Summary

Table of Content

Aerospace Coatings Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aerospace Coatings Market Size

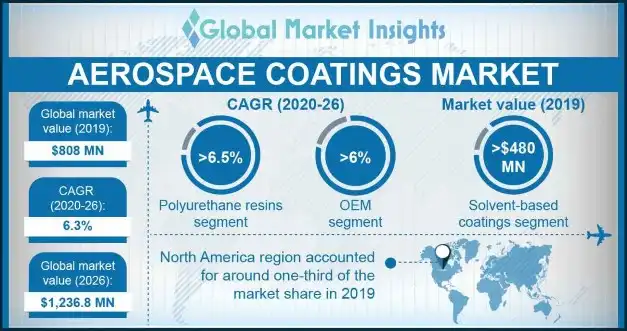

Aerospace Coatings Market size surpassed USD 800 million in 2019 and is poised to witness around 6% CAGR between 2020 and 2026. Rising demand for commercial aircrafts coupled with strong presence of aerospace & defense sector in North American region will augment the market growth.

According to Boeing, one of the largest aircraft manufacturers in the world, more than 39,000 new aircrafts are required over the next two decades to cater the rising air passengers. Growing air passenger traffic along with the increasing consumer preference toward air travel is augmenting the demand for new commercial aircraft.

To get key market trends

Rising demand for new generation aircrafts to replace the existing commercial aircraft fleet will drive the aerospace coatings industry growth. Moreover, increasing popularity of lightweight aerospace coatings among the major aircraft manufacturers will positively influence the market demand.

Aerospace Coatings Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 808.0 Million (USD) |

| Forecast Period 2020 to 2026 CAGR | 6.3% |

| Market Size in 2026 | 1,236.8 Million (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Aerospace Coatings Market Analysis

Polyurethane resins in the market will witness a growth of over 6.5% though 2026. It can be attributed to several advantages associated with this resin type such as durability, flexibility, resistance against abrasion, staining and chemicals, etc. These resins provide higher resistance to the corrosive effects due to UV rays.

Solvent-based aerospace coatings market size valued at over USD 480 million in 2019. It can be majorly credited to extensive application of these products in military aircrafts. Solvent-based topcoat provides excellent camouflage and colour, chemical resistance and enhances external durability properties. It provides faster drying time even in humid weather. However, stringent VOC regulations might hamper the growth of this technology segment.

OEM segment is likely register gains at over 6%till 2026. Major investments in the emerging economies to develop new air routes along with upgradation of existing airports will drive the growth of this segment. Moreover, rising number of air passengers, increasing aircraft production, etc. will also augment the segment demand.

Learn more about the key segments shaping this market

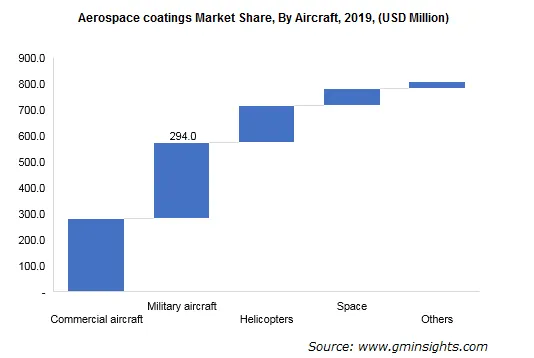

In 2019, the military aircraft segment generated more than USD 290 million revenue in the aerospace coatings market. Rising aerospace & defense spending across the globe will chiefly drive the growth of this aircraft segment. Rising military aircraft deliveries maritime & border missions will positively influence the market growth.

Exterior coatings segment is likely to dominate the market with more than four-fifth revenue share. The high demand for aerospace coatings in exterior applications is owing to requirement for coating to safeguard from extreme weather conditions.

A giant A380 Airbus requires an average of around 480 kgs of coating. Additionally, after every 5 to 8 years, airline repairs their planes, which needs extensive downtime, especially for repairing paint. In order to reduce the downtime, these airlines prefer advance coating technologies. Rising demand for commercial aircrafts will drive the growth of this application segment.

Learn more about the key segments shaping this market

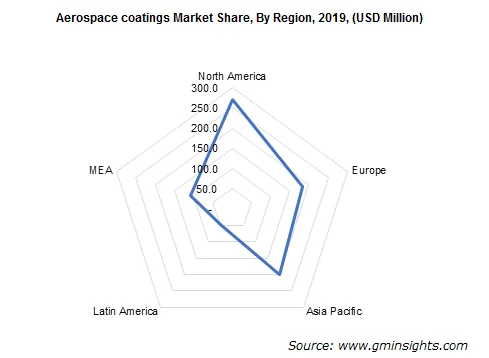

North America aerospace coatings market dominated around one-third revenue share in 2019 impelled by presence of major A&D manufacturers in the region. Aerospace & defense industry in the U.S. generated over USD 850 billion in 2017.

Moreover, in 2018, the U.S. military & defense expenditure was recorded at around USD 630 billion. Presence of rising demand for commercial aircrafts and ongoing research & development projects to reduce emission is expected to influence the market size across the region.

Aerospace Coatings Market Share

Some of the prominent players in the market include

- Akzo Nobel NV

- BASF

- PPG Industries

- Brycoat Inc

- Heinkel

- IHI Ionbond AG

- Argosy International

- The Sherwin-Williams Company

Major manufacturer opts for acquisitions, partnerships, new product development and production capacity expansion to strengthen their position in the market.

For instance, AkzoNobel announced the establishment of a manufacturing unit in China in September 2017, to manufacture advanced coating solutions for aerospace applications. It has helped the company to cater the rising demand in Asia Pacific region.

In December 2016, BASF announced the acquisition of Chemetall, a company specialized in manufacturing coating solutions for diverse business platforms. This acquisition will enable the company to expand its portfolio to become a more complete solution provider.

The market research report on aerospace coatings includes in-depth coverage of the industry with estimates & forecast in terms of volume in tons and revenue in USD million from 2016 to 2026, for the following segments:

Market by Resin

- Polyurethane resin

- Epoxy resin

- Others

Market by Technology

- Solvent Based Coatings

- Water Based Coatings

- Powder Coatings

- Others

Market by User Type

- Original Equipment Manufacturers (OEM)

- Maintenance, repair and overhaul (MRO)

Market by Aircraft

- Commercial aircraft

- Military aircraft

- Helicopter

- Spacecraft

- Others

Market by Application

- Exterior

- Interior

The above information has been provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Poland

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Singapore

- Australia

- Thailand

- Malaysia

- Taiwan

- Latin America

- Brazil

- Mexico

- Argentina

- Peru

- Chile

- Colombia

- Venezuela

- Middle East & Africa

- Israel

- Egypt

- Turkey

- Iran

- Algeria

- UAE

- Syria

- South Africa

Frequently Asked Question(FAQ) :

What are the growth expectations for OEMs in the industry?

OEM segment is likely register gains at over 6% till 2026 led by major investments in the emerging economies to develop new air routes along with upgradation of existing airports.

How much will the polyurethane resins gain in the market during the forecast period?

According to this forecast report by GMI, the polyurethane resin segment in the market will witness a growth of over 6.5% though 2026.

What was the size of the global aerospace coatings market in 2019?

The market size of aerospace coatings was surpassed USD 800 million in 2019.

What is the expected growth rate for aerospace coatings industry share during the forecast timespan?

The industry share of aerospace coatings is poised to witness around 6% CAGR between 2020 and 2026.

Why is the North America aerospace coatings industry witnessing high demand?

The North American region is witnessing high market demand on account of presence of major aerospace & defense manufacturers in the region.

Which are the major players operating in the aerospace coatings market?

Some of the prominent players in the market include Akzo Nobel NV, BASF, PPG Industries, Brycoat Inc, Heinkel, IHI Ionbond AG, Argosy International and The Sherwin-Williams Company.

Aerospace Coatings Market Scope

Related Reports