Summary

Table of Content

Aramid Fiber Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aramid Fiber Market Size

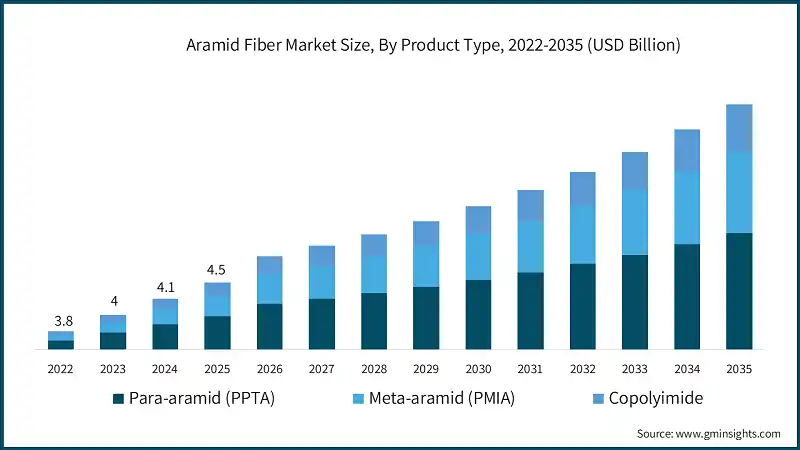

The global aramid fiber market was valued at USD 4.5 billion in 2025. The market is expected to grow from USD 4.9 billion in 2026 to USD 7.1 billion in 2035, at a CAGR of 4.8% according to the latest report published by Global Market Insights Inc.

To get key market trends

- Aramid fibers refer to synthetic fibers known for temperature resistance, high strength, and durability. These fibers belong to aromatic polyamide fibers that have properties like high tensile strength, abrasion resistance, and thermal stability. Aramid fibers are generally used in aerospace, military operations, personal protective equipment, and industrial manufacturing, where they bring enhanced performance where durability and safety are of utmost importance. Aramid fibers include para-aramid (PPTA) & meta-aramid (PMIA), with specific properties suited for different end-use applications.

- Aramid fibers with significant advances in technology in the past few years which have been influenced by advancements in polymer chemistry and fiber spinning techniques. Improved processing methods have increased fiber tenacity while reducing elongation, thereby yielding stronger materials fit for more applications in industry.

- Advancements in the recycling process have allowed the manufacture of recycled aramid fibers that solve some sustainability issues and reduced environment impact by offering manufacturers with greener products. Nanotechnology and hybrid composites have further enhanced the scope of applications for aramid fibers, especially in lightweight armor and advanced aerospace materials.

Aramid Fiber Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 4.5 Billion |

| Market Size in 2026 | USD 4.9 Billion |

| Forecast Period 2026-2035 CAGR | 4.8% |

| Market Size in 2035 | USD 7.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand in aerospace & defence | Aramid fibers are essential for lightweight, high-strength materials used in aircraft, spacecraft, and defense equipment, boosting market growth. |

| Rising need for personal protective equipment | Growing safety regulations and awareness drive demand for bulletproof vests, helmets, and protective gear made from aramid fibers. |

| Technological advancements | Innovations in fiber production, recycling, and hybrid composites increase performance and reduce costs, encouraging broader adoption. |

| Pitfalls & Challenges | Impact |

| High production costs | Complex manufacturing processes and expensive raw materials lead to higher prices, limiting widespread adoption. |

| Competition from alternative fibers | Emerging materials like carbon fibers and Ultra-High-Molecular-Weight Polyethylene offer competitive properties, challenging aramid fibers market share. |

| Opportunities: | Impact |

| Expansion into renewable energy | Use of aramid fibers in wind turbine blades and solar panel components presents a growing market segment. |

| Advanced composite materials | Integration of aramid fibers with nanomaterials and other fibers for next-gen composites can unlock new applications. |

| Automotive lightweighting trends | Growing electric vehicle production and fuel-efficiency regulations create demand for lighter, stronger materials. |

| Market Leaders (2025) | |

| Market Leaders |

17.6% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Fastest growing market |

| Emerging country | UAE, Saudi Arabia, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Aramid Fiber Market Trends

- Growing demand for fuel-efficient and emission-reduced high-performance engineering applications enhances the growth of lightweight materials in automotive and aerospace applications. Aramid fibers are widely in use within vehicle components, aircraft structures, tires, and brake systems as they enhance the weight reduction without compromising strength.

- Increasing renewable energy and infrastructure projects will provide new opportunities for aramid fibers. Their high tensile strength and fatigue resistance profile makes them suitable for wind turbine blades, suspension cables, and reinforcement in construction, especially in regions that are developing rapidly

- Continuous advancement in fiber processing and composite materials technology is rendering aramid applications further diversified. Hybrid composites and nano-reinforced fibers technologies will enhance performance, thereby appealing to modern industrial applications for further penetration.

- Urbanization, industrialization, and defence modernization in emerging economies are also fuelling demand. With governments investing in infrastructure, transportation, and security solutions, high-performance materials like aramid fibers are seeing accelerated uptake.

Aramid Fiber Market Analysis

Learn more about the key segments shaping this market

The market by product type is segmented into Para-aramid (PPTA), Meta-aramid (PMIA) and Copolyimide. Para-aramid (PPTA) hold the largest market value of USD 3.3 billion in 2025.

- Para-aramid (PPTA) is showing consistency in demand due to its high durability, lightweight properties, and ability to be applied in protective equipment, automotive parts, and industrial reinforcements. This is attributed to industries such as the automotive sector that bridges the gap in terms of improved performance and increased durability of components while saving on weight. Furthermore, ongoing improvements in fiber processing and composite integration have increased applications for new and existing applications.

- Another growing fiber is meta-aramid (PMIA) and copolyimide fibers as industries are leaning more towards heat resistance, flame retardancy, and stability for a long time for materials. Meta-aramid fibers find applications in safety apparel, produce electrical insulation as well as industrial safety equipment because of more stringent workplace safety protocols. Copolyimide fibers, while having more specific requirements, are becoming more important in environments with very high temperatures, such as aerospace, electronics, and chemical processing.

The aramid fiber market by physical form is segmented into filament yarn, staple fiber, spun yarn and blended fibers. Filament yarn holds the largest market value of USD 1.8 billion in 2025.

- Filament yarn and staple fiber are maintained in continuous use across diverse industrial and protection applications due to their strength, versatility, and appropriateness for processing in different types. Filament yarn is most likely used where continuous strength and uniformity are needed like ropes, cables, and technical textiles, whereas staple fibers are more common in nonwoven fabrics and protective wear offering blending flexibility and ease of manufacture. The ever-growing emphasis on the lightweight and high-performance textiles also adds to the relevance of both continues demand in physical forms.

- However, even spun yarn and blended fibers seem to be trending at the moment because the whole industry is exploring material that can maintain balance between performance, comfort, and value in every aspect of the cost. Spun yarn, with average mechanical properties, is highly applied in garments, filtration media, and industrial textile products. Blended fibers together with another synthetic or natural fiber, are used in improvements like comfort, thermal stability, or abrasiveness. While these physical forms maintain constant applications in many industries, manufacturers increasingly look for customizable and application-specific solutions.

The aramid fiber market by performance grade is segmented into standard tenacity (300-400 mN/tex), high tenacity (400-500+ mN/tex). Standard tenacity (300-400 mN/tex) holds the largest market value of USD 2 billion in 2025.

- Applications are based on the strength of aramid fibers in both standard and high tenacity. Standard tenacity fibers (300-400 mN/tex) are mainly applied in protective clothing, non-woven fabrics, and industrial textiles, in which they are sufficiently strong. High tenacity fibers (400-500+ mN/tex) are used in more demanding applications such as ballistic protection, aviation components, and high-performance ropes, where increased tensile strength correlates with better durability and safety. This means that the choice of grades will depend almost entirely on the specific mechanical and structural requirements set out by the industries that will ultimately use them.

The aramid fiber market by sources is segmented into virgin aramid fiber and recycled aramid fiber. Virgin aramid fiber holds the largest market value of USD 2.9 billion in 2025.

- Virgin aramid fiber has made very strong presence in many industries due to its total uniformity in quality, strength, and performance characteristics. Aerospace and defence, automotive, and personal protective equipment applications prefer virgin fibers to meet safety and durability standards since they are more rigid and stringent. Continued developments in fiber processing and manufacturing have kept the virgin aramid fibers available for high-end-critical applications.

- Recycled aramid fiber is becoming popular because industries tend to focus on sustainability and reducing environmental impact. Production scrap, end-of-life products or post-industrial waste sources recycled aramid, which is then reprocessed for protective clothing, composites, and nonwoven textiles.

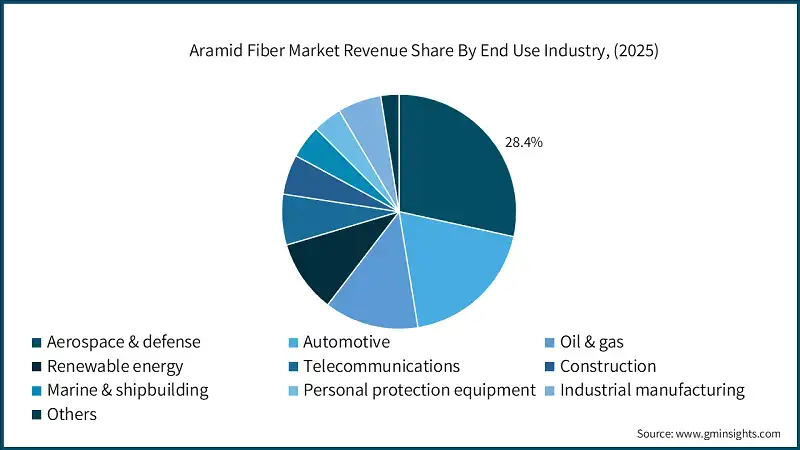

Learn more about the key segments shaping this market

The aramid fiber market by end use industry is segmented into aerospace & defense, automotive, oil & gas, renewable energy, telecommunications, construction, marine & shipbuilding, personal protection equipment, industrial manufacturing and others. Aerospace & defence holds the largest market value of USD 12.9 billion in 2025.

- Demand for aramid fibers arises from the aerospace and defence, automotive, and oil and gas sectors because these sectors require high strengths, heat resistance, and lightweight materials. In aerospace and defence applications, aramid fibers find their use in aircraft components, protective wear, and reinforcement of structures. As the automotive domain is concerned, automotive tire properties, durability, and lightweighting of components like brakes and engine parts increasingly depend on aramid fibers. Aramid fibers are used in harsh conditions within the oil & gas industry in hoses, cables, and safety equipment.

- Renewable energy, telecommunications, construction, marine & shipbuilding, personal protection equipment, industrial manufacturing, and other sectors began to adopt aramid fibers because of need for specified performance. Applications in renewable energy are blade structures of wind turbines and solar panel materials, while telecommunications would require aramid-reinforced cables for strength and stability. Composite and protective materials are used in construction and marine industries and for industrial manufacturing it is used in machines, and safety products. Personal protection equipment remains a major application area for all of them, with a special focus on firefighting and law enforcement, echoing the continued demand across different sectors.

Looking for region specific data?

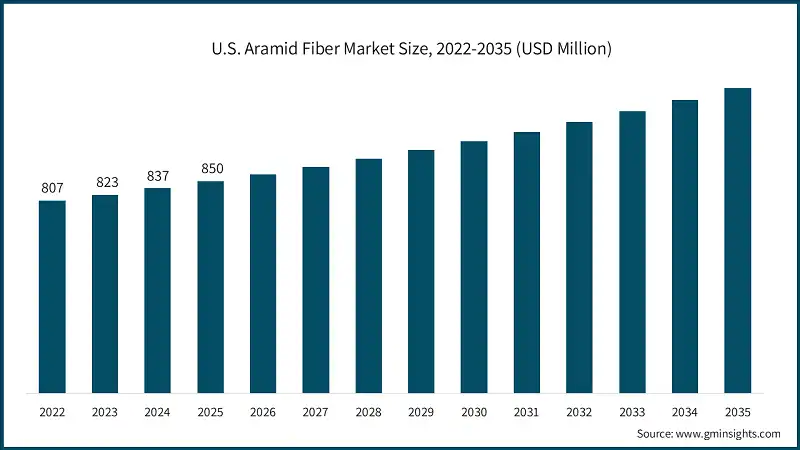

The U.S. aramid fiber market accounted for USD 850 million in 2025.

- The strong support for aramid fiber in North America comes primarily, from the United States, wherein consistent demand is driven by strong defense spending and advanced aerospace manufacturing. Constant emphasis on high-performance materials for military gear and aircraft components, along with industrial safety applications, consistently elevates the country's market position.

The market in the Germany is expected to experience significant and promising growth from 2025 to 2035.

- Aramid fiber growth in Europe is an integral component of the market due to the strong automotive engineering and well-established sectors of industrial manufacturing. Also, In Germany car manufacturers are getting into new lightweight, high-strength materials, which can improve the safety of vehicles and meet stricter emissions regulations, driving the advance of aramid fiber technology into advanced composite systems.

The aramid fiber market in China is expected to experience significant and promising growth from 2025 to 2035.

- APAC is the fastest-growing region in the aramid fiber industry and includes China, India, and Japan. China remains the most essential growth of the Asia-Pacific market, which is increasingly driven by the expansion of domestic manufacturing, rapid industrialization, and growing defense modernization efforts. The country is increasing the production capacity of both old and new players, thus becoming a competitive supplier in the global arena. The regional momentum is further fueled by strong demand from electronics, telecommunications, and automotive industries.

UAE market is expected to experience significant and promising growth from 2025 to 2035.

- The aramid fiber market keeps steadily growing in the Middle East and Africa catered by rising investments in defense, infrastructure, and industrial safety. The modernization of security forces, growing aerospace activity, and enormous construction projects requiring advanced materials are the drivers for such high-performance requirements in countries like the UAE in the Middle East. In Africa, such as those from South Africa, are highly adopted in mining, utilities, and manufacturing all needing flame-resistant and durable protective gear.

Brazil is expected to experience significant and promising growth from 2025 to 2035.

- Brazil is contributing to the aramid fibre market in Latin America owing to its increasing emphasis on industrial safety, energy infrastructure, and protective equipment needs. With the growth in Brazil's oil & gas sector, gaining momentum for worker safety regulations, and thus demand for heat-resistant and high-strength materials is steady. Systems and industries are maintaining the trend with increasing regional adoption of aramid fibres for applications in protective clothing, cables, and reinforcement materials.

Aramid Fiber Market Share

- Aramid Fiber markets are moderately consolidated with players like Teijin, Kolon Industries, Yantai Tayho, Hyosung, Toray holding 37.1% market share and Teijin being the market leader holding the market share of 17.6% in 2025.

- Aramid fiber manufacturers are constantly involved in research and development to improve fiber properties, designs of new variants, and production efficiency. Innovations in high-tenacity fibers, hybrid composites, and heat-resistant applications help companies meet evolving customer needs and remain relevant in the high-performance sectors such as aerospace, defense, and automotive.

- By establishing collaborations with technology providers, end user industries, and research institutions or universities, companies are increasing the strength of its market presence. These collaborations can facilitate co-development of customized solutions for new applications such as renewable energy or advanced composites; and sharing best practices which will lead to improved production processes.

- Eco-friendly practices, such as use of recycled aramid fibers, optimization of energy utilization, and reduction of chemical waste at the company level, are becoming the trend. Beyond being environmentally friendly, these practices are often adopted by consumers looking for sustainable solutions, maximizing the reputation of the brand and making it competitive in the market.

- Companies are maintaining their position in the market by engaging with customers and providing technical support for specific applications. Training, consulting, and testing services are given to customers to optimize the use of aramid fibers in their products. This builds very strong, long-term relationships but allows manufacturers to react quickly to changing industry requirements and emerging trends in the market, thus firming their status as players in the international aramid fiber industry.

Aramid Fiber Market Companies

Major players operating in the aramid fiber industry are:

- Aramid HPM S.L

- Beijing Landingji Engineering Tech Co. Ltd.

- China National Bluestar (Group) Co. Ltd.

- Guangdong Charming Chemical Co. Ltd.

- Henan Longsheng New Material Technology Co. Ltd.

- Huvis Corporation

- Hyosung Advanced Materials

- Jiangsu Shino New Materials Technology Co. Ltd.

- Jiaxing Newtex Composites Co. Ltd.

- Kermel

- Kolon Industries Inc.

- Ningxia Eppen Biotech Co. Ltd.

- SRO Aramid

- Sinopec Yizheng Chemical Fibre Co. Ltd.

- Taekwang Industrial Co. Ltd.

- Teijin Aramid B.V.

- Toray Industries Inc.

- X-FIPER New Material Co. Ltd.

- Yantai Tayho Advanced Materials Co. Ltd.

Teijin is a Japanese multinational firm that mainly deals in the cutting-edge technologies to make aramid fibres, advanced composites, and high-performance plastics. It produces aramid for protective clothing, industrial reinforcements, and automotive components. With innovation, sustainability, and performance it continues to develop stronger aramid fibres through improved thermal stability and versatility for wider industrial applications.

Kolon Industries manufactures a wide range of chemical and textile products including aramid fibers. It focuses on the high-strength heat-resistant fibers supplied for protective clothing, automotive parts and industrial applications. With technology development and quality control, Kolon delivers fibers in line with international performance standards ensuring its global presence in domestic and international markets.

Yantai Tayho in China, is a manufacturer of aramid fibers and other high-performance chemical materials. It supports various sectors that involve aerospace, defense, industrial manufacturing, and personal protection by offering fibers with strong tensile strength and thermal resistance. Currently, Yantai Tayho is busy with the expansion of production capabilities alongside technological innovation and application development to meet the future demand increase of high-performance fibers.

Hyosung is a South Korean company specializing in aramid fibers, carbon fibers, and other high-performance materials. The applications found in protective apparel, automotive components, and industrial reinforcements where it is prized for strength, heat resistance, and durability. Hyosung invests into further developing R&D and sustainable manufacturing practices that will enhance fiber performance and increase its market presence across the globe.

Toray is leveraging its competence in polymer chemistry, biotechnology, and nanotechnology to manufacture a myriad of products such as fibers and textiles, plastics and resins, carbon-fiber composites, and performance chemicals. Toray's target sectors include aerospace, automobile, electronic, healthcare, and environmental engineering industries. Committed to innovation and sustainability, this company manufactures high-performance materials to address industry and societal needs while maintaining a global presence through its many subsidiaries and affiliated companies.

Aramid Fiber Industry News

- In August, 2025, Arclin has acquired DuPont’s aramid business, including Kevlar and Nomex, marking a strategic expansion into high-performance fibers for aerospace, defense, personal protection, and electric vehicle sectors. The acquisition strengthens Arclin’s ability to offer advanced protective and structural solutions while broadening its global reach. By integrating these established brands, Arclin aims to drive innovation, enhance application development, and create synergies across industries, positioning itself for long-term growth in markets demanding lightweight, durable, and high-strength materials.

The aramid fiber market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of kilo tons from 2022–2035 for the following segments:

Market, By Product Type

- Para-aramid (PPTA)

- Meta-aramid (PMIA)

- Copolyimide

Market, By Physical Form

- Filament yarn

- Staple fiber

- Spun yarn

- Blended fibers

Market, By Performance Grade

- Standard tenacity (300-400 mN/tex)

- High tenacity (400-500+ mN/tex)

Market, By Source

- Virgin aramid fiber

- Recycled aramid fiber

Market, By End Use Industry

- Aerospace & defense

- Automotive

- Oil & gas

- Renewable energy

- Telecommunications

- Construction

- Marine & shipbuilding

- Personal protection equipment

- Industrial manufacturing

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

What was the valuation of the filament yarn segment in 2025?

The filament yarn segment accounted for USD 1.8 billion in 2025, making it the largest physical-form category due to its continuous strength, uniformity, and suitability for high-performance technical textiles.

What is the aramid fiber market size in 2025?

The market size for aramid fiber was valued at USD 4.5 billion in 2025, driven by growing demand in aerospace, defense, and high-performance protective applications.

What is the market size of the aramid fiber industry in 2026?

The market size reached USD 4.9 billion in 2026, supported by strong consumption in automotive, industrial manufacturing, and personal protective equipment.

What is the projected value of the aramid fiber market by 2035?

The industry size for aramid fiber is expected to reach USD 7.1 billion by 2035, growing at a CAGR of 4.8% (2026–2035). Advancements in fiber technologies, rising defense modernization, and renewable energy expansion are key growth drivers.

How much revenue did the para-aramid (PPTA) segment generate in 2025?

The para-aramid (PPTA) segment held the largest value at USD 3.3 billion in 2025, supported by high usage in protective gear, automotive components, ropes, cables, and industrial reinforcements.

What is the growth outlook for the aerospace & defense segment from 2025 to 2035?

The aerospace & defense segment remains the largest end-use industry, valued at USD 12.9 billion in 2025.

What was the market size of the U.S. aramid fiber industry in 2025?

The U.S. aramid fiber market was valued at USD 850 million in 2025, driven by strong defense spending, advanced aerospace manufacturing, and rising demand for high-performance protective materials across industrial sectors.

What are the upcoming trends in the aramid fiber industry?

Key trends include adoption of recycled aramid fibers, increased use of nano-reinforced and hybrid composites, expansion into renewable energy applications (wind turbine blades, solar components), and rising demand for lightweight materials in EVs.

Who are the key players in the aramid fiber market?

Major players include Teijin, Kolon Industries, Yantai Tayho, Hyosung, Toray, Huvis, Sinopec Yizheng, Kermel, X-FIPER, and Beijing Landingji Engineering Tech. These companies focus on innovation, sustainability, advanced composites, and high-tenacity fiber development.

Aramid Fiber Market Scope

Related Reports