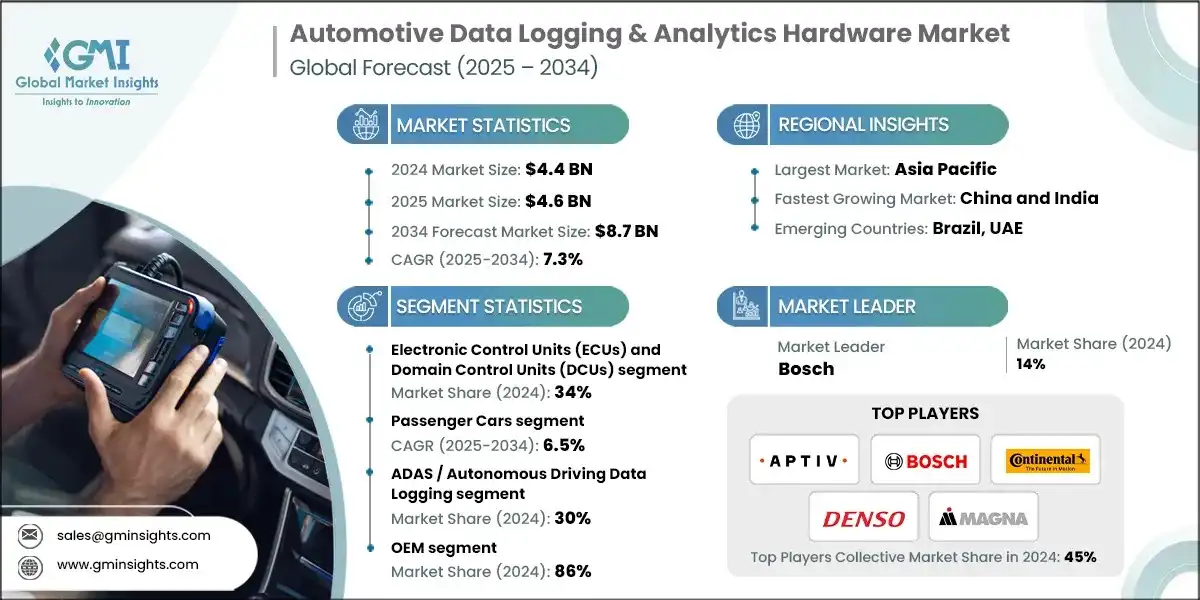

The global automotive data logging & analytics hardware market size was estimated at USD 4.4 billion in 2024. The market is expected to grow from USD 4.6 billion in 2025 to USD 8.7 billion in 2034, at a CAGR of 7.3%, according to latest report published by Global Market Insights Inc.

To get key market trends

The automotive sector is experiencing a major shift due to developments in vehicle connectivity, electrification, and automation. At the center of the shift is harnessing new data logging and analytics hardware, which is vital to improving vehicle performance, safety, and regulatory compliance.

Governments around the world are initiating policies mandating the installation of data logging devices in vehicles. In the United States, for instance, the Federal Motor Carrier Safety Administration mandated the installation of Electronic Logging Devices on commercial trucks. The devices automatically record driving time and assist in compliance with hours-of-service regulations and enhance road safety.

In Massachusetts, there is a legislative requirement that from model year 2022 cars, Original Equipment Manufacturers ought to provide standardized open data platforms in cars. This is intended to facilitate vehicle-specific data, including telematics, to be made available to car owners and independent repair shops to utilize in the diagnosis and repairing of cars without needing approval from OEMs.

Data logging devices serve an important purpose in capturing critical data about vehicle usage. Event Data Recorders are applied by the National Highway Traffic Safety Administration to retrieve information when a vehicle crashes. This information is used to understand crash dynamics and improve vehicle safety features.

Automotive Data Logging & Analytics Hardware Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 4.4 Billion |

| Market Size in 2025 | USD 4.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 7.3% |

| Market Size in 2034 | USD 8.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing adoption of ADAS and autonomous driving systems | Boosts demand for high-bandwidth data logging and multi-sensor platforms |

| Expansion of electric vehicles (EVs) and battery management systems | Enhances requirement for telemetry and edge analytics hardware |

| Growing fleet digitization and predictive maintenance | Promotes investment in telematics and diagnostic data logging systems |

| Software-defined vehicle (SDV) adoption | Creates need for OTA update logging, lifecycle monitoring, and secure modules |

| Pitfalls & Challenges | Impact |

| High cost of advanced logging hardware | Slows adoption in mid- and entry-level vehicles |

| Complexity in hardware-software integration | Limits deployment across multiple vehicle platforms |

| Opportunities: | Impact |

| Expansion of connected vehicle infrastructure | Drives demand for large-scale logging and telematics modules |

| Growth of aftermarket retrofit solutions | Enables predictive maintenance and insurance telematics adoption |

| Market Leaders (2024) | |

| Market Leaders |

14% market share |

| Top Players |

Collective market share in 2024 is 45% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia-Pacific |

| Fastest growing market | China and India |

| Emerging countries | Brazil, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Automotive Data Logging & Analytics Hardware Market Trends

The transition to software-defined vehicles (SDVs) is revolutionizing the requirements for automotive data logging hardware. An SDV needs a stable system with the capability for over-the-air (OTA) updates, software update life cycle tracking, and real-time telemetry. It is also a requirement of UNECE Regulations R155 and R156 that manufacturing acquirers have a plan for each vehicle that adheres to global enforcement for safety and cybersecurity, leading manufacturers to implement advanced data recording platforms in order to meet this important regulation.

Vehicles is increasingly using edge computing and AI enabled hardware to support the massive data generated by various sensors process this data locally. Data logging systems will need capture of terabytes of data daily, accommodate a network throughput of >1.2GB/s, and/or >30 channels with <1ms synchronisation. Denso's technical specifications identify architecture based on FPGA, and high-performance data storage, which will be required to efficiently process real-time data processing in autonomous driving.

Connected vehicles and Vehicle-to-everything (V2X) communication is driving the demand for telematics units, sensor interface, and network hardware. United States Department of Transportation (USDOT) National V2X Deployment Plan envisions the need for secure, interoperable data logging hardware to enable safety-related applications. Hardware for managing different data communications protocols (5G/LTE, Wifi, Bluetooth, DSRC) while enabling data logging for comprehensive and interconnected V2V, V2I, and V2P data collections is becoming a more pressing need in modern fleet and mobility.

Hardware design is heavily influenced by government regulations. NHTSA mandates crash reporting in ADS and Level 2 ADAS vehicles, necessitating standardized data recorders. IEEE Standard 1616-2021 mandates crash-survivable logging systems with tamper-evidence, precise timestamps, and defined sampling rates. Adoption is prompted by compliance to ruggedized hardware that stores critical safety and operational data in harsh environments.

Electric vehicle growth propels the requirement for specialized logging systems monitoring battery cells, thermal levels, and charging cycles. Logging equipment requires accurate analog-to-digital conversion, isolated sensing, and real-time processing. Cloud-based BMS applications, facilitated by predictive analytics and artificial intelligence algorithms, enhance remote monitoring and battery lifecycle optimization, research in the Journal of Power Sources and TI technical information concludes.

Automotive Data Logging & Analytics Hardware Market Analysis

Learn more about the key segments shaping this market

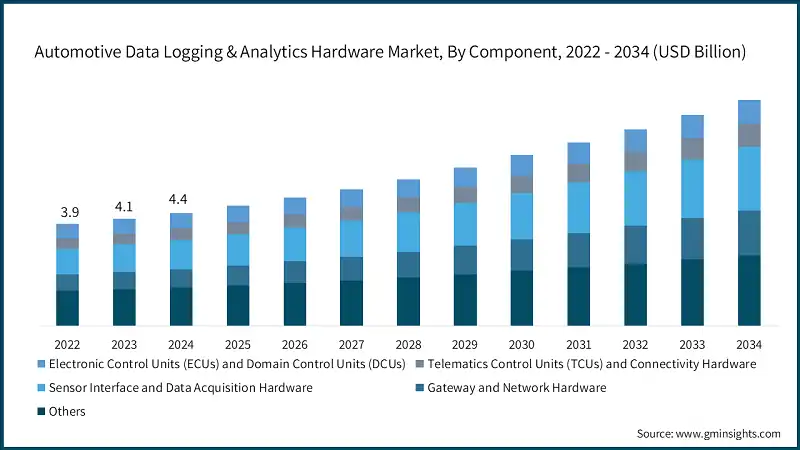

Based on component, the automotive data logging & analytics hardware market is divided into Electronic Control Units (ECUs) and Domain Control Units (DCUs), Telematics Control Units (TCUs) and Connectivity Hardware, Sensor Interface and Data Acquisition Hardware, Gateway and Network Hardware, and Others. Electronic Control Units (ECUs) and Domain Control Units (DCUs) segment dominated the market in 2024, accounting for 34% of total revenue.

- Vehicle design is transforming from traditional distributed ECUs towards centralized domain control systems with support for sophisticated data logging integration. The systems must support multiple communication protocols, safe storage of data, as well as rapid processing. UNECE R155 cybersecurity standards are promoting the use of ECUs with HSMs, secure boot, and tamper-evident logging features.

- Next-generation TCUs now support a variety of communication protocols, including 5G, LTE, Wi-Fi 6, Bluetooth 5.0, and DSRC, catering to V2X networks. With embedded edge computing, these TCUs enable real-time analysis and minimize data transmission. As a result, fleet management systems increasingly depend on these TCUs for tasks like remote monitoring, predictive maintenance, and detailed vehicle data logging, all with minimal latency.

- Developing autonomous vehicles requires sensor interface hardware capable of fusing radar, LiDAR, and camera data within microseconds. The interfaces must be designed to accommodate large data streams from many sensors and incorporate AI-enabled processors to provide real-time sensor fusion, object detection, and environmental mapping, according to a technical report from Denso.

- The emergence of software-defined vehicles has driven the need for intelligent network gateways to securely manage massive data traffic. The IEEE automotive Ethernet standards support higher bandwidth data flow while allowing for network segmentation to separate safety-critical and infotainment domains.

Learn more about the key segments shaping this market

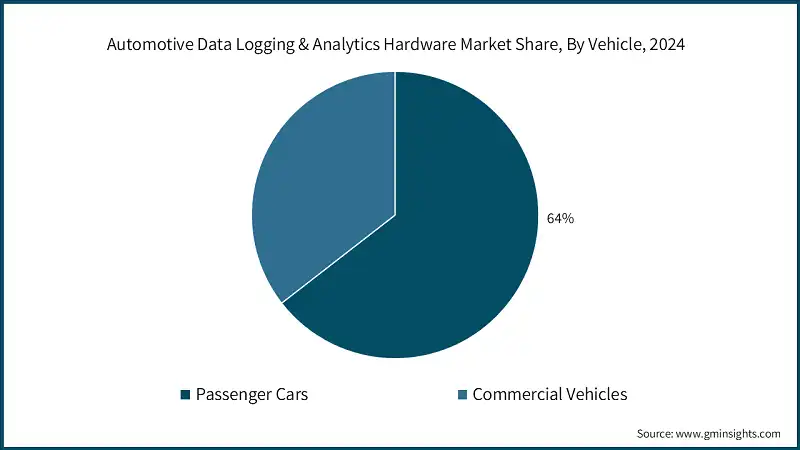

Based on vehicle, the automotive data logging & analytics hardware market is segmented into Passenger Cars and Commercial Vehicles. Passenger Cars led the market in 2024 and is expected to grow at a CAGR of 6.5% from 2025 to 2034.

- The prevalence of passenger vehicles in the deployment of data logging hardware is driven by increased connectivity within current infotainment, ADAS, and EV systems. The U.S. Department of Energy stated that global passenger EV sales increased to 13.6 million units in 2023, further increasing the deployment of data logging hardware.

- The transition to electric and hybrid vehicles emphasizes the need for data logging hardware to monitor battery state-of-health, charge cycles, and power distribution in real-time.

- Commercial fleets are quickly deploying sophisticated data logging systems to monitor both vehicle performance and driver behavior. In the US, the Federal Motor Carrier Safety Administration (FMCSA) has made it mandatory to use Electronic Logging Devices (ELDs) to remain in regulatory compliance for hours-of-service recording. This regulation has led to wider adoption of ELDs in commercial logistics fleets as a result of this regulatory-driven digitization, it has contributed to continual hardware upgrades for analytics purposes in real-time.

- Heavy-duty commercial vehicles contribute heavily to our used telematics hardware to monitor emissions and predict needed maintenance. According to the European Environment Agency, heavy-duty vehicles contribute nearly 25% of all road transport CO2 emissions globally. As such, implementation of more expansive reporting and monitoring frameworks are desired.

Based on application, the automotive data logging & analytics hardware market is segmented into ADAS / Autonomous Driving Data Logging, Fleet Management and Telematics, EV Battery Management, Software-Defined Vehicle (SDV) Support, and Others. The ADAS / Autonomous Driving Data Logging segment dominated the market, accounting for share of 30% in 2024.

- Data logging for ADAS and autonomous driving is evolving quickly with the increasing use of advanced sensors and real-time decision-making systems. The US National Highway Traffic Safety Administration (NHTSA) requires detailed data logging for autonomous vehicle testing, which is driving investments in high-speed, multi-channel data loggers that can record radar, LiDAR, and camera streams at the same time.

- Fleet operators are using telematics more often for data logging to improve route planning, meet safety regulations, and support predictive maintenance. The US Department of Transportation's ELD mandate requires continuous monitoring of operational data, leading to upgrades in hardware. Real-time analytics and IoT-enabled logging are also helping fleets save fuel and cut operational costs in logistics and public transportation.

- Data logging systems can be applied to monitoring EV batteries charging cycles with specified logging of temperature, charge cycles, and per cell performance. The International Energy Agency (IEA) notes that the global stock of EVs has increased to over 40 million in 2024, which fuels more hardware adoption and the desire to implement variable charge sourcing technologies. Governments are providing incentives for monitoring the safety and recycling of EV batteries, which drives integration of high-resolution logging technologies.

- SDVs require powerful logging hardware to support software updates, remote diagnostics, and cybersecurity compliance. UNECE Regulation R156 requires that vehicles have a secure method for software updates. This regulatory enforcement will drive demand for logging systems with modular, upgradeable, cloud-supported logging, and over-the-air (ota) update potential and capability.

Based on end use, the automotive data logging & analytics hardware market is segmented into OEM and Aftermarket. The OEM segment dominated the market, accounting for share of 86% in 2024.

- OEMs hold the dominant share in the market for the hardware needed for vehicle data logging and analytics, installing data logging in vehicles as part of their manufacturing process to fulfil requirements for compliance and functionality enhancements. The requirement of UNSCE Regulation R155 for a risk management system to address cybersecurity in the design of new vehicles is stimulating OEM interest in data logging hardware that can provide security for on-going monitoring, diagnostics, compliance reporting and risk management, across the automotive landscape worldwide.

- Car manufacturers have units within their EV and ADAS equipped vehicles designed to log data for diagnostics, firmware updates, and predictive maintenance. The European Commission has determined that all new vehicles sold in the European Union by 2030 must comply with the EU's digital safety data requirements, which is encouraging OEMs to standardize hardware development within their manufacturing processes.

- In the aftermarket space, players are looking to grow to provide retrofitted devices attached to data logging hardware for older vehicles and commercial fleets. The U.S. EPA is stimulating demand for plug-in, potential plug-and-play data logging hardware for emissions verification, onboard diagnostics in their decision to support this marketplace. As independent workshops adjust to new market conditions they are increasingly using these systems to gain access to program remote monitoring, and building trust in post-market data analytics.

- As connectivity continues to grow, the aftermarket professional sector sees a business opportunity to develop retrofitting solutions for previously driven low-tech vehicles. In support of this strategy, India's Ministry of Road Transport/Road Safety made a new regulation that all GPS tracking and data logging for commercial fleets be AIS-140 compliant, which will push the industry towards after-market. These GPS devices not only allow for compliance within the Ministry's enforcement efforts, they also enable fleet analytics, maintenance scheduling, in-frame conditions and offer a way to stay/re- introduce former customers beyond hardware and software manufactured equipment.

Looking for region specific data?

Looking for region specific data?

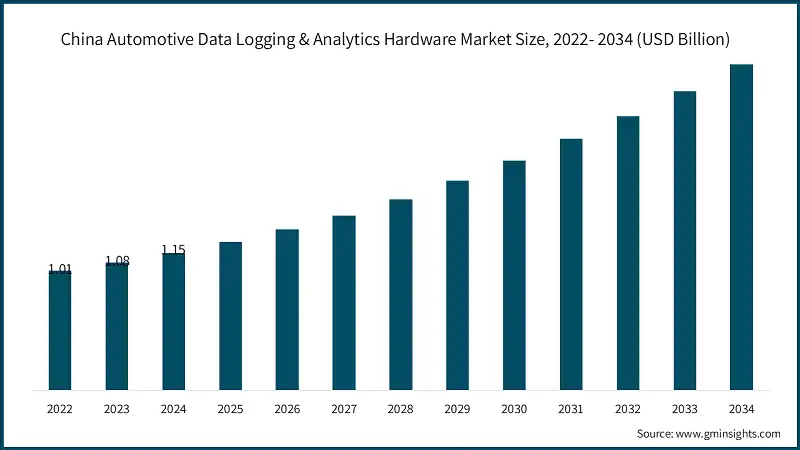

The China dominates the Asia Pacific automotive data logging & analytics hardware market, generating USD 1.15 billion revenue in 2024.- China is the frontrunner in the worldwide market for automotive data logging and analytics hardware, thanks to its substantial vehicle production as well as the speedy adoption of connected technologies. The China Association of Automobile Manufacturers (CAAM) states that China produced more than 30 million vehicles in 2024, further driving demand for data logging hardware integration.

- To promote intelligent connected vehicles (ICVs), the Ministry of Industry and Information Technology (MIIT) has driven the national standards for collecting vehicle data in real-time. In addition, polices espoused under China’s "Intelligent Vehicle Innovation Development Strategy" also emphasizes advanced data logging hardware to promote safety, automation, and centralized vehicle tracking and storage for the data collected.

- China's leadership in the electric vehicle (EV) market is increasing the demand for data logging systems, especially for battery monitoring and telematics. A report from China EV100 stated that over 60% of new EVs produced in 2023 included real-time data logging modules. These modules improve energy efficiency, support diagnostics, and comply with the Ministry of Industry and Information Technology (MIIT) regulations for national data-sharing standards.

- Numerous Chinese Original Equipment Manufacturers (OEMs) including BYD and SAIC are also researching their own in-house data logging solutions, in part to reduce reliance on the market of non-Chinese suppliers. With support from the National Development and Reform Commission (NDRC), localization policies are seeing enhanced competitiveness by ensuring all hardware is compliant with their own national cybersecurity, data storage, and vehicle network security standards.

The automotive data logging & analytics hardware market in the US is expected to experience robust growth from 2025 to 2034.

- The marketplace for automotive data logger and analytics hardware in the U.S. is growing rapidly, fueled by federal safety regulations and progressive vehicle initiatives. NHTSA has indicated that 90% of new vehicles in the market include event data recorders, thus helping to drive the adoption of logging hardware that conforms to regulations.

- The federal government is heavily focused on autonomous driving research, through the U.S. Department of Transportation and AV TEST Initiative, which has stimulated the demand for performance data logging systems that can record and process real-time sensor data across ADAS and self-driving vehicle systems.

- The increase in electric and connected vehicles in the U.S. is another area bolstering the marketplace. The U.S. Department of Energy reported and estimated that over 4.5 million EVs will be on the road by 2024, creating new opportunities for integrated battery management and telemetry data capture hardware solutions.

- Original Equipment Manufacturers, such as Ford, GM and Tesla are investing heavily in R&D domestically, with the goal of integrated secure and high-speed automotive data systems. The federal government has swayed automotive frameworks to encourage rules around cybersecurity compliance under FMVSS, resulting in an emerging industry that develops robust and tamper-proof automotive data logging hardware that is designed to fit emerging vehicle technologies.

The automotive data logging & analytics hardware market in Germany is expected to experience strong growth from 2025 to 2034.

- Germany continues to be a leading center for automotive innovation, with the EU and UNECE regulations driving heavily towards deploying advanced data logging hardware. With its continuing leadership in autonomous and electric vehicle technology, the country has maintained investigation into systems for documenting safety-compliant data capture, real-time analytics, and integrating those systems into mass-produced vehicles.

- The investment of German OEMs, such as BMW, Volkswagen, and Mercedes-Benz, in creating the next generation of product development, particularly with the enhancement of where and how data is collected in the vehicle, is significant. Under the Germany Federal Ministry for Digital and Transport (BMDV), the government continues to support innovative projects towards improving vehicle-to-everything (V2X) connectivity and fast data acquisition to improve the safety and communications across vehicles moving within a boundary.

- The nation's Industry 4.0 strategy is accelerating the proliferation of modern intelligence automotive hardware that captures data using cloud analytic applications and processing the data at the edge. These innovations will increasingly allow vehicles to coordinate seamlessly with advanced manufacturing systems across integrated infrastructure within industry, benefitting from meeting EU cybersecurity compliance and from independent data privacy regulations.

The automotive data logging & analytics hardware market in UAE is anticipated to register consistent growth from 2025 to 2034, driven by increasing adoption of ADAS and smart mobility technologies.

- UAE is an emerging market for automotive radar semiconductors, driven by the country's increasing focus on vehicle safety, smart mobility and adoption of Advanced Driver Assistance Systems (ADAS). Increasing investment in car infrastructure and adoption of connected and electric vehicles has accelerated the distribution of radar ICs and sensor modules in both passenger cars and commercial vehicles.

- Car manufacturers in the UAE integrate long-distance radar (LRR) and short-distance radar (SRR) systems in the mid-range and premium vehicles to improve adaptive cruise control, collision avoidance, path-determined assistance and parking support. These systems require high-performance radar ICs and contribute to the growing demand for the market.

- Government initiatives that promote smart urban development, vehicle automation and electrification have strengthened the radar semiconductor market. Guidelines that encourage the use of connected and autonomous vehicles promote investments in radar technologies, thus ensuring a stable supply of radar ICs and modules for local car manufacturers.

- In addition, local and regional semiconductor manufacturers work with global Radar IC suppliers to meet the growing demand. These partnerships facilitate technology transfer, improve the reliability of the product and strengthen UAE's position as a growing hub for integration and innovation of vehicle radar.

The Brazil automotive data logging & analytics hardware market is anticipated to grow at a robust pace from 2025 to 2034, reflecting advancements in autonomous driving and sensor integration.

- The automotive data logging and analytics hardware market is consistently expanding in Brazil due to the rise in connected vehicle deployments and the upgrading of transport infrastructure in Brazil. There has been an increased presence of telematics and onboard data recording systems in passenger vehicle fleets and commercial vehicles as a result of the Brazilian government's initiatives in digital mobility and emissions monitoring.

- The National Traffic Department (DENATRAN) and Brazil’s automotive safety initiatives are encouraging the incorporation of advanced driver monitoring and event data recording technology. Alluding to roadway safety and cooperating local compliance and international automobile manufacturers’ compliance requirements.

- One of Brazil’s current expanding areas of potential automotive data analytics is the electric and hybrid vehicle market driven by tax incentives and import tax exemption. There is interest for data logging hardware specific to advanced battery and powertrain. Local companies are even partnering with international companies to offer more diagnostics and analytics.

- Fleet digitization and logistics efficiency have increased the demand for telematics hardware in Brazil's commercial transport sector. With the vehicle connectivity rate increase, government digital transformation, and commercial regional manufacturer interests, Brazil is positioned as a developing region for an emerging automotive data system market.

Automotive Data Logging & Analytics Hardware Market Share

- The top 7 companies in the automotive data logging & analytics hardware industry are Infineon technologies, NXP semiconductors, Texas instruments (TI), Analog devices (ADI), Renesas electronics, STMicroelectronics, Qorvo, contributing around 55% of the market in 2024.

- Bosch leads the market in broad automotive technology capabilities in sensors, processing devices, connectivity solutions, and data analytics platforms. Bosch's combined capabilities enable end-to-end data logging solutions to tackle applications ranging from straightforward vehicle diagnosis to advanced autonomous driving systems.

- Denso using its strong automotive electronics and existing relationships with major OEMs, especially in Asia, Denso has established itself in the market. Denso is well-positioned with respect to electrification and autonomous driving technologies and the increasing demand for more sophisticated vehicle data logging capabilities.

- Continental's vast product portfolio includes telematics control units, sensor interface systems, and network infrastructure components for a comprehensive vehicle data logging and analysis capability. Continental's R&D in developing software-defined vehicle technologies and cybersecurity helps support its competitive strength in a changing environment.

- Valeo, focused on advanced driver assistance systems and electrification, offers specialized applications of data logging for these burgeoning technologies. Valeo draws on its experience with sensors (cameras, LiDAR, and ultrasonic sensors) to produce integrated data logging solutions that further enhance sensor fusion and autonomous driving. Valeo's entry into artificial intelligence and machine learning capabilities has expanded its data analytics ability.

- Aptiv, with its deep-rooted experience in vehicle architecture and connectivity, lays down the essential framework for holistic data logging and analytics. The company's command over automotive Ethernet, gateway systems, and network security ensures data collection and transmission are both secure and dependable. Aptiv's strategy, centered on a software-defined vehicle architecture, resonates with the industry's shift towards more adaptable and comprehensive data logging systems.

- ZF Friedrichshafen has vehicle dynamics and chassis systems know-how, and provides specialized data logging technology for autonomous driving, suspension control, and vehicle stability control applications. Sensor, actuator, and control system integration by the company enables end-to-end data acquisition for vehicle dynamics applications. ZF investment in artificial intelligence and predictive analytics enables improved data processing.

- Magna International provides integrated automotive systems and manufacturing capacity to enable extensive data logging solutions on multiple vehicle platforms. Its vehicle integration and manufacturing abilities provide cost-effective deployment of data logging systems within high-volume production environments.

Automotive Data Logging & Analytics Hardware Market Companies

Major players operating in the automotive data logging & analytics hardware industry are:

- Aptiv

- Bosch

- Continental

- Denso

- Hyundai Mobis

- Lear

- Magna

- Valeo

- Vector Informatik

- ZF Friedrichshafen

- The combined market share held by the top seven players reflects a moderate level of market concentration, suggesting opportunities for incumbent suppliers as well as newer technology businesses. The remaining market is served by smaller suppliers, system integrators, and specialized technology companies, reflecting a dynamic competitive landscape for innovation and advancing technology.

- Amid this innovation, competitive intensity is also rising as traditional automobile suppliers begin to compete with technology companies entering the automotive sector. The converging worlds of the automobile and technology sectors create new competitive dynamics; established companies in adjacent industries are using their resources and knowledge in artificial intelligence, cloud computing, and cybersecurity to build capabilities in automotive data logging.

Automotive Data Logging & Analytics Hardware Industry News

- In January 2025, Bosch announced an expansion of its Automotive Data Logger portfolio with new edge computing capabilities for software-defined vehicles. This new functionality combines artificial intelligence processing capabilities with secure data storage, allowing for real-time, OTA updates and the ability to optimize the vehicle itself. This expansion reflects the rapid increased demand for smart data loggers in today's connected vehicles.

- In December 2024, NHTSA broadened its guidance on Automated Driving System data recording, widening the data elements essential for crash investigations and safety analyses. These updated mandates, as highlighted by the National Highway Traffic Safety Administration, are spurring a surge in demand for advanced data logging hardware.

- In November 2024, Continental announced the launch of a new telematics control unit with integrated edge computing and 5G connectivity capabilities. This unit was designed for real-time data processing and secure data transmission to meet impending demands for fleet management, automated driving, and connected vehicles. This development reflects the industry's transition to smart data logging systems.

- In October 2024, The International Organization for Standardization released ISO/TS 15638-26:2024, establishing its standard for monitoring dynamic charging for electric vehicles. This standard has stimulated the increase in demand for data logging equipment for electric vehicles built for supervised dynamic charging in battery electric commercial vehicles according to ISO.

The automotive data logging & analytics hardware market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) and volume (Units) from 2021 to 2034, for the following segments:

Market, By Component

- Electronic Control Units (ECUs) and Domain Control Units (DCUs)

- Telematics Control Units (TCUs) and Connectivity Hardware

- Sensor Interface and Data Acquisition Hardware

- Gateway and Network Hardware

- Others

Market, By Vehicle

- Passenger Cars

- Hatchback

- Sedan

- SUV

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Medium Commercial Vehicles (MCV)

- Heavy Commercial Vehicles (HCV)

Market, By Application

- ADAS / Autonomous Driving Data Logging

- Fleet Management and Telematics

- EV Battery Management

- Software-Defined Vehicle (SDV) Support

- Others

Market, By End Use

- OEMs

- Aftermarket and Service Providers

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Southeast Asia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- China is the frontrunner in the worldwide market for automotive data logging and analytics hardware, thanks to its substantial vehicle production as well as the speedy adoption of connected technologies. The China Association of Automobile Manufacturers (CAAM) states that China produced more than 30 million vehicles in 2024, further driving demand for data logging hardware integration.

Frequently Asked Question(FAQ) :

Who are the key players in the automotive data logging and analytics hardware industry?

Key players include Aptiv, Bosch, Continental, Denso, Hyundai Mobis, Lear, Magna, Valeo, Vector Informatik, and ZF Friedrichshafen.

Which region leads the automotive data logging and analytics hardware sector?

China leads the Asia Pacific market, generating USD 1.15 billion in revenue in 2024, supported by substantial vehicle production and rapid adoption of connected technologies.

What are the upcoming trends in the automotive data logging and analytics hardware market?

Key trends include software-defined vehicles, edge computing, AI hardware, V2X communication, UNECE compliance, and specialized EV logging systems.

What was the valuation of the passenger cars segment?

The passenger cars segment is expected to observe around 6.5% CAGR from 2025 to 2034.

How much revenue did the ECUs and DCUs segment generate in 2024?

The ECUs and DCUs segment generated approximately 34% of the total market revenue in 2024, led by the shift towards centralized domain control systems and compliance with cybersecurity standards.

What is the expected size of the automotive data logging and analytics hardware industry in 2025?

The market size is projected to reach USD 4.6 billion in 2025.

What is the market size of the automotive data logging and analytics hardware in 2024?

The market size was USD 4.4 billion in 2024, with a CAGR of 7.3% expected through 2034. The growth is driven by advancements in vehicle connectivity, electrification, and automation.

What is the projected value of the automotive data logging and analytics hardware market by 2034?

The market is poised to reach USD 8.7 billion by 2034, fueled by the adoption of software-defined vehicles, edge computing, and AI-enabled hardware.

Automotive Data Logging & Analytics Hardware Market Scope

Related Reports