Summary

Table of Content

Anti-acne Cosmetics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Anti-acne Cosmetics Market Size

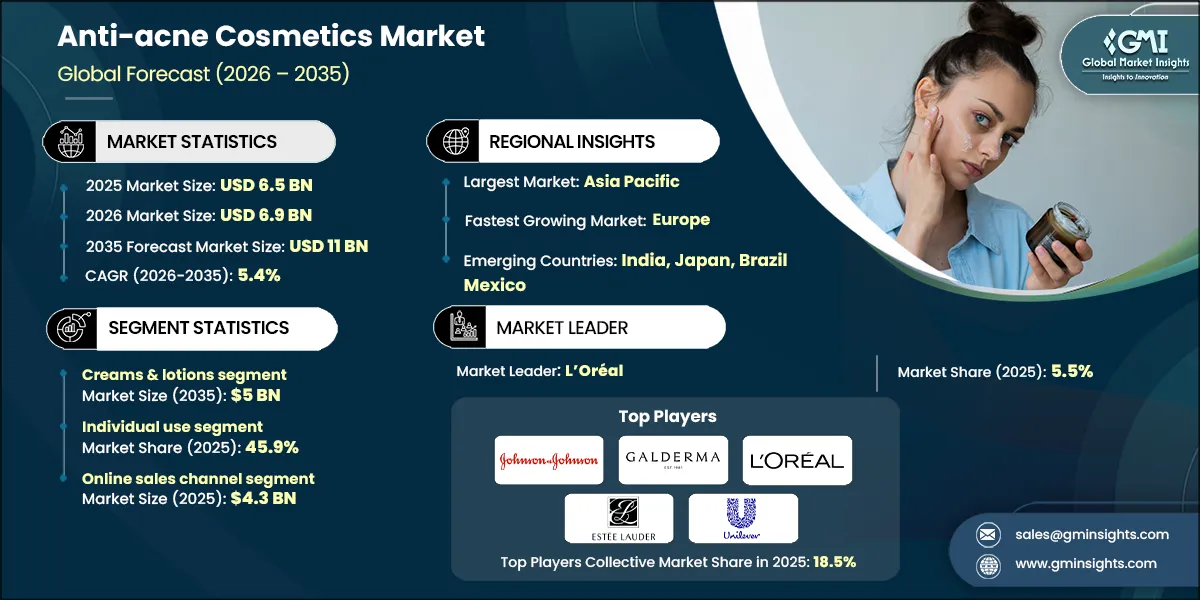

The global anti-acne cosmetics market was valued at USD 6.5 billion in 2025. The market is expected to grow from USD 6.9 billion in 2026 to USD 11 billion in 2035, at a CAGR of 5.4%, according to latest report published by Global Market Insights Inc.

To get key market trends

The clean beauty trend is significantly influencing the anti-acne cosmetics market. According to the American Academy of Dermatology Association, nearly 50 million people in America developed acne and is one of the most common skin conditions in the United States. Nearly 15% of adult women will be affected by acne, while 85% of people aged 12-24 years of age will have mild acne.

Further the demand for natural and organic skincare items is driving growth in this market. Many consumers now look for products with clean, natural and nontoxic ingredients when shopping for skincare items and want to move away from items that contain synthetic ingredients due to the concern about the side effects associated with them. To meet this demand for natural alternative products, numerous manufacturers like Neutrogena and the Ordinary have introduced product lines that focus on the use of natural, plant-based ingredients for the treatment of acne.

The U.S. Food and Drug Administration continues to regulate the manufacture and marketing of acne treatment products to maintain safety and effectiveness. This has helped to create confidence among consumers to purchase these products. Public health campaigns conducted by the Centers for Disease Control and Prevention also support consumer education in the management of acne and skincare, which supports the use of effective treatment options.

There has been considerable growth of the clean beauty market over the past few years and, according to Ulta's 2024 Beauty Consumer Insights research, 90% of Gen Z and younger millennials have stated they are interested in purchasing clean beauty products. Therefore, there has been considerable interest in purchasing sustainable, environmentally friendly products.

Many consumers are seeking natural, clean, and safe products for their skin, as seen by the growing number of consumers requesting these types of products. In addition, there has been a growing societal interest in environmentally sustainable beauty and the increasing government support through legislation and regulation for environmentally sustainable beauty products. Therefore, the demand for anti-acne products will continue to grow until 2025 and beyond.

Anti-acne Cosmetics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 6.5 Billion |

| Market Size in 2026 | USD 6.9 Billion |

| Forecast Period 2026-2035 CAGR | 5.4% |

| Market Size in 2035 | USD 11 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising prevalence of acne among adolescents and adult | Increasing acne cases globally, driven by hormonal changes and lifestyle factors, significantly boost demand for targeted cosmetic solutions. |

| Growing awareness and dermatological consultations | Higher consumer education and easy access to dermatologists encourage adoption of clinically tested anti-acne products. |

| nnovation in formulations and delivery systems | Higher consumer education and easy access to dermatologists encourage adoption of clinically tested anti-acne products. |

| Pitfalls & Challenges | Impact |

| Changing consumer preferences and trends | Frequent shifts toward natural or minimalist skincare can disrupt demand for traditional acne products, requiring brands to adapt quickly. |

| Counterfeit and imitation products | Proliferation of fake products online undermines consumer trust and poses safety risks, impacting brand reputation and market growth. |

| Opportunities: | Impact |

| Integration of smart skincare and personalization | AI-driven skin analysis and personalized product recommendations create new engagement channels and boost premium product adoption. |

| Sustainability and clean beauty trends | Rising demand for eco-friendly, cruelty-free formulations opens opportunities for brands to differentiate through green innovations. |

| Market Leaders (2025) | |

| Market Leader |

5.5% market share |

| Top Players |

Collective market share in 2025 is 18.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Europe |

| Emerging countries | India, Japan, Brazil, Mexico |

| Future outlook |

|

What are the growth opportunities in this market?

Anti-acne Cosmetics Market Trends

Changing innovation and technology transformation are important for the growth of the market.

- The market is witnessing notable trends, including the increasing adoption of digital marketing strategies and a growing focus on dermatologist-recommended products. According to the American Academy of Dermatology Association, over 50 million individuals in the US are affected by acne annually. Brands such as Neutrogena and La Roche-Posay have effectively utilized digital platforms to highlight their dermatologist endorsements, aligning with consumer preferences for expert-backed skincare solutions.

- One of the driving trends shaping the anti-acne cosmetics market is the introduction of innovative new product formulations such as anti-acne masks containing activated charcoal as well as clay and salicylic acid, both of which have excellent acne-fighting abilities. Many consumers are attracted to the convenience offered by sheet masks, peel-off masks, and overnight masks.

- Another major trend driving the market is the increasing popularity of natural & cruelty-free products. Anti-acne creams and lotions are now more widely utilizing natural ingredients like tea tree oil, aloe vera, and green tea. Companies like The Body Shop and Paulas Choice have capitalized on this trend by offering eco-friendly dermatologist-approved therapeutic products that meet end-users’ demands for sustainable, ethical skin care choices.

- Consumers are looking for multifaceted skin care products such as those that help control the development of acne, but also have hydrating, calming and anti-inflammatory properties. One example is CeraVe's acne foaming cream cleanser, which provides treatment for acne while also providing moisture to the skin; therefore, it appeals to a much larger audience than just those who are experiencing acne. This trend towards holistic products is indicative of a growing demand for skin care solutions that are all-inclusive and provide other benefits as well as acne treatment.

- According to the federal government and industry experts, the anti-acne products will continue to grow through the year 2026. Companies such as Proactiv and Murad are investing heavily in research and development to produce and launch more advanced products so that they can remain competitive with one another by continuing to meet the ever-changing needs of their consumers.

Anti-acne Cosmetics Market Analysis

Learn more about the key segments shaping this market

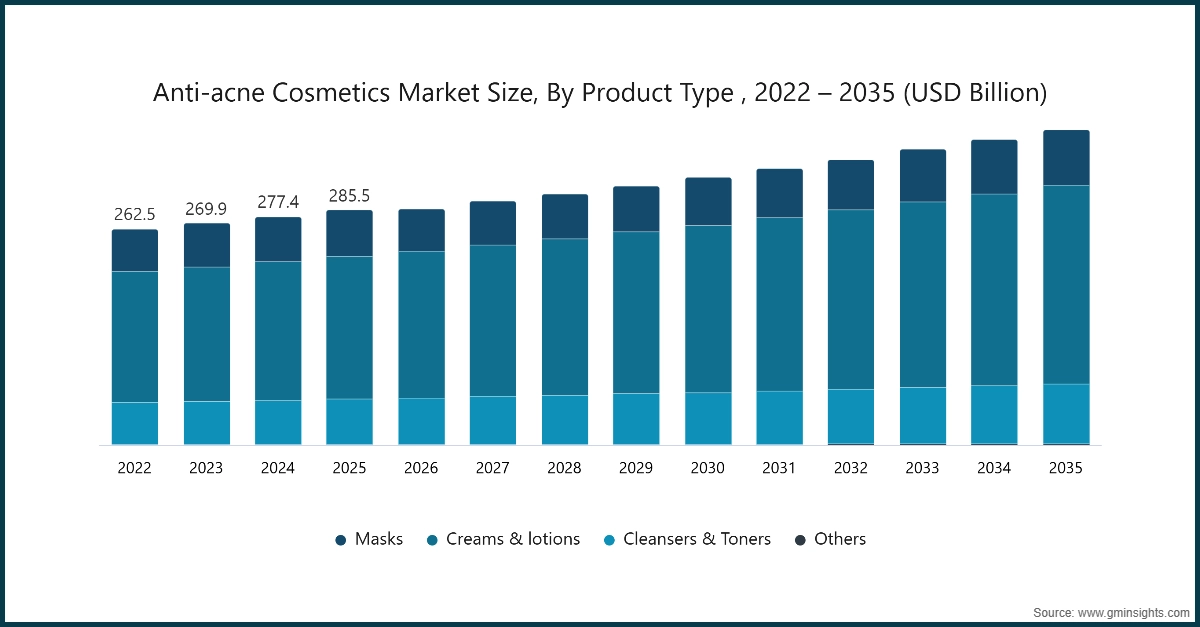

Based on product, the anti-acne cosmetics market is segmented masks, creams & lotions, cleansers & toners, and others. The creams & lotions segment accounts for revenue of around USD 2.9 billion in the year 2025 and is expected to reach USD 5 billion by 2035.

- The creams and lotions segment continues to lead the market, driven by its multifunctional benefits. Consumers increasingly prefer products that address acne while offering additional advantages such as anti-aging, hydration, and skin brightening. It is anticipated that this trend will continue until 2025 due to changing tastes and trends regarding what consumers want in an anti-acne skin care product.

- Government data indicates that there is a constant growth in the number of consumers who want to purchase natural and/or organic based skin care products. In FDA 2023 (United States) reported a 15% increase in interest from consumers to purchase organic based cosmetics from the. Therefore, products containing ingredients like tea tree oil, aloe vera, and green tea are becoming popular with manufacturers, such as Neutrogena and The Body Shop utilizing them in their products.

- Products that have both salicylic acid, benzoyl peroxide, or retin-a (retinoids) combined with soothing agents such as hyaluronic acid have taken shares of the market. La Roche-Posay and CeraVe have both successfully produced this type of formulation to meet the demand of consumers looking for effective but gentle methods to treat their acne.

- The market leaders are continuing to lower irritation while also increasing their efficacy. Proactiv has taken a different approach to treating acne based on the skin-nourishing qualities of their recent product line and the combination of these two approaches meets consumer demand for a total solution for skin care.

- As the forecast period progresses, the creams and lotions segment is expected to dominate, supported by innovation and consumer trust. The segment's growth is further fueled by rising awareness and accessibility, with companies leveraging e-commerce platforms to expand their reach globally.

Learn more about the key segments shaping this market

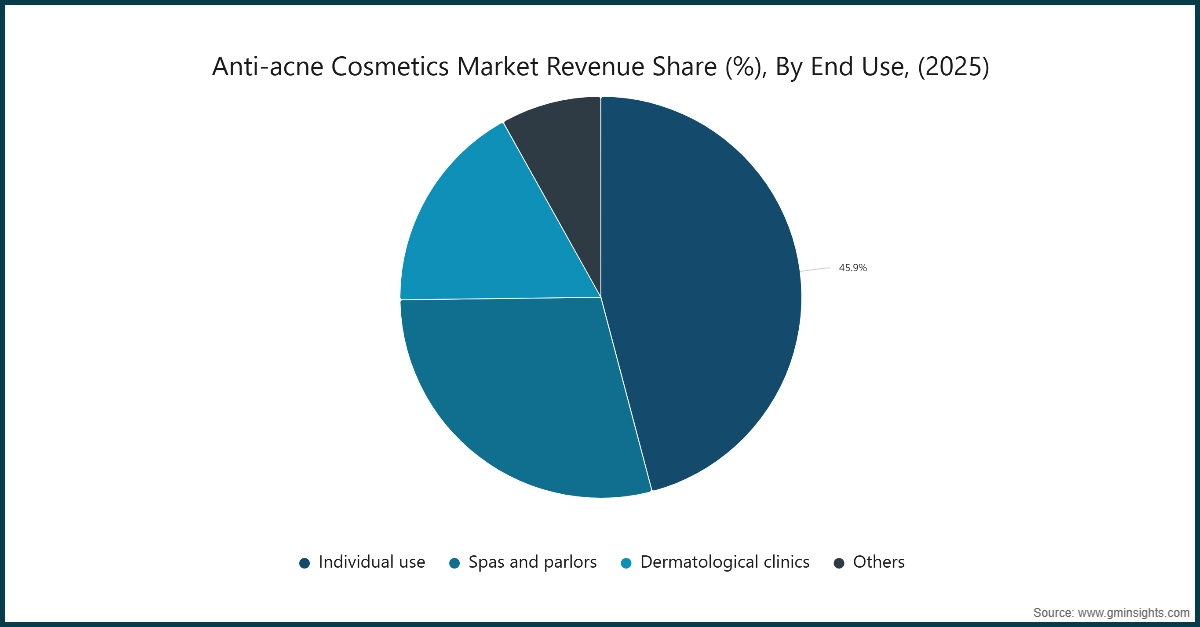

Based on the end use, the anti-acne cosmetics market is bifurcated into individual use, spas and parlors, dermatological clinics and others. The individual use segments held the largest share, accounting for 45.9% of the global market in 2025.

- Individual end users drive the market due to their growing preference for convenient and cost-effective solutions for acne treatment. The shift toward at-home treatments eliminates the need for frequent clinical visits, saving both time and money. Products like Neutrogena's acne therapy cleansers cater to this demand by offering professional-grade results. Highlighting the increasing reliance on self-care solutions among consumers, further solidifying their role in market growth.

- Social media and the concept of self-care have also played a large role in creating more and more anti-acne products. Platforms like Instagram and TikTok have played a large role in providing the public with access to knowledge about the potential benefits associated with using anti-acne cosmetics

- Individual-use products provide various solutions for every type of consumer need and market, from budget-savvy options such as clean & clear to premium products like La Roche-Posay. Additionally, various individual-use products include multiple targeted approaches to managing acne, including, but not limited to, spot treatments and weight-control serums.

- Skincare technologies have changed the way people use anti-acne products. There is now a quicker way for people to get results from using Proactiv's advanced micro-crystal benzoyl peroxide technology than ever before and as a result, many consumers are looking for fast-acting remedies to treat their acne and maintain their clear skin.

- Companies are continuing to expand outside their traditional range of products in order to reach new customers. For example, L'Oréal's active cosmetics division reported that it had increased its revenue by double digits in the year 2025, largely due to the success of its brands focused on treating acne (Vichy and CeraVe

Based on distribution channel, the anti-acne cosmetics market is segmented online and offline. The online sales channel segment held the largest share, generating a revenue of USD 4.3 billion of the global market in 2025.

- The market relies heavily on the use of the online distribution channel. Because of the ability for customers to be able to easily access a large variety of products at once, the online distribution channel accounts for the largest portion of the overall anti-acne market. The US Census Bureau anticipates an increase in e-commerce sales, which will grow by 14% in 2026.In addition to shopping through traditional retail outlets, consumers are going to platforms such as Amazon, Sephora, Ulta, and their own brand-specific websites for their convenience and the ability to easily compare products.

- Through the use of online distribution channels, a variety of information about products and their ingredients is easily accessible to consumers, leading to a more informed buying decision. Many brands such as Neutrogena and La Roche-Posay provide online platforms to showcase verified user testimonials and ratings, thus helping to create consumer trust in their products.

- The online review and rating system is also instrumental in driving the online purchase of anti-acne products. According to a survey in 2025, 80% of consumers use customer reviews before purchasing skin care products online. Brands such as The Ordinary and Paula's Choice encourage their users to provide feedback about their experiences and highlight positive ratings to build consumer credibility and ultimately attract new customers.

- As a result of the growing popularity of e-commerce in the Asia-Pacific region due to increased internet access and smartphone usage, the Asia-Pacific region is becoming a key growth market for online anti-acne cosmetics. The World Bank estimates that e-commerce in the Asia-Pacific region experienced 16% growth per annum through 2025.

Looking for region specific data?

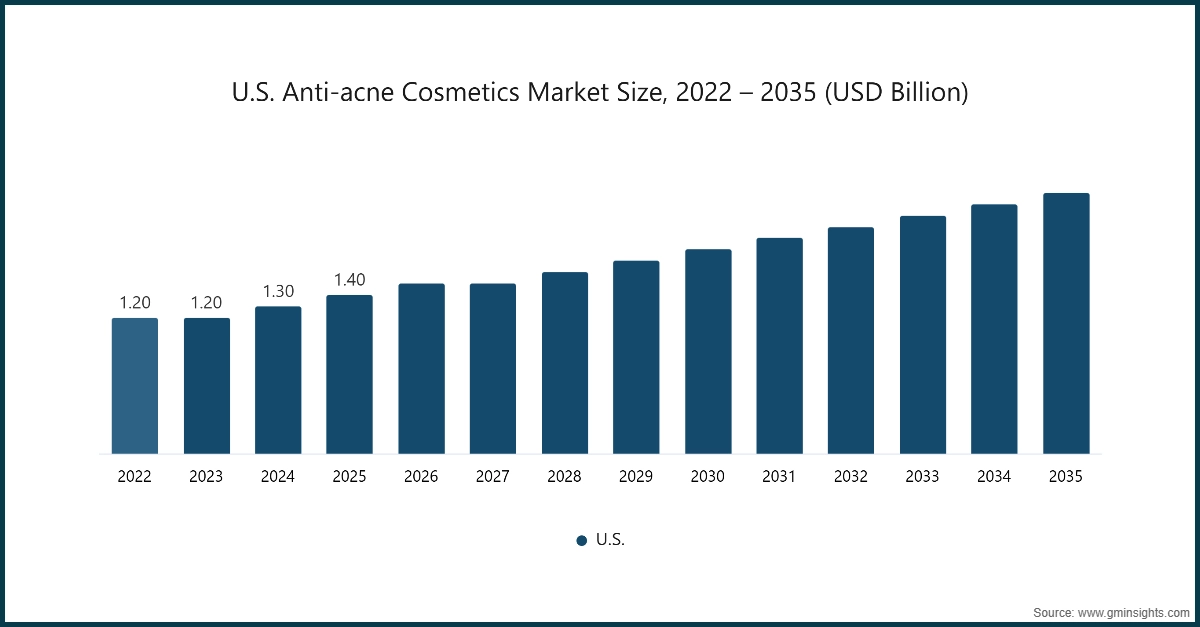

North America Anti-acne Cosmetics Market

In 2025, the U.S. dominated the market growth in North America, accounting for 74.5% of the share in the region.

- The U.S. dominates due to high consumer awareness, strong presence of premium skincare brands, and widespread access to dermatologists. Rising demand for clinically proven, OTC anti-acne cosmetics and influencer-driven marketing further boosts adoption.

- The U.S. skincare market benefits from robust spending power, with personal care expenditure exceeding USD 90 billion according to U.S. Bureau of Economic Analysis 2024. Additionally, acne affects nearly 50 million Americans annually as per American Academy of Dermatology, driving consistent demand for advanced solution .

Asia Pacific Anti-acne Cosmetics Market

Asia Pacific market is expected to grow at 5.7% during the forecast period.

- Growth is fueled by rising disposable incomes, urbanization, and increasing prevalence of acne among young consumers. Social media influence and K-beauty trends accelerate adoption of innovative anti-acne formulations across countries like China, India, and South Korea.

Europe Anti-acne Cosmetics Market

Europe market is expected to grow at 5.4% during the forecast period.

- Europe’s growth is supported by strong demand for clean beauty and dermatologist-endorsed products. Regulatory emphasis on safe, sustainable formulations and rising preference for natural actives like tea tree oil and niacinamide drive market expansion.

Middle East and Africa Anti-acne Cosmetics Market

Middle East and Africa market is expected to grow at 4.7% during the forecast period.

- MEA growth stems from increasing awareness of skincare, rising middle-class incomes, and expansion of premium beauty retail channels. Hot and humid climates contribute to higher acne incidence, boosting demand for oil-control and anti-acne solutions.

Anti-acne Cosmetics Market Share

The top companies in the market include Johnson & Johnson, Galderma, Estée Lauder, Unilever and L’Oreal and collectively hold a share of 18.5% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Johnson & Johnson leverages brands like Clean & Clear and Neutrogena to target acne-prone skin through clinically proven actives and teen-focused marketing. Their Clean & Clear “Advantage” line emphasizes clear, oil-free skin and engages younger consumers via social media campaigns. Ongoing R&D and dermatology-backed innovations ensure the brand remains relevant in global acne care. Galderma, as a pure-play dermatology leader, focuses on science-backed acne treatments through its Cetaphil and therapeutic product lines.

With a strong presence in over 90 countries and engagement with 110,000+ HCPs, it emphasizes education, clinical validation, and omni-channel reach to penetrate markets including the Middle East. Estée Lauder’s strategy includes hyper-personalized skincare driven by AI analytics and targeted innovation, spotlighting scientifically effective routines. Their acquisition of brands like The Ordinary strengthens evidence-based product offerings and boosts appeal in prestige skincare. DTC and digital channels account for over a third of revenues, reinforcing their focus on targeted acne skincare.

Anti-acne Cosmetics Market Companies

Major players operating in the anti-acne cosmetics industry are:

- AbbVie

- Bayer

- Beiersdorf

- Estée Lauder

- Galderma

- Honasa Consumer

- Johnson & Johnson

- L'Oréal

- Mario Badescu

- Natura & Co

- Pierre Fabre

- Shiseido

- Sunday Riley

- Teva

- Unilever

Unilever’s Lifebuoy Skin Solutions line integrates acne-targeting actives into its hygiene-first cleansers, offering germ protection with skincare benefits. This multipurpose approach addresses acne, oily skin, and blemishes, aimed at value-seeking consumers in diverse markets. The brand’s success reflects growing demand for functional bodycare with clinical efficacy.

L’Oréal leads with dermocosmetic brands such as La Roche-Posay and Vichy, focusing on microbiome science and dermatologist-endorsed formulations. The company invests in global skin health initiatives and advanced R&D to strengthen its acne care portfolio.

Anti acne cosmetics Industry News

- In July 2025, L’Oréal’s La Roche?Posay brand unveiled strategic plans to drive USD 3 billion in sales, emphasizing acne management tools, microbiome research, and a Gen Z acne coaching app, underscoring its shift toward science-based dermo cosmetics in the acne segment.

- In May 2025, Beiersdorf entered a strategic partnership with Vincere Biosciences to develop next-generation skincare solutions, targeting cellular health mechanisms, such as mitophagy, that could lead to innovative acne and skin-rejuvenating products.

- In March 2025, Galderma announced at AAD 2025 it would present new data from its acne and sensitive skin portfolio, highlighting its scientific leadership in acne care alongside updates on other dermatological innovations.

- In early 2025, Mario Badescu expanded its Acne Fighters line with the launch of “Deep Blemish Solution”, targeting deep under-skin blemishes using a novel B?vitamin treatment; the new product is already live in its acne-focused collection.

- In April 2024, AbbVie launched two new SkinMedica anti-acne products, the “Acne Clarifying Treatment” and “Pore Purifying Gel Cleanser”, formulated with 2% encapsulated salicylic acid, niacinamide, and bakuchiol, all part of a clinically backed acne-care regimen.

The anti-acne cosmetics market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2022 to 2035), for the following segments:

Market, By Product Type

- Masks

- Creams & lotions

- Cleansers & toners

- Others

Market, By Price

- Low

- Medium

- High

Market, By End Use

- Individual use

- Spas and parlors

- Dermatological clinics

- Others

Market, By Distribution Channel

- Online

- E-Commerce

- Company website

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Others (Individual stores, Departmental stores, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

Who are the key players in the anti-acne cosmetics market?

Key players include AbbVie, Bayer, Beiersdorf, Estée Lauder, Galderma, Honasa Consumer, Johnson & Johnson, L'Oréal, and Mario Badescu.

Which region leads the anti-acne cosmetics market?

The U.S. dominated the North American market in 2025, accounting for 74.5% of the regional share, driven by a high prevalence of acne and strong consumer demand for advanced skincare products.

What are the upcoming trends in the anti-acne cosmetics industry?

Key trends include the adoption of digital marketing strategies, the introduction of innovative formulations such as activated charcoal and salicylic acid masks, and the growing popularity of convenient skincare solutions like sheet masks and overnight treatments.

What was the valuation of the online sales channel segment?

The online sales channel segment held the largest share, generating USD 4.3 billion in revenue in 2025.

What is the projected size of the anti-acne cosmetics market in 2026?

The market is expected to grow to USD 6.9 billion in 2026.

How much revenue did the creams & lotions segment generate?

The creams & lotions segment generated approximately USD 2.9 billion in 2025 and is projected to reach USD 5 billion by 2035.

What was the market size of the anti-acne cosmetics market in 2025?

The market size was valued at USD 6.5 billion in 2025, with a CAGR of 5.4% expected through 2035, driven by technological innovations and increasing consumer demand for dermatologist-recommended products.

What is the projected value of the anti-acne cosmetics market by 2035?

The market is expected to reach USD 11 billion by 2035, fueled by innovative product formulations, digital marketing strategies, and growing consumer preference for expert-backed skincare solutions.

Anti-acne Cosmetics Market Scope

Related Reports