Summary

Table of Content

Aeroderivative Sensor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aeroderivative Sensor Market Size

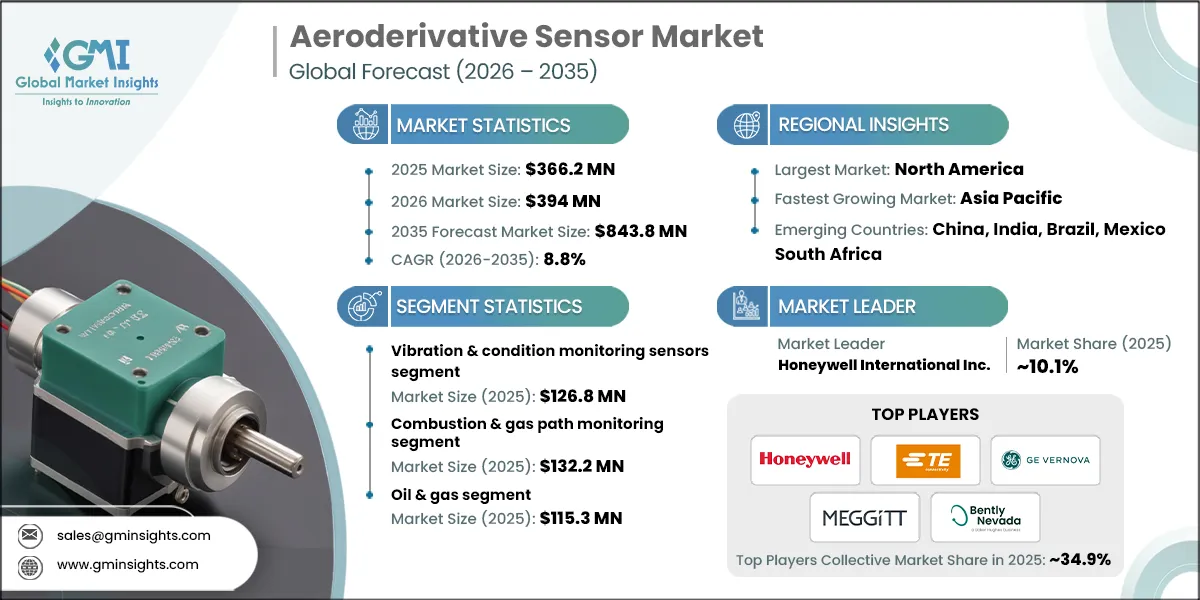

The global aeroderivative sensor market was valued at USD 366.2 million in 2025 with the volume of 194 thousand units in 2025. The market is expected to grow from USD 394 million in 2026 to USD 843.8 million in 2035, at a CAGR of 8.8% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

The market is being propelled by the expansion of advanced aerospace systems, encompassing both commercial and military aircraft. These sensors play a pivotal role in overseeing and regulating diverse aircraft systems, from engine performance and navigation to environmental monitoring.

With the aerospace sector advancing towards more sophisticated and efficient systems, there's an escalating demand for high-precision sensors. These sensors must not only deliver reliability but also endure extreme conditions. This growing demand is largely driven by the industry's emphasis on heightened safety, superior performance, and enhanced operational efficiency in contemporary aerospace applications.

As drone usage continues to grow, more attention is being paid to safety and compliance with federal regulations. This trend toward increased safety & regulatory compliance is creating an increased need for advanced aeroderivative sensors for the automation of aircraft. In February 2024, ParaZero Technologies expanded its partnership with Vayu Aerospace for the integration of its SafeAir parachute system into Vayu's G-1MKII, G-1MKIII, US-1 MKII & US -2 UAVs. This innovative SafeAir parachute system utilizes advanced aeroderivative sensors that enable continuous monitoring of flight paths to identify when there has been a failure or crash. When such a situation arises, the SafeAir parachute system will deploy a parachute, thus, allowing for a controlled descent of the aircraft and enhancing the likelihood of safe descent for drone operators, thus improving compliance with FAA regulations.

The aeroderivative sensors market will continue growing due to technological advancements (miniaturization and increased accuracy). The introduction of new technologies like optical fibre sensors, Micro-Electro-Mechanical Systems (MEMS), and new material combinations allowed sensors to be built stronger and more reliably and to measure more accurately in aerospace application. Additionally, the improvement of sensor materials has allowed the ability to build compact sensors that fit into small systems, leading to their increased use in many different aerospace and defense applications.

Aeroderivative Sensor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 366.2 Million |

| Market Size in 2026 | USD 394 Million |

| Forecast Period 2026-2035 CAGR | 8.8% |

| Market Size in 2035 | USD 843.8 Million |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for advanced aerospace systems | Drives demand for high-performance, miniaturized semiconductor chips used in avionics, navigation, and communication systems, enabling more sophisticated and reliable aerospace technologies. |

| Drone safety and regulations are driving demand for real-time aeroderivative sensors. | Encourages foundries to supply specialized, low-power, and high-precision chips that support real-time sensor data processing, ensuring regulatory compliance and operational safety of UAVs. |

| Expansion of commercial aviation | Stimulates production of chips for in-flight entertainment, navigation, and communication systems, supporting higher passenger volumes and more technologically advanced aircraft fleets. |

| Focus on maintenance and upgrades | Promotes semiconductor adoption in predictive maintenance systems, advanced monitoring, and upgradable avionics platforms, enhancing operational efficiency and reducing lifecycle costs for aerospace equipment. |

| Miniaturization & Advanced Sensor Technologies | Drives market growth by enabling compact, lightweight, and high-performance sensors suitable for harsh environments, facilitating higher integration, improved responsiveness, and reduced system complexity. |

| Pitfalls & Challenges | Impact |

| Complex Certification, Integration, and Long Development Cycles | Restrains adoption by extending time-to-market and raising compliance costs, as sensors must meet stringent aerospace and defense standards and integrate seamlessly with legacy turbine control systems. |

| High Operating Costs and Harsh Operating Environments | Impacts market growth by increasing sensor failure rates and maintenance costs, as extreme temperatures, vibration, and pressure demand highly ruggedized and expensive sensor solutions. |

| Opportunities: | Impact |

| Growth in offshore oil and gas projects | Creates demand for efficient, compact power generation solutions in remote and harsh environments. |

| Rising need for fast-start and flexible power plants | Enables integration of aeroderivative turbines for quick response and grid stability in renewable energy systems. |

| Market Leaders (2025) | |

| Market Leader |

~10.1% Market Share |

| Top Players |

Collective Market Share is ~34.9% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Aeroderivative Sensor Market Trends

- As the integration of advanced sensors into today’s aerospace systems continues to grow, the number of new players that enter into the aeroderivative sensor business as they react to the new opportunities that are created by this increased demand. In May 2025, Honeywell announced plans to create lightweight, custom-engineered sensors for Lilium’s all-electric vertical take-off and landing (eVTOL) jet. These new sensor designs will allow Lilium to accurately position their engines and help them achieve their goal of providing sustainable regional air mobility at high speeds with zero emissions.

- In July 2024, IdeaForge entered a partnership with the newly formed GalaxEye Space, a spacetech company that will create drone-based sensors that can penetrate fog and foliage. This is part of IdeaForge’s strategy to expand into the U.S., as well as provide enhanced capabilities for their existing UAV systems. The combination of these two factors is driving the increased use of aeroderivative sensors in commercial and military aviation.

- The use of aeroderivative sensors for predictive maintenance and improving system performance is increasing in popularity. As the aerospace industry uses data to dictate the way it conducts business, the ability to know when a piece of equipment will fail and to prevent these failures is becoming increasingly important. Aeroderivative sensors provide vital information about the health of the aircraft system.

- Airlines and military personnel are therefore able to optimize their maintenance schedules, decrease aircraft downtime, and increase their overall operational effectiveness. The trend of using aeroderivative sensors reflects the overall increase in the use of complex, technologically advanced sensor technology in the aerospace industry.

Aeroderivative Sensor Market Analysis

Learn more about the key segments shaping this market

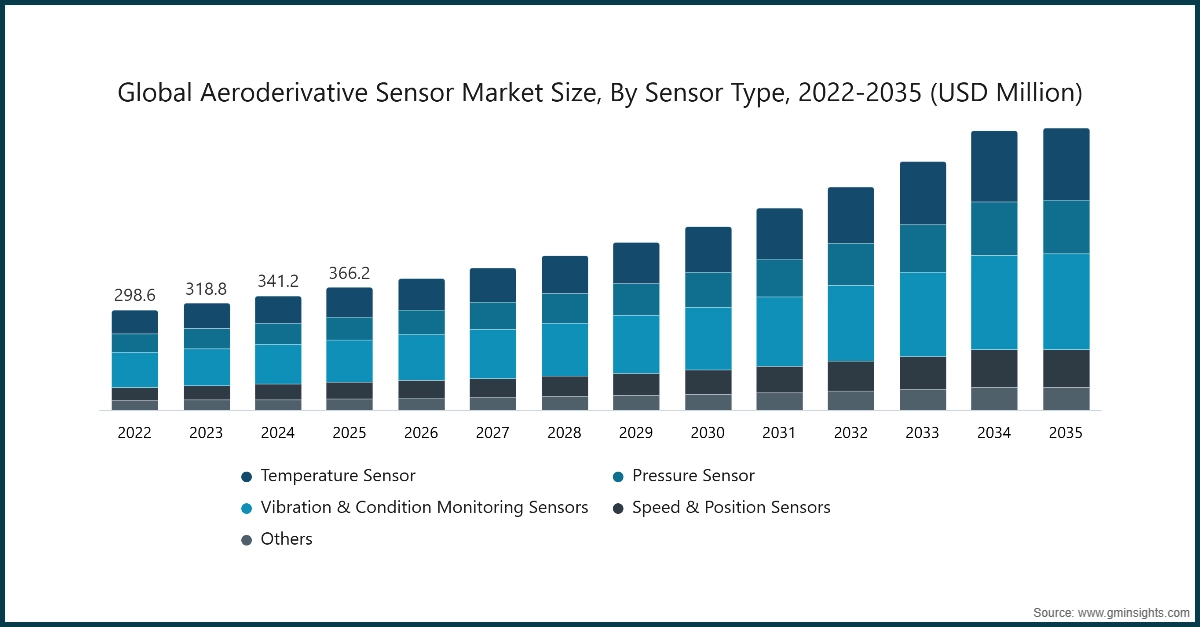

By sensor type, the aeroderivative sensor market is segmented into temperature sensors, pressure sensors, vibration & condition monitoring sensors, speed & position sensors, and others. The vibration & condition monitoring sensors accounted for the largest market size of USD 126.8 million in 2025.

- The vibration & condition monitoring sensors holds the largest market due to its critical role in real-time monitoring of aeroderivative turbines and rotating machinery. These sensors enable early detection of mechanical issues, preventing downtime and ensuring operational efficiency in power generation and aviation applications.

- Vibration sensors provide high-precision data, durability under harsh operating conditions, and integration capabilities with predictive maintenance systems. These advantages make them essential for monitoring turbine health, rotor imbalance, bearing wear, and overall system reliability in industrial and aerospace environments.

- This segment benefits from established deployment across aeroderivative power plants and aerospace systems, proven scalability, and strong adoption by turbine OEMs and service providers, ensuring consistent usage and widespread implementation globally.

- Growing demand for higher turbine efficiency, predictive maintenance solutions, and real-time performance monitoring continues to reinforce the dominance of vibration and condition monitoring sensors in the aeroderivative sensor market.

- The temperature sensor segment is the fastest-growing and is expected to register a 9.5% CAGR during the forecast period due to increasing demand for precise thermal monitoring in aeroderivative turbines. Temperature sensors are essential for safe, efficient operation and integration with advanced turbine control systems.

- Advancements in high-temperature resistant materials, miniaturization, and wireless sensor technologies are further improving the efficiency, accuracy, and deployment flexibility of temperature sensors, driving rapid growth in aeroderivative applications requiring thermal management and predictive diagnostics.

By system integration point, the aeroderivative sensor market is segmented into combustion & gas path monitoring, rotor & shaft monitoring, fuel system monitoring, lubrication & cooling system monitoring, and emissions & environmental monitoring. The combustion & gas path monitoring accounted for the largest market size of USD 132.2 million in 2025.

- The combustion & gas path monitoring segment holds the largest market due to its critical importance in monitoring core turbine operations, including combustion stability, exhaust gas temperature, pressure, and airflow. These parameters directly impact turbine efficiency, power output, fuel consumption, and emissions compliance in aeroderivative systems.

- Sensors integrated in the combustion and gas path enable real-time performance optimization, early fault detection (such as hot spots or combustion instability), and protection against thermal overstress, making them indispensable for continuous turbine operation in power generation and aviation-derived applications.

- This segment benefits from mandatory deployment across all aeroderivative turbines, strong integration with turbine control systems, and widespread adoption by OEMs and service providers, ensuring consistent demand and large-scale implementation globally.

- Increasing focus on efficiency optimization, emissions reduction, and regulatory compliance continues to reinforce the dominance of combustion and gas path monitoring in the aeroderivative sensor market.

- The rotor & shaft monitoring segment is the fastest-growing and is expected to register the 9.9% CAGR during the forecast period due to rising demand for advanced condition monitoring of rotating components in aeroderivative turbines.

- Rotor and shaft sensors play a crucial role in detecting imbalance, misalignment, torsional vibration, and bearing degradation, enabling predictive maintenance and preventing catastrophic mechanical failures.

- Growing adoption of digital twins, predictive analytics, and real-time health monitoring systems is accelerating the deployment of rotor and shaft monitoring sensors, particularly in high-speed aeroderivative turbines operating under demanding conditions.

- The shift toward reliability-centered maintenance, reduced unplanned downtime, and lifecycle cost optimization is driving rapid growth of this segment across power generation, oil & gas, and aerospace-derived turbine installations.

Learn more about the key segments shaping this market

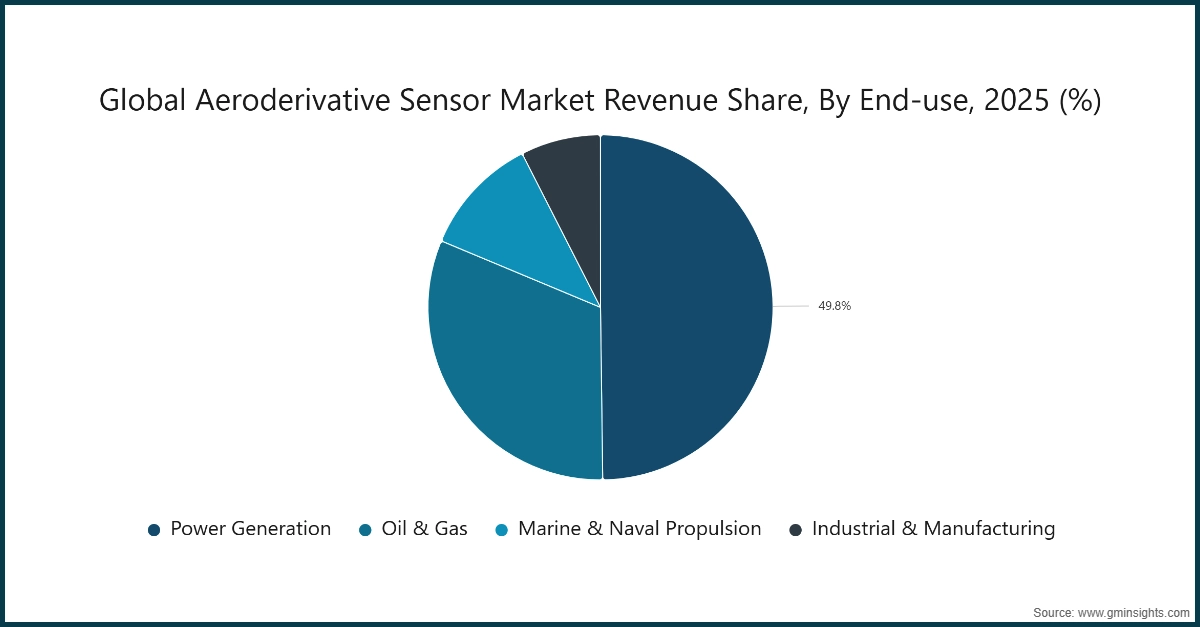

By end-use, the aeroderivative sensor market is segmented into power generation, oil & gas, marine & naval propulsion, and industrial & manufacturing. The oil & gas segment accounted for USD 115.3 million market size in 2025.

- The oil & gas segment holds the market due to extensive use of aeroderivative turbines in upstream, midstream, and downstream operations. Sensors in this sector enable real-time monitoring of turbines, compressors, and critical machinery, ensuring operational efficiency and minimizing downtime.

- These sensors support predictive maintenance, high reliability under harsh conditions, and compliance with stringent safety and environmental regulations, making them essential for offshore platforms, refineries, and gas processing facilities.

- The segment benefits from established industry adoption, robust infrastructure, and strong OEM partnerships, ensuring widespread deployment of aeroderivative sensors across global oil and gas operations.

- The power generation segment is the fastest-growing and is expected to register a 9.4% CAGR during the forecast period due to rising demand for flexible, fast-start power solutions.

- Sensors in power generation monitor turbine performance, rotor health, temperature, and vibrations, enabling predictive maintenance, efficiency optimization, and seamless integration with renewable energy systems in combined-cycle and grid-support applications.

North America Aeroderivative Sensor Market

Looking for region specific data?

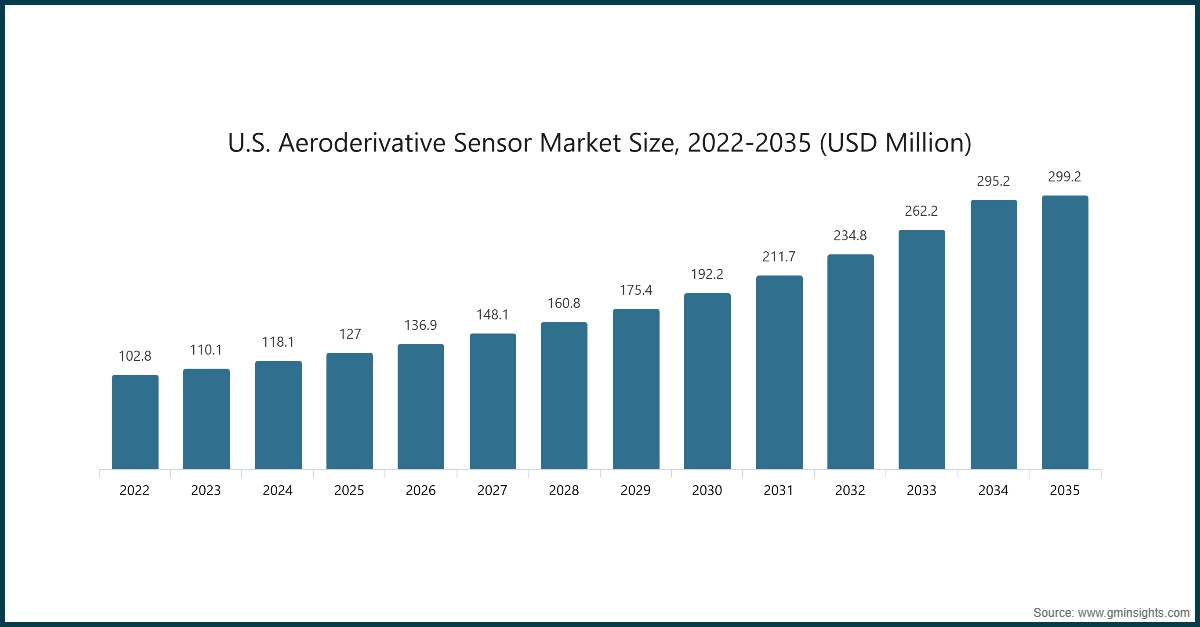

The North America aeroderivative sensor market dominated over 39.4% of the revenue share in 2025.

- The North American market is growing steadily, fueled by the increasing adoption of smart turbines and predictive maintenance solutions. Industries are investing in high-precision sensors to improve operational efficiency, reduce downtime, and enhance safety.

- Integration of IoT and industrial automation across energy and aerospace sectors is further driving sensor deployment. Rising focus on regulatory compliance and real-time monitoring is creating opportunities for advanced aeroderivative sensor solutions.

The U.S. aeroderivative sensor market was valued at USD 102.8 million and USD 110.1 million in 2022 and 2023, respectively. The market size reached USD 127 million in 2025, growing from USD 11.8.1 million in 2024.

- The U.S. market is expanding due to strong aerospace, defense, and energy sector investments. Increasing demand for high-precision and real-time monitoring sensors is driving adoption across turbines, drones, and industrial equipment.

- In October 2025, Industrial Control Solutions (ICS), a portfolio company of LDR Partners LP, acquired Duro-Sense Corporation. This move expands ICS’s precision temperature measurement capabilities and strengthens its presence in aerospace and defense, highlighting growth opportunities for aeroderivative sensors.

Europe Aeroderivative Sensor Market

- Europe’s aeroderivative sensor industry is benefiting from stringent energy efficiency and safety regulations. Adoption of predictive maintenance and smart turbine solutions is rising across industrial, aerospace, and power generation sectors.

- Investment in renewable energy and hybrid power generation technologies is creating additional opportunities. The market is further supported by a focus on reducing operational risks and enhancing turbine performance through advanced sensor technologies.

The aeroderivative sensor market in Germany is driven by the country’s robust aviation manufacturing sector, which is investing in cutting-edge aircraft technology.

- Germany is a leading market in Europe due to its strong industrial automation and advanced turbine infrastructure. Precision aeroderivative sensors are increasingly deployed to ensure safety, efficiency, and regulatory compliance.

- Government incentives for energy-efficient systems and growing aerospace applications are driving sensor adoption. Focus on smart manufacturing and industrial IoT integration is expected to sustain market growth in the coming years.

Asia Pacific Aeroderivative Sensor Market

- Asia Pacific is witnessing rapid market growth driven by infrastructure expansion, rising energy demand, and increasing aerospace and defense investments. Advanced turbine and predictive maintenance solutions are becoming critical for operational efficiency.

- The region is also focusing on integrating IoT and smart sensor technologies to enhance real-time monitoring and safety. Investment in renewable energy and hybrid power plants is further boosting aeroderivative sensor adoption.

China aeroderivative sensor market is estimated to grow with a 10.9% CAGR till 2035.

- China is emerging as a major market due to modernization of power plants, smart industrial initiatives, and government policies supporting advanced sensor technologies. Aeroderivative sensors are being increasingly deployed in turbines and drone systems.

- The focus on operational safety, efficiency, and predictive maintenance in industrial and aerospace sectors is driving demand. Expansion of renewable energy infrastructure and industrial automation is expected to accelerate market growth.

Latin American Aeroderivative Sensor Market

- Brazil’s market growth is supported by rising energy infrastructure investments and adoption of advanced turbine technologies. Industrial and aerospace sectors are increasingly relying on real-time sensor monitoring for operational safety.

- Regulatory focus on energy efficiency and safety compliance is creating opportunities for advanced aeroderivative sensor solutions. The integration of predictive maintenance technologies is expected to further drive market expansion.

Middle East and Africa Aeroderivative Sensor Market

- South Africa is experiencing gradual market growth as industrial and aerospace sectors adopt advanced sensor technologies. Focus on predictive maintenance and safety monitoring is driving aeroderivative sensor adoption.

- Increasing investments in smart turbine solutions and energy efficiency projects are creating new opportunities. The market is expected to benefit from the growing emphasis on operational reliability and regulatory compliance.

Aeroderivative Sensor Market Share

The competitive landscape of the aeroderivative sensor industry is characterized by moderate consolidation, high technological intensity, and a strong focus on precision, reliability, and real-time performance. Key players such as Honeywell International Inc. (10.1%), TE Connectivity Ltd. (2.2%), GE Vernova / GE Aviation (5.4%), Meggitt PLC (Parker Hannifin) (4.6%), and Bently Nevada (Baker Hughes) (12.5%) collectively account for a significant portion of the market, reflecting a semi-consolidated structure where major industrial and aerospace sensor providers coexist with specialized technology firms.

Market participants primarily compete on technological sophistication, sensor accuracy, durability under extreme conditions, and integration capabilities for real-time monitoring in aeroderivative turbines. Leading companies focus on continuous innovation in vibration sensors, temperature and pressure monitoring systems, condition-based monitoring modules, and smart diagnostic solutions to serve aerospace, power generation, and industrial applications.

Major players invest heavily in research and development, advanced sensor manufacturing facilities, and automated testing systems to enhance product reliability and precision. Strategic collaborations with turbine OEMs, aerospace manufacturers, energy operators, and industrial automation firms are widely adopted to expand technological capabilities, optimize sensor performance, and accelerate adoption of predictive maintenance and safety solutions.

Aeroderivative Sensor Market Companies

Prominent players operating in the aeroderivative sensor industry are as mentioned below:

- AMETEK, Inc.

- Bently Nevada (Baker Hughes)

- Columbia Research Labs, Inc.

- Conax Technologies

- GE Vernova / GE Aviation

- Honeywell International Inc.

- Kistler Instrument Corp.

- Kulite Semiconductor Products, Inc.

- Meggitt SA

- PCB Piezotronics, Inc.

- Scanivalve Corporation

- Sensirion AG

- Smith Systems, Inc.

- TE Connectivity Ltd.

- Thermocoax, Inc.

- Unison LLC

- Woodward, Inc.

- Honeywell International Inc.

Honeywell International Inc. is a leading player in the global aeroderivative sensor market with a market share of approximately 10.1%. The company specializes in high-precision vibration, temperature, and pressure sensors for aeroderivative turbines, industrial gas turbines, and aerospace applications. Honeywell focuses on reliability, accuracy, and real-time monitoring capabilities, enabling predictive maintenance and enhanced turbine performance. Continuous investments in R&D, advanced sensor technologies, and collaborations with turbine OEMs strengthen its position as a market leader in innovative and high-performance sensor solutions.

TE Connectivity Ltd. holds a market share of around 2.2% in the aeroderivative sensor market. The company provides robust, high-reliability sensors and connectivity solutions, including vibration, temperature, and pressure monitoring systems for power generation, aerospace, and industrial applications. TE Connectivity emphasizes precision manufacturing, miniaturized sensor designs, and multifunctional integration to meet evolving industry demands. Strategic partnerships with turbine manufacturers and industrial operators allow the company to expand its global footprint and maintain a competitive edge in advanced sensor technologies.

GE Vernova / GE Aviation commands approximately 5.4% of the aeroderivative sensor market. The company delivers integrated sensor solutions for turbine monitoring, including vibration, temperature, and pressure sensing systems critical for operational efficiency and safety. GE focuses on sensor reliability, high accuracy, and compatibility with predictive maintenance platforms. Investments in advanced sensor R&D, digital monitoring technologies, and collaborations with aerospace and energy partners enhance their ability to provide innovative, high-performance solutions for the global aeroderivative market.

Aeroderivative Sensor Industry News

- In February 2025, TE Connectivity announced the acquisition of Richards Manufacturing Co., a leading provider of underground electrical distribution products, from Oaktree Capital Management and the Bier family. The USD 2.3 million all-cash deal aimed to strengthen TE’s presence in North America’s energy market, combining complementary product portfolios and leveraging Richards’ expertise to capitalize on grid upgrades and rising energy demand. The acquisition was expected to close in TE’s fiscal third quarter, ending June 2025, and contribute approximately USD 400 million in annual sales.

- In April 2024, Honeywell and ITP Aero announced the establishment of a new authorized service center for Honeywell’s F124-GA-200 aircraft engines at ITP Aero’s Ajalvir facility in Madrid. The center, operational by the end of 2024, will provide local maintenance, repair, and overhaul (MRO) capabilities for over 150 engines in Europe, reducing turnaround times. This marks Honeywell’s third regional service center for the engine, enhancing operational efficiency, sustainability, and support for European operators.

The aeroderivative sensor market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in (USD Million) & Volume (Units) from 2022 – 2035 for the following segments:

Market, By Sensor Type

- Temperature Sensor

- Pressure Sensor

- Vibration & Condition Monitoring Sensors

- Speed & Position Sensors

- Others

Market, By System Integration Point

- Combustion & Gas Path Monitoring

- Rotor & Shaft Monitoring

- Fuel System Monitoring

- Lubrication & Cooling System Monitoring

- Emissions & Environmental Monitoring

Market, By Interface

- Analog Output Sensors

- Digital Output Sensors

- Wireless / Remote Sensors

Market, By Sales Channel

- Original Equipment Manufacturers (OEMs)

- Aftermarket & MRO Service Providers

- System Integrators

- Direct End Users

Market, By End-use

- Power Generation

- Oil & Gas

- Marine & Naval Propulsion

- Industrial & Manufacturing

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the aeroderivative sensor market?

Integration of lightweight custom sensors for eVTOLs, drone-based sensing for UAVs, predictive maintenance use cases, and wider adoption of advanced aerospace sensor technologies.

Which region leads the aeroderivative sensor sector?

North America leads the market with a 39.4% revenue share in 2025, propelled by the adoption of smart turbines and predictive maintenance solutions.

What is the growth outlook for the Oil & Gas segment?

The Oil & Gas segment, valued at USD 115.3 million in 2025, due to the extensive use of aeroderivative turbines in upstream, midstream, and downstream operations.

Who are the key players in the aeroderivative sensor industry?

Key players include AMETEK, Inc., Bently Nevada (Baker Hughes), Columbia Research Labs, Inc., Kistler Instrument Corp., Kulite Semiconductor Products, Inc., Meggitt SA, PCB Piezotronics, Inc., and Scanivalve Corporation.

What was the valuation of the Combustion & Gas Path Monitoring segment in 2025?

The Combustion & Gas Path Monitoring segment accounted for USD 132.2 million in 2025, led by its importance in monitoring turbine operations and ensuring efficiency and emissions compliance.

What is the expected size of the aeroderivative sensor industry in 2026?

The market size is projected to reach USD 394 million in 2026.

How much revenue did the Vibration & Condition Monitoring Sensors segment generate in 2025?

The Vibration & Condition Monitoring Sensors segment generated approximately USD 126.8 million in 2025

What is the projected value of the aeroderivative sensor market by 2035?

The market is poised to reach USD 843.8 million by 2035, fueled by the adoption of advanced aerospace technologies and the emphasis on safety and operational efficiency.

What was the market size of the aeroderivative sensor in 2025?

The market size was USD 366.2 million in 2025, with a CAGR of 8.8% expected through 2035. The growth is driven by advancements in aerospace systems and the increasing demand for high-precision sensors.

Aeroderivative Sensor Market Scope

Related Reports