Summary

Table of Content

Afterburner Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Afterburner Market Size

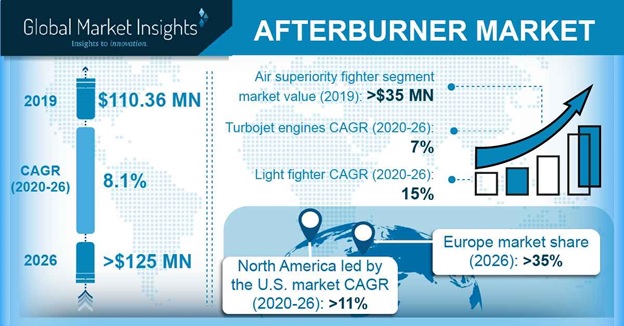

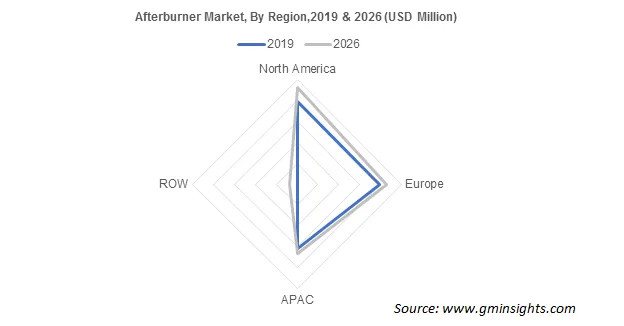

Afterburner Market size exceeded USD 110.36 million in 2019 and is estimated to exhibit over 8% CAGR from 2020 to 2026. The increasing fighter aircraft backlog & production along with rising fleet of the old generation fighter aircraft in various countries across the globe is expected to drive the industry growth.

The afterburner is gaining recognition in the industry as it is used for the shorter runway take-off, assisting in catapult launches from aircraft carriers and air combat. There is an increasing demand for new fighter aircraft worldwide to replace aging aircraft with the next-generation fighter aircraft to recover from the fighter aircraft depleting strength. Moreover, there is an increased demand for next-generation fighter aircraft such as 5th generation fighter that combines advanced stealth with fighter speed and agility. Air superiority fighter planes are fully fused with sensor information and network-enabled operations, increasing their adoption across China, North America, and Europe, in turn, propelling the afterburner industry demand.

To get key market trends

Numerous countries are focusing on manufacturing their own 5th or 6th generation fighter aircraft as importing would involve significant costs and leave the country to be dependent on the exporter country for software updates, maintenance, and spare parts. For instance, Germany and France are planning to launch a fighter jet by the end of 2025. Strong rivalry among market participants has impacted the price trend of the product. Industry participants are concentrating on value addition to the product such as lower fuel consumption, lower weight, lower size, and improved efficiency.

Afterburner Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 110.36 Million |

| Forecast Period 2020 to 2026 CAGR | 8.1% |

| Market Size in 2026 | USD 126.36 Million |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Afterburner Market Analysis

The air superiority fighter segment generated around USD 35 million in 2019 owing to increasing fighter aircraft demand in the past few years to ensure aerial supremacy. The air superiority fighter is equipped with advanced stealth coating or materials, information fusion technology, and sensors. The air superiority fighter provides situational awareness, greater survivability, effectiveness for pilots, as well as enhanced readiness at lesser support expenses. Moreover, the increasing development of indigenous 5th generation aircraft by various countries will lead to a greater demand for afterburners.

Learn more about the key segments shaping this market

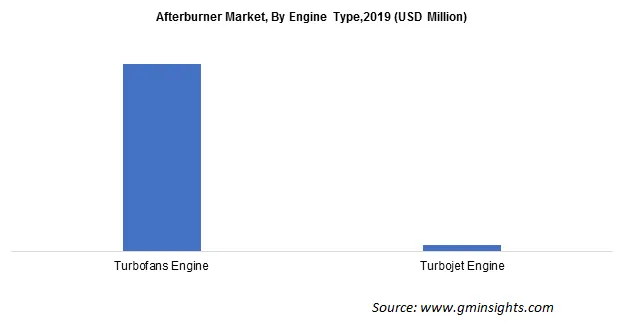

The turbofans engine type captured around 95% of the afterburner market share. The countries are strengthening military strength to ensure border safety. Switzerland is likely to buy up to 40 fighter aircraft and Finland is planning to buy new fighter aircraft as a replacement for its aging F-18 fleet. The ongoing covid-19 has substantially obstructed the fighter aircraft production in 2020, and with the enforced lockdown, the production and supply of parts have come to a halt, globally.

The aerospace and defense industry observed noteworthy growth in 2019; for instance, in 2019, Lockheed Martin Corporation produced nearly 134 F-35s fighter planes, with 47% increase from 2018 and nearly two times more production compared to 2016, which are likely to drive the turbofans engine and afterburner market.

Learn more about the key segments shaping this market

North America afterburner market led by the U.S. is projected to witness more than 11% CAGR through 2026. The U.S. alone produced above 160 fighter aircraft in 2019 and the U.S. held about one-third of the global fighter aircraft production. Furthermore, the U.S. has witnessed a significant number of orders of its new 5th generation fighter aircraft despite covid-19. In 2020, the Polish defense minister, Mariusz Blaszczak signed a contract with the U.S. government to buy 32 F-35 fighter aircraft, which is scheduled to be delivered by 2024.

The increasing cases of covid-19 has significantly impacted the fighter aircraft production and delay in the supply of engine components as U.S. aircraft manufacturers are heavily dependent on Mexico for fuel systems or sensor-related products, increasing backlog for manufacturers.

The afterburner market is highly consolidated with four key market participants holding majority share in the industry. These players are involved in partnerships with fighter aircraft manufacturers or with the regional government to gain a competitive advantage on rest of the manufacturers. For instance, in June 2019, Pratt & Whitney was awarded a USD 3.2 billion contract to provide 233 fighter aircraft engines with the afterburner for F-35 fighter jets to the U.S. and its allies.

With the increasing demand for 5th generation fighter aircraft, many manufacturers are collaborating with 5th generation aircraft manufacturers to provide their products in the future. For instance, MTU Aero Engines AG has been in contact with Germany and France to develop Next European Fighter Engine (NEFE) to replace multinational Eurofighter engine and Rafale.

Afterburner Market Share

Some of the key manufacturers are:

- Rolls-Royce plc

- GE AVIATION

- Pratt & Whitney

- Honeywell Aerospace

- Aviadvigatel

- SE Ivchenko-Progress

- Safran

- Eurojet

- JSC "Klimov" — United engine corporation

- MTU Aero Engines AG

Some of the significant strategies implemented by these manufacturers are collaboration with aircraft manufacturers, acquisition, new product development, and production capacity expansion.

The market report afterburner includes in-depth coverage of the industry with estimates & forecast in terms of volume in Units and revenue in USD million from 2016 to 2026 for the following segments:

Market, By Engine Type

Turbofans Engine

- Turbojet Engine

Market, By Plane Type

Air Superiority Fighter

- Light fighter

- Electric Compressor

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- Spain

- U.K

- Russia

- Asia Pacific

- China

- India

- Rest of the World

- Brazil

Frequently Asked Question(FAQ) :

Why will North America region grow as a leading market for afterburner?

North America afterburner market forecast is impacted by the high production of fighter aircraft in the U.S. and the regional industry will register over 11% CAGR through 2026.

What factors will augment afterburner demand from turbofans engine segment?

Aircraft with turbofans engine contributed about 95% of global afterburner industry share in 2019 as countries focus on reinforcing their military prowess and border safety.

What will be the value of global afterburner market share by 2026?

The market for afterburner had reached USD 110.36 million in value during 2019 and will record about 8% CAGR up to 2026 by 2026 with the expanding backlog and production of fighter aircraft.

How will air superiority fighter planes influence afterburner market trends?

The share of air superiority fighters was valued at nearly USD 35 million in 2019 owing to increased afterburner demand from the growing deployment of fighter aircraft for aerial domination.

Afterburner Market Scope

Related Reports