Summary

Table of Content

Aramid Honeycomb Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aramid Honeycomb Market Size

Aramid Honeycomb Market size was USD 214.5 million in 2019 and will grow at a CAGR of 9.4% from 2020 to 2026. Growing trend of aramid composite material usage in automotive and aerospace industries will propel product demand.

The aramid honeycomb market is anticipated to witness a rapid growth due to the increasing number of end users of aramid composite materials in the aerospace industry. Aramid honeycomb core material demand has grown rapidly since its inception owing to the product’s extraordinary properties. The industry is also witnessing a weight reduction trend due to the material’s cost benefits, driving product demand.

To get key market trends

Aramid honeycomb core materials are increasingly gaining popularity among automotive and marine vehicle manufacturers. This is mainly attributed to its low cost compared to other composite materials. Its exceptional properties make it ideal for sandwich end users in the marine, automotive, rail, transport, and sports industries. Increasing demand for new-generation marine vehicles for commercial & personal uses will fuel the aramid honeycomb market share.

Aramid Honeycomb Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 214.5 Million |

| Forecast Period 2020 to 2026 CAGR | 9.4% |

| Market Size in 2026 | USD 314.88 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Currently, aramid honeycomb core materials are largely used in the aviation industry. The industry is expected to witness a moderate growth owing to a large number of retiring aircraft in the next 20 years. The reduction in air travel demand due to the Covid-19 pandemic has further forced airline companies to move up the aircraft retirement date. The introduction of new-generation aircraft will sideline older aircraft. Thus, in the next 10 years, most of the established airlines will order new aircraft, driving the aramid honeycomb market demand.

A similar trend can be witnessed in the marine industry as most cruise ships are facing the problem of early retirement. This is also attributed to lowered marine tourism due to the Covid-19 pandemic. However, the governments have acknowledged the impacts of the economic crisis on aviation & marine industries. They are offering stimulus packages to ensure industries’ survival and secure jobs for thousands of workers. The packages will increase production of aircraft and marine vessels around the world, propelling the aramid honeycomb market.

Growth in the defense expenditure in major economies is due to rising geopolitical conflicts and increasing conservatism. However, a large number of fighter aircraft in major military power countries are outdated and on the verge of retirement. These countries are procuring new generation aircraft, thus raising market opportunities for product manufacturers. Increasing conflicts between countries are boosting the demand for military shelters, that incorporate aramid honeycomb, further increasing the aramid honeycomb market demand in the coming years.

The automotive industry is also witnessing an increasing adoption of lightweight and strong composite materials. Materials such as fiberglass, carbon fiber, and aramid composites are witnessing a rising demand. This is mainly attributed to the high demand for fuel-efficient automotive. Aramid honeycombs are lightweight with higher tensile strength. It has witnessed a strong demand in the luxury automobiles segment and formula one race cars. However, in the past couple of years, the automotive industry growth has slowed down owing to the economic slowdown in major consumer markets.

Furthermore, the Covid-19 pandemic has forced manufacturers to suspend production in factories in the first half of 2020. Even after the opening of factories in the second half, the market was still affected by lower consumer confidence and decreased automotive demand, impacting aramid honeycomb market sales in 2020.

The Covid-19 pandemic has had a significant impact on product demand in 2020. Aviation and marine industries are highly affected due to the Covid-19 pandemic. Suspension of international & domestic flights has decreased air & marine travel demand and lockdowns have further affected product demand from the aforementioned industries. The economic slowdown has decreased the production of automobiles, aircraft, and marine vehicles, impacting product demand. Furthermore, aramid honeycomb industry stakeholders are also expected to face challenges from raw material price fluctuations.

Aramid Honeycomb Market Analysis

Learn more about the key segments shaping this market

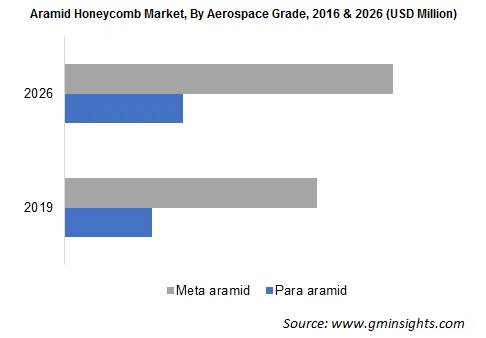

The para-aramid segment, in terms of volume, will grow with around 9.9% by 2026. Para-aramid honeycomb will witness the highest growth owing to its impact resistance. Para-aramid honeycomb such as Kevlar by Dupont has witnessed a sudden rise in demand from the aviation industry. Composites manufactured by para-aramid can withstand extreme pressure and forces, making it ideal for aerospace end users. The increasing production of new-generation lightweight aircraft will drive the aramid honeycomb market demand.

Learn more about the key segments shaping this market

The product is mainly available in two grades, i.e., aerospace commercial grades. It has extensive uses in the aerospace industry such as in aircraft floorings, panels, external body structures, compartments, etc. The growing production of new-generation commercial &V fighter aircraft will majorly drive aerospace-grade product demand. The aerospace grade segment demand share will reach around 75% in 2026.

Looking for region specific data?

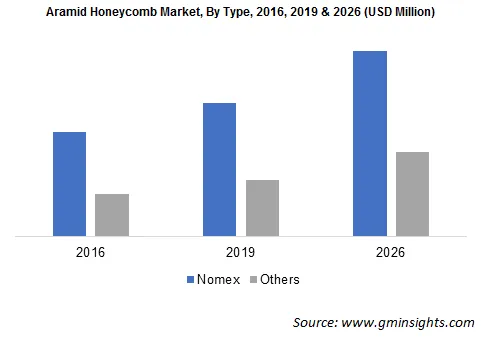

Nomex honeycomb is extensively used in aerospace & defense industries owing to its excellent properties and comparatively low cost. The aramid honeycomb market segment is expected to grow at a CAGR of more than 9% in terms of revenue. Nomex honeycomb provides excellent corrosion resistance, fire resistance, and strength-to-weight ratio, thus is ideal for the defense and aerospace industries. Aircraft manufacturing companies are also increasing the usage of lightweight materials with high-strength in multiple components, propelling product demand.

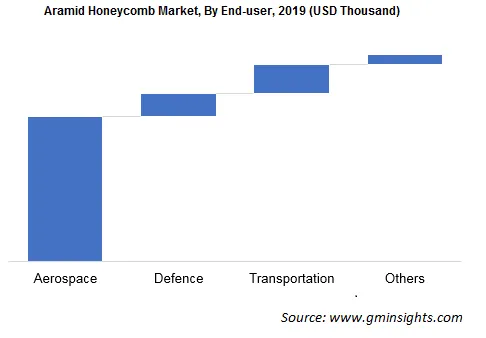

Aviation held a 70% market share by revenue in 2019. The aviation sector dominates the market as aramid honeycomb materials are used in manufacturing aircraft components. The commercial aerospace sector is expected to grow modestly due to the rapid growth in the number of passengers in Asia Pacific and Africa. Additionally, the increasing number of airports in emerging economies is creating a lucrative opportunity for aircraft manufacturers.

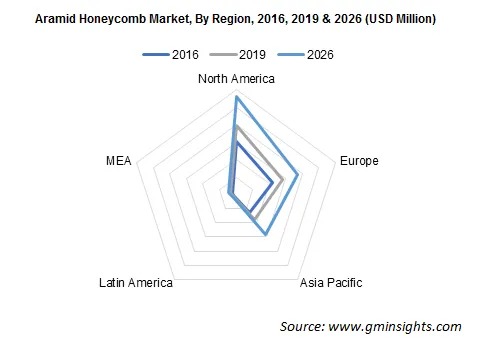

North America held the largest share in 2019, reaching a share of 43% in the overall market volume. The highest demand share is largely attributed to the presence of large aircraft manufacturers in the region. The increasing adoption of electrical automotive by consumers in the region will further propel product demand. The region also has a strong presence of automotive manufacturers, which will further solidify the aramid honeycomb market growth rate.

Aramid Honeycomb Market Share

Plascore, Inc., a major player involved in the aramid honeycomb industry, announced the expansion of production capacity at the Zeeland, Mich., U.S. facility. In September 2019, it started the construction of a 73,500-square-foot additional production facility. With this expansion, the company is expected to manufacture products at competitive prices. The other notable players engaged in the market are:

- Hexcel Corporation

- Euro-Composites S.A

- The Gill Corporation

- Argosy International, Inc

- Showa Aircraft Company Ltd

The aramid honeycomb market report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2016 to 2026 for the following segments:

By Aramid Type

- Para-aramid

- Meta-aramid

By Grade

- Aerospace

- Commercial

By Type

- Nomex

- Others

By End-user

- Aviation

- Defense

- Transportation

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Mexico

- Brazil

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

How will the demand for Nomex honeycomb impact the expansion of global aramid honeycomb industry?

Global aramid honeycomb industry share from the Nomex honeycomb segment is poised to grow at over 9% CAGR through 2026 owing to benefits like excellent corrosion resistance, fire resistance, and strength-to-weight ratio.

How much valuation did the global aramid honeycomb market achieve in 2019?

The global market for aramid honeycomb was valued at USD 214.5 million in 2019 and is likely to expand at 9.4% CAGR through 2026.

What aspects will influence the growth of para aramid honeycomb industry share?

The para-aramid segment is projected to grow at a 9.9% CAGR up to 2026 in terms of volume as composites manufactured using para-aramid can endure extreme forces and pressure, making it ideal for aerospace end-users.

Why is North America expected to emerge as a profitable revenue pocket for aramid honeycomb producers?

North America held a 43% share of the global market in 2019 and is poised to witness substantial growth owing to the presence of numerous aircraft manufacturers in the region.

Why is the aviation sector expected to dominate global aramid honeycomb market?

The aviation segment captured a 70% share of the industry revenue, attributed to the usage of aramid honeycomb materials in manufacturing aircraft components, coupled with the rising number of airports in developing economies.

Aramid Honeycomb Market Scope

Related Reports