Summary

Table of Content

Aerospace Landing Gear Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aerospace Landing Gear Market Size

The global aerospace landing gear market size was valued at USD 11.2 billion in 2024. The market is expected to grow from USD 12.1 billion in 2025 to USD 25.2 billion by 2034, growing at a CAGR of 8.5% during 2025 to 2034.

To get key market trends

- The aerospace landing gear industry growth is attributed to the rising global commercial aircraft deliveries, increasing military modernization programs, growth in air passenger traffic and expansion of MRO market.

- Rising global commercial aircraft deliveries significantly drive the aerospace landing gear market. The growing demand for air travel, especially in emerging markets, is driving the expansion of the fleet of narrow-body, wide-body, and regional jets. Boeing anticipates that by 2044, there will be 49,600 commercial aircraft in the fleet, underscoring the continuous growth in aircraft manufacturing. This growth translates into a higher demand for landing gear systems, both for original equipment and for aftermarket services, supporting long-term market expansion.

- The growth of military modernisation programs as countries equip their fleets with state-of-the-art fighter jets, transport aircraft, and helicopters is the main factor propelling the aerospace landing gear market. Increased defense spending and geopolitical tensions drive the acquisition of new platforms that require sophisticated landing gear systems. For example, in mid-2025, Poland secured a USD 4 billion loan guarantee to finance military modernization. This is a result of increased investments, which raise demand for the defense industry's aftermarket services and landing gear production.

- The steady increase in international air travel is a key driver for the aerospace landing gear market. According to Airports Council International (ACI), international passenger traffic is expected to grow at a CAGR of 3.4% from 2024-2043 to 17.7 billion passengers. This steady growth fuels demand for new commercial aircraft, fleet expansion, and longer landing gear replacement and overhaul cycles, all of which support OEM production and aftermarket services in major international aviation markets.

- North America held the largest share of 38.9% in 2024, due to its strong commercial aircraft fleet and established aerospace manufacturing ecosystem. The region benefits from major military spending on modernization projects, a large array of aftermarket services, and leading OEMs. The demand for landing gear will rise as more than 1,200 F-35 aircraft are expected to be in service by 2030, according to U.S. Department of Defense estimates.

Aerospace Landing Gear Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 11.2 Billion |

| Forecast Period 2025 - 2034 CAGR | 8.5% |

| Market Size in 2034 | USD 25.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising global commercial aircraft deliveries | Drives 25% growth in landing gear demand due to fleet expansion. |

| Increasing military modernization programs | Contributes around 20% growth through new defense aircraft procurements and upgrades. |

| Growth in air passenger traffic | Supports 22% increase in aftermarket and new landing gear installations. |

| Focus on lightweight materials and composite landing gear | Enables 15% growth by boosting adoption of advanced, fuel-efficient landing gear systems. |

| Expansion of MRO (maintenance, repair, overhaul) market | Fuels 20% growth driven by rising overhaul cycles and aging aircraft fleets. |

| Pitfalls & Challenges | Impact |

| High development and certification costs | Limits entry of new players and slows introduction of innovative landing gear technologies. |

| Volatility in raw material prices | Increases production costs, affecting pricing and supplier margins, especially titanium and composites. |

| Opportunities: | Impact |

| Electrification and more-electric aircraft trend | Accelerates adoption of electric/electro-mechanical landing gear actuation systems, reducing maintenance costs. |

| Expansion of indigenous aircraft programs | Opens new markets in emerging economies, driving localized production and supply chain growth. |

| Aftermarket digitalization and predictive maintenance | Enables predictive health monitoring and digital twin technologies, enhancing service efficiency and reducing downtime. |

| Market Leaders (2024) | |

| Market Leaders |

Top 2 companies hold 32.5% market share |

| Top Players |

Collective market share in 2024 is 63.1% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | China, India, UAE, Brazil |

| Future Outlook |

|

What are the growth opportunities in this market?

Aerospace Landing Gear Market Trends

- The increase in narrow-body fleet size in emerging markets fuels the requirement for landing gear systems and subsequent aftermarket services. For instance, Indigo Airlines is to expand its fleet size of more than 280 Airbus A320 family aircraft to over 500 by 2030. This trend gained traction around 2021 and is anticipated to dominate from 2029-2030, characterized by rapid fleet expansion and passenger growth, together with strong growth opportunities in all segments of Asia's airline industry.

- OEM-sponsored landing gear exchange and overhaul schemes are increasingly in trend among airlines seeking to minimize downtime and lifecycle costs. Boeing's 787 Landing Gear Exchange Agreement in January with Ethiopian Airlines is an ideal example of the trend toward formal, OEM-sponsored maintenance agreements. Surfacing in about 2020, the trend enables larger-scale predictive maintenance plans and efficient asset optimization, with adoption forecasted to peak around 2028-2029 as airlines invest in larger-bodies and long-haul operations in competitive markets.

- Predictive maintenance and digitalization are revolutionizing the landing gear aftermarket environment with new sensors, digital twin technology, and integrated health monitoring systems. Since 2020, data-driven services by OEMs and MRO providers improving component life and overhaul planning have been extremely well-funded. Expected to continue making a difference through 2029, this trend enables airlines to maximize reliability, reduce surprise failures, and optimize total cost of ownership, particularly for big and old commercial fleets.

Aerospace Landing Gear Market Analysis

Learn more about the key segments shaping this market

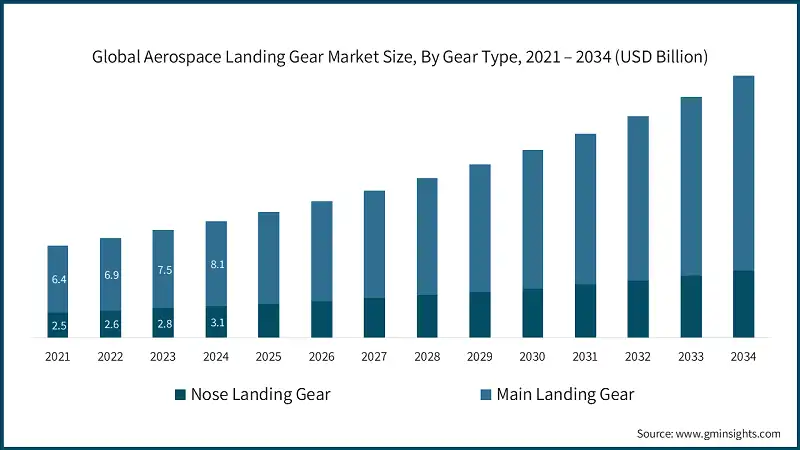

On the basis of gear type, the market is divided into nose landing gear and main landing gear.

- The main landing gear segment dominated with a 72.8% share in 2024 because of its critical role in supporting aircraft weight, absorbing landing shocks, and frequent replacement cycles driven by high operational loads and regulatory requirements. This dominance is further reinforced by rising wide-body and narrow-body deliveries worldwide.

- To capitalize on opportunities in fleet expansion, businesses should channel their research development on the widening, advanced actuation systems for the main landing gear, and lightweight materials. This aligns with the airlines’ needs for enhanced fuel efficiency, longer maintenance overhaul intervals, and maintenance performed on a predictive basis.

- The nose landing gear segment is expected to grow at a CAGR of 7.4% between 2025 and 2034 because of the surge in deliveries of narrow-body and regional jets, high utilization on short-haul routes, and increased replacement demand owing to frequent taxiing and landing. Airlines' focus on accelerating turnaround times further increases the demand for nose gear parts and overhaul services.

- Businesses should focus on lightweight composite designs, predictive maintenance programs, and quick turnaround aftermarket support to meet this demand and enhance their competitive positioning in both established and emerging fleets.

Learn more about the key segments shaping this market

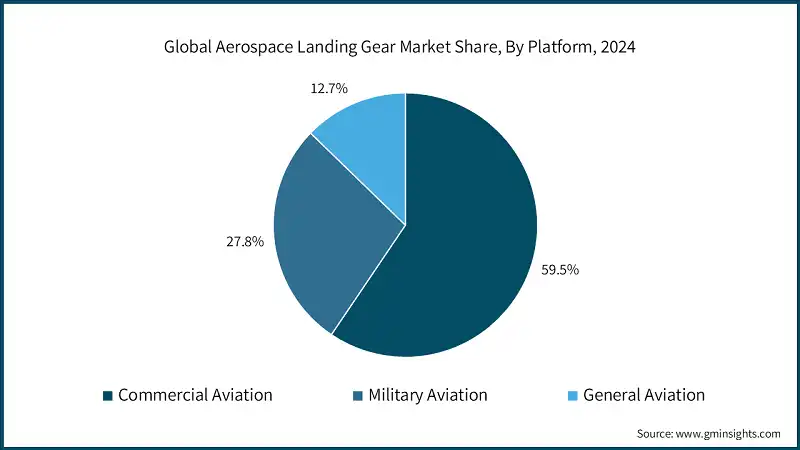

Based on the platform, the aerospace landing gear market is categorized into commercial aviation, military aviation and general aviation.

- The military aviation segment is expected to reach USD 6.2 billion by 2034, due to higher defense expenditure, fleet upgrades, and induction of next-generation aircraft with advanced landing systems. Rising geopolitical tensions and focus on operational readiness also drive demand for durable, high-performance landing gear solutions.

- Businesses should focus on creating novel, lightweight, and robust materials and partnering with defence contractors in order to secure contracts for future defence programs. Offering maintenance, upgrades, and aftermarket services will bring in a consistent income stream.

- Commercial aviation segment dominated the aerospace landing gear market with a 59.5% share in 2024, due to rising global passenger traffic, increasing airline fleets, and consistent deliveries of new narrow and wide-body aircraft. As airlines focus on operational efficiency and fleet modernization, there is demand for dependable and effective landing gear systems.

- To capitalize on the expanding opportunities in fleet expansion and aftermarket maintenance, companies must focus on manufacturing durable, reasonably priced landing gear components and cultivate positive relationships with major commercial OEMs.

On the basis of end use, the aerospace landing gear market is divided into OEM (original equipment manufacturer), and aftermarket.

- The OEM segment held a 58.4% market share in 2024, owing to direct supplier relationships with aircraft manufacturers and integrated contracts for landing gear systems. OEMs maintain an advantage with stringent certification mandates and protracted product development cycles, which provide high barriers to entry and consistent demand for aftermarket programs.

- Companies should strengthen OEM collaborations, invest in R&D for next-gen landing gear technologies, and focus on compliance to secure long-term contracts and enhance competitive positioning in new aircraft platforms.

- Aftermarket segment is expected to grow at a CAGR of 9.9% during 2025 to 2034. This growth is driven by an aging global aircraft fleet requiring frequent maintenance, repair, and overhaul services. Additionally, airlines are increasingly prioritizing cost-efficient landing gear refurbishment and parts replacement to reduce operational downtime and extend asset lifespan.

- Companies should invest in advanced predictive maintenance technologies, expand MRO service offerings, and strengthen aftermarket support infrastructure to capitalize on this rising demand and build lasting customer partnerships.

Looking for region specific data?

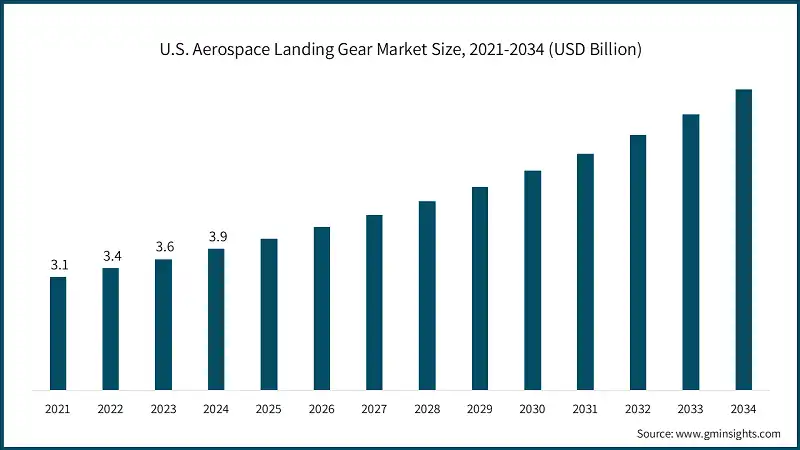

North America held the largest market share of 38.9% in 2024, due to a strong presence of major aerospace OEMs, extensive military modernization programs, and high commercial aircraft deliveries supporting robust landing gear demand.

- U.S. aerospace landing gear market was valued at USD 3.9 billion in 2024 due to robust commercial aircraft deliveries and ongoing military modernization programs. According to Airlines for America (A4A), 11 U.S. passenger airlines received 523 new aircraft deliveries in 2024, significantly boosting demand for landing gear manufacturing and aftermarket maintenance services.

- Companies should focus on strengthening partnerships with key OEMs, advancing lightweight and durable landing gear technologies, and expanding MRO capabilities to capture growth from both commercial and defense sectors in the U.S. market.

- Canada market is estimated to grow at a 6% CAGR during the forecast period due to expanding aerospace manufacturing and rising MRO demand. According to the Aerospace Industries Association of Canada, the national aerospace industry contributed USD 28.9 billion to GDP in 2023, supported by strong exports and targeted government incentives for technological upgrades.

- Companies should invest in localized production, build MRO partnerships, and align offerings with Canada’s innovation and sustainability priorities to strengthen market presence and capture emerging growth opportunities.

Europe accounted for 26.8% of the aerospace landing gear market in 2024 due to strong presence of leading OEMs like Airbus, sustained defense modernization, and growing demand for fuel-efficient aircraft across major economies including Germany, France, and the UK.

- Germany is predicted to grow at a CAGR of 8.1% between 2025 and 2034 due to sustained investments in aerospace R&D and defense modernization. According to the German Federal Ministry of Defence, defense spending rose to USD 60.2 billion in 2024, while the BDLI reported over USD 53.1 billion in civil aviation exports, reinforcing strong demand for advanced landing gear systems.

- Companies should target partnerships with local OEMs and Tier-1 suppliers, invest in lightweight and sustainable technologies, and expand aftermarket service networks to address Germany’s growing civil and defense aircraft programs.

- The UK aerospace landing gear market is estimated to grow at 8.4% CAGR during 2025-2034. This growth is supported by sustained investments in advanced manufacturing and defense programs. According to ADS Group, UK aerospace turnover reached USD 34.1 billion in 2023, while the Ministry of Defence USD 3 billion to air equipment procurement, boosting demand for modern landing gear systems.

- Companies should strengthen local partnerships, invest in lightweight composite technologies, and align product development with UK defense and civil aviation priorities to capture growth and enhance market competitiveness over the next decade.

The Asia-Pacific region is the fastest growing in the aerospace landing gear market with a CAGR of 10.9% during the forecast period. Rapid fleet expansion by low-cost carriers, rising passenger traffic, and large-scale narrow-body aircraft deliveries is accelerating the demand for landing gears in the region. Additionally, significant government investments in indigenous aircraft programs across China, India, and Japan is further driving the growth of the market.

- The China aerospace landing gear market is estimated to reach USD 3.5 billion by 2034. Growth is driven by rapid commercial fleet expansion, ongoing military modernization, and strong indigenous aircraft development programs. According to Boeing, China’s commercial fleet will grow at a 4.1% CAGR, rising from 4,345 to 9,740 airplanes by 2043. This robust growth fuels increasing demand for landing gear systems and related services.

- Companies should build strategic local partnerships, enhance manufacturing capacity compliant with Chinese standards, and tailor landing gear solutions to meet China’s expanding commercial and defense aviation requirements.

- Japan aerospace landing gear market was valued at USD 616.9 million in 2024. Japan’s steady commercial aircraft fleet growth and significant defense modernization efforts focused on upgrading fighter and transport aircraft driving the growth. According to Japan’s Ministry of Defense, defense budget reaching USD 59.5 billion, a 16.5% increase from the previous year. Rising defense expenditure is accelerating upgrades to fighter jets and transport aircraft, boosting demand for advanced landing gear systems.

- Companies should focus on supplying high-precision, reliable landing gear components, strengthen collaborations with Japanese OEMs, and invest in R&D to meet stringent quality and regulatory standards in this mature market.

- The South Korea aerospace landing gear market is anticipated to grow at a CAGR of 10.4% during the forecast period. This growth is driven by increased government investment in defense modernization, expansion of commercial aviation, and the country’s push for indigenous aircraft manufacturing. According to the Korea Aerospace Industries Association, South Korea plans to increase its aerospace exports by over 15% annually through 2030.

- Companies should focus on strengthening local collaborations, investing in advanced manufacturing technologies, and aligning product development with South Korea’s growing commercial and military aerospace sectors to capture emerging opportunities.

Latin America held 4% market share in 2024 driven by growing air passenger traffic, modernization of commercial fleets, and increasing defense spending in countries like Brazil and Mexico. The region’s commercial aircraft fleet is increasing landing gear demand.

Middle East and Africa projected to grow at a CAGR of 6.4% during the forecast period owing to increasing investments in military modernization, rapid expansion of commercial aviation hubs, and rising demand for fleet upgrades driving the market for landing gears.

- Saudi Arabia is projected to grow at a CAGR of 6.5% during the forecast period owing to the country’s Vision 2030-driven defense industrial modernization, growing commercial aviation activities, and the rising investment in domestic aerospace manufacturing facilities. Furthermore, the expanding airport infrastructure and renewal programs of the national carriers are driving the demand for sophisticated landing gear systems and services.

- Companies should focus on local partnerships, invest in compliant manufacturing capabilities, and offer customized landing gear solutions to support Saudi Arabia’s strategic aviation growth initiatives.

- South Africa market is anticipated to grow at a CAGR of 5.5% during the forecast period. Increasing commercial air traffic, modernization of the air force’s fleet, and greater allocations to the defense budget are driving growth, also supportive South African government policies aimed at improving aerospace manufacturing and the maintenance infrastructure are driving growth.

- UAE aerospace landing gear market is projected to grow to USD 270.3 million by 2034 because of increased spending on the defense industry, fleet upgrades by national carriers, and the rapid expansion of commercial aviation in the region. The country's landing gear systems and aftermarket services also benefit from its strategic location as a global transit hub.

- Companies must focus on establishing regional service centers, enhancing maintenance and overhaul activities, as well as developing bespoke solutions to serve the expanding aerospace ecosystem in the UAE.

Aerospace Landing Gear Market Share

- The top 5 players in the aerospace landing gear industry are Safran, Raytheon Technologies, Honeywell International, GKN Aerospace, Liebherr Aerospace, which collectively held 63.1% of the global market in 2024.

- In 2024, Safran led the aerospace landing gear industry with a 17.3% market share. Safran supports major commercial and military programs worldwide with its integrated landing gear systems and strong OEM relationships. Safran held a strong position due to its investments in lightweight composites and predictive maintenance technologies. These investments help the company meet changing industry needs for reliability and operational efficiency.

- In 2024, Raytheon Technologies held a 15.6% market share, because of its advanced landing gear lineup and dominance in modernization programs for defense. Raytheon Technologies focus on innovation in electro-mechanical actuation and digital health monitoring systems enhances fleet availability and lifecycle management for crucial aerospace customer globally.

- Honeywell International Inc. held a share of 13.7% of in 2024. Honeywell maintains a strong position in predictive maintenance and systems integration, which benefits its diverse aerospace portfolio that includes landing gear actuation systems and avionics. The company’s more electric, intelligent aircraft technologies propel further growth in the commercial and business aviation segments.

- GKN Aerospace held a 6.1% market share in 2024. GKN Aerospace's focus on additive manufacturing, as well as responsiveness in the supply chain, allows effective service of OEM and aftermarket customers in a competitive environment. The company also held a strong position in the fabrication of lightweight, high-performance landing gear components.

- Liebherr Aerospace accounted for 10.4% of the market in 2024, benefiting from its comprehensive landing gear system solutions and strong aftermarket support. Liebherr's digitalization investments and condition-based maintenance solutions enhance operational efficiency, particularly for commercial aviation fleets that are growing and updating.

Aerospace Landing Gear Market Companies

Major players operating in the aerospace landing gear industry are:

- Safran

- Raytheon Technologies

- Honeywell International Inc.

- GKN Aerospace

- Liebherr Aerospace

- Sumitomo Precision Products Co., Ltd.

- Tata Advanced Systems Limited (TASL)

- Triumph Group, Inc.

- GA Telesis

- Heroux-Devtek Inc.

- Safran, Raytheon Technologies, Honeywell International, Liebherr Aerospace, and GKN Aerospace are recognized as leaders. They are leaders due to broad landing gear system portfolios, robust OEM alliances, and investments in advanced materials and predictive maintenance. Broad participation in commercial, military, and business aviation programs gives them strong order pipelines and protection against industry cyclicality.

- Boeing, Meggitt, Heroux-Devtek, Magellan Aerospace, and Triumph Group are positioned as challengers. These companies utilize vast aerospace manufacturing capability, broadened bases of products, and global service networks. Focused on retrofit, aftermarket service, and local aerospace program support, they steadily increase market share in evolving customer demand.

- Crane Aerospace & Electronics, Kawasaki Heavy Industries, Sumitomo Precision Products Co., Ltd., Tata Advanced Systems Limited, and MAG Inc. are classified as followers. They are expanding on specialized landing gear components, strategic alliances, and niche aerospace businesses. Modular design take-up and open system integration allow them to leverage mid-range commercial and defense aviation demand.

- CIRCOR International, Eaton Corporation, GA Telesis, and Whippany Actuation Systems operate as niche competitors. They focus on specialized subsystems, such as actuation, hydraulic systems, and after-market logistics. For new and retrofit aerospace projects, they have an edge because of their innovative solutions, affordable options, and partnerships with local MRO suppliers.

Aerospace Landing Gear Market News

- In April 2025, GA Telesis completed the acquisition of AAR CORP.'s Landing Gear Overhaul and Wheels & Brakes business unit. The newly acquired operations are now fully integrated into GA Telesis’ MRO Services Division as GA Telesis Landing Gear Services.

- In April 2025, McFarlane Aviation and The Landing Gear Works (TLGW) formed a distribution partnership to supply TLGW’s airframe components, including titanium landing gear legs and tailwheel assemblies, primarily for Cessna aircraft in the general aviation market.

- In February 2024, Liebherr-Aerospace and Japan Airlines (JAL), specifically its regional subsidiary J-Air, have signed a long-term service contract for the overhaul of landing gear systems on J-Air's fleet of Embraer E170 and E190 aircraft.

The aerospace landing gear market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Gear Type

- Nose landing gear

- Main landing gear

Market, By Platform

- Commercial aviation

- Narrow-body aircraft

- Wide-body aircraft

- Regional jets

- Cargo Aircraft

- Military aviation

- Fighter jets

- Military transport aircraft

- Military helicopters

- General aviation

- Business jets

- Light aircraft

- Turboprops

Market, By Arrangement

- Tail wheel landing gear

- Tandem landing gear

- Tricycle landing gear

Market, By Actuation System

- Hydraulic

- Electric

- Electro-mechanical

Market, By End Use

- OEM (original equipment manufacturer)

- Aftermarket

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the aerospace landing gear market?

Key players include Safran, Raytheon Technologies, Honeywell International Inc., GKN Aerospace, Liebherr Aerospace, Sumitomo Precision Products Co., Ltd., Tata Advanced Systems Limited (TASL), Triumph Group, Inc., GA Telesis, Heroux-Devtek Inc.

What are the upcoming trends in the aerospace landing gear market?

Key trends include electrification and more-electric aircraft systems, predictive maintenance and digitalization with sensors and digital twin technology, OEM-sponsored exchange programs, and expansion of indigenous aircraft programs in emerging markets.

Which region leads the aerospace landing gear market?

North America leads with 38.9% market share in 2024, due to strong commercial aircraft fleet, established aerospace manufacturing ecosystem, major military spending on modernization projects, and leading OEMs presence.

What is the growth outlook for aftermarket segment from 2025 to 2034?

Aftermarket segment is projected to grow at a 9.9% CAGR from 2025 to 2034, propelled by aging global aircraft fleet requiring frequent maintenance, repair, and overhaul services, with airlines prioritizing cost-efficient refurbishment.

What was the valuation of military aviation segment by 2034?

Military aviation segment is expected to reach USD 6.2 billion by 2034, driven by higher defense expenditure, fleet upgrades, and induction of next-generation aircraft with advanced landing systems.

What is the market size of the aerospace landing gear in 2024?

The market size was USD 11.2 billion in 2024, with a CAGR of 8.5% expected through 2034 on account of rising aircraft deliveries, military modernization, increasing air travel, and MRO expansion.

What is the projected value of the aerospace landing gear market by 2034?

The aerospace landing gear market is expected to reach USD 25.2 billion by 2034, propelled by global commercial aircraft deliveries, military modernization programs, and growth in air passenger traffic.

How much market share did the main landing gear segment hold in 2024?

The main landing gear dominated with a 72.8% share in 2024, due to its critical role in supporting aircraft weight, absorbing landing shocks, and frequent replacement cycles.

Aerospace Landing Gear Market Scope

Related Reports