Summary

Table of Content

Acrylic Emulsion Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Acrylic Emulsion Market Size

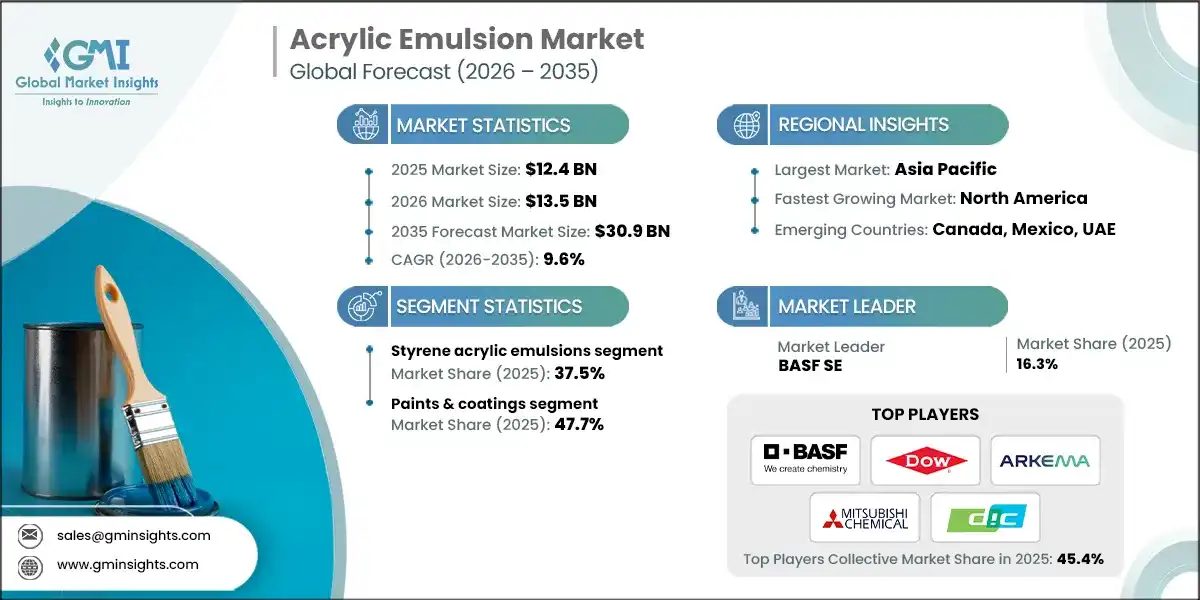

The global acrylic emulsion market was valued at USD 12.4 billion in 2025. The market is expected to grow from USD 13.5 billion in 2026 to USD 30.9 billion in 2035, at a CAGR of 9.6% according to latest report published by Global Market Insights Inc.

To get key market trends

- Acrylic emulsions are synthetic elastomers characterized by their high resistance toward heat, chemicals, and different fluids. These materials are used in industries that require demanding sealing solutions, such as automotive, aerospace, oil and gas, and chemical processing.

- As such, the suppliers of raw materials used-acrylic monomers and other chemical inputs-are subject to market dynamics of global supply-demand imbalances influenced by geopolitical events and natural calamities. The sudden volatility in prices can result in unexpected upward price movements, which immediately influence the cost structure of acrylic emulsion manufacturers.

- This, in a way, poses a large challenge to maintain constant end-product pricing, hence compromising on profit margins and operating efficiency. Manufacturers may find it hard to assume a sudden increase in costs, which may even prompt them to adjust their pricing strategies, in turn affecting profit margins.

Acrylic Emulsion Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 12.4 Billion |

| Market Size in 2026 | USD 13.5 Billion |

| Forecast Period 2026 - 2035 CAGR | 9.6% |

| Market Size in 2035 | USD 30.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing demand for eco-friendly and low-VOC coatings | Rising eco-friendly and low-VOC coatings boost market adoption, encouraging manufacturers to develop sustainable, safer acrylic emulsion products. |

| Growth in the construction industry, driving demand for acrylic emulsion-based paints | Increased construction activity fuels demand for durable, high-quality acrylic emulsion paints, expanding market size and product innovation opportunities. |

| Growth in the textile industry, leveraging acrylic emulsions in functional finishes | Acrylic emulsions enable advanced functional finishes, driving growth in textile applications and expanding market versatility and applications. |

| Pitfalls & Challenges | Impact |

| Increasing demand for eco-friendly and low-VOC coatings | Rising demand for eco-friendly and low-VOC coatings may lead to higher production costs and regulatory pressures in the global acrylic emulsion market |

| Growth in the construction industry, driving demand for acrylic emulsion-based paints | The expansion of construction activities globally significantly increases the demand for acrylic emulsion-based paints, boosting market growth. |

| Opportunities: | Impact |

| Growing demand in packaging and labeling industries | Growing demand in packaging and labeling industries presents substantial opportunities for innovation and expansion of acrylic emulsion applications. |

| Expansion into innovative and eco-friendly formulations | Developing sustainable and eco-friendly formulations offers a competitive edge and drives growth in the global market. |

| Market Leaders (2025) | |

| Market Leaders |

16.3% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | Canada, Mexico, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Acrylic Emulsion Market Trends

- Sustainable and eco-friendlier formulations are one of the major upcoming trends in the acrylic emulsion industry, such trends being birthed from global environmental consciousness and tight regulations. Water-based acrylic emulsions with low VOC levels will, therefore, gain traction within many other industries. VOCs not only threaten the environment but also human health; as government bodies and organizations tighten environmental standards, businesses will gravitate towards waterborne systems that help protect the environment by improving air quality. Among others, this green trend supports sustainability and corporate social responsibility initiatives aimed at fulfilling the provisions of global environmental policies.

- Another considerable ongoing trend is the spread of technology-use of acrylic emulsions in the building sector. Acrylic emulsions are highly regarded in paint, coating, and adhesive applications for their adhesion, flexibility, and durability. These properties create applications that are longer-lasting and more resistant to degradation in the environmental context; hence, these emulsions are perfect for interior and exterior construction applications alike. Cost-effectiveness paired with environmental wear-and-tear resistance has earned acrylic emulsion the acceptance of building materials.

- There is also increasing demand for coatings based on acrylic emulsion in the automotive industry. These coatings give the highest level of aesthetic appeal, UV protection, and durability to improve the look and lifespan of vehicles. The trend towards enhanced brightness, gloss retention, and scratch resistance has led manufacturers to favor acrylic emulsions.

- Collectively, these trends refer to the versatile nature and growing market for acrylic emulsions through eco-friendly solution approaches, material performance, and environmental compliance, thereby making acrylic emulsions one of the integral components of the future horizon of sustainable industrial applications.

Acrylic Emulsion Market Analysis

Learn more about the key segments shaping this market

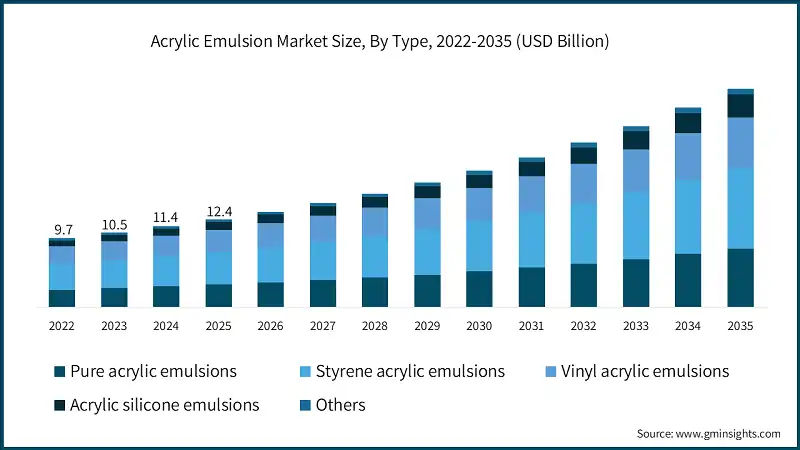

Based on type, the market is segmented into pure acrylic emulsions, styrene acrylic emulsions, vinyl acrylic emulsions, acrylic silicone emulsions and others. Styrene acrylic emulsions dominated the market with an approximate market share of 37.5% in 2025 and is expected to grow with a CAGR of 9.4% by 2035.

- The pure acrylic emulsions are favorably simple to make in terms of a paint for exterior and interior use along with wall coatings and finishes of elastomeric quality, as a result of this gives outstanding UV and weather resistance, color retention, water resistance, and adhesion to all types of surfaces. They are useful in high-performance architectural applications while giving opportunities to eco-friendly coating formulations and reflective roof coatings and advanced waterproofing membranes for green building initiatives and new-age infrastructure projects.

- Performance and cost-effectiveness are the two most vital terms standing up to the definition of styrene-acrylic emulsion as a desired polymer to cover requirements in decorative paints, sealants, and adhesives. The scope concerns developing cost-effective aqueous coatings, water-resistant coatings, and consumer-grade adhesive solutions, mostly intended for price-sensitive markets, as well as for those growth areas within increasingly urban spaces.

- Vinyl acrylic emulsions are primarily meant for interior wall paints, primers, and construction adhesives where UV and harsh weather resistance are not essential. Their reduced prices and easy formulations provide huge openings for poorer VOC paints that are expected to be mostly for indoor use, primers for porous substrates, and even cheaper formulations possibly targeted at institutional or low-income housing projects.

- Acrylic silicone emulsions are, to be sure, more appropriate for higher-end applications requiring much more elaborate options; these emulsions could be employed for waterproofing protective coatings, water-repellent surfaces, and industrial finishes. Their superior resistance to moisture, extremes of temperature, and chemicals opens up opportunities for infrastructure coatings, facade protection systems, and waterproofing solutions for long-lasting customer satisfaction in bridges, tunnels, and exterior building surfaces.

Learn more about the key segments shaping this market

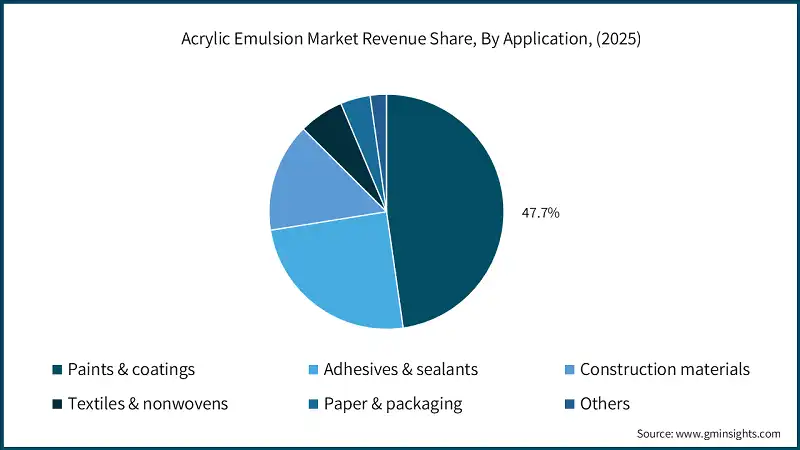

Based on application, the market is segmented into paints & coatings, adhesives & sealants, construction materials, textiles & nonwovens, paper & packaging and others. Paints & coatings held the largest market share of 47.7% in 2025.

- Extensive use in different industries is propelling the growth of the acrylic emulsion market, with a major portion crowded by its demand in paint and coating works. this segment is dominated by architectural coats, which can be subdivided into interior, exterior, or industrial coatings. Thus, it can be stated that interior coatings are appropriate because they are good adhesion and durability types of paints with very low VOC emissions and thus can be used in residential and commercial spaces.

- Acrylic emulsions confer much-needed weather resistance and UV stability to exterior coatings so as to be able to sustain the rigors of the environmental conditions. These emulsions, however, have found a place in industrial coatings because they can resist chemicals as well as have flexibility for manufacturing and heavy machinery applications.

- Acrylic emulsions are also an important area of application in automotive coatings besides wood, metal, and others' special purpose coatings. Their role in automotive finishes is to provide high adhesion strength, corrosion resistance, and aesthetic appeal.

- Wood coatings possess flexibility and crack resistance, while metal coatings are appreciated for their protection against rust and abrasion. Marine and protective coatings are special purpose coatings that use acrylic emulsions to withstand extreme marine environments and to provide durable surface protection in sectors requiring long-term reliability and resistance.

- Acrylic emulsions are also widely used in adhesives & sealants, construction materials, textiles, nonwovens, and paper & packaging industries. Pressure-sensitive adhesives and construction adhesives require acrylic emulsions for tackiness and bonding strength, while cement modifiers and waterproofing compounds impart durability to construction work.

Based on end use industry, the acrylic emulsion market is segmented into building & construction, automotive & transportation, industrial, consumer goods, packaging, textile & leather and others.

- The demand for acrylic emulsions is thus mainly derived from the commercial construction, which remains one of the two strongest end use segments. Another strong demand driver is the residential construction sector, which relies on rising urbanization, income levels, and consumer trends favoring sustainable, low-VOC materials.

- Commercial construction and infrastructure projects, such as roads, bridges, and public facilities, are also factors that have contributed heavily to market growth, as specialized acrylic emulsions are required for protective coatings, waterproofing compounds, and cement modifiers that support structural integrity and long service life.

- Another great enabler for acrylic emulsions is the automotive and transportation sector, wherein acrylics are particularly employed in passenger cars and commercial vehicles. Increasingly being applied for automotive coatings, these acrylic emulsions uplift the requirements for corrosion resistance, flexibility, and surface finish, with the growing impulse of the consumer for high-performance, green coatings for vehicles.

- The section of the industry covering metal and chemical processing has applied acrylic emulsions mainly for protective and functional coatings that withstand the rigors of their operating conditions. With the properties of chemical resistance and adhesion, such emulsions increase the durability and functional efficacy of machinery and equipment within these industries.

Looking for region specific data?

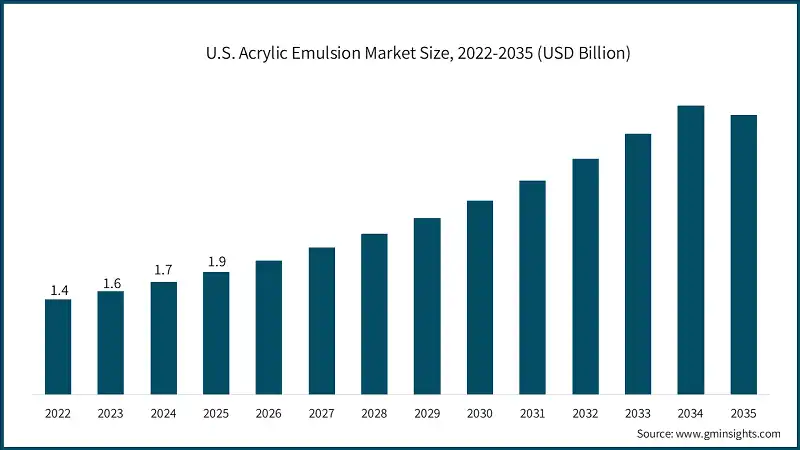

The acrylic emulsion market in North America will grow at a CAGR from approximately 9.4% between 2026 and 2035.

- Promotion of industrial processes where acrylic emulsions are being used through innovations in wastewater recycling and industrial effluent treatment in line with the principles of circular economy and enhancement of sustainability.

- Increasing consumer awareness and preference for eco-friendly products, particularly in cleaning, healthcare, and personal care sectors, are also driving brands to prefer acrylic emulsions meeting higher environmental standards, thereby increasing market growth.

The acrylic emulsion markets in Europe, especially in a few countries like Germany, are expected to grow with a rapid pace in the coming years.

- The increasing awareness among consumers regarding clean labels, vegan formulations, and allergen-free formulations is pushing investments in environmentally sustainable acrylic emulsions mainly in the personal care and food industrial sectors, reinforcing the trend toward healthy and eco-friendly products.

The market in China and India is expected to have lucrative growth between 2026 and 2035, with CAGR 10.8% in the Asia Pacific region.

- Boosting demand from industries, such as packaging, construction, and healthcare, are the rapidly increasing disposable incomes, urbanization, and trends towards biodegradable fertilizers, biogas, and eco-friendly cleaning agents.

- Most business entities are influenced by the increased consumer preferences toward natural and organic products, which drive the growth of health and wellness sections, hence favoring demand for bio-based and pharmaceutical-grade acrylic emulsions produced sustainably.

Between 2026 and 2035, the market for acrylic emulsion in the Middle East is projected to grow significantly during this period.

- Advances in biological and thermal treatment technologies of waste have made it possible to reduce operating costs, and subsequently the much wider acceptance and use of UV adhesives in various sectors and consumer markets.

Between 2025 and 2035, a promising expansion of the acrylic emulsion sector is foreseen in the Latin America.

- Increasing environmental consciousness and efforts toward sustainable waste recycling are adding value for eco-UVs for cosmetics and functional food applications. Increased disposable incomes, coupled with the focus of scientific research towards natural extracts and bio-based ingredients, will fuel demand for natural bio-based UVs in applications such as cosmetics, food, and pharmaceuticals.

Acrylic Emulsion Market Share

Acrylic emulsion industry is moderately consolidated with players like BASF SE, Dow Inc., Arkema S.A, Mitsubishi Chemical Corporation and DIC Corporation which accounts for 45.4% market share in 2025.

The acrylic emulsion market consists of such leading companies operating mostly in their regional areas. Their long years of experience with acrylic emulsion have allowed these companies to maintain a strong market position worldwide. Their product offerings are diverse and majorly supported by production capacities and distribution networks, which can serve the increasing demand for acrylic emulsion in various regions.

Acrylic Emulsion Market Companies

Major players operating in the acrylic emulsion industry includes:

- BASF SE

- AkzoNobel N.V

- Allnex

- Arkema S.A

- Asian Paints

- Celanese Corporation

- DIC Corporation

- Dow Inc.

- Evonik Industries AG

- Lubrizol Corporation

- Mitsubishi Chemical Corporation

- Momentive Performance Materials Inc

- Sika AG

- Synthomer plc

- Wacker Chemie AG

BASF SE is a leader in acrylic emulsion production with a diversified product range to offer innovative and sustainable solutions for coatings, adhesives, and construction applications. Strong R&D efforts have been directed toward developing sustainable and high-performance acrylic emulsions customized to the requirements of various industries.

Dow Inc. specifically works on acrylic emulsion technology, cutting across the spectrum from interior to exterior coatings. They find this systems superior due to their performance and sustainability which persuade customers in these sectors to move on to other alternatives.

Arkema S.A. producing acrylic emulsions to high standard allowing application-sided polymers for architectural coatings, adhesives in packaging. Details on certain sustainable-business pillars like eco-efficient production and bio-based innovations, held as a modus to promote sustainable development to ensure compliance with stringent environmental regulations, have been outlined.

Mitsubishi Chemical Corporation, their highly durable and effective acrylic emulsions of the highest quality in the market are suitable for advanced use in paints, inks as well as sealants through R&D.

DIC Corporation provides acrylic emulsions for a broad range to printing inks, coatings, and adhesives, while calling for newer techniques in the chemical industry that, in conjunction with less VOCs, contribute to making the product more sustainable and also to improving performance of the chemicals as a good choice for various fields.

Acrylic Emulsion Industry News

- In April 2024, Lubrizol announced a USD 20 million investment in its Gastonia, North Carolina plant to enhance the production of innovative acrylic emulsions. This investment underscores their commitment to advancing acrylic emulsion technologies, which have been a key part of their portfolio since the 1950s. These emulsions are widely used in coatings for applications such as paper, textiles, and construction materials.

- In July 2022, BASF SE completed the installation of an acrylic dispersions production line in Dahej, India. This new manufacturing facility enhances BASF's capabilities to cater to the coatings, construction, adhesives, and paper industries, specifically targeting the South Asian markets. The establishment of this production line signifies BASF's commitment to meeting the growing demands of various sectors in the region, reinforcing its presence and influence in the acrylic emulsions market.

This acrylic emulsion market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Type

- Pure acrylic emulsions

- Styrene acrylic emulsions

- Vinyl acrylic emulsions

- Acrylic silicone emulsions

- Others

Market, By Application

- Paints & coatings

- Architectural coatings

- Interior coatings

- Exterior coatings

- Industrial coatings

- Automotive coatings

- Wood coatings

- Metal coatings

- Others

- Special purpose coatings

- Marine coatings

- Protective coatings

- Others

- Architectural coatings

- Adhesives & sealants

- Pressure-sensitive adhesives

- Construction adhesives

- Packaging adhesives

- Others

- Construction materials

- Cement modifiers

- Waterproofing compounds

- Grouts and mortars

- Others

- Textiles & nonwovens

- Textile finishes

- Nonwoven binders

- Others

- Paper & packaging

- Paper coatings

- Packaging coatings

- Others

- Others

Market, By End Use Industry

- Building & construction

- Residential construction

- Commercial construction

- Infrastructure development

- Automotive & transportation

- Passenger vehicles

- Commercial vehicles

- Others

- Industrial

- Metal processing

- Chemical processing

- Others

- Consumer goods

- Furniture

- Appliances

- Others

- Packaging

- Food & beverage packaging

- Consumer goods packaging

- Industrial packaging

- Textile & leather

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Which type segment dominates the acrylic emulsion market?

Styrene acrylic emulsions dominated the market with around 37.5% share in 2025, owing to their cost-effectiveness and wide use in decorative paints, sealants, and adhesives.

Which application segment leads the acrylic emulsion industry?

Paints & coatings led the market with a 47.7% share in 2025, driven by strong demand for architectural, industrial, and automotive coatings.

What is the growth outlook for the North American acrylic emulsion market?

The North American market is projected to grow at a CAGR of approximately 9.4% between 2026 and 2035, driven by rising demand for low-VOC, water-based coatings and sustainable construction materials.

What are the key trends in the acrylic emulsion industry?

Key trends include growing adoption of water-based and low-VOC formulations, increased use in sustainable construction materials, and expanding applications in packaging and textiles.

Who are the key players in the acrylic emulsion market?

Major players include BASF SE, Dow Inc., Arkema S.A., Mitsubishi Chemical Corporation, DIC Corporation, AkzoNobel N.V., and Lubrizol Corporation, focusing on sustainable and high-performance acrylic emulsion solutions.

What is the projected value of the acrylic emulsion market by 2035?

The market is projected to reach USD 30.9 billion by 2035, growing at a CAGR of 9.6% from 2026 to 2035, fueled by sustainability regulations and increased use of water-based formulations.

What is the market size of the acrylic emulsion industry in 2026?

The market size for acrylic emulsion is expected to reach USD 13.5 billion in 2026, reflecting steady growth supported by expanding construction and packaging activities.

What is the acrylic emulsion market size in 2025?

The global market size for acrylic emulsion was valued at USD 12.4 billion in 2025, driven by rising demand for eco-friendly, low-VOC coatings across construction and industrial applications.

Acrylic Emulsion Market Scope

Related Reports