Summary

Table of Content

Agricultural Machinery Maintenance Services Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Agricultural Machinery Maintenance Services Market Size

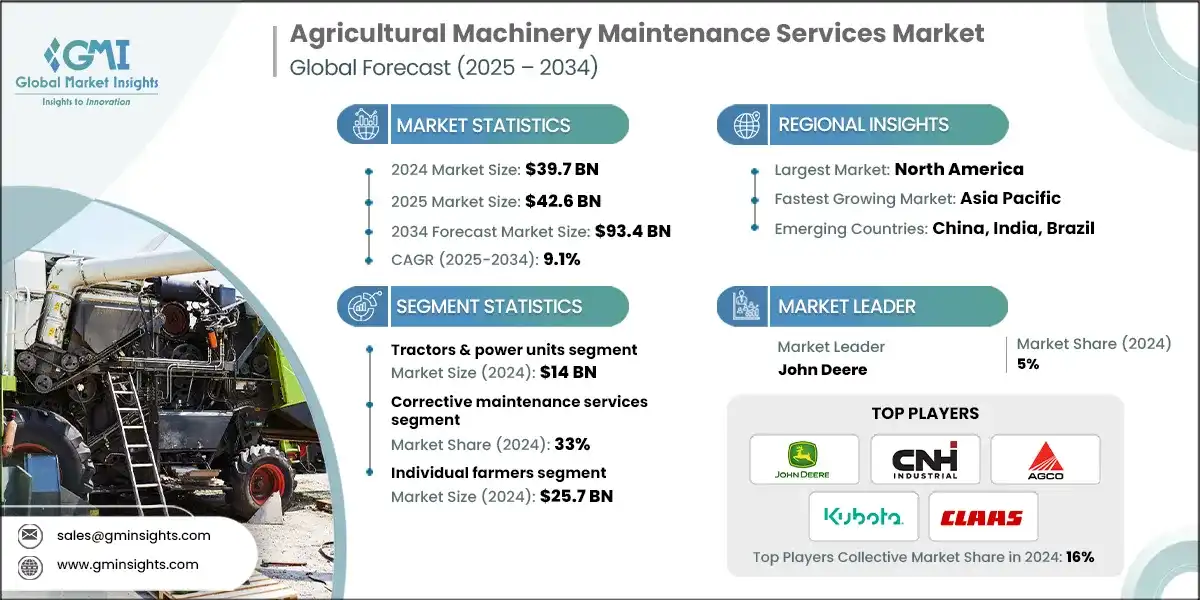

The global agricultural machinery maintenance services market was estimated at USD 39.7 billion in 2024. The market is expected to grow from USD 42.6 billion in 2025 to USD 93.4 billion in 2034, at a CAGR of 9.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

As mechanization increases in labor-intensive tasks in agriculture, the global agricultural machinery maintenance services industry is developing. In modern agriculture, machinery is used extensively by farmers to improve productivity. As a result, regular maintenance service operations are an absolute necessity and integral to farming. The maintenance services market is transformed into a model driven by preventive or predictive maintenance, where smart sensors and digital monitoring and control enable farmers to address troublesome agricultural equipment before they break down, thereby minimizing costly downtime during critical farming periods.

The rising utilization of farm machinery in developing regions is creating an opportunity for maintenance service providers as farmers are replacing human labor with investments in operating machinery, such as tractors, harvesters, and irrigation equipment. Digital platforms now often help manage maintenance by facilitating scheduling repairs, ordering spare parts and initiating remote technical support. However, the maintenance services market faces several pitfalls, particularly in rural areas, with challenges presented by smallholders as often they do not have the resources to purchase advanced maintenance tools and technicians can be challenging to find.

Government programs, such as subsidies and support programs for agricultural infrastructure which can indirectly increase the effectiveness of this market, can also expand the maintenance services market. As agriculture continues to evolve technologically, maintenance services are also continuing to become a critical component of agricultural value chains, while also providing advantage in bottlenecks in efficiency and management of both crop production and timely harvesting. Overall, the next stage of development in this market is the accessibility and cost of maintenance services particularly at the appropriate timeframes needed for agricultural equipment and technology.

Agricultural Machinery Maintenance Services Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 39.7 Billion |

| Market Size in 2025 | USD 42.6 Billion |

| Forecast Period 2025 - 2034 CAGR | 9.1% |

| Market Size in 2034 | USD 93.4 billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising adoption of smart farming technologies | The growth of IoT and predictive analytics in agricultural machinery is creating demand for advanced maintenance services that minimize downtime and maximize speed of operation. |

| Expansion of mechanized farming in emerging economies | Markets emerging in agricultural development are investing in machinery, increasing the need for reliable maintenance services that optimize equipment performance over the long term. |

| Focus on equipment longevity and cost efficiency | Farmers are aware of the need for preventive maintenance to extend the life of machinery and reduce appliance repair costs, which creates a steady demand for the services of maintenance service providers. |

| Pitfalls & Challenges | Impact |

| Limited access to skilled technicians in rural areas | Rural farm centers typically do not have trained personnel nor infrastructure to provide a service, resulting in delays and less quality of service in the market. |

| High cost of advanced diagnostic tools and services | Small and mid-sized farms may struggle to afford contemporary maintenance services, making access to market limited. |

| Opportunities: | Impact |

| Growth of mobile and remote maintenance platforms | Digital platforms are developing service processes that may include remote diagnostics with mobile repair following. |

| Increasing demand for sustainable maintenance practices | Eco-sustainable farms have become interested in service maintenance that may help reduce waste and save energy and support circular equipment possibilities. |

| Market Leaders (2024) | |

| Market Leaders |

5% market share |

| Top Players |

Collective market share in 2024 is 16% |

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Agricultural Machinery Maintenance Services Market Trends

The market for agricultural machinery repair services is moving toward smarter, personalized options that provide sustainability and convenience to farmers while providing support tailored to their unique needs.

- Predictive maintenance utilizes IoT sensors, telematics, and data analytics to predict equipment failure. By employing machine performance data to forecast maintenance actions, it is a proactive solution that helps minimize downtime, improve efficiency in the field, and enhance the overall lifespan of machinery.

- Remote diagnostics with improved connectivity allow technicians to assess or diagnose machinery issues remotely. This reduces in-field service visits, saving time and money for both the farmer and the service provider, while increasing the speed of resolution for machinery across a dispersed farm.

- Integration of precision agriculture means maintenance service providers will have to adapt their service to GPS and systems of automation. More so than ever, they will have to develop their in-house service knowledge of electronic components to calibrate, initialize and repair precision farming equipment.

- Changes in service delivery and subscription-based service contracts are changing the conversation about reactive repair to a more proactive service maintenance contract. This allows for predictable costs, and will include regular inspections, updates to software, and priority service when crises arise, and each of these will ensure consistent performance of equipment throughout the growing season.

- The industry's technician shortage is being addressed with more robust training programs and artificial intelligence (AI) tools for diagnostics. Companies are developing user-friendly farmer-assist tools to remove some of the sector's service provision shortage, while continuing to maintain quality standards of service.

Agricultural Machinery Maintenance Services Market Analysis

Learn more about the key segments shaping this market

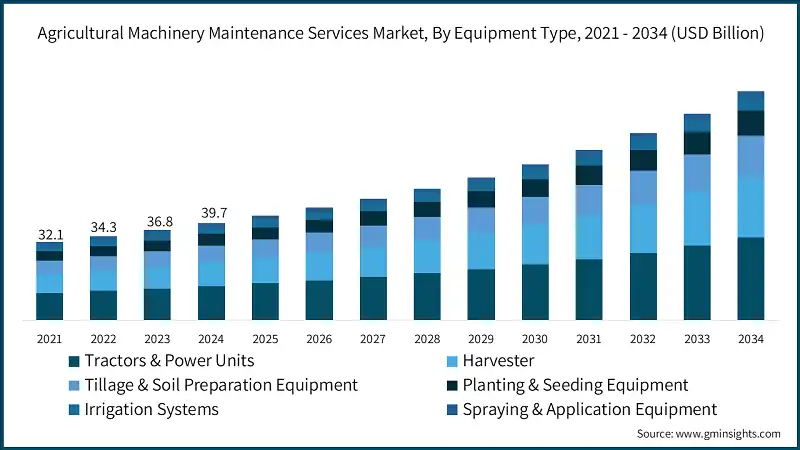

Based on equipment type, the agricultural machinery maintenance services industry is divided into tractors & power units, harvester, tillage & soil preparation equipment, planting & seeding equipment, irrigation systems, and spraying & application equipment. In 2024, tractors & power units held the major market share, generating a revenue of USD 14 billion.

- The market's largest segment represents tractors and power units. This shows the core purpose of these machines in agriculture, particularly how extensively they are used across agricultural activities. This segment has continued to grow significantly due to precision agriculture technology becoming more widespread, and tractors being more complicated than before.

- The maintenance of these tractors has changed with the introduction of GPS guidance and precision rate technology. Today's tractors are equipped with electronic control units, hydraulic systems, transmission controls, and engine management systems. If a technician evaluates a tractor for maintenance, the following are included: engine rebuilding/overhaul, transmission maintenance, hydraulic troubleshooting/repair, electrical diagnostics and troubleshooting, software updates.

- The harvester equipment maintenance segment shows significant growth trends from seasonal demand and machine complexity. Maintenance includes the threshing mechanisms, cleaning systems, grain handling equipment, yield monitors, and GPS guidance. Since harvesting is seasonal in nature, this can create a significant amount of maintenance demand in a narrow window of time. This impacts maintenance needs and drives demand for maintenance and repair services quickly during harvest and whole systems overhaul in the 'off-season'. This segment benefits from the value of the equipment and the urgency of the harvest season itself to create maintenance and repair demands.

Learn more about the key segments shaping this market

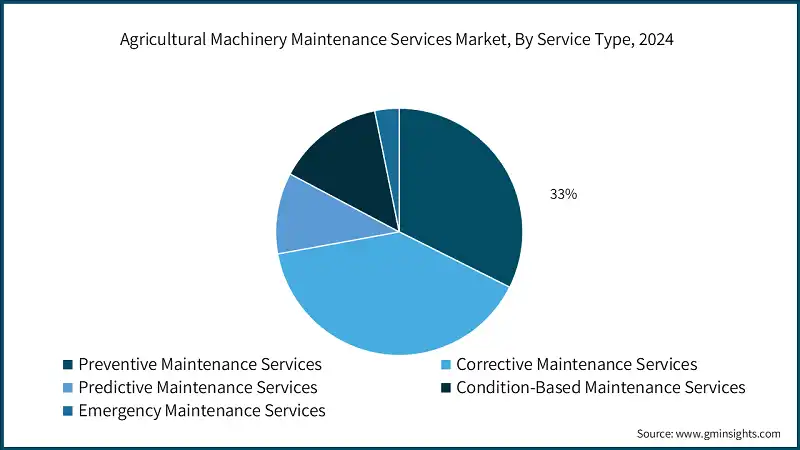

Based on service type, the agricultural machinery maintenance services market is segmented into Preventive maintenance services, corrective maintenance services, predictive maintenance services, condition-based maintenance services, and emergency maintenance services. The corrective maintenance services segment held the largest share, accounting for 33% of the global agricultural machinery maintenance services industry in 2024.

- Corrective maintenance has the most significant market share in agricultural equipment maintenance, as it provides repair services for equipment failures and breakdowns. Segment growth remains consistent reflecting the mature nature of corrective maintenance services and the industry's slow movement from corrective to preventive measures. Corrective maintenance continues to be important due to the potential for unexpected equipment failures, and for responding quickly to problems, especially during critical agricultural times.

- The segment includes emergency repairs, replacing components, system troubleshooting, and performing root cause failure analysis. While corrective maintenance has pressured a growing predictive maintenance field, it is required to address unexpected failures and failures caused by operators' actions. Remote diagnostics continue to improve service efficiency.

- Preventive maintenance service has a substantial market share and evidence that scheduled maintenance has gained acceptance in the field. Preventive services include routine servicing, periodic inspections, fluid changes, and filter changes. Continued growth in this segment can be attributed to the growing complexity of the equipment, and the high cost of replacement of the newest agricultural equipment. Service and equipment providers have also begun providing periodic service with condition monitoring and data analysis to implement maintenance schedule changes and develop programs specific to operating conditions.

Based on the ownership, the agricultural machinery maintenance services market is segmented into individual farmers and corporate farms. In 2024, individual farmers held a major market share, generating a revenue of USD 25.7 billion.

- The agricultural machinery maintenance service market is largely made up of individual farmers. This segment indicates small to medium-scale farmers, and it reflects those who maintain and own their own agricultural equipment. Individual farming operations are increasing the use of machinery and greater demands for complex farms means the requirement for maintenance by specialized technicians is increasing.

- The maintenance requirement for individual farmers varies due to the wide variations of their equipment and needs that are seasonal in nature for farming purposes. Individual farmers maintain multiple types of equipment such as tractors, implements and specialized machinery. In addition, individual farms are supported by a long-standing dealer network for any major equipment manufacturer.

- Corporate farms represent a considerable share of agricultural machinery maintenance services. Corporate farms can be defined as either large-scale agricultural operations, agribusiness companies, or institutional farming operations. Like individual farmer maintenance services, segment growth can be attributed to consolidation of agricultural operations and adoption of new and more advanced maintenance management systems.

Looking for region specific data?

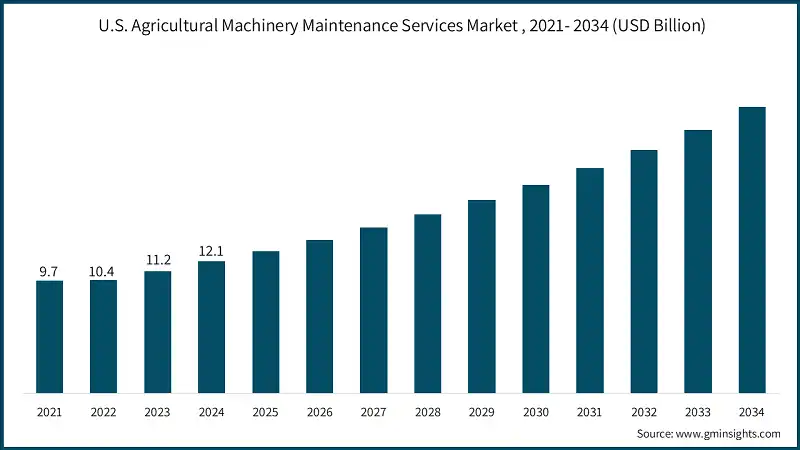

North America Agricultural Machinery Maintenance Services Market In 2024, the U.S. dominated the North America market, accounting for around 77% and generating around USD 12.1 billion revenue in the same year. Europe market, Germany leads the market 27% share in 2024 and is expected to grow at 8.9% during the forecast period. The Asia Pacific leads the market. China holds a market share of around 41.6% in 2024 and is anticipated to grow with a CAGR of around 10% from 2025 to 2034. John Deere is leading with 5% market share. John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, and CLAAS Group collectively hold around 16%, indicating moderately fragmented market concentration. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position. Major players operating in the agricultural machinery maintenance services industry are: Kubota Corporation provides aftermarket support for agricultural machinery globally through its dealer network. The dealer network also provides service diagnoses and repairs through their technicians, along with a service application that enhances awareness of dealer locations, engine capability registration, and maintenance information to improve their operations. CLAAS Group provides support for harvesting machinery through regular service of equipment and through post-harvest inspection and repair services. The company utilizes trained technicians to provide fully remote diagnostics while providing MAXI CARE contracts for full machine warranty and protection.Europe Agricultural Machinery Maintenance Services Market

Asia Pacific Agricultural Machinery Maintenance Services Market

Agricultural Machinery Maintenance Services Market Share

Agricultural Machinery Maintenance Services Market Companies

Agricultural Machinery Maintenance Services Industry News

The agricultural machinery maintenance services market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Equipment Type

- Tractors & power units

- Harvester

- Tillage & soil preparation equipment

- Planting & seeding equipment

- Irrigation systems

- Spraying & application equipment

Market, By Ownership

- Individual farmers

- Corporate farms

Market, By Operational Size

- Small-scale operations

- Medium-sized farms

- Large sized farms

Market, By Application

- Crops

- Livestock

Market, By Service Type

- Preventive maintenance services

- Corrective maintenance services

- Predictive maintenance services

- Condition-based maintenance services

- Emergency maintenance services

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the agricultural machinery maintenance services market?

Key players include John Deere, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, CLAAS Group, Mahindra & Mahindra, Escorts Kubota Limited, SDF Group, JCB, and Yanmar Holdings.

What are the upcoming trends in the agricultural machinery maintenance services industry?

Key trends include growth of mobile and remote diagnostics, subscription-based maintenance contracts, AI-powered predictive maintenance, and sustainable servicing practices aligned with circular agriculture.

Which region leads the agricultural machinery maintenance services market?

The U.S. led the North American market with USD 12.1 billion in revenue in 2024, accounting for around 77% of the regional share. Growth is driven by precision agriculture adoption, extensive dealer networks, and strong federal R&D initiatives in agri-tech infrastructure.

How much revenue did the tractors & power units segment generate in 2024?

The tractors & power units segment generated USD 14 billion in 2024.

What is the market size of the agricultural machinery maintenance services industry in 2024?

The market size was USD 39.7 billion in 2024, with a CAGR of 9.1% expected through 2034, driven by rising adoption of smart farming technologies and predictive maintenance solutions.

What was the valuation of the corrective maintenance services segment in 2024?

The corrective maintenance services segment held 33% market share and generated the largest revenue share in 2024.

What is the current agricultural machinery maintenance services market size in 2025?

The market size is projected to reach USD 42.6 billion in 2025.

What is the projected value of the agricultural machinery maintenance services market by 2034?

The agricultural machinery maintenance services market is expected to reach USD 93.4 billion by 2034, fueled by mechanization in emerging economies, IoT-based monitoring, and increasing demand for preventive maintenance programs.

Agricultural Machinery Maintenance Services Market Scope

Related Reports