Summary

Table of Content

Aluminum Pigments Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aluminum Pigments Market Size

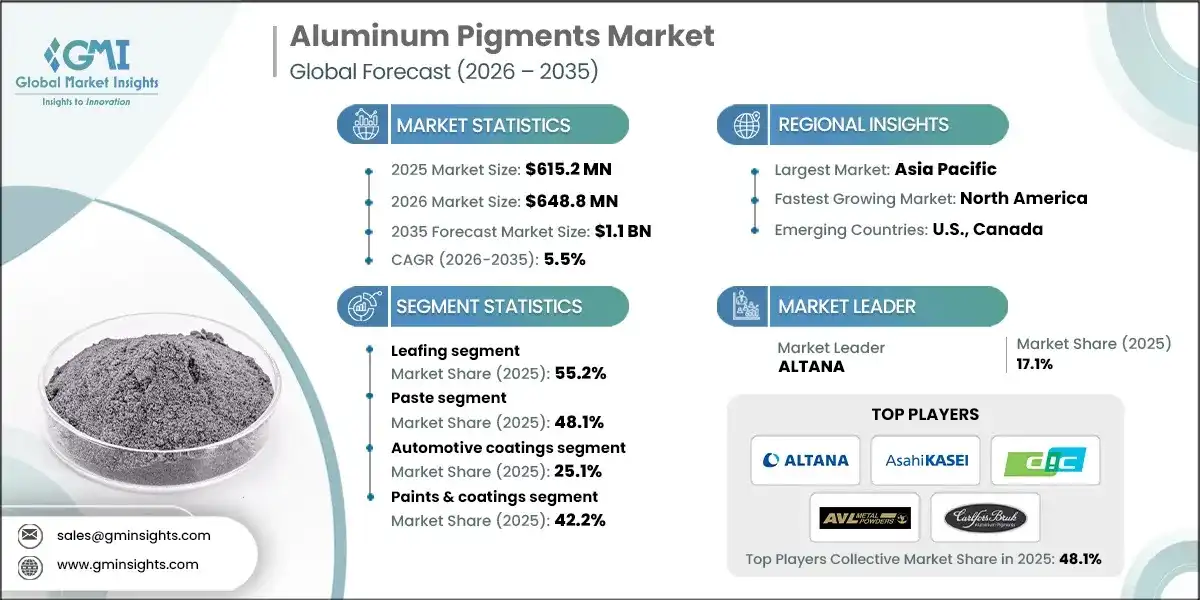

The global aluminum pigments market was valued at USD 615.2 million in 2025. The market is expected to grow from USD 648.8 million in 2026 to USD 1.1 billion in 2035, at a CAGR of 5.5% according to latest report published by Global Market Insights Inc.

To get key market trends

- The growth of aluminum pigments is notable as demand is increasing in various sectors such as automotive, packaging, cosmetics and paint & coatings. The pigments, which are recognized for highly reflective and metallic look, are simply understood to either enhance aesthetic appeal or functional property of products. Its main duty is to ensure a high-gloss and mirror-like finish and enhance durability, corrosion tolerance, and thermal stability in the end-use applications.

- Aluminum pigments are known for their tremendous benefits, they provide a high degree of opacity, brightness and metallic effects-most desirable conditions for decorative coatings and packaging. The reflective property of these pigments enables energy conservation through lesser heat absorption, thereby promoting their use in reflective paints and roofing materials. They are also respected for their chemical stability and environmental resistance, which adds to the durability of the products.

- In applications, aluminum pigments are mainly used in automobile coatings giving a metallic look. In cosmetics, these pigments are being applied for products such as eye shadow, nail paints, and face powders that require a touch of luxuriant metallic effect. The packaging industries utilize aluminum pigments in printing inks and foils, which apply to the layering of aesthetic gratification. Additionally, they are internationally accepted for use in decorative paints, protective coatings, and plastics to enhance aesthetic appeal and functional performance.

Aluminum Pigments Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 615.2 Million |

| Market Size in 2026 | USD 648.8 Million |

| Forecast Period 2026-2035 CAGR | 5.5% |

| Market Size in 2035 | USD 1.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising demand in automotive and aerospace industries | Aluminum pigments are increasingly used in automotive coatings and aerospace applications due to their reflective and aesthetic properties, driving market expansion. |

| Growing preference for eco-friendly and sustainable coatings | The shift towards eco-friendly paints and coatings utilizing aluminum pigments for enhanced durability and reflectivity is boosting market growth. |

| Expanding use in decorative and packaging applications | The increasing demand for metallic finishes in packaging, consumer goods, and decorative paints is fueling the adoption of aluminum pigments. |

| Pitfalls & Challenges | Impact |

| Volatility in raw material prices | Fluctuations in the prices of aluminum and other raw materials can impact production costs and profit margins. |

| Environmental and regulatory challenges | Stringent environmental regulations related to the production and disposal of aluminum pigments may hinder market growth and increase compliance costs. |

| Opportunities: | Impact |

| Innovation in nano-aluminum pigments | Developing nano-sized aluminum pigments with enhanced properties presents opportunities for high-performance coatings and specialty applications. |

| Integration with smart coatings and technologies | Combining aluminum pigments with smart coating technologies for UV protection, anti-corrosion, or thermal management opens new avenues for market expansion. |

| Market Leaders (2025) | |

| Market Leaders |

17.1% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Emerging Country | U.S., Canada |

| Future Outlook |

|

What are the growth opportunities in this market?

Aluminum Pigments Market Trends

- The aluminum pigments industry is projected to witness dynamic growth due to technological advances, developing regulatory frameworks, and ongoing product innovations. Recent technological enhancement has improved the production process in a manner that enables manufacturers to produce aluminum pigments of greater uniformity with higher quality standards, thereby improving reflectivity, stability and environmental efficiency.

- As regards the use of hazardous chemicals and solvent emissions, the regulatory framework is becoming quite stricter. This change in regulation is triggering an industry-wide inclination toward greener manufacturing practices. Governments and various environmental agencies have begun tightening regulations around volatile organic compounds (VOCs) and heavy metals, hastening the move away from toxic aluminum pigments toward safer alternatives. In turn, this sets the stage for more research on innovative materials that fulfill safety requirements without compromising performance, leading to further market growth.

- Among the many factors driving market growth product innovation is a major one. New aluminum pigment varieties are manufactured by manufacturers but with improved characteristics such as thermal resistance, corrosion protection, and some aesthetic effects like those of chameleon or holographic finish. Such innovations are applied in areas like automotive coatings, cosmetics, packaging, and architectural paints where aesthetic enhancement and durability are of utmost importance.

Aluminum Pigments Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is segmented into leafing, and non-leafing. Leafing dominated the market with an approximate market share of 55.2% in 2025 and is expected to grow with a CAGR of 5.6% by 2035.

- The leafing aluminum pigments segment of the market is growing steadily, mainly due to their widespread use in automotive coatings, architectural paints, and packaging applications. Leafing pigments are expressed by their ability to create a very thin reflective layer on the surface of coatings resulting in a very metallic-looking and highly glossy finish. This quality makes them most coveted in high-end automotive paints and decorative applications, where aesthetics is prime.

- Non-leafing aluminum pigments are increasingly being adopted due to their functional benefits such as opacity, corrosion resistance, and uniform dispersibility in coatings. Non-leafing pigments are significant because they are highly used in applications such as industrial coatings, heat reflective paints, and plastics, since they retain metallic appearance and durability. The growing demand trend of non-leaving pigments is driven by superior performance in terms of both protective and eco-friendly formulations. Innovations in surface treatment and particle size reduction broaden their scope of application.

Learn more about the key segments shaping this market

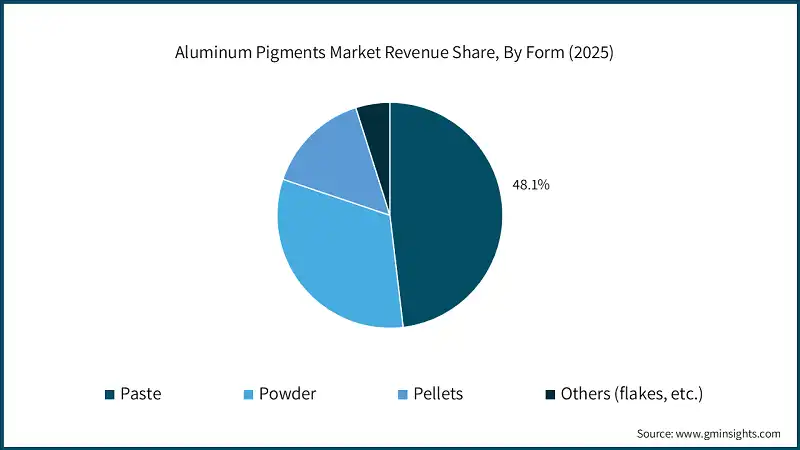

Based on form, the aluminum pigments market is segmented into paste, powder, pellets, others (flakes, etc.). Paste held the largest market share of 48.1% in 2025 and is expected to grow at a CAGR of 5.6% during 2026-2035.

- The paste form segment of aluminum pigments enjoys the largest opportunity among the applications because of its growing use in automotive coatings, industrial paints, and decorative finishes. Paste aluminum pigments are known to have excellent dispersibility and are easy to use on high-quality coatings that require a smooth, reflective surface. Paste pigments are also appealing to the manufacturers who want to beautify and provide durability for their products because they offer easy-blending and uniform distribution.

- The powder form is dependent on application for a wide range of manufacturing processes. Applications include automotive paints, plastics, and cosmetics. Excellent heat space stability, superior humidity, and easy handling during manufacture are some advantages of powder aluminum. Eco-friendliness is also attributed to powder aluminum pigments because, in contrast to liquid pigments, powder pigments contain relatively lesser volatile organic compounds (VOCs), whose efficacy in growing importance on sustainability and low-emission products further propels it along in the acceptance of powder aluminum pigments in various industries.

- Pellets particles have unique optical characteristics such as high reflectivity and metallic luster, which makes them attractive for applications requiring precise control of appearance and performance. The present technological developments are almost exclusively targeted at optimization of pellet dimensions and surface treatment to enhance dispersion and adhesion in various matrices.

Based on application, the market is segmented into automotive coatings, industrial coatings, architectural/decorative coatings, gravure inks, flexographic inks, industrial plastic, nail products, face makeup, hair care products, and others. Automotive coatings segments dominated the market with an approximate market share of 25.1% in 2025 and is expected to grow with a CAGR of 5.8% by 2035.

- The most heavily relied-on segment of the aluminum pigments market is automotive coatings, which is expected to undergo phenomenal growth because of the increasing need for high-gloss, shiny, and durable finishes in vehicles during production. These pigments are primarily used for metallic effects, color enhancement and resistance to corrosion. Evidence of manufacturers keener interest in adopting the latest high-performance innovative and green technologies for automotive coatings is reflected in their increased usage of aluminum pigments.

- Aluminum pigments are one of the components used in industrial coatings with their superior reflective, durability, and corrosion-resistant properties justifiably installed both for protection and ornament. This segment receives a buoyant boost due to the increase in demand for strong, long-lasting weather-resistant coatings used in infrastructural machinery and maritime installations. It has been extended further by eco-friendly formulations like water-based and low-VOC coatings, which extend the boundaries of aluminum pigments towards end applications in industrial coatings.

- The aesthetic market of architectural and decorative coatings has aluminum pigments, as high-gloss, metallic, and textured finishes convert from interior to exterior applications. With consumers and builders demanding innovative and visually striking surfaces, aluminum pigments have infiltrated paint and decorative coatings, apparently with drastic increased use. The trend also features specialized pigment grades built with better dispersibility, color consistency, and environmental safety.

- Aluminum pigments is incorporated in the development of other products like inks in gravure and flexography printing that result in metallic visual effects on materials that enhance aesthetics and brand distinction. Such improvements in developing aluminum-based inks are driven by the increasing market for luxury packaging purposes, cosmetics, and specialty printed materials.

- Aluminum pigment is used in personal care applications, including nail products, face makeup, and hair care formulations, to achieve shimmer, reflection, and metallic effects sought by consumers who crave novelty in cosmetics. The most demanding high-quality aluminum pigments are used in this sector of the beauty industry since they specialize in presenting visually attractive products with unique textures and finishes.

Based on end user, the aluminum pigments market is segmented into paint & coatings, printing inks, plastics, personal care & cosmetics, and others. Paints & coatings segments dominated the market with an approximate market share of 42.2% in 2025 and is expected to grow with a CAGR of 5.6% by 2035.

- The end users of aluminum pigments are primarily in the paints and coatings industry, which requires durable, high-gloss, and reflective finishes for automotive, architectural, and industrial maintenance purposes. Aluminum pigments are highly valued for their considerable anti-corrosion property, high-refractive index, and aesthetic appeal, suit decorative and protective coatings equally.

- Within the printing inks sector, aluminum pigments are mainly employed as metallic effects to visually enhance packaging, labels, and decorative prints, giving them an appearance of premium quality. Demand for metallic inks containing aluminum pigments has increased significantly with the growth of luxury packaging, cosmetics, and specialty printing.

- Aluminum pigments are employed in the plastics industry to give a metallic appearance, improve heat-reflective properties and provide corrosion resistance in plastic items. Its applications range from automotive parts and consumer appliances to packaging and decorative items. Market trends highlight the development of lightweight, eco-friendly aluminum pigments that disperse well in polymer matrices while improving the aesthetic, and functional qualities of plastics.

- The personal care and cosmetics sector is experiencing rapid growth, spurred by the consumer demand for innovative products. Aluminum pigments find an extensive application in nail polish, face makeup, eyeshadows, and hair care products to produce shimmering metallic and holographic effects. The continuing trend toward premium, luxury and unique cosmetic formulations is increasing demand for aluminum-based pigments that aid brands in product differentiation on the shelves.

Looking for region specific data?

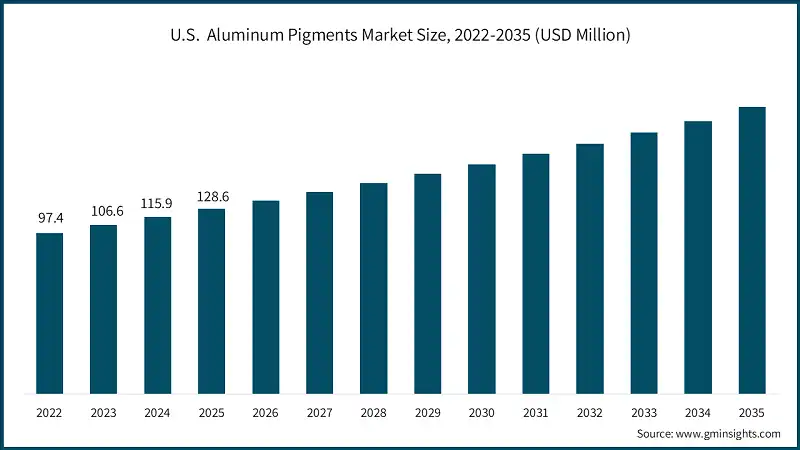

The North America aluminum pigments market is growing rapidly on the global level with a market share of 26.1% in 2025.

- The demand for aluminum pigments in North America has witnessed fast growth and is still growing owing to increased demand from automotive, paints and coatings, and packaging. Sustainability and eco-friendliness have become priorities for the manufacturers in the region, leading to the production of aluminum pigments that are low in VOCs and can base formulations on water. The major driving sector in this region remains the automotive industry where the consumer and automaker demand for high gloss and reflective finishes on vehicles is realized. Technological advances in pigment production improve dispersibility and color stability, thereby enhancing the market outlook.

Europe aluminum pigments market leads the industry with revenue of USD 146.5 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- The market in Europe is characterized by the concern of sustainability, regulatory compliance, and high standards of quality. Over the years, Europe's stringent environmental regulations have fostered the use of low-VOC, solvent-free, and eco-friendly pigments and have an impact on product development. Among the top consumers are the automotive, industrial and architectural sectors, as there is an increasing trend towards high-end, decorative, and reflective coatings. The shift of most countries towards renewable energy projects and infrastructure upgrades further promises well for demand in architectural coatings. All in all, innovation, sustainability commitments, and much more is expected from consumers in terms of quality and safety are the characteristics of any market growth in Europe.

The Asia Pacific aluminum pigments market is anticipated to grow at a CAGR of 5.5% during the analysis timeframe.

- The rapidly growing aluminum pigment market in Asia Pacific primarily benefits from the inside growth of demanding automotive, construction, and packaging industries. The rapidly emerging urbanization and industrialization along with the rising disposable incomes are gradually increasing decoration and protective coatings consumption. Emerging markets like China, India, and Southeast Asian countries are preferring advanced, cost-effective production techniques and even newer means to meet the ever-increasing demands. The focus on sustainable and eco-friendly products highly influences many aspects of market trends and standards in the region, as the usage of water-based and low-VOC aluminum pigments continues to grow.

Latin America aluminum pigments market accounted for 8% market share in 2025 and is anticipated to show steady growth over the forecast period.

- The aluminum pigment market in Latin America is slowly growing but consistently driven by the automotive, construction, and packaging markets. Opportunities for the market are offering new opportunities for providing decorative and protective coatings with aluminum pigments in economic recovery and infrastructure development initiatives across the region. Market players are focusing on cost-effective, green formulations to meet regional regulatory standards and match the consumers' preferences. The major markets include Brazil and Mexico, where investment in automotive manufacture and infrastructure development projects is increasing. Sustainable development trends and eco-consumer products have changed new product innovations to produce pigments that are low in VOC and paint based.

Middle East & Africa aluminum pigments market accounted for 4% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The MEA market for aluminum pigments is one of the slowly showing markets in the region with gradual growth resulting from its construction, automotive and packaging industries. Infrastructure development, urbanization and luxury real estate projects are all great boosters for sales of reflective and decorative coatings. Economic diversification of countries like the UAE, Saudi Arabia, and South Africa encourages further investments in industrial and infrastructural projects and helps build the market. In general, challenges are regulatory variability and an economy focused on providing affordable solutions; hence, manufacturers will need to come up with cost-effective, sustainable aluminum pigments.

Aluminum Pigments Market Share

The top 5 companies in Aluminum pigments industry include ALTANA, Asahi Kasei, DIC CORPORATION, AVL Metal Powders n.v., Carlfors Bruk. These are prominent companies operating in their respective regions covering approximately 48.1% of the market share in 2025. These companies hold strong positions due to their extensive experience in aluminum pigments industry. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- ALTANA is an important name in specialty chemicals, focusing primarily on high-performance pigments, with aluminum pigments being some of its most visible offerings for coatings, plastics, and cosmetics. The main area through which the company derives its competitive edge has been pointed to as its innovative and sustainable approach to product development.

- Asahi Kasei is a diversified Japanese conglomerate with extensive interests in chemicals, materials, and electronics. It mainly plays a part in the aluminum pigment market through advanced material solutions for coatings, plastics, and personal care. Its advantage for competition is based on the knowledge and experience that the company has developed in surface chemistry and particle technology, which are what differentiate and give it the possibility of producing high-performance lightweight environmentally friendly aluminum pigments.

- DIC Corporation is one of the global manufacturers of printing inks, coatings, and specialty chemicals, occupying a significant share of the aluminum pigment market. Its present portfolio of products comprises metallic and pearlescent pigments that entertain applications in an extensive number of end use industries, including automotive, packaging, and decorative coatings.

- AVL METAL POWDERS n.v. is a specialized manufacturer of metal powders, including aluminum powders for use in pigments, coatings, and many other industrial applications. It has set itself apart from other firms by producing metal powders of very high purity and, at the same time, very fine and even property grades that are considered indispensable for producing quality aluminum pigments.

- Carlfors Bruk specializes in producing aluminum powders and pigments. The key competitive advantage that the company holds is expertise in surface treatment and particle engineering that enables formulating environmentally friendly and high-performance aluminum pigments. Therefore, the company is well positioned to manufacturing processes that are eco-conscious and developing innovative surface coatings for highly developed markets that have stringent environment regulations.

Aluminum Pigments Market Companies

Major players operating in the aluminum pigments industry include:

- ALTANA

- Asahi Kasei

- AVL METAL POWDERS n.v.

- Carlfors Bruk

- DIC CORPORATION

- Kolortek Co., Ltd.

- Metaflake Ltd

- SCHLENK SE

- Shan Dong Jie Han Metal Material Co., Ltd

- TOYO ALUMINIUM K.K.

- Zhangqiu metallic pigment co.,ltd.

- ZuXing New Materials Co., Ltd.

Aluminum Pigments Industry News

- In December 2024, Eckart, a member of Altana and a global manufacturer in the effect pigments market, entered into a joint venture agreement with Runaya, a pioneer in sustainable manufacturing whose product portfolio is aligned with global technology leaders.

- In January 2024, ALTANA completed the acquisition of Silberline, consolidating its global manufacturing and distribution network for aluminum pigments through its subsidiary, ECKART.

This aluminum pigments market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Million) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Type

- Leafing

- Non-leafing

Market, By Form

- Paste

- Powder

- Pellets

- Others (flakes, etc)

Market, By Application

- Automotive coatings

- Industrial coatings

- Architectural/decorative coatings

- Gravure inks

- Flexographic inks

- Industrial plastic

- Nail products

- Face makeup

- Hair care products

- Others

Market, By End Use Industry

- Paints & coatings

- Printing inks

- Plastics

- Personal care & cosmetics

- Others (construction, electronics, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What was the valuation of the paste form segment in 2025?

Paste aluminum pigments held 48.1% market share in 2025, supported by superior dispersibility and widespread use in automotive and industrial coating applications.

What is the growth outlook for automotive coatings application through 2035?

The automotive coatings segment is expected to grow at a CAGR of 5.8% through 2035, driven by demand for metallic appearance, corrosion resistance, and durable surface finishes.

Which region leads the aluminum pigments market?

North America held 26.1% market share of the aluminum pigments industry in 2025, supported by strong consumption across automotive, paints & coatings, and packaging industries. Market growth is driven by rising adoption of low-VOC and eco-friendly aluminum pigment formulations.

Who are the key players in the aluminum pigments market?

Key players operating in the industry include ALTANA, Asahi Kasei, DIC Corporation, AVL Metal Powders n.v., Carlfors Bruk, SCHLENK SE, Metaflake Ltd, and TOYO ALUMINIUM K.K.

What are the key trends shaping the aluminum pigments industry?

Major trends include innovation in nano-aluminum pigments, rising preference for sustainable coatings, and increasing use of aluminum pigments in smart and high-performance coatings.

How much revenue did the leafing aluminum pigments segment generate in 2025?

Leafing aluminum pigments accounted for approximately 55.2% market share in 2025, making it the leading segment due to strong demand for high-gloss and metallic finishes.

What is the projected value of the aluminum pigments market by 2035?

The aluminum pigments industry is expected to reach USD 1.1 billion by 2035, growing at a CAGR of 5.5% due to increasing adoption in automotive coatings, decorative paints, and sustainable coating formulations.

What is the current aluminum pigments market size in 2026?

The aluminum pigments industry is projected to reach USD 648.8 million in 2026 as demand for metallic and reflective coatings continues to expand across end-use industries.

What is the market size of the aluminum pigments market in 2025?

The market size was USD 615.2 million in 2025 and is expected to grow at a CAGR of 5.5% through 2035, driven by rising demand from automotive, packaging, and paints & coatings industries.

Aluminum Pigments Market Scope

Related Reports